India Bakery Premixes Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD3728

December 2024

85

About the Report

India Bakery Premixes Market Overview

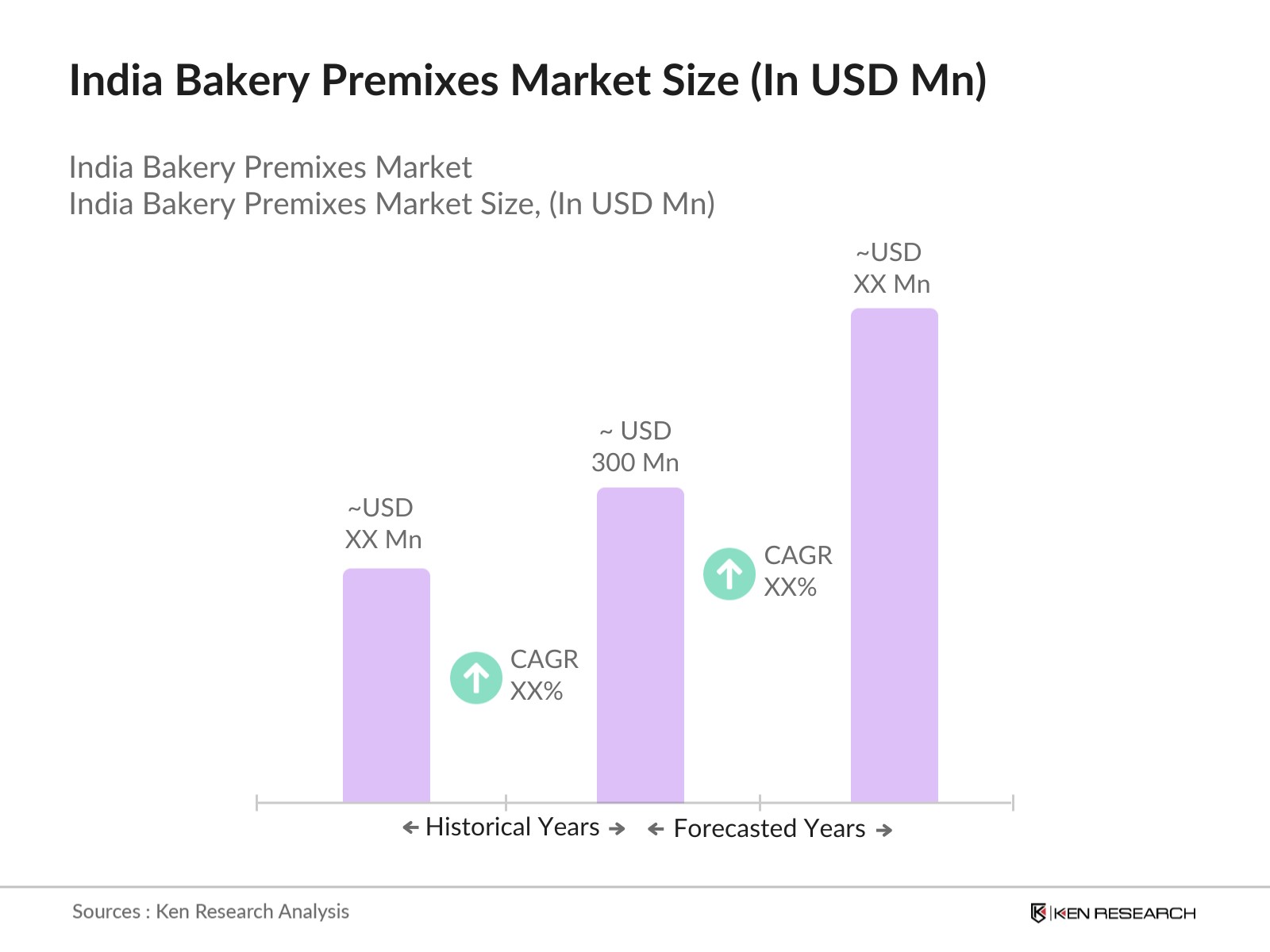

- The India Bakery Premixes Market, valued at USD 300 Mn, is witnessing robust growth due to the increasing consumer demand for ready-to-use baking solutions, driven by urbanization, changing food habits, and the growing popularity of home baking. The convenience offered by bakery premixesrequiring minimal preparation timehas significantly contributed to their adoption among both commercial and home bakers. The market is driven by the rise in disposable income, the expansion of the foodservice sector, and the influence of Western food trends across India.

