India Automated Guided Vehicle Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD2393

October 2024

85

About the Report

India Automated Guided Vehicle Market Overview

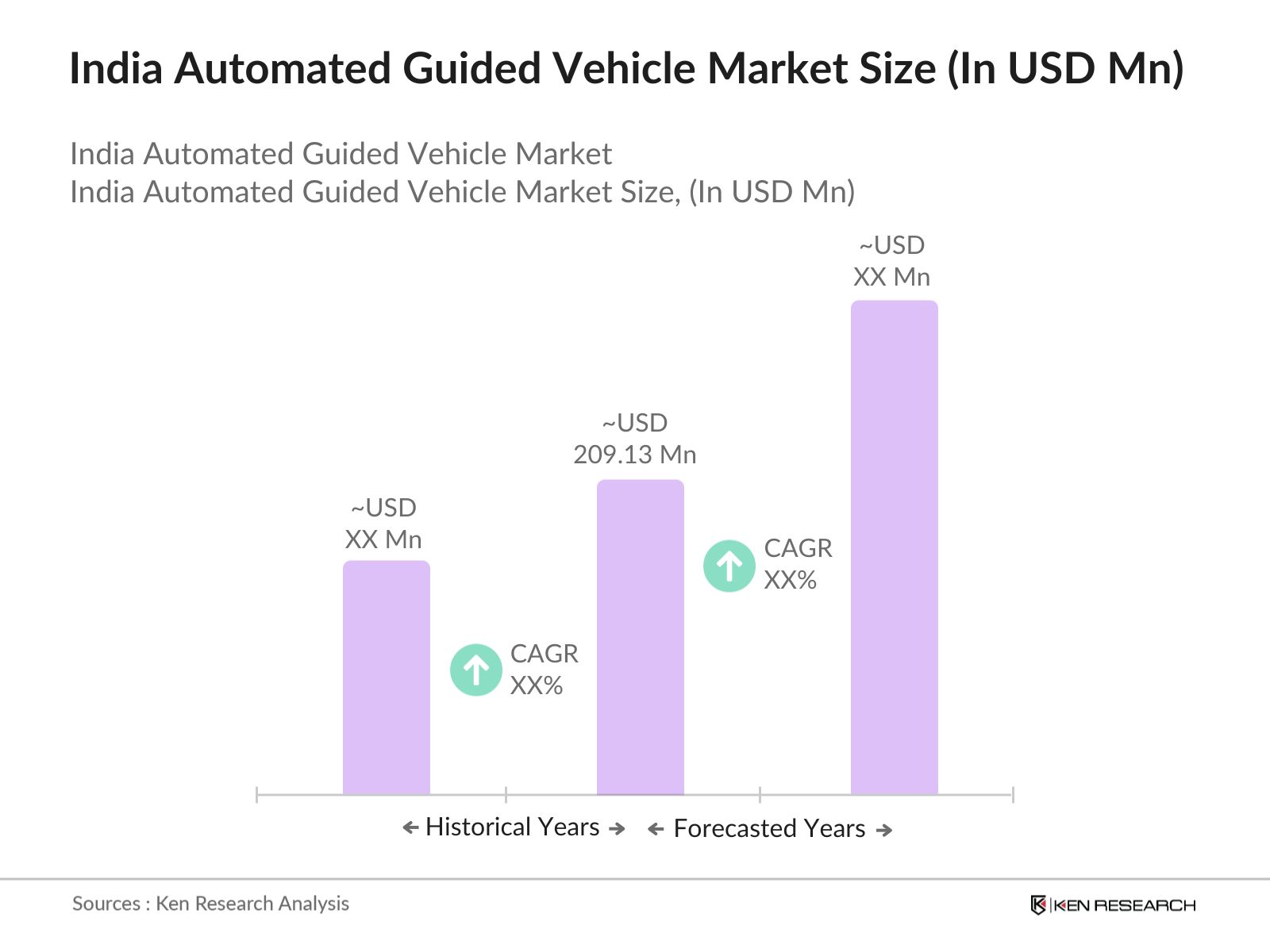

- The India AGV market is valued at USD 209.13 Million in 2023, driven by a surge in automation across industries like automotive, food and beverages, and e-commerce. The need for efficiency in warehouses, reduced labor costs, and enhanced operational safety is pushing businesses to adopt AGVs. The booming e-commerce sector in India, which has seen a rapid expansion, particularly in logistics and distribution, is a significant driver of this market.

