India Biofertilizers Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3268

December 2024

96

About the Report

India Biofertilizers Market Overview

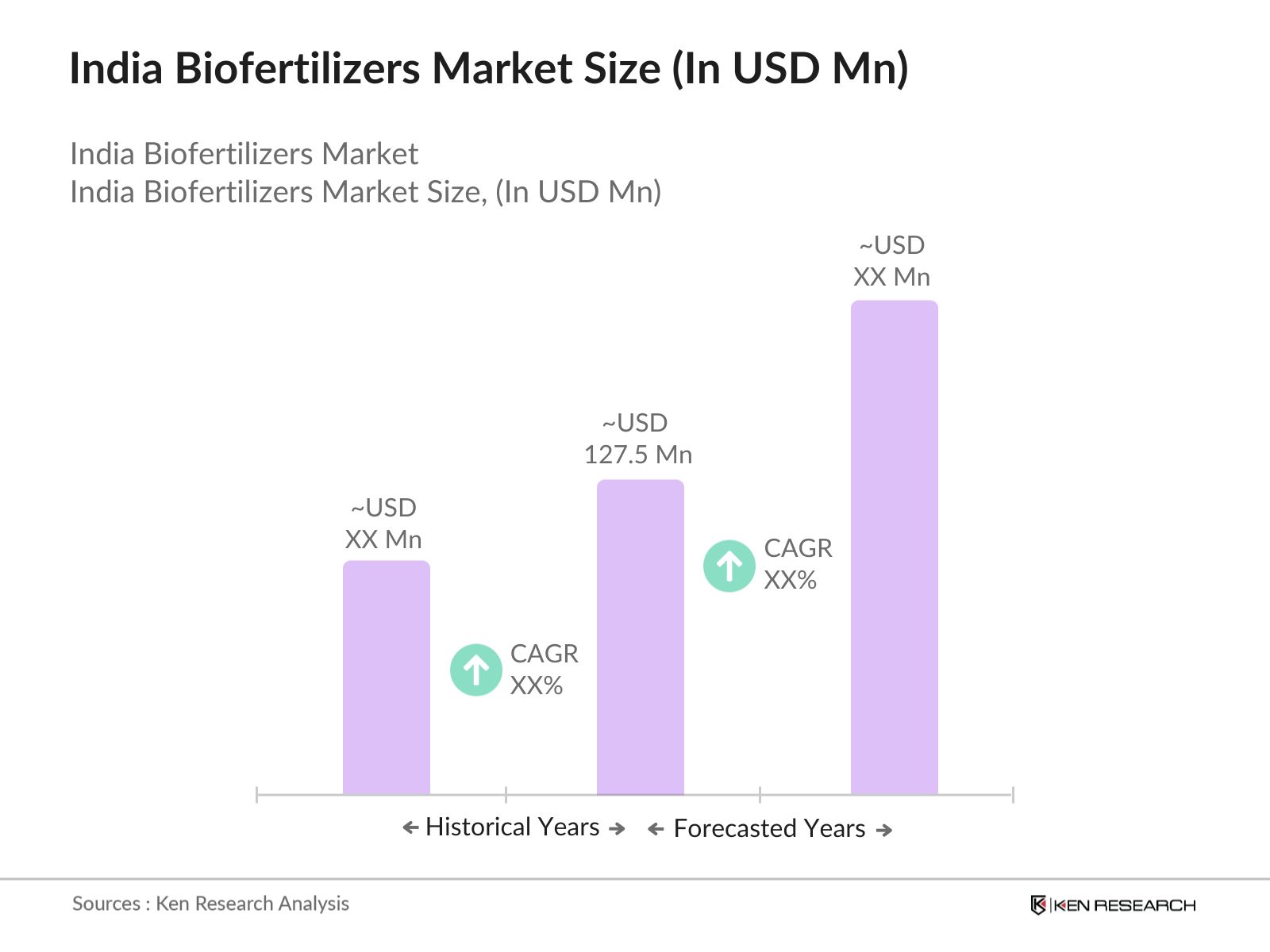

- The India biofertilizers market is valued at USD 127.5 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for organic agricultural produce, rising awareness about the environmental impact of chemical fertilizers, and government initiatives promoting sustainable farming practices. Biofertilizers are increasingly being adopted as an eco-friendly alternative to conventional fertilizers due to their ability to improve soil fertility and crop productivity without adverse environmental effects.

