India Automotive Sensors Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD1600

October 2024

93

About the Report

India Automotive Sensors Market Overview

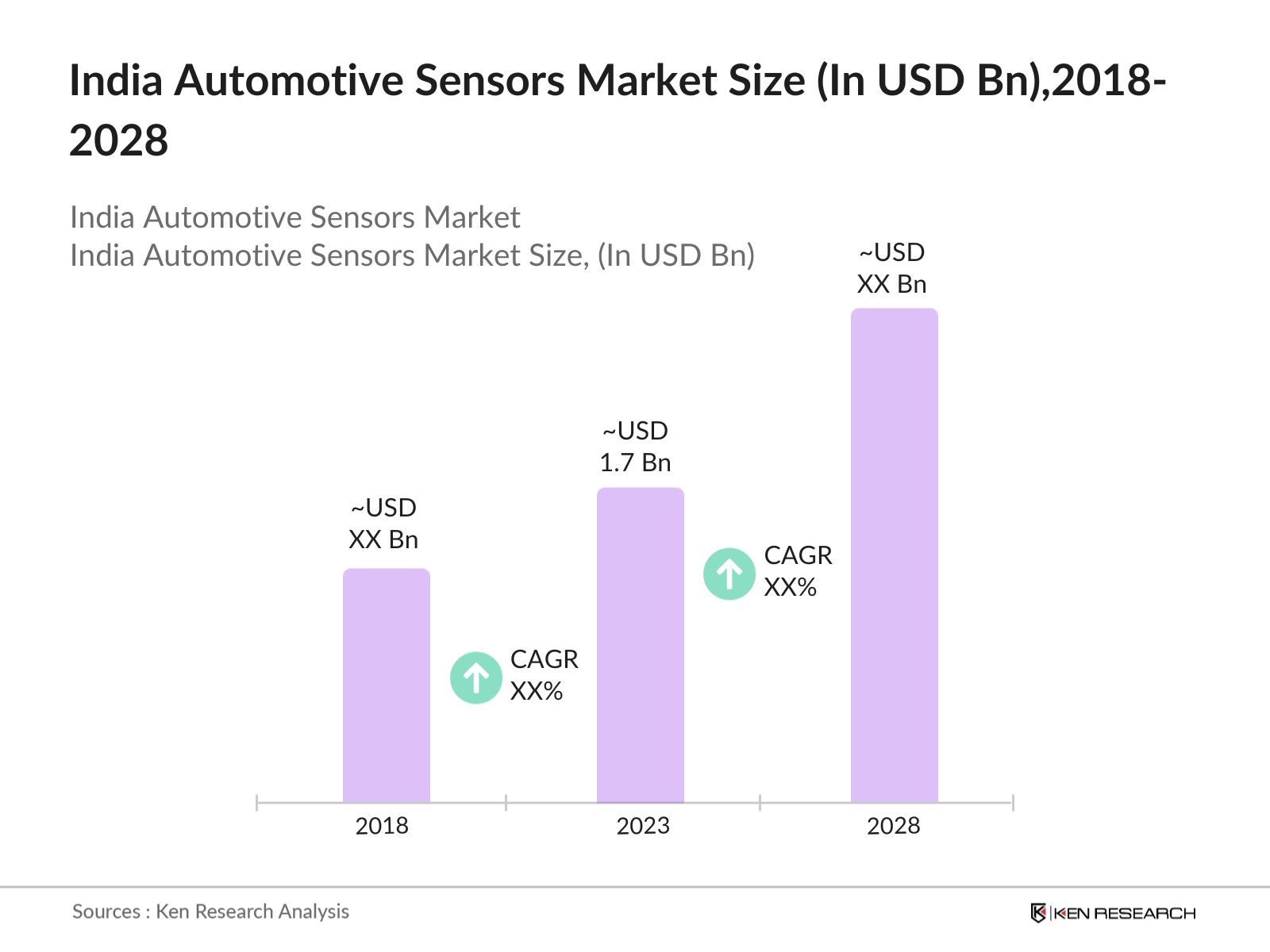

- The India Automotive Sensors Market was valued at USD 1.7 billion in 2023. The primary drivers of this growth include the increasing adoption of advanced driver assistance systems (ADAS), stringent government regulations for vehicle safety and emissions, and the rising demand for electric vehicles (EVs). The integration of sensors in vehicles enhances performance, safety, and comfort, thereby driving market growth.

