India Banking Market Outlook to 2030

Region:Asia

Author(s):Samanyu Maan

Product Code:KROD277

June 2024

100

About the Report

India Banking Market Overview

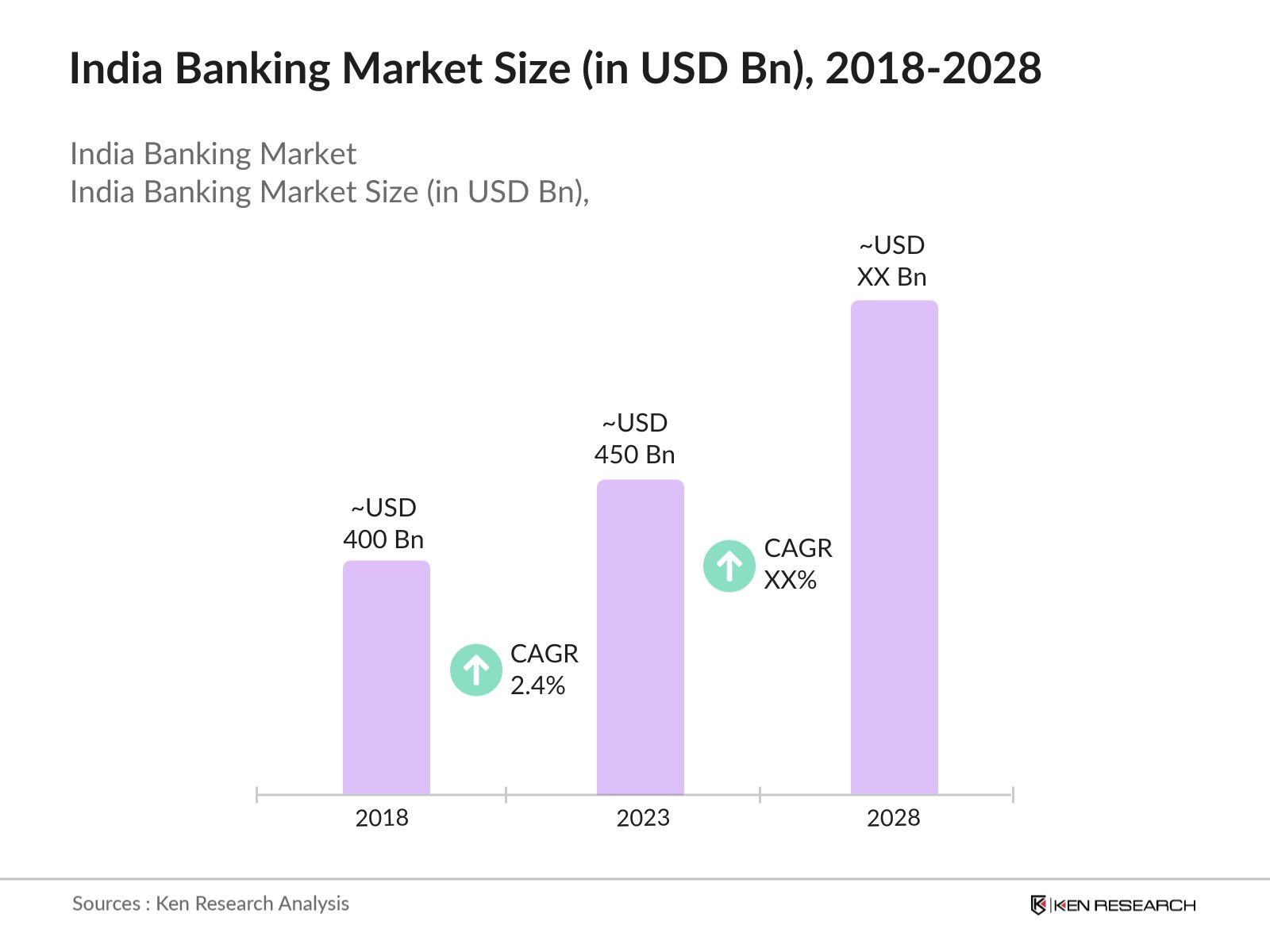

- The Indian banking industry, was valued at USD 400 Bn in 2018 and USD 450 Bn in 2023, features a mix of public, private, and foreign banks.

