India Bamboo Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD7937

November 2024

99

About the Report

India Bamboo Market Overview

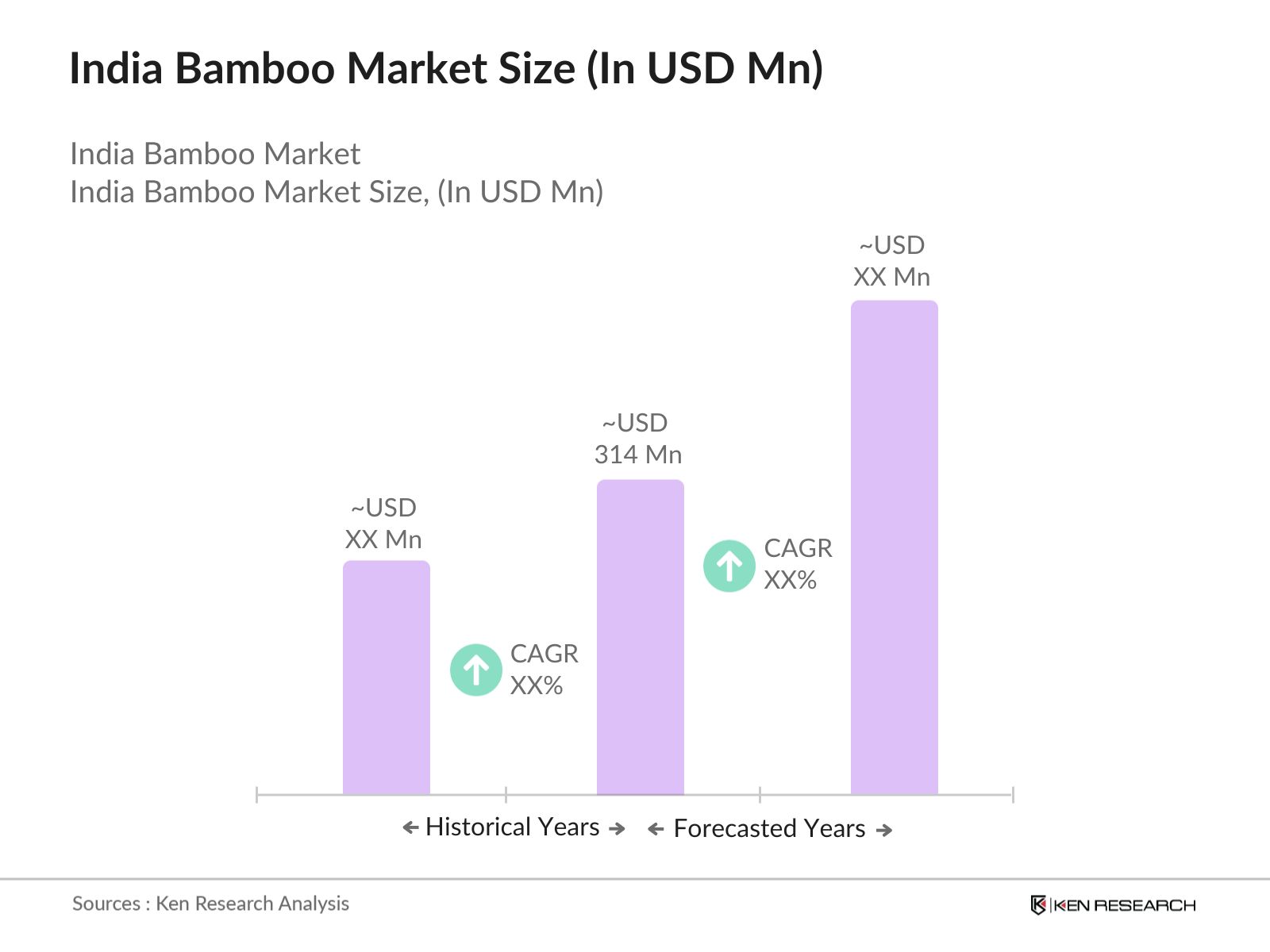

- The India Bamboo Market is valued at USD 314 million based on a five-year historical analysis. This market is driven by the increasing use of bamboo in construction, furniture, and packaging industries, as well as government initiatives like the National Bamboo Mission that promote bamboo cultivation. Bamboos role in sustainability, with its application in reducing plastic waste and use as a renewable material, further fuels its growth. The versatility of bamboo, from being a food source to an industrial material, has made it a key player in the agroforestry sector.

