India Baby Food Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD11235

December 2024

85

About the Report

India Baby Food Market Overview

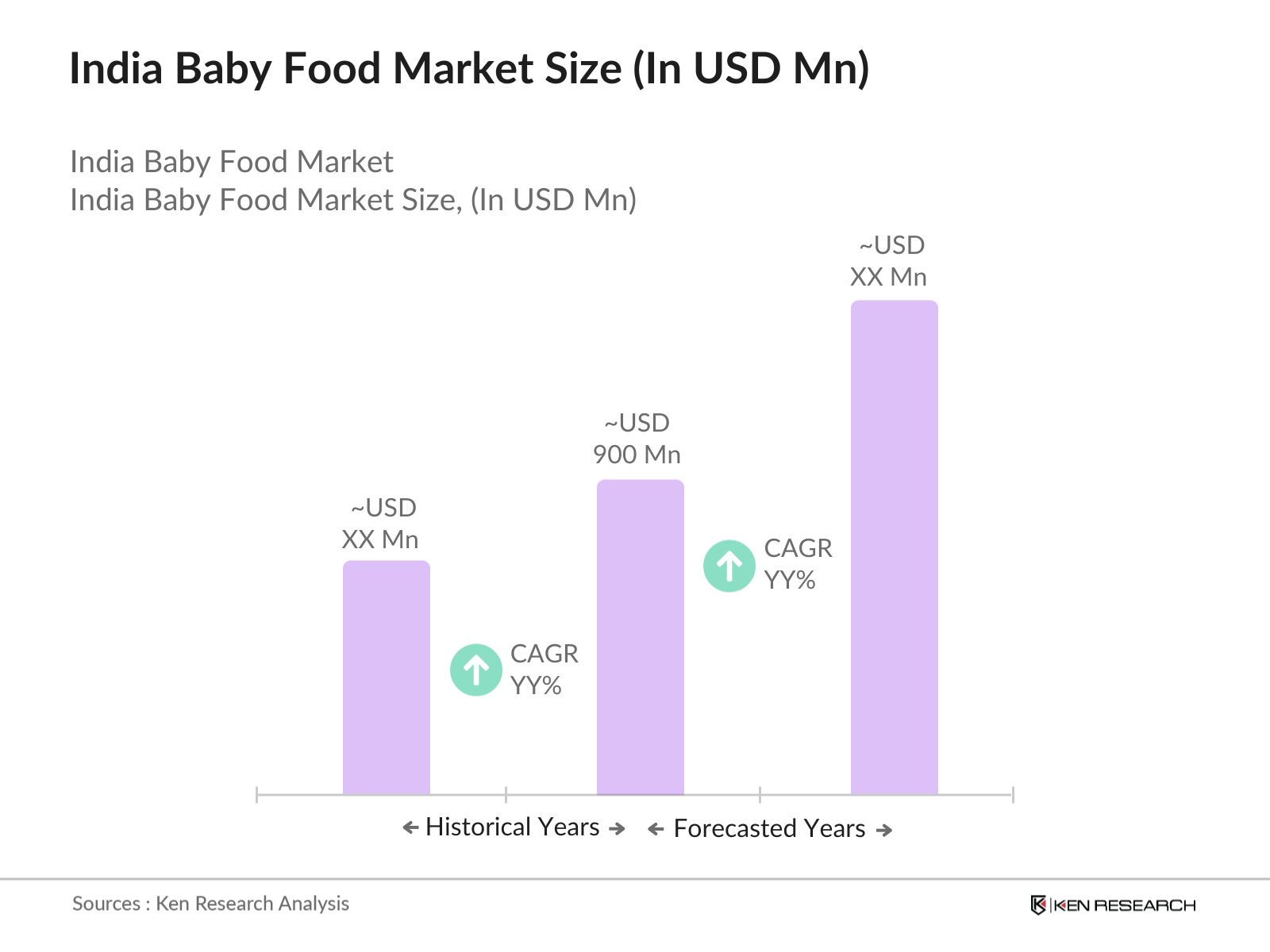

- The India baby food market is valued at USD 900 million, based on a five-year historical analysis. This market is driven by increasing parental awareness about infant nutrition, along with growing disposable incomes. The demand for specialized, nutrient-rich baby food options is rising, with both urban and semi-urban populations seeking convenience-based solutions.

