India Automotive Glass Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2359

November 2024

83

About the Report

India Automotive Glass Market Overview

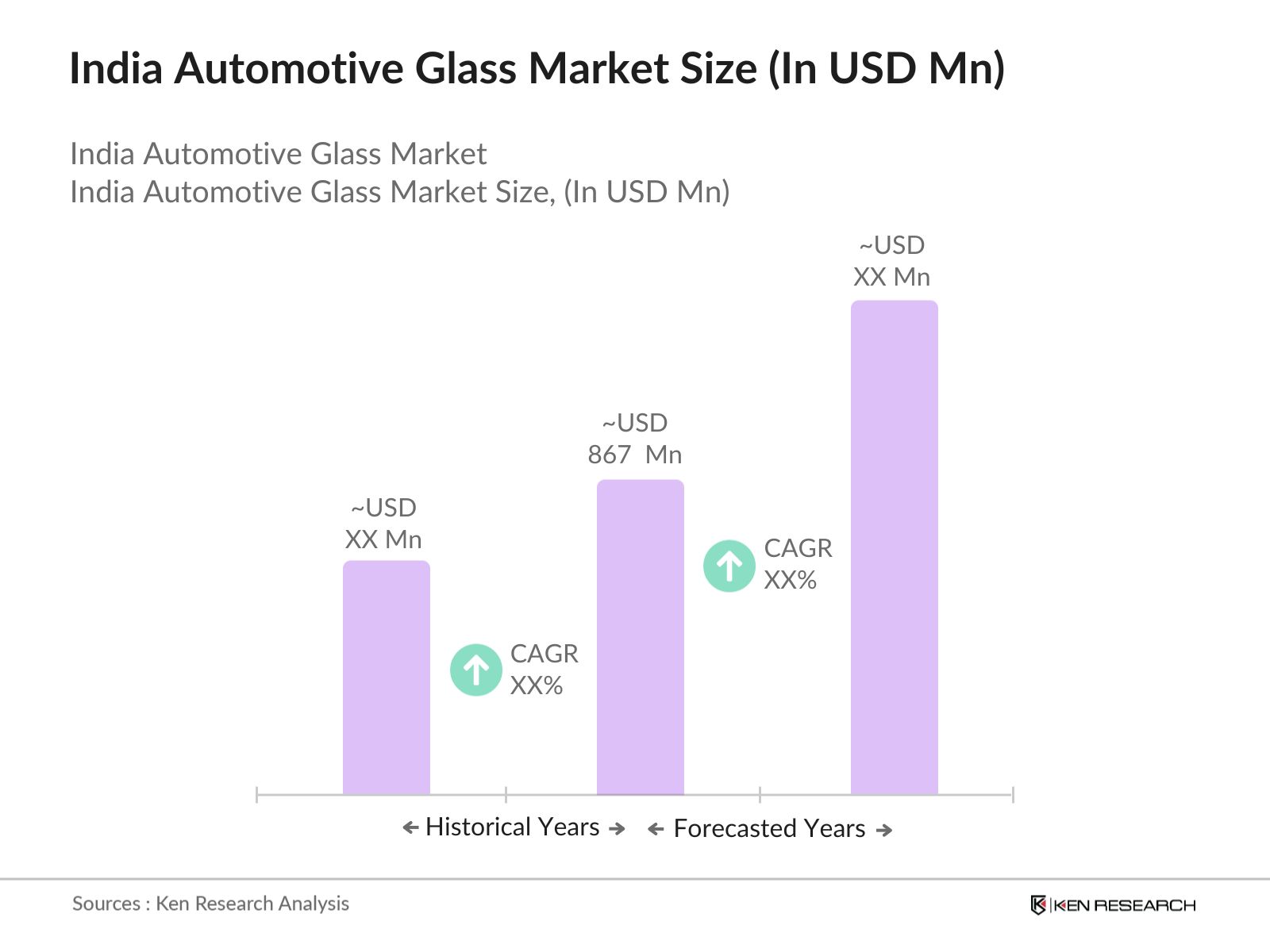

- The India Automotive Glass Market is valued at 867 million, driven by growing demand for safety features in automobiles, the rising production of passenger and commercial vehicles, and the increasing adoption of electric vehicles (EVs). The market growth is supported by government regulations mandating the use of safety glass in vehicles, coupled with the surge in consumer preference for premium features such as UV protection and noise insulation. These factors are pushing manufacturers to innovate and expand their product portfolios with laminated, tempered, and solar control glass options.

