India Biopharmaceutical Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD3553

November 2024

99

About the Report

India Biopharmaceutical Market Overview

- The India Biopharmaceutical market is valued at USD 53 billion, driven by a combination of increasing healthcare needs, rising R&D investments, and strong government initiatives aimed at bolstering the biotechnology sector. The market growth is primarily fueled by the rising prevalence of chronic diseases, increasing investments in biologics, and the countrys growing capacity for research and innovation in the pharmaceutical and biotechnology sectors. The market is characterized by substantial investments in biosimilars and biologics, particularly in oncology, autoimmune diseases, and vaccines. This robust infrastructure positions India as a key player in the global biopharma landscape.

- The biopharmaceutical market is dominated by cities like Hyderabad and Bangalore, known for their advanced biotechnology hubs and the presence of numerous pharmaceutical giants. Hyderabad, home to Genome Valley, a biotechnology cluster, and Bangalore, with its burgeoning startup ecosystem in life sciences and healthcare technology, have attracted investments from both domestic and international companies. These cities benefit from government support, a strong workforce of skilled scientists, and proximity to top research institutions, making them critical to the market's expansion.

- India's National Pharmaceutical Pricing Authority (NPPA) regulates the pricing of essential biopharmaceuticals, ensuring affordability. In 2023, the NPPA capped the prices of 34 critical biologics, including treatments for cancer and diabetes, to make them accessible to a larger population. While this ensures patient access, it poses a challenge to manufacturers in balancing profitability and compliance with pricing controls.