- Indias northeastern states, particularly Assam and Manipur, dominate the bamboo market due to their rich bamboo forests and favorable climatic conditions. These states are hubs for bamboo-based industries, with strong government backing and investments in bamboo processing units. Additionally, the Western Ghats and states like Kerala are also pivotal due to their advanced bamboo cultivation practices and the rise of eco-friendly initiatives.

- The Forest Rights Act of 2006, which governs bamboo cultivation in forested areas, allows tribal communities and other forest dwellers to harvest bamboo, thereby increasing its supply. In 2022, the government amended the law to classify bamboo as a grass, making it easier for farmers to cultivate and trade bamboo without requiring forest clearance. This regulatory framework has enabled the cultivation of bamboo across 9.6 million hectares of land, according to the Ministry of Environment.

India Bamboo Market Segmentation

India's Bamboo market is segmented by product type and by application.

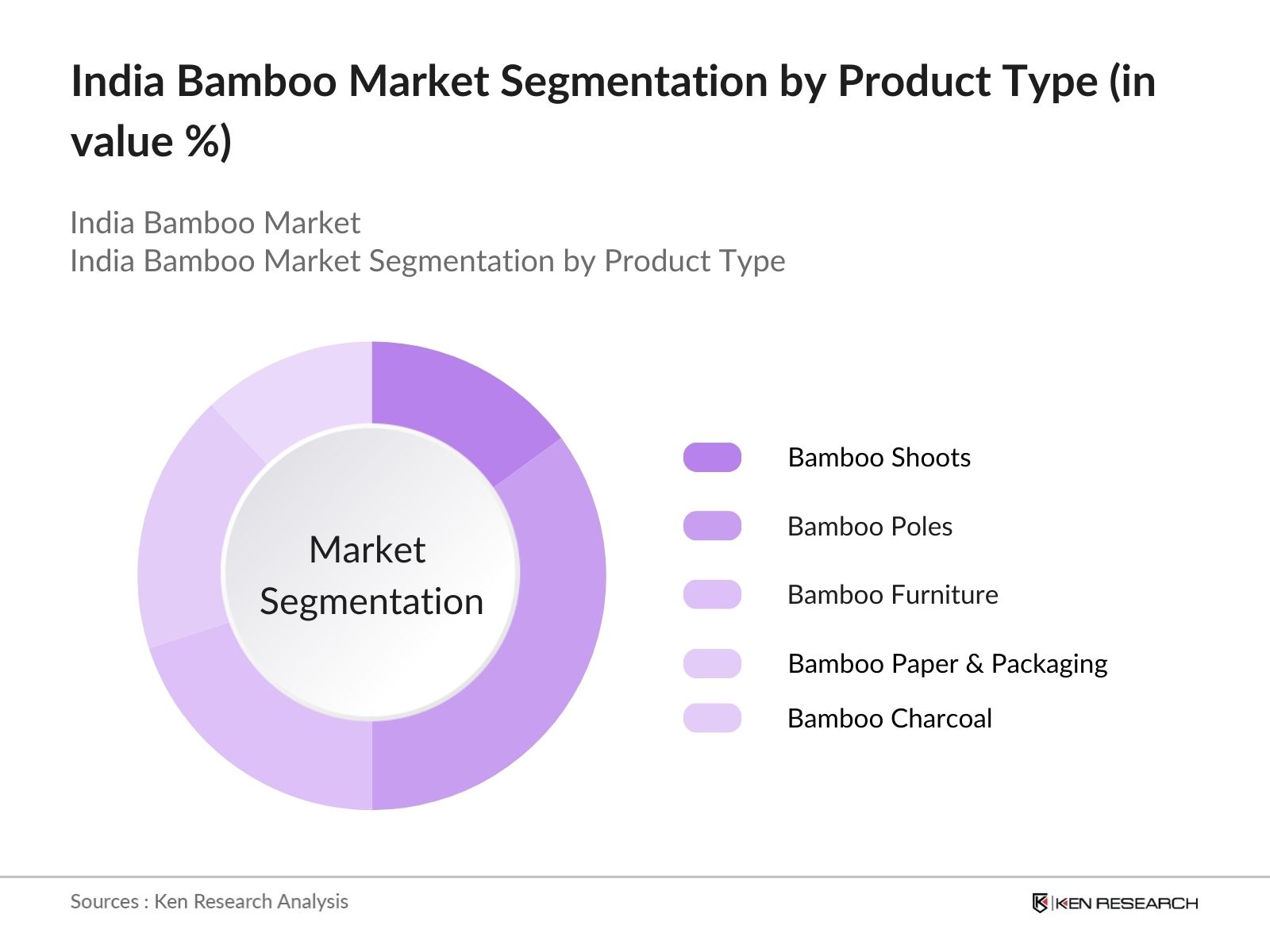

- By Product Type: India's Bamboo market is segmented by product type into bamboo shoots, bamboo poles, bamboo furniture, bamboo paper and packaging, and bamboo charcoal. Bamboo poles hold a dominant market share under this segmentation, primarily due to their extensive use in construction and infrastructure projects. The strength and sustainability of bamboo poles make them a preferred material for scaffolding, especially in rural and urban areas undergoing rapid construction. Furthermore, the use of bamboo poles in traditional housing and agriculture adds to their widespread demand.