- The key players in the India automotive sensors market include Robert Bosch GmbH, Continental AG, Denso Corporation, Infineon Technologies AG, and Sensata Technologies. These companies have a strong foothold in the market due to their extensive product portfolios, continuous innovation, and strategic partnerships with automotive manufacturers.

- In 2023, Robert Bosch GmbH announced the launch of a new generation of MEMS sensors for automotive applications. This development is expected to enhance the precision and reliability of automotive systems, thereby increasing vehicle safety and performance. Boschs new sensors are designed to support the latest automotive trends, including autonomous driving and electrification.

- The state of Maharashtra dominates the market in 2023, primarily due to the presence of major automotive manufacturing hubs like Pune and Mumbai. The states robust infrastructure, skilled workforce, and favorable government policies have attracted significant investments from leading automotive manufacturers and sensor suppliers.

India Automotive Sensors Market Segmentation

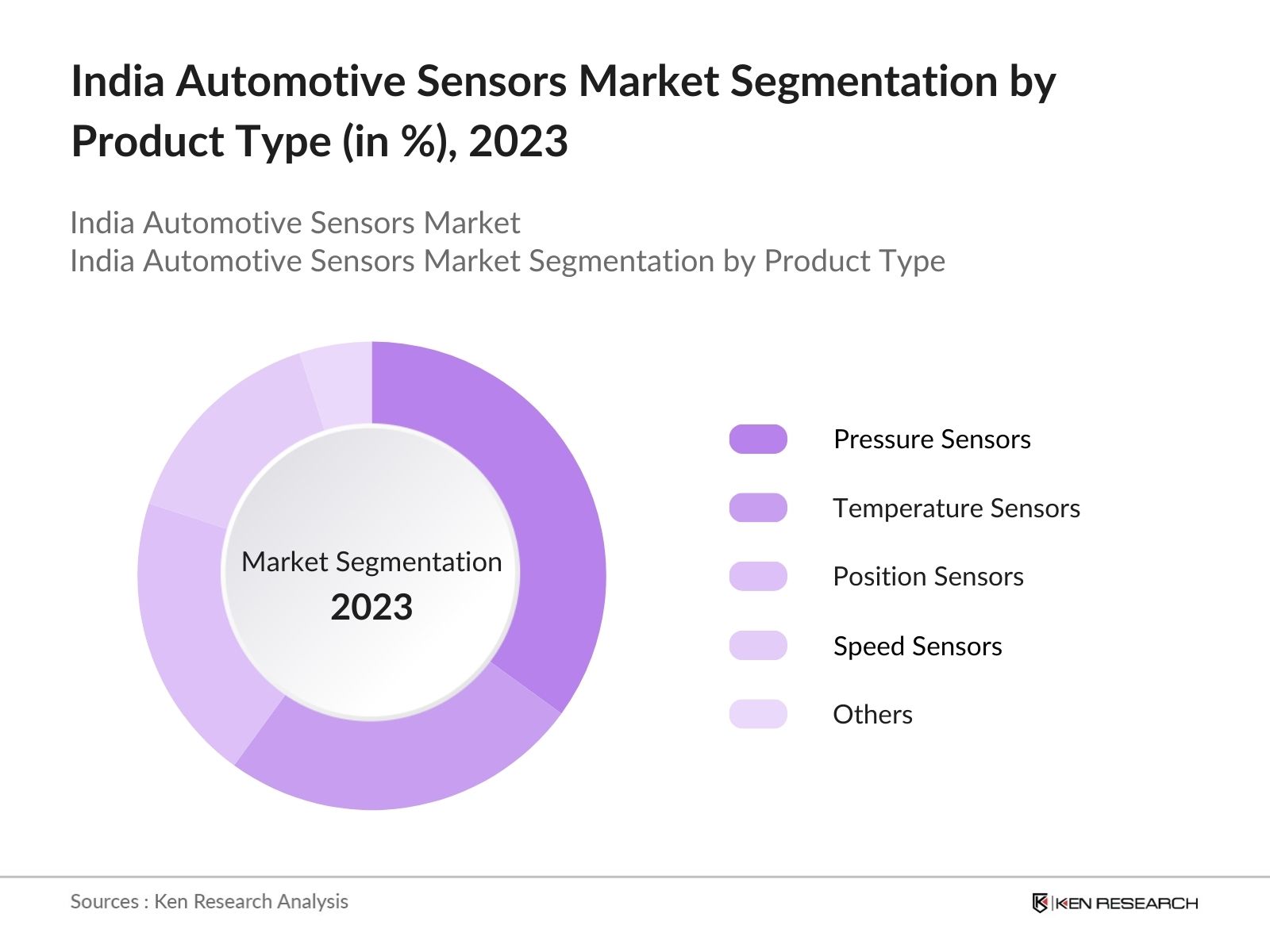

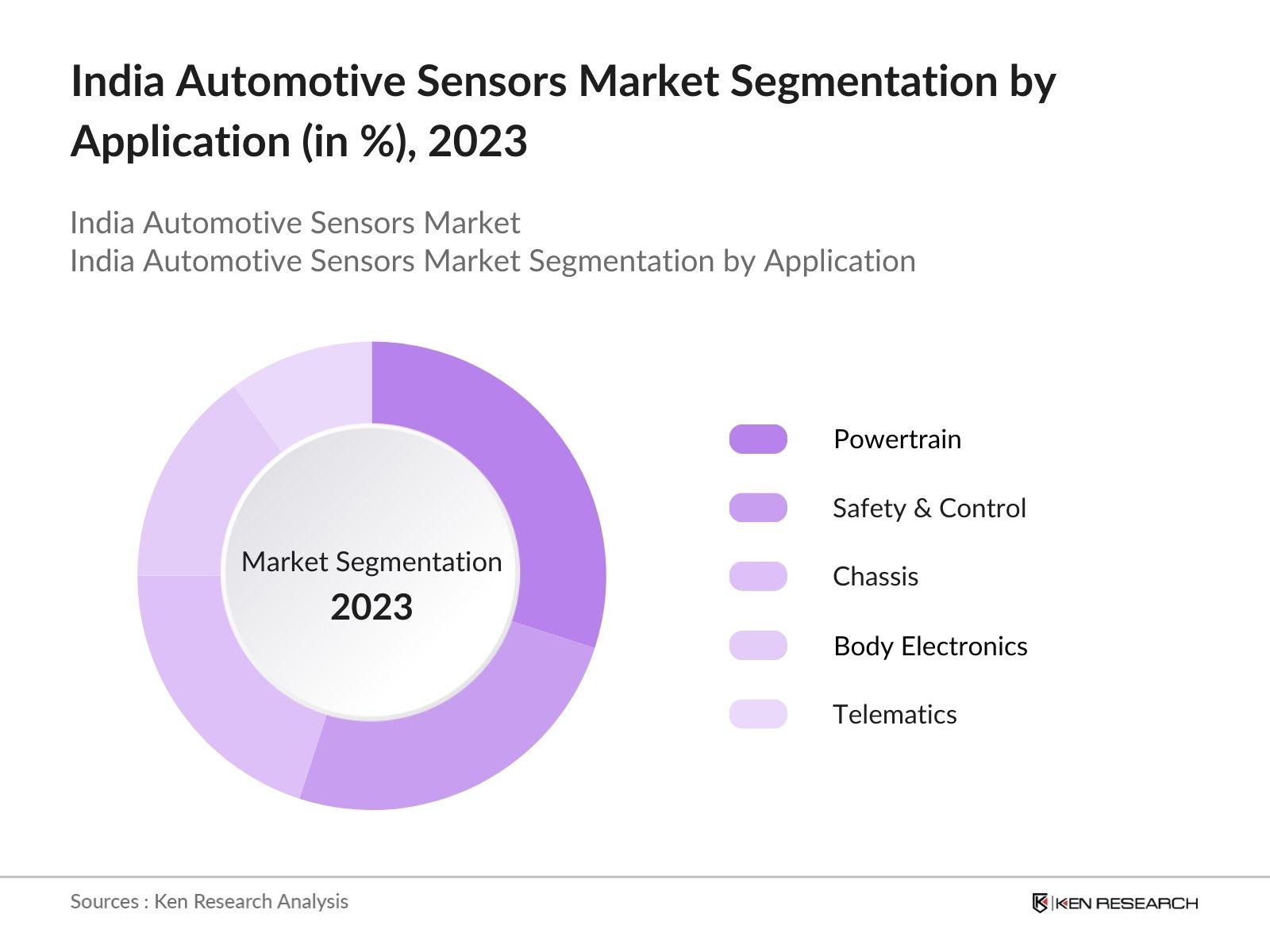

The India AI Market is segmented into different factors like by product type, by application and by region.

By Product Type: The market is segmented by product type into Pressure Sensors, Temperature Sensors, Position Sensors, Speed Sensors, Others. In 2023, pressure sensors held a dominant market under the product type segmentation. This dominance is attributed to the increasing integration of pressure sensors in various automotive systems, such as tire pressure monitoring systems (TPMS) and fuel injection systems, which are critical for vehicle safety and efficiency.

