India Autonomous Vehicle Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3518

December 2024

85

About the Report

India Autonomous Vehicle Market Overview

- The India Autonomous Vehicle (AV) market is valued at USD 2 billion, according to a five-year historical analysis. This market is largely driven by significant advancements in sensor technology, artificial intelligence (AI), and the rising demand for efficient mobility solutions. The Indian government's increasing focus on developing smart cities, coupled with national policies aimed at reducing vehicular emissions and promoting clean energy, has been a major driving factor for the AV markets growth. This trend is further supported by collaborations between global tech companies and Indian automakers, which are accelerating the pace of AV innovation.

- In terms of geographical dominance, cities like Bengaluru, Hyderabad, and Pune are leading the market for autonomous vehicles in India. These cities have emerged as tech hubs, benefiting from the presence of top-tier IT companies and startups focused on AV research and development. Additionally, the availability of modern infrastructure and favorable government policies have created a conducive environment for the growth of autonomous vehicle testing and deployment in these regions. This technological dominance is expected to maintain its momentum as these cities continue to spearhead India's innovation in the AV space.

- The NEMMP initiative aims to promote electric and autonomous vehicle integration in India. In 2024, the Indian government has pledged 5000 crore to encourage the adoption of autonomous EVs by subsidizing R&D and reducing import duties on AV components. This initiative not only accelerates AV development but also encourages the integration of smart transportation technologies.

