India Automobile Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD9590

November 2024

88

About the Report

India Automobile Market Overview

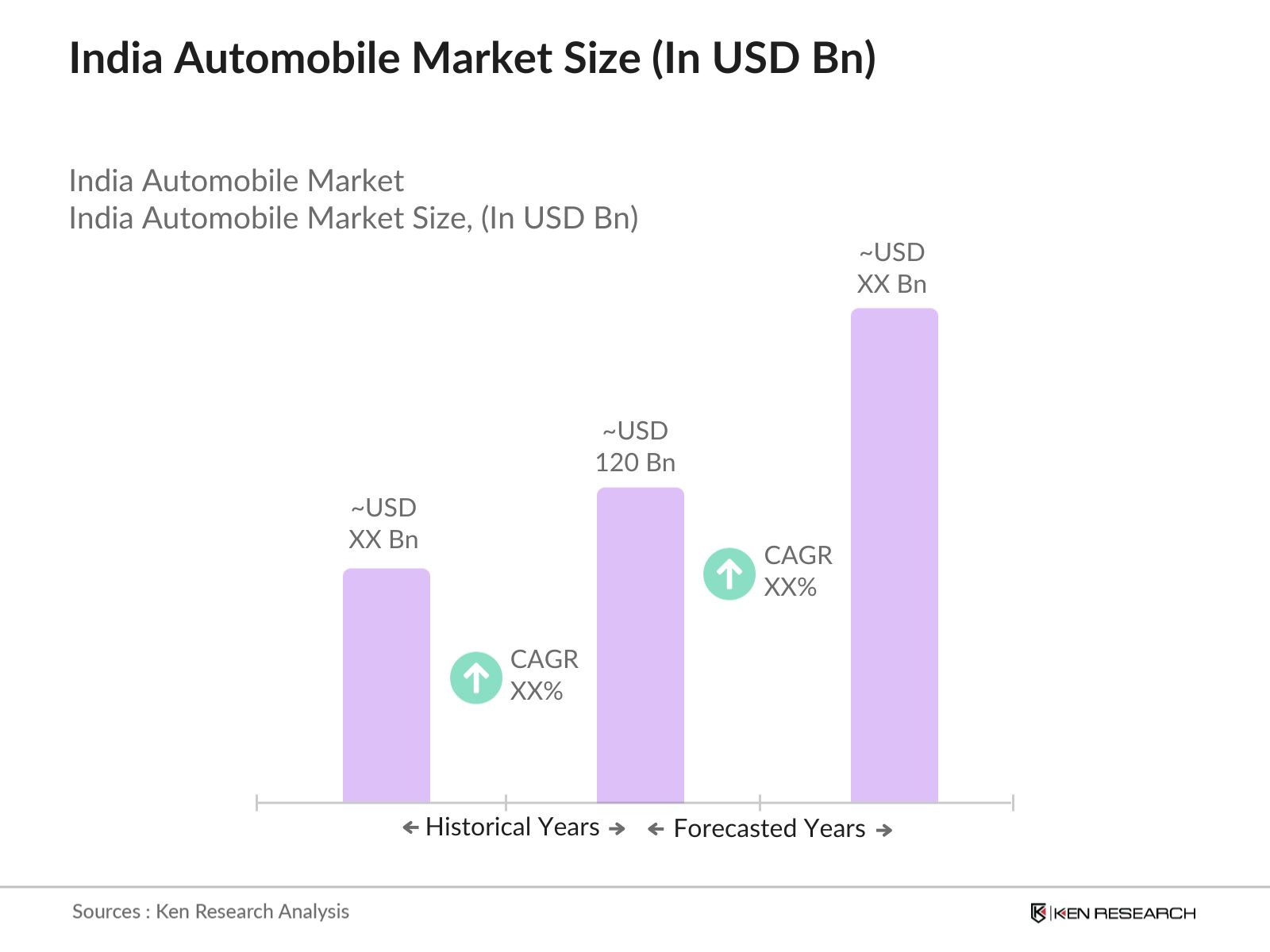

- The India automobile market, valued at USD 120 Billion, is driven by the increasing purchasing power of the middle class and government initiatives such as the FAME II scheme, which encourages the adoption of electric vehicles (EVs). The shift towards electric mobility, along with the continuous demand for commercial and passenger vehicles, is fueling market growth. Another key factor is the surge in rural and urban transportation needs, which are being met by diverse offerings across the passenger vehicle and two-wheeler segments.