- Major cities such as Mumbai, Delhi, and Bengaluru dominate the India Bakery Premixes Market due to their large population, high number of retail and foodservice outlets, and a thriving food culture. These cities are home to the highest concentration of artisan bakeries, cafes, and quick-service restaurants (QSRs), which are key drivers of the demand for premixes. Furthermore, their affluent middle-class population, with a preference for convenience and premium baked goods, supports the market dominance of these urban centers.

- The Food Safety and Standards Authority of India (FSSAI) updated its guidelines on the permissible ingredients in bakery premixes in 2022, ensuring product safety. These guidelines restrict the use of certain additives and emphasize the importance of labeling ingredients. The guidelines are aimed at ensuring transparency and maintaining public health, especially with the rise of nutritionally enriched and clean label bakery products

India Bakery Premixes Market Segmentation

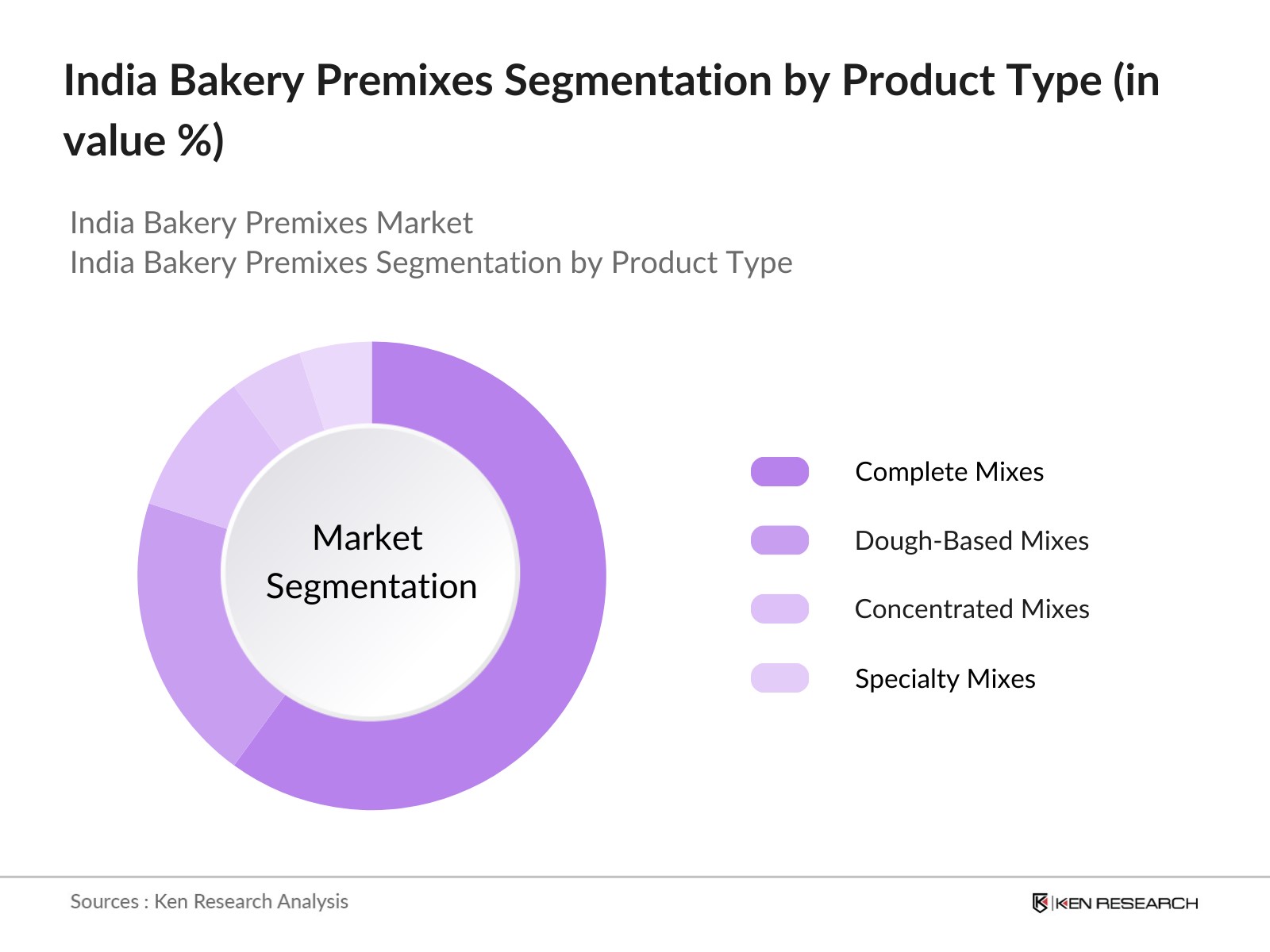

By Product Type: The India Bakery Premixes Market is segmented by product type into complete mixes, dough-based mixes, concentrated mixes, and specialty mixes. Recently, complete mixes have gained a dominant market share, largely due to their ease of use and growing demand from home bakers and small-scale commercial bakers. Complete mixes allow consumers to quickly prepare bakery products with consistent quality, without requiring complex baking skills. This has made them particularly popular in households and smaller bakeries, driving their dominance in the market.

