India Bakery Products Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD2594

October 2024

99

About the Report

India Bakery Products Market Overview

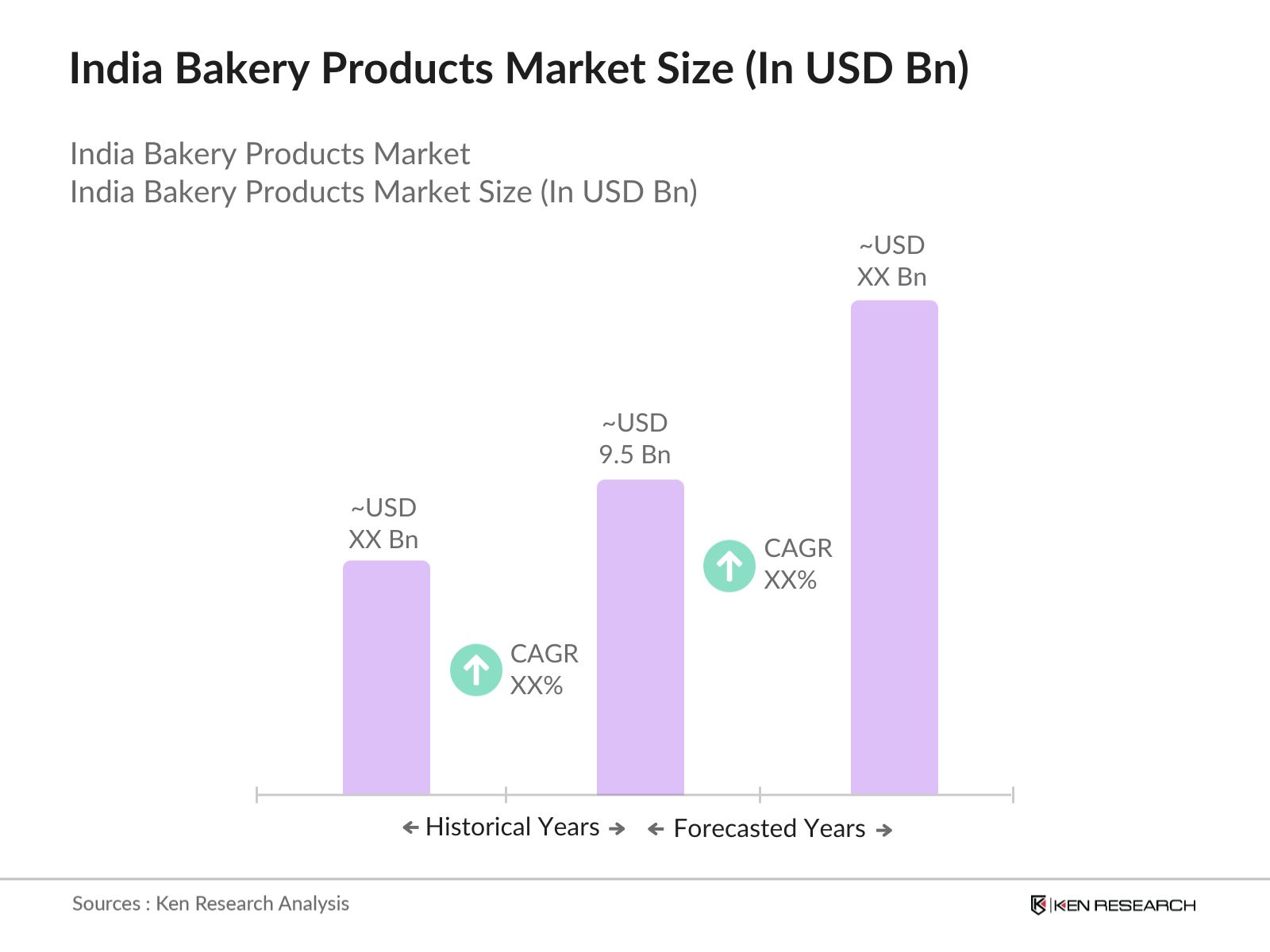

- The India bakery products market was valued at USD 9.5 billion and has witnessed steady growth due to increased consumer demand for convenient, ready-to-eat food products. The market is driven by rapid urbanization, growing disposable incomes, and a shift in consumer preferences toward healthier bakery options such as whole grain bread, low-calorie pastries, and gluten-free products. The increasing popularity of artisanal and specialty bakery products is also contributing to market expansion.

