India Automotive Lighting Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD7926

December 2024

93

About the Report

India Automotive Lighting Market Overview

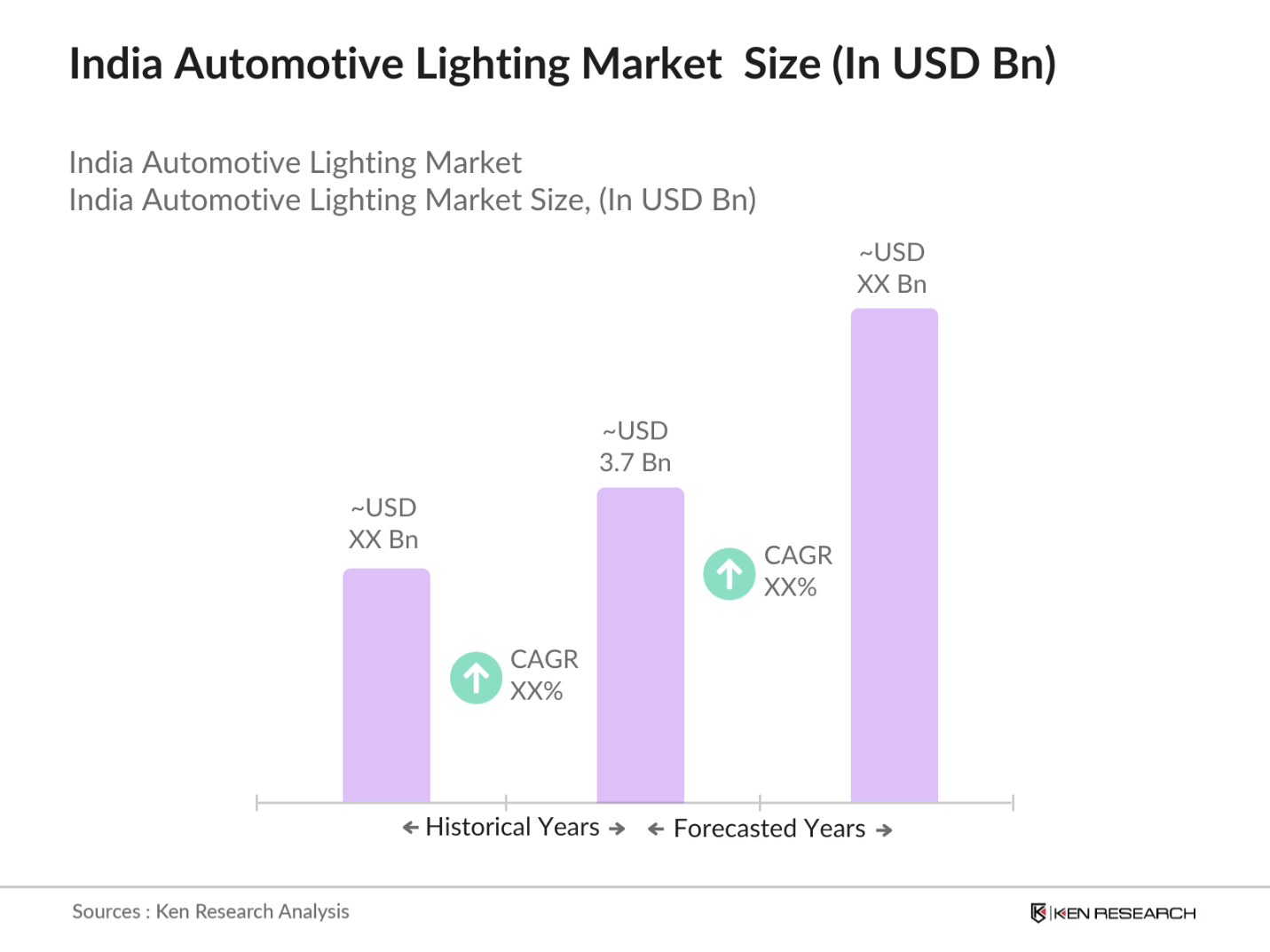

- The India automotive lighting market, valued at USD 3.7 billion, is driven by several key factors. The ongoing advancements in lighting technologies, such as LED (Light Emitting Diode) and OLED (Organic Light Emitting Diode), contribute to improved efficiency, visibility, and design possibilities, thereby driving the market.

