India Battery Energy Storage Systems Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3544

October 2024

85

About the Report

India Battery Energy Storage Systems Market Overview

- The India Battery Energy Storage Systems (BESS) market is billion, based on a five-year historical analysis. This market has been driven primarily by the rapid expansion of renewable energy projects across the country, which require efficient storage solutions for grid stabilization and peak load management. The Indian government's emphasis on increasing renewable energy capacity, especially solar and wind, has significantly boosted the demand for battery energy storage solutions. Additionally, advancements in battery technology, such as the declining cost of lithium-ion batteries, have contributed to the increasing adoption of BESS.

- Key cities and regions leading in battery energy storage systems include Mumbai, Bangalore, Delhi, and states like Tamil Nadu and Gujarat. These regions dominate the market due to their rapid industrialization, urbanization, and large-scale renewable energy projects. Mumbai and Bangalore are home to several technology companies and energy innovators, while Tamil Nadu and Gujarat have extensive solar and wind power generation capacities, necessitating efficient energy storage systems for grid stability.

- The Indian government has launched the Battery Energy Storage Systems (BESS) Scheme, which aims to develop 4,000 battery storage projects by 2030-31 with an initial budget of USD 1.129 billion. This initiative is part of India's broader goal to achieve 500 GW of renewable energy capacity by 2030. The BESS Scheme is a crucial part of India's broader goal to achieve 500 GW of renewable energy capacity by 2030. This target is a significant step towards reducing India's emission intensity by 33-35% from 2005 levels by 2030 and achieving 40% electricity generation from non-fossil fuels.