- Key regions contributing to the markets growth include metropolitan cities like Delhi, Mumbai, and Bengaluru. These cities are home to a rising middle-class population with higher purchasing power, which has led to increased consumption of premium and packaged bakery products. Additionally, rural areas are witnessing a gradual rise in the demand for affordable bakery items, spurred by improved infrastructure and distribution channels.

- The Food Safety and Standards Authority of India (FSSAI) has laid down stringent guidelines for bakery products to ensure quality and safety standards. In 2022, the FSSAI introduced new regulations limiting the trans-fat content in bakery products to 2%, in line with the global trend toward reducing unhealthy fats. Compliance with these guidelines is crucial for manufacturers, especially those targeting health-conscious consumers.

India Bakery Products Market Segmentation

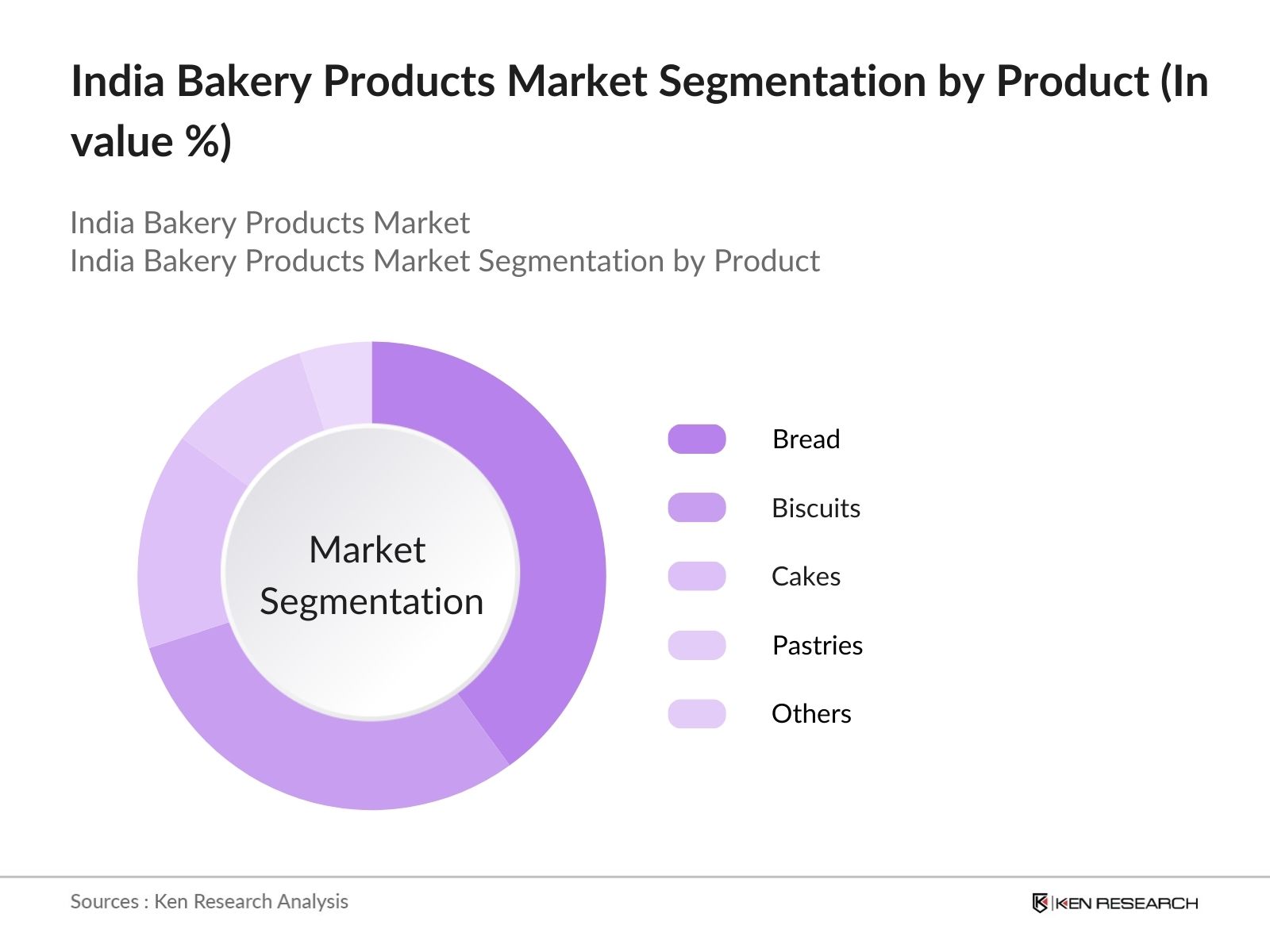

- By Product Type: The market is segmented into bread, biscuits, cakes, pastries, and others. Bread remains the dominant segment, accounting for the largest market share, driven by its affordability and wide consumption as a staple food item. Specialty breads, such as multigrain and sourdough, are gaining popularity among health-conscious consumers. Biscuits, particularly digestive and cream-filled varieties, also hold a significant share due to their convenience and long shelf life.

