India Baby Care Products Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3726

December 2024

85

About the Report

India Baby Care Products Market Overview

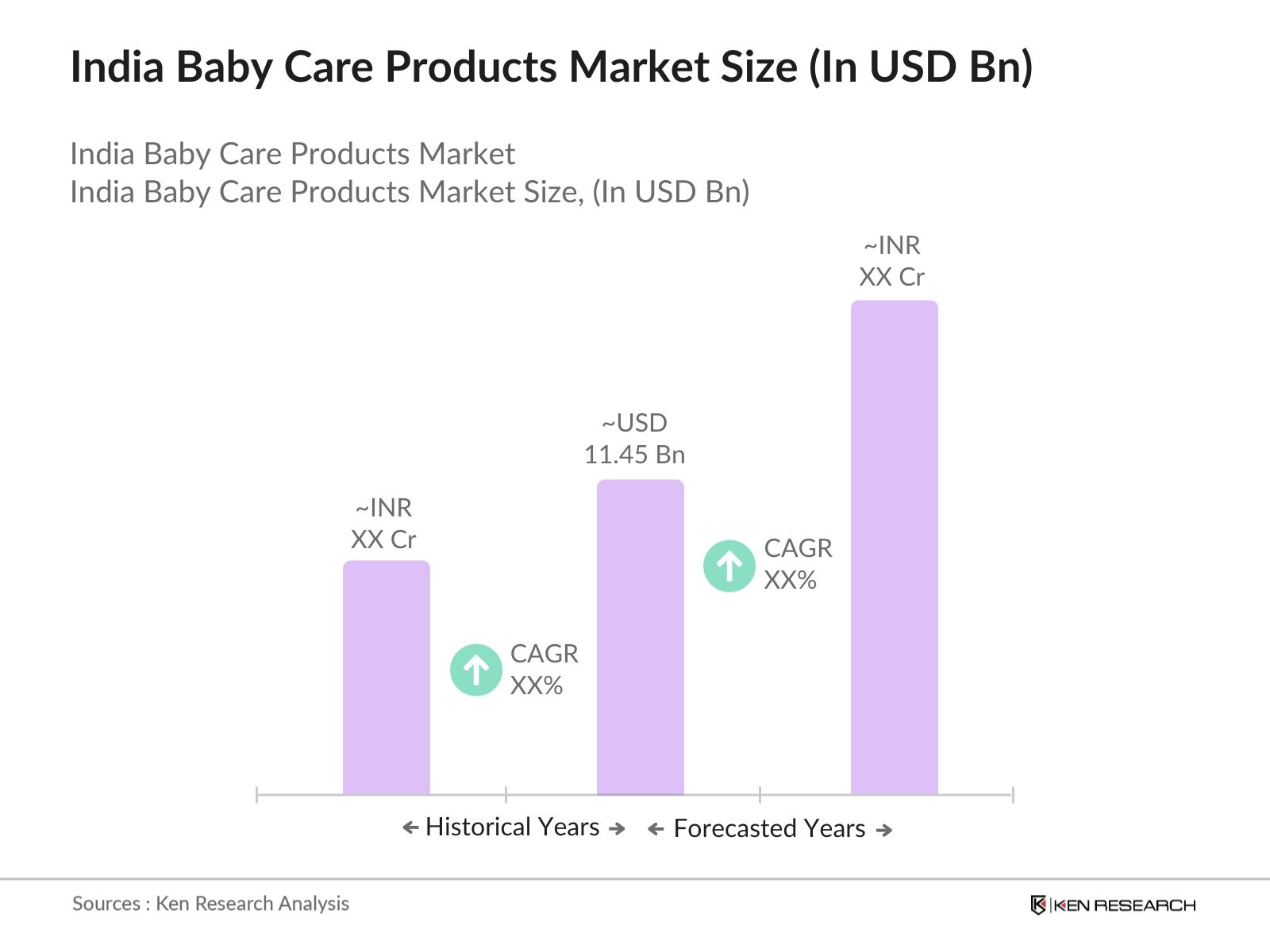

- The India baby care products market is valued at USD 11.45 billion based on a five-year historical analysis. The market is driven by an increase in the country's birth rate, improved disposable income among middle-class families, and expanding awareness about infant health and hygiene. Urbanization has also led to a significant demand for baby care products as more parents seek high-quality and safe products for their children. The rising penetration of e-commerce platforms across the country has further supported market growth.