By Application: The market is segmented by application into Powertrain, Safety & Control, Chassis, Body Electronics, Telematics. In 2023, the powertrain application segment held a dominant market share due to the growing demand for efficient and emission-compliant engines, which require advanced sensor technologies to monitor and control various engine parameters, enhancing overall vehicle performance and compliance with stringent emission norms.

By Region: The market is segmented by region by north, south, east and west. In 2023, the northern region was dominating the market that is driven by the concentration of automotive manufacturing units, industrial infrastructure, including well-developed transportation networks, logistics facilities, and proximity to major ports. This infrastructure supports efficient manufacturing and distribution operations, making it an attractive location for automotive and sensor manufacturers.

India Automotive Sensors Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Robert Bosch GmbH |

1886 |

Stuttgart, Germany |

|

Continental AG |

1871 |

Hanover, Germany |

|

Denso Corporation |

1949 |

Kariya, Japan |

|

Infineon Technologies |

1999 |

Neubiberg, Germany |

|

Sensata Technologies |

1916 |

Attleboro, USA |

- Continental AG: In February 2023, Continental AG introduced a high-speed e-motor position sensor (e-RPS), designed to be compact and efficient. This sensor is suitable for various electric vehicle (EV) motors, highlighting Continental's commitment to supporting the growing EV market in India and globally.

- Infineon Technologies: In November 2022, Infineon Technologies AG introduced the XENSIV TLE4971 family as the newest addition to their current sensor series designed for automotive applications. These devices provide accurate magnetic current sensing by utilizing proprietary temperature and stress compensation techniques, eliminating the negative impacts of magnetic cores such as hysteresis or saturation effects.

India Automotive Sensors Market Analysis

India Automotive Sensors Market Growth Drivers

- Increase in Vehicle Electrification: The rising trend of vehicle electrification, including the shift towards electric and hybrid vehicles, is significantly driving the demand for automotive sensors. Electric vehicles require advanced sensors for battery management systems, motor control, and ensuring overall vehicle safety and performance

- Government Push for Advanced Driver Assistance Systems (ADAS): The Indian government's mandate for implementing ADAS in all new vehicles by 2024 has accelerated the adoption of sensors like LiDAR, radar, and ultrasonic sensors. According to a study by the National Highway Traffic Safety Administration (NHTSA) in the United States, vehicles equipped with forward-collision warning and autonomous emergency braking systems experienced 50% fewer rear-end crashes.