- North India dominates the biofertilizers market due to its extensive agricultural activities, including the cultivation of high-demand crops such as wheat and rice. Favorable climatic conditions, combined with government-led programs promoting organic farming practices, further strengthen the region's position as a market leader. Additionally, South India is emerging as a key contributor, owing to significant adoption of biofertilizers in horticulture and plantation crops such as spices and coffee.

- The National Mission for Sustainable Agriculture (NMSA) is a key initiative by the Government of India aimed at promoting sustainable agricultural practices. Under NMSA, programs like the Paramparagat Krishi Vikas Yojana (PKVY) encourage organic farming by providing financial assistance to farmers adopting organic practices, thereby promoting the use of biofertilizers.

India Biofertilizers Market Segmentation

The India biofertilizers market is segmented by fertilizers type and by application.

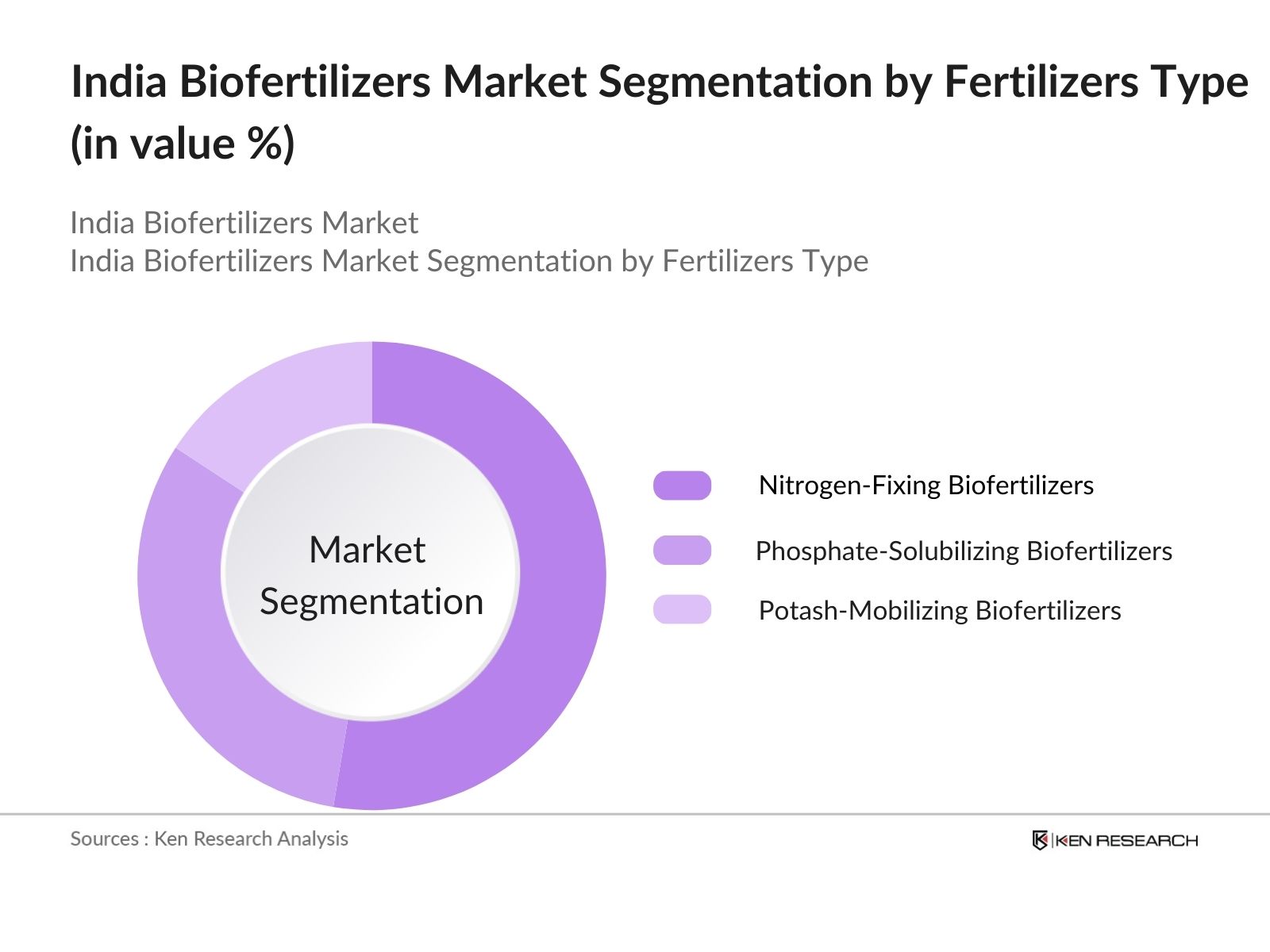

- By Fertilizers Type: The India biofertilizers market is segmented by fertilizers type into nitrogen-fixing biofertilizers, phosphate-solubilizing biofertilizers, potash-mobilizing biofertilizers, and others. Nitrogen-fixing biofertilizers hold a dominant market share due to their critical role in enhancing nitrogen availability to crops. These biofertilizers promote plant growth by converting atmospheric nitrogen into a form that plants can readily absorb, thereby reducing the reliance on synthetic nitrogen-based fertilizers. Farmers prefer nitrogen-fixing biofertilizers due to their proven effectiveness in improving yields and reducing cultivation costs.

