India Biofuel Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4882

December 2024

80

About the Report

India Biofuel Market Overview

- The India Biofuel Market is valued at USD 2.56 billion based on a five-year historical analysis. The market is driven by the increasing demand for alternative energy sources due to rising environmental concerns and government policies like the National Biofuel Policy. The use of biofuels, particularly bioethanol and biodiesel, is seeing growth, fueled by initiatives to reduce dependence on fossil fuels and promote cleaner energy. The rapid growth in industrial applications and advancements in biofuel production technology are other key drivers.

- Cities like Mumbai, Delhi, and Bangalore dominate the biofuel market due to their high energy consumption, dense population, and better infrastructure for biofuel distribution. Additionally, these cities are central to the logistics and manufacturing sectors, which heavily rely on industrial heating and transportation, creating high demand for biofuels. State-level policies supporting biofuel adoption, particularly in Maharashtra and Karnataka, also contribute to their dominance.

- The National Biofuel Policy 2018 is a cornerstone in Indias renewable energy framework. It aims to increase ethanol production from 4.2 billion liters in 2022 to 10 billion liters by 2025. The policy focuses on the use of non-food feedstocks, such as lignocellulosic biomass, and waste-to-energy technologies. The policy also provides financial incentives for setting up bio-refineries and aims to reduce the country's oil import bill by $6 billion annually by 2025, supporting the broader goal of energy security.

