India Biofertilizer Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2294

November 2024

83

About the Report

India Biofertilizer Market Overview

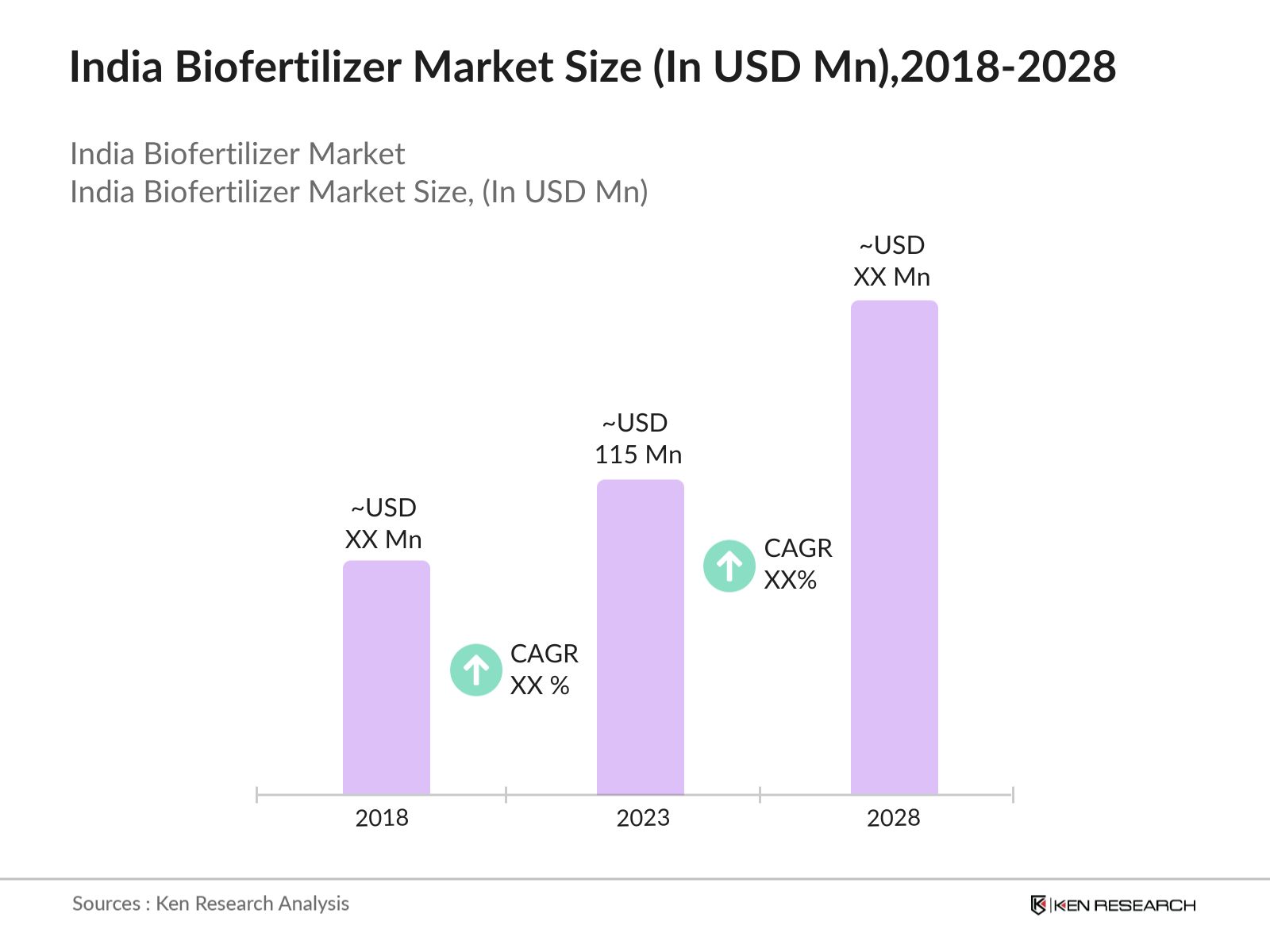

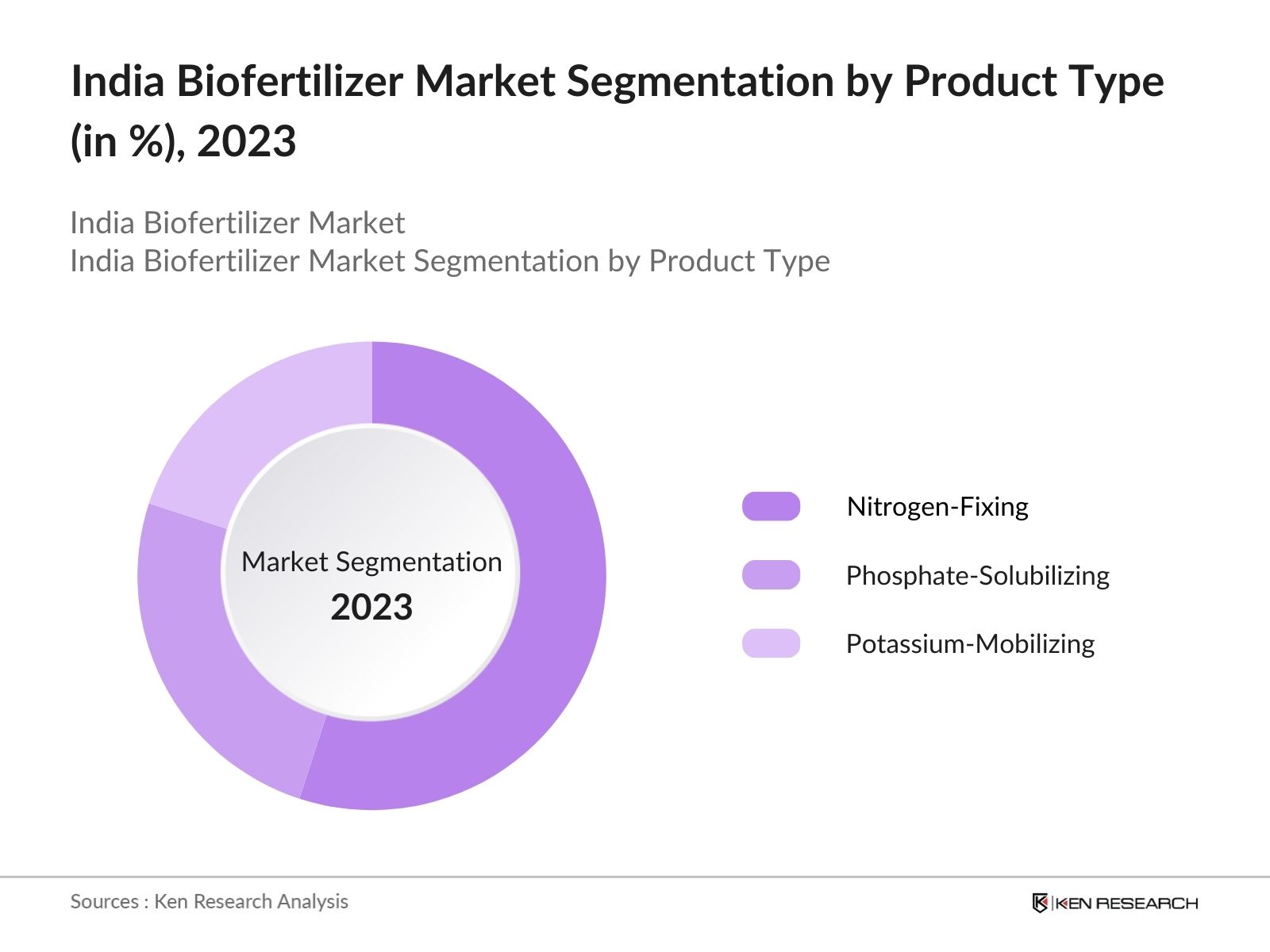

- The India Biofertilizer Market was valued at USD 115 Million in 2023, driven by the increasing demand for organic farming and the rising awareness of sustainable agricultural practices. The market is segmented into nitrogen-fixing biofertilizers, phosphate-solubilizing biofertilizers, and potassium-mobilizing biofertilizers, with nitrogen-fixing biofertilizers being the most dominant due to their wide applicability in various crops.