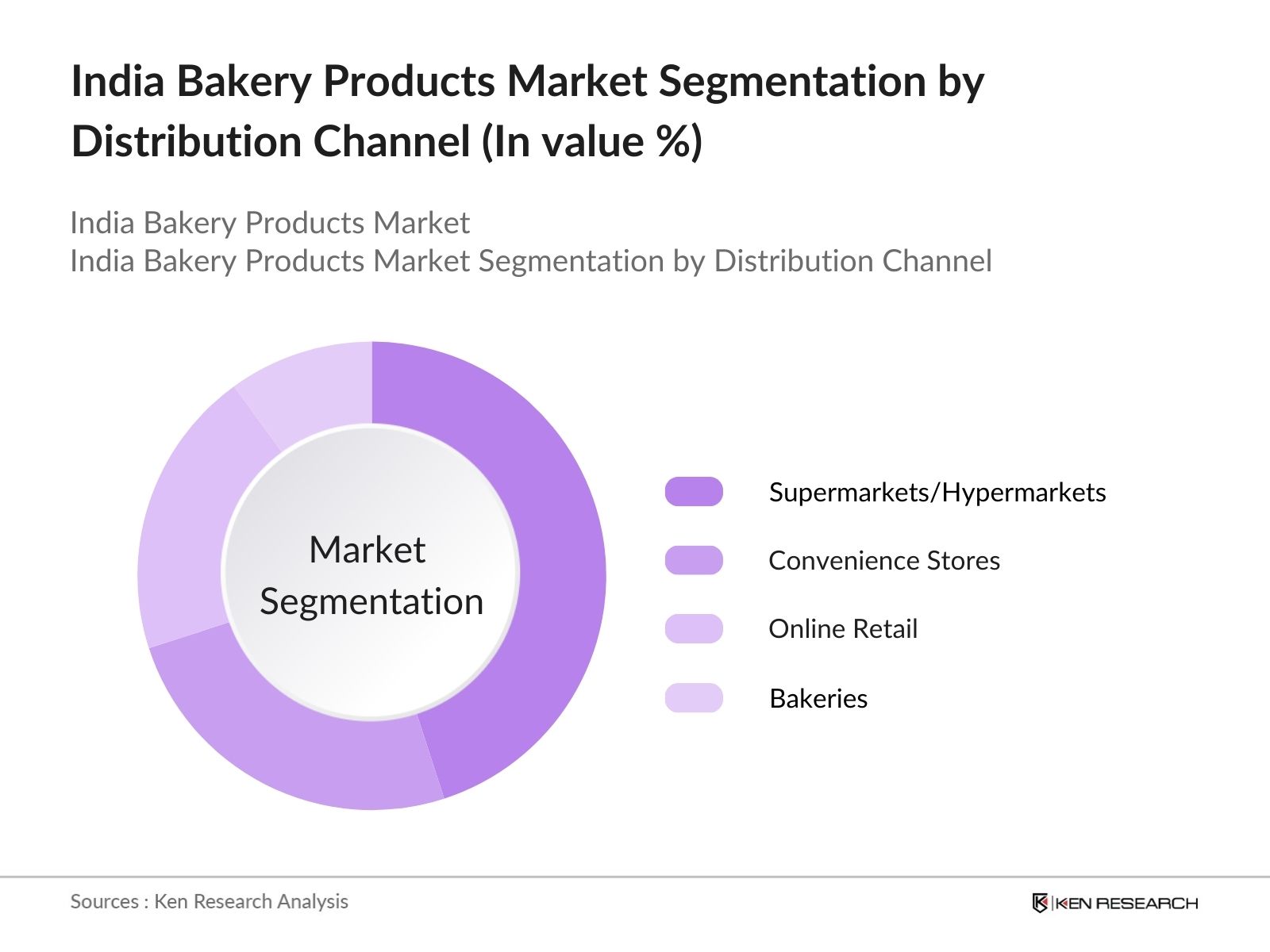

- By Distribution Channel: The market is segmented by distribution channels into supermarkets/hypermarkets, convenience stores, online retail, and bakeries. Supermarkets and hypermarkets dominate the market due to their wide product offerings and attractive pricing strategies. However, online retail is rapidly growing, fueled by the increasing penetration of e-commerce platforms and the convenience of home delivery services, especially in urban areas.

India Bakery Products Market Competitive Landscape

The Indian bakery products market is highly fragmented, with numerous local and regional players competing with well-established national brands. Companies such as Britannia, Parle, and ITC dominate the market with their extensive product portfolios and wide distribution networks. These companies continue to invest in product innovation, focusing on health and wellness trends by launching products such as gluten-free bread and sugar-free biscuits.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

R&D Investment |

Revenue (2023) |

No. of Employees |

Market Reach |

Brand Loyalty |

Partnerships |

|

Britannia Industries |

1892 |

Bengaluru |

|||||||

|

Parle Products |

1929 |

Mumbai |

|||||||

|

ITC Limited |

1910 |

Kolkata |

|||||||

|

Anmol Industries |

1994 |

Kolkata |

|||||||

|

Mrs. Bector's Food Specialties |

1995 |

Ludhiana |

India Bakery Products Industry Analysis

Growth Drivers

- Urbanization & Changing Lifestyles (Impact of Urbanization, Changing Eating Habits): The rapid urbanization in India, where over 31.6 % (377.1 million) of the population now resides in urban areas, has significantly influenced changing dietary habits. According to the National Sample Survey Office (NSSO), urban households spend an average of INR 6,459 per month on processed and ready-to-eat foods, a figure that includes bakery products like bread, biscuits, and cakes. As the working population in cities grows, consumers seek convenient food options, contributing to the increased demand for bakery products. Urban consumers are increasingly purchasing bakery items for breakfast and snacks, leading to higher sales in metropolitan areas2 Rising Health Consciousness.

