India Base Metal Mining Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD9622

November 2024

85

About the Report

India Base Metal Mining Market Overview

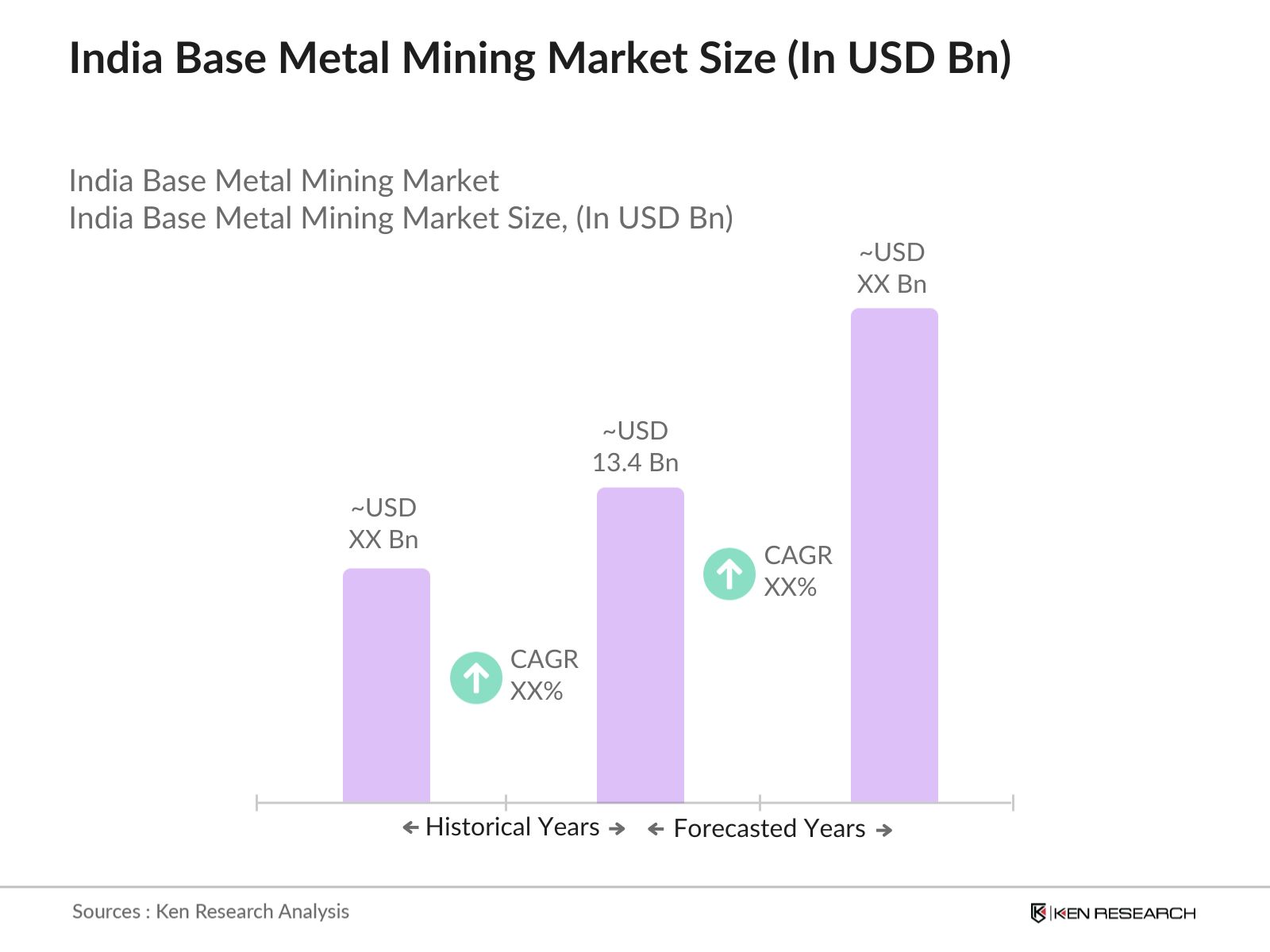

- The India base metal mining market has been driven by the demand for key metals like copper, aluminum, zinc, and lead, which are crucial for sectors such as construction, automotive, and power generation. The market is valued at USD 13.4 billion, according to an analysis of the last five years. This growth is primarily fueled by rapid industrialization, government initiatives such as Make in India, and increasing investments in infrastructure development projects, all of which demand large volumes of base metals for manufacturing and construction purposes.