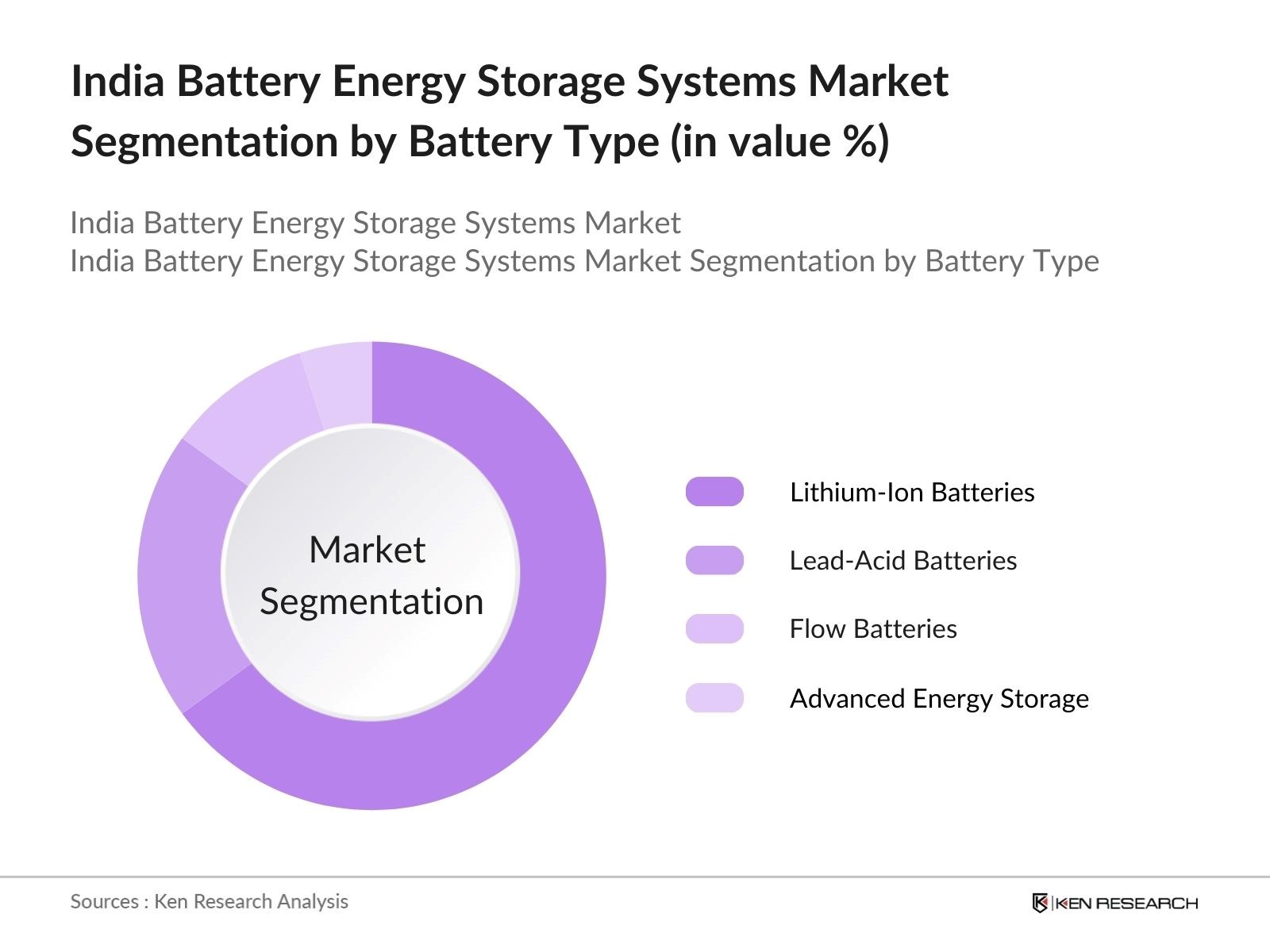

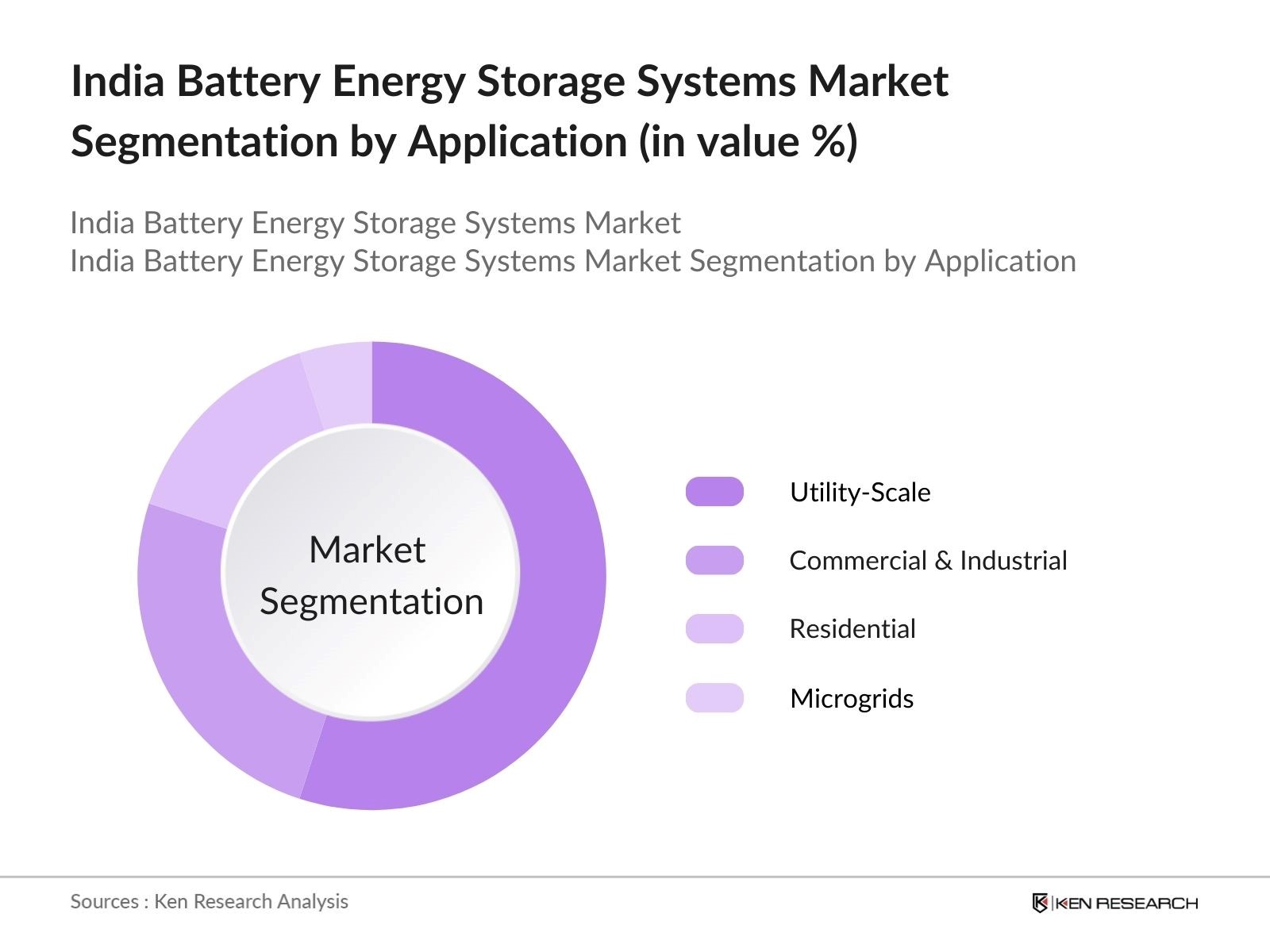

India Battery Energy Storage Systems Market Segmentation

By Battery Type: The India Battery Energy Storage Systems market is segmented by battery type into Lithium-Ion Batteries, Lead-Acid Batteries, Flow Batteries, and Advanced Energy Storage Technologies. Lithium-Ion Batteries have emerged as the dominant segment in India due to their high energy density, longer life cycles, and reduced costs. Their widespread use in electric vehicles (EVs) and renewable energy storage makes them the preferred choice across multiple sectors. Lithium-ion batteries are also favored for their scalability and efficiency in grid applications, which drives their dominance in the market.

By Application: The market is segmented by application into Residential, Commercial & Industrial, Utility-Scale, and Microgrids. Utility-Scale Applications dominate the market as large-scale renewable energy projects, especially in solar and wind, are becoming increasingly popular in India. The ability of utility-scale battery energy storage systems to store large amounts of energy and balance grid load has made them a critical component in India’s energy infrastructure. This segment benefits from government initiatives aimed at modernizing the grid and integrating renewable sources, which further fuels its growth.

India Battery Energy Storage Systems Market Competitive Landscape

The India Battery Energy Storage Systems market is characterized by a few key players that dominate the landscape, including domestic manufacturers and multinational corporations. These companies are recognized for their investments in technology, large-scale manufacturing capabilities, and ability to meet India's increasing energy storage demands. The competitive landscape is highly consolidated, with major players including Tata Power Solar Systems, Exide Industries, and Luminous Power Technologies. Companies are leveraging advancements in battery technology, extensive distribution networks, and partnerships with government initiatives to capture market share.

|

Company |

Established Year |

Headquarters |

Battery Technology |

Applications |

R&D Investment |

Market Share |

Regional Presence |