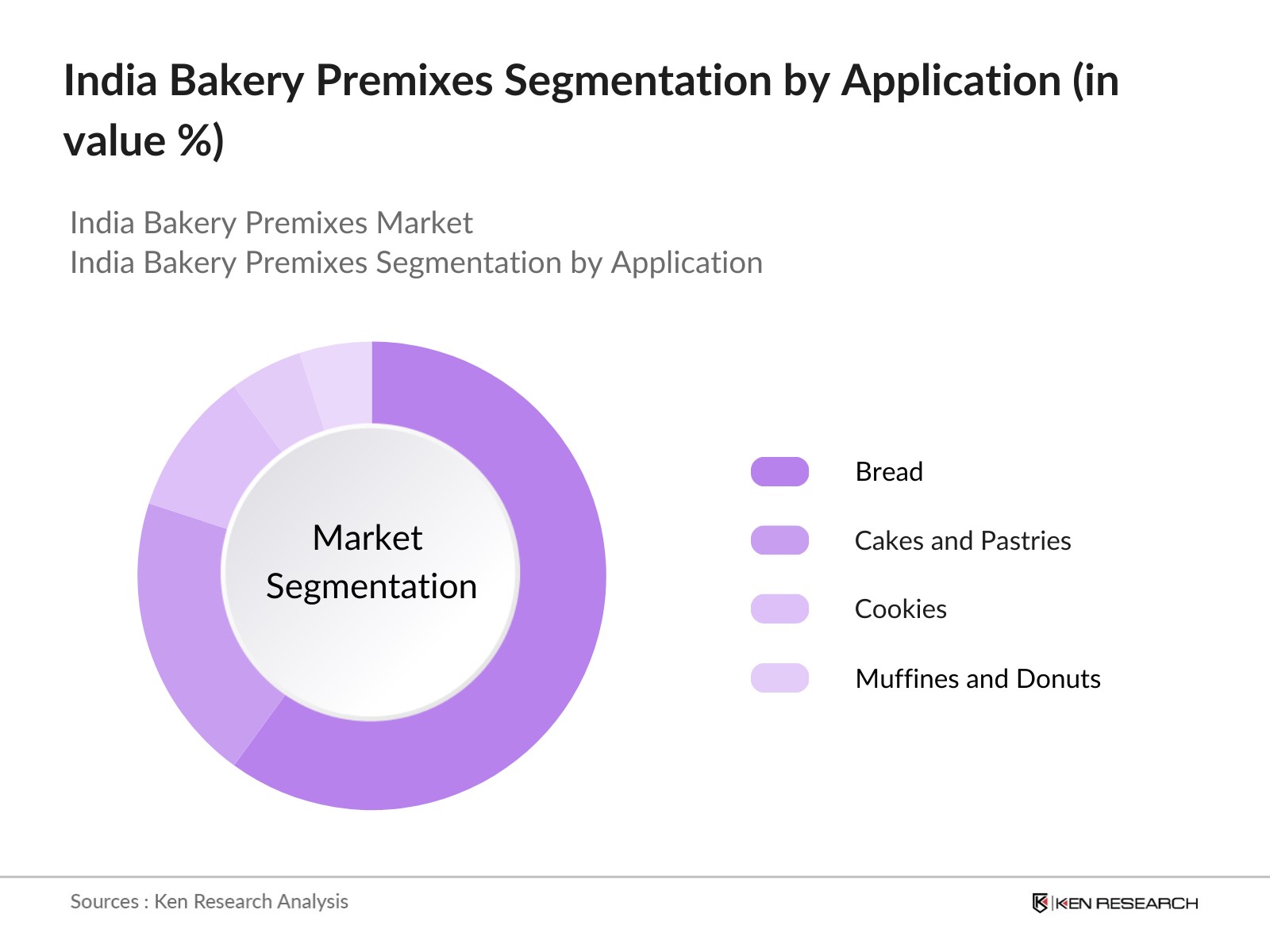

By Application: India Bakery Premixes Market is also segmented by application into bread, cakes and pastries, cookies, and muffins and donuts. Bread is the leading segment under application due to its widespread consumption across both urban and rural India. The affordability of bread, combined with its versatility in meals, has fueled its continuous growth. Furthermore, commercial bakers extensively use premixes to ensure uniformity and speed in large-scale bread production, reinforcing this segments strong market position.

India Bakery Premixes Market Competitive Landscape

The India Bakery Premixes Market is dominated by both international and domestic players, leveraging their strong distribution networks, innovation in product offerings, and understanding of consumer preferences. Companies like Cargill and Puratos have maintained their market positions through continuous R&D, introducing products catering to the growing demand for healthier and specialty bakery premixes, such as gluten-free or organic mixes. Moreover, the market sees competition in pricing strategies, distribution reach, and the ability to provide customized premixes for specific baking needs.

|

Company |

Establishment Year |

Headquarters |

R&D Expenditure |

Product Portfolio |

Distribution Network |

Market Share |

Revenue |

No. of Employees |

|

Cargill |

1865 |

Minneapolis, USA |

- |

- |

- |

- |

- |

- |

|

Puratos |

1919 |

Groot-Bijgaarden, BE |

- |

- |

- |

- |

- |

- |

|

AB Mauri |

1910 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Lesaffre |

1853 |

Marcq-en-Barul, FR |

- |

- |

- |

- |

- |

- |

|

Bakels India |

1999 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

India Bakery Premixes Market Analysis

Growth Drivers