- Mumbai, Delhi, and Bangalore dominate the baby care products market in India, primarily due to their high population density, rising middle-class incomes, and better awareness regarding infant care products. These cities have well-developed retail infrastructures and a growing online shopping trend, making it easier for consumers to access a variety of baby care products. The strong presence of both international and domestic brands further strengthens the market in these metropolitan regions.

- The Pradhan Mantri Matru Vandana Yojana is a government scheme aimed at promoting maternal and child health by providing financial assistance to pregnant women and lactating mothers. Under this scheme, women receive 5,000 in three installments for the first living child to support nutritional intake and healthcare during pregnancy and postnatal care. This initiative indirectly benefits the baby care products market by encouraging parents to invest in better healthcare products, baby food, and hygiene products for their newborns. The schemes focus on maternal and infant health drives awareness and demand for high-quality baby care items such as baby toiletries and nutritional supplements, especially in rural areas.

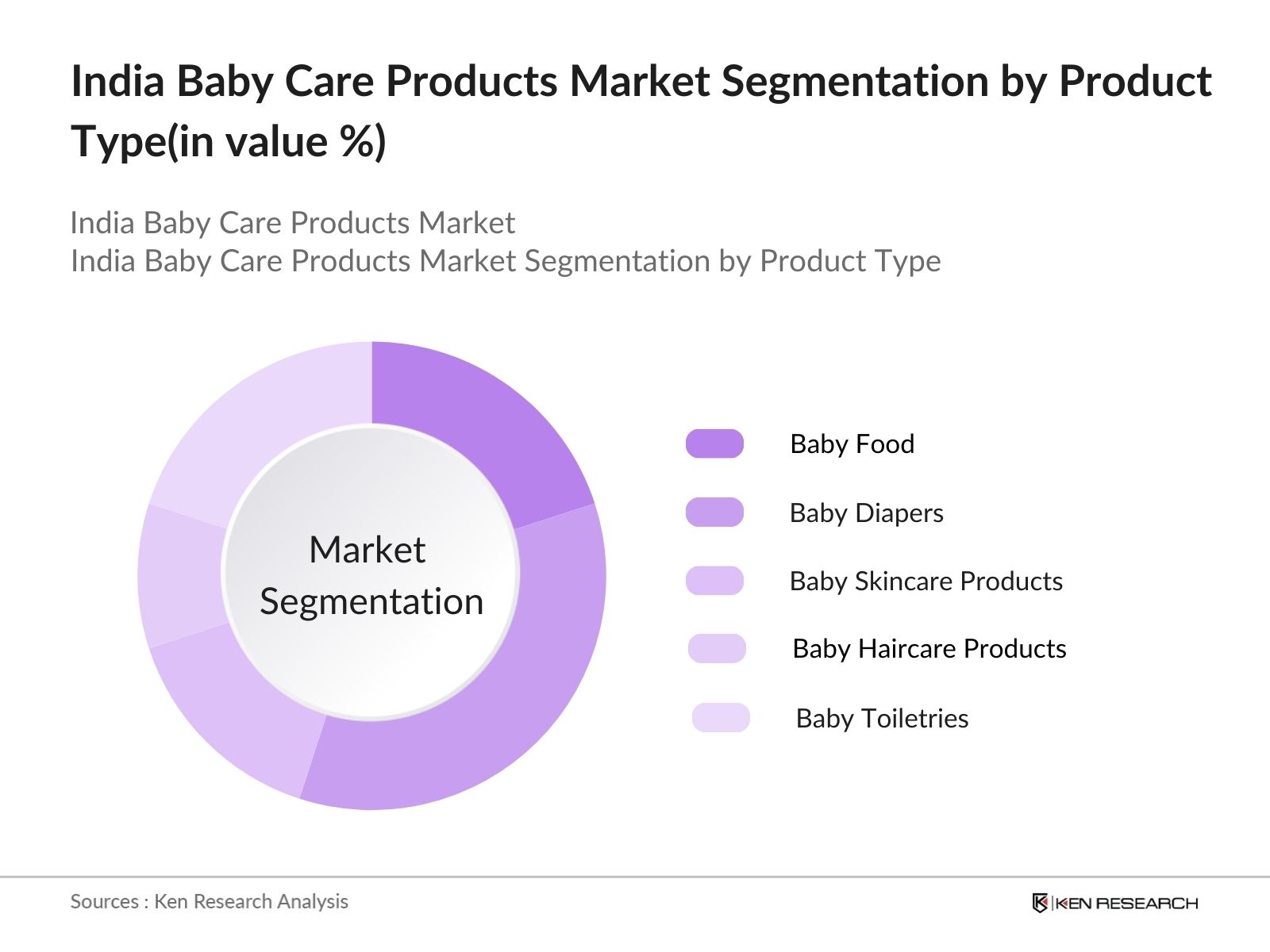

India Baby Care Products Market Segmentation

By Product Type: The India baby care products market is segmented by product type into baby food, baby diapers, baby skincare products, baby haircare products, and baby toiletries. Baby diapers have a dominant market share in India under the segmentation by product type. This dominance can be attributed to the convenience they offer and increasing awareness among parents about the importance of hygiene in infants. Additionally, the growing availability of affordable diaper options, especially in rural areas, is driving the demand for this product. The high penetration of brands like Huggies and Pampers also solidifies the diaper segment's leadership in the market.