- The cities of Delhi, Mumbai, and Bangalore, along with the states of Maharashtra and Tamil Nadu, dominate the Indian automobile market due to their advanced infrastructure, industrial hubs, and large consumer base. These regions are home to major automobile manufacturing plants, favorable policies, and strategic ports, facilitating both production and exports. Maharashtra, in particular, benefits from its extensive automotive ecosystem, which includes both manufacturing and R&D centers.

- The Automotive Mission Plan 2026 aims to make India one of the top three automotive manufacturers globally by enhancing production capabilities and boosting exports. In 2023, Indias automobile sector contributed over USD 100 billion to the GDP, and the plan is accelerating growth in vehicle production and the adoption of advanced technologies.

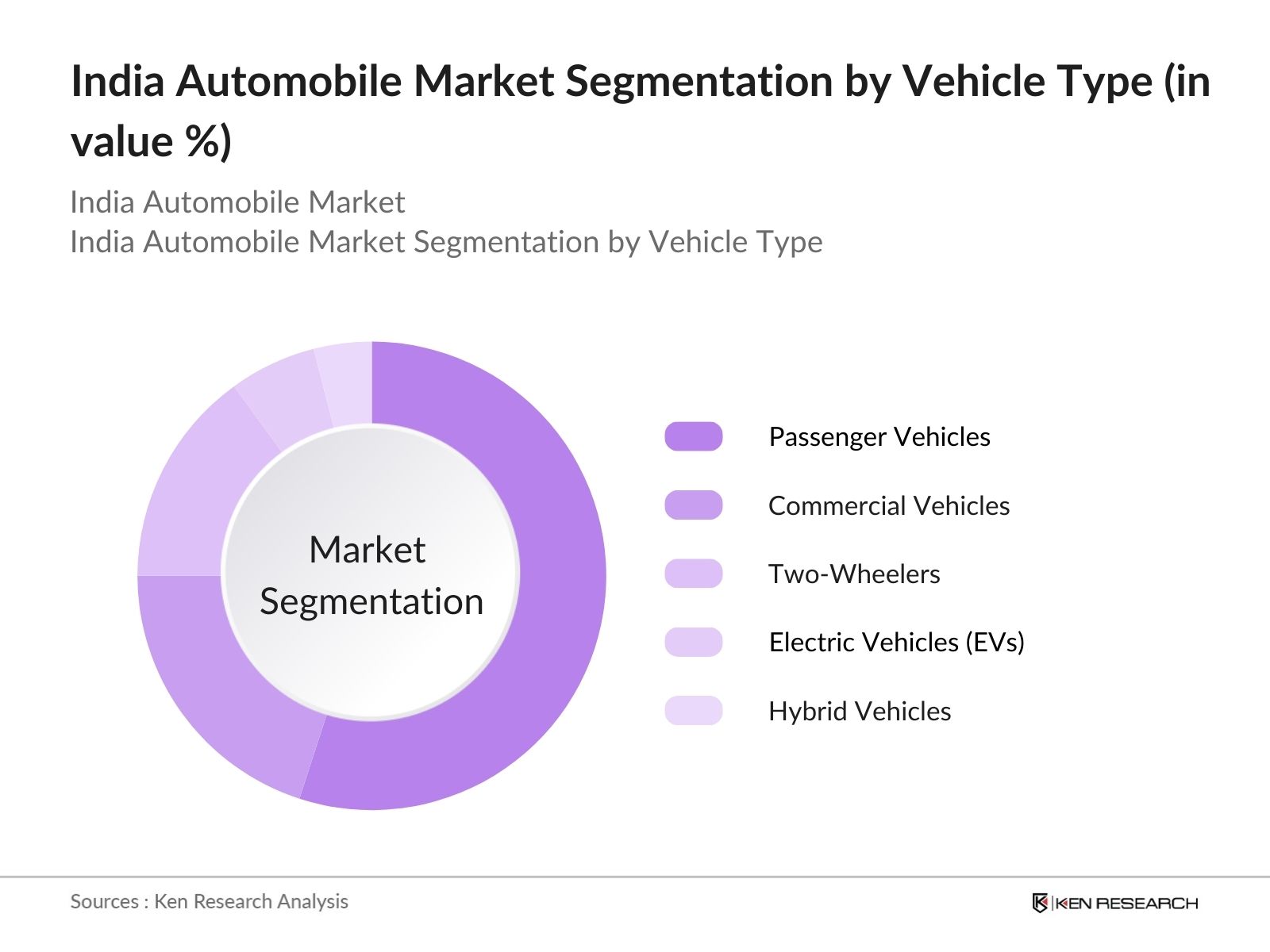

India Automobile Market Segmentation

By Vehicle Type: The market is segmented by vehicle type into passenger vehicles, commercial vehicles, two-wheelers, electric vehicles (EVs), and hybrid vehicles. Passenger vehicles are the dominant sub-segment, driven by rising income levels and urbanization, leading to higher personal vehicle ownership. Additionally, the expansion of ride-hailing services and the need for personal transportation during the pandemic boosted passenger vehicle sales.