India Biopharmaceutical Market Segmentation

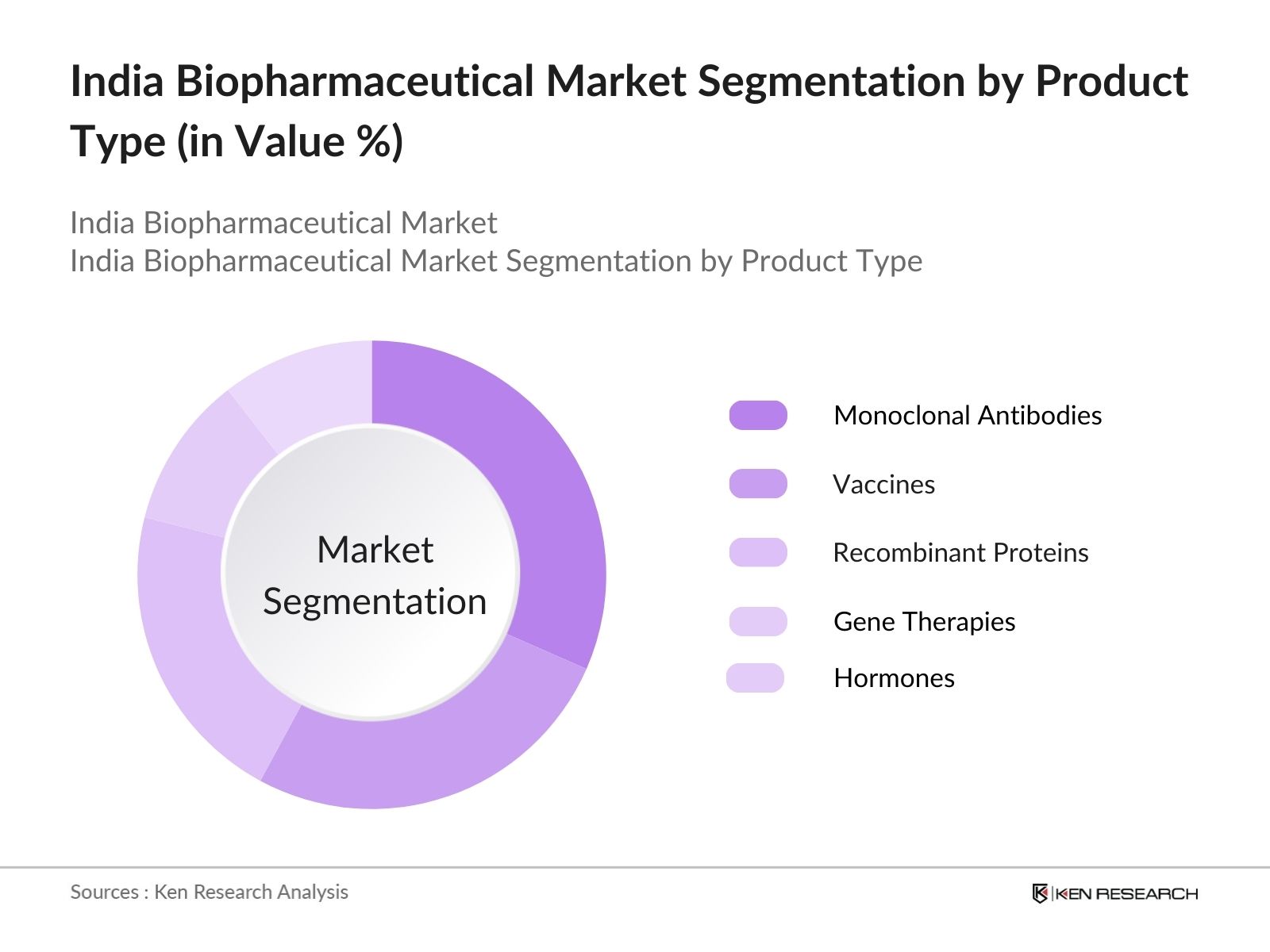

- By Product Type: The India Biopharmaceutical market is segmented by product type into monoclonal antibodies, vaccines, gene therapies, recombinant proteins, and hormones. Recently, monoclonal antibodies have held a dominant market share due to their critical role in treating cancer, autoimmune diseases, and inflammatory conditions. The widespread use of these targeted therapies is driven by advancements in precision medicine, combined with their high success rates in clinical trials and the increasing approval rates by regulatory bodies. Furthermore, the demand for biosimilars and biobetters is rising, further cementing their market leadership.