India Autonomous Vehicle Market Segmentation

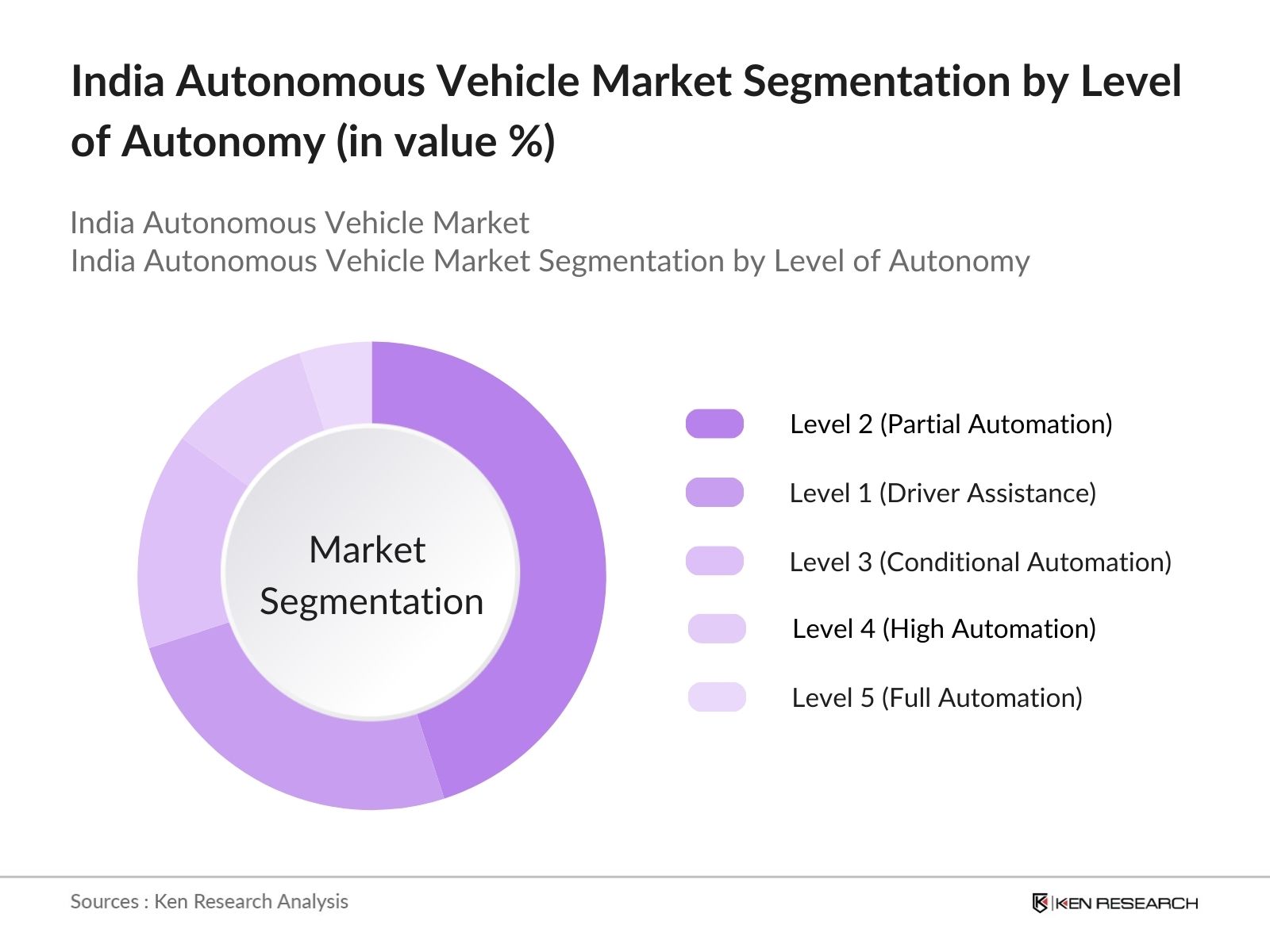

By Level of Autonomy: The India Autonomous Vehicle market is segmented by the level of autonomy into Level 1 (Driver Assistance), Level 2 (Partial Automation), Level 3 (Conditional Automation), Level 4 (High Automation), and Level 5 (Full Automation). Level 2 vehicles currently hold a dominant market share, driven by the increasing adoption of advanced driver-assistance systems (ADAS) in passenger vehicles. The popularity of Level 2 automation is largely due to its affordability and availability in a wide range of vehicle models, making it accessible to a broader consumer base. Furthermore, safety features such as lane-keeping assistance, adaptive cruise control, and automated emergency braking have driven customer demand for these vehicles.