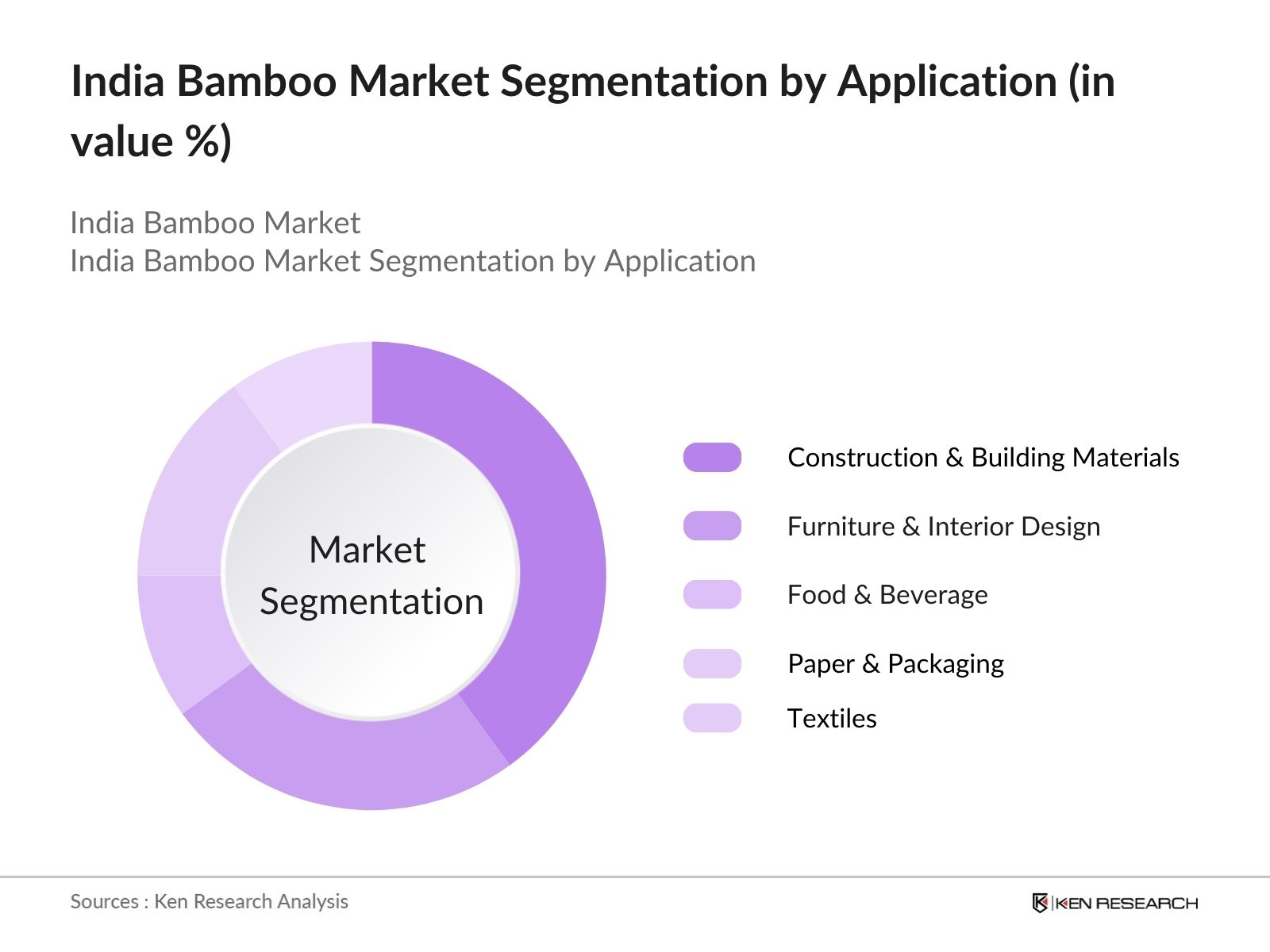

- By Application: The market is also segmented by application into construction and building materials, furniture and interior design, food and beverage, paper and packaging, and textiles. Construction and building materials represent the largest application segment in 2023 due to the increasing recognition of bamboos benefits in sustainable architecture. The material's strength, flexibility, and fast-growing nature make it a natural fit for eco-friendly construction projects. Moreover, the government's push for bamboo to be used in infrastructure projects provides an additional boost to this sub-segment.