- Indias base metal mining industry is dominated by regions such as Odisha, Jharkhand, and Chhattisgarh, owing to their rich mineral reserves, strategic location, and well-established mining infrastructure. These regions offer favorable policies for mining, easy access to ports, and a robust supply chain network, allowing them to produce and process base metals more efficiently than other regions. States like Gujarat and Maharashtra also contribute significantly due to their industrial capacity and proximity to key market hubs.

- Indias Mineral Conservation and Development Rules (MCDR), revised in 2021, emphasize sustainable mining practices, including stricter requirements for mineral conservation, waste management, and rehabilitation of mined land. In 2023, compliance audits revealed that 95% of mining companies met these requirements, showcasing improvements in environmental stewardship. The Ministry of Mines monitors these regulations, ensuring that mining companies adhere to guidelines aimed at minimizing environmental impact and ensuring long-term mineral sustainability.

India Base Metal Mining Market Segmentation

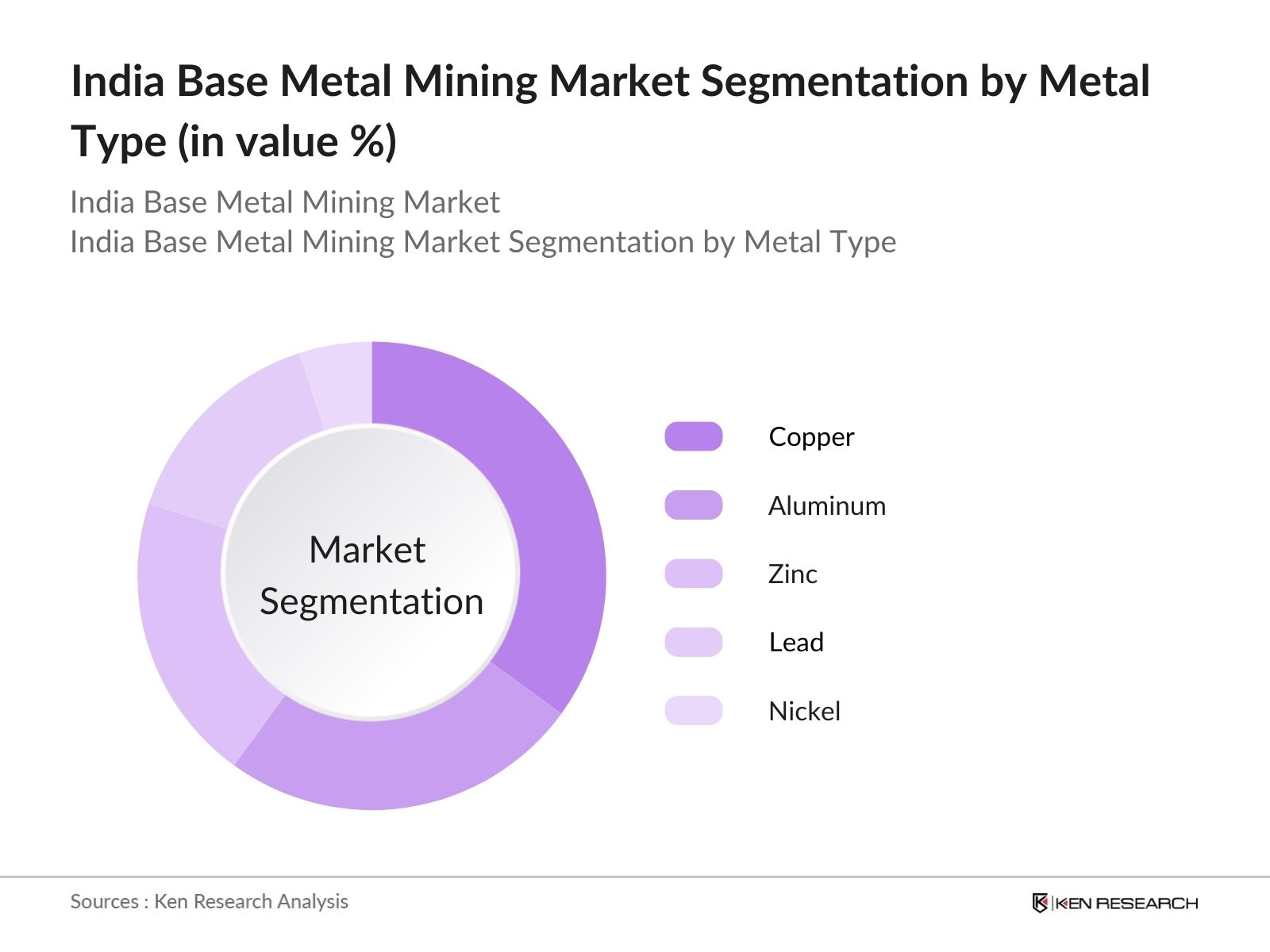

By Metal Type: The market is segmented into copper, aluminum, zinc, lead, and nickel. Copper holds a dominant market share in 2023, contributing approximately 35% of the overall market. This is attributed to its widespread application in electrical wiring, electronics, and power generation. The rising demand for renewable energy technologies and electric vehicles has further fueled copper consumption. Zinc follows closely, with significant usage in galvanizing steel for infrastructure projects.

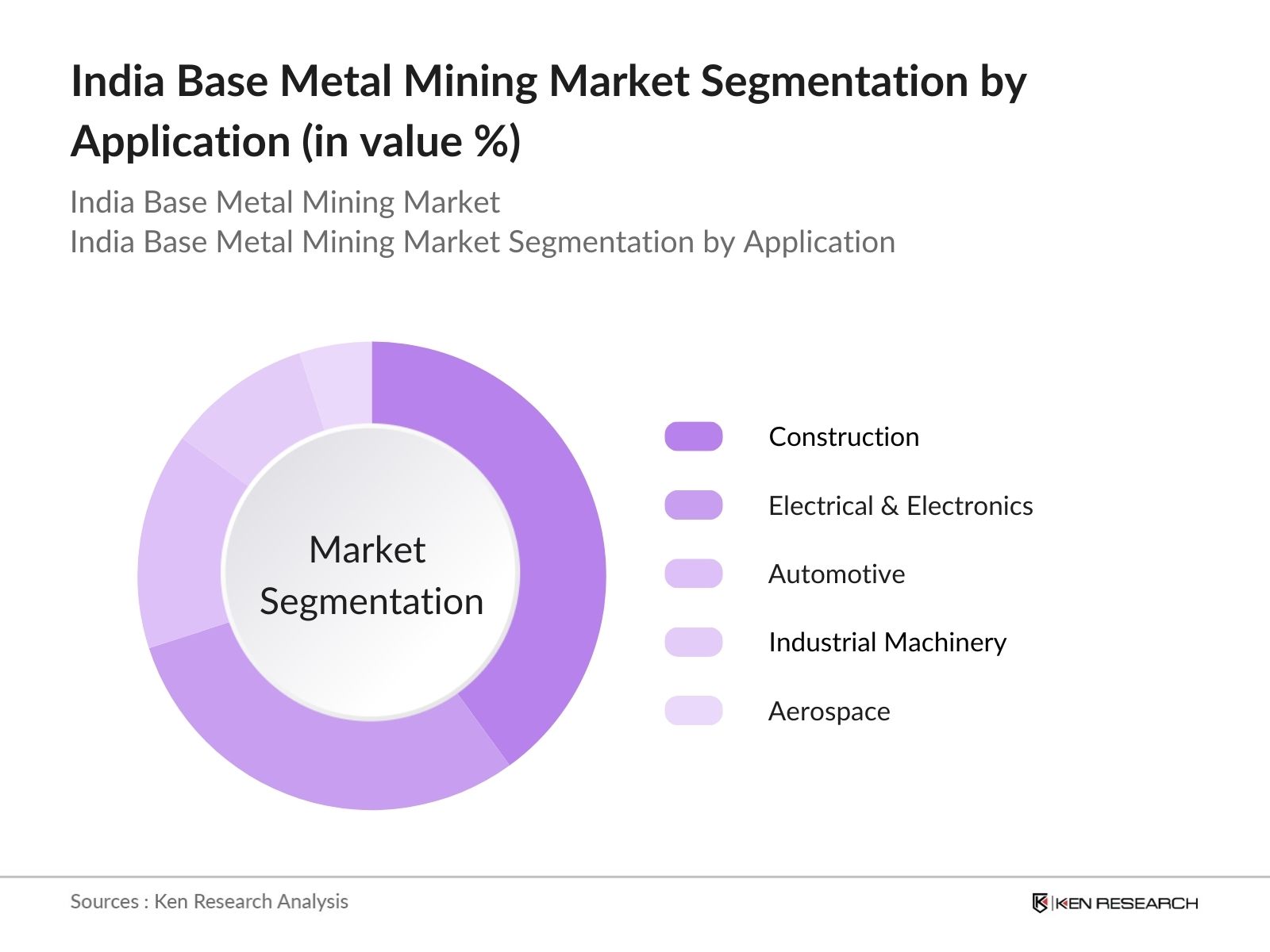

By Application: The market is also segmented by applications, including electrical and electronics, construction, automotive, aerospace, and industrial machinery. The construction sector dominates the market with a 40% share, as base metals are key components for infrastructure development, including roads, bridges, and residential buildings. Rapid urbanization and government projects such as the Smart Cities Mission are driving the demand for steel and other base metals.