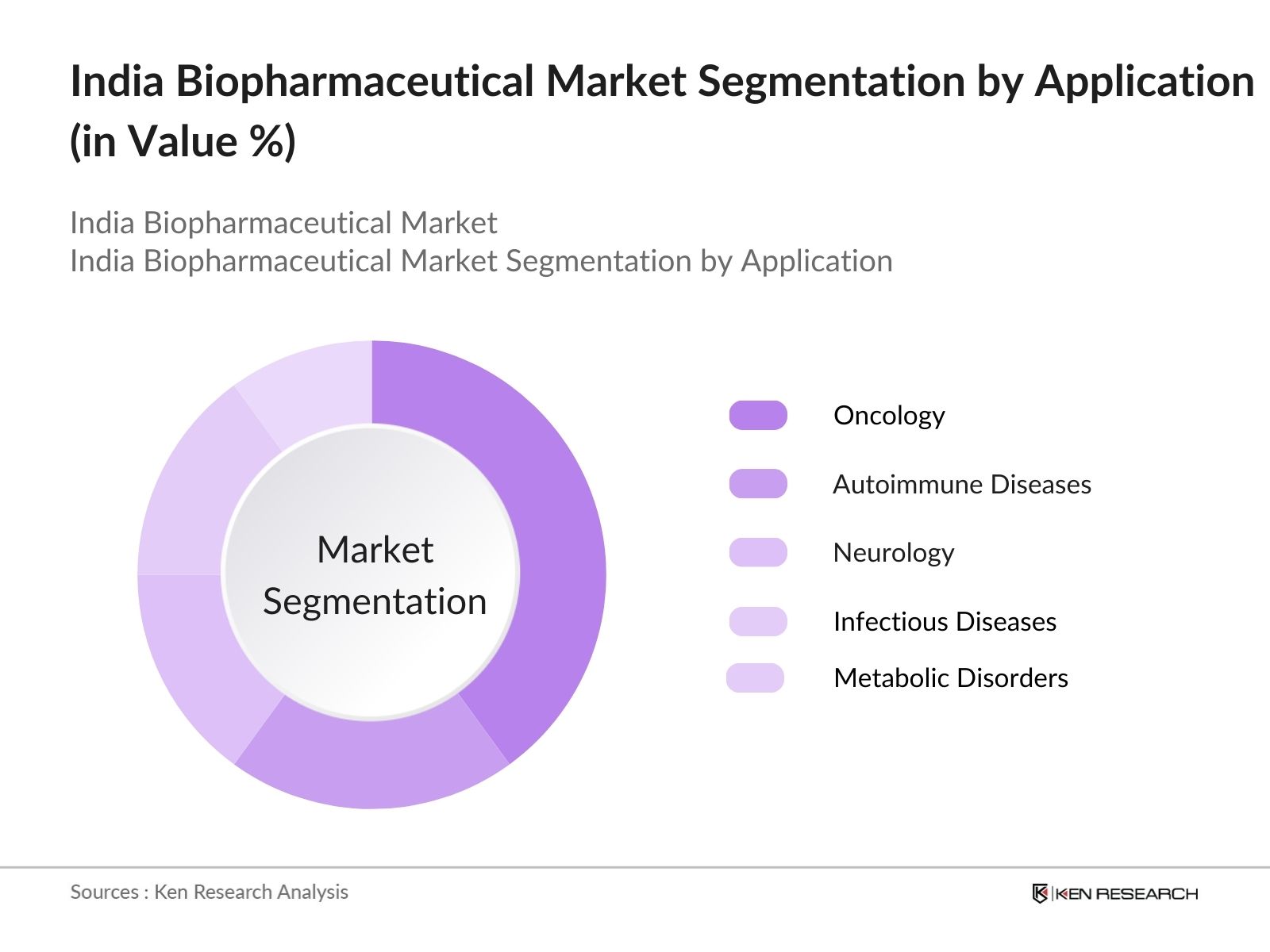

- By Application: The market is segmented by application into oncology, autoimmune diseases, neurology, infectious diseases, and metabolic disorders. Oncology dominates the application segment, primarily due to the rise in cancer incidences in India, and the need for innovative therapies. Biopharmaceutical treatments in oncology are highly effective due to their targeted approach, which reduces side effects compared to traditional chemotherapy. Major pharmaceutical companies are investing heavily in oncology research, further boosting the segment's growth and market share.

India Biopharmaceutical Market Competitive Landscape

The India biopharmaceutical market is dominated by a mix of domestic and international players, with companies focused on R&D, manufacturing, and commercialization. Several key players have established research facilities and manufacturing capacities, benefiting from government policies like the 'Make in India' initiative and investment in biotechnology clusters like Genome Valley. The competition is shaped by innovation in biosimilars, strategic partnerships, and collaborations with research institutions.

|

Company |

Year Established |

Headquarters |

No. of Employees |

R&D Investment (USD) |

Key Product Segment |

Global Presence |

Revenue from Biopharma (USD) |

|

Biocon Limited |

1978 |

Bangalore |

- |

- |

- |

- |

- |

|

Dr. Reddys Laboratories |

1984 |

Hyderabad |

- |

- |

- |

- |

- |

|

Sun Pharmaceutical |

1983 |

Mumbai |

- |

- |

- |

- |

- |

|

Serum Institute of India |

1966 |

Pune |

- |

- |

- |

- |

- |

|

Cipla Limited |

1935 |

Mumbai |

- |

- |

- |

- |

- |

India Biopharmaceutical Market Analysis

India Biopharmaceutical Market Growth Drivers

- Increasing Prevalence of Chronic Diseases: The prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer is indeed a major driver for the biopharmaceutical market. As of 2024, India has over77 million diabetics, making it the second-highest globally.Additionally, cancer cases exceeded1.39 millionin 2023, and cardiovascular diseases accounted for 28%of all deaths in the country, as reported by the World Health Organization.This growing burden necessitates advanced biopharmaceutical treatments like monoclonal antibodies and personalized medicine, which aim to improve patient outcomes.

- Rising Healthcare Expenditure: India's healthcare expenditure is on the rise, supporting its growing healthcare needs. The government's budget for healthcare was INR 2.23 trillion(around$27 billion) in 2023, reflecting a15.6%increase from previous years.This increase is aimed at enhancing healthcare infrastructure and innovation, including biopharmaceutical development. However, it's important to note that while the budget has increased, public health expenditure as a percentage of GDP remains relatively low at around2.1%for FY23.

- Growth of Personalized Medicine: The demand for personalized medicine is indeed growing due to advancements in genomics and biomarker research. In 2023, it was reported that over40%of cancer treatments in urban centers utilized targeted therapies.Initiatives like theGenome India Project, which aims to sequence the genomes of over10,000 individuals, are contributing to this growth by identifying disease-specific biomarkers that enable customized treatments.

India Biopharmaceutical Market Challenges

- High Manufacturing Costs: Biopharmaceutical manufacturing remains expensive due to the complex processes involved, including fermentation, purification, and cold-chain logistics. In India, the cost of establishing a biopharma manufacturing facility ranges from INR 500 crore to INR 1,000 crore ($60-$120 million), making it a growth barrier for new entrants. The need for specialized equipment and highly skilled personnel further escalates costs, challenging the scalability of biopharma companies, particularly for smaller firms.

- Complex Regulatory Approvals: The regulatory landscape for biopharmaceuticals in India is complex and time-consuming. On average, the approval process for a new biologic drug takes 2-4 years, with multiple rounds of clinical trials required to meet the stringent guidelines of the Central Drugs Standard Control Organization (CDSCO). In 2023, over 60 biosimilars awaited approval, reflecting the backlog and regulatory challenges. These prolonged timelines pose risks for companies seeking faster market entry and revenue generation.