- Rise in Demand for Convenient Food Solutions: The rise in demand for convenient food solutions in India is closely tied to the evolving urban lifestyle. Indias urban population reached approximately 490 million by 2023, leading to increased consumption of ready-to-eat and easy-to-prepare food products, including bakery premixes. This trend is particularly prominent in metro cities, where working professionals favor time-saving solutions, spurring demand for bakery premixes in both commercial and household sectors. Furthermore, India's rapid economic growth, projected at a 6.3% GDP expansion for 2024, supports increased consumer spending on processed foods.

- Growth of Bakery Chains and Cafs: India's bakery industry has experienced growth, fueled by the expansion of bakery chains and cafs. Leading bakery franchises and small caf setups have increased from 95,000 outlets in 2021 to approximately 108,000 outlets by mid-2024. This expansion has led to higher demand for bakery premixes, especially for ready-to-bake solutions used in cakes, pastries, and bread. Metro cities like Mumbai, Delhi, and Bengaluru account for about 50% of these outlets, with Tier-2 and Tier-3 cities contributing the rest.

Market Challenges

- High Production Costs: The Indian bakery premixes market faces challenges due to rising production costs, primarily driven by increased raw material prices. In 2023, wheat prices surged by 22% compared to 2021, while sugar prices saw a rise of 18%, directly affecting the cost of premixes. Additionally, logistics and transportation costs have increased by 12% in the same period, largely due to fuel price hikes, making the supply chain more expensive for manufacturers

- Need for Cold Chain Logistics: The demand for bakery premixes that require specific storage conditions is increasing, but the need for cold chain logistics remains a challenge. Indias cold storage capacity is currently at 37 million metric tons, but there is a 20% gap in demand and supply for cold chain logistics, particularly for perishable bakery ingredients. This shortage hampers the efficient distribution of certain types of premixes, especially those containing dairy or other temperature-sensitive ingredients.