- Dominant cities in the AGV market include Bangalore, Pune, and Chennai. These cities are hubs for manufacturing and technological innovation, making them key areas for AGV adoption. The presence of major automotive and industrial companies in these regions, coupled with well-established infrastructure, provides a fertile ground for AGV demand.

- The integration of technologies such as artificial intelligence (AI), machine learning, and computer vision has enhanced the efficiency and capabilities of AGVs. These advancements are particularly relevant in the e-commerce sector, where there is a growing need for efficient warehouse operations to meet rising online shopping demands.

India Automated Guided Vehicle Market Segmentation

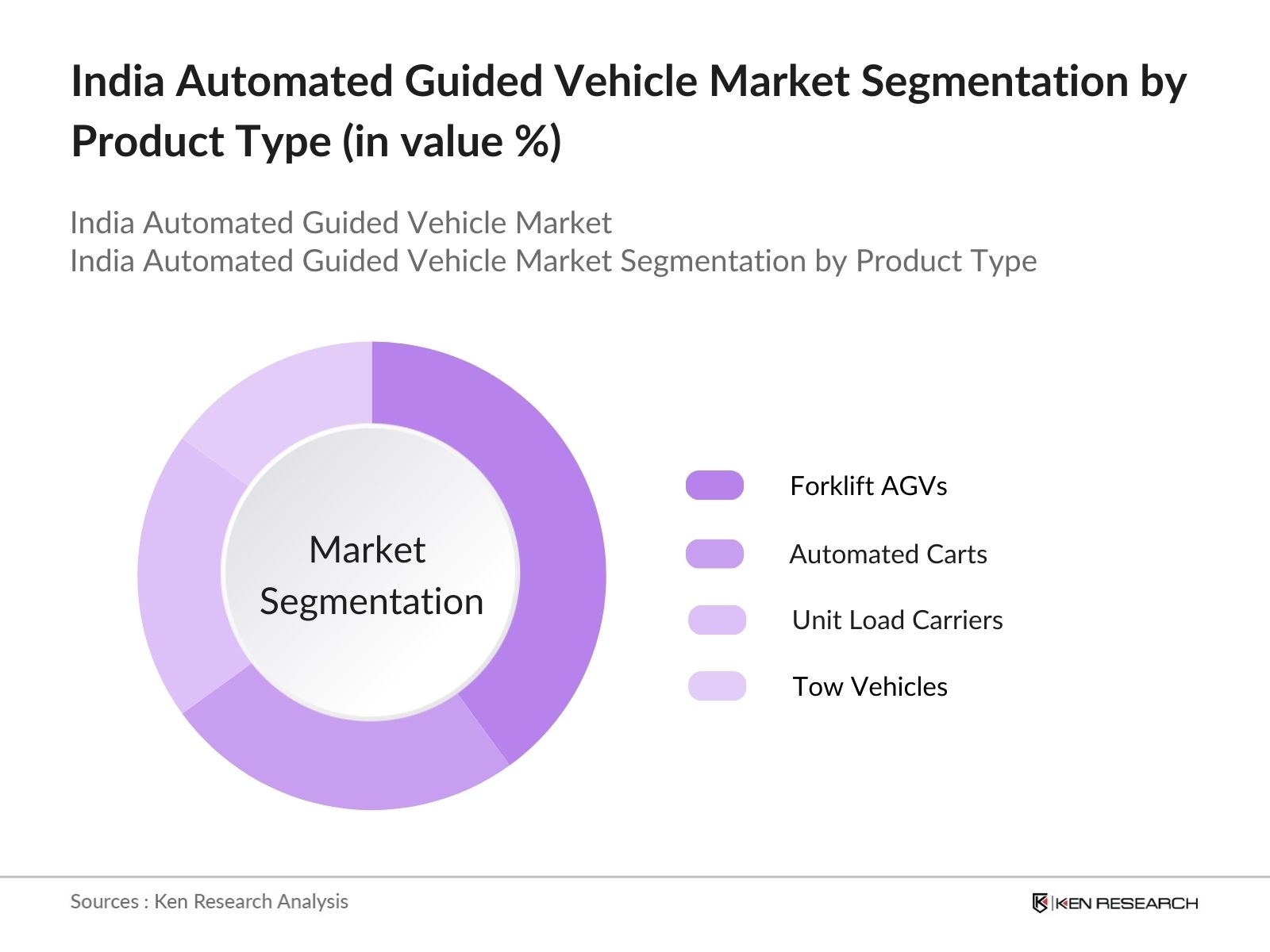

By Product Type: India's AGV market is segmented by product type into unit load carriers, tow vehicles, forklift AGVs, and automated carts. Among these, forklift AGVs dominate the market, mainly due to their extensive use in warehousing and manufacturing industries. Forklift AGVs streamline pallet transportation in complex environments, significantly reducing manual labor and increasing efficiency in high-traffic warehouses. As industries in India push towards more automated systems, forklift AGVs are proving to be a key solution for reducing time and labor costs.