India Biopharmaceutical Market Future Outlook

The India biopharmaceutical market is expected to show substantial growth over the next five years. This growth is driven by the increasing demand for innovative biologic therapies, continuous advancements in gene and cell therapies, and a rapidly expanding biosimilars market. Additionally, favorable government policies, such as the National Biopharma Mission, and public-private partnerships will play a key role in driving this expansion. The rising investments in biotechnology research and the development of state-of-the-art manufacturing facilities will further strengthen India's position in the global market.

India Biopharmaceutical Market Opportunities

- Expanding Contract Manufacturing Organizations (CMOs): India is becoming a global hub for Contract Manufacturing Organizations (CMOs) in the biopharmaceutical sector. In 2023, the country had over 100 CMOs offering services to both domestic and international companies. With growing demand from global pharma firms to outsource biopharmaceutical production, Indias cost-efficient manufacturing and compliance with Good Manufacturing Practices (GMP) present lucrative opportunities for further expansion. The CMO market is expected to benefit from increasing outsourcing of biologics manufacturing due to rising production costs in western markets.

- Biosimilar Growth Potential: India is emerging as a leader in biosimilar production, with over 95 biosimilars approved by the Drug Controller General of India (DCGI) by 2023. The rising adoption of biosimilars, particularly in therapeutic areas like oncology and autoimmune diseases, offers substantial market opportunities. With increasing healthcare costs globally, the demand for affordable biosimilars is set to rise, and Indias manufacturing capabilities provide a competitive edge to capitalize on this growing market segment.

Scope of the Report

|

By Product Type |

Monoclonal Antibodies Vaccines Hormones Enzymes Gene Therapy Products |

|

By Application |

Oncology Autoimmune Diseases Metabolic Disorders Neurology Infectious Diseases |

|

By Technology |

Recombinant DNA Technology Hybridoma Technology Gene Editing Cell Culture Technology Protein Purification Technology |

|

By Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Clinics |

|

By Region |

North India South India West India East India |

Products

Key Target Audience

Pharmaceutical Manufacturers

Biotechnology Firms

Government and Regulatory Bodies (CDSCO, DBT)

Contract Manufacturing Organizations (CMOs)

Healthcare Institutions

Investors and Venture Capital Firms

Distributors and Suppliers of Biopharmaceuticals

Hospitals and Clinics

Companies

Major Players in India Biopharmaceutical Market

Biocon Limited

Dr. Reddys Laboratories

Sun Pharmaceutical Industries

Cipla Limited

Serum Institute of India

Wockhardt Ltd.

Zydus Cadila

Lupin Limited

Panacea Biotec

Bharat Biotech

Gland Pharma

Aurobindo Pharma

Hetero Drugs

Intas Pharmaceuticals

Glenmark Pharmaceuticals

Table of Contents

1. India Biopharmaceutical Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Regulatory environment, R&D intensity, Public-Private Partnerships)