India Biofuel Market Segmentation

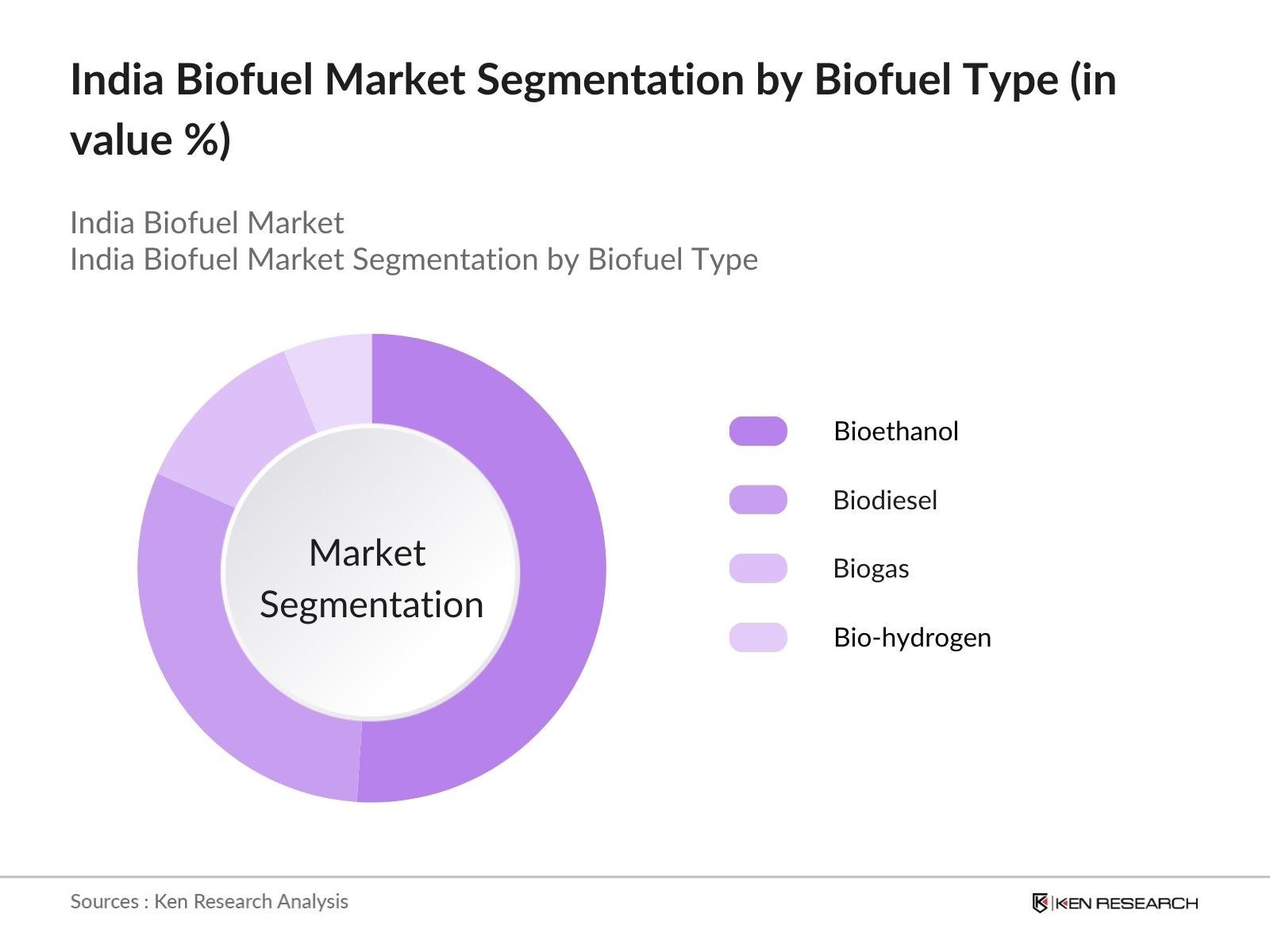

- By Biofuel Type: The India Biofuel Market is segmented by biofuel type into bioethanol, biodiesel, biogas, and bio-hydrogen. Currently, bioethanol holds a dominant market share in this segment due to its extensive use in the transportation industry, driven by the Ethanol Blending Program. The program mandates a substantial blend of ethanol with gasoline, boosting demand for bioethanol. Additionally, bioethanol's lower carbon emissions and cost-effectiveness in comparison to fossil fuels make it a favourable choice, particularly for automotive and aviation fuel.