- Urban areas, particularly metro cities like Mumbai, Delhi, and Bengaluru, are key markets, dominating due to higher disposable incomes, lifestyle changes, and a stronger preference for premium products. These cities host a significant concentration of dual-income families, which, coupled with exposure to diverse dietary options, drives demand for baby food products tailored to modern needs.

- Launched to combat malnutrition and stunting, the mission has an allocation of INR 3,000 crore in 2024. It has led to collaborations with baby food companies to distribute fortified food products in rural areas, increasing awareness and indirectly boosting the baby food market.

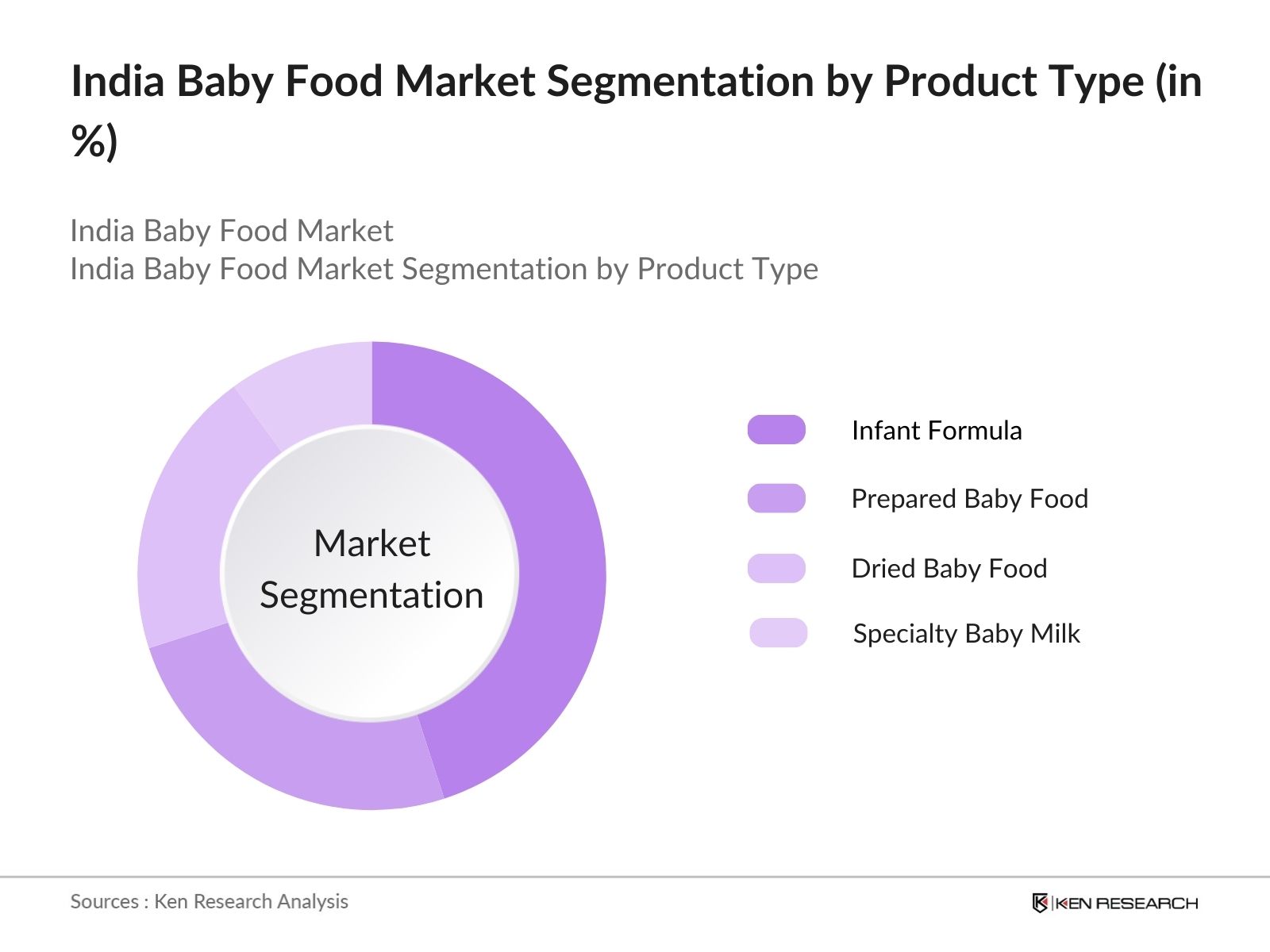

India Baby Food Market Segmentation

By Product Type: The market is segmented by product type into infant formula, prepared baby food, dried baby food, and specialty baby milk. Recently, infant formula has a dominant market share in India within the product type segmentation, attributed to its convenience and essential nutrient profile for infants. Busy urban lifestyles and the influence of healthcare professionals recommending infant formula as a suitable alternative to breast milk in specific cases further bolster its demand among Indian parents.

