India Apparel Market Outlook to 2030

Region:Asia

Author(s):Anmol

Product Code:KR1536

December 2024

85

About the Report

India Apparel Market Overview

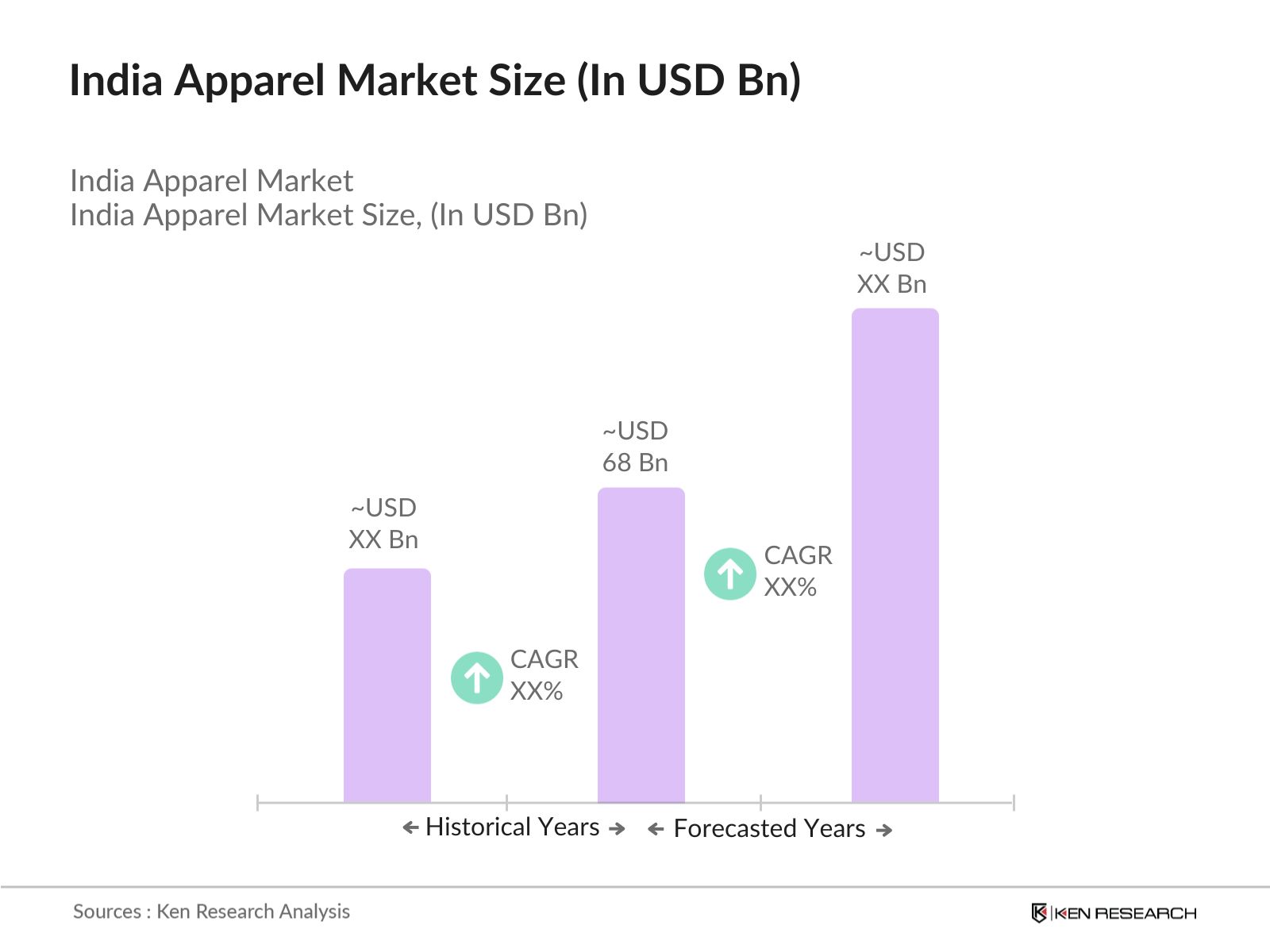

- The India apparel market is valued at USD 68 billion, primarily driven by rising consumer spending, urbanization, and the expansion of organized retail and e-commerce platforms. The surge in disposable income and a growing preference for branded apparel across urban and rural regions also contribute to the market's growth. Additionally, a focus on fashion and the adoption of Western trends are further bolstering demand across various segments, making India one of the fastest-growing apparel markets globally.