- Regions like Chennai, Pune, and Gurugram dominate the India automotive glass market due to their well-established automotive hubs, which house major Original Equipment Manufacturers (OEMs) and automotive glass producers. These regions benefit from a robust supply chain, skilled workforce, and access to raw materials, making them key production centers. Additionally, these cities have proximity to major ports, facilitating the export of automotive glass products to international markets. The strong presence of automotive clusters further cements their dominance in this sector.

- India's transition to BSVI emission norms in 2020 and subsequent EV incentives in 2022 have significantly impacted the automotive sector, including the glass market. The push for cleaner vehicles has increased the demand for lighter, energy-efficient glass products. In 2023, the government provided incentives worth INR 1,500 crore for EV production, encouraging automakers to invest in innovative glass technologies to enhance vehicle efficiency.

India Automotive Glass Market Segmentation

The India Automotive Glass Market is segmented into product and vehicle.

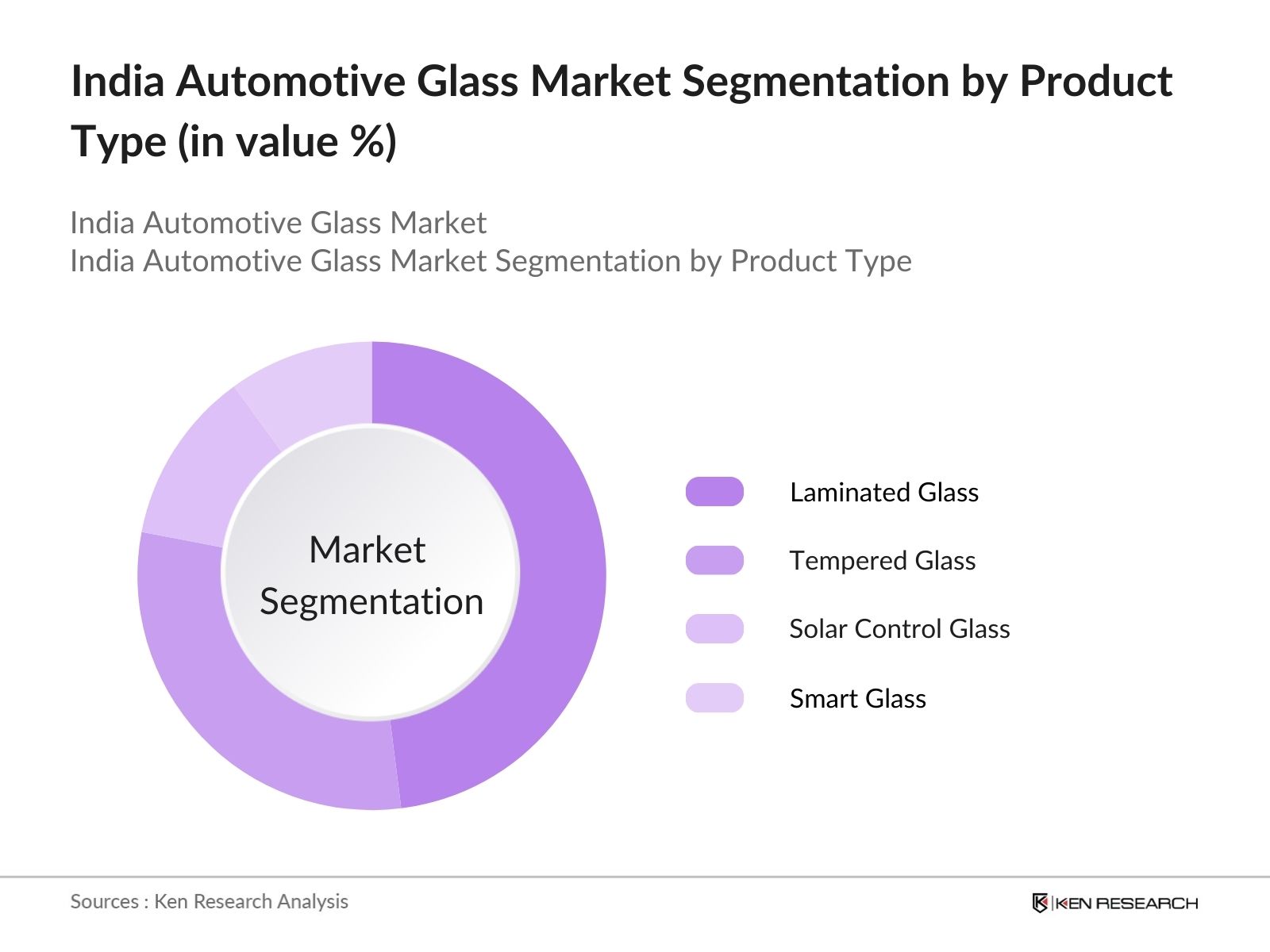

- By Product Type: The market is segmented by product type into laminated glass, tempered glass, solar control glass, and smart glass. Laminated glass holds a dominant market share within this segment, driven by its widespread application in vehicle windshields. Laminated glass provides enhanced safety as it does not shatter easily, making it an essential component in passenger safety systems. Additionally, laminated glass is favored for its soundproofing capabilities and UV protection, further contributing to its demand in both the OEM and aftermarket segments.