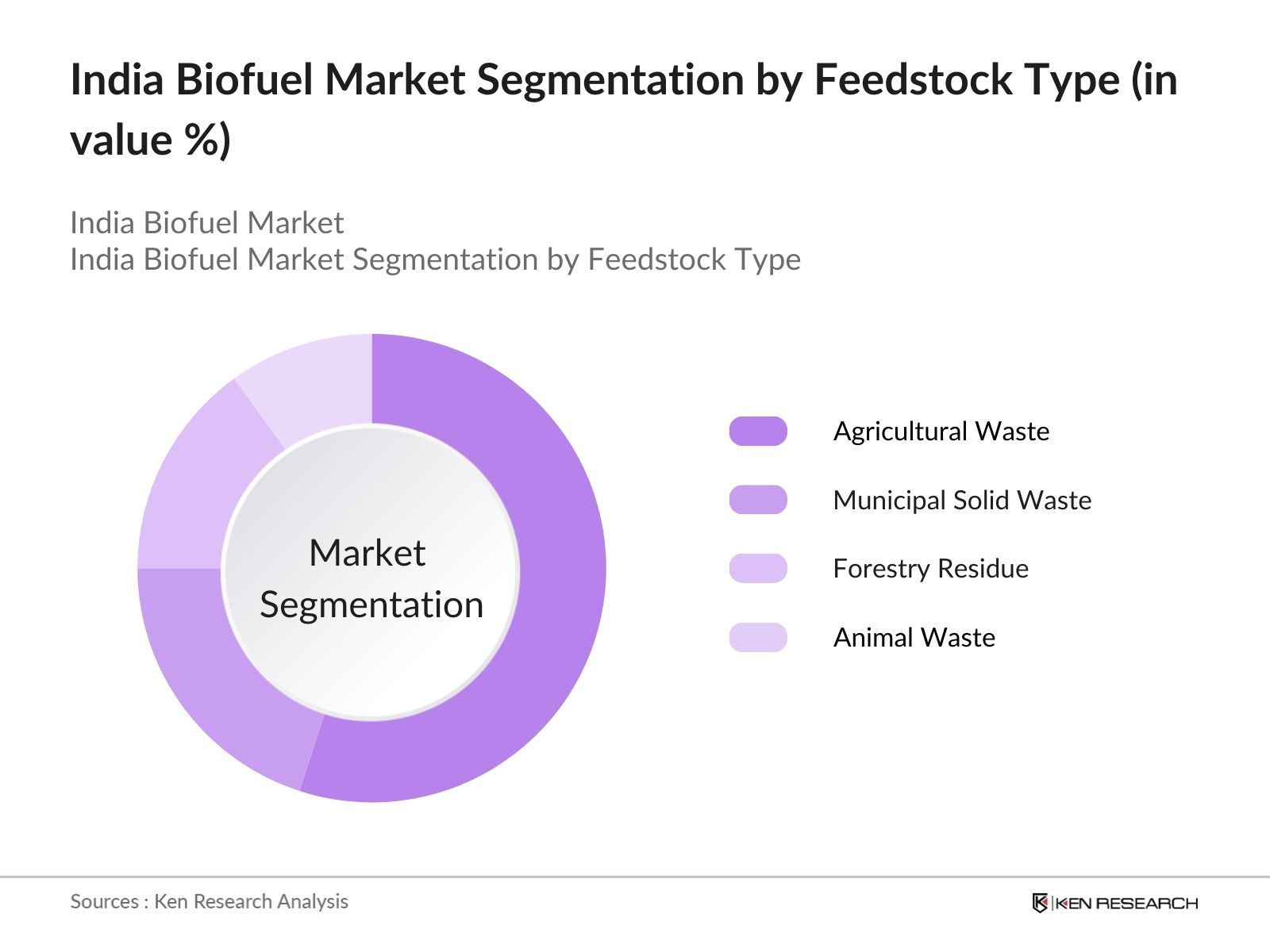

- By Feedstock Type: The India Biofuel Market is further segmented by feedstock type into agricultural waste, municipal solid waste, forestry residue, and animal waste. Agricultural waste dominates this segment, accounting for the largest market share. This is primarily because India has a large agrarian economy, producing an abundance of feedstock like sugarcane bagasse, rice husk, and corn starch, which are readily available and cost-effective for biofuel production. This feedstock provides a sustainable and renewable source for biofuel production, further promoted by government incentives for farmers and producers.

India Biofuel Market Competitive Landscape

The India biofuel market is dominated by several key players, both local and international, who contribute to the development and growth of the industry. These companies focus on increasing production capacity, technological innovation, and strategic partnerships. The competition is fierce, with leading companies like Indian Oil Corporation and Bharat Petroleum leading the market through investments in biofuel infrastructure and blending facilities.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Production Capacity |

Technology Adoption |

Feedstock Source |

Partnerships |

Sustainability Initiatives |

Regional Presence |

|

Indian Oil Corporation |

1959 |

New Delhi, India |

- |

- |

- |

- |

- |

- |

- |

|

Bharat Petroleum Corporation |

1952 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

Reliance Industries Ltd. |

1966 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

Praj Industries |

1983 |

Pune, India |

- |

- |

- |

- |

- |

- |

- |

|

My Eco Energy |

2010 |

Pune, India |

- |

- |

- |

- |

- |

- |

- |

India Biofuel Market Analysis

India Biofuel Market Growth Drivers

- Increasing Energy Demand: Indias biofuel market is being propelled by the countrys escalating energy consumption, driven by its growing population, industrialization, and urbanization. In 2024, Indias energy consumption is projected to surpass 1,300 million tons of oil equivalent (Mtoe), placing it among the top three energy consumers globally. The reliance on fossil fuels to meet this demand, which constitutes over 85% of the energy mix, makes the transition to biofuels a critical alternative to reduce import dependency and enhance energy security. This shift aligns with Indias efforts to diversify its energy portfolio, reducing its oil import bill, which exceeded $120 billion in 2022.

- Rising Environmental Concerns: India is facing severe environmental challenges, with carbon emissions reaching over 2.88 billion metric tons in 2022, making it the worlds third-largest emitter. The transportation sector contributes about 14% of these emissions. To combat this, Indias biofuel policy prioritizes the adoption of sustainable fuel alternatives, such as ethanol and biodiesel. By 2023, the country had already reduced CO2 emissions by 2.7 million tons through its Ethanol Blending Program (EBP). This underscores the growing role of biofuels in reducing Indias carbon footprint, in line with global climate goals.

- Government Subsidies and Mandates: The Indian governments strong policy framework supports biofuel development. The Ethanol Blending Program (EBP) mandates a 10% ethanol blend in petrol, with plans to achieve 20% blending by 2025. Additionally, the National Biofuel Policy (2018) promotes the production of biofuels from non-food feedstocks like agricultural residues and municipal waste. In 2022, India produced over 4.2 billion liters of ethanol, driven by fiscal incentives like tax rebates and viability gap funding. These policies are part of broader efforts to reduce crude oil imports, which account for 85% of Indias energy needs.

India Biofuel Market Challenges

- High Production Costs: Indias biofuel industry faces high production costs due to feedstock availability issues and expensive infrastructure requirements. As of 2023, the average cost of producing biofuels from first-generation feedstocks, such as sugarcane and corn, is 20%-30% higher than conventional fossil fuels, resulting in limited scalability. The availability of feedstock is also constrained by agricultural priorities and land-use limitations. For instance, sugarcane used for ethanol competes with food production, creating a supply bottleneck for biofuel production.

- Technological Barriers: Indias biofuel production faces technological barriers, particularly in improving conversion efficiency. While first-generation biofuels like ethanol have reached commercial viability, second-generation biofuels, such as cellulosic ethanol and algae-based fuels, remain in the research and pilot stages due to inefficiencies in converting lignocellulosic biomass. Current technology allows only 50-60 liters of ethanol per ton of biomass, far below the commercial scale required. As of 2023, only a few pilot plants were operational, limiting the impact of advanced biofuels on the energy mix.