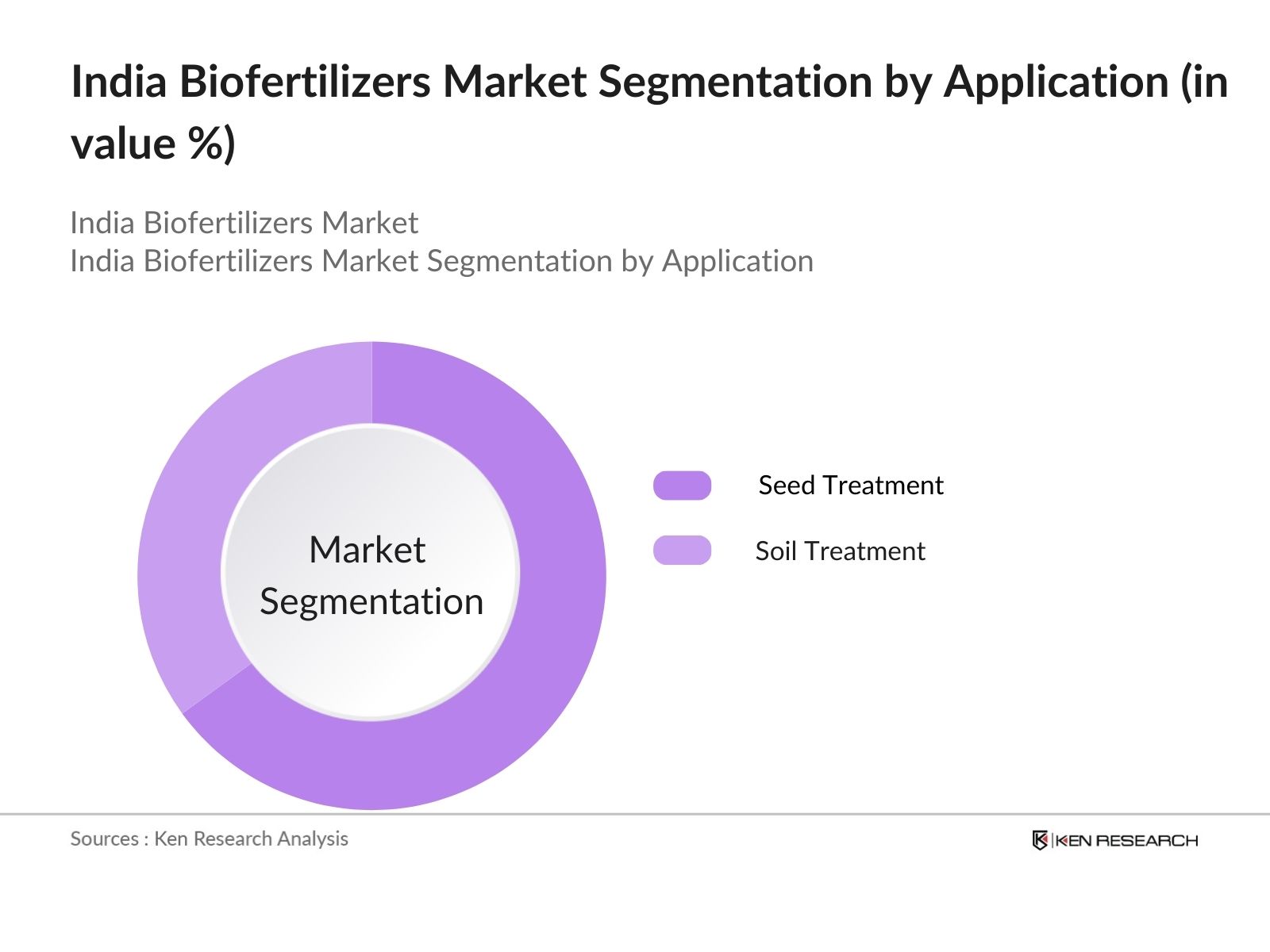

- By Application: The market is also segmented by application into seed treatment, soil treatment, and others. Seed treatment applications dominate the market, as biofertilizers applied directly to seeds help establish beneficial microbial colonies early in the plant's lifecycle. This enhances seed germination rates and contributes to healthier crop growth. The cost-effectiveness of seed treatment, coupled with its role in improving the nutrient uptake efficiency of plants, makes it a preferred method among small and large-scale farmers.