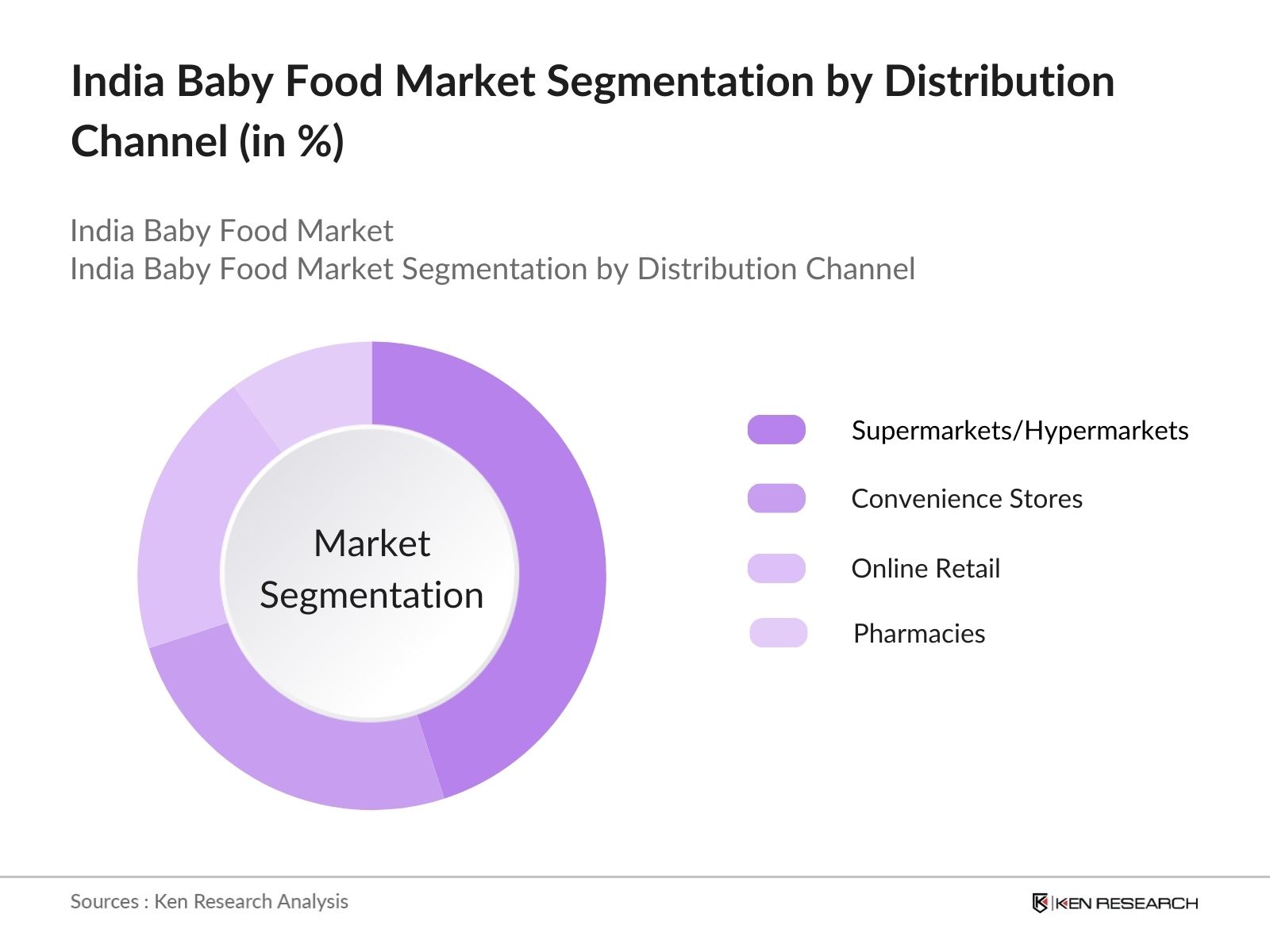

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, and pharmacies. Supermarkets/hypermarkets hold the largest share within the distribution channel segmentation, primarily due to their extensive product visibility and variety. These channels enable customers to compare different brands conveniently and are often stocked with the