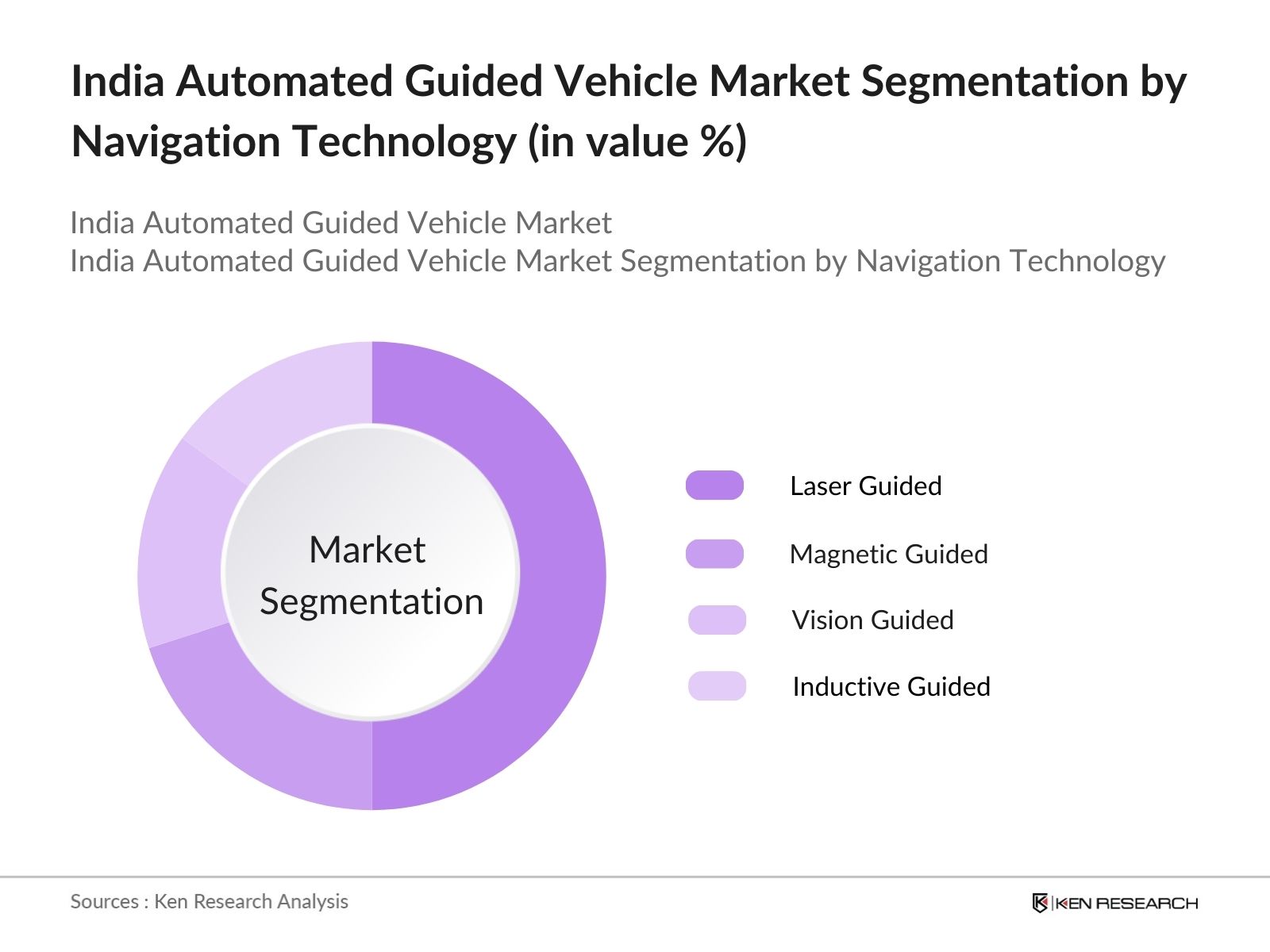

By Navigation Technology: Indias AGV market is segmented by navigation technology into laser-guided, magnetic-guided, vision-guided, and inductive-guided. Laser-guided AGVs have the largest share, owing to their high accuracy and flexibility in complex industrial environments. Laser guidance offers precise navigation even in crowded areas, making it ideal for industries like automotive and e-commerce. The adaptability of laser-guided systems to various environments, from cold storage to high-traffic areas, further bolsters their dominance.

India Automated Guided Vehicle Market Competitive Landscape

The India AGV market is dominated by both international and local players who have a strong presence in the automation sector. Companies like Daifuku Co., Ltd., JBT Corporation, and Toyota Industries Corporation lead the market with their innovation-driven solutions and well-established distribution networks. Indian companies are also increasingly focusing on AGV technology, with several collaborations and partnerships emerging in the industry.

Competitive Landscape Table

|

Company Name |

Establishment Year |

Headquarters |

Vehicle Portfolio |

Battery Technology |

R&D Expenditure |

Sustainability Initiatives |

Market Strategy |

Production Capacity |

Company Name |

|

Tata Motors Ltd. |

1945 |

Mumbai, India |

|||||||

|

Mahindra Electric Mobility |

1945 |

Bengaluru, India |

|||||||

|

Hyundai Motor India Ltd. |

1996 |

Chennai, India |

|||||||

|

Ather Energy Pvt. Ltd. |

2013 |

Bengaluru, India |

|||||||

|

Tesla Inc. |

2003 |

Palo Alto, US |

India Automated Guided Vehicle Market Analysis

Growth Drivers