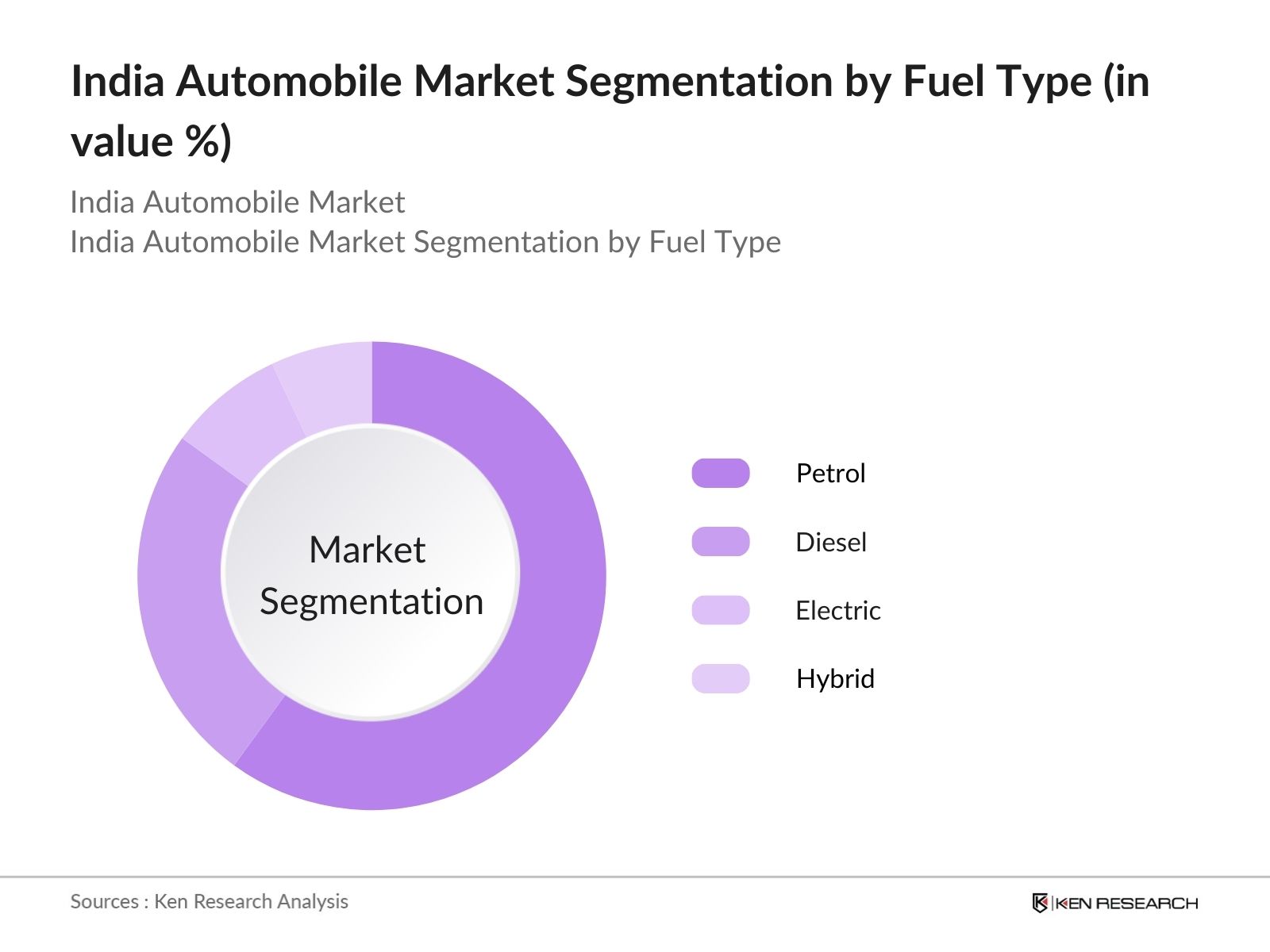

By Fuel Type: The market is also segmented by fuel type into petrol, diesel, electric, and hybrid. Petrol remains the most dominant sub-segment, accounting for a significant portion of the market. The affordability and widespread availability of petrol, coupled with consumer preference for petrol-powered vehicles for short-distance city travel, support its dominance.

India Automobile Market Competitive Landscape

The Indian automobile market is characterized by the presence of both local and global players, resulting in fierce competition. Market leaders such as Maruti Suzuki, Tata Motors, and Hyundai dominate the landscape due to their extensive dealer networks, manufacturing capabilities, and ability to offer a wide range of products catering to various income groups. The market also sees the increasing presence of electric vehicle manufacturers, such as Ather Energy and Ola Electric, contributing to the evolving competitive dynamics.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (INR Cr) |

Production Capacity (Units) |

R&D Investments (INR Cr) |

EV Portfolio |

Global Presence |

Dealer Network |

Collaborations |

|

Maruti Suzuki India Ltd. |

1981 |

New Delhi |

|||||||

|

Tata Motors Ltd. |

1945 |

Mumbai |

|||||||

|

Hyundai Motor India Ltd. |

1996 |

Chennai |

|||||||

|

Mahindra & Mahindra Ltd. |

1945 |

Mumbai |

|||||||

|

Ather Energy Pvt. Ltd. |

2013 |

Bangalore |

India Automobile Industry Analysis

Growth Drivers