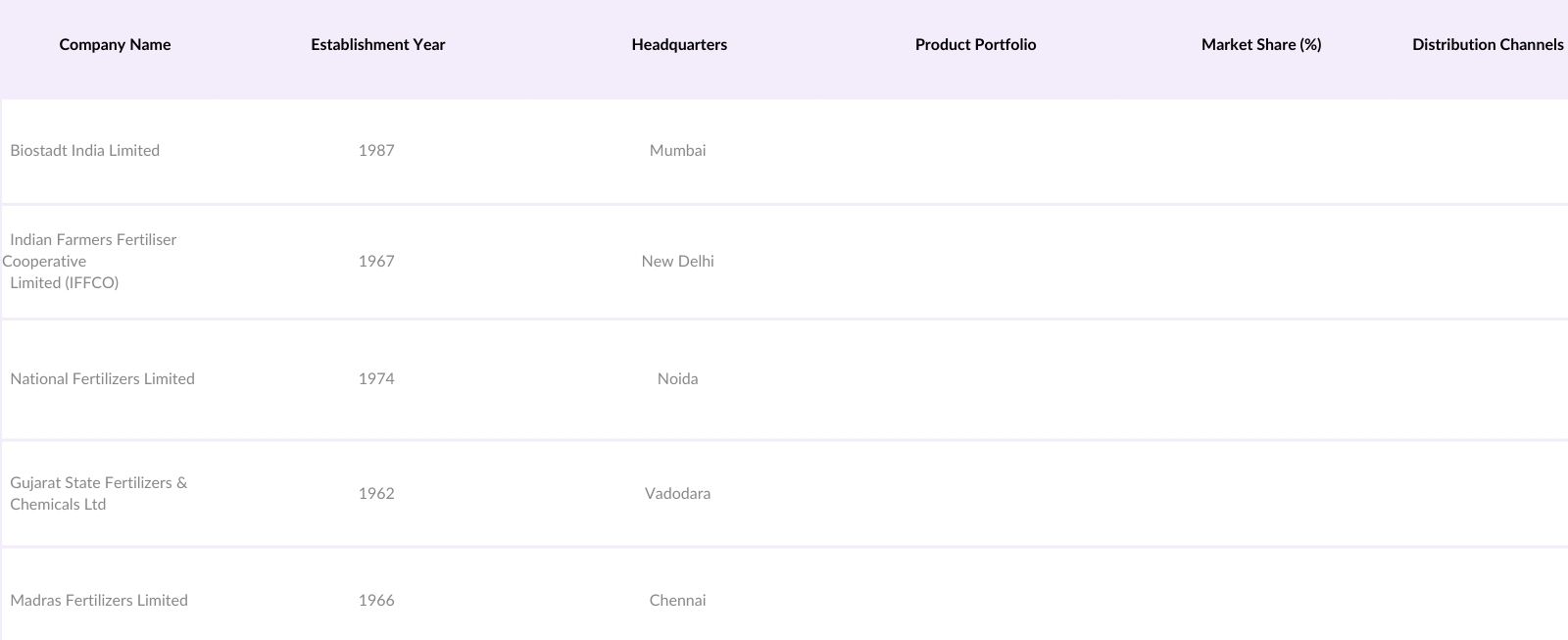

India Biofertilizers Competitive Landscape

The India biofertilizers market is characterized by the presence of several established players who focus on research and development, product innovation, and strategic partnerships to maintain their market positions. These players invest heavily in expanding their product portfolios and enhancing distribution networks to meet the growing demand for biofertilizers. The market is dominated by these key players, who leverage economies of scale and strong research capabilities to stay competitive. Their focus on developing innovative biofertilizer formulations tailored for specific crop needs has contributed significantly to their market dominance.

India Biofertilizers Industry Analysis

Growth Drivers

- Increasing Demand for Organic Food Products: India's organic food market has been expanding significantly, with the domestic organic food and beverage industry valued at USD 108 million in 2022. This growth is driven by rising consumer awareness of health and environmental benefits associated with organic produce. The increasing demand for organic products has led to a surge in organic farming practices, thereby boosting the adoption of biofertilizers as a sustainable alternative to chemical fertilizers.

- Government Initiatives Promoting Sustainable Agriculture: The Indian government has implemented several initiatives to promote sustainable agriculture. The National Mission for Sustainable Agriculture (NMSA) focuses on enhancing agricultural productivity through sustainable practices, including the use of biofertilizers. Additionally, the Paramparagat Krishi Vikas Yojana (PKVY) scheme supports organic farming by providing financial assistance to farmers adopting organic practices, thereby encouraging the use of biofertilizers.

- Rising Awareness of Soil Health and Environmental Concerns: Farmers in India are becoming increasingly aware of the adverse effects of chemical fertilizers on soil health and the environment. The overuse of chemical fertilizers has led to soil degradation and pollution. This growing awareness has prompted a shift towards biofertilizers, which enhance soil fertility and structure without harmful environmental impacts. The Indian Council of Agricultural Research (ICAR) has been actively promoting the benefits of biofertilizers through various programs and workshops

Market Challenges

- Limited Awareness Among Farmers: Despite the benefits of biofertilizers, many Indian farmers remain unaware or skeptical of their efficacy. A lack of knowledge about application methods and benefits hinders widespread adoption. The Ministry of Agriculture and Farmers Welfare has recognized this challenge and is working on educational programs to increase awareness among farmers.