- Key players like State Bank of India (SBI), HDFC Bank, and ICICI Bank dominate with extensive branch networks and digital capabilities.

- Market players also faces challenges like managing non-performing assets (NPAs), cybersecurity risks, and competition from fintech firms pose significant hurdles.

- In 2024, Axis Bank partnered with a leading fintech startup to launch an AI-powered lending platform, offering instant loans to SMEs. Such collaborations are fostering a dynamic financial ecosystem and promoting financial inclusion.

India Banking Current Market Analysis

- The Indian banking sector is rapidly digitizing and focusing on financial inclusion through regulatory reforms and technological advancements like AI-driven services.

- The banking sector in India is rapidly adopting digital technologies to enhance customer experience and operational efficiency. The increased use of mobile banking and digital payment platforms has significantly contributed to the growth of the sector.

- Government programs such as Jan Dhan Yojana, which aim to provide every household with access to banking facilities, have significantly boosted the number of bank accounts and financial literacy across the country.

- The growing middle class and increasing disposable incomes are driving the demand for banking products and services, including loans, credit cards, and investment products.

- Banks are seeing increased revenue from digital transactions and higher loan disbursements, particularly in retail and MSME sectors, underscoring the sector's digital resilience and growth potential.

Indian Banking Market Segmentation

The Indian Banking Market can be segmented based on several factors:

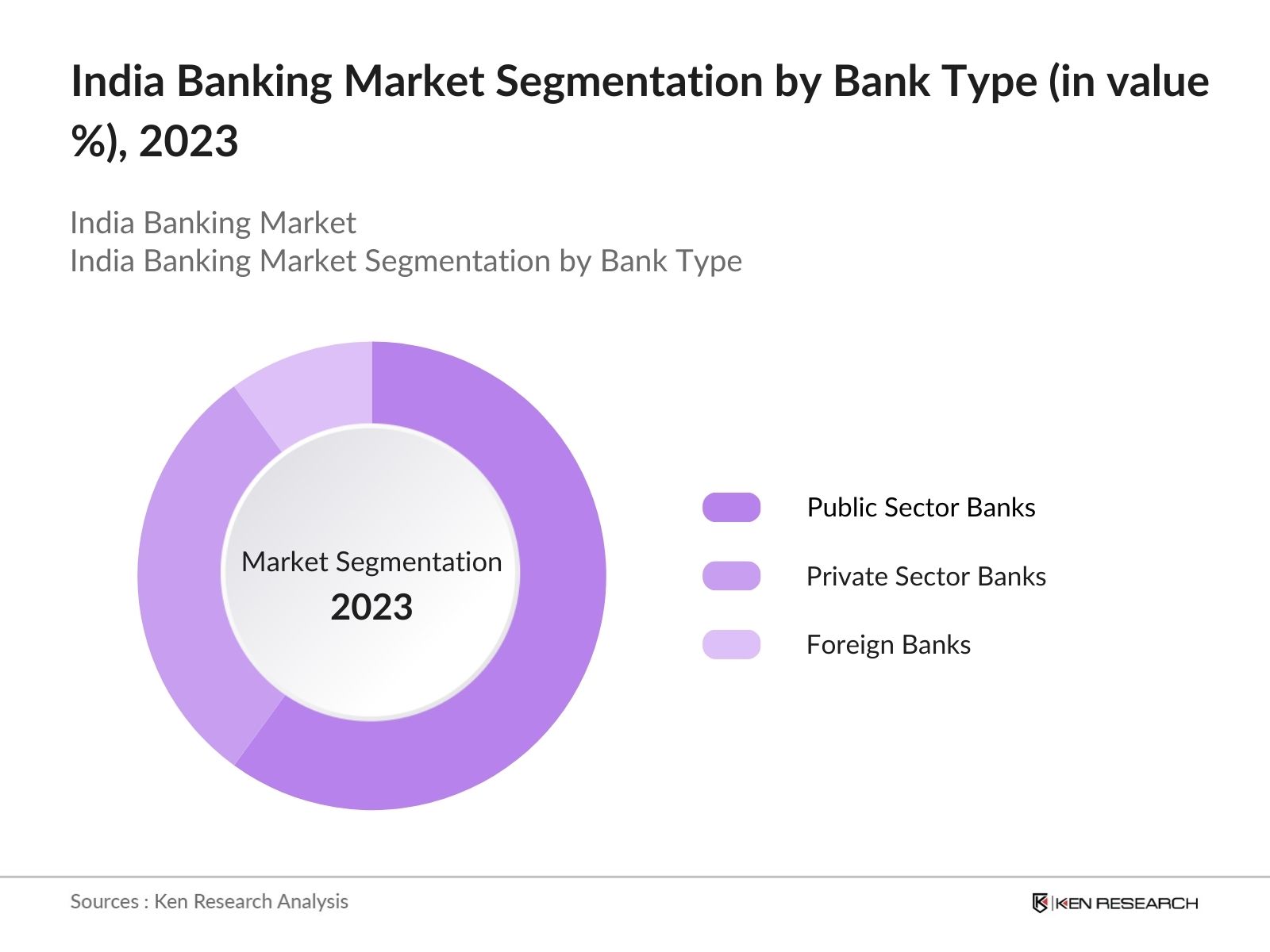

By Bank Type: In 2023, the Indian banking market is segmented by bank type divided into public sector, private sector and foreign banks, with public sector banks holding the majority share in terms of value. This dominance is attributed to their government ownership, which provides stability and backing, extensive branch networks spanning urban and rural areas, and a large customer base.

Public sector banks play a pivotal role in offering a wide range of financial services across diverse demographics, contributing significantly to the overall resilience and accessibility of the Indian banking system.