- Rising Disposable Income: India has seen a significant rise in disposable income over the last few years, leading to higher purchasing power for consumers. In 2023, India's per capita income stood at INR 172,000 compared to INR 132,000 in 2020, driven by growth in multiple sectors like IT, manufacturing, and services. This rise in income has contributed to a surge in vehicle ownership. As the middle class expands, demand for affordable and premium vehicles is rising, directly fueling growth in the automobile sector.

- Urbanization and Increasing Vehicle Ownership: Indias urban population increased to 483 million in 2023, up from 461 million in 2020, accounting for 35% of the total population. The rapid urbanization has created more demand for personal vehicles in cities like Mumbai, Delhi, and Bengaluru. Additionally, vehicle ownership has grown from 210 vehicles per 1,000 people in 2020 to 245 vehicles per 1,000 people in 2023, as urbanization has facilitated more consumers owning cars.

- Government Push for Electric Vehicles: Indias electric vehicle market is being propelled by government initiatives such as the FAME II scheme, which allocated INR 10,000 crore for promoting electric and hybrid vehicles. In 2023, 450,000 electric vehicles were sold, doubling the 2022 figures, primarily due to government subsidies on electric two-wheelers, cars, and commercial vehicles. The governments goal of 30% EV penetration by 2030 has already led to a sharp rise in demand for electric vehicles, particularly in urban areas.

Market Challenges

- Regulatory Compliance: Compliance with stringent regulations, such as BS-VI norms and enhanced safety standards, remains a challenge for the automotive sector. In 2023, the cost of compliance for auto manufacturers increased by approximately INR 15,000 to INR 30,000 per vehicle. Meeting these regulations requires substantial investments in technology and testing facilities, straining the profit margins of smaller players in the market.