- Rise in Passenger Vehicle Sales: Passenger vehicle sales in India have experienced substantial growth, with 3.6 million units in 2023, according to the Federation of Automobile Dealers Associations (FADA). This increase is attributed to the growing middle-class population and improving economic conditions. The expanding passenger vehicle market necessitates the integration of various sensors to enhance safety, performance, and comfort, driving the automotive sensors market forward.

India Automotive Sensors Market Challenges

- High Cost of Advanced Sensor Technologies Advanced sensor technologies, such as LiDAR and radar, significantly increase the overall cost of vehicles. This poses a challenge for manufacturers in maintaining profitability while offering affordable prices, particularly in the budget-sensitive markets. The high cost of these technologies can limit their adoption in mid-range and economy vehicles, restricting market growth.

- Supply Chain Disruptions Global supply chain disruptions, such as semiconductor shortages, have severely impacted the production of automotive sensors. These disruptions lead to delays, increased costs, and reduced availability of essential components, affecting the entire automotive industry's ability to meet market demands efficiently. Such instability in the supply chain can hamper the growth of the automotive sensors market.

India Automotive Sensors Market Government Initiatives

- Production Linked Incentive (PLI) Scheme: The PLI scheme for the automotive sector, launched in 2021 with a financial outlay of INR 25,938 crore, aims to boost domestic manufacturing and attract investments. In December 2023, the Ministry of Heavy Industries extended the tenure of the scheme by one year, with incentives now applicable for five consecutive financial years starting from 2023-24. This initiative supports the production of high-value sensor technologies, encouraging manufacturers to develop innovative sensor solutions locally and reduce dependency on imports.

- Implementation of Greenfield Access-Controlled Corridors: The government has initiated the implementation of 21 greenfield access-controlled corridors, with approximately 3,336 km already completed. These corridors are designed to facilitate high-speed transportation, reduce travel time, and improve road safety. The development of these corridors will necessitate the integration of advanced sensor technologies for traffic management and vehicle monitoring, thereby driving the demand for automotive sensors.

India Automotive Sensors Market Future Outlook

The India automotive sensors market is anticipated to grow substantially by 2028. This growth is anticipated to be driven by the increasing penetration of autonomous vehicles, advancements in sensor technologies, and the expansion of the EV market. Additionally, government initiatives promoting smart transportation systems and safety regulations will further propel market growth.

Market Trends

- Rapid Growth in Electric Vehicle Segment: The electric vehicle (EV) segment is anticipated to expand rapidly due to increasing environmental concerns, government incentives, and advancements in battery technology. Over the next five years, the market will see a significant rise in the adoption of EVs, requiring sophisticated sensors for battery management, motor control, and safety features. The development of a robust charging infrastructure will further support this growth, enhancing the demand for related sensor technologies.

- Integration of IoT in Automotive Industry: The integration of Internet of Things (IoT) technology in the automotive industry is projected to increase, leading to smarter and more connected vehicles. IoT-enabled sensors will play a vital role in real-time data collection, vehicle-to-vehicle (V2V) communication, and predictive maintenance. This trend will enhance vehicle performance, safety, and efficiency, driving the demand for advanced automotive sensors.

Scope of the Report

|

By Product Type |

Pressure Sensors Temperature Sensors Position Sensors Speed Sensors Others |

|

By Application |

Powertrain Safety & Control Chassis Body Electronics Telematics |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities who can benefit by subscribing this report:

Automotive Research Institutes

Original Equipment Manufacturers (OEMs)

Electric Vehicle Manufacturers

Autonomous Vehicle Developers

Automotive Software Developers

Insurance Companies

Automotive Transportation Departments

Investment and VC Firms

Government Regulatory Bodies (Vehicle Safety Certification Bodies)

Companies

Players Mention in the Report:

Robert Bosch GmbH

Continental AG

Denso Corporation

Infineon Technologies AG

Sensata Technologies

NXP Semiconductors

Analog Devices, Inc.