latest products, helping cater to Indias urban and semi-urban populations.

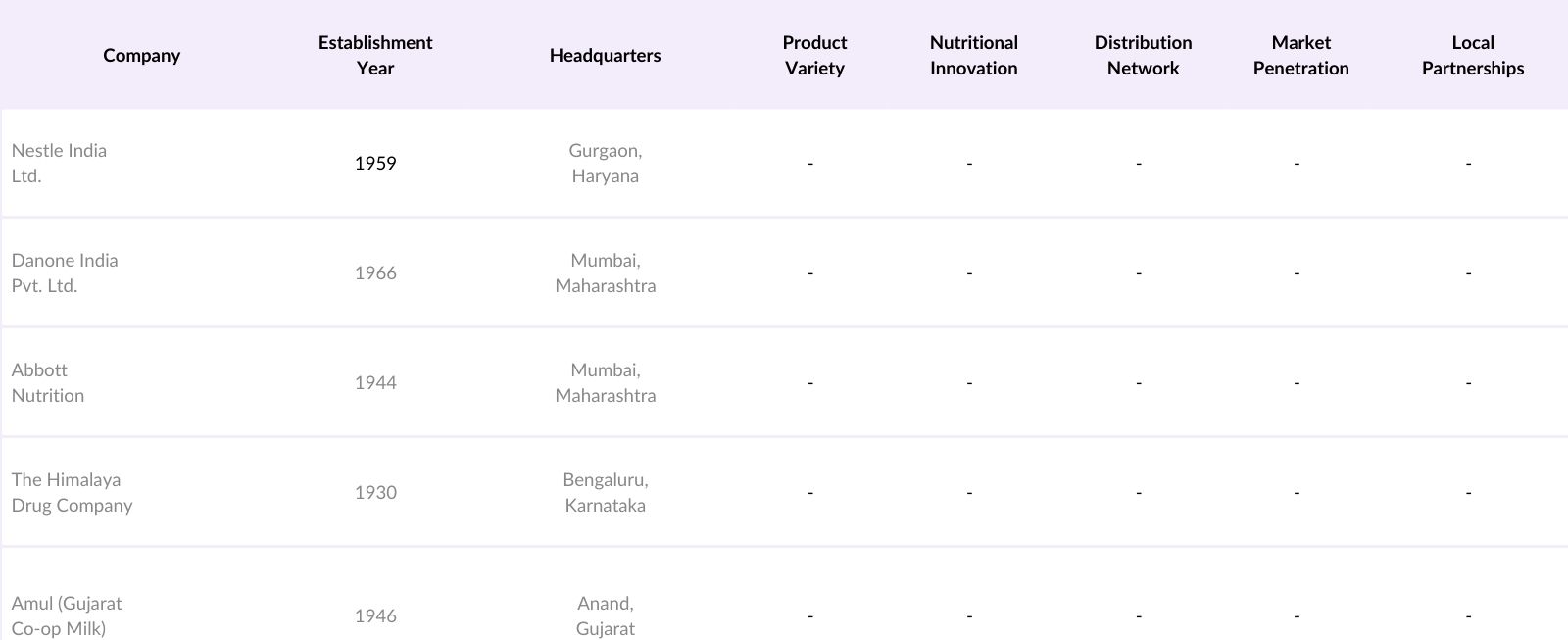

India Baby Food Market Competitive Landscape

The market is dominated by a few major players, including local and international companies such as Nestle India and Danone, which are widely recognized for their diverse offerings and focus on infant nutrition.