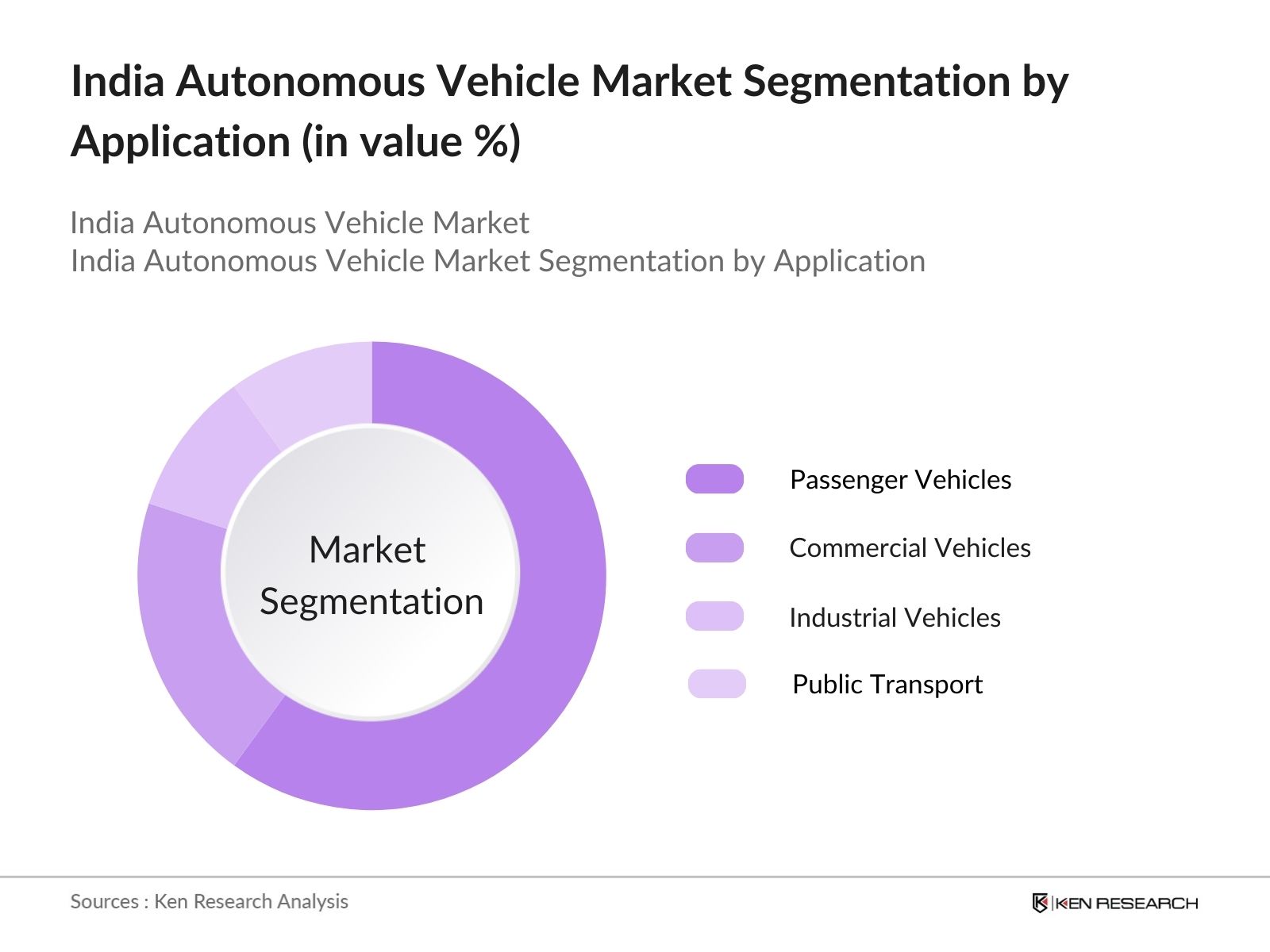

By Application: The India Autonomous Vehicle market is segmented by application into passenger vehicles, commercial vehicles, industrial vehicles, and public transport. Passenger vehicles dominate the market under this segmentation, accounting for the largest share. This is primarily due to the rising demand for personal mobility solutions in metropolitan areas and the growing inclination toward safer, more efficient modes of transportation. The integration of semi-autonomous features in high-end passenger cars, especially from luxury car brands, is also contributing to the dominance of this segment.

India Autonomous Vehicle Market Competitive Landscape

The India Autonomous Vehicle market is dominated by a mix of domestic automakers and global technology companies. Established players are forming strategic partnerships with tech firms to accelerate R&D in autonomous driving technologies, such as AI, sensor fusion, and machine learning.

|

Company Name |

Establishment Year |

Headquarters |

R&D Expenditure (USD Mn) |

Market Presence |

Revenue (2023) |

Product Range |

Partnerships |

Patents Held |

|

Tata Motors |

1945 |

Mumbai |

- | - | - | - | - | - |

|

Mahindra & Mahindra |

1945 |

Mumbai |

- | - | - | - | - | - |

|

Ashok Leyland |

1948 |

Chennai |

- | - | - | - | - | - |

|

Tata Elxsi |

1989 |

Bengaluru |

- | - | - | - | - | - |

|

Tech Mahindra |

1986 |

Pune |

- | - | - | - | - | - |

India Autonomous Vehicle Market Analysis

Growth Drivers

- Advancements in AI and Machine Learning: India's focus on integrating AI for autonomous vehicle (AV) technology has significantly advanced in 2024. AI algorithms, particularly in machine learning, have been pivotal in enhancing AVs' real-time decision-making capabilities. The market has seen an influx of over 1500 crore in AI research specifically dedicated to improving AV responses in unpredictable driving conditions. These developments have been supported by government funding and collaboration with major tech institutes. The growing use of deep learning models has made real-time data processing and decision-making more efficient, directly influencing the expansion of autonomous driving systems across commercial and passenger vehicles.

- Government Initiatives for Smart Transportation: The Indian government has taken substantial steps toward promoting smart transportation solutions through initiatives like the National Electric Mobility Mission Plan (NEMMP). This initiative has received increased funding of 10,000 crore in 2024 to encourage the adoption of electric and autonomous vehicles. The program includes policy frameworks that reduce import duties on essential AV components and prioritize the development of AV-friendly infrastructure. By making way for easier regulatory approval processes for testing and deploying autonomous vehicles, this initiative fosters a conducive environment for AV manufacturers to grow in India.

- Increasing Investments in Connected Vehicle Infrastructure: Investments in connected vehicle infrastructure, particularly IoT-enabled devices and Vehicle-to-Everything (V2X) technology, have surged. As of 2024, approximately 8000 crore has been allocated toward enhancing smart infrastructure, which is integral for autonomous vehicle communication. This connected infrastructure facilitates real-time vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, providing a seamless integration of AVs into Indian roads. Collaborations with tech giants have also emerged to improve cloud connectivity and network capabilities for AV operations.

Market Challenges

- High Initial Costs and R&D Expenditure (Lidar, Sensor Technology): The development of autonomous vehicles involves substantial R&D costs, particularly in integrating Lidar and advanced sensor technologies. In 2024, the cost of implementing a single high-performance Lidar system in India is estimated to be around 10-15 lakh, creating a financial barrier for local manufacturers. Additionally, the overall R&D expenditure required to meet international safety standards further adds to the financial strain, limiting the markets expansion to well-funded entities.