Delphi Technologies

STMicroelectronics

Valeo

ZF Friedrichshafen AG

TE Connectivity

Hella GmbH & Co. KGaA

Magna International Inc.

Texas Instruments Incorporated

Table of Contents

1. India Automotive Sensors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Automotive Sensors Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Automotive Sensors Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of ADAS Technologies

3.1.2. Government Regulations and Safety Standards

3.1.3. Increase in Vehicle Electrification

3.1.4. Technological Advancements in Sensor Technologies

3.2. Restraints

3.2.1. High Cost of Advanced Sensor Technologies

3.2.2. Supply Chain Disruptions

3.2.3. Lack of Standardization

3.2.4. Stringent Regulatory Requirements

3.3. Opportunities

3.3.1. Expansion of Electric Vehicle Market

3.3.2. Development of Autonomous Vehicles

3.3.3. Integration of IoT in Automotive Industry

3.3.4. Growth of Connected Car Market

3.4. Trends

3.4.1. Increasing Use of AI and Machine Learning

3.4.2. Adoption of Smart Sensors

3.4.3. Focus on Vehicle Safety

3.4.4. Rise in Aftermarket Sensor Sales

3.5. Government Regulation

3.5.1. Vehicle Safety Standards

3.5.2. Emission Norms

3.5.3. Incentives for Electric Vehicles

3.5.4. Infrastructure Development Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India Automotive Sensors Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Pressure Sensors

4.1.2. Temperature Sensors

4.1.3. Position Sensors

4.1.4. Speed Sensors

4.1.5. Others

4.2. By Application (in Value %)

4.2.1. Powertrain

4.2.2. Safety & Control

4.2.3. Chassis

4.2.4. Body Electronics

4.2.5. Telematics

4.3. By Technology (in Value %)

4.3.1. MEMS Sensors

4.3.2. Non-MEMS Sensors

4.4. By Vehicle Type (in Value %)

4.4.1. Passenger Cars

4.4.2. Commercial Vehicles

4.4.3. Electric Vehicles

4.5. By Region (in Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Automotive Sensors Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Robert Bosch GmbH

5.1.2. Continental AG

5.1.3. Denso Corporation

5.1.4. Infineon Technologies AG

5.1.5. Sensata Technologies

5.1.6. NXP Semiconductors

5.1.7. Analog Devices, Inc.

5.1.8. Delphi Technologies

5.1.9. STMicroelectronics

5.1.10. Valeo

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Automotive Sensors Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Automotive Sensors Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India Automotive Sensors Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Automotive Sensors Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Technology (in Value %)

9.4. By Vehicle Type (in Value %)

9.5. By Region (in Value %)

10. India Automotive Sensors Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building

Collating statistics on India Automotive Sensors Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Automotive Sensors Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple automotive sensors manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach fromsuch industry specific firms.

Frequently Asked Questions

01 How big is the India Automotive Sensors Market?

The India Automotive Sensors Market was valued at USD 1.7 billion in 2023, driven by the increasing adoption of advanced driver assistance systems (ADAS), stringent government regulations for vehicle safety and emissions, and the rising demand for electric vehicles (EVs).

02 What are the challenges in the India Automotive Sensors Market?

Challenges in the India Automotive Sensors Market include the high cost of advanced sensor technologies, supply chain disruptions, lack of standardization in sensor protocols, and stringent regulatory requirements for vehicle safety and emissions.

03 Who are the major players in the India Automotive Sensors Market?

Key players in the India automotive sensors market include Robert Bosch GmbH, Continental AG, Denso Corporation, Infineon Technologies AG, and Sensata Technologies. These companies are known for their extensive product portfolios, continuous innovation, and strategic partnerships with automotive manufacturers.

04 What are the growth drivers of the India Automotive Sensors Market?

Growth drivers in India Automotive Sensors Market include the increasing adoption of ADAS technologies, stringent government regulations and safety standards, the rise in vehicle electrification, and continuous technological advancements in sensor technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.