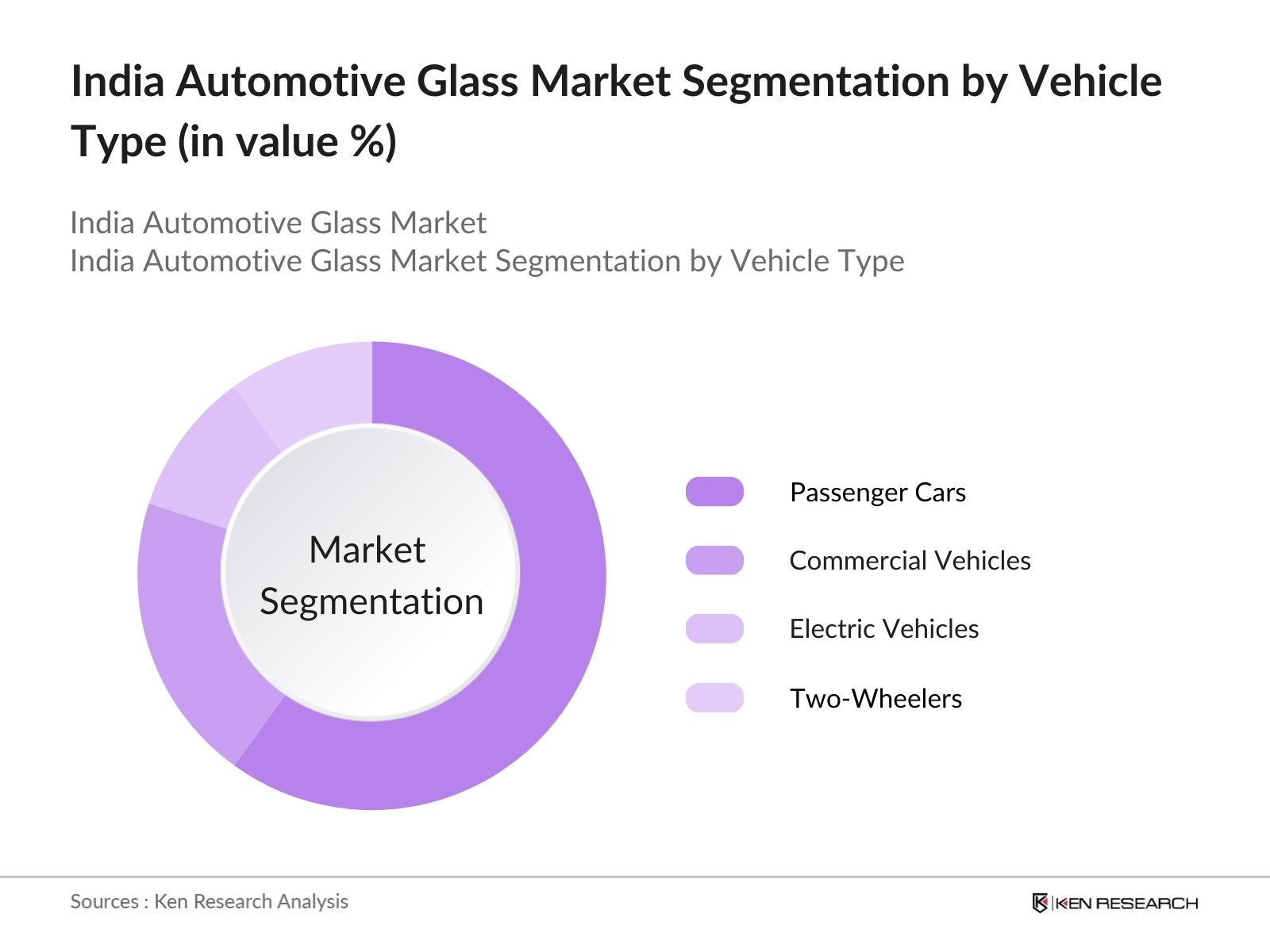

- By Vehicle Type: Indias automotive glass market is also segmented by vehicle type into passenger cars, commercial vehicles, electric vehicles, and two-wheelers. Passenger cars dominate this segment due to their high production volume and increasing consumer preference for vehicles equipped with advanced safety features. The rising demand for electric vehicles, especially in urban areas, further enhances the need for high-quality automotive glass that is both lightweight and energy efficient, supporting the dominance of this sub-segment.

India Automotive Glass Market Competitive Landscape

The India automotive glass market is led by major companies such as Asahi India Glass Ltd., Saint-Gobain Sekurit India Ltd., and Gujarat Borosil Limited. These companies dominate the market due to their established manufacturing capacities, extensive distribution networks, and continuous investment in research and development (R&D) to produce innovative glass products. Additionally, the presence of global players like Nippon Sheet Glass and Xinyi Glass Holdings further intensifies competition, driving technological advancements and price competitiveness.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment (INR Mn) |

Manufacturing Locations |

Revenue (INR Bn) |

Technological Innovations |

|

Asahi India Glass Ltd. |

1984 |

Gurugram, India |

|||||

|

Saint-Gobain Sekurit India |

1997 |

Chennai, India |

|||||

|

Gujarat Borosil Limited |

1988 |

Gujarat, India |

|||||

|

Nippon Sheet Glass Co., Ltd. |

1918 |

Tokyo, Japan |

|||||

|

Xinyi Glass Holdings Ltd. |

1988 |

Hong Kong |

India Automotive Glass Industry Analysis

Growth Drivers