- Demand for Gluten-Free, Sugar-Free, and Wholegrain Products: India has seen a significant rise in health-conscious consumers, with nearly 80% of consumers seeking healthier food options, including gluten-free, sugar-free, and wholegrain bakery products. Data from the Food Safety and Standards Authority of India (FSSAI) highlights that majority of respondents to a 2023 survey showed interest in healthier bakery items due to rising concerns about obesity, diabetes, and heart diseases. Consumers, particularly in urban centers, are increasingly opting for wholegrain bread, which has resulted in a surge in demand for multigrain and high-fiber bakery products.

- Technological Advancements in Baking (Automation, New Production Techniques): Technological advancements in the baking industry, including automation, are transforming the production process, making it more efficient and reducing the reliance on manual labour. According to data from the Confederation of Indian Industry (CII), majority of large-scale bakery manufacturers have integrated automated production lines to enhance operational efficiency and consistency. The adoption of advanced equipment has reduced production times substantially and minimized wastage, leading to higher output at lower costs. New techniques such as the use of smart ovens and precise ingredient measurement systems are helping bakers meet the growing demand for quality and consistency.

Market Challenges

- Fluctuating Raw Material Prices (Wheat, Sugar, Butter Price Volatility): One of the major challenges facing the bakery industry is the volatility in raw material prices, particularly wheat, sugar, and butter. Erratic weather patterns affecting crop yields and disruptions in supply chains have led to significant fluctuations in the cost of these essential ingredients. This price volatility greatly impacts the profitability of bakery manufacturers, especially smaller players who depend on stable input costs to maintain competitive pricing. The unpredictability in raw material costs also poses challenges in long-term pricing strategies for bakery products.

- Competition from Unorganized Sector (Local Bakers and Homemade Products): Indias bakery market is highly fragmented, with a substantial portion of the sector being unorganized, consisting of local bakers and homemade products. The unorganized sector offers fresh, low-cost products that appeal to price-sensitive consumers, particularly in smaller towns and rural areas. These local players provide tough competition to larger, organized companies, making it difficult for them to penetrate these markets. The widespread availability of local bakery products, often customized to regional tastes, further challenges the growth of organized bakery businesses.

India Bakery Products Market Future Outlook

The India bakery products market is expected to witness steady growth over the next five years, driven by rising health consciousness, increasing urbanization, and the growth of the foodservice sector. The demand for premium, healthy, and artisanal bakery products will continue to rise, particularly in metropolitan areas. Furthermore, advancements in packaging technology and the growth of e-commerce platforms will make bakery products more accessible to a wider audience.

Future Market Opportunities

- Expansion in Tier II and III Cities (Emerging Markets, Distribution Challenges): As Indias urbanization extends into Tier II and III cities, bakery product consumption is rising steadily. Migration has significantly contributed to urban growth, with various reports indicating that rural-to-urban migration accounts for about 20% of urban population growth in India, resulting in increased demand for packaged and processed food, including bakery items. The improvement in infrastructure and retail distribution channels is facilitating the entry of organized bakery brands into these emerging markets, where consumers are shifting from traditional snacks to modern bakery products .

- E-Commerce Growth (Online Retail, Direct-to-Consumer Brands)

The rapid growth of e-commerce in India, with online retail sales surpassing INR 4 trillion in 2023, presents a significant opportunity for bakery product manufacturers. According to the Internet and Mobile Association of India (IAMAI), more than half of urban consumers now purchase food items, including bakery products, online. The rise of direct-to-consumer (D2C) brands and online grocery platforms like BigBasket and Grofers has enabled bakery companies to reach a broader audience, especially during periods of lockdown and restricted mobility.