- Manufacturing Sector Expansion: Indias manufacturing sector has seen significant growth due to the government's "Make in India" initiative, contributing $437 billion in exports in 2023. Automation through AGVs is increasing efficiency across industries such as automotive, electronics, and pharmaceuticals. According to government reports, over 17% of total manufacturing operations in sectors like automotive and electronics in India are automated, requiring advanced AGVs to handle complex logistics. Increased demand for AGVs is further fueled by Indias goal to achieve $1 trillion in manufacturing output by 2025.

- E-commerce and Warehousing Boom: Indias e-commerce market witnessed a growth trajectory driven by increased online retailing and rapid urbanization. This surge in demand has led to a 60% rise in warehousing capacity, with logistics companies adopting AGV technology to streamline order fulfillment. In fact, AGV implementation has improved productivity by 20% in large e-commerce hubs, per industry reports. The shift towards automated warehousing is crucial in meeting delivery timelines and maintaining operational efficiency.

- Industry 4.0 Adoption: Indias Industry 4.0 roadmap has led to an increase in smart factories, where AGVs play a critical role in ensuring seamless integration between IoT devices, AI-driven systems, and robotics. By 2024, it is estimated that over 7,500 manufacturing units across India will be leveraging Industry 4.0 technologies, with automation through AGVs reducing downtime by 15%. Automation is further boosted by government investments into digital infrastructure, as India aims to become a global smart manufacturing hub.