- Major metropolitan areas like Delhi, Mumbai, and Bangalore dominate the market due to their high vehicle density and rapid urbanization. These cities have a significant concentration of automotive manufacturers and consumers, leading to increased demand for advanced lighting solutions.

- The Bharat Stage Emission Standards (BSES) play a crucial role in shaping the automotive lighting market in India. Implemented by the Government of India, these standards set emission limits for vehicles, thereby influencing the design and functionality of automotive components, including lighting systems. The stringent regulations push manufacturers to adopt energy-efficient lighting technologies that comply with environmental norms. As of 2023, the BSES has prompted many vehicle manufacturers to integrate advanced lighting systems that not only meet regulatory requirements but also enhance energy efficiency and vehicle safety, driving the growth of the automotive lighting sector.

India Automotive Lighting Market Segmentation

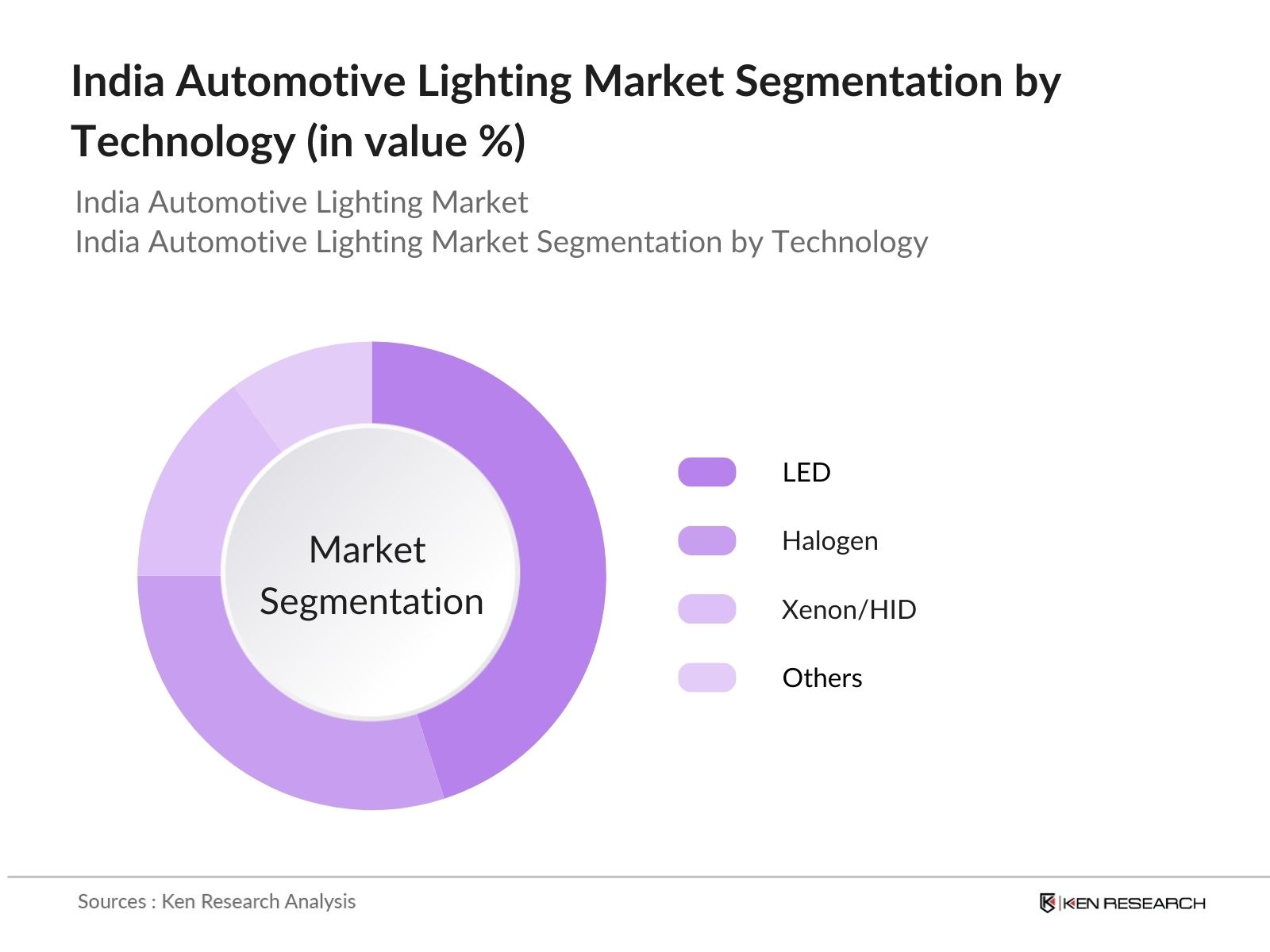

By Technology: The market is segmented by technology into Halogen, Xenon/HID, LED, and Others. LED technology holds a dominant market share due to its energy efficiency, longer lifespan, and superior illumination compared to traditional lighting solutions. The increasing adoption of LED lighting in vehicles is driven by consumer preference for modern aesthetics and enhanced safety features.