India Bakery Premixes Market Future Outlook

Over the next five years, the India Bakery Premixes Market is expected to grow substantially due to increased consumer preference for convenience foods, innovations in bakery ingredients, and the rise in home baking. Key growth drivers include the expanding middle-class population, which seeks premium and healthier baked products, along with advancements in ingredient technology that improve product shelf life and nutritional value. This growth will be supported by strategic partnerships between bakery premix manufacturers and retail chains, fostering greater market penetration.

Market Opportunities

- Increased Investment in Green Energy Infrastructure: Government spending on renewable energy has surged globally in 2024. For example, the US government allocated $370 billion to clean energy projects under the Inflation Reduction Act, focusing on solar and wind power. Similarly, the European Union invested 250 billion in renewable infrastructure through the REPowerEU plan. These investments are driving significant development in renewable energy technologies, resulting in higher energy generation capacity. In China, the installed renewable energy capacity reached over 1,300 gigawatts by mid-2024, reflecting a clear transition towards green energy.

- Rise in Global Electricity Generation from Renewable Sources: According to the International Energy Agency (IEA), renewable energy sources, particularly wind and solar, contributed around 12,000 terawatt-hours (TWh) to global electricity generation in 2024. This marked a considerable increase in output as compared to 2022, where global electricity generation from renewables was around 10,000 TWh. These increases have been driven by government incentives and policies promoting clean energy adoption across several major economies, including the US, China, and India.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Complete Mixes Dough-Based Mixes Concentrated Mixes Specialty Mixes |

|

By Application |

Bread Cakes and Pastries Cookies Muffins and Donuts |

|

By Ingredient |

Flours Enzymes and Emulsifiers Preservatives Sweeteners and Colorants |

|

By End-User |

Commercial Bakers Home Bakers Industrial Bakers Cafes and Quick-Service Restaurants (QSRs) |

|

By Region |

North South East West |

Products

Key Target Audience

Commercial Bakers

Home Bakers

Quick-Service Restaurants (QSRs)

Industrial Bakers

Artisan Bakeries

Government and Regulatory Bodies (FSSAI)

Investor and Venture Capitalist Firms

Ingredients Suppliers and Distributors

Companies

Major Players mentioned in the report

Cargill

AB Mauri

Puratos

Lesaffre

Swiss Bake Ingredients

Bakels India

Eurostar Commodities

Associated British Foods Plc

General Mills India

Premia Food Ingredients

IREKS India Pvt Ltd.

Dawn Foods

Rich Graviss

Corbion N.V.

Zeelandia Group

Table of Contents

1. India Bakery Premixes Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Bakery Premixes Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Bakery Premixes Market Analysis

3.1 Growth Drivers

3.1.1 Rising Consumer Demand for Convenience Foods

3.1.2 Growing Popularity of Healthy and Nutritional Premixes

3.1.3 Urbanization and Increasing Disposable Income

3.1.4 Growth in Artisan Bakeries and Cafs

3.2 Market Challenges

3.2.1 Volatility in Raw Material Prices (Wheat, Flour, Sugar)

3.2.2 Stringent Government Regulations on Food Quality and Safety

3.2.3 High Production Costs Due to Customization Needs

3.3 Opportunities

3.3.1 Innovation in Gluten-Free and Vegan Bakery Premixes

3.3.2 Expanding Distribution Networks

3.3.3 Growing Influence of Western Bakery Trends

3.4 Trends

3.4.1 Rise in Demand for Organic and Natural Ingredient-Based Premixes

3.4.2 Integration of Premixes with E-Commerce Platforms

3.4.3 Increase in Customization for Specialty Bakery Products

3.5 Government Regulations

3.5.1 Food Safety and Standards Authority of India (FSSAI) Guidelines

3.5.2 Import/Export Restrictions on Ingredients

3.5.3 Nutritional Labeling Requirements

3.5.4 Compliance with ISO Food Safety Certifications

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Bakers, Ingredient Suppliers, Retailers, and Distributors)