Challenges

- High Capital Investment (Cost Barriers): Although AGVs are becoming essential, the high initial capital required for deployment presents a challenge for small- and medium-sized enterprises (SMEs). In 2023, the average cost of deploying a standard AGV in India was around 20 lakh, deterring many companies from adopting the technology. Government data indicates that only 15% of SMEs in India have the financial capacity to invest in large-scale automation. However, subsidies under the Production Linked Incentive (PLI) scheme could reduce this barrier in the coming years.

- Lack of Skilled Workforce (Operational Efficiency Issues): Indias lack of skilled personnel for managing AGVs limits the efficiency of automated operations. According to industry reports, only 25% of the workforce in logistics and manufacturing sectors have been trained to handle such automation systems. This gap in skilled labor creates a bottleneck for AGV adoption, with operational inefficiencies resulting in productivity losses of up to 10%. Government training programs, such as Skill India, aim to bridge this gap, but widespread implementation is still pending.

India Automated Guided Vehicle Market Future Outlook

The India AGV market is expected to experience robust growth over the next five years, driven by the rapid adoption of smart manufacturing techniques and increased government support for automation and Industry 4.0 initiatives. The demand for flexible, scalable, and efficient logistics and warehouse automation systems will continue to push AGV deployment across various industries.

Market Opportunities

- Rise in E-commerce Automation: E-commerce automation is transforming logistics in India, and AGVs are becoming central to warehouse automation strategies. In 2023, India processed over 300 million e-commerce orders monthly, necessitating faster, more efficient inventory management solutions. The adoption of AGVs in large fulfillment centers such as those owned by Amazon and Flipkart has led to a 30% increase in order processing speeds. This trend presents a significant opportunity for AGV manufacturers to target the fast-growing e-commerce market.

- Customizable AGV Solutions (Tailored for Specific Industries): The demand for customized AGVs tailored to industry-specific needs is growing in India, particularly in sectors like automotive and pharmaceuticals. For example, AGVs designed to handle hazardous materials have seen a 40% rise in demand in 2024 due to increased regulations around safe handling. Moreover, government incentives aimed at enhancing manufacturing capabilities encourage companies to adopt industry-specific AGV solutions. These solutions reduce downtime and increase productivity, positioning AGVs as key components in Indias industrial future.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Vehicle Type |

Electric Hatchbacks Electric Sedans Electric SUVs Electric Two-Wheelers Electric Three-Wheelers |

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries Solid-State Batteries |

|

By Charging Infrastructure |

Home Charging Public Charging Fast Charging Stations Battery Swapping Stations |

|

By Application |

Personal Use Commercial Use (Fleet, Taxi, Ride-Hailing) Government and Public Transport |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Automotive Manufacturers

Warehouse and Logistics Companies

Government and Regulatory Bodies (e.g., Ministry of Heavy Industries, Bureau of Indian Standards)

Technology Providers (AI, IoT, and Robotics Solution Providers)

Industrial Automation Vendors

Retail and E-commerce Giants

Food and Beverage Companies

Companies

Players mentioned in the report:

Daifuku Co., Ltd.

JBT Corporation

Toyota Industries Corporation

Kollmorgen Corporation

Egemin Automation

KION Group AG

Seegrid Corporation

Fetch Robotics

Dematic

KUKA AG

Table of Contents

1. India AGV Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India AGV Market Size (In INR Cr)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India AGV Market Analysis