India Bamboo Market Competitive Landscape

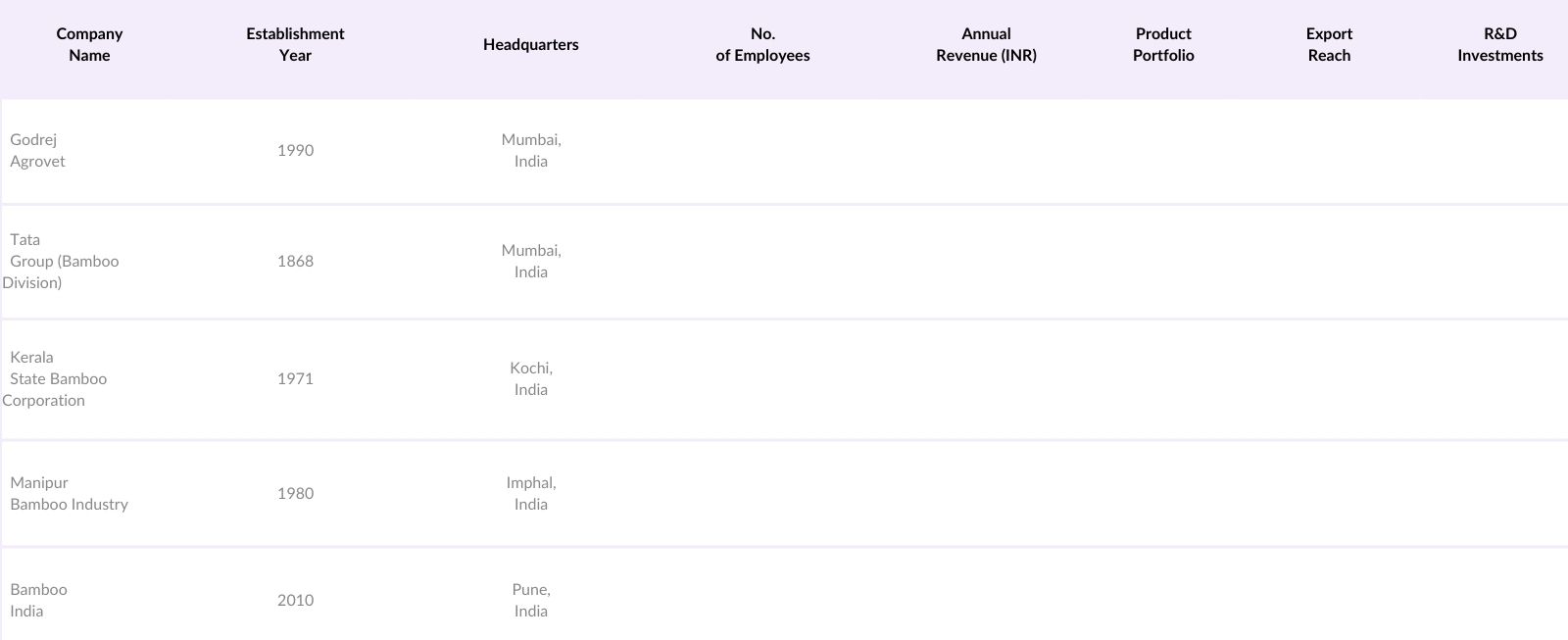

The India Bamboo market is dominated by a few major players, including Godrej Agrovet, Tata Group (Tata Bamboo Division), and Kerala State Bamboo Corporation. These companies have significant influence due to their large-scale production capabilities, investment in technology for bamboo processing, and strong distribution networks. Their leadership in promoting sustainable bamboo products has allowed them to capture a substantial market share.

India Bambo Industry Analysis

Market Growth Drivers

- Government Policies on Agroforestry and Bamboo Missions (National Bamboo Mission, Agricultural Subsidies): The Government of India has been actively promoting bamboo cultivation through the National Bamboo Mission (NBM) since 2018. Under this initiative, financial assistance of up to 120,000 per hectare is provided for bamboo plantations on non-forest lands. The governments 2023 Union Budget also allocated 5,000 crores for agroforestry projects, including bamboo plantations, boosting rural economies. The mission is expected to create employment for over 8 million people in rural sectors, according to government data. Agricultural subsidies further incentivize bamboo cultivation by reducing input costs for farmers.

- Rising Demand for Eco-Friendly Products (Sustainability Trends, Substitution of Plastics): The increasing global emphasis on sustainability has driven demand for eco-friendly materials like bamboo, which is a renewable resource. Bamboo has emerged as a viable substitute for plastic, especially in packaging and single-use products. Indias bamboo industry is benefiting from the rising preference for biodegradable products, with exports of bamboo goods reaching 3,500 crores in 2023, according to Ministry of Commerce data. This shift is part of Indias broader commitment to reducing plastic waste, in line with the governments ban on single-use plastics implemented in 2022.

- Employment Generation in Rural Areas (Specific to Bamboo Industry and Craftwork): The bamboo sector has become a significant source of employment in Indias rural regions, contributing to poverty alleviation. According to the Ministry of Rural Development, the bamboo industry currently supports around 12 million workers, particularly in states like Assam, Odisha, and West Bengal. The governments Skill India Mission has introduced programs to train rural artisans in bamboo craftwork, further promoting job creation. In 2022, the bamboo sector employed over 500,000 new workers in rural craft industries, strengthening local economies.