- High Production and R&D Costs: Increased production and R&D costs, especially for electric and hybrid vehicles, are a significant challenge. By 2023, the average cost of manufacturing an electric vehicle in India stood at INR 1.2 million, compared to INR 700,000 for internal combustion engine vehicles. The higher cost of EV components, particularly lithium-ion batteries, and the investments needed to adapt to new technologies have escalated production expenses for manufacturers.

India Automobile Market Future Outlook

Over the next few years, the Indian automobile market is poised for significant transformation, driven by multiple factors such as advancements in electric vehicle technology, increasing demand for eco-friendly vehicles, and evolving consumer preferences. The government's focus on electric vehicle promotion through subsidies, incentives, and infrastructure development is expected to further fuel growth in the EV segment. Moreover, rising urbanization and increasing disposable income will continue to support the expansion of passenger vehicles and two-wheelers, while commercial vehicles will see sustained demand driven by industrial growth and e-commerce expansion.

Future Market Opportunities

- Expansion of EV Infrastructure: India is rapidly expanding its EV charging infrastructure, which grew from 1,500 charging stations in 2020 to 8,500 by mid-2023. The government aims to install at least 22,000 charging stations across the country by 2025. This increased infrastructure will encourage higher EV adoption, providing an immense opportunity for manufacturers and suppliers in the electric vehicle ecosystem.

- Localization of Supply Chains: To reduce dependency on imports, especially for critical components like batteries and semiconductors, the Indian government has launched initiatives to localize supply chains. In 2023, 60% of automobile components were manufactured domestically, up from 50% in 2020. This presents an opportunity for local manufacturers to scale up production and reduce costs, further strengthening Indias automotive sector.

Scope of the Report

|

Vehicle Type |

Passenger Vehicles Commercial Vehicles Two-Wheelers EV Hybrid |

|

Fuel Type |

Petrol Diesel Electric Hybrid |

|

Transmission Type |

Manual Automatic CVT |

|

Sales Channel |

OEMs Aftermarket Online |

|

Region |

Northern India Southern India Eastern India Western India |

Products

Key Target Audience

Automobile Manufacturers

Component Suppliers

Dealer Networks

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Heavy Industries, NITI Aayog)

Electric Vehicle Charging Infrastructure Providers

Logistics and Supply Chain Firms

Fleet Operators

Companies

Major Players

Maruti Suzuki India Ltd.

Tata Motors Ltd.

Mahindra & Mahindra Ltd.

Hyundai Motor India Ltd.

Honda Cars India Ltd.

Toyota Kirloskar Motor Pvt. Ltd.

Bajaj Auto Ltd.

Hero MotoCorp Ltd.

TVS Motor Company Ltd.

Ashok Leyland Ltd.

Eicher Motors Ltd.

Ather Energy Pvt. Ltd.

Ola Electric Mobility Pvt. Ltd.

MG Motor India Pvt. Ltd.

Kinetic Green Energy & Power Solutions Ltd.

Table of Contents

1. India Automobile Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Automobile Market Size (In INR Cr)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Automobile Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Urbanization and Increasing Vehicle Ownership

3.1.3. Government Push for Electric Vehicles (EV)

3.1.4. Automotive Industry Reforms (e.g., BS-VI norms)

3.2. Market Challenges

3.2.1. Regulatory Compliance (BS-VI, Safety Standards)

3.2.2. High Production and R&D Costs

3.2.3. Fluctuating Fuel Prices and EV Adoption Costs

3.2.4. Supply Chain Constraints

3.3. Opportunities

3.3.1. Expansion of EV Infrastructure

3.3.2. Localization of Supply Chains

3.3.3. Technological Advancements (Autonomous Driving, Connected Vehicles)

3.3.4. International Collaborations for R&D

3.4. Trends

3.4.1. Shift Towards Electric Vehicles

3.4.2. Growing Adoption of Shared Mobility Solutions

3.4.3. Increasing Demand for Hybrid Vehicles

3.4.4. Use of IoT and AI in Automotive Manufacturing

3.5. Government Regulation

3.5.1. Automotive Mission Plan

3.5.2. FAME India Scheme (Faster Adoption and Manufacturing of Electric Vehicles)

3.5.3. Production-Linked Incentive (PLI) Scheme for Automobiles

3.5.4. National Automotive Testing and R&D Infrastructure Project (NATRIP)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Automobile Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Passenger Vehicles