India Base Metal Mining Market Competitive Landscape

The Indian base metal mining market is dominated by several large-scale players, both domestic and multinational, that have established a strong presence in the sector. The market features a mix of vertically integrated mining companies with significant refining and processing capabilities, as well as firms involved in specialized mining operations. The market is dominated by a few key players with extensive mining capacities and market influence. These players leverage advanced mining technologies and strategic partnerships to maintain their competitive edge. Here are five major players:

|

Company |

Establishment Year |

Headquarters |

Market Revenue (USD Mn) |

Number of Mines |

Processing Plants |

Global Presence |

Employees |

Metal Output (MT) |

Export Volume |

|

Vedanta Resources |

1976 |

Mumbai, India |

|||||||

|

Hindalco Industries |

1958 |

Mumbai, India |

|||||||

|

Hindustan Zinc |

1966 |

Udaipur, India |

|||||||

|

National Aluminium Company |

1981 |

Bhubaneswar, India |

|||||||

|

Tata Steel Mining |

1907 |

Jamshedpur, India |

India Base Metal Mining Industry Analysis

Growth Drivers

- Rise in Urbanization: Indias urban population is expected to reach 600 million by 2030, with urbanization trends in 2024 continuing to fuel base metal consumption, particularly for residential and commercial infrastructure. Industrial output increased by 8% in the last year, with sectors such as manufacturing, construction, and electricity contributing significantly. The surge in real estate, with over 2.2 million housing units constructed in 2023 alone, further propels the demand for metals like steel and copper for pipes, wiring, and structural elements. Data from Indias Ministry of Housing highlights this rapid residential expansion.

- Renewable Energy Projects: Indias renewable energy capacity, with a target of 175 GW achieved in 2022, spurs the demand for base metals. Copper is crucial for solar panel wiring and wind turbines, while aluminums lightweight properties make it essential for electric vehicles (EVs). India added 12 GW of solar capacity in 2023, contributing to the increased copper consumption for electrical conductivity. Similarly, the governments plan to sell 10 million EVs annually by 2025 drives demand for aluminum in the automotive sector. Indias renewable energy ministry projects a significant role for these metals in reducing carbon footprints.

- Government Policies: The "Make in India" initiative encourages the domestic manufacturing of metals, boosting local base metal mining. India's National Mineral Policy 2019 targets increasing mining sector output by streamlining exploration and auctioning of new mining blocks. Government incentives like reduced corporate taxes for new manufacturing units and simplifying mining lease approvals have led to a surge in domestic mining production, with iron ore production at 230 million metric tons in 2023. Indias Ministry of Mines has actively supported local production and mineral exploration, further strengthening the base metal industry.

Market Challenges

- Environmental Regulations: India's mining sector faces stringent environmental regulations under the Mines and Minerals (Development and Regulation) Act. These regulations impose penalties for non-compliance, increasing operational costs. The adoption of sustainable mining practices is mandated to meet environmental standards, such as reducing CO2 emissions from mining activities, which reached 650,000 metric tons in 2023. This creates additional challenges in terms of technology adoption and retrofitting existing infrastructure. Data from the Ministry of Environment, Forest and Climate Change underscores the regulatory burden placed on mining operations to mitigate environmental impacts.

- Supply Chain Disruptions: Indias mining sector encountered significant logistics challenges in 2023 due to a strained supply chain, with export and import bottlenecks for base metals like copper, aluminum, and zinc. Port congestion, especially in major ports like Mundra and Kandla, slowed down the export of mined metals, which were valued at over $30 billion in 2023. Transportation costs rose by 20%, causing delays and increased operational expenses. The government's efforts to streamline logistics under the National Logistics Policy are ongoing, but the disruptions persist as a key concern.