Market Challenges

- Lack of Standardization in Bamboo Processing: One of the major hurdles in India's bamboo market is the absence of standardized processing techniques, leading to inconsistent product quality. This challenge particularly affects small-scale producers and artisans. Despite government initiatives, less than 30% of bamboo-processing units in the country are currently mechanized, according to the Ministry of Agriculture data. The lack of standardization hinders bamboo products from meeting international quality benchmarks, limiting export potential.

- Supply Chain and Transportation Bottlenecks (Issues in Remote Areas): The bamboo supply chain in India faces logistical bottlenecks, particularly in remote areas where transportation infrastructure is underdeveloped. The northeastern states, which account for over 60% of Indias bamboo cultivation, face difficulties in transporting bamboo to processing centers. According to the Ministry of Road Transport and Highways, transportation costs for bamboo in these regions are up to 20% higher compared to other agricultural products, which affects profitability for local farmers.

India Bambo Market Future Outlook

Over the next five years, the India Bamboo Market is expected to witness substantial growth, driven by increasing demand for sustainable and eco-friendly products, the expansion of bamboo applications in construction and biofuels, and government programs aimed at promoting bamboo cultivation and usage. The market's rapid growth is also supported by advancements in bamboo processing technology, which is expected to enhance the quality and durability of bamboo-based products.

Market Opportunities

- Expansion of Bamboo Products in Furniture and Packaging: Bamboos lightweight and durable nature make it an ideal material for furniture and packaging. The Indian furniture industry is expected to significantly benefit from bamboo, with over 15% of new furniture brands incorporating bamboo designs. In 2023, India exported bamboo furniture worth 2,500 crores, marking an increase from the previous year. Additionally, the packaging industry is gradually transitioning to bamboo-based materials, especially in e-commerce, where demand for sustainable packaging has surged.