- Major players in the India Biofertilizer Market include National Fertilizers Limited, Gujarat State Fertilizers & Chemicals Limited, Rashtriya Chemicals & Fertilizers, Madras Fertilizers Limited, and Kan Biosys. These companies are recognized for their extensive distribution networks and focus on sustainable farming solutions. National Fertilizers Limited leads the market with its range of biofertilizer products aimed at improving soil fertility and crop yield.

- In key agricultural states like Uttar Pradesh, Punjab, and Maharashtra, the demand for biofertilizers is high due to the increasing shift towards organic farming and sustainable agricultural practices. These states have a strong emphasis on reducing chemical fertilizer usage and improving soil health through biofertilizers.

- In 2023, Rashtriya Chemicals & Fertilizers launched a new range of phosphate-solubilizing biofertilizers targeting small and medium farmers in North India. This initiative reflects the growing demand for innovative biofertilizer solutions that cater to region-specific agricultural needs.

India Biofertilizer Market Segmentation

The India Biofertilizer Market can be segmented by product type, application, and region:

- By Product Type: The market is segmented into Nitrogen-Fixing Biofertilizers, Phosphate-Solubilizing Biofertilizers, and Potassium-Mobilizing Biofertilizers. In 2023, nitrogen-fixing biofertilizers dominate the market due to their ability to enhance nitrogen availability in crops like pulses, oilseeds, and legumes. These biofertilizers play a crucial role in improving soil fertility and crop productivity.