India Baby Food Market Analysis

Market Growth Drivers

- Rising Working Mothers in India: In 2024, India has around 30 million working women, contributing significantly to the need for convenient, healthy, and nutritionally balanced baby food options. The demand from this segment alone creates a substantial market opportunity, as more working mothers prefer ready-to-feed solutions that save time without compromising on nutritional value.

- Increased Health Awareness for Infant Nutrition: With over 14 million infants born annually in India, more parents are emphasizing nutrition-rich and hygienic food for their children. This shift is evident in the growing sales of fortified baby foods rich in vitamins, minerals, and probiotics, catering to parents who prioritize infant health and immunity.

- Governments Focus on Infant and Child Health Programs: The Indian governments ongoing efforts under initiatives like the National Nutrition Mission target malnutrition in children and have led to the promotion of nutrient-rich products, including baby foods. The government has allocated nearly INR 3,000 crore in 2024 towards programs aimed at enhancing nutritional standards among infants, indirectly supporting the growth of the baby food market.

Market Challenges

- Prevalence of Homemade Baby Food: Over 60% of Indian households continue to rely on homemade food for infants, as they believe it is safer and healthier. This cultural preference challenges the growth of the formal baby food market, as traditional recipes and family-made foods remain highly favored, limiting market expansion potential.

- Stringent Regulatory Standards: Compliance with regulatory standards like the Food Safety and Standards Authority of India (FSSAI) increases operational costs for baby food manufacturers. In 2024, the cost associated with adhering to FSSAIs standards can be upwards of INR 10 lakh for small and medium-sized enterprises, posing challenges for new entrants and smaller players.

India Baby Food Market Future Outlook

Over the next five years, the India baby food industry is expected to experience steady growth. This expansion is anticipated to be driven by increased parental awareness of infant nutrition, ongoing urbanization, and an expanding middle class with disposable income.

Future Market Opportunities

- Growth in E-commerce Distribution Channels: As internet penetration is anticipated to reach nearly 1 billion users in India by 2029, baby food brands will continue to expand their online presence, improving product accessibility, especially for young, urban families who prefer shopping online.

- Technological Advancements in Packaging: With rising concerns around food safety, baby food manufacturers are expected to adopt smart packaging that indicates freshness and nutritional content. By 2029, around 40% of baby food products are projected to use advanced packaging solutions, ensuring quality and providing transparent information to consumers.

Scope of the Report

|

Product Type |

Infant Formula Prepared Baby Food Dried Baby Food Specialty Baby Milk |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Pharmacies |

|

Age Group |

0-6 Months 6-12 Months 1-2 Years 2-4 Years |

|

Ingredient Type |

Organic Conventional Lactose-Free |

|

Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Baby Food Manufacturers

Retail Chains and Supermarkets

Pharmaceutical Companies

Organic Food Product Providers

Distribution and Supply Chain Partners

Pediatric Healthcare Providers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Health and Family Welfare)

Companies

Players Mentioned in the Report:

Nestle India Ltd.

Danone India Pvt. Ltd.

Abbott Nutrition

The Himalaya Drug Company

Amul (Gujarat Cooperative Milk Marketing Federation Ltd.)

Mead Johnson Nutrition

Britannia Industries

Kraft Heinz India

Pristine Organics

Hindustan Unilever Ltd.