- Increasing Vehicle Production (OEM demand, Aftermarket demand): India's automotive industry saw a production of 4.4 million vehicles in 2023, driving demand for OEM and aftermarket glass. As the country continues to expand its vehicle manufacturing base, automotive glass demand is expected to rise. In 2023, vehicle exports reached 770,000 units, further bolstering the demand for high-quality automotive glass used in windshields, windows, and sunroofs. The rise in vehicle ownership in Tier-2 and Tier-3 cities also contributes to this demand surge.

- Rising Automotive Safety Standards (Safety glass regulations, Windshield safety standards): Automotive safety standards in India are becoming increasingly stringent. The government mandates the use of laminated safety glass in windshields as per AIS-037 regulations, which became more strictly enforced in 2022. The Indian automotive industry, including OEMs and aftermarket suppliers, is adapting to meet these standards. Additionally, the total production of safety glass reached approximately 25 million square meters in 2023, largely driven by these regulatory shifts.

- Government Regulations on Automotive Safety (AIS-037, BSVI norms): Government regulations such as AIS-037 and BSVI standards have impacted the automotive glass market. AIS-037 mandates laminated glass in windshields for increased safety, and the transition to BSVI norms in 2020 led to stricter manufacturing and safety standards for automotive components, including glass. The government's drive for improved vehicle safety is boosting demand for advanced glass products. In 2023, over 3.7 million vehicles were BSVI compliant, requiring higher quality glass for compliance.

Market Challenges

- High Manufacturing Costs (Raw material pricing, Supply chain constraints): Automotive glass manufacturers in India face rising production costs due to volatile raw material prices. Additionally, supply chain disruptions have caused delays in raw material imports, adding to the production challenges. Glass manufacturers have struggled to balance these rising costs while maintaining competitive pricing in a price-sensitive market.