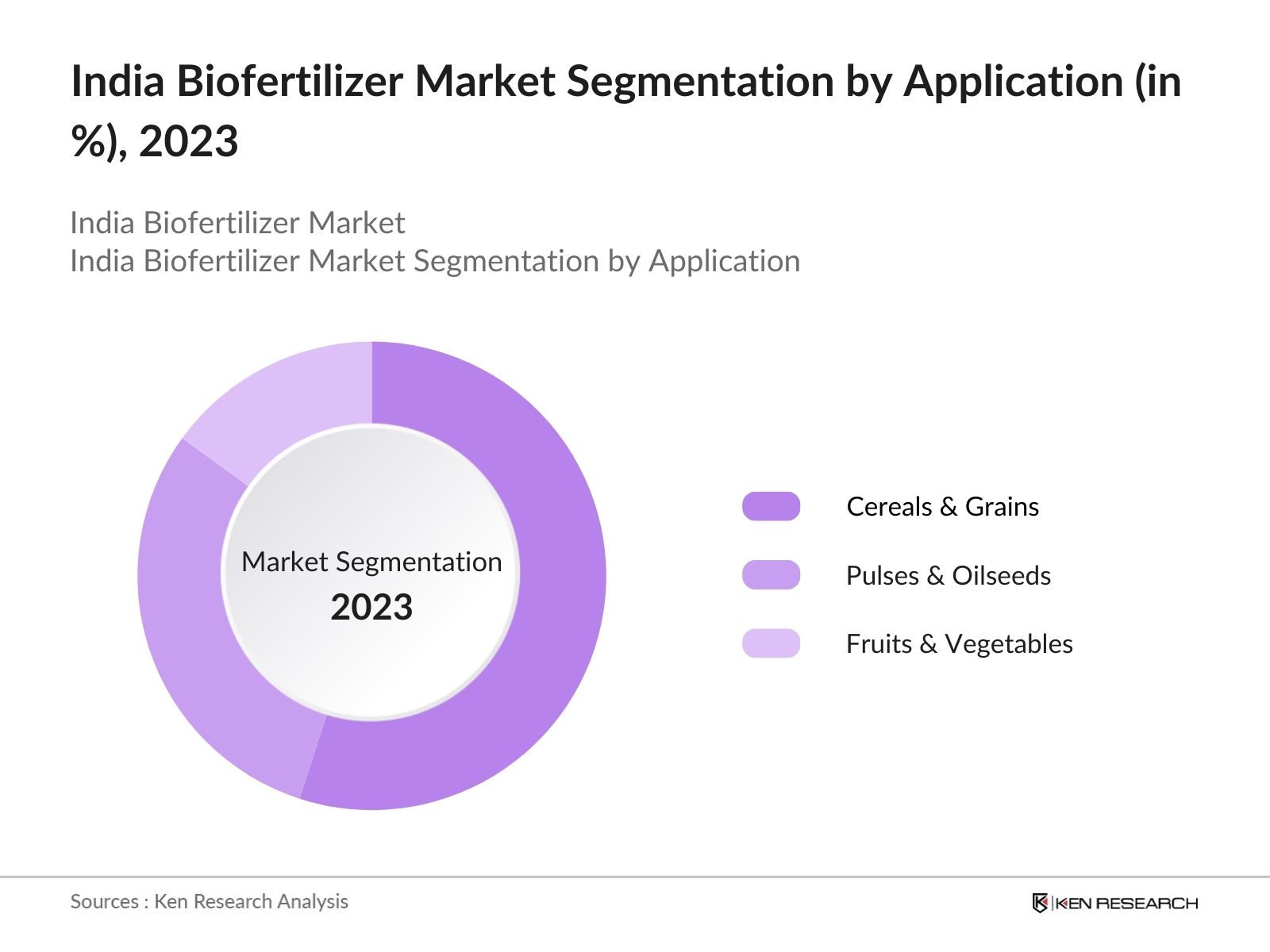

- By Application: The market is segmented into Cereals & Grains, Pulses & Oilseeds, and Fruits & Vegetables. Biofertilizers are widely used in cereal and grain cultivation, especially in states like Punjab and Haryana, where wheat and rice production dominate.

- By Region: The market is segmented into North, East, South, and West. In 2023, North India leads the market due to high agricultural output and government initiatives promoting organic farming. States like Punjab, Haryana, and Uttar Pradesh have strong adoption rates for biofertilizers.

India Biofertilizer Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

National Fertilizers Limited |

1974 |

Noida, India |

|

Gujarat State Fertilizers & Chemicals Limited |

1962 |

Vadodara, India |

|

Rashtriya Chemicals & Fertilizers |

1978 |

Mumbai, India |

|

Madras Fertilizers Limited |

1966 |

Chennai, India |

|

Kan Biosys |

1992 |

Pune, India |

- National Fertilizers Limited: In 2023, National Fertilizers Limited introduced a new line of biofertilizers specifically targeting organic farming practices in Western India. The new range includes nitrogen-fixing and phosphate-solubilizing biofertilizers, helping farmers improve crop yield and soil health.

- Rashtriya Chemicals & Fertilizers: In 2024, Rashtriya Chemicals & Fertilizers expanded its biofertilizer product line with new offerings for horticulture and floriculture. These products are designed to improve soil structure and nutrient availability for high-value crops.

India Biofertilizer Market Analysis

Market Growth Drivers:

- Increased Demand for Organic Farming: The area under organic farming in India has grown to 2.78 million hectares by 2023, with a significant portion of this land relying on biofertilizers for nutrient management. The increasing number of organic farms is driving the demand for biofertilizers.

- Government Support: Government initiatives such as the Paramparagat Krishi Vikas Yojana (PKVY) and the National Mission on Sustainable Agriculture (NMSA) have allocated over INR 1,800 crore to promote the use of biofertilizers and organic farming across India. This financial support has significantly increased adoption rates.