Scope of the Report

|

Product Type |

Bread Biscuits Cakes Pastries Others |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Bakeries |

|

Ingredients |

Wheat Oats Sugar Chocolate Butter |

|

Application |

Household Consumption Foodservice Institutional Use |

|

Region |

North West South East |

Products

Key Target Audience

-

Bakery Manufacturers

Food & Beverage Producing Firms

Food Service Providers (Cafs, QSRs)

Banks and Financial Institutes

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Packaging and Ingredient Suppliers

Companies

Major Players of the Market

-

Britannia Industries

Parle Products

ITC Limited

Mrs. Bectors Food Specialties

Anmol Industries

Surya Food & Agro Ltd (PriyaGold)

Cremica Food Industries

Harvest Gold

Modern Foods

Monginis Food Pvt Ltd

Kwality Foods

Bonn Group of Industries

Hindustan Unilever Limited

Patanjali Ayurved

Bonn Nutrients Pvt Ltd

Table of Contents

1. India Bakery Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview (Product Type, Distribution Channel, Ingredients, Application, Region)

2. India Bakery Products Market Size (In USD Bn)

2.1. Historical Market Size (Overall Revenue, Year-on-Year Growth, Regional Breakdown)

2.2. Year-On-Year Growth Analysis (YoY Growth, Consumer Spending Behavior, Economic Influences)

2.3. Key Market Developments and Milestones (New Product Launches, Market Expansion, Government Policies)

3. India Bakery Products Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization & Changing Lifestyles (Impact of Urbanization, Changing Eating Habits)

3.1.2. Rising Health Consciousness (Demand for Gluten-Free, Sugar-Free, and Wholegrain Products)

3.1.3. Technological Advancements in Baking (Automation, New Production Techniques)

3.1.4. Growing Foodservice Industry (Increased Caf and QSRs Penetration)

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices (Wheat, Sugar, Butter Price Volatility)

3.2.2. Competition from Unorganized Sector (Local Bakers and Homemade Products)

3.2.3. Stringent Regulatory Environment (FSSAI Standards, Food Labeling Requirements)

3.3. Opportunities

3.3.1. Expansion in Tier II and III Cities (Emerging Markets, Distribution Challenges)

3.3.2. Innovations in Product Packaging (Eco-Friendly Packaging, Shelf Life Enhancement)

3.3.3. E-Commerce Growth (Online Retail, Direct-to-Consumer Brands)

3.4. Trends

3.4.1. Growth of Artisanal and Specialty Bakery Products (Craft Breads, Gourmet Pastries)

3.4.2. Health and Wellness Products (Organic, Vegan, Low-Calorie Items)

3.4.3. Expansion of Frozen Bakery Products (Freezer-to-Oven Products)

3.5. Government Regulations

3.5.1. FSSAI Guidelines for Bakery Products (Trans Fat Limits, Labeling Rules)

3.5.2. GST Impact on Bakery Product Pricing (Tax Structure Influence on Pricing)

3.5.3. Support for MSME Bakery Units (Incentives for Small Bakers, Employment Opportunities)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Bakers, Suppliers, Distributors, Retailers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitutes, Threat of New Entrants)

3.9. Competition Ecosystem (Market Concentration, Role of Large and Small Players)

4. India Bakery Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bread (Wholegrain, Multigrain, White, Brown)

4.1.2. Biscuits (Digestive, Cream-Filled, Cookies)

4.1.3. Cakes (Dry Cakes, Cream Cakes, Muffins)

4.1.4. Pastries (Puffs, Tarts, Croissants)

4.1.5. Others (Rusks, Doughnuts, Bagels)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Bakeries

4.3. By Ingredients (In Value %)

4.3.1. Wheat (Whole Wheat, Refined Flour)

4.3.2. Oats (Oat Bran, Rolled Oats)

4.3.3. Sugar (Refined, Brown, Artificial Sweeteners)

4.3.4. Chocolate (Cocoa-Based, White Chocolate)

4.3.5. Butter (Unsalted, Low-Fat Butter)

4.4. By Application (In Value %)

4.4.1. Household Consumption

4.4.2. Foodservice (Cafs, Restaurants, QSRs)

4.4.3. Institutional Use (Schools, Hospitals, Government Organizations)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. South