- Environmental Regulations (Emission standards, Sustainable glass production): India's push towards reducing emissions has impacted the automotive glass market, particularly with regulations emphasizing the use of eco-friendly production processes. Glass manufacturers face challenges in adopting low-emission technologies, as the transition requires significant investment. Sustainable production methods have added to the complexity of meeting environmental standards.

India Automotive Glass Market Future Outlook

The India automotive glass market is expected to experience significant growth over the next five years, driven by advancements in glass technology, the rising production of electric vehicles, and the increasing adoption of safety standards. Innovations in lightweight and energy-efficient glass will play a pivotal role in the markets expansion, particularly in the passenger car segment. The growing trend towards electric and autonomous vehicles will further fuel demand for advanced glass solutions such as solar control and smart glass.

Future Market Opportunities

- Development of Smart Glass Technology (Electrochromic glass, Self-tinting glass)

India's automotive glass market is witnessing innovation with the rise of smart glass technologies, such as electrochromic and self-tinting glass, which saw a 15% increase in adoption among premium vehicles in 2023. Smart glass can control light and heat transmission, offering energy efficiency and comfort. This technological advancement presents a lucrative opportunity for automotive glass manufacturers catering to luxury car segments, as OEMs increasingly integrate smart glass for its energy-saving benefits. - Expansion in Rural Markets (Demand from Tier-2 and Tier-3 cities, Aftermarket opportunities)

Rural areas, particularly Tier-2 and Tier-3 cities, are emerging as growth hubs for the automotive aftermarket, including automotive glass. In 2023, vehicle ownership in these regions increased by 12%, driving aftermarket demand for glass replacement. The growing vehicle population in rural India offers a significant opportunity for glass manufacturers and retailers to expand their distribution networks, ensuring quick and cost-effective glass solutions in these areas.

Scope of the Report

|

By Product Type |

Laminated Glass Tempered Glass Solar Control Glass Smart Glass |

|

By Vehicle Type |

Passenger Cars Commercial Vehicles Electric Vehicles Two-Wheelers |

|

By Application |

Windshields Side Windows Rear Windows Sunroofs |

|

By End-User Industry |

OEMs Aftermarket |

|

By Region |

North East West South |

Products

Key Target Audience

Original Equipment Manufacturers (OEMs)

Automotive Glass Manufacturers

Automotive Aftermarket Suppliers

Government and Regulatory Bodies (Ministry of Road Transport and Highways, Bureau of Indian Standards)

Electric Vehicle Manufacturers

Investments and Venture Capitalist Firms

Glass Raw Material Suppliers

Automotive Safety Equipment Manufacturers

Companies

List of Major Players in the India Automotive Glass Market

Asahi India Glass Ltd.

Saint-Gobain Sekurit India Ltd.

Gujarat Borosil Limited

Nippon Sheet Glass Co., Ltd.

Xinyi Glass Holdings Ltd.

Fuyao Glass Industry Group Co., Ltd.

Pilkington Automotive Ltd.

Guardian Industries

AGC Glass Europe

Vitro, S.A.B. de C.V.

Magna International Inc.

Independent Glass Co. Ltd.

Central Glass Co., Ltd.

Glavostek Group

PPG Industries

Table of Contents

1. India Automotive Glass Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Automotive Glass Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Automotive Glass Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Production (OEM demand, Aftermarket demand)