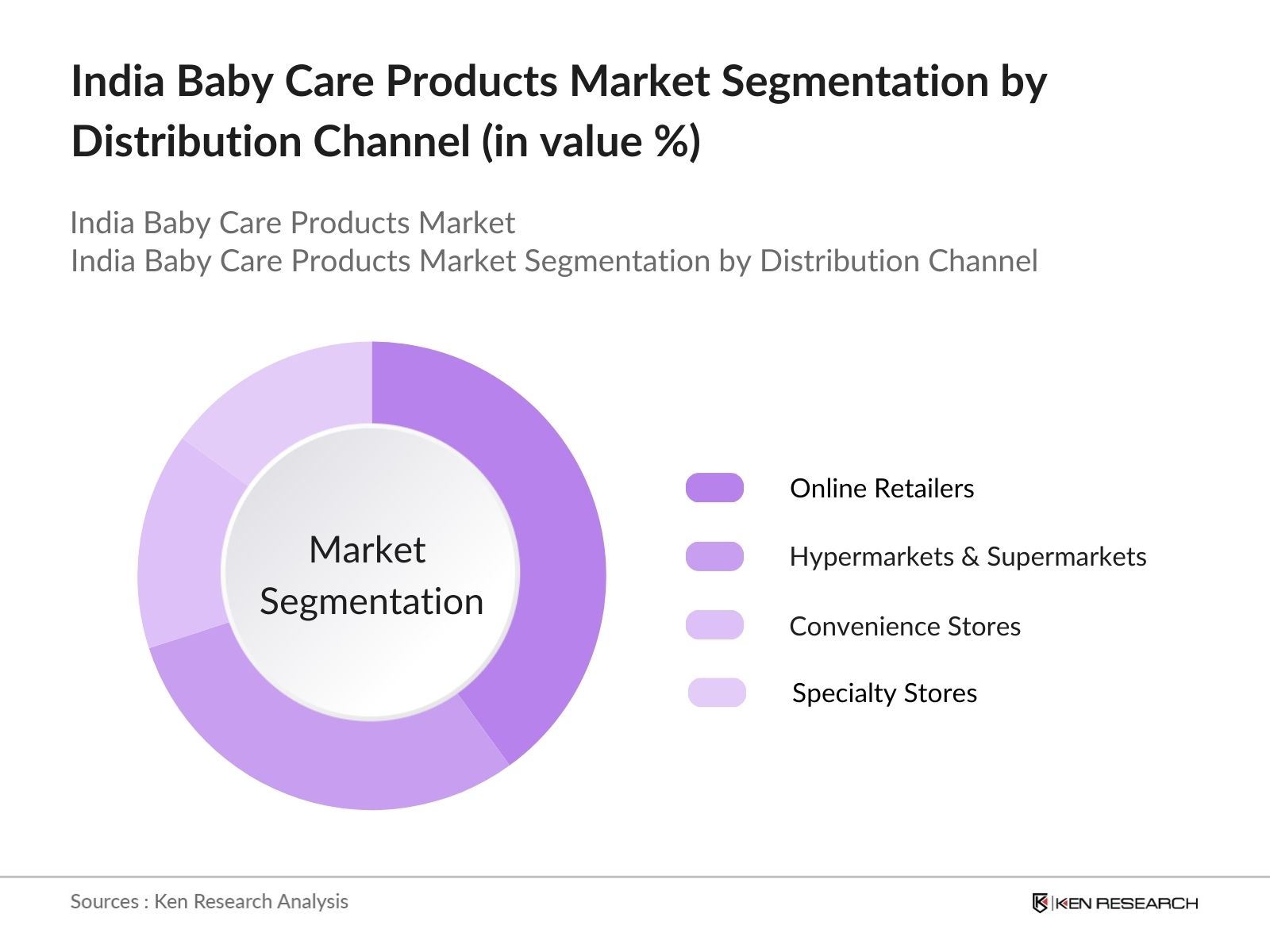

By Distribution Channel: The India baby care products market is segmented by distribution channel into hypermarkets & supermarkets, convenience stores, online retailers, and specialty stores. The online retail segment is dominating the market share due to the growing trend of e-commerce platforms and the increased accessibility to baby care products in both urban and rural areas. The convenience of home delivery, wide product range, and attractive discounts on online platforms have made this segment the fastest-growing distribution channel in recent years. Additionally, the COVID-19 pandemic accelerated the shift towards online shopping for baby care products.

India Baby Care Products Market Competitive Landscape

The India baby care products market is characterized by the presence of both global and domestic players. The competition is intense, with companies focusing on product innovation, extensive distribution networks, and strong branding to gain a competitive edge. The market is dominated by multinational companies like Johnson & Johnson and Procter & Gamble, alongside strong domestic brands like Dabur and Himalaya.

|

Company Name |

Established Year |

Headquarters |

No. of Employees |

Revenue (INR Bn) |

R&D Investments (INR Bn) |

Product Portfolio |

Market Presence |

|

Johnson & Johnson |

1886 |

USA |

- | - | - | - | - |

|

Procter & Gamble (Pampers) |

1837 |

USA |

- | - | - | - | - |

|

The Himalaya Drug Company |

1930 |

India |

- | - | - | - | - |

|

Dabur India Ltd. |

1884 |

India |

- | - | - | - | - |

|

Unilever (Hindustan Unilever) |

1929 |

India |

- | - | - | - | - |

India Baby Care Products Market Analysis

Growth Drivers

- Increasing Birth Rates (national health statistics): India has one of the highest birth rates globally, with approximately 23.5 million births recorded annually as of 2024, according to national health statistics. The consistent rise in population growth, especially in rural and semi-urban areas, drives the demand for baby care products. The large-scale population growth provides a solid foundation for manufacturers, retailers, and distributors to tap into an expanding consumer base. Moreover, state-sponsored health programs aimed at promoting maternal and child welfare further increase the demand for baby care products. The rising number of births creates a long-term demand for products such as baby diapers, toiletries, and baby food.

