India Beauty Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD918

July 2024

100

About the Report

India Beauty Market Overview

- The India beauty market, was valued at USD 30.5 Bn in 2023, is driven by increased internet penetration, rise in working women population, and the influence of beauty and fashion trends.

- Key players in the market include Hindustan Unilever, L'Oréal India, Procter & Gamble, and Lakmé. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

- In 2023, Procter & Gamble's new research and development center in India focuses on creating products tailored to local consumer needs. This center emphasizes solutions for common skin and hair issues, strengthening P&G's market presence.

India Beauty Current Market Analysis

- Social media platforms like Instagram and YouTube shape beauty trends and consumer behavior. India had 467 Mn social media users in 2023, up from 326 Mn in 2018, with beauty influencers driving awareness and demand for innovative products.

- The Startup India initiative, launched in 2016, promotes entrepreneurship and innovation across various sectors, including beauty and personal care. This initiative provides funding, mentorship, and regulatory support to startups, encouraging new entrants in the beauty market.

- Brands are adopting recyclable, biodegradable, and reusable packaging materials to reduce their environmental footprint. A study by the Confederation of Indian Industry (CII) in 2023 found that 55% of beauty brands in India had adopted sustainable packaging solutions, reflecting the growing importance of sustainability in consumer purchasing decisions.

India Beauty Market Segmentation

The India Beauty Market can be segmented based on several factors:

By Product Type: In the India Beauty market segmentation by product type is divided into skincare, haircare, color cosmetic and fragrances. In 2023, skincare leads the India beauty market, driven by increased consumer focus on healthy skin and specific concerns like acne and aging. Rising disposable incomes and the influence of social media have boosted demand for diverse skincare products, solidifying its dominance.

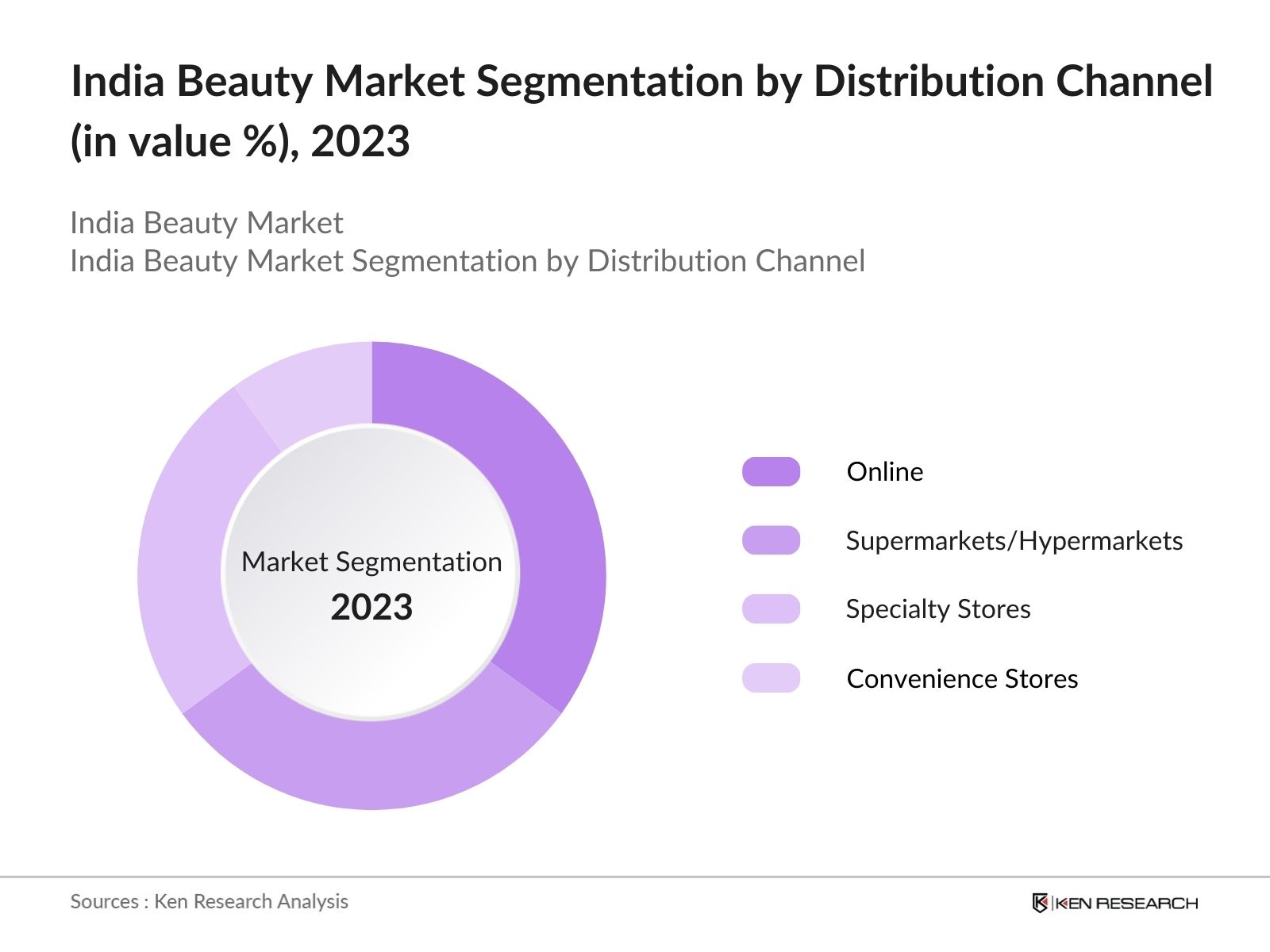

By Distribution Channel: In the India Beauty market segmentation by distribution channel is divided into online, supermarkets, specialty stores and convenience stores. In 2023, online channels dominate the India beauty market, driven by the convenience of home shopping, a wide product range, and attractive discounts. Consumers prefer the ease of comparing products and reading reviews, boosting the popularity of online beauty shopping.

By Gender: India Beauty market segmentation by gender is divided into male and female. In 2023, female consumers dominate the India beauty market, driving demand for a wide range of beauty and personal care products. Increased awareness of personal grooming, fashion trends, and social media influence, along with rising disposable incomes, solidify their leading position.

India Beauty Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Hindustan Unilever |

1933 |

Mumbai, India |

|

L'Oréal India |

1994 |

Mumbai, India |

|

Procter & Gamble |

1964 |

Mumbai, India |

|

Lakmé |

1952 |

Mumbai, India |

|

Emami |

1974 |

Kolkata, India |

- Nykaa Acquires Dot & Key (2021): Nykaa's acquisition of Dot & Key strengthens its position in the premium skincare segment. This move expands Nykaa's product portfolio to include over 50 new specialized skincare products, catering to the growing demand for targeted skincare solutions. The Indian skincare market is valued at approximately $2 billion, and this acquisition positions Nykaa to capture a larger share​.

- Hindustan Unilever's Sustainability Initiatives (2023): Hindustan Unilever launched eco-friendly beauty products, with 80% of ingredients sourced naturally and 90% of packaging recyclable. This aligns with the growing consumer preference for sustainable products. In 2023, sales of their eco-friendly range reached ₹1,000 crores, supporting the company's goal of reducing its environmental footprint by 50% by 2030​.

- L'Oréal India's Digital Transformation (2022): L'Oréal India's digital initiatives, including an AI-powered beauty advisor and virtual try-on tools, led to a significant boost in online sales. These tools enhanced customer engagement, with over 1 million users trying virtual tools. This digital transformation connects with tech-savvy consumers, contributing to L'Oréal's goal of achieving 50% of sales through e-commerce by 2025​.

India Beauty Industry Analysis

India Beauty Market Growth Drivers:

- Rising Expenditure on Premium and Luxury Beauty Products: The increase in disposable income among Indian households has significantly boosted spending on beauty and personal care products. The per capita income in India rose from INR 94,954 in 2015 to INR 135,050 in 2023, leading to higher expenditure on premium and luxury beauty products. This growth reflects a robust expansion in the Indian beauty market, which benefits from greater consumer purchasing power and a growing preference for high-end products.

- Urbanization and Lifestyle Changes: Rapid urbanization in India is significantly contributing to the beauty market's growth. The urban population increased from approximately 285 million in 2001 to around 493 million in 2023. This shift leads to higher exposure to global beauty trends and increased demand for skincare, haircare, and cosmetics.

- Growing E-commerce Sector: The expansion of the e-commerce sector has revolutionized beauty product distribution and accessibility in India. The number of online shoppers increased from 140 million in 2018 to 290 million in 2023, driving market growth through a wider product range, competitive pricing, and convenience. This surge has significantly boosted the beauty market, making premium products more accessible to a broader audience​.

India Beauty Market Challenges:

- Counterfeit Products: The Organisation for Economic Co-operation and Development (OECD) reports that counterfeit beauty products account for approximately $5.4 billion in global losses annually. In India, this issue is particularly challenging for the beauty market due to the lack of stringent enforcement and low consumer awareness. These factors exacerbate the spread of counterfeit products, which not only erode brand trust but also pose significant health risks.

- Rising Raw Material Costs: In 2023, prices of essential oils and natural extracts rose by 20%, significantly impacting pricing strategies and profit margins for Indian beauty product manufacturers. For instance, lavender oil increased from INR 8,000 per kg in 2022 to INR 10,000 per kg in 2023, and rose oil from INR 40,000 per kg to INR 50,000 per kg. These hikes are due to supply chain disruptions, increased demand, and geopolitical events like the Russia-Ukraine conflict, posing a major challenge for the industry.

India Beauty Market Government Initiatives:

- Consumer Protection Act (2019): This act includes measures to curb counterfeit products and ensure beauty product safety and quality. It mandates proper labeling, ingredient disclosure, and adherence to safety standards, enhancing consumer trust and protection. In 2022, enforcement of this act helped reduce the incidence of counterfeit beauty products by 30%, significantly improving market credibility​.

- Skill India Mission: Launched in 2015, this mission provides vocational training in beauty and wellness. It creates a skilled workforce, supporting industry growth and enhancing service quality in salons and wellness centers. By 2023, over 1.3 lakh individuals were trained under this mission, contributing to the professionalization and growth of the beauty and wellness industry in India​​.

India Beauty Future Market Outlook

The India Beauty Market is expected to show significant growth driven by expanding e-commerce, growing youth population, and increasing adoption of international beauty brands.

Future Market Trends

-

- Organic and Natural Products: There will be a significant shift towards organic and natural beauty products among Indian consumers. Concerns about synthetic chemicals will drive this trend, leading to the emergence of more brands focused on organic formulations.

- Men's Grooming Segment: The men's grooming segment is set to experience rapid growth in the coming years. Increased awareness and acceptance of grooming routines among men will drive demand for skincare, haircare, and grooming tools.

- Personalized Beauty Solutions: Consumers will increasingly seek personalized beauty solutions tailored to their specific needs. Advancements in AI and machine learning in beauty tech will enable brands to offer customized product recommendations and formulations, with innovations such as AI-powered skin analysis tools becoming more prevalent.

Scope of the Report

|

By Product Type |

Skincare Haircare Color Cosmetics Fragrances |

|

By Distribution Channel |

Online Supermarkets/Hypermarkets Specialty Stores Convenience Stores |

|

By Gender |

Male Female |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Beauty Product Manufacturers

E-commerce Platforms

Beauty Products Retailers and Distributors

Banks and Financial Institutions

Government and Regulatory Bodies (Central Drugs Standard Control Organization)

Beauty and Personal Care Consultants

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Hindustan Unilever

L'Oréal India

Procter & Gamble

Lakmé

Emami

Dabur India

Nykaa

Himalaya

Johnson & Johnson

Revlon

Avon

Godrej Consumer Products

VLCC

The Body Shop

Shahnaz Husain

Patanjali Ayurved

Biotique

Lotus Herbals

Forest Essentials

Mamaearth

Table of Contents

1. India Beauty Market Overview

1.1 India Beauty Market Taxonomy

2. India Beauty Market Size (in USD Bn), 2018-2023

3. India Beauty Market Analysis

3.1 India Beauty Market Growth Drivers

3.2 India Beauty Market Challenges and Issues

3.3 India Beauty Market Trends and Development

3.4 India Beauty Market Government Regulation

3.5 India Beauty Market SWOT Analysis

3.6 India Beauty Market Stake Ecosystem

3.7 India Beauty Market Competition Ecosystem

4. India Beauty Market Segmentation, 2023

4.1 India Beauty Market Segmentation by Product Type (in value %), 2023

4.2 India Beauty Market Segmentation by Distribution Channel (in value %), 2023

4.3 India Beauty Market Segmentation by Gender (in value %), 2023

5. India Beauty Market Competition Benchmarking

5.1 India Beauty Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Beauty Future Market Size (in USD Bn), 2023-2028

7. India Beauty Future Market Segmentation, 2028

7.1 India Beauty Market Segmentation by Product Type (in value %), 2028

7.2 India Beauty Market Segmentation by Distribution Channel (in value %), 2028

7.3 India Beauty Market Segmentation by Gender (in value %), 2028

8. India Beauty Market Analysts’ Recommendations

8.1 India Beauty Market TAM/SAM/SOM Analysis

8.2 India Beauty Market Customer Cohort Analysis

8.3 India Beauty Market Marketing Initiatives

8.4 India Beauty Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on India beauty market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India beauty market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple beauty products manufacturers, suppliers and distributors and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from beauty products manufacturers, suppliers and distributors.

Frequently Asked Questions

01 How big is India Beauty Market?

The India beauty market, was valued at USD 30.5 Bn in 2023, is driven by increased internet penetration, rise in working women population, and the influence of beauty and fashion trends.

02 What are the challenges in India Beauty Market?

Challenges include high competition among brands, regulatory hurdles, and the counterfeit products market. The increasing cost of raw materials also poses a threat to market profitability.

03 Who are the major players in the India Beauty Market?

Key players in the market include Hindustan Unilever, L'Oréal India, Procter & Gamble, and Lakmé. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04 What are the growth drivers of India Beauty Market?

The market is propelled by factors such as increased internet penetration, rise in working women population, and the influence of beauty and fashion trends. Additionally, the demand for organic and natural products is boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.