India Biofuel Market Future Outlook

Over the next five years, the India biofuel market is expected to witness robust growth due to a combination of government mandates, technological advancements, and a growing awareness of environmental sustainability. The governments continued push for the Ethanol Blending Program and National Biofuel Policy is expected to drive market growth. Furthermore, investments in second-generation biofuels and innovations in production technology will impact the biofuel sector's expansion.

India Biofuel Market Opportunities

- Advancements in Second-Generation Biofuels: India is increasingly focusing on the development of second-generation biofuels, such as cellulosic ethanol, produced from agricultural waste and non-food crops. In 2023, India launched its first commercial-scale second-generation ethanol plant in Haryana with a production capacity of 100 kiloliters per day. This plant converts 200,000 tons of rice straw annually into biofuel, addressing both the biofuel demand and the problem of crop residue burning, which contributes to air pollution in North India. Continued investment in similar technologies is expected to reduce feedstock dependency and enhance production efficiency.

- Expansion in Rural and Semi-Urban Areas: Rural India, home to over 800 million people, presents growth opportunities for biofuel production, especially from locally available feedstocks like agricultural residues. With 65% of Indias population residing in rural areas, the government is promoting decentralized biofuel production units to increase local energy security and reduce transportation costs. The Ministry of New and Renewable Energy (MNRE) has identified over 150 districts as potential biofuel hubs, supported by initiatives like the Gobardhan scheme, which converts animal waste into biofuels.

Scope of the Report

|

By Biofuel Type |

Bioethanol Biodiesel Biogas Bio-Hydrogen |

|

By Feedstock Type |

Agricultural Waste Municipal Solid Waste Forestry Residue Animal Waste |

|

By Application |

Transportation Industrial Heating Power Generation Household Cooking |

|

By Technology |

First-Generation Second-Generation Third-Generation Fourth-Generation |

|

By Region |

North India South India East India West India |

Products

Key Target Audience

Biofuel Production Companies

Energy and Utility Firms

Automotive and Aviation Fuel Suppliers

Agricultural Waste Producers

Government and Regulatory Bodies (Ministry of New and Renewable Energy, Ministry of Petroleum and Natural Gas)

Environmental Protection Agencies

Banks and Financial Institutions

Investor and Venture Capitalist Firms

Municipal Solid Waste Management Authorities

Companies

India Biofuel Market Major Players

Indian Oil Corporation

Bharat Petroleum Corporation Ltd. (BPCL)

Reliance Industries Ltd.

Praj Industries

My Eco Energy

Shell India Markets Pvt. Ltd.

Aemetis Inc.

Novozymes South Asia Pvt. Ltd.

Regen Powertech Pvt. Ltd.

GEVO, Inc.

Indian Sugar Mills Association (ISMA)

Abellon CleanEnergy

LanzaTech

Green Plains Inc.

Clariant AG

Table of Contents

1. India Biofuel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Biofuel Market Size (In USD Billion)

2.1. Historical Market Size (Bioethanol, Biodiesel, Biogas)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Government Initiatives, Private Investments, Policy Changes)

3. India Biofuel Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Energy Demand

3.1.2. Rising Environmental Concerns

3.1.3. Government Subsidies and Mandates (Ethanol Blending Program, National Biofuel Policy)

3.2. Market Challenges

3.2.1. High Production Costs (Feedstock Availability, Infrastructure Costs)

3.2.2. Technological Barriers (Conversion Efficiency, Innovation Gaps)

3.2.3. Competition from Fossil Fuels

3.3. Opportunities

3.3.1. Advancements in Second-Generation Biofuels (Cellulosic Ethanol, Algae Biofuel)

3.3.2. Expansion in Rural and Semi-Urban Areas

3.3.3. International Collaborations (Import-Export Opportunities)

3.4. Trends

3.4.1. Transition to Sustainable Aviation Fuel (SAF)

3.4.2. Growth in Electric Vehicle Integration (Impact on Biofuel Demand)

3.4.3. Decentralized Biofuel Production Units

3.5. Government Regulation

3.5.1. National Biofuel Policy 2018

3.5.2. Ethanol Blending Program (EBP) Targets

3.5.3. Renewable Energy Tariffs and Subsidies

3.5.4. State-Level Policies on Biofuel Adoption

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Government Bodies, Private Players, Feedstock Suppliers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Threat of Substitutes, Competitive Rivalry)