- Technological Advancements in Bamboo Processing (Automation in Bamboo Crafts): Recent technological advancements are revolutionizing bamboo processing in India, particularly with the introduction of automation. Bamboo craft workshops are adopting automated weaving machines, increasing production efficiency by 30%, as reported by the Ministry of MSME. Automation in bamboo processing reduces labor costs and allows for more intricate and high-quality designs, boosting the competitiveness of Indian bamboo crafts in global markets.

Scope of the Report

|

Bamboo Shoots Bamboo Poles Bamboo Furniture Bamboo Paper and Packaging Bamboo Charcoal |

|

|

By Application |

Construction Furniture, Food & Beverage Paper & Packaging Textiles & Apparel |

|

By End-Use |

Residential Commercial Industrial Agriculture |

|

By Processing Technology |

Traditional Handcrafting Automated Bamboo Processing |

|

By Region |

North East West South |

Products

Key Target Audience

Bamboo Product Manufacturers

Construction Companies

Furniture Manufacturers

Paper & Packaging Industries

Agriculture & Agroforestry Firms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (National Bamboo Mission, Ministry of Agriculture)

Exporters & Importers of Bamboo Products

Companies

Players Mention in the Report:

Godrej Agrovet

Tata Group (Tata Bamboo Division)

Manipur Bamboo Industry

Kerala State Bamboo Corporation

Mutha Industries Pvt. Ltd.

Grassroots Bamboo Products Pvt. Ltd.

North East Cane & Bamboo Development Council (NECBDC)

Konkan Bamboo and Cane Development Centre (KONBAC)

Bamboooz Furniture Pvt. Ltd.

Tripura Bamboo Mission

Assam Bamboo Forest Products

Bamboo India

CII Agro & Bamboo Division

Agri-Bamboo India

Eco-friendly Bamboo Products Pvt. Ltd.

Table of Contents

1. India Bamboo Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Specific to Bamboo Cultivation, Harvesting, and Processing)

1.4. Market Segmentation Overview (By Application, Product, Region, End-Use, and Processing Technology)

2. India Bamboo Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Major Investments, Expansion of Cultivated Area, Regulatory Support)

3. India Bamboo Market Analysis

3.1. Growth Drivers

3.1.1. Government Policies on Agroforestry and Bamboo Missions (National Bamboo Mission, Agricultural Subsidies)

3.1.2. Rising Demand for Eco-Friendly Products (Sustainability Trends, Substitution of Plastics)

3.1.3. Employment Generation in Rural Areas (Specific to Bamboo Industry and Craftwork)

3.1.4. Infrastructure Development (Use of Bamboo in Construction and Road Projects)

3.2. Market Challenges

3.2.1. Lack of Standardization in Bamboo Processing

3.2.2. Supply Chain and Transportation Bottlenecks (Issues in Remote Areas)

3.2.3. Limited Awareness Among Consumers

3.3. Opportunities

3.3.1. Expansion of Bamboo Products in Furniture and Packaging

3.3.2. Technological Advancements in Bamboo Processing (Automation in Bamboo Crafts)

3.3.3. Export Potential to Asian and European Markets

3.4. Trends

3.4.1. Integration of Bamboo in Construction Materials (Bamboo Reinforced Concrete)

3.4.2. Rise of Bamboo-Based Biofuels and Bioplastics

3.4.3. Online Retail Expansion for Bamboo Products (E-commerce)

3.5. Government Regulations

3.5.1. Forest Rights Act and Bamboo Cultivation Policies

3.5.2. GST Implications on Bamboo Goods

3.5.3. Schemes Promoting Agroforestry and Bamboo Plantations

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Farmers, Manufacturers, Retailers, Exporters)