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. India Bakery Premixes Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Complete Mixes

4.1.2 Dough-Based Mixes

4.1.3 Concentrated Mixes

4.1.4 Specialty Mixes

4.2 By Application (In Value %)

4.2.1 Bread

4.2.2 Cakes and Pastries

4.2.3 Cookies

4.2.4 Muffins and Donuts

4.3 By Ingredient Type (In Value %)

4.3.1 Flours

4.3.2 Enzymes and Emulsifiers

4.3.3 Preservatives

4.3.4 Sweeteners and Colorants

4.4 By End-User (In Value %)

4.4.1 Commercial Bakers

4.4.2 Home Bakers

4.4.3 Industrial Bakers

4.4.4 Cafes and Quick-Service Restaurants (QSRs)

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Bakery Premixes Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Cargill

5.1.2 AB Mauri

5.1.3 Puratos

5.1.4 Lesaffre

5.1.5 Swiss Bake Ingredients

5.1.6 Bakels India

5.1.7 Eurostar Commodities

5.1.8 Associated British Foods Plc

5.1.9 General Mills India

5.1.10 Premia Food Ingredients

5.1.11 IREKS India Pvt Ltd.

5.1.12 Dawn Foods

5.1.13 Rich Graviss

5.1.14 Corbion N.V.

5.1.15 Zeelandia Group

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Distribution Network, R&D Investments, No. of Manufacturing Units, Head Office Location, Employee Strength)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. India Bakery Premixes Market Regulatory Framework

6.1 FSSAI Standards for Premixes

6.2 Compliance with Additive Regulations

6.3 Labeling Requirements (Nutritional, Allergen Information)

6.4 Certifications for Organic and Gluten-Free Premixes

7. India Bakery Premixes Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Bakery Premixes Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Ingredient Type (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. India Bakery Premixes Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the India Bakery Premixes Market ecosystem, identifying the key stakeholders, including ingredient suppliers, bakers, distributors, and retail chains. Extensive desk research using secondary and proprietary databases was conducted to gather market-level data, highlighting essential market dynamics such as demand patterns and pricing structures.

Step 2: Market Analysis and Construction

This step focused on analyzing historical market data, including the penetration of bakery premixes in commercial and home-baking sectors. Data on bakery ingredient imports, bakery premix production, and sales trends were collected to determine market performance. The analysis also included evaluating sales by product type and application.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of market projections, hypotheses were validated through interviews with industry experts from leading bakery premix companies and ingredient suppliers. These consultations provided insights into market trends, consumer preferences, and the competitive landscape, contributing to more precise forecasts.

Step 4: Research Synthesis and Final Output

In the final step, all data points, hypotheses, and market insights were synthesized into the final report. This included a top-down and bottom-up approach to ensure a balanced analysis of market size, segmentation, and future trends.

Frequently Asked Questions

01. How big is the India Bakery Premixes Market?

The India Bakery Premixes Market was valued at USD 300 Mn is driven by increasing consumer demand for convenience in baking, along with rising urbanization and changing food consumption patterns.

02. What are the challenges in the India Bakery Premixes Market?

Challenges in the India Bakery Premixes market include volatility in raw material prices, compliance with stringent food safety regulations, and the need for continuous product innovation to meet evolving consumer demands.

03. Who are the major players in the India Bakery Premixes Market?

Key players in India Bakery Premixes include Cargill, AB Mauri, Puratos, and Lesaffre, which dominate the market due to their strong distribution networks, extensive product offerings, and continuous R&D investments.

04. What are the growth drivers of the India Bakery Premixes Market?

The India Bakery Premixes market growth is propelled by increasing disposable income, the expansion of foodservice outlets, and growing consumer interest in premium, healthier bakery products such as gluten-free and organic options.

05. Which cities dominate the India Bakery Premixes Market?

Mumbai, Delhi, and Bengaluru lead the market due to their thriving bakery culture, high number of foodservice outlets, and large population of middle-class consumers seeking convenience and premium bakery products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.