4.5.4. East

5. India Bakery Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Britannia Industries

5.1.2. Parle Products

5.1.3. ITC Limited

5.1.4. Mondelez India

5.1.5. Mrs. Bectors Food Specialties

5.1.6. Hindustan Unilever Limited

5.1.7. Anmol Industries

5.1.8. Bonn Group of Industries

5.1.9. Modern Foods

5.1.10. Cremica Food Industries

5.1.11. Surya Food & Agro Ltd (PriyaGold)

5.1.12. Harvest Gold

5.1.13. Monginis Food Pvt Ltd

5.1.14. Frontier Biscuit Factory

5.1.15. Kwality Foods

5.2. Cross Comparison Parameters (Revenue, Market Share, Production Capacity, Distribution Network, Product Variety, R&D Investment, Consumer Satisfaction, Sustainability Initiatives)

5.3. Market Share Analysis (By Product Type, Distribution Channel, Regional Analysis)

5.4. Strategic Initiatives (Partnerships, New Product Development, Distribution Expansion)

5.5. Mergers and Acquisitions (Recent Deals, Impact on Market Position)

5.6. Investment Analysis (Key Investments by Market Players, Infrastructure Expansion)

5.7. Venture Capital Funding (Funding Rounds, Impact on Innovation)

5.8. Government Grants (Support for SMEs, Subsidies)

5.9. Private Equity Investments (Top Investment Firms, Key Deals)

6. India Bakery Products Market Regulatory Framework

6.1. Food Safety Standards (FSSAI Guidelines, Certification Processes)

6.2. Compliance Requirements (Ingredient Labeling, Trans-Fat Regulations)

6.3. Certification Processes (Quality Certifications, Export Certifications)

7. India Bakery Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections (Product Segments, Growth Potential)

7.2. Key Factors Driving Future Market Growth (Urbanization, Technological Advancements, Consumer Preferences)

8. India Bakery Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredients (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. India Bakery Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis (Customer Demographics, Purchase Behavior)

9.3. Marketing Initiatives (Branding Strategies, Digital Marketing Trends)

9.4. White Space Opportunity Analysis (Untapped Regions, Product Gaps)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive overview of the India bakery products market, incorporating all key stakeholders. Extensive desk research, supplemented by proprietary databases, is utilized to gather data on product types, distribution channels, and consumer preferences. This step is crucial in identifying the core variables affecting market performance.

Step 2: Market Analysis and Construction

Historical market data is compiled to analyze past trends in consumer behavior, product development, and revenue growth. This step also involves evaluating the market share of key segments, such as bread and biscuits, as well as examining the impact of regional and global market forces.

Step 3: Hypothesis Validation and Expert Consultation

We validate our hypotheses through interviews with industry experts and stakeholders. These consultations provide insights into operational challenges, product development, and competitive strategies, ensuring a well-rounded understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the data gathered and producing an actionable market report. This includes a detailed analysis of each segment, future market projections, and competitive landscape analysis, ensuring accuracy and relevance for decision-makers.

Frequently Asked Questions

1 How big is India Bakery Products Market?

The India bakery products market is valued at USD 9.53 billion, driven by increasing consumer demand for convenient, ready-to-eat food options and rising disposable incomes.

2 What are the challenges in India Bakery Products Market?

Challenges include competition from unorganized players, fluctuating raw material prices, and strict regulatory requirements imposed by the Food Safety and Standards Authority of India (FSSAI).

3 Who are the major players in the India Bakery Products Market?

Key players in the market include Britannia Industries, Parle Products, ITC Limited, and Mrs. Bectors Food Specialties. These companies dominate due to their extensive distribution networks and strong brand presence.

4 What are the growth drivers of India Bakery Products Market?

The market is driven by urbanization, changing consumer lifestyles, increasing demand for healthier products, and the rapid growth of modern retail channels such as supermarkets and online platforms.

5 Which product type dominates the India Bakery Products Market?

Bread dominates the product type segmentation due to its widespread consumption as a staple food, with increasing demand for whole grain and multigrain varieties.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.