- Major demand centers in India include metropolitan cities like Mumbai, Delhi, and Bangalore, which lead the market due to high consumer spending, urban lifestyles, and the presence of major retail outlets. Tier II and Tier III cities also play an increasing role as disposable incomes rise and consumers in these areas demand branded and quality apparel. This growth in semi-urban regions is driven by changing consumer preferences and enhanced brand penetration through online and offline retail expansions.

- The Government of India launched the Production Linked Incentive (PLI) scheme in 2022, which has allocated INR 10,683 crore to boost domestic textile manufacturing. This initiative has directly benefited the apparel sector by encouraging local production and reducing reliance on imports. These policies have helped create jobs and support small and medium-sized enterprises, ultimately strengthening India's position as a textile and apparel hub.

India Apparel Market Segmentation

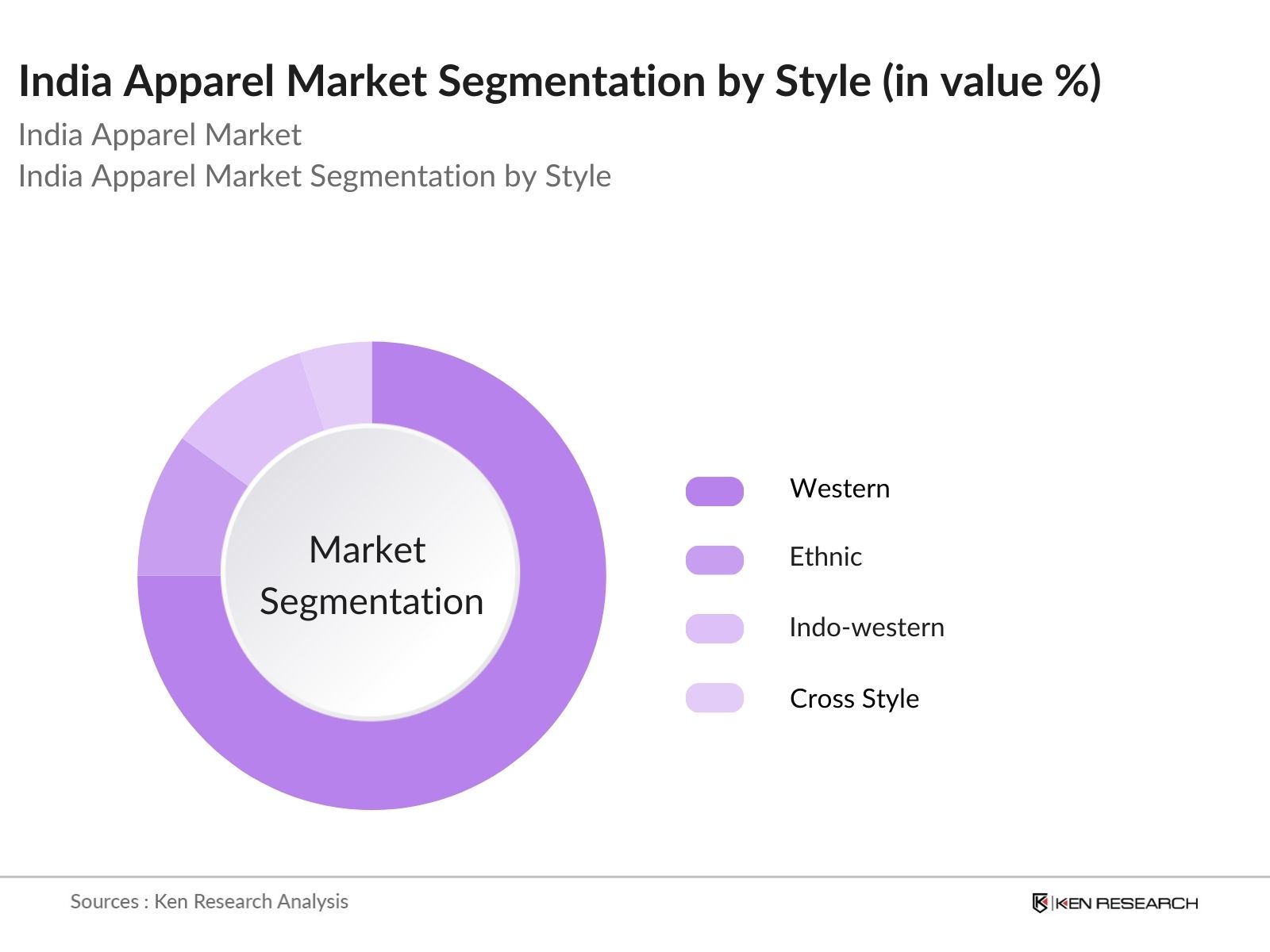

By Style: The market is segmented by style into Western, Ethnic, Indo-western, and Cross Style. Among these, Western wear dominates the market, fueled by rising urbanization, an expanding female workforce, and increasing adoption of global fashion trends. The surge in demand for workwear and casual western attire, especially among young professionals, has driven rapid growth in this segment. Brands are intensifying investments in western-style collections, supported by evolving retail formats and digital marketing strategies, reinforcing western wear’s position as the leading style category in the market.