- Regulatory Hurdles (Lack of Unified Autonomous Driving Laws): India currently lacks a unified legal framework for autonomous vehicle testing and deployment, creating uncertainty for manufacturers. Despite ongoing discussions, regulations on liability, road use, and safety testing remain fragmented across states. The lack of nationwide AV regulations continues to pose a challenge for industry players looking to scale operations across India in 2024.

India Autonomous Vehicle Market Future Outlook

Over the next five years, the India Autonomous Vehicle market is expected to experience robust growth, driven by continuous investments in technology infrastructure, growing public awareness of the benefits of autonomous driving, and supportive government policies. The Indian governments focus on smart cities, coupled with increased research and development by domestic and international automakers, is poised to further drive the adoption of autonomous vehicles. Additionally, advancements in AI, sensor technology, and 5G networks are expected to make autonomous vehicles more reliable and efficient, fueling market demand.

Opportunities

- Expansion of Fleet and Mobility-as-a-Service: The Indian market is seeing growing interest in Mobility-as-a-Service (MaaS) models, particularly for ride-hailing services. By 2024, cities like Bengaluru and Hyderabad have introduced pilot projects for self-driving taxis. The expansion of fleet services in these cities is supported by the governments increased funding of 1000 crore towards autonomous public transport initiatives. This provides significant opportunities for companies to tap into the demand for autonomous ride-hailing services.

- Technological Advancements in Sensor Fusion and Real-Time Mapping: Recent breakthroughs in sensor fusion technologies have enabled more precise and real-time mapping capabilities in autonomous vehicles. By 2024, AI-driven sensor systems, which combine Lidar, radar, and camera feeds, have reduced operational costs by nearly 20% and improved vehicle performance in adverse weather conditions. Indian companies are collaborating with international technology firms to refine these systems, opening new avenues for AV applications in complex driving environments.

Scope of the Report

|

By Level of Autonomy |

Level 1 (Driver Assistance) Level 2 (Partial Automation) Level 3 (Conditional Automation) Level 4 (High Automation) Level 5 (Full Automation) |

|

By Application |

Passenger Vehicles Commercial Vehicles Industrial Vehicles Public Transport |

|

By Technology |

Radar-Based Systems Lidar-Based Systems Camera-Based Systems Sensor Fusion Systems |

|

By Mobility Type |

Personal Mobility Shared Mobility Goods Mobility |

|

By Region |

North South East West |

Products

Key Target Audience

Autonomous Vehicle Manufacturers

AI and Software Development Companies

Automotive OEMs

Connected Vehicle Technology Providers

Logistic and Fleet Operators

Public Transportation Authorities

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Road Transport and Highways, Department of Heavy Industry)

Companies

Players Mentioned in the Report:

Tata Motors

Mahindra & Mahindra

Ashok Leyland

Tata Elxsi

Tech Mahindra

Bosch India

Continental Automotive India

ZF Friedrichshafen AG

NVIDIA India

Wipro Limited

Table of Contents

1. India Autonomous Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Stakeholders Overview

1.4. Market Segmentation Overview

2. India Autonomous Vehicle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Current Market Size

2.3. Year-On-Year Growth Analysis

2.4. Key Market Developments and Milestones

3. India Autonomous Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in AI and Machine Learning (Autonomous Decision-Making Capabilities)

