India Aviation Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD6598

December 2024

88

About the Report

India Aviation Market Overview

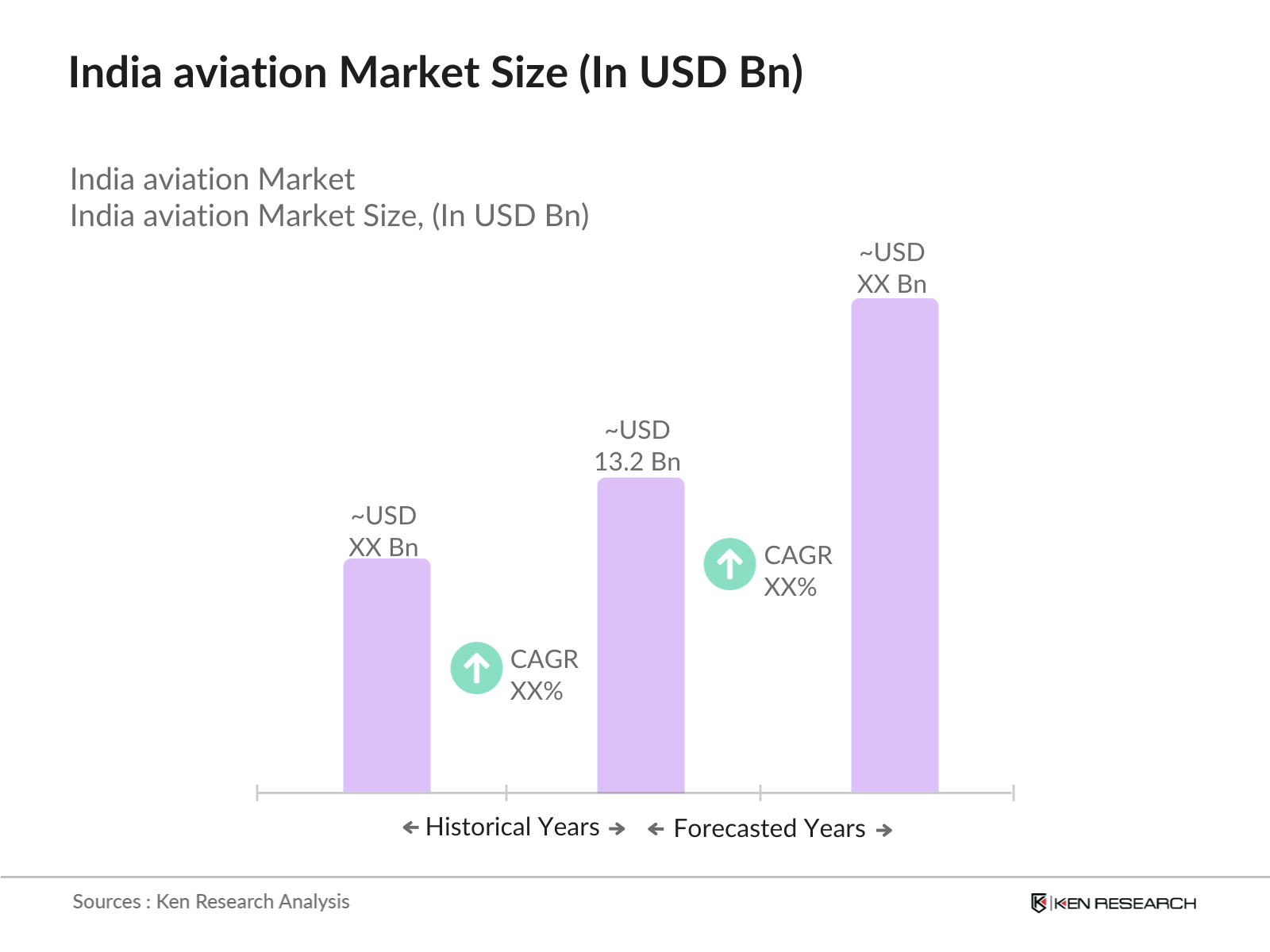

- The India aviation market is valued at USD 13.2 billion, driven by robust growth in air passenger traffic and increasing investments in airport infrastructure. Key factors propelling this market include the rise in disposable income, urbanization, and a burgeoning middle-class population eager for air travel. Additionally, government initiatives aimed at enhancing regional connectivity and simplifying regulations are further stimulating growth.