Table of Contents

1. India Baby Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Baby Food Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Baby Food Market Analysis

3.1 Growth Drivers

3.1.1 Rising Health Consciousness

3.1.2 Increasing Disposable Income

3.1.3 Urbanization and Changing Lifestyles

3.1.4 Expansion of Organized Retail

3.2 Market Challenges

3.2.1 High Cost of Baby Food Products

3.2.2 Regulatory Restrictions

3.2.3 Consumer Preference for Homemade Alternatives

3.3 Opportunities

3.3.1 Growing Demand for Organic Baby Food

3.3.2 E-commerce Penetration

3.3.3 Rising Awareness of Nutritional Needs

3.4 Trends

3.4.1 Premiumization of Baby Food

3.4.2 Increased Demand for Plant-Based Baby Food

3.4.3 Innovations in Packaging

3.5 Government Regulation

3.5.1 FSSAI Standards and Guidelines

3.5.2 Import and Export Regulations

3.5.3 Labeling and Advertising Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. India Baby Food Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Infant Formula

4.1.2 Prepared Baby Food

4.1.3 Dried Baby Food

4.1.4 Specialty Baby Milk

4.2 By Distribution Channel (In Value %)

4.2.1 Supermarkets/Hypermarkets

4.2.2 Convenience Stores

4.2.3 Online Retail

4.2.4 Pharmacies

4.3 By Age Group (In Value %)

4.3.1 0-6 Months

4.3.2 6-12 Months

4.3.3 1-2 Years

4.3.4 2-4 Years

4.4 By Ingredient Type (In Value %)

4.4.1 Organic

4.4.2 Conventional

4.4.3 Lactose-Free

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Baby Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nestle India Ltd.

5.1.2 Danone India Pvt. Ltd.

5.1.3 Abbott Nutrition

5.1.4 The Himalaya Drug Company

5.1.5 Amul (Gujarat Cooperative Milk Marketing Federation Ltd.)

5.1.6 Mead Johnson Nutrition

5.1.7 Britannia Industries

5.1.8 Kraft Heinz India

5.1.9 Pristine Organics

5.1.10 Hindustan Unilever Ltd.

5.1.11 Raptakos Brett & Co. Ltd.

5.1.12 Plum Organics

5.1.13 Gerber Products Company

5.1.14 Nurture Inc.

5.1.15 Organic India Pvt. Ltd.

5.2 Cross Comparison Parameters (Revenue, Market Presence, Distribution Networks, Product Portfolio, Customer Loyalty, Product Innovation, Local Sourcing, Digital Marketing Strategies)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Baby Food Market Regulatory Framework

6.1 FSSAI Certification Requirements

6.2 Compliance for Imported Baby Food

6.3 Advertising Regulations

6.4 Nutritional Labeling Standards

7. India Baby Food Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Baby Food Market Segmentation (Future)

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Age Group (In Value %)

8.4 By Ingredient Type (In Value %)

8.5 By Region (In Value %)

9. India Baby Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all significant stakeholders in the India baby food market, guided by extensive desk research. By integrating data from multiple secondary sources, we aim to outline variables critical to understanding market dynamics.

Step 2: Market Analysis and Construction

This phase includes compiling historical data on the India baby food market, focusing on key metrics such as market growth trends, product demand, and distribution channels. This data aids in constructing an accurate market projection.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews, providing industry-specific insights. This feedback helps refine data accuracy, incorporating practical industry knowledge.

Step 4: Research Synthesis and Final Output

The last phase synthesizes findings from interviews and data analysis, leading to a cohesive market analysis. This approach ensures a validated report, enriched by industry insights and robust quantitative data.

Frequently Asked Questions

01. How big is the India Baby Food Market?

The India baby food market is valued at USD 900 million, driven by factors like rising disposable incomes, a growing working population, and increased awareness of infant health.

02. What are the challenges in the India Baby Food Market?

Challenges in the India baby food market include regulatory restrictions, competition from homemade alternatives, and high product costs, impacting consumer adoption rates in rural areas.

03. Who are the major players in the India Baby Food Market?

Key players in the India baby food market include Nestle India Ltd., Danone India Pvt. Ltd., and Abbott Nutrition, known for their extensive distribution networks, brand reputation, and diverse product offerings.

04. What are the growth drivers of the India Baby Food Market?

The India baby food market is propelled by urbanization, increased parental awareness of nutrition, and the expansion of organized retail chains that provide easy access to baby food products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.