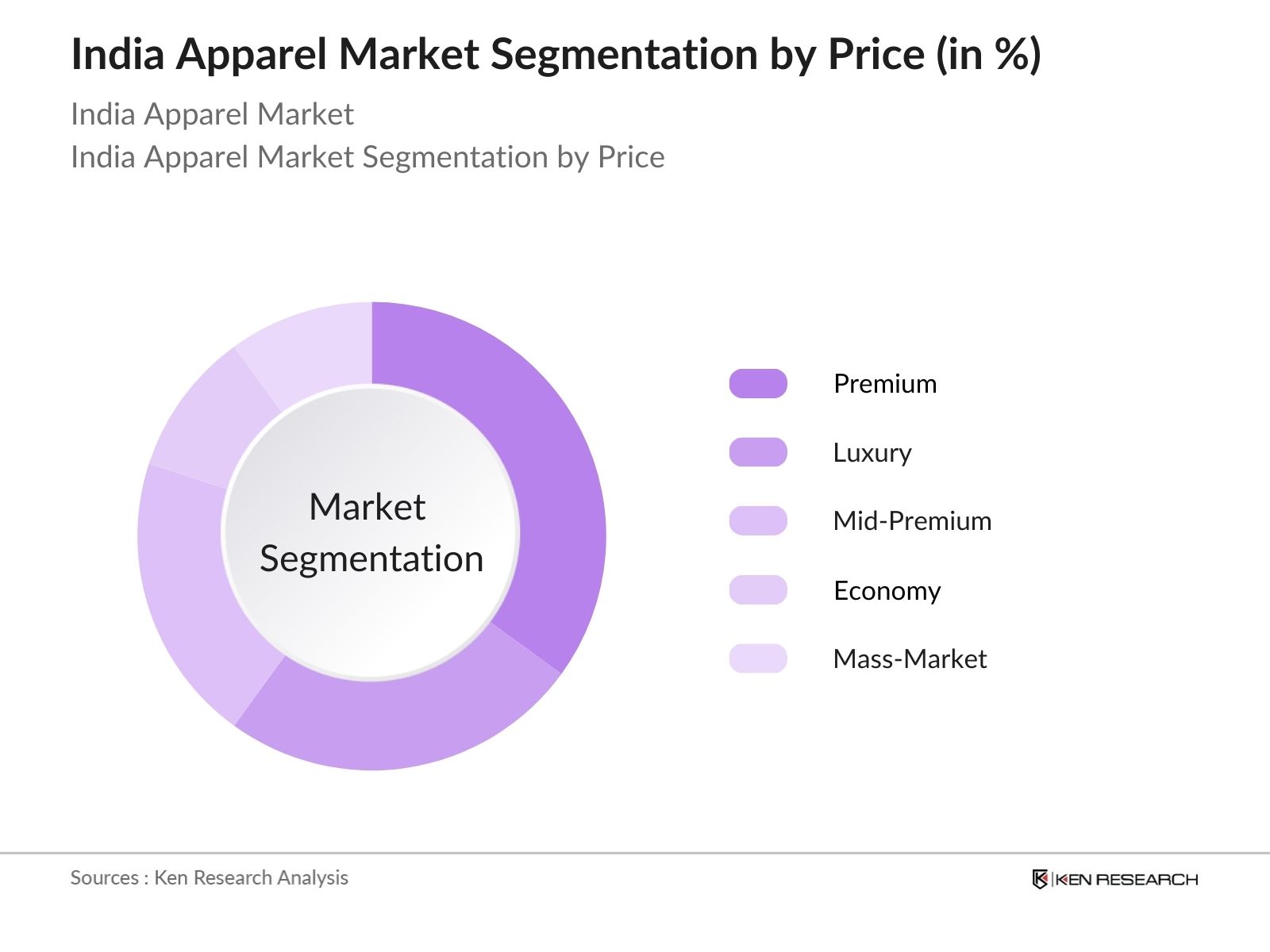

By Price: The market is segmented by price into Mass-Market, Economy, Mid-Premium, Premium, and Luxury. Among these, the Mid-Premium and Premium segments are witnessing the fastest growth, driven by aspirational consumers, rising urban incomes, and strong brand engagement via social media. Premium segments benefit from status-driven purchasing behavior and expansion into Tier-II/III cities, while the Luxury segment remains niche but steadily growing among affluent buyers. Meanwhile, Mass-Market clothing is losing share as even low-income consumers migrate toward branded and affordable mid-tier apparel, reducing demand for unbranded budget wear.

India Apparel Market Competitive Landscape

The India apparel market is characterized by a competitive landscape dominated by both domestic and international brands. Key players like Zara India, Fabindia, Uptownie, Navvi, and TIC leverage their robust distribution networks, strong brand presence, and continuous innovation to maintain market dominance.

India Apparel Market Analysis

Growth Drivers

- Rising Consumer Apparel Spending: Per capita apparel spending in India has shown consistent growth, rising from ?3,900 in 2018 to ?6,500 in 2023, with projections estimating it will reach ?8,000 by 2026. This steady annual growth rate of nearly 10% reflects increasing consumer demand for fashion across segments. The rising spending capacity is not only driving higher sales volumes but also allowing brands to diversify product offerings and expand into mid-premium categories across metros and Tier II cities.

- Rapid Growth in Fashion E-Commerce: India’s fashion e-commerce segment grew by 10–12% in 2023, expanding its market share from 14% to 15%. This growth is driven by increasing adoption in smaller cities, where digital penetration and improved delivery networks have enabled greater access to online fashion platforms. As a result, consumer behavior is shifting toward higher purchase frequency, aided by discounts, easy returns, and a wider selection of styles across online channels.

- Policy-Led Manufacturing Incentives: Government schemes like PM-MITRA and ATUFS are providing strong policy support to apparel manufacturers, particularly in states like Karnataka. Kalaburagi, Karnataka, being one of the seven designated PM-MITRA park locations, offers integrated infrastructure, connectivity, and operational benefits. These developments are encouraging investments in garment manufacturing units and strengthening India’s textile value chain by promoting large-scale, competitive production hubs.

