India Biochar Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD9766

December 2024

83

About the Report

India Biochar Market Overview

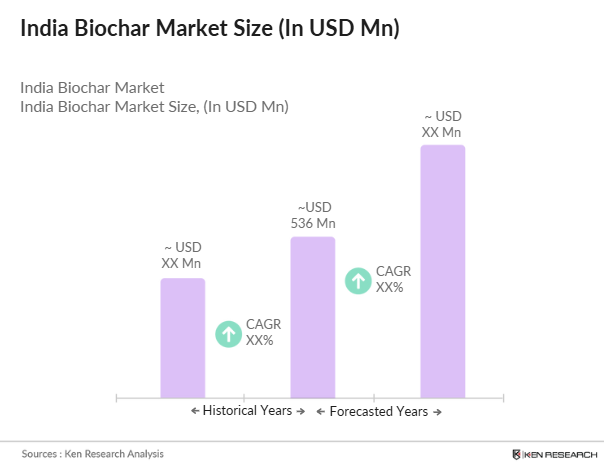

- The India Biochar market is valued at USD 536 million based on a comprehensive analysis over five years. This growth has been driven by the increasing awareness of biochars benefits in enhancing soil health, retaining water, and reducing greenhouse gas emissions. Biochar's popularity in India has surged as both small-scale farmers and large agribusinesses recognize its role in sustainable agriculture. Supported by initiatives from the Ministry of Agriculture, the market benefits from significant government interest in sustainable farming practices, further solidifying biochar's position in the market.

- Regions like Maharashtra and Uttar Pradesh lead the India Biochar market due to their vast agricultural landscapes and high adoption of sustainable farming techniques. These states possess extensive rural farming communities that seek sustainable soil enhancement solutions. Furthermore, Maharashtras progressive agricultural policies and active promotion of biochar applications encourage its market dominance. Additionally, these regions have higher soil degradation rates, creating a strong need for biochar's soil-restorative properties, thus positioning them as key markets within India.

- This mission promotes biochar as a soil enhancer and climate resilience tool, with subsidies and incentives to encourage adoption. The policy supports using biochar on 5 million hectares of degraded land to restore soil fertility and reduce emissions. Its part of the National Action Plan on Climate Change, which aims to integrate climate-friendly practices in agriculture, allocating INR 30 billion to these initiatives in the past two years, highlighting the governments commitment to sustainable land management and climate-smart agriculture.

India Biochar Market Segmentation

By Application: The India Biochar market is segmented by application into soil amendment, carbon sequestration, and animal feed. Among these, soil amendment is the dominant sub-segment. The adoption of biochar for soil enhancement has grown due to its ability to improve soil fertility, increase water retention, and support sustainable crop production. Biochar is particularly effective in regions facing soil degradation, as it improves soil structure and nutrient availability, thus enhancing agricultural productivity. This has made soil amendment the preferred application, with substantial adoption across various states in India.