- Major cities such as Delhi, Mumbai, and Bengaluru dominate the aviation landscape due to their status as economic and technological hubs. These cities host the countrys busiest airports and serve as primary gateways for both domestic and international travel. The concentration of corporate offices, educational institutions, and tourist attractions in these urban centers contributes to their prominence in the aviation market, ensuring continued growth and investment in aviation services.

- India maintains strict air safety and security regulations to ensure safe air travel. The Bureau of Civil Aviation Security (BCAS) has implemented stringent measures, which include regular audits and compliance checks at airports. In 2023, the BCAS reported a 15% increase in compliance inspections to ensure adherence to safety protocols. Such regulatory oversight is crucial for maintaining public confidence in air travel and enhancing the overall safety standards of the aviation sector. The government's commitment to safety and security continues to foster growth and attract investments in the industry.

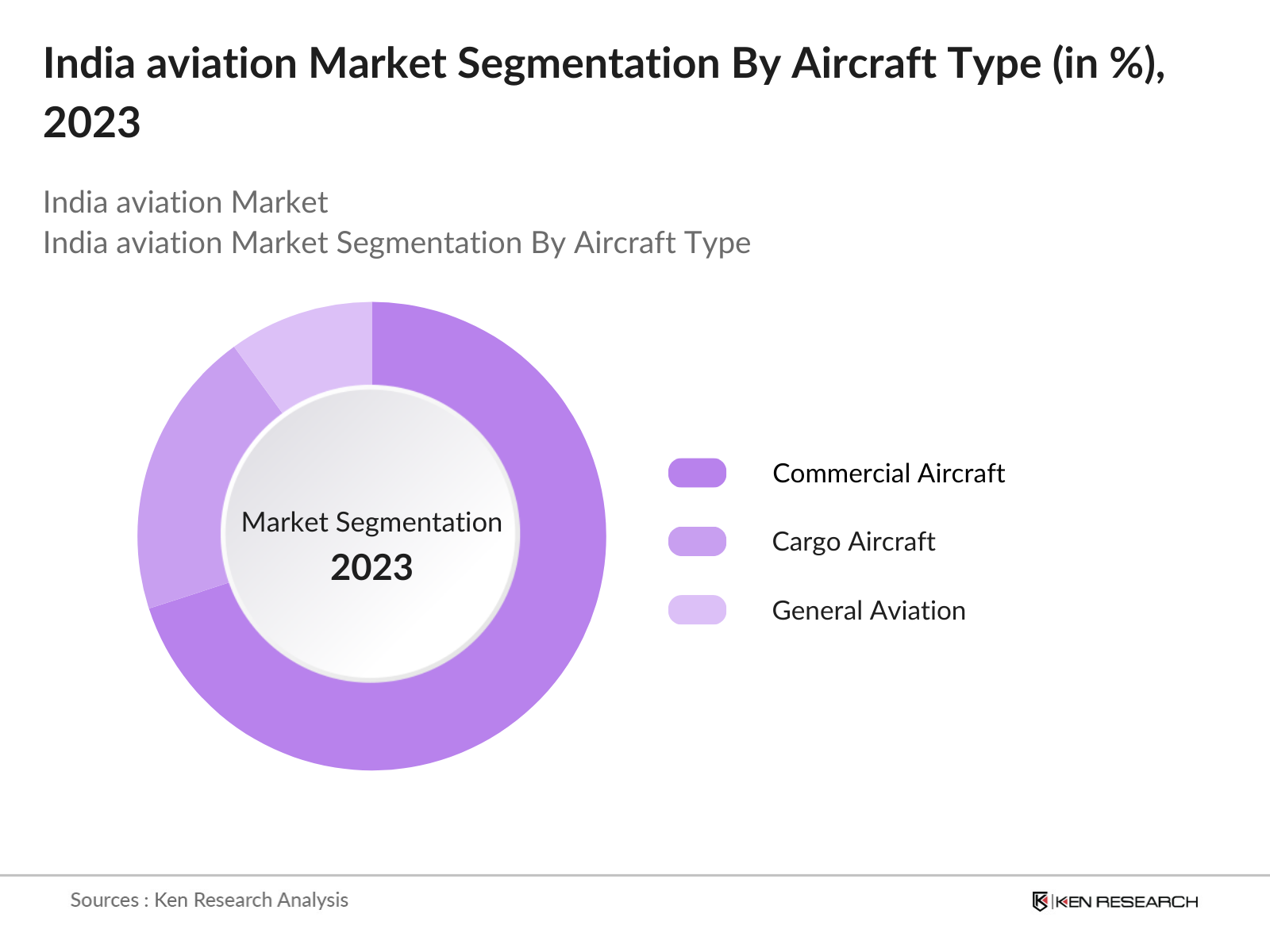

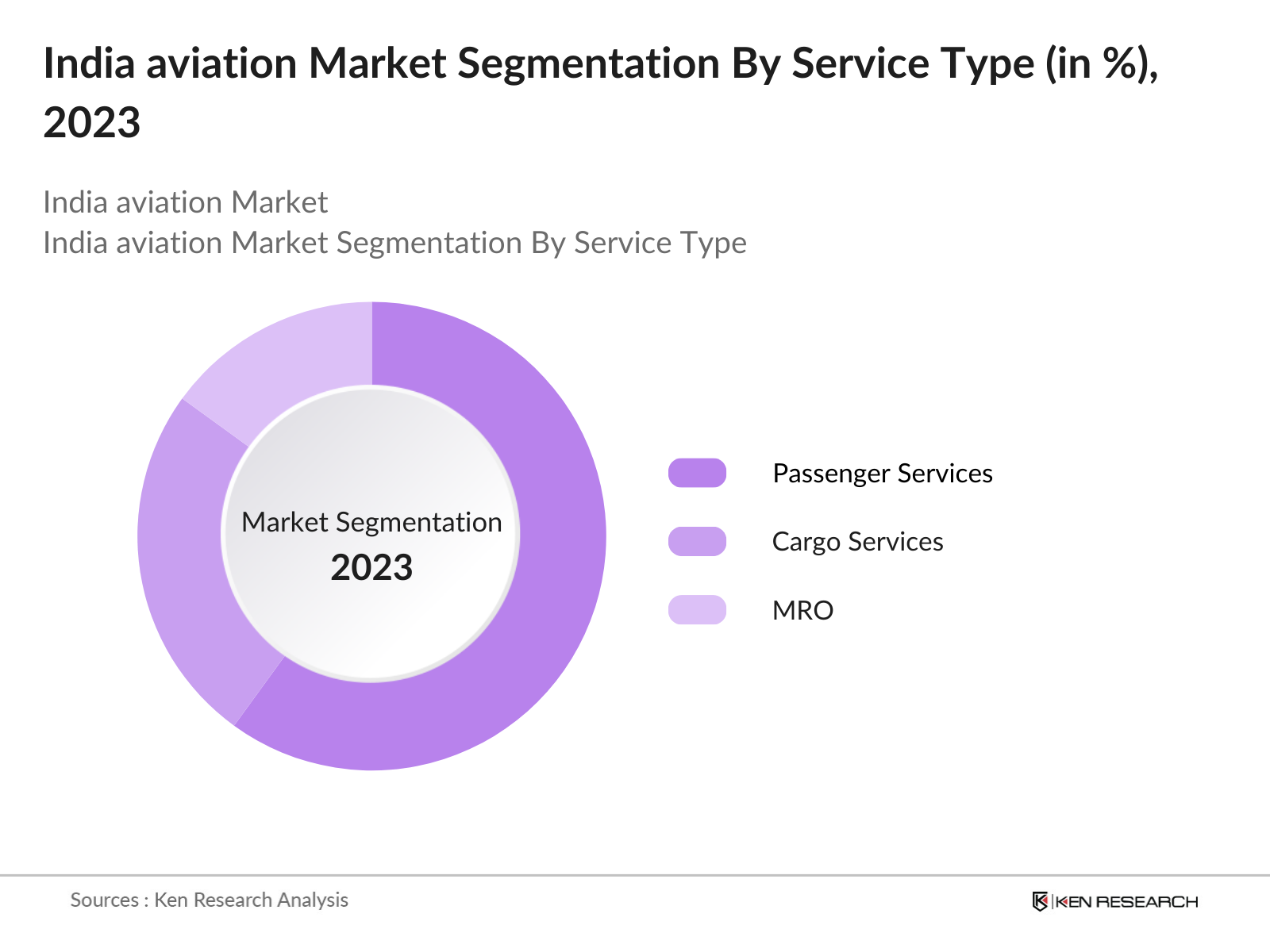

India Aviation Market Segmentation