Challenges

- Maintaining Differentiation in a Crowded Market: India’s apparel sector is saturated with brands competing for visibility and share, making it difficult to sustain customer loyalty. Overdependence on paid ads and frequent discounting often erodes brand value without delivering consistent returns. To remain competitive, brands must adopt data-led inventory planning, leverage micro-influencers for authentic engagement, and build a strong omnichannel presence that bridges online and offline touchpoints effectively.

- Balancing Cost Efficiency Amid Fabric Dependence: Cost pressures remain high for apparel manufacturers as they strive to offer value-driven products without compromising on quality. Cotton-blend fabrics offer a strategic advantage by improving cost-efficiency and ensuring higher customer acceptance. Relying solely on traditional sourcing methods or skipping inventory planning can lead to stock imbalances and inflated logistics costs, further squeezing margins in an already competitive environment.

India Apparel Market Future Outlook

The India apparel market is poised for robust growth, with anticipated expansion driven by increased consumer spending, the growing influence of Western fashion, and technological advancements in production. The rise of sustainable and eco-friendly apparel options, alongside the continued penetration of online platforms, is expected to drive further growth, enhancing accessibility and consumer reach across the country.

Future Market Opportunities

- Tier II & III Cities Driving Omnichannel Apparel Growth: Apparel sales in India’s Tier II and III cities now contribute nearly 40% of the market, driven by increased retail penetration and rising per capita fashion spend. Brands can tap this growth by adopting a strong omnichannel presence—integrating offline stores with digital touchpoints—and offering functional daily wear that resonates with evolving consumer needs in these emerging regions.

- Premiumization of Sustainable and Ethnic Fashion: Rising demand for eco-friendly and culturally rooted apparel is unlocking premium positioning opportunities. Consumers increasingly favor cotton-blend fabrics and ethnic wear with seasonal relevance. By leveraging micro-influencers and UGC for authentic storytelling, brands can enhance product discovery while using data-led inventory planning to align with sustainability-conscious and heritage-driven fashion preferences.