- High Production Costs: The production of biofertilizers involves complex processes and stringent quality control measures, leading to higher costs compared to chemical fertilizers. These costs can be a barrier for both manufacturers and farmers, especially small-scale farmers with limited financial resources. Efforts are being made to develop cost-effective production methods to make biofertilizers more accessible.

India Biofertilizers Market Future Outlook

Over the next five years, the India biofertilizers market is poised for substantial growth, driven by increasing consumer preference for organic agricultural produce, advancements in biofertilizer production technology, and continuous government support for sustainable farming practices. Efforts to minimize the environmental footprint of agriculture and reduce the dependency on chemical fertilizers will further fuel the market expansion. Additionally, the emergence of liquid biofertilizers and multi-functional formulations will open new avenues for growth.

Market Opportunities

- Expansion into Untapped Markets: There is significant potential for biofertilizer adoption in regions of India where chemical fertilizers are predominantly used. States with large agricultural areas but low biofertilizer usage present opportunities for market expansion. Targeted awareness campaigns and demonstrations of biofertilizer benefits can facilitate entry into these untapped markets.

- Development of Multi-Functional Biofertilizers: Research is underway to develop biofertilizers that offer multiple benefits, such as nitrogen fixation, phosphate solubilization, and pest resistance. These multi-functional products can provide comprehensive solutions to farmers, reducing the need for multiple inputs and enhancing crop yields. Institutions like ICAR are leading efforts in this area, aiming to create more versatile and effective biofertilizer formulations.

Scope of the Report

|

Nitrogen-Fixing Biofertilizers Phosphate-Solubilizing Biofertilizers Potash-Mobilizing Biofertilizers |

|

|

By Microorganism |

Rhizobium Azotobacter Azospirillum Phosphate-Solubilizing Bacteria VAM |

|

By Application |

Seed Treatment |

|

By Crop Type |

Cereals Pulses & Oilseeds Fruits & Vegetables |

|

By Region |

North East West South |

Products

Key Target Audience

Agricultural Input Manufacturers

Organic Farming Associations

Government and Regulatory Bodies (e.g., Ministry of Agriculture & Farmers Welfare)

Agricultural Research Institutes

Farmers and Farming Cooperatives

Agrochemical Distributors

Environmental NGOs

Investment and Venture Capitalist Firms

Companies

Players Mention in the Report:

Biostadt India Limited

Indian Farmers Fertiliser Cooperative Limited (IFFCO)

National Fertilizers Limited

Gujarat State Fertilizers & Chemicals Ltd

Madras Fertilizers Limited

Fertilizers and Chemicals Travancore Limited

IPL Biologicals Limited

T. Stanes & Company Limited

Rashtriya Chemicals & Fertilizers Ltd

Nagarjuna Fertilizers and Chemicals Limited

Krishak Bharati Cooperative Limited

Zuari Agro Chemicals Ltd

Coromandel International Limited

Chambal Fertilisers and Chemicals Limited

Paradeep Phosphates Limited

Table of Contents

1. India Biofertilizers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Biofertilizers Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Biofertilizers Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Organic Food Products