3.1.2. Government Initiatives for Smart Transportation (Policies such as National Electric Mobility Mission)

3.1.3. Increasing Investments in Connected Vehicle Infrastructure (IoT and V2X Technology)

3.1.4. Growing Demand for Safety and Reduction in Traffic Accidents (Reduction in Human Error)

3.2. Market Challenges

3.2.1. High Initial Costs and R&D Expenditure (Lidar, Sensor Technology)

3.2.2. Regulatory Hurdles (Lack of Unified Autonomous Driving Laws)

3.2.3. Cybersecurity Threats in Connected Vehicles (Hacking and Data Privacy Issues)

3.2.4. Limited Road Infrastructure Readiness (Smart Infrastructure)

3.3. Opportunities

3.3.1. Expansion of Fleet and Mobility-as-a-Service (Self-Driving Taxis and Ride-Hailing Services)

3.3.2. Technological Advancements in Sensor Fusion and Real-Time Mapping (AI-driven Sensor Systems)

3.3.3. Collaborations Between Automakers and Tech Companies (Strategic Partnerships for AV Development)

3.3.4. Penetration into Tier-2 and Tier-3 Cities (Expanding Roadmaps for Autonomous Solutions)

3.4. Trends

3.4.1. Integration with Electric Vehicles (Autonomous EV Development)

3.4.2. Rise in 5G Deployment for Vehicle-to-Everything (V2X) Communication (High-Speed Data Transmission)

3.4.3. Shift Towards Level 4 and Level 5 Automation (Fully Autonomous Driving)

3.4.4. Increased Adoption of Autonomous Vehicles in Logistics and Freight Transport (Automated Trucks and Drones)

4. India Autonomous Vehicle Market Segmentation

4.1. By Level of Autonomy (In Value %)

4.1.1. Level 1 (Driver Assistance)

4.1.2. Level 2 (Partial Automation)

4.1.3. Level 3 (Conditional Automation)

4.1.4. Level 4 (High Automation)

4.1.5. Level 5 (Full Automation)

4.2. By Application (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Industrial Vehicles

4.2.4. Public Transport

4.3. By Technology (In Value %)

4.3.1. Radar-Based Systems

4.3.2. Lidar-Based Systems

4.3.3. Camera-Based Systems

4.3.4. Sensor Fusion Systems

4.4. By Mobility Type (In Value %)

4.4.1. Personal Mobility

4.4.2. Shared Mobility

4.4.3. Goods Mobility

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Autonomous Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tata Motors Ltd.

5.1.2. Mahindra & Mahindra

5.1.3. Maruti Suzuki India Ltd.

5.1.4. Ashok Leyland

5.1.5. Tech Mahindra Ltd.

5.1.6. Tata Elxsi

5.1.7. Infosys Limited

5.1.8. Wipro Limited

5.1.9. Hyundai Mobis India

5.1.10. Bosch India

5.1.11. Continental Automotive India

5.1.12. ZF Friedrichshafen AG

5.1.13. NVIDIA India

5.1.14. Waymo India

5.1.15. Intel India Pvt. Ltd.

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. R&D Expenditure

5.2.4. Partnerships and Collaborations

5.2.5. Investment in Autonomous Driving Solutions

5.2.6. Product Innovation and Patents

5.2.7. Market Share (In Value %)

5.2.8. Strategic Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Autonomous Vehicle Market Regulatory Framework

6.1. National Electric Mobility Mission (NEMM)

6.2. Ministry of Road Transport and Highways (MoRTH) Initiatives

6.3. Autonomous Vehicle Testing Standards

6.4. Safety and Compliance Regulations

7. India Autonomous Vehicle Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Autonomous Vehicle Future Market Segmentation

8.1. By Level of Autonomy (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Mobility Type (In Value %)

8.5. By Region (In Value %)

9. India Autonomous Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior and Adoption Analysis

9.3. Key Market Entry Strategies

9.4. Competitive Positioning Strategies

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping out key stakeholders within the India Autonomous Vehicle market ecosystem. A combination of desk research and proprietary databases was used to identify key variables affecting market dynamics, including technological advancements, government initiatives, and industry collaborations.

Step 2: Market Analysis and Construction

This phase involved gathering and analyzing historical data related to the India Autonomous Vehicle market. Parameters such as adoption rates of autonomous features, penetration in different vehicle types, and infrastructure development were assessed to create reliable revenue models.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts from automakers and technology providers. These interviews were conducted via Computer-Assisted Telephone Interviews (CATI), providing real-time insights into market trends and technological advancements.

Step 4: Research Synthesis and Final Output

This step involved integrating the insights gathered from primary research with data from industry databases, ensuring comprehensive coverage of the market. Detailed inputs from OEMs and tech firms helped validate the final market analysis.

Frequently Asked Questions

01. How big is the India Autonomous Vehicle Market?

The India Autonomous Vehicle Market is valued at USD 2 billion, driven by increased investments in autonomous technologies, collaborations between automotive and tech companies, and supportive government initiatives.

02. What are the challenges in the India Autonomous Vehicle Market?

The India Autonomous Vehicle Market faces challenges such as high initial R&D costs, regulatory complexities, and cybersecurity concerns. Additionally, the lack of smart infrastructure in certain regions is slowing down market adoption.

03. Who are the major players in the India Autonomous Vehicle Market?

Key players in the India Autonomous Vehicle Market include Tata Motors, Mahindra & Mahindra, Ashok Leyland, Tata Elxsi, and Tech Mahindra. These companies dominate due to their significant investments in autonomous technologies and strong market presence.

04. What are the growth drivers of the India Autonomous Vehicle Market?

Growth drivers in the India Autonomous Vehicle Market include advancements in AI, sensor fusion technology, government initiatives to reduce emissions, and the increasing demand for safe and efficient transportation solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.