Scope of the Report

|

By Style |

Western |

|

By Price |

Premium Luxury Mid-Premium Economy |

|

By Sales Channel |

|

|

By Preference Type |

Tops/Shirts & Dresses |

|

By Fabric |

Cotton Rayon Khadi Hemp Others |

Products

Key Target Audience

Apparel Manufacturers

Retailers and Distributors

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Textiles, Government of India)

E-commerce Platforms

Fashion Designers and Consultants

Textile Suppliers

Companies

Players Mentioned in the Report

Zara India

Fabindia

Uptownie

Navvi

TIC

Sassafras

Freakins

Aditya Birla Fashion and Retail Ltd.

Reliance Retail Ltd.

Raymond Ltd.

Table of Contents

1. India Apparel Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Apparel Market Size (In INR Trillion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Apparel Market Analysis

3.1 Growth Drivers

3.1.1 Rising Disposable Income

3.1.2 Urbanization and Lifestyle Changes

3.1.3 Expansion of E-commerce Platforms

3.1.4 Influence of Western Fashion Trends

3.2 Market Challenges

3.2.1 Intense Market Competition

3.2.2 Fluctuating Raw Material Prices

3.2.3 Regulatory Compliance and Taxation

3.3 Opportunities

3.3.1 Growth in Tier II and III Cities

3.3.2 Demand for Sustainable and Ethnic Wear

3.3.3 Technological Advancements in Production

3.4 Trends

3.4.1 Shift Towards Fast Fashion

3.4.2 Rise of Athleisure and Casual Wear

3.4.3 Increasing Collaborations with International Brands

3.5 Government Regulations

3.5.1 Textile Policies and Initiatives

3.5.2 Import and Export Regulations

3.5.3 Goods and Services Tax (GST) Impact

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. India Apparel Market Segmentation

4.1 By Style (In Value %)

4.1.1 Western

4.1.2 Ethnic

4.1.3 Indo-western

4.1.4 Cross Style

4.2 By Price (In Value %)

4.2.1 Premium

4.2.2 Luxury

4.2.3 Mid-Premium

4.2.4 Economy

4.2.5 Mass Market

4.3 By Price Sales Channel (In Value %)

4.3.1 Offline Store

4.3.2 Marketplace

4.3.3 Company Website

4.4 By Preference Type (In Value %)

4.4.1 Tops/Shirts & Dresses

4.4.2 Bottoms

4.4.3 Sarees

4.4.4 Jackets & Shrugs

4.4.5 Others

4.5 By Fabric (In Value %)

4.5.1 Cotton

4.5.2 Rayon

4.5.3 Blended or Synthetic Fabrics

4.5.4 Georgette/Chiffon

4.5.5 Linen

4.5.6 Khadi

4.5.7 Hemp

4.5.8 Others

5. India Apparel Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Zara India

5.1.2 Fabindia

5.1.3 Uptownie

5.1.4 Navvi

5.1.5 TIC

5.1.6 Sassafras

5.1.7 Freakins

5.1.8 Aditya Birla Fashion and Retail Ltd.

5.1.9 Reliance Retail Ltd.

5.1.10 Raymond Ltd.

5.2 Cross Comparison Parameters (Revenue, Number of Stores, Market Share, Product Portfolio, Online Presence, Brand Positioning, Target Demographics, Growth Strategies)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. India Apparel Market Regulatory Framework

6.1 Textile and Apparel Policies

6.2 Compliance Requirements

6.3 Certification Processes

7. India Apparel Market Future Size (In INR Trillion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Apparel Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Price Range (In Value %)

8.4 By Fabric Type (In Value %)

8.5 By Region (In Value %)

9. India Apparel Market Analysts' Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Apparel Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Apparel Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple apparel manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Apparel Market.

Frequently Asked Questions

01. How big is the India Apparel Market?

The India apparel market is valued at USD 68 billion, driven by factors such as rising disposable incomes, urbanization, and the proliferation of e-commerce platforms.

02. What are the challenges in the India Apparel Market?

Challenges in the India apparel market include intense competition among brands, fluctuating raw material prices, and regulatory compliance issues. Additionally, the rise of counterfeit products poses a threat to market integrity.

03. Who are the major players in the India Apparel Market?

Key players in the India apparel market include Aditya Birla Fashion and Retail Ltd., Reliance Retail Ltd., Raymond Ltd., Arvind Ltd., and Future Lifestyle Fashions Ltd. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04. What are the growth drivers of the India Apparel Market?

The India apparel market is propelled by factors such as increasing disposable incomes, urbanization, the expansion of e-commerce platforms, and the influence of Western fashion trends

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.