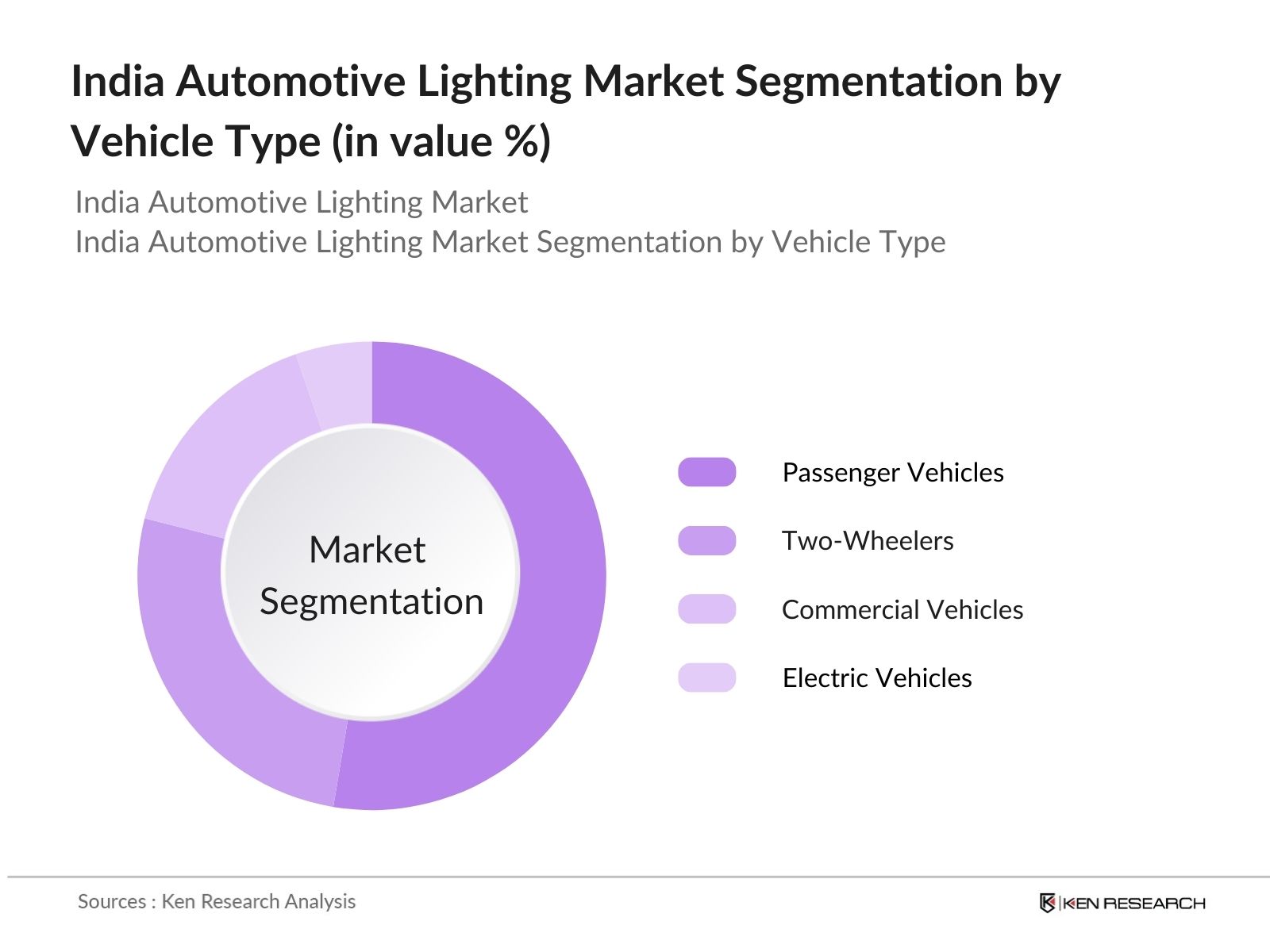

By Vehicle Type: The market is further segmented by vehicle type into Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Electric Vehicles, and Others. Passenger vehicles account for the largest market share, attributed to the higher production and sales volumes in this segment. The demand for advanced lighting systems in passenger vehicles is propelled by consumer expectations for safety and aesthetics.