3.9. Competition Ecosystem (Local and Global Competitors)

4. India Biofuel Market Segmentation

4.1. By Biofuel Type (In Value %)

4.1.1. Bioethanol

4.1.2. Biodiesel

4.1.3. Biogas

4.1.4. Bio-Hydrogen

4.2. By Feedstock Type (In Value %)

4.2.1. Agricultural Waste (Sugarcane Bagasse, Rice Husk, Corn Starch)

4.2.2. Municipal Solid Waste

4.2.3. Forestry Residue

4.2.4. Animal Waste (Manure, Sewage Sludge)

4.3. By Application (In Value %)

4.3.1. Transportation (Automotive, Aviation)

4.3.2. Industrial Heating

4.3.3. Power Generation

4.3.4. Household Cooking (Biogas Utilization)

4.4. By Technology (In Value %)

4.4.1. First-Generation Biofuels (Conventional Biofuels)

4.4.2. Second-Generation Biofuels (Lignocellulosic Biofuels)

4.4.3. Third-Generation Biofuels (Algae-Based)

4.4.4. Fourth-Generation Biofuels (Synthetic Fuels)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Biofuel Market Competitive Analysis

5.1 Detailed Profiles of Major Companies (Market Position, Strategies)

5.1.1. Indian Oil Corporation

5.1.2. Bharat Petroleum Corporation Ltd. (BPCL)

5.1.3. Reliance Industries Ltd.

5.1.4. Praj Industries

5.1.5. Shell India Markets Pvt. Ltd.

5.1.6. Aemetis Inc.

5.1.7. Abellon CleanEnergy

5.1.8. Novozymes South Asia Pvt. Ltd.

5.1.9. GEVO, Inc.

5.1.10. Indian Sugar Mills Association (ISMA)

5.1.11. My Eco Energy

5.1.12. Regen Powertech Pvt. Ltd.

5.1.13. LanzaTech

5.1.14. Green Plains Inc.

5.1.15. Clariant AG

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Feedstock Source, Technology Adoption, Regional Presence, Market Share, Sustainability Initiatives, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Collaborations, R&D Investments)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, Venture Capital Funding)

5.7. Government Grants and Subsidies for Biofuel Projects

6. India Biofuel Market Regulatory Framework

6.1. Compliance with National Biofuel Policy

6.2. Certification Processes (Biofuel Sustainability Standards)

6.3. Incentives for Biofuel Adoption (Tax Benefits, Grants)

6.4. Trade Policies and Import/Export Regulations

7. India Biofuel Future Market Size (In USD Billion)

7.1. Future Market Size Projections (Bioethanol, Biodiesel, Biogas)

7.2. Key Factors Driving Future Market Growth

8. India Biofuel Future Market Segmentation

8.1. By Biofuel Type (In Value %)

8.2. By Feedstock Type (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. India Biofuel Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives for Biofuel Adoption

9.4. White Space Opportunity Analysis (Emerging Regions, Untapped Feedstock)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved mapping key stakeholders in the India biofuel market, from biofuel producers to government regulators. Desk research and proprietary databases were used to gather crucial market data, including production trends, demand drivers, and regulations.

Step 2: Market Analysis and Construction

This phase focused on analyzing historical market data, including market penetration, production volumes, and revenue generation across different biofuel types and feedstock. The research also examined government incentives and regulatory impacts on market growth.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through computer-assisted telephone interviews (CATIs) to validate initial hypotheses on market trends, technological advancements, and production capacities. Their insights helped refine market estimates.

Step 4: Research Synthesis and Final Output

Direct engagement with biofuel producers provided detailed insights into segment performance and consumer demand. The final report synthesizes the collected data, ensuring a validated and accurate analysis of the market.

Frequently Asked Questions

01. How big is the India Biofuel Market?

The India biofuel market is valued at USD 2.56 billion, driven by rising demand for cleaner energy solutions and government initiatives like the Ethanol Blending Program.

02. What are the key challenges in the India Biofuel Market?

Challenges in the India biofuel market include high production costs, technological barriers, and competition from cheaper fossil fuels, which affect the overall adoption of biofuels.

03. Who are the major players in the India Biofuel Market?

Key players in the India biofuel market include Indian Oil Corporation, Bharat Petroleum Corporation Ltd., Reliance Industries Ltd., Praj Industries, and My Eco Energy, who dominate due to their large production capacities and strategic partnerships.

04. What drives growth in the India Biofuel Market?

The India biofuel market is driven by increasing energy demand, government subsidies, and technological advancements in biofuel production. The Ethanol Blending Program and National Biofuel Policy are crucial growth drivers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.