Recent Initiatives |

|

Exide Industries Ltd. |

1947 |

Kolkata |

|

|

|

|

|

|

|

Tata Power Solar Systems Ltd. |

1989 |

Mumbai |

|

|

|

|

|

|

|

Luminous Power Technologies Pvt. Ltd. |

1988 |

Gurgaon |

|

|

|

|

|

|

|

Amara Raja Batteries Ltd. |

1985 |

Hyderabad |

|

|

|

|

|

|

|

Reliance New Energy Solar Ltd. |

2021 |

Mumbai |

|

|

|

|

|

|

India Battery Energy Storage Systems Market Analysis

Growth Drivers

- Renewable Energy Integration: India’s energy sector is witnessing a significant shift towards renewable energy. As of 2024, installed over 120 GW of renewable energy capacity, with a target of reaching 500 GW by 2030. The integration of Battery Energy Storage Systems (BESS) is critical for managing intermittent energy from solar and wind sources. The International Energy Agency reports that India's share of renewable energy in electricity generation will reach 25% by 2025. This drives demand for storage systems to ensure a stable supply during periods of low renewable generation.

- Grid Stabilization (Energy Demand & Supply Gap): The in India is expected to grow to 1,905 TWh in 2024, according to the Central Electricity Authority (CEA). However, the current supply capacity cannot always meet peak demand, leading to frequent grid imbalances. BESS offers a solution to store excess energy during low demand periods and release it during high demand, ensuring grid stabilization. The Indian government aims to improve grid reliability through initiatives such as the Green Energy Corridor, which connects renewable power to the grid with storage solutions playing a crucial role.

- Government Incentives (FAME II, National Energy Storage Mission): Government initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME II) and the National Energy Storage Mission are key drivers for BESS adoption. The Indian government has allocated INR 10,000 crore for FAME II to promote electric mobility and energy storage solutions. Additionally, the Ministry of Power’s draft National Energy Storage Mission targets 4 GWh of storage by 2025 to support renewable energy integration and grid stability. These incentives provide a strong financial boost to the development of storage infrastructure.