- Rising Parental Disposable Income (macroeconomic data): Indias per capita income reached 2.12 Lakhs in 2024, leading to increased disposable income among the middle class. With more income, parents, especially in urban areas, are inclined to spend on premium baby care products, including organic skin care, advanced feeding systems, and specialized nutrition products. The increase in dual-income households has also contributed to this rise in disposable income, encouraging parents to invest in high-quality products that offer comfort and safety for their children. The higher disposable income enables the growth of the premium baby care segment, which appeals to consumers willing to pay more for superior quality.

- Expansion of E-commerce Platforms: Indias e-commerce market has experienced exponential growth, with over 850 million internet users in 2024. The proliferation of e-commerce platforms like Amazon, Flipkart, and first-party websites of baby product manufacturers has significantly changed the way baby care products are purchased. Online retail now accounts for a substantial share of baby care product sales due to convenience, variety, and frequent discounts. The digital marketplace also enables smaller and newer brands to reach a wider audience, further boosting the growth of the sector. The increasing penetration of online shopping in Tier-II and Tier-III cities presents new opportunities for baby care brands to expand their reach.

Market Challenges

- Increasing Competition from Local Brands: The Indian baby care market is witnessing intense competition from both established multinational brands and local players. Local brands like Himalaya and Dabur are aggressively expanding their presence, often at lower price points. This competition poses a challenge to premium brands like Johnson & Johnson, forcing them to reconsider their pricing strategies or risk losing market share. According to a recent market analysis, local brands now account for approximately 40% of the total market share in several product categories like baby creams and oils, driven by their cost-effective offerings and strong distribution networks.