3.1.2. Rising Automotive Safety Standards (Safety glass regulations, Windshield safety standards)

3.1.3. Government Regulations on Automotive Safety (AIS-037, BSVI norms)

3.1.4. Growth in Electric Vehicles (EV market penetration, EV glass needs)

3.2. Market Challenges

3.2.1. High Manufacturing Costs (Raw material pricing, Supply chain constraints)

3.2.2. Environmental Regulations (Emission standards, Sustainable glass production)

3.2.3. Dependence on Import of Raw Materials (Global supply chain disruption, Import duties)

3.3. Opportunities

3.3.1. Development of Smart Glass Technology (Electrochromic glass, Self-tinting glass)

3.3.2. Expansion in Rural Markets (Demand from Tier-2 and Tier-3 cities, Aftermarket opportunities)

3.3.3. Strategic Partnerships with OEMs (Automotive partnerships, Localization strategies)

3.4. Trends

3.4.1. Use of Lightweight Glass for Fuel Efficiency (Tempered glass, Laminated glass)

3.4.2. Integration of Solar Glass in EVs (Solar roofs, Energy-efficient glass)

3.4.3. Growing Adoption of Windshield HUD (Head-Up Display, AR integration in windshields)

3.5. Government Regulation

3.5.1. Automotive Industry Standards (AIS-037 compliance, Road safety norms)

3.5.2. Emission Reduction Initiatives (BSVI, EV incentives)

3.5.3. National Safety Standards for Glass Manufacturing

3.5.4. Public-Private Partnerships for Localization of Glass Production

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Automotive Glass Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Laminated Glass

4.1.2. Tempered Glass

4.1.3. Solar Control Glass

4.1.4. Smart Glass

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.2.4. Two-Wheelers

4.3. By Application (In Value %)

4.3.1. Windshields

4.3.2. Side Windows

4.3.3. Rear Windows

4.3.4. Sunroofs

4.4. By End-User (In Value %)

4.4.1. OEMs

4.4.2. Aftermarket

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Southern India

4.5.3. Western India

4.5.4. Eastern India

5. India Automotive Glass Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Asahi India Glass Ltd.

5.1.2. Saint-Gobain Sekurit India Ltd.

5.1.3. Gujarat Borosil Limited

5.1.4. Nippon Sheet Glass Co., Ltd.

5.1.5. Xinyi Glass Holdings Limited

5.1.6. Fuyao Glass Industry Group Co., Ltd.

5.1.7. Pilkington Automotive Ltd.

5.1.8. Guardian Industries

5.1.9. AGC Glass Europe

5.1.10. Vitro, S.A.B. de C.V.

5.1.11. Central Glass Co., Ltd.

5.1.12. PPG Industries

5.1.13. Magna International Inc.

5.1.14. Independent Glass Co. Ltd.

5.1.15. Glavostek Group

5.2 Cross Comparison Parameters (Product Portfolio, Production Capacity, Manufacturing Locations, R&D Investment, Key Patents, Strategic Partnerships, Supply Chain Integration, Revenue Breakdown)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Automotive Glass Market Regulatory Framework

6.1. Safety Standards for Glass (Crash test standards, Windshield safety standards)

6.2. Compliance Requirements (AIS standards, Emission regulations)

6.3. Certification Processes (ISO certification, Industry approvals)

7. India Automotive Glass Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Automotive Glass Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Automotive Glass Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact US

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping out key variables that impact the India automotive glass market, including vehicle production trends, technological advancements, and regulatory requirements. This is done through a combination of secondary research, utilizing proprietary databases and government reports.

Step 2: Market Analysis and Construction

Historical market data is analyzed to evaluate the growth trajectory of the India automotive glass market. The analysis focuses on market penetration, vehicle production, and the ratio of OEM demand to aftermarket demand. Data from trusted sources, such as the Ministry of Road Transport and Highways, is used to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, including manufacturers and OEM representatives, are conducted to validate market assumptions and refine data estimates. These insights help address operational and financial challenges faced by the industry.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing insights from expert consultations, historical data, and secondary research to produce a comprehensive analysis. This ensures the accuracy and relevance of the final report.

Frequently Asked Questions

01. How big is the India Automotive Glass Market?

The India Automotive Glass Market is valued at 867 million, driven by rising vehicle production and increasing demand for advanced glass technologies.

02. What are the challenges in the India Automotive Glass Market?

Key challenges include high manufacturing costs for advanced glass products and supply chain disruptions, particularly in the sourcing of raw materials.

03. Who are the major players in the India Automotive Glass Market?

Major players include Asahi India Glass Ltd., Saint-Gobain Sekurit India Ltd., Gujarat Borosil Limited, Nippon Sheet Glass Co., Ltd., and Xinyi Glass Holdings Ltd.

04. What are the growth drivers of the India Automotive Glass Market?

The market is driven by rising vehicle production, government regulations mandating safety glass, and the growing adoption of electric vehicles in India.

05. Which product type dominates the India Automotive Glass Market?

Laminated glass dominates the market, especially in windshields, due to its safety benefits and soundproofing capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.