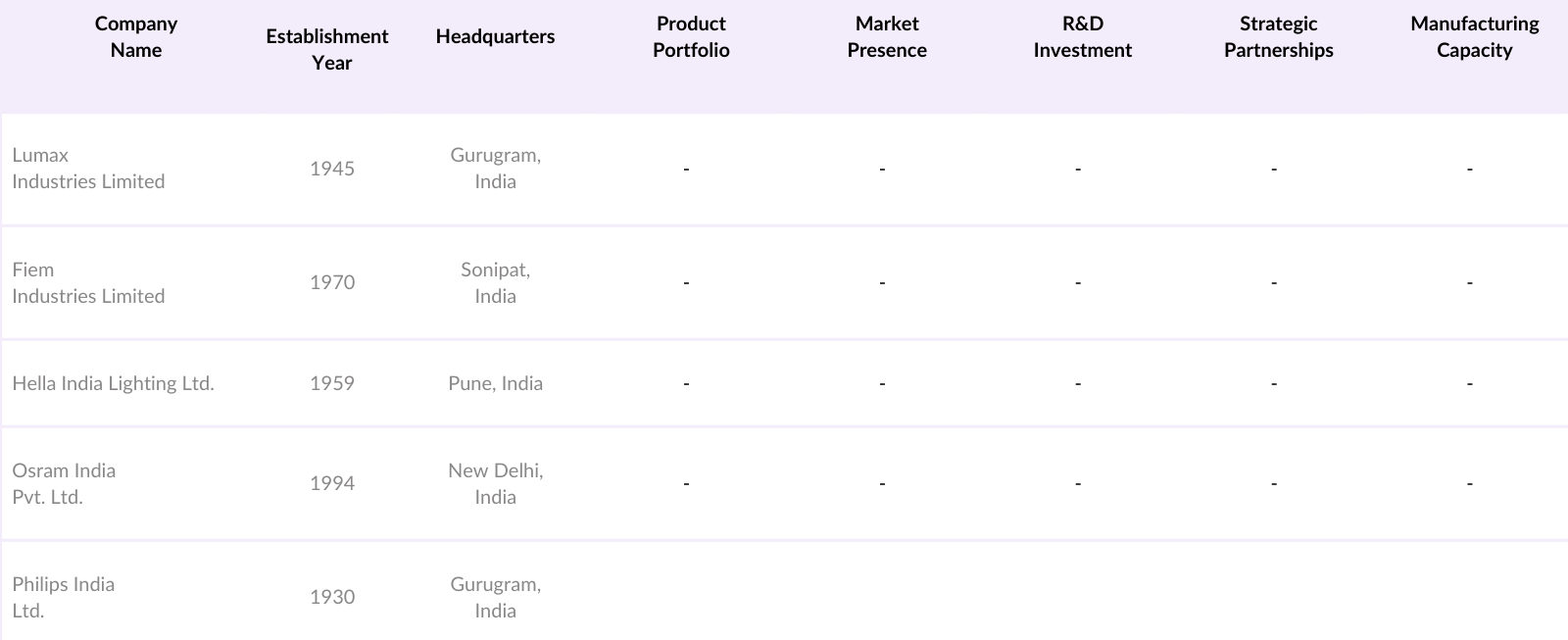

India Automotive Lighting Market Competitive Landscape

The India automotive lighting market is characterized by the presence of several key players who contribute significantly to the industry's growth. These companies are engaged in the manufacturing and supply of a wide range of automotive lighting solutions, catering to both domestic and international markets.

India Automotive Lighting Industry Analysis

Growth Drivers

- Technological Advancements in Lighting Solutions: The automotive industry in India is witnessing significant technological advancements in lighting solutions, particularly with the adoption of LED and OLED technologies. These innovations offer enhanced energy efficiency, longer lifespan, and improved illumination compared to traditional halogen lamps. The Indian government's push for energy-efficient technologies has further accelerated this transition. For instance, the National Electric Mobility Mission Plan (NEMMP) aims to promote electric and hybrid vehicles, which often incorporate advanced lighting systems to optimize energy consumption.