- Regulatory Compliance and Safety Standards: India's regulatory landscape for baby care products is stringent, with the government enforcing safety and quality standards under bodies such as the Bureau of Indian Standards (BIS) and the Food Safety and Standards Authority of India (FSSAI). Companies face challenges ensuring compliance with these regulations, especially in the case of imported products. Any breach in regulatory compliance can result in product recalls, fines, or legal issues, impacting a company's reputation. Manufacturers must continually monitor and update their product formulations to meet the latest safety guidelines, which adds to the operational costs.

India Baby Care Products Market Future Outlook

The India baby care products market is expected to see sustained growth in the coming years, driven by increasing birth rates, urbanization, and rising consumer awareness of the importance of infant health and hygiene. As disposable incomes rise, particularly in Tier-II and Tier-III cities, demand for high-quality and premium baby care products is expected to grow. Moreover, the expanding reach of e-commerce will play a critical role in driving sales, particularly in rural regions where access to baby care products has been traditionally limited.

Market Opportunities

- Growth in Tier-II and Tier-III Cities: As urban centers become saturated, baby care companies are increasingly focusing on Tier-II and Tier-III cities, where birth rates remain high-, and disposable-income levels are rising. These cities, such as Lucknow, Jaipur, and Coimbatore, represent significant untapped markets for baby care products. According to demographic data, these cities are home to around 200 million potential consumers. By adapting their products and pricing strategies to cater to these regions, companies have the opportunity to capture a large, growing segment of the market that remains underserved by multinational brands.

- Rise of D2C Brands: The Direct-to-Consumer (D2C) business model is gaining prominence in India, with an increasing number of brands opting to bypass traditional retail channels. The D2C market has enabled newer players like Mamaearth to establish a strong foothold in the baby care segment by directly reaching consumers through online platforms. This model offers better margins and a more direct connection with the customer, allowing brands to respond faster to consumer feedback and trends. The success of D2C brands in India is paving the way for other companies to enter the market with innovative and niche baby care products.

Scope of the Report

|

By Product Type |

Baby Food Baby Diapers Baby Skincare Products Baby Haircare Products Baby Toiletries |

|

By Distribution Channel |

Hypermarkets & Supermarkets Convenience Stores Online Retailers Specialty Stores |

|

By Age Group |

0-6 Months 6-12 Months 12-24 Months 2-4 Years |

|

By Material Type |

Organic Non-Organic |

|

By Region |

North South East West |

Products

Key Target Audience

Baby Care Product Manufacturers

Retailers (Online and Offline)

Distributors and Wholesalers

Pediatricians and Healthcare Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, BIS)

Baby Care Service Providers

Consumer Goods Importers and Exporters

Companies

Players Mentioned in the Report:

Johnson & Johnson

Procter & Gamble (Pampers)

The Himalaya Drug Company

Dabur India Ltd.

Unilever (Hindustan Unilever)

Nestle India Ltd.

Kimberly-Clark (Huggies)

Emami Ltd.

Me N Moms Pvt. Ltd.