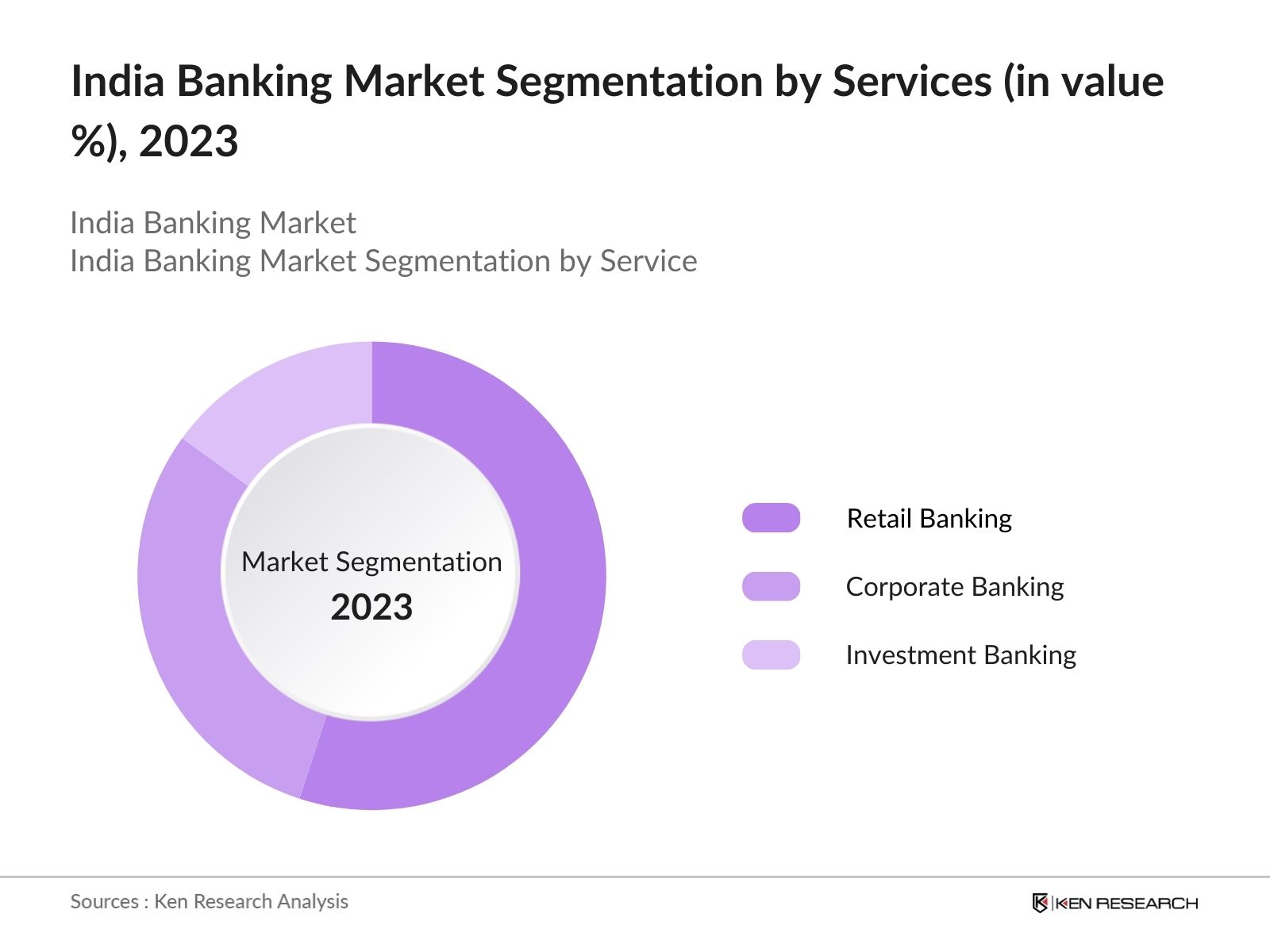

By Services: India banking market segmentation by service is divided into retail banking, corporate banking and investment banking. Retail banking is the dominant segment due to its widespread demand among individual consumers. The growth of the middle class and increasing financial literacy contribute to higher adoption of retail banking products.

By Digital Banking Services: Indian banking market segmentation by digital services is divided into mobile banking, internet banking and ATM service. In 2023 the mobile banking leads due to the rapid adoption of smartphones and the convenience of banking on the go. Banks are investing heavily in mobile app development to offer a seamless user experience.

India Banking Market Competitive Landscape

- Indian banks maintain extensive branch networks to enhance accessibility and customer reach. State Bank of India (SBI) operates over 22,000 branches across India, ensuring widespread service availability even in remote areas.

- Investment in digital banking technologies and collaborations with fintech firms have revolutionized service delivery. Banks like HDFC Bank have pioneered mobile banking apps, significantly increasing convenience for customers and improving operational efficiency.

- Indian banks offer a diverse range of products and services tailored to meet varied customer needs. For instance, ICICI Bank offers specialized products such as wealth management services, catering to high-net-worth individuals and enhancing market penetration.

- Maintaining strong financial health is vital for competitive positioning. Banks emphasize asset quality and profitability metrics, such as net interest margins and return on assets, to ensure sustained growth and stability in the dynamic banking landscape.

India Banking Industry Analysis

India Banking Market Growth Drivers:

- Digital Transformation and Fintech Integration: The Indian banking sector is undergoing a major shift due to digitalization and fintech integration, with services like mobile and internet banking transforming consumer interactions. In 2024, UPI transactions surpassed 10 billion monthly, reflecting widespread adoption. The government's push for a cashless economy and the Digital India campaign have further driven this trend.

- Government Initiatives and Financial Inclusion: Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) have boosted financial inclusion, opening over 450 million bank accounts by 2024. This has significantly increased banking access in rural and semi-urban areas. Additionally, the Direct Benefit Transfer (DBT) scheme, which deposits subsidies directly into bank accounts, has heightened the demand for banking services among the underbanked.

- Rising Middle Class and Increased Consumer Spending: The expanding middle class and rising disposable incomes are fueling the Indian banking market. The World Bank projects a 50% growth in India's middle class by 2025, driving demand for banking products like loans, credit cards, and savings accounts. A 2024 NCAER survey showed that 60% of middle-class households had increased their spending on financial services, underscoring the sector's growth potential.

India Banking Market Challenges:

- Non-Performing Assets (NPAs): High levels of non-performing assets (NPAs) are a significant challenge for Indian banks, affecting their profitability and lending capacity. Bad loans, especially in public sector banks, constrain credit extension and impact economic growth, despite measures like the Insolvency and Bankruptcy Code (IBC) aimed at addressing NPAs.

- Cybersecurity Threats: The growing use of digital banking services has increased cybersecurity threats, with cyberattacks, data breaches, and financial fraud posing significant risks. The Indian Computer Emergency Response Team (CERT-IN) reported a 20% rise in cyberattacks on financial institutions in 2024. This underscores the need for robust cybersecurity measures and investments to protect financial data and maintain consumer trust.