Market Challenges

- High Capital Investment: The initial cost of setting up large-scale BESS is still relatively high, with estimates ranging from $300 to $500 per kWh for utility-scale storage. This poses a challenge for developing countries like India, where energy projects must often balance cost-effectiveness with capacity. The Indian Ministry of Power estimates that an investment of over INR 2 lakh crore will be needed by 2025 to develop the country’s energy storage infrastructure. High capital requirements are a major hurdle for widespread BESS adoption in the short term.

- Battery Lifecycle and Recycling Challenges: Batteries used in energy storage have a limited lifespan, typically between 10 to 15 years, depending on the technology. Recycling and disposal of spent batteries, particularly those containing hazardous materials like lithium and cobalt, remain a significant challenge. The Indian government has yet to implement a comprehensive policy for battery recycling, though the Ministry of Environment, Forest and Climate Change has initiated preliminary discussions. However, as of 2024, the lack of infrastructure for safe recycling is hampering sustainable growth in this sector.

India Battery Energy Storage Systems Market Future Outlook

Over the next five years, the India Battery Energy Storage Systems market is expected to grow significantly due to continued government initiatives aimed at increasing the adoption of renewable energy sources. The National Energy Storage Mission, along with financial incentives and subsidies for clean energy projects, will be a key driving factor in the expansion of the market. Additionally, advancements in battery technology, such as solid-state batteries, and the growing demand for energy storage in the electric vehicle sector will contribute to market growth. Investments in grid modernization, particularly in energy-deficient regions, will also accelerate the deployment of battery energy storage systems across India, further solidifying the market's trajectory toward substantial growth.

Market Opportunities

- Expansion of Renewable Energy Capacity (Solar & Wind): India’s renewable energy sector is rapidly expanding, with solar energy capacity reaching 65 GW and wind energy contributing 45 GW as of 2024. This growing capacity increases the demand for BESS to store surplus energy generated during peak production periods. The Indian Renewable Energy Development Agency (IREDA) is spearheading projects that integrate solar power plants with storage solutions, further boosting the role of BESS in optimizing renewable energy use.

- Rural Electrification Initiatives: Despite significant progress, around 4% of India’s rural population still lacks access to reliable electricity as of 2024. The Indian government’s Saubhagya scheme aims to achieve universal electrification by deploying decentralized energy solutions like solar panels paired with BESS. These storage systems are crucial in areas with limited grid connectivity, allowing rural communities to store solar energy during the day for nighttime use, improving energy access and quality of life.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Battery Type |

Lithium-Ion Lead-Acid Flow Batteries Solid-State |

|

By Application |

Residential Commercial & Industrial Utility-Scale Microgrids |

|

By Power Capacity |

Below 100 MWh 100 – 500 MWh Above 500 MWh |

|

By Connection Type |

On-Grid Off-Grid Hybrid Systems |

|

By Region |

North South East West |

Products

Key Target Audience

Renewable Energy Project Developers

Battery Manufacturers

Grid Operators and Utilities

Electric Vehicle Manufacturers

Industrial Energy Consumers

Solar and Wind Energy Companies

Government and Regulatory Bodies (Ministry of New and Renewable Energy, Central Electricity Regulatory Commission)

Investments and Venture Capitalist Firms

Companies

Exide Industries Ltd.

Tata Power Solar Systems Ltd.

Luminous Power Technologies Pvt. Ltd.

Amara Raja Batteries Ltd.

Reliance New Energy Solar Ltd.

Sterling and Wilson Pvt. Ltd.

Su-Kam Power Systems Ltd.

Panasonic India Pvt. Ltd.

Samsung SDI Co., Ltd.

Tesla, Inc.

LG Energy Solution

Fluence Energy, Inc.

Hitachi Energy India Limited

Coslight India Telecom Pvt. Ltd.

ABB India Ltd.

Table of Contents

1.India Battery Energy Storage Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.India Battery Energy Storage Systems Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.India Battery Energy Storage Systems Market Analysis

3.1. Growth Drivers

3.1.1. Renewable Energy Integration

3.1.2. Grid Stabilization (Energy Demand & Supply Gap)

3.1.3. Government Incentives (FAME II, National Energy Storage Mission)

3.1.4. Reduction in Battery Costs

3.2. Market Challenges

3.2.1. High Capital Investment

3.2.2. Battery Lifecycle and Recycling Challenges

3.2.3. Infrastructure Limitations

3.2.4. Supply Chain Disruptions (Lithium and Cobalt Dependence)

3.3. Opportunities

3.3.1. Expansion of Renewable Energy Capacity (Solar & Wind)

3.3.2. Rural Electrification Initiatives

3.3.3. Energy-as-a-Service (EaaS) Model Adoption

3.3.4. Foreign Direct Investment in Energy Sector

3.4. Trends

3.4.1. Hybrid Energy Storage Solutions

3.4.2. Decentralized Energy Storage Systems

3.4.3. Energy Storage in Electric Vehicle (EV) Infrastructure

3.4.4. Advancements in Lithium-Ion and Solid-State Batteries

3.5. Government Regulation

3.5.1. National Energy Storage Framework

3.5.2. Grid Modernization Policies

3.5.3. Renewable Purchase Obligations (RPO)

3.5.4. Manufacturing Incentives under ‘Make in India’

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4.India Battery Energy Storage Systems Market Segmentation