3.8. Porters Five Forces (Bamboo Sector Competition, Buyer Power, Supplier Power)

3.9. Competition Ecosystem (Local vs. Global Market Participants)

4. India Bamboo Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bamboo Shoots

4.1.2. Bamboo Poles

4.1.3. Bamboo Furniture

4.1.4. Bamboo Paper and Packaging

4.1.5. Bamboo Charcoal

4.2. By Application (In Value %)

4.2.1. Construction and Building Materials

4.2.2. Furniture and Interior Design

4.2.3. Food and Beverage

4.2.4. Paper and Packaging

4.2.5. Textiles and Apparel

4.3. By End-Use (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Agriculture

4.4. By Processing Technology (In Value %)

4.4.1. Traditional Handcrafting

4.4.2. Automated Bamboo Processing

4.5. By Region (In Value %)

4.5.1. Northeast India

4.5.2. Western Ghats

4.5.3. Northern India

4.5.4. Southern India

4.5.5. Central India

5. India Bamboo Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Godrej Agrovet

5.1.2. Tata Group (Tata Bamboo Division)

5.1.3. Manipur Bamboo Industry

5.1.4. Kerala State Bamboo Corporation

5.1.5. Mutha Industries Pvt. Ltd.

5.1.6. Grassroots Bamboo Products Pvt. Ltd.

5.1.7. North East Cane & Bamboo Development Council (NECBDC)

5.1.8. Konkan Bamboo and Cane Development Centre (KONBAC)

5.1.9. Bamboooz Furniture Pvt. Ltd.

5.1.10. Tripura Bamboo Mission

5.1.11. Assam Bamboo Forest Products

5.1.12. Bamboo India

5.1.13. CII Agro & Bamboo Division

5.1.14. Agri-Bamboo India

5.1.15. Eco-friendly Bamboo Products Pvt. Ltd.

5.2. Cross Comparison Parameters (Annual Revenue, Inception Year, Manufacturing Capacity, Geographic Reach, Product Portfolio, R&D Investments, Market Share, No. of Employees)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital, Government Funding)

5.7. Export Opportunities

5.8. Government Support Programs

5.9. Collaboration with International Organizations

6. India Bamboo Market Regulatory Framework

6.1. Forest Protection Laws

6.2. Agroforestry Policies for Bamboo Cultivation

6.3. Certification and Compliance Standards (Bamboo Products)

6.4. Export-Import Regulations

7. India Bamboo Market Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Bamboo Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use (In Value %)

8.4. By Processing Technology (In Value %)

8.5. By Region (In Value %)

9. India Bamboo Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step focuses on identifying critical factors in the India Bamboo Market, including bamboo production, processing technologies, and end-use applications. Primary and secondary research is employed to map the bamboo ecosystem, with inputs from proprietary databases and government reports.

Step 2: Market Analysis and Construction

In this phase, historical data on bamboo cultivation, export statistics, and product applications are analyzed. This involves understanding the value chain, from bamboo farmers to end-product manufacturers, to estimate market size and demand trends accurately.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses, particularly regarding the growth of bamboo applications in furniture and construction, are validated through expert consultations with industry professionals. These insights help refine market size estimations and provide ground-level realities from the bamboo industry.

Step 4: Research Synthesis and Final Output

The final output synthesizes all research findings, offering a clear picture of the India Bamboo Market. This includes a detailed analysis of bamboo product demand, technological developments, and recommendations for future growth strategies.

Frequently Asked Questions

01. How big is the India Bamboo Market?

The India Bamboo Market was valued at USD 314 million based on historical data, driven by increasing demand for sustainable materials and government incentives for bamboo cultivation.

02. What are the challenges in the India Bamboo Market?

Challenges in India Bamboo Market include a lack of standardization in bamboo processing, transportation issues in remote areas, and limited consumer awareness of bamboo products, which hinders market growth.

03. Who are the major players in the India Bamboo Market?

Key players in India Bamboo Market include Godrej Agrovet, Tata Group (Bamboo Division), Kerala State Bamboo Corporation, Manipur Bamboo Industry, and Bamboo India, all known for their extensive market presence and product innovations.

04. What are the growth drivers of the India Bamboo Market?

The India Bamboo Market is driven by increasing usage of bamboo in construction, furniture, and packaging, along with government support through initiatives like the National Bamboo Mission.

05. What is the future outlook for the India Bamboo Market?

The India Bamboo Market is expected to see significant growth due to advancements in bamboo processing technology, the rising demand for eco-friendly products, and the government's promotion of bamboo in various sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.