- Increasing Vehicle Production and Sales: India's automotive sector has experienced substantial growth in vehicle production and sales. According to the Society of Indian Automobile Manufacturers (SIAM), the total production of vehicles, including passenger and commercial vehicles, reached approximately 29 million units in the fiscal year 2022-2023. This surge is attributed to rising disposable incomes, urbanization, and a growing middle-class population.

- Government Regulations on Vehicle Safety: The Indian government has implemented stringent regulations to enhance vehicle safety, directly impacting the automotive lighting market. The Central Motor Vehicles Rules (CMVR) mandate specific lighting requirements for vehicles, including the use of high-intensity headlamps and proper signaling devices. Additionally, the Bharat New Vehicle Safety Assessment Program (BNVSAP) emphasizes the importance of adequate lighting systems in vehicles to ensure road safety.

Market Challenges

- High Cost of Advanced Lighting Technologies: The adoption of advanced lighting technologies, such as LEDs and OLEDs, is often associated with higher costs compared to traditional halogen lamps. This price disparity poses a challenge for manufacturers aiming to offer cost-effective solutions, particularly in the budget and mid-range vehicle segments. The higher initial investment required for advanced lighting systems can deter both manufacturers and consumers, especially in a price-sensitive market like India. Efforts to reduce production costs and economies of scale are essential to overcome this challenge and facilitate wider adoption of advanced lighting technologies.

- Limited Adoption in Low-End Vehicle Segments: While premium and mid-range vehicles increasingly incorporate advanced lighting systems, low-end vehicle segments often continue to rely on traditional lighting solutions. This limited adoption is primarily due to cost constraints and the focus on affordability in these segments. Manufacturers targeting the budget-conscious consumer base may prioritize essential features over advanced lighting technologies, resulting in slower market penetration in this segment.

India Automotive Lighting Market Future Outlook

Over the next five years, the India automotive lighting market is expected to experience significant growth. This expansion is anticipated to be driven by continuous advancements in lighting technologies, increasing vehicle production, and a growing emphasis on vehicle safety and aesthetics. The shift towards energy-efficient solutions, such as LED and OLED lighting, is likely to further propel market growth.

Future Market Opportunities

- Growth in Electric Vehicle Segment: The electric vehicle (EV) market in India is poised for significant growth, driven by government initiatives and increasing environmental awareness. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme aims to promote the adoption of EVs through subsidies and incentives. As EVs often incorporate advanced lighting systems to enhance energy efficiency and aesthetics, this growth presents a substantial opportunity for the automotive lighting market. Manufacturers can capitalize on this trend by developing lighting solutions tailored for EVs, aligning with the industry's shift towards sustainable mobility.

- Expansion in Rural and Semi-Urban Markets: The expansion of the automotive market into rural and semi-urban areas of India offers new growth avenues for the automotive lighting industry. Improved infrastructure and rising incomes in these regions have led to increased vehicle ownership. According to the National Sample Survey Office (NSSO), rural households owning vehicles have seen a steady rise, indicating a growing market for automotive components, including lighting systems. Companies can tap into this opportunity by offering affordable and durable lighting solutions tailored to the specific needs of rural consumers.

Scope of the Report

|

By Technology |

Halogen |

|

By VehicleType |

Passenger Vehicles |

|

By Application |

Front/Headlamps |

|

By SalesChannel |

Original EquipmentManufacturers(OEMs) |

|

By Region |

North |

Products

Key Target Audience

Automotive Manufacturers

Automotive Component Suppliers

Vehicle Lighting System Integrators

Automotive Aftermarket Distributors

Government and Regulatory Bodies (e.g., Ministry of Road Transport and Highways)

Investor and Venture Capitalist Firms

Automotive Industry Associations

Research and Development Organizations

Companies

Major Players in the Market

Lumax Industries Limited

Fiem Industries Limited

Hella India Lighting Ltd.

Osram India Pvt. Ltd.

Philips India Ltd.

Koito Manufacturing Co., Ltd.

Valeo Lighting Systems

Magneti Marelli India Pvt. Ltd.

Varroc Engineering Ltd.

Minda Industries Ltd.

Neolite ZKW Lightings Pvt. Ltd.