- Regulatory Compliance: The evolving regulatory landscape challenges banks to stay compliant with anti-money laundering (AML), know your customer (KYC), data protection, and Basel III norms. The RBI tightened regulatory norms in 2024 to enhance transparency and accountability, increasing the compliance burden on banks.

India Banking Market Government Initiatives:

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Launched in 2014, PMJDY has opened over 43 crore bank accounts, providing financial services like insurance and overdraft facilities to previously unbanked individuals, significantly boosting financial inclusion nationwide.

- Digital India Campaign: This initiative, launched in 2015, aims to transform India into a digitally empowered society. By 2024, the campaign had facilitated the adoption of digital banking services among 80% of the population, according to the Ministry of Electronics and Information Technology.

- Insolvency and Bankruptcy Code (IBC): Introduced in 2016, the IBC aims to resolve corporate insolvencies efficiently. As of 2024, the resolution rate under IBC had improved, with over 4,000 cases resolved, reducing the burden of NPAs on banks, as per the Insolvency and Bankruptcy Board of India.

- Banking Correspondent (BC) Model: With over 3.5 lakh BCs operational, this model has expanded banking services in remote regions by facilitating transactions like deposits and withdrawals, bridging the gap between banks and rural communities.

India Banking Future Market Outlook

The Indian banking industry is expected to show significant growth, driven by economic growth and digital banking adoption.

Future Market Trends:

- Rise of Neobanks: Neobanks, or digital-only banks, are expected to gain traction, offering personalized and convenient banking solutions without the need for physical branches. This trend will enhance customer experience and expand banking access.

- Focus on Cybersecurity: With the increase in digital transactions, banks will invest heavily in cybersecurity measures to protect against cyber threats. Enhanced security protocols and the adoption of blockchain technology will play a crucial role in securing digital banking.

- Adoption of AI and Automation: Banks will increasingly adopt AI and automation to streamline operations, improve customer service, and reduce costs. AI-driven chatbots, automated loan processing, and predictive analytics will become more prevalent in the banking sector.

Scope of the Report

|

By Bank Type |

Public Sector Banks Private Sector Banks Foreign Banks |

|

By Services |

Retail Banking Corporate Banking Investment Banking |

|

By Digital Banking Services |

Mobile Banking Internet Banking ATM Services |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing this Report:

Investors and Financial Institutions

Investors and Analysts

FinTech Providers

Consulting Firms

Risk Management Firms

Regulatory Bodies and Government Agencies (RBI)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