Sebamed India

Table of Contents

1. India Baby Care Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (market-specific growth rate)

1.4. Market Segmentation Overview

2. India Baby Care Products Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (market-specific trends)

2.3. Key Market Developments and Milestones (policy shifts, product innovations, distribution network expansions)

3. India Baby Care Products Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Birth Rates (national health statistics)

3.1.2. Rising Parental Disposable Income (macroeconomic data)

3.1.3. Urbanization and Changing Lifestyles (urban development indicators)

3.1.4. Expansion of E-commerce Platforms (specific e-commerce adoption in India)

3.2. Market Challenges

3.2.1. Increasing Competition from Local Brands (market share analysis)

3.2.2. Regulatory Compliance and Safety Standards (Indian standards and certifications)

3.2.3. High Pricing for Premium Products (pricing studies)

3.2.4. Fragmented Distribution Network (regional distribution analysis)

3.3. Opportunities

3.3.1. Growth in Tier-II and Tier-III Cities (regional demographic data)

3.3.2. Product Diversification (organic and sustainable product trends)

3.3.3. Rise of D2C Brands (market entry strategies for D2C brands in India)

3.3.4. Innovation in Baby Skincare Products (R&D and product innovation data)

3.4. Trends

3.4.1. Organic and Natural Baby Care Products (consumer preference shifts)

3.4.2. Sustainability and Eco-Friendly Packaging (specific regulations and trends)

3.4.3. Increasing Focus on Baby Nutrition (growth in baby food segment)

3.4.4. Social Media Influencing Purchases (consumer behavior reports)

3.5. Government Regulations

3.5.1. FSSAI Guidelines for Baby Food Products (regulatory framework)

3.5.2. BIS Standards for Baby Care Products (compliance requirements)

3.5.3. Health Ministry Initiatives for Maternal and Child Care (government programs)

3.5.4. Taxation and Import Regulations (GST and import duty specifics for baby products)

3.6. SWOT Analysis (market-specific strengths, weaknesses, opportunities, threats)

3.7. Stake Ecosystem (stakeholders including manufacturers, retailers, distributors, and regulatory bodies)

3.8. Porters Five Forces Analysis (supplier power, buyer power, competitive rivalry, etc.)

3.9. Competition Ecosystem

4. India Baby Care Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Baby Food

4.1.2. Baby Diapers

4.1.3. Baby Skincare Products

4.1.4. Baby Haircare Products

4.1.5. Baby Toiletries

4.2. By Distribution Channel (In Value %)

4.2.1. Hypermarkets & Supermarkets

4.2.2. Convenience Stores

4.2.3. Online Retailers

4.2.4. Specialty Stores

4.3. By Age Group (In Value %)

4.3.1. 0-6 Months

4.3.2. 6-12 Months

4.3.3. 12-24 Months

4.3.4. 2-4 Years

4.4. By Material Type (In Value %)

4.4.1. Organic

4.4.2. Non-Organic

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Baby Care Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson

5.1.2. Procter & Gamble (Pampers)

5.1.3. Unilever (Himalaya)

5.1.4. Kimberly-Clark (Huggies)

5.1.5. Dabur India Ltd.

5.1.6. Nestle India Ltd.

5.1.7. The Himalaya Drug Company

5.1.8. Emami Ltd.

5.1.9. Me N Moms Pvt. Ltd.

5.1.10. Pigeon Corporation

5.1.11. Chicco India

5.1.12. Sebamed India

5.1.13. FirstCry

5.1.14. R for Rabbit Baby Products

5.1.15. Mamaearth

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Market Share

5.2.6. Product Portfolio

5.2.7. Distribution Network

5.2.8. R&D Investments

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers & Acquisitions, Partnerships, Joint Ventures)

5.5. Venture Capital Funding

5.6. Investment Analysis

6. India Baby Care Products Market Regulatory Framework

6.1. BIS Compliance

6.2. FSSAI Guidelines

6.3. Certification Processes (ECOCERT, Organic Certifications)

6.4. Import and Export Regulations

7. India Baby Care Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Baby Care Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Age Group (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. India Baby Care Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying major stakeholders, including manufacturers, distributors, and retailers in the India baby care products market. Extensive desk research was carried out to gather industry-level information from credible sources such as government databases, company reports, and regulatory bodies.

Step 2: Market Analysis and Construction

This phase involved analyzing historical data on market penetration, revenue generation, and distribution channels. Additionally, we assessed the impact of regulatory changes, such as FSSAI guidelines, and shifts in consumer behavior towards eco-friendly products.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews and surveys with industry experts and stakeholders, we validated our market hypotheses. These consultations provided insights into market challenges, growth drivers, and evolving trends in the baby care industry.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the gathered data and consultations into a comprehensive report. Cross-verification of the data through multiple sources ensured the accuracy and reliability of the final output.

Frequently Asked Questions

1. How big is the India Baby Care Products Market?

The India baby care products market is valued at USD 11.45 Billion, driven by rising disposable incomes, urbanization, and increased awareness of infant hygiene.

2. What are the challenges in the India Baby Care Products Market?

Challenges in the India baby care products market include rising competition from domestic brands, regulatory hurdles in manufacturing and importing baby care products, and the high cost of premium products.

3. Who are the major players in the India Baby Care Products Market?

Key players in the India baby care products market include Johnson & Johnson, Procter & Gamble (Pampers), The Himalaya Drug Company, Dabur India Ltd., and Unilever (Hindustan Unilever).

4. What are the growth drivers of the India Baby Care Products Market?

Growth drivers in the India baby care products market include rising birth rates, increasing disposable income, urbanization, and the growing popularity of e-commerce as a distribution channel.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.