India Base Metal Mining Market Future Outlook

The India base metal mining market is poised for substantial growth in the coming years, driven by several factors. With increasing investments in infrastructure, electrification of transportation, and the renewable energy sector, the demand for base metals, particularly copper, aluminum, and zinc, is expected to rise. Additionally, government initiatives focused on mineral exploration and mining efficiency will play a critical role in shaping the future of the industry. As global economies transition towards low-carbon futures, the demand for base metals used in renewable energy technologies will likely surge.

Future Market Opportunities

- Technological Innovations: The adoption of artificial intelligence (AI) and automation in Indias mining sector presents significant opportunities. In 2023, major mining companies like Hindustan Zinc introduced automated ore sorting technologies, increasing production efficiency by 10%. AI-driven predictive maintenance systems are also reducing downtime and lowering equipment maintenance costs by 15%. These technological advancements not only improve productivity but also reduce operational risks, creating a more stable production environment. Government incentives for adopting AI in heavy industries are helping propel these innovations, according to the Ministry of Heavy Industries.

- Exploration of Untapped Reserves: Indias unexplored mineral reserves offer substantial opportunities for future mining projects. The Geological Survey of India reported the discovery of untapped zinc and copper deposits in Odisha and Jharkhand in 2023, with potential reserves of 50 million metric tons. Exploration of these reserves could significantly increase India's base metal production, particularly zinc, which is used extensively in infrastructure projects. The government's National Mineral Exploration Trust (NMET) allocates resources for further exploration of these areas, aiming to expand the countrys mining capabilities.

Scope of the Report

|

Metal Type |

Copper Zinc Aluminum Lead Nickel |

|

Application |

Electrical and Electronics Construction Automotive Aerospace Industrial Machinery |

|

Extraction Process |

Open-Pit Mining Underground Mining In-Situ Leaching Hydrometallurg Pyrometallurgy |

|

End-Use Industry |

Power Generation Consumer Goods Manufacturing Transport Infrastructure Defense and Security Renewable Energy |

|

Region |

Northern India Southern India Western India Eastern India Central India |

Products

Key Target Audience

Mining Companies

Base Metal Refining and Processing Firms

Government and Regulatory Bodies (Ministry of Mines, Indian Bureau of Mines)

Metal Traders and Suppliers

Construction and Infrastructure Companies

Automotive Manufacturers

Renewable Energy Companies

Investors and Venture Capitalist Firms

Companies

Major Players

Hindalco Industries

Hindustan Zinc

National Aluminium Company

Tata Steel Mining

JSW Steel

Jindal Steel & Power

Sesa Goa Iron Ore

Bharat Aluminium Company

Hindustan Copper

MOIL Limited

NMDC Limited

Steel Authority of India Limited (SAIL)

Gujarat NRE Coke

Indian Metals & Ferro Alloys

Table of Contents

1. India Base Metal Mining Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Base Metal Mining Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Base Metal Mining Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Construction Material Demand, Steel Industry, Electrical Grids)

3.1.2. Rise in Urbanization (Increased Industrial Output, Increased Residential Development)

3.1.3. Renewable Energy Projects (Copper in Solar and Wind Energy, Aluminum in Electric Vehicles)

3.1.4. Government Policies (Make in India Initiative, National Mineral Policy)

3.2. Market Challenges

3.2.1. Environmental Regulations (Mining Act Compliance, Sustainability Requirements)

3.2.2. Supply Chain Disruptions (Logistics and Export-Import Bottlenecks)

3.2.3. Fluctuating Commodity Prices (Volatility in Copper, Zinc, and Nickel Prices)

3.2.4. High Operational Costs (Energy Consumption, Labor Costs, Equipment Maintenance)

3.3. Opportunities

3.3.1. Technological Innovations (AI, Automation in Mining, Ore Sorting Technology)

3.3.2. Exploration of Untapped Reserves (Undiscovered Zinc, Copper Mines in Eastern India)

3.3.3. Expansion into New Applications (Base Metals in Aerospace, Telecommunications)

3.3.4. Foreign Direct Investment (FDI in Mining, Strategic Partnerships)

3.4. Trends

3.4.1. Shift Towards Green Mining (Low Emission Techniques, Sustainable Resource Management)

3.4.2. Increased Focus on Recycling (Base Metal Recycling, Circular Economy)

3.4.3. Integration of Blockchain for Traceability (Supply Chain Transparency, Ethical Sourcing)

3.4.4. Decentralized Energy Usage (Microgrids in Mining Operations)

3.5. Government Regulation

3.5.1. Mineral Conservation and Development Rules

3.5.2. National Mineral Exploration Policy

3.5.3. Mining Lease Regulations and Amendments

3.5.4. Environmental Clearances for Mining Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Base Metal Mining Market Segmentation