By Aircraft Type: The India aviation market is segmented by aircraft type into commercial aircraft, cargo aircraft, and general aviation. Recently, commercial aircraft have captured the largest market share, largely due to the increasing demand for passenger air travel. With a growing middle-class population and enhanced connectivity from government initiatives, airlines are expanding their fleets to accommodate rising passenger numbers. This segments dominance is further supported by significant investments in airport infrastructure and the ongoing liberalization of air transport policies.

By Service Type: The aviation market is also segmented by service type into passenger services, cargo services, and maintenance, repair, and overhaul (MRO). Passenger services lead this segment, fueled by a strong resurgence in travel demand post-pandemic. Increased air travel affordability and a shift towards low-cost carriers have made flying more accessible, significantly contributing to the growth of this sub-segment. Moreover, enhanced customer service and technological innovations in booking and flight operations further solidify its dominance.

India Aviation Market Competitive Landscape

The India aviation market is characterized by a competitive landscape dominated by a few major players, including well-established airlines and service providers. The consolidation among key companies emphasizes their significant influence in shaping market trends and consumer preferences. Key players include local airlines as well as international giants that have made substantial investments in the Indian aviation sector.

|

Company |

Establishment Year |

Headquarters |

Fleet Size |

Annual Revenue (USD Bn) |

Market Position |

Notable Services |

|

IndiGo Airlines |

2006 |

Gurgaon |

_ |

_ |

_ |

_ |

|

Air India |

1932 |

Delhi |

_ |

_ |

_ |

_ |

|

SpiceJet |

2005 |

Gurgaon |

_ |

_ |

_ |

_ |

|

GoAir |

2005 |

Mumbai |

_ |

_ |

_ |

_ |

|

Vistara |

2013 |

Delhi |

_ |

_ |

_ |

_ |

India Aviation Industry Analysis

Growth Drivers

- Increasing Air Passenger Traffic: The Indian aviation sector witnessed an impressive growth in air passenger traffic, with 341 million domestic air travelers recorded in 2022, marking a significant recovery from the pandemic. This surge is expected to continue, supported by India's robust economic growth projected at 6.3% in 2023 and 6.1% in 2024 according to the World Bank. Additionally, the Government of India is focusing on improving regional air connectivity, facilitating more direct routes and thereby encouraging more travelers. The International Air Transport Association (IATA) predicts that India will be the third-largest aviation market globally by 2025, further underscoring the upward trajectory in passenger numbers.