1.4. Market Segmentation Overview

2. India Biopharmaceutical Market Size (In USD Bn)

2.1. Historical Market Size (Product pipeline, R&D expenditures, Drug commercialization timelines)

2.2. Year-On-Year Growth Analysis (Clinical trial outcomes, Biologic approvals)

2.3. Key Market Developments and Milestones (Breakthrough therapies, Biosimilar introductions, Biologic patent expiries)

3. India Biopharmaceutical Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Chronic Diseases

3.1.2. Rising Healthcare Expenditure

3.1.3. Strong Government Initiatives (e.g., National Biopharma Mission)

3.1.4. Technological Advancements (Bioprocessing innovations, mRNA technology)

3.1.5. Growth of Personalized Medicine

3.1.6. Collaborations and Strategic Partnerships

3.2. Market Challenges

3.2.1. High Manufacturing Costs

3.2.2. Complex Regulatory Approvals

3.2.3. Skilled Workforce Deficiency

3.2.4. Patent Expirations and Market Competition

3.2.5. Limited Infrastructure for Advanced Therapies

3.3. Opportunities

3.3.1. Expanding Contract Manufacturing Organizations (CMOs)

3.3.2. Biosimilar Growth Potential

3.3.3. Outsourcing R&D Activities

3.3.4. Emerging Markets for Biopharmaceuticals

3.4. Trends

3.4.1. Expansion of mRNA and Gene Therapy

3.4.2. Shift towards Continuous Manufacturing

3.4.3. Increasing Investments in Oncology Biopharmaceuticals

3.4.4. Rise in Biologics for Autoimmune Diseases

3.5. Government Regulation

3.5.1. Drug Pricing Controls

3.5.2. Biopharma-specific Regulatory Guidelines (Biosimilars, Cell & Gene Therapies)

3.5.3. Clinical Trial Reforms

3.5.4. Fast-track Approvals for Breakthrough Therapies

3.6. SWOT Analysis

3.6.1. Strengths (Skilled Workforce, R&D Capabilities)

3.6.2. Weaknesses (Regulatory Delays, Lack of Infrastructure)

3.6.3. Opportunities (Global Export Potential, Growing Domestic Demand)

3.6.4. Threats (International Competition, Price Pressures)

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers

3.7.2. Distributors

3.7.3. Research Institutions

3.7.4. Regulatory Bodies (CDSCO, DBT)

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers (Raw Materials, APIs)

3.8.2. Bargaining Power of Buyers (Hospitals, Distributors, Retail Pharmacies)

3.8.3. Threat of New Entrants (Barriers to Entry, Patent Protections)

3.8.4. Threat of Substitutes (Small Molecule Drugs, Generic Medicines)

3.8.5. Competitive Rivalry (Market Consolidation, M&A Activity)

4. India Biopharmaceutical Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Monoclonal Antibodies

4.1.2. Vaccines

4.1.3. Hormones

4.1.4. Enzymes

4.1.5. Gene Therapy Products

4.2. By Application (In Value %)

4.2.1. Oncology

4.2.2. Autoimmune Diseases

4.2.3. Metabolic Disorders

4.2.4. Neurology

4.2.5. Infectious Diseases

4.3. By Technology (In Value %)

4.3.1. Recombinant DNA Technology

4.3.2. Hybridoma Technology

4.3.3. Gene Editing

4.3.4. Cell Culture Technology

4.3.5. Protein Purification Technology

4.4. By Distribution Channel (In Value %)

4.4.1. Hospital Pharmacies

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.4.4. Specialty Clinics

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Biopharmaceutical Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Biocon Limited

5.1.2. Dr. Reddys Laboratories

5.1.3. Sun Pharmaceutical Industries

5.1.4. Zydus Cadila

5.1.5. Cipla Limited

5.1.6. Wockhardt Ltd.

5.1.7. Lupin Limited

5.1.8. Serum Institute of India

5.1.9. Panacea Biotec

5.1.10. Bharat Biotech

5.1.11. Intas Pharmaceuticals

5.1.12. Gland Pharma

5.1.13. Aurobindo Pharma

5.1.14. Hetero Drugs

5.1.15. Glenmark Pharmaceuticals

5.2. Cross Comparison Parameters (No. of Employees, Manufacturing Capacity, Clinical Trial Network, R&D Investments, Regulatory Approvals, Product Portfolio, Revenue Contribution from Biopharma, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Biopharmaceutical Market Regulatory Framework

6.1. Drug Approval Process

6.2. Intellectual Property Rights (IPR) for Biopharmaceuticals

6.3. Clinical Trial Regulations

6.4. Compliance and Certification Standards

7. India Biopharmaceutical Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Biopharmaceutical Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Biopharmaceutical Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the key stakeholders in the India biopharmaceutical market. This is achieved through extensive desk research using proprietary databases and secondary sources. The focus is to identify the primary variables influencing the market, such as regulatory frameworks, R&D investments, and technological advancements.

Step 2: Market Analysis and Construction

This step includes compiling historical data and analyzing trends in the biopharmaceutical market, particularly focusing on the development of biosimilars, gene therapies, and other biologic drugs. This data is used to build a comprehensive analysis of the market's past performance and revenue generation patterns.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market growth and challenges are developed based on initial data and then validated through interviews with industry experts. These interviews provide insight into operational trends and strategic developments from leading biopharma firms.

Step 4: Research Synthesis and Final Output

In the final step, we consolidate all gathered information through a bottom-up approach, ensuring a validated and complete analysis of the biopharmaceutical market. This process includes collaboration with manufacturers to cross-check production data and market forecasts.

Frequently Asked Questions

01. How big is the India Biopharmaceutical Market?

The India biopharmaceutical market is valued at USD 53 billion, driven by increasing demand for biologic treatments and government initiatives supporting biotechnology.

02. What are the challenges in the India Biopharmaceutical Market?

Challenges include high production costs, stringent regulatory approvals, and the need for skilled professionals in advanced biotechnology processes.

03. Who are the major players in the India Biopharmaceutical Market?

Key players include Biocon Limited, Dr. Reddys Laboratories, