India Beverage Market Outlook to 2029

Region:Asia

Author(s):Nishika and Kartika

Product Code:KR1495

April 2025

80-100

About the Report

India Beverage Market Overview

- The India Beverages Market is valued at 1,43,300 Cr units in production volume, based on a five-year historical analysis. The market has witnessed consistent expansion, driven by India's Extended Producer Responsibility (EPR) framework, rising adoption of recyclable aluminum packaging, and the increasing popularity of ready-to-drink beverages. The production volume further rose, reflecting ongoing demand from beverage brands focused on sustainability and packaging innovation.

- The domestic aluminum can production in India is primarily dominated by regions like Maharashtra, Haryana, and Andhra Pradesh. These locations benefit from proximity to raw materials, skilled labor, and robust infrastructure. For instance, Canpack India operates mega plants in Aurangabad and Nuh, while Ball Beverage Packaging runs facilities in Mumbai and Sri City. Their regional dominance is also reinforced by industrial policies, established supply chains, and access to export routes and local demand hubs.

- The Extended Producer Responsibility (EPR) guidelines under the Plastic Waste Management (Amendment) Rules, implemented by the Central Pollution Control Board, mandate recyclability declarations and trackable returns for all beverage containers. As of 2024, CPCB has approved 421 authorized recyclers for aluminum packaging in India. This has increased compliance pressure on brands and driven procurement preference for materials like aluminum that meet EPR recovery targets seamlessly.

India Beverage Market Segmentation

By Type of Beverage: Carbonated and alcoholic beverages dominate the market, accounting for nearly two-thirds of consumption. The rising health focus is boosting demand for juices and RTD drinks. Carbonates retain popularity for on-the-go convenience, while alcoholic cans continue to be strong due to portability. Dairy-based drinks hold a minor share due to packaging preferences.

By Material Type: Aluminum cans dominate due to their lightweight, higher recycling value, and extended shelf life. A growing focus on sustainability and cost-efficiency is driving a gradual shift away from tin. Brands prefer aluminum for its eco-friendly benefits and lower transport costs, contributing to its rising share in beverage packaging.

India Beverage Market Competitive Landscape

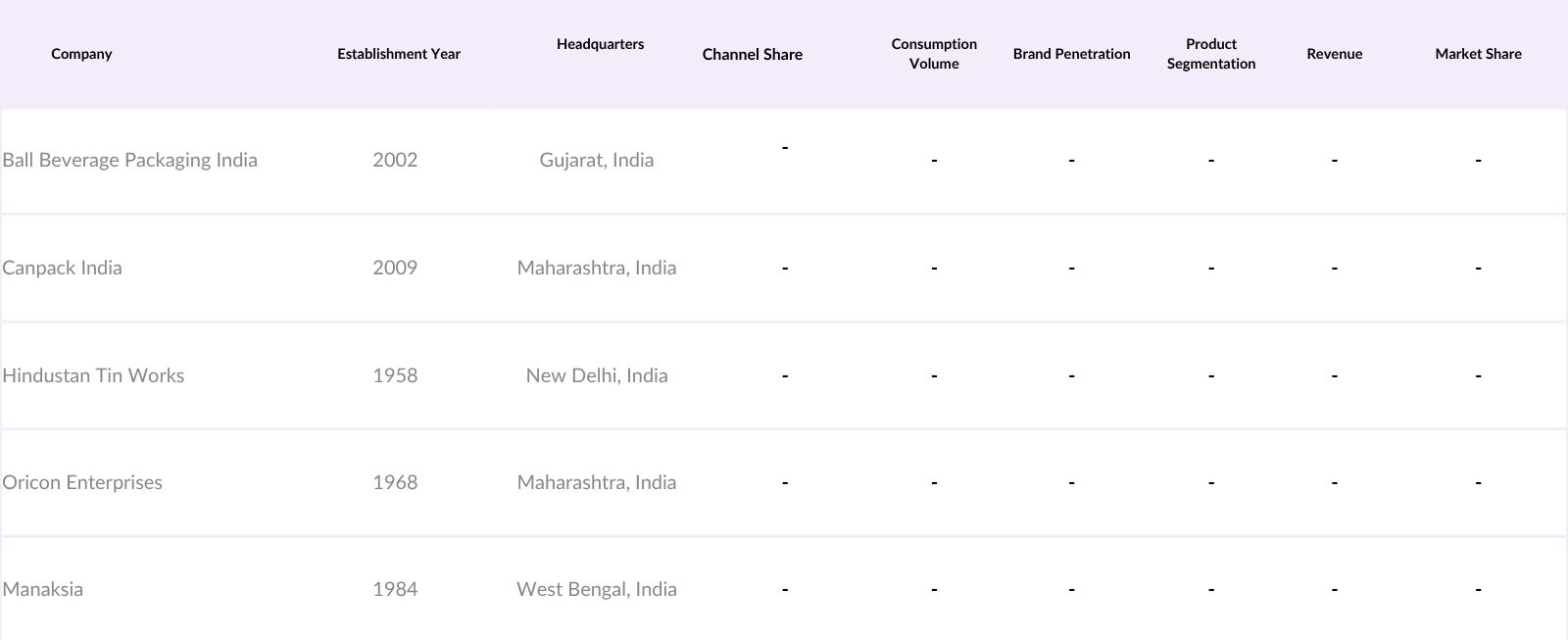

The market is consolidated, with two major players commanding the entire domestic supply. These firms operate high-capacity manufacturing units with advanced production lines and wide distribution networks. They serve both multinational and domestic beverage brands across carbonated, alcoholic, and dairy segments. Entry barriers remain high due to capital intensity, technical standards, and scale economies.

India Beverage Market Analysis

Growth Drivers

- Surge in Demand for Sustainable Packaging: Aluminum cans are gaining traction due to their high recyclability and alignment with India's EPR (Extended Producer Responsibility) mandates. FMCG brands and beverage manufacturers are increasingly shifting from plastic and glass to metal to meet sustainability goals, boosting long-term demand for eco-friendly and circular packaging formats.

- Growth in Carbonated and Functional Beverages: The consumption of soft drinks, energy beverages, and flavored waters has risen sharply, particularly among the youth and urban middle class. Beverage cans offer convenience, portability, and extended shelf life, making them the preferred format for new-age drink launches and high-frequency consumption.

- Premiumization and Rise of Portion-Sized Packaging: Brands are introducing smaller SKUs like 150 ml and 180 ml cans to support affordable pricing and portion control. This shift addresses urban consumers demand for health-focused, single-serve formats and supports sugar reduction campaigns, making cans ideal for both premium and functional beverage launches.

Market Challenges

- Volatility in Raw Material Costs (Aluminum): Aluminum price fluctuations directly impact manufacturing margins and pricing stability. Global supply chain disruptions, import dependency on bauxite/alumina, and energy-intensive production processes expose domestic manufacturers to input cost pressures affecting long-term pricing contracts with beverage brands.

- Limited Penetration in Rural and Tier-2 Cities: Despite growing urban demand, the penetration of beverage cans remains low in rural and semi-urban markets due to higher unit cost compared to PET and glass bottles. Retailers in price-sensitive regions prefer refillable or cheaper alternatives, limiting the scalability of cans beyond metro and Tier-1 clusters.

India Beverage Market Future Outlook

Over the next five years, the India Beverage Market is expected to witness steady growth. Key drivers include rising urban consumption, the adoption of sustainable packaging practices, and the premiumization of beverage portfolios. Expanding consumer demand for convenience is likely to drive the use of cans in emerging categories such as dairy, functional beverages, and craft drinks, while circular economy policies will further strengthen aluminum's market position.

Market Opportunities

- Cold Chain Expansion in FMCG Logistics: According to the Ministry of Food Processing Industries, India has added over 7 million metric tonnes of cold storage capacity since 2022. Improved refrigeration logistics across secondary and tertiary markets opens up new shelf opportunities for canned beverages that require less refrigeration but benefit from stackability and reduced leak risk, making them attractive for long-haul retail routes.

- Localizing Component Manufacturing: With the Production Linked Incentive (PLI) scheme expanding into packaging materials in 2023, multiple component manufacturers have proposed aluminum tab, lid, and body production facilities. Localization of components like easy-open ends and digital printing sheets will reduce dependency on imported raw inputs and give Indian canmakers better control over supply chain costs and lead time.

Scope of the Report

|

By Beverage Type |

Carbonates |

|

By Material Type |

Aluminium |

|

By Procurement Mode |

Domestic Production |

Products

Key Target Audience

- Beverage Can Manufacturers

- Aluminum and Tin Raw Material Suppliers

- FMCG and Beverage Brands

- Retailers and Packaging Distributors

- Environmental Sustainability Consultants

- EPR Compliance and Waste Management Agencies

- Government and Industry Policy Maker

Companies

Players Mentioned in the Report

Ball Beverage Packaging India Pvt. Ltd

Canpack India Pvt. Ltd

Hindustan Tin Works Ltd

Oricon Enterprises Ltd

Manaksia Limited

Table of Contents

1. Product Taxonomy

1.1 Segment Flowchart

2. Part A: India Beverage Market

2.1 India Overall Beverage Market

2.1.1 India Beverage Market: Ecosystem

2.1.2 India Beverage Market: Value Chain

2.1.3 India Beverage Market Size, 2019–2030F

2.1.4 Segmentation by Organized & Unorganized, 2024 & 2030F

2.1.5 Segmentation by Packaging Type, 2024 & 2030F

2.1.6 Segmentation by Distribution Channel, 2024 & 2030F

2.1.7 Segmentation by Geography, 2024 & 2030F

2.1.8 Top 40 Cities in Focus for the Beverages Market in India

2.1.9 Segmentation by Demographics, 2024 & 2030F

2.1.10 Threats and Challenges in the India Beverages Market

2.1.11 Market Trends and Developments in India Beverages Market

2.2 India Bottled Water Market

2.2.1 India Bottled Water Market Size, 2019–2030F

2.2.2 India Sparkling Water Market Size, 2019–2030F

2.2.3 Segmentation by Organized & Unorganized, 2024 & 2030F

2.2.4 Segmentation by Price Range, 2024 & 2030F

2.2.5 Segmentation by Packaging Type, 2024 & 2030F

2.2.6 Segmentation by Distribution Channel, 2024 & 2030F

2.2.7 Channel Mix: Insights from Industry Experts

2.2.8 Segmentation by Geography, 2024 & 2030F

2.2.9 Segmentation by Demographics, 2024 & 2030F

2.2.10 Market Share of Key Players in India Bottled Water Market, FY’24

2.2.11 Cross Comparison of Key Players in India Bottled Water Market

2.3 India Carbonated & Soft Drinks Market

2.3.1 India Carbonated & Soft Drinks Market Size, 2019–2030F

2.3.2 India Soda Market Size, 2019–2030F

2.3.3 Segmentation by Organized & Unorganized, 2024 & 2030F

2.3.4 Segmentation by Price Range, 2024 & 2030F

2.3.5 Segmentation by Packaging Type, 2024 & 2030F

2.3.6 Segmentation by Pack Type, 2024 & 2030F

2.3.7 Segmentation by Distribution Channel, 2024 & 2030F

2.3.8 Channel Mix: Insights from Industry Experts

2.3.9 Segmentation by Geography, 2024 & 2030F

2.3.10 Segmentation by Demographics, 2024 & 2030F

2.3.11 Market Share of Key Players in India Carbonated & Soft Drinks Market, FY’24

2.3.12 Cross Comparison of Key Players in India Carbonated & Soft Drinks Market

2.4 India Juices & Nectar Market

2.4.1 India Juices & Nectar Market Size, 2019–2030F

2.4.2 Segmentation by Organized & Unorganized, 2024 & 2030F

2.4.3 Segmentation by Price Range, 2024 & 2030F

2.4.4 Segmentation by Packaging Type, 2024 & 2030F

2.4.5 Segmentation by Distribution Channel, 2024 & 2030F

2.4.6 Channel Mix: Insights from Industry Experts

2.4.7 Segmentation by Geography, 2024 & 2030F

2.4.8 Segmentation by Demographics, 2024 & 2030F

2.4.9 Market Share of Key Players in India Juices & Nectar Market, FY’24

2.4.10 Cross Comparison of Key Players in India Juices & Nectar Market

2.5 India Energy & Sports Market

2.5.1 India Energy & Sports Market Size, 2019–2030F

2.5.2 Segmentation by Organized & Unorganized, 2024 & 2030F

2.5.3 Segmentation by Price Range, 2024 & 2030F

2.5.4 Segmentation by Packaging Type, 2024 & 2030F

2.5.5 Segmentation by Distribution Channel, 2024 & 2030F

2.5.6 Channel Mix: Insights from Industry Experts

2.5.7 Segmentation by Geography, 2024 & 2030F

2.5.8 Segmentation by Demographics, 2024 & 2030F

2.5.9 Market Share of Key Players in India Energy & Sports Drinks Market, FY’24

2.5.10 Cross Comparison of Key Players in India Energy & Sports Drinks Market

3. Case Study

3.1 Varun Beverages

3.2 Bisleri

3.3 Campa Cola

4. Analyst Recommendation

4.1 Price Mix Strategy

4.2 Bottled Water

4.3 Carbonated Soft Drinks Market

4.4 Juices and Nectars

4.5 Sports & Energy Drinks

5. Industry Speaks

6. Part B: India Food & Beverage Market

6.1 Macro-Economic Parameters, 2024

6.2 Policy Changes in the F&B Sector

6.3 F&B Sector in India and China, 2024

6.4 Prices of Major Commodities

6.5 Cross-Comparison of Major Players

6.6 Market Trends and Development: India F&B Market

6.7 Growth Drivers: India F&B Market

6.8 Porter’s 5 Forces: India F&B Market

7. Research Methodology

7.1 Market Definitions and Assumptions

7.2 Market Sizing Approach

7.3 Appendix

7.4 Research Limitations and Conclusion

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The study began by identifying core variables including beverage categories, material usage, and manufacturing locations. Government notifications, industry reports, and secondary data from packaging associations were examined to define the structural base of the market.

Step 2: Market Analysis and Construction

Production data, procurement trends, and material share were triangulated using company financials, secondary sources, and import-export records. Projections were built on volume trends, sustainability policies, and segment-level beverage demand.

Step 3: Hypothesis Validation and Expert Consultation

Over 30 stakeholders were interviewed via CATI including beverage producers, can manufacturers, and supply chain intermediaries. Inputs were gathered on manufacturing capacity, procurement strategies, and future packaging preferences.

Step 4: Research Synthesis and Final Output

Validated data was aggregated and projected up to 2029 using CAGR modeling. Category-wise, material-wise, and procurement-based splits were prepared to provide a holistic market outlook. Sustainability influence, policy interventions, and pricing inputs were also considered.

Frequently Asked Questions

01. How big is the India Beverage Market?

The India Beverages Market is valued at 1,43,300 Cr units in production volume, based on a five-year historical analysis. The market has witnessed consistent expansion, driven by India's Extended Producer Responsibility (EPR) framework.

02. What are the key challenges in this market?

India Beverage market faces challenges like volatile aluminum prices and limited penetration in rural regions due to high cost compared to PET and glass are the main challenges.

03. Who are the major players in the India Beverage Market?

India Beverage market key players include Ball Beverage Packaging, Canpack India, Hindustan Tin Works, Oricon Enterprises, and Manaksia Limited.

04. What drives growth in the market?

India Beverage market is driven by Demand for sustainable, recyclable packaging, growing urban beverage consumption, and rising preference for portion-controlled, portable drink formats.

05. Which beverage categories dominate can usage?

Carbonated drinks and alcoholic beverages dominate India Beverage market followed by juices and dairy-based beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.