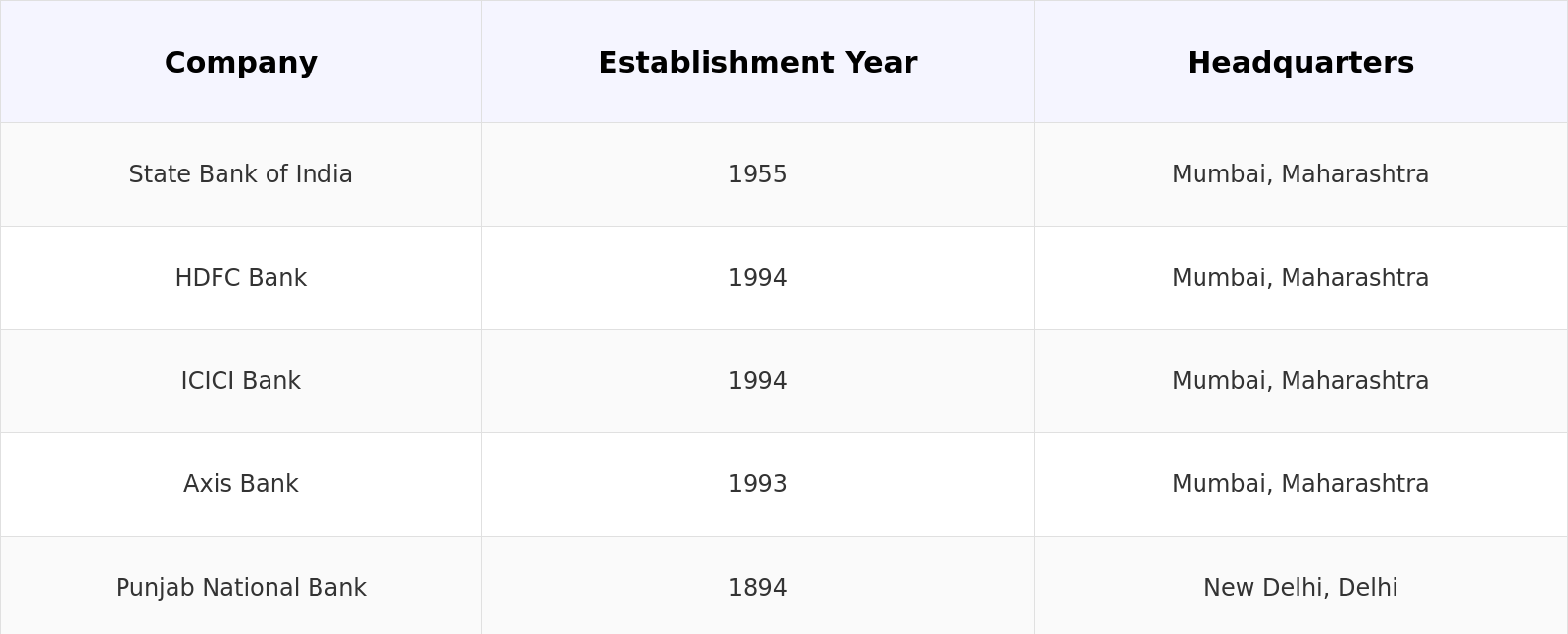

State Bank of India (SBI)

HDFC Bank

ICICI Bank

Axis Bank

Bank of Baroda

Punjab National Bank

Kotak Mahindra Bank

Yes Bank

IndusInd Bank

Canara Bank

Union Bank of India

IDBI Bank

Federal Bank

RBL Bank

Citibank India

Table of Contents

1 India Banking Market Overview

1.1 India Banking Market Taxonomy

2 India Banking Market Size (in USD Bn), 2018-2023

3 India Banking Market Analysis

3.1 India Banking Market Growth Drivers

3.2 India Banking Market Challenges and Issues

3.3 India Banking Market Trends and Development

3.4 India Banking Market Government Regulation

3.5 India Banking Market SWOT Analysis

3.6 India Banking Market Stake Ecosystem

3.7 India Banking Market Competition Ecosystem

4 India Banking Market Segmentation, 2023

4.1 India Banking Market Segmentation by Bank Type (in value %), 2023

4.2 India Banking Market Segmentation by Service (in value %), 2023

4.3 India Banking Market Segmentation by Digital Banking Service (in value %), 2023

5 India Banking Market Competition Benchmarking

5.1 India Banking Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6 India Banking Future Market Size (in USD Bn), 2023-2028

7 India Banking Future Market Segmentation, 2028

7.1 India Banking Market Segmentation by Bank Type (in value %), 2028

7.2 India Banking Market Segmentation by Service (in value %), 2028

7.3 India Banking Market Segmentation by Digital Banking Services (in value %), 2028

8 India Banking Market Analysts’ Recommendations

8.1 India Banking Market TAM/SAM/SOM Analysis

8.2 India Banking Market Customer Cohort Analysis

8.3 India Banking Market Marketing Initiatives

8.4 India Banking Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on Indian banking market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India banking market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple banks and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from banks.

Frequently Asked Questions

01 How big is Indian Banking Market?

The Indian Banking Market was valued at USD 450 Bn in 2023 driven by government-led initiatives for digital payments and mobile banking adoption.

02 What are the key challenges faced in Indian Banking Market?

The key challenges faced in Indian Banking Market are regulatory compliance, cyber security issues and competition form fintech.

03 Who are some of the major players in the Indian Banking Market?

Some of the major players in the Indian Banking Market include State Bank of India (SBI), HDFC Bank, ICICI Bank and Axis Bank.

04 What are the factors driving Indian banking industry?

Major drivers include government-led initiatives for digital payments, such as the Jan Dhan Yojana, increasing mobile banking adoption, and overall economic growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.