- Rise in Biofertilizer Production: In 2023, biofertilizer production in India reached 90,000 metric tons, supported by both public and private sector initiatives to meet the growing demand for sustainable agriculture inputs.

Market Challenges:

- Lack of Standardization: One of the major challenges is the lack of standardization in biofertilizer products across the country. This inconsistency in quality and effectiveness hinders the trust of farmers and creates difficulties in ensuring uniform application and results. Many small manufacturers struggle to adhere to strict quality standards set by regulatory authorities.

- Limited Infrastructure for Cold Storage: Biofertilizers, especially liquid formulations, often require specific storage conditions to maintain their effectiveness. However, limited infrastructure for cold storage in rural areas affects product shelf life and performance, leading to reduced efficacy by the time they reach end users.

- Distribution Challenges in Remote Areas: The distribution network for biofertilizers is still underdeveloped in several remote regions of India. Many rural areas face logistical challenges, making it difficult for manufacturers and suppliers to ensure timely delivery and availability of biofertilizers, especially during peak agricultural seasons.

Government Initiatives:

- Paramparagat Krishi Vikas Yojana (PKVY): Under the PKVY scheme, the Indian government has allocated INR 300 crore to promote organic farming and the use of biofertilizers. The program focuses on financial assistance and awareness campaigns to encourage farmers to adopt sustainable farming practices.

- National Mission on Sustainable Agriculture (NMSA): In December 2022, the government approved a separate scheme called the National Mission on Natural Farming with a budget of INR 1,584 crore.This mission aims to promote natural farming practices, but it is distinct from the NMSA.

India Biofertilizer Market Future Market Outlook

The India Biofertilizer Market is projected to witness robust growth over the forecast period, driven by the increasing adoption of organic farming, government support, and rising awareness of sustainable agriculture practices.

Future Market Trends:

- Integration of Biofertilizers with Smart Farming Technologies: The adoption of precision agriculture tools, such as drones and IoT-based soil monitoring systems, is expected to drive demand for biofertilizers. These technologies help farmers optimize biofertilizer application, improving efficiency and crop yields while reducing input costs.

- Collaboration with Agri-tech Startups: The increasing number of collaborations between biofertilizer manufacturers and agri-tech startups is expected to enhance product innovation and distribution. Startups specializing in digital platforms for agriculture will enable broader outreach and better access to biofertilizers for small and marginal farmers.

- Focus on Carbon-Sequestration Solutions: As India works towards reducing its carbon footprint in agriculture, biofertilizers that enhance carbon sequestration in the soil will see increased demand. These biofertilizers not only improve soil health but also contribute to sustainable farming practices that mitigate climate change.

Scope of the Report

|

By Region |

West East North South |

|

By Application |

Cereals & Grains Pulses & Oilseeds Fruits & Vegetables |

|

By Product Type |

Nitrogen-Fixing Biofertilizers Phosphate-Solubilizing Biofertilizers Potassium-Mobilizing Biofertilizers |

|

By Sales Channel |

Retail Online Distributors |

Products

Key Target Audience:

Farmers & Agricultural Co-operatives

Government and Regulatory Bodies (NCOF, ICAR, FSSAI, SAUs)

Biofertilizer Manufacturers

Agricultural Research Institutes

Distributors and Retailers

E-commerce Platforms

Agricultural NGOs

Organic Certification Bodies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

National Fertilizers Limited

Gujarat State Fertilizers & Chemicals Limited

Rashtriya Chemicals & Fertilizers

Madras Fertilizers Limited

Kan Biosys

Prathista Industries

T. Stanes & Company

Biomax

Fertilizer Corporation of India

Indian Farmers Fertiliser Cooperative (IFFCO)

Manidharma Biotech Private Limited

Aumgene Biosciences

Agri Life

Varsha Bioscience and Technology

Krishna Agro Biotech

Table of Contents

1. India Biofertilizer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Biofertilizer Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Biofertilizer Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Organic Farming