4.1. By Metal Type (In Value %)

4.1.1. Copper

4.1.2. Zinc

4.1.3. Aluminum

4.1.4. Lead

4.1.5. Nickel

4.2. By Application (In Value %)

4.2.1. Electrical and Electronics

4.2.2. Construction

4.2.3. Automotive

4.2.4. Aerospace

4.2.5. Industrial Machinery

4.3. By Extraction Process (In Value %)

4.3.1. Open-Pit Mining

4.3.2. Underground Mining

4.3.3. In-Situ Leaching

4.3.4. Hydrometallurgy

4.3.5. Pyrometallurgy

4.4. By End-Use Industry (In Value %)

4.4.1. Power Generation

4.4.2. Consumer Goods Manufacturing

4.4.3. Transport Infrastructure

4.4.4. Defense and Security

4.4.5. Renewable Energy

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Southern India

4.5.3. Western India

4.5.4. Eastern India

4.5.5. Central India

5. India Base Metal Mining Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vedanta Resources

5.1.2. Hindustan Zinc

5.1.3. Hindalco Industries

5.1.4. National Aluminium Company (NALCO)

5.1.5. JSW Steel

5.1.6. Jindal Steel & Power

5.1.7. Tata Steel Mining

5.1.8. Bharat Aluminium Company (BALCO)

5.1.9. Sesa Goa Iron Ore

5.1.10. Hindustan Copper

5.1.11. MOIL Limited

5.1.12. NMDC Limited

5.1.13. Steel Authority of India Limited (SAIL)

5.1.14. Gujarat NRE Coke

5.1.15. Indian Metals & Ferro Alloys

5.2. Cross Comparison Parameters (Production Capacity, Market Share, Revenue, Number of Mines, Global Presence, Processing Plants, Metal Output, Export Volume)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Investments

5.8. Government Grants and Subsidies

6. India Base Metal Mining Market Regulatory Framework

6.1. Mining Safety Laws

6.2. Compliance Requirements for Environmental Protection

6.3. Mineral Royalties and Taxes

6.4. Licensing and Approval Process

7. India Base Metal Mining Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Base Metal Mining Market Future Segmentation

8.1. By Metal Type (In Value %)

8.2. By Application (In Value %)

8.3. By Extraction Process (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. India Base Metal Mining Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Identification

9.3. Go-to-Market Strategy

9.4. Key Strategic Partnerships

Research Methodology

Step 1: Identification of Key Variables

The initial step focuses on constructing a detailed ecosystem map covering all key stakeholders in the Indian base metal mining market. This step is grounded in extensive desk research using proprietary databases and secondary research to gather information about market size, market share, and production capacity.

Step 2: Market Analysis and Construction

The second phase involves compiling historical data related to production and export volumes of base metals in India. The data gathered is then analyzed to establish trends in market dynamics, which helps in understanding the performance of various segments over the last five years.

Step 3: Hypothesis Validation and Expert Consultation

In the third phase, we validate hypotheses through consultations with experts in the mining sector. These interviews provide insights into operational challenges, market growth drivers, and emerging opportunities within the base metal mining market in India.

Step 4: Research Synthesis and Final Output

The final phase integrates the primary and secondary data sources into a cohesive analysis. This phase also involves cross-verification of market statistics with key players in the mining sector to ensure the highest level of accuracy in the report's output.

Frequently Asked Questions

01 How big is the India base metal mining market?

The India base metal mining market is valued at USD 13.4 billion, driven by rising demand from the construction, automotive, and power generation sectors.

02 What are the challenges in the India base metal mining market?

Challenges in the India base metal mining market include fluctuating commodity prices, stringent environmental regulations, and high operational costs, which impact profitability and efficiency in mining operations.

03 Who are the major players in the India base metal mining market?

Major players in the India base metal mining market include Vedanta Resources, Hindalco Industries, Hindustan Zinc, National Aluminium Company, and Tata Steel Mining. These companies have established themselves due to their significant production capacities and integrated supply chains.

04 What are the growth drivers of the India base metal mining market?

Growth in the India base metal mining market is driven by infrastructure development, urbanization, and increasing demand for renewable energy. Government initiatives like the Make in India program also play a pivotal role.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.