4.1.2. Commercial Vehicles

4.1.3. Two-Wheelers

4.1.4. Electric Vehicles (EV)

4.1.5. Hybrid Vehicles

4.2. By Fuel Type (In Value %)

4.2.1. Petrol

4.2.2. Diesel

4.2.3. Electric

4.2.4. Hybrid

4.3. By Transmission Type (In Value %)

4.3.1. Manual

4.3.2. Automatic

4.3.3. CVT (Continuously Variable Transmission)

4.4. By Sales Channel (In Value %)

4.4.1. OEMs

4.4.2. Aftermarket

4.4.3. Online

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Southern India

4.5.3. Eastern India

4.5.4. Western India

5. India Automobile Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Maruti Suzuki India Ltd.

5.1.2. Tata Motors Ltd.

5.1.3. Mahindra & Mahindra Ltd.

5.1.4. Hyundai Motor India Ltd.

5.1.5. Honda Cars India Ltd.

5.1.6. Toyota Kirloskar Motor Pvt. Ltd.

5.1.7. Bajaj Auto Ltd.

5.1.8. Hero MotoCorp Ltd.

5.1.9. TVS Motor Company Ltd.

5.1.10. Ashok Leyland Ltd.

5.1.11. Eicher Motors Ltd.

5.1.12. Ather Energy Pvt. Ltd.

5.1.13. Ola Electric Mobility Pvt. Ltd.

5.1.14. MG Motor India Pvt. Ltd.

5.1.15. Kinetic Green Energy & Power Solutions Ltd.

5.2. Cross Comparison Parameters (Market Share, Revenue, Production Capacity, Dealership Network, R&D Investments, EV Portfolio, Global Presence, Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Automobile Market Regulatory Framework

6.1. Emission Standards

6.2. Safety Compliance

6.3. Certification Processes

6.4. Import-Export Regulations

7. India Automobile Market Future Market Size (In INR Cr)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Automobile Market Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Transmission Type (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

9. India Automobile Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step in the research process involves creating a detailed ecosystem of all the key players in the Indian automobile market, from vehicle manufacturers to supply chain stakeholders. This step relies on in-depth desk research using secondary sources such as industry reports, government databases, and proprietary data.

Step 2: Market Analysis and Construction

Next, historical data is analyzed to develop a comprehensive understanding of the market size, growth rate, and segmentation. We focus on various parameters like vehicle type, fuel type, and regional contributions to assess the market accurately.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from key automobile companies are consulted via structured interviews and surveys. This step helps in validating the hypotheses and assumptions made during the data analysis stage, ensuring accuracy in our findings.

Step 4: Research Synthesis and Final Output

In the final stage, all the data is compiled and synthesized to provide a detailed and accurate analysis of the Indian automobile market. The report is validated through multiple rounds of feedback from industry professionals.

Frequently Asked Questions

01. How big is the India Automobile Market?

The India automobile market is valued at USD 120 Billion, driven by increasing demand for both passenger and commercial vehicles, along with the rising adoption of electric vehicles (EVs).

02. What are the challenges in the India Automobile Market?

Challenges in the India automobile market include regulatory compliance, such as the transition to BS-VI emission norms, high R&D costs, and fluctuating raw material prices, which can impact production costs.

03. Who are the major players in the India Automobile Market?

Major players in the India automobile market include Maruti Suzuki, Tata Motors, Hyundai Motor India, Mahindra & Mahindra, and Hero MotoCorp. These companies dominate due to their strong manufacturing capabilities, extensive dealer networks, and robust brand presence.

04. What are the growth drivers of the India Automobile Market?

Key growth drivers in the India automobile market include the rising disposable incomes of the middle class, urbanization, government policies promoting electric vehicles, and increasing vehicle ownership in both urban and rural areas.

05. Which vehicle type dominates the India Automobile Market?

Passenger vehicles dominate the India automobile market due to the growing need for personal transportation, the expansion of ride-hailing services, and a shift in consumer preference toward private vehicle ownership.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.