- Infrastructure Development: Significant investments are being made in airport infrastructure, with the Airports Authority of India (AAI) planning to invest approximately 1 trillion (around $12 billion) in airport upgrades and expansions by 2025. This includes the modernization of existing airports and the construction of new greenfield projects. In 2023, India had 141 operational airports, with plans to increase this number to 220 by 2025. The Governments UDAN (Ude Desh ka Aam Naagrik) scheme aims to enhance air travel accessibility, contributing to the growth of the sector. The World Bank estimates that investments in transport infrastructure can significantly boost economic growth by facilitating trade and mobility.

- Liberalization of Air Transport Policy: India's liberalization of air transport policies has been a key driver of growth, with the government promoting open skies agreements and enhancing foreign direct investment (FDI) in the aviation sector. As of 2022, FDI in aviation reached approximately $1.5 billion, reflecting a 25% increase from the previous year. The new National Civil Aviation Policy encourages competition, leading to reduced airfares and increased services. The Ministry of Civil Aviation aims to achieve 1 billion air travelers by 2030, bolstered by supportive regulatory frameworks. Such policy shifts not only enhance operational efficiency but also stimulate investment in the sector.

Market Challenges

- High Operational Costs: High operational costs pose a significant challenge for Indian airlines, with fuel costs constituting approximately 30% of the total operating expenses as of 2022. Aviation turbine fuel (ATF) prices have seen an increase of 12% in early 2023, exacerbating financial pressures on airlines. Moreover, the average airport charges in India are among the highest in the region, affecting profitability. The Indian aviation sector is grappling with rising maintenance costs and the need for extensive pilot training, which further inflate operational expenditures. These challenges necessitate strategic measures to enhance operational efficiency and cost management.

- Regulatory Hurdles: The aviation sector faces several regulatory hurdles that can impede growth, including stringent safety regulations and complex approval processes for new routes and services. As of 2023, it takes an average of six months to obtain the necessary approvals for starting new domestic flights. Furthermore, regulatory inconsistencies can lead to operational delays, impacting service delivery and customer satisfaction. The Government of India is working on streamlining these processes, but the existing framework still presents challenges that need to be addressed to facilitate smoother operations for airlines.

India Aviation Future Outlook

Over the next five years, the India aviation market is expected to witness substantial growth, fueled by continuous government support, infrastructural enhancements, and rising consumer demand for air travel. Factors such as increasing foreign direct investment (FDI) in airports, enhanced air connectivity in tier-II cities, and the introduction of new aircraft models will play pivotal roles in this growth trajectory. Additionally, the focus on sustainable aviation practices is likely to reshape the industry's landscape, further driving investment and innovation.

Opportunities

- Expansion of Regional Connectivity: The Indian governments UDAN scheme is a major initiative to promote regional connectivity, making air travel more accessible in tier-II and tier-III cities. As of 2023, 400 routes have been operationalized under this scheme, connecting more than 70 underserved airports. With the goal of establishing around 1,000 such routes by 2025, there is a significant opportunity for airlines to tap into these new markets. The increase in regional air traffic is projected to create more jobs and stimulate local economies, presenting a promising growth avenue for the aviation sector.

- Adoption of Sustainable Aviation Fuel: The aviation sector is increasingly focusing on sustainable practices, with a push towards the adoption of sustainable aviation fuel (SAF). In 2023, the Indian government announced plans to mandate the use of SAF by 2025, with investments in infrastructure to support its production. The global aviation industry is moving towards net-zero emissions by 2050, and India's alignment with this goal presents a significant opportunity for innovation and investment in green technologies. By incorporating SAF, airlines can reduce their carbon footprint, enhance their brand image, and meet regulatory requirements while appealing to environmentally conscious travelers.