Autolite (India) Ltd.

Unitech Machines Ltd.

Jagan Lamps Ltd.

Suprajit Engineering Ltd.

Table of Contents

India Automotive Lighting Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Automotive Lighting Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Automotive Lighting Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements in Lighting Solutions

3.1.2. Increasing Vehicle Production and Sales

3.1.3. Government Regulations on Vehicle Safety

3.1.4. Rising Consumer Preference for Aesthetic Features

3.2. Market Challenges

3.2.1. High Cost of Advanced Lighting Technologies

3.2.2. Limited Adoption in Low-End Vehicle Segments

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Growth in Electric Vehicle Segment

3.3.2. Expansion in Rural and Semi-Urban Markets

3.3.3. Aftermarket Sales Potential

3.4. Trends

3.4.1. Shift Towards LED and OLED Technologies

3.4.2. Integration of Smart Lighting Systems

3.4.3. Customization and Personalization in Lighting

3.5. Government Regulations

3.5.1. Bharat Stage Emission Standards

3.5.2. Automotive Industry Standards (AIS) for Lighting

3.5.3. Incentives for Energy-Efficient Technologies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

India Automotive Lighting Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Halogen

4.1.2. Xenon/HID

4.1.3. LED

4.1.4. Others

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Two-Wheelers

4.2.4. Electric Vehicles

4.2.5. Others

4.3. By Application (In Value %)

4.3.1. Front/Headlamps

4.3.2. Rear Lighting

4.3.3. Side Lighting

4.3.4. Interior Lighting

4.3.5. Fog Lamps

4.4. By Sales Channel (In Value %)

4.4.1. Original Equipment Manufacturers (OEMs)

4.4.2. Aftermarket

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

India Automotive Lighting Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lumax Industries Limited

5.1.2. Fiem Industries Limited

5.1.3. Hella India Lighting Ltd.

5.1.4. Osram India Pvt. Ltd.

5.1.5. Philips India Ltd.

5.1.6. Koito Manufacturing Co., Ltd.

5.1.7. Valeo Lighting Systems

5.1.8. Magneti Marelli India Pvt. Ltd.

5.1.9. Varroc Engineering Ltd.

5.1.10. Minda Industries Ltd.

5.1.11. Neolite ZKW Lightings Pvt. Ltd.

5.1.12. Autolite (India) Ltd.

5.1.13. Unitech Machines Ltd.

5.1.14. Jagan Lamps Ltd.

5.1.15. Suprajit Engineering Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Investment, Regional Presence, Strategic Initiatives, Manufacturing Capacity, Technological Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Automotive Lighting Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

India Automotive Lighting Market Future Projections (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Automotive Lighting Market Future Segmentation

8.1. By Technology (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Application (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

India Automotive Lighting Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Automotive Lighting Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Automotive Lighting Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple automotive lighting manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Automotive Lighting market.

Frequently Asked Questions

01. How big is the India Automotive Lighting Market?

The India automotive lighting market is valued at USD 3.7 billion, driven by advancements in lighting technologies and increasing vehicle production. The markets growth reflects a trend toward energy-efficient lighting solutions and heightened safety standards, underpinned by consumer demand for superior lighting.

02. What are the challenges in the India Automotive Lighting Market?

Challenges in the India automotive lighting market include high costs of LED and advanced lighting technologies, limited adoption in budget segments, and occasional supply chain disruptions impacting raw material availability and production timelines. These obstacles restrict market growth potential, especially among price-sensitive consumers.

03. Who are the major players in the India Automotive Lighting Market?

Key players in the India automotive lighting market include Lumax Industries Limited, Fiem Industries Limited, Hella India Lighting Ltd., Osram India Pvt. Ltd., and Philips India Ltd. These companies dominate due to their robust product portfolios, extensive market presence, and continuous investment in R&D to deliver innovative solutions.

04. What are the growth drivers of the India Automotive Lighting Market?

The India automotive lighting market is propelled by factors such as increasing vehicle production, government safety regulations, and technological advancements in lighting. The shift towards energy-efficient lighting options like LEDs also drives market expansion, with consumer preference for safety and aesthetic appeal further fueling demand.

05. Which technology segment holds the largest market share?

LED technology holds the largest share in the India automotive lighting market. Its popularity stems from its energy efficiency, long lifespan, and superior illumination, making it a preferred choice for both consumers and automotive manufacturers aiming to meet safety and environmental standards.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.