3.1.2. Government Support

3.1.3. Rise in Biofertilizer Production

3.2. Restraints

3.2.1. Lack of Standardization

3.2.2. Limited Infrastructure for Cold Storage

3.2.3. Distribution Challenges in Remote Areas

3.3. Opportunities

3.3.1. Technological Advancements in Biofertilizers

3.3.2. International Collaborations

3.3.3. Expanding Demand in Organic Farming

3.4. Trends

3.4.1. Integration of Biofertilizers with Smart Farming Technologies

3.4.2. Focus on Carbon-Sequestration Solutions

3.4.3. Collaboration with Agri-tech Startups

3.5. Government Regulation

3.5.1. Paramparagat Krishi Vikas Yojana (PKVY)

3.5.2. National Mission on Sustainable Agriculture (NMSA)

3.5.3. Soil Health Card Scheme

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India Biofertilizer Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Nitrogen-Fixing Biofertilizers

4.1.2. Phosphate-Solubilizing Biofertilizers

4.1.3. Potassium-Mobilizing Biofertilizers

4.2. By Application (in Value %)

4.2.1. Cereals & Grains

4.2.2. Pulses & Oilseeds

4.2.3. Fruits & Vegetables

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. India Biofertilizer Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. National Fertilizers Limited

5.1.2. Gujarat State Fertilizers & Chemicals Limited

5.1.3. Rashtriya Chemicals & Fertilizers

5.1.4. Madras Fertilizers Limited

5.1.5. Kan Biosys

5.1.6. Prathista Industries

5.1.7. Biomax

5.1.8. Indian Farmers Fertiliser Cooperative (IFFCO)

5.1.9. Aumgene Biosciences

5.1.10. Manidharma Biotech Private Limited

5.1.11. T. Stanes & Company

5.1.12. Agri Life

5.1.13. Krishna Agro Biotech

5.1.14. Varsha Bioscience and Technology

5.1.15. Fertilizer Corporation of India

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Biofertilizer Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Biofertilizer Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India Biofertilizer Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Biofertilizer Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. India Biofertilizer Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and sustainable agricultural trends. We also assess regulatory impacts and market dynamics specific to the Indian biofertilizer market.

Step 2: Market Building:

We collect historical data on market size, growth rates, product segmentation (nitrogen-fixing biofertilizers, phosphate-solubilizing biofertilizers, potassium-mobilizing biofertilizers), and the distribution of sales channels (retail, online, distributors). We also analyze market share and revenue generated by leading brands, emerging trends in sustainable agriculture, and farmer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing:

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading biofertilizer manufacturers, distributors, and agricultural bodies. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, supply chain management, and farmer purchasing behavior.

Step 4: Research Output:

Our team interacts with biofertilizer manufacturers, agricultural experts, farmers, and market analysts to understand the dynamics of market segments, evolving agricultural practices, and regional trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How large is the India Biofertilizer Market?

In 2023, the India Biofertilizer Market was valued at approximately USD 115 Million. The market's growth is driven by the increasing demand for organic farming, rising awareness of sustainable agricultural practices, and government initiatives supporting biofertilizer use.

02. What are the challenges in the India Biofertilizer Market?

Challenges in the India Biofertilizer Market include the lack of awareness among small-scale farmers about the long-term benefits of biofertilizers, limited shelf life of biofertilizer products, and slow adoption rates in regions where chemical fertilizers are traditionally dominant.

03. Who are the major players in the India Biofertilizer Market?

Major players in the India Biofertilizer Market include National Fertilizers Limited, Gujarat State Fertilizers & Chemicals Limited, Rashtriya Chemicals & Fertilizers, Madras Fertilizers Limited, and Kan Biosys. These companies lead the market with their extensive product portfolios and strong distribution networks.

04. What are the growth drivers of the India Biofertilizer Market?

Key growth drivers include the rising adoption of organic farming, government initiatives promoting sustainable agriculture, and increasing awareness of the benefits of biofertilizers in improving soil health and crop yields.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.