Scope of the Report

|

Aircraft Type |

Commercial Aircraft Cargo Aircraft General Aviation |

|

Service Type |

Passenger Services Cargo Services Maintenance, Repair, and Overhaul |

|

End User |

Government Private Sector Charter Operators |

|

Region |

North India South India East India West India |

|

Technology Adoption |

Traditional Technologies Advanced Technologies |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Civil Aviation, Airports Authority of India)

Airlines and Airline Industries

Airport Operators and Authorities

Aircraft Companies

MRO Service Companies

Travel and Tourism Companies

Logistics and Cargo Companies

Companies

Players Mentioned in the Report:

IndiGo Airlines

Air India

SpiceJet

GoAir

Vistara

Jet Airways

Boeing India

Airbus India

Hindustan Aeronautics Limited (HAL)

Airports Authority of India (AAI)

Air Works India Engineering Pvt Ltd

Taj Air

GMR Group

Adani Airports

Lufthansa Technik

Table of Contents

1. India Aviation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Aviation Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Aviation Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Air Passenger Traffic

3.1.2. Infrastructure Development

3.1.3. Liberalization of Air Transport Policy

3.1.4. Rising Disposable Income

3.2. Market Challenges

3.2.1. High Operational Costs

3.2.2. Regulatory Hurdles

3.2.3. Infrastructure Bottlenecks

3.3. Opportunities

3.3.1. Expansion of Regional Connectivity

3.3.2. Adoption of Sustainable Aviation Fuel

3.3.3. Technological Innovations

3.4. Trends

3.4.1. Digital Transformation in Operations

3.4.2. Enhanced Passenger Experience Initiatives

3.4.3. Growth of Cargo Services

3.5. Government Regulation

3.5.1. National Civil Aviation Policy

3.5.2. Air Safety and Security Regulations

3.5.3. Environmental Compliance Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Aviation Market Segmentation

4.1. By Aircraft Type (In Value %)

4.1.1. Commercial Aircraft

4.1.2. Cargo Aircraft

4.1.3. General Aviation

4.2. By Service Type (In Value %)

4.2.1. Passenger Services

4.2.2. Cargo Services

4.2.3. Maintenance, Repair, and Overhaul (MRO)

4.3. By End User (In Value %)

4.3.1. Government

4.3.2. Private Sector

4.3.3. Charter Operators

4.4. By Region (In Value %)

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

4.5. By Technology Adoption (In Value %)

4.5.1. Traditional Technologies

4.5.2. Advanced Technologies

5. India Aviation Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IndiGo Airlines

5.1.2. Air India

5.1.3. SpiceJet

5.1.4. GoAir

5.1.5. Vistara

5.1.6. Jet Airways

5.1.7. Boeing India

5.1.8. Airbus India

5.1.9. Hindustan Aeronautics Limited (HAL)

5.1.10. Airports Authority of India (AAI)

5.1.11. Air Works India Engineering Pvt Ltd

5.1.12. Taj Air

5.1.13. GMR Group

5.1.14. Adani Airports

5.1.15. Lufthansa Technik

5.2. Cross Comparison Parameters (Fleet Size, Headquarters, Inception Year, Revenue, Market Share, Customer Base, Service Types Offered, Geographic Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Support

5.8. Private Equity Investments

6. India Aviation Market Regulatory Framework

6.1. Air Transport Policies

6.2. Safety Regulations

6.3. Environmental Regulations

7. India Aviation Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Aviation Market Future Segmentation

8.1. By Aircraft Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By End User (In Value %)

8.4. By Region (In Value %)

8.5. By Technology Adoption (In Value %)

9. India Aviation Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India aviation market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India aviation market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aviation manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India aviation market.

Frequently Asked Questions

1.How big is the India aviation market?

The India aviation market is valued at USD 13.2 billion, driven by robust growth in air passenger traffic and increasing investments in airport infrastructure.

2.What are the challenges in the India aviation market?

Challenges include high operational costs, regulatory hurdles, and infrastructure bottlenecks, which could impede growth in the sector despite rising demand.

3.Who are the major players in the India aviation market?

Key players include IndiGo Airlines, Air India, SpiceJet, and Vistara, which dominate due to their extensive networks and customer loyalty.

4.What are the growth drivers of the India aviation market?

The market is propelled by increasing air passenger traffic, urbanization, and government initiatives aimed at enhancing connectivity and reducing travel costs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.