4.1. By Battery Type (In Value %)

4.1.1. Lithium-Ion Batteries

4.1.2. Lead-Acid Batteries

4.1.3. Flow Batteries

4.1.4. Advanced Energy Storage Technologies (Solid-State, Supercapacitors)

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial & Industrial

4.2.3. Utility-Scale

4.2.4. Microgrids

4.3. By Power Capacity (In Value %)

4.3.1. Below 100 MWh

4.3.2. 100 – 500 MWh

4.3.3. Above 500 MWh

4.4. By Connection Type (In Value %)

4.4.1. On-Grid

4.4.2. Off-Grid

4.4.3. Hybrid Systems

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5.India Battery Energy Storage Systems Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Exide Industries Ltd.

5.1.2. Tata Power Solar Systems Ltd.

5.1.3. Amara Raja Batteries Ltd.

5.1.4. Sterling and Wilson Pvt. Ltd.

5.1.5. Luminous Power Technologies Pvt. Ltd.

5.1.6. Su-Kam Power Systems Ltd.

5.1.7. Panasonic India Pvt. Ltd.

5.1.8. Samsung SDI Co., Ltd.

5.1.9. Tesla, Inc.

5.1.10. LG Energy Solution

5.1.11. Fluence Energy, Inc.

5.1.12. Hitachi Energy India Limited

5.1.13. Coslight India Telecom Pvt. Ltd.

5.1.14. Reliance New Energy Solar Ltd.

5.1.15. ABB India Ltd.

5.2. Cross Comparison Parameters (Battery Technology, Application, Power Capacity, Operational Footprint, Innovation Capabilities, R&D Investments, Supply Chain Reliability, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6.India Battery Energy Storage Systems Market Regulatory Framework

6.1. Energy Storage Standards

6.2. Grid Connectivity Requirements

6.3. Certification Processes

7.India Battery Energy Storage Systems Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8.India Battery Energy Storage Systems Future Market Segmentation

8.1. By Battery Type (In Value %)

8.2. By Application (In Value %)

8.3. By Power Capacity (In Value %)

8.4. By Connection Type (In Value %)

8.5. By Region (In Value %)

9.India Battery Energy Storage Systems Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the ecosystem of the India Battery Energy Storage Systems market. This phase focused on identifying major stakeholders, battery types, and applications influencing the market. Extensive desk research was conducted using proprietary databases and secondary sources to collect industry-specific information.

Step 2: Market Analysis and Construction

In this stage, we compiled historical data from the last five years to understand the growth patterns and market penetration across various segments. Special emphasis was placed on the evolving demand for grid stability and renewable energy storage in India.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses were formulated regarding the market growth drivers and restraints, which were validated through interviews with industry experts. These interviews provided crucial insights into current market trends, technological innovations, and competitive strategies.

Step 4: Research Synthesis and Final Output

The final phase of research synthesis involved triangulating data from various sources, including government reports and industry stakeholders. This was used to create a validated and comprehensive market report that accurately reflects the current state and future projections of the India Battery Energy Storage Systems market.

Frequently Asked Questions

01. How big is the India Battery Energy Storage Systems market?

The India Battery Energy Storage Systems market is valued at USD 3.5 billion, driven by the rapid growth in renewable energy projects and government initiatives.

02. What are the challenges in the India Battery Energy Storage Systems market?

Challenges include high initial capital investment, supply chain disruptions for critical materials like lithium, and technical issues related to battery lifecycle and recycling.

03. Who are the major players in the India Battery Energy Storage Systems market?

Key players include Exide Industries, Tata Power Solar Systems, Luminous Power Technologies, Amara Raja Batteries, and Reliance New Energy Solar.

04. What are the growth drivers of the India Battery Energy Storage Systems market?

Growth is propelled by the increasing integration of renewable energy sources, grid stabilization needs, and advancements in battery technologies, especially lithium-ion batteries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.