3.1.2. Government Initiatives Promoting Sustainable Agriculture

3.1.3. Rising Awareness of Soil Health and Environmental Concerns

3.1.4. Technological Advancements in Biofertilizer Production

3.2. Market Challenges

3.2.1. Limited Awareness Among Farmers

3.2.2. High Production Costs

3.2.3. Regulatory Hurdles

3.3. Opportunities

3.3.1. Expansion into Untapped Markets

3.3.2. Development of Multi-Functional Biofertilizers

3.3.3. Strategic Collaborations and Partnerships

3.4. Trends

3.4.1. Integration of Biofertilizers with Biopesticides

3.4.2. Adoption of Liquid Biofertilizers

3.4.3. Customized Biofertilizer Solutions for Specific Crops

3.5. Government Regulations

3.5.1. National Mission for Sustainable Agriculture (NMSA)

3.5.2. Fertilizer Control Order (FCO) Guidelines

3.5.3. Subsidies and Incentives for Biofertilizer Adoption

3.5.4. Certification and Quality Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Biofertilizers Market Segmentation

4.1. By Type (In Value %)

4.1.1. Nitrogen-Fixing Biofertilizers

4.1.2. Phosphate-Solubilizing Biofertilizers

4.1.3. Potash-Mobilizing Biofertilizers

4.1.4. Others

4.2. By Microorganism (In Value %)

4.2.1. Rhizobium

4.2.2. Azotobacter

4.2.3. Azospirillum

4.2.4. Phosphate-Solubilizing Bacteria

4.2.5. Vesicular-Arbuscular Mycorrhiza (VAM)

4.2.6. Others

4.3. By Application (In Value %)

4.3.1. Seed Treatment

4.3.2. Soil Treatment

4.3.3. Others

4.4. By Crop Type (In Value %)

4.4.1. Cereals

4.4.2. Pulses & Oilseeds

4.4.3. Fruits & Vegetables

4.4.4. Others

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. West & Central India

4.5.3. South India

4.5.4. East India

5. India Biofertilizers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Biostadt India Limited

5.1.2. Fertilizers and Chemicals Travancore Limited

5.1.3. Gujarat State Fertilizers & Chemicals Ltd

5.1.4. Indian Farmers Fertiliser Cooperative Limited

5.1.5. National Fertilizers Limited

5.1.6. IPL Biologicals Limited

5.1.7. Madras Fertilizers Limited

5.1.8. T. Stanes & Company Limited

5.1.9. Rashtriya Chemicals & Fertilizers Ltd

5.1.10. Nagarjuna Fertilizers and Chemicals Limited

5.1.11. Krishak Bharati Cooperative Limited

5.1.12. Zuari Agro Chemicals Ltd

5.1.13. Coromandel International Limited

5.1.14. Chambal Fertilisers and Chemicals Limited

5.1.15. Paradeep Phosphates Limited

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. India Biofertilizers Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. India Biofertilizers Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Biofertilizers Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Microorganism (In Value %)

8.3. By Application (In Value %)

8.4. By Crop Type (In Value %)

8.5. By Region (In Value %)

9. India Biofertilizers Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Distribution Initiatives

9.4. White Space Opportunity Analysis

9.5. Key Strategic Imperatives for Market Players

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Biofertilizers Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data related to the India Biofertilizers Market. It includes assessing market penetration, the ratio of market players to service providers, and resultant revenue generation. Additionally, service quality metrics are evaluated to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry experts. These consultations provide valuable insights into operational and financial data, refining and corroborating market information.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with biofertilizer manufacturers is conducted to gather detailed insights on product segments, consumer preferences, and market trends. This interaction ensures the reliability and comprehensiveness of the analysis.

Frequently Asked Questions

01. How big is the India Biofertilizers Market?

The India biofertilizers market is valued at USD 127.5 million. This growth is driven by increased adoption of organic farming practices and government support for sustainable agriculture.

02. What are the challenges in the India Biofertilizers Market?

Challenges include limited farmer awareness about biofertilizers, high production costs, and regulatory hurdles. Additionally, the lack of infrastructure for large-scale distribution affects market penetration.

03. Who are the major players in the India Biofertilizers Market?

Key players include Biostadt India Limited, IFFCO, National Fertilizers Limited, Gujarat State Fertilizers & Chemicals Ltd, and Madras Fertilizers Limited. Their dominance is attributed to extensive distribution networks and innovative product offerings.

04. What are the growth drivers of the India Biofertilizers Market?

The market is propelled by the increasing demand for organic produce, technological advancements in biofertilizer formulations, and growing awareness of soil health. Government subsidies also play a significant role.

05. What trends are shaping the India Biofertilizers Market?

Emerging trends include the adoption of liquid biofertilizers, integration of biofertilizers with biopesticides, and the development of crop-specific formulations to cater to diverse agricultural needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.