3.1. Growth Drivers

3.1.1. Manufacturing Sector Expansion

3.1.2. E-commerce and Warehousing Boom

3.1.3. Industry 4.0 Adoption

3.1.4. Labor Shortage and Safety Enhancements

3.2. Market Challenges

3.2.1. High Capital Investment (Cost Barriers)

3.2.2. Lack of Skilled Workforce (Operational Efficiency Issues)

3.2.3. Integration Complexities (Interoperability of Systems)

3.3. Opportunities

3.3.1. Rise in E-commerce Automation

3.3.2. Customizable AGV Solutions (Tailored for Specific Industries)

3.3.3. Technological Advancements (AI, IoT, and Machine Learning Integration)

3.4. Trends

3.4.1. Use of Hybrid AGVs

3.4.2. Real-Time Fleet Management Solutions (Cloud-Based Platforms)

3.4.3. AGV Swarm Technology

3.5. Government Regulation

3.5.1. Industrial Automation Policies (Make in India Initiative)

3.5.2. Incentives for Smart Manufacturing (PLI Schemes)

3.5.3. Standardization and Safety Certifications for AGV Systems

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (OEMs, Component Manufacturers, Software Providers)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India AGV Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Unit Load Carriers

4.1.2. Tow Vehicles

4.1.3. Forklift AGVs

4.1.4. Automated Carts

4.2. By Navigation Technology (In Value %)

4.2.1. Laser Guided

4.2.2. Magnetic Guided

4.2.3. Vision Guided

4.2.4. Inductive Guided

4.3. By Industry Vertical (In Value %)

4.3.1. Automotive

4.3.2. Food & Beverages

4.3.3. E-commerce & Logistics

4.3.4. Healthcare

4.4. By Payload Capacity (In Value %)

4.4.1. < 500 Kg

4.4.2. 500 Kg 1,000 Kg

4.4.3. 1,000 Kg 2,000 Kg

4.4.4. > 2,000 Kg

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India AGV Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Daifuku Co., Ltd.

5.1.2. JBT Corporation

5.1.3. KION Group AG

5.1.4. Toyota Industries Corporation

5.1.5. Egemin Automation

5.1.6. Kollmorgen Corporation

5.1.7. Balyo

5.1.8. Seegrid Corporation

5.1.9. Dematic

5.1.10. Murata Machinery, Ltd.

5.1.11. Oceaneering International, Inc.

5.1.12. SSI Schaefer

5.1.13. Fetch Robotics

5.1.14. KUKA AG

5.1.15. Scott Automation

5.2. Cross Comparison Parameters (Revenue, AGV Fleet Size, Manufacturing Capabilities, Technology Innovation, R&D Investments, Number of Patents, Market Presence, Key Customers)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Partnerships, and Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. India AGV Market Regulatory Framework

6.1. Industry Standards and Certifications (ISO 3691-4, CE Marking, UL Certifications)

6.2. Government Compliance (Automated Vehicle Guidelines)

6.3. Environmental Regulations

7. India AGV Future Market Size (In INR Cr)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India AGV Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Navigation Technology (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Payload Capacity (In Value %)

8.5. By Region (In Value %)

9. India AGV Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem of the India AGV Market by identifying key stakeholders such as OEMs, technology providers, and logistics operators. Extensive desk research, supported by secondary databases, is used to pinpoint critical factors influencing the market.

Step 2: Market Analysis and Construction

This step entails a thorough analysis of historical data and current market penetration. Special attention is given to the relationship between AGV deployment and industrial growth, particularly in high-demand sectors like e-commerce and automotive.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from key AGV companies. These interviews provide practical insights and operational details that help refine our market models and projections.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all gathered data into a comprehensive market report. Further interactions with AGV manufacturers ensure the accuracy of sales and product segment data, solidifying our final output.

Frequently Asked Questions

01. How big is the India AGV market?

The India AGV market is valued at 209.13 million in 2023, driven by industrial automation in sectors like automotive, e-commerce, and food & beverage.

02. What are the challenges in the India AGV market?

Key challenges in the India AGV market include high initial costs for AGV systems, limited skilled workforce for maintenance and operation, and integration complexities with existing infrastructure.

03. Who are the major players in the India AGV market?

Key players in the India AGV market include Daifuku Co., Ltd., Toyota Industries Corporation, Kollmorgen Corporation, and JBT Corporation. These companies have a strong presence due to their technological innovations and comprehensive service offerings.

04. What are the growth drivers of the India AGV market?

The India AGV market is primarily driven by the rise in e-commerce, growing demand for automation in warehouses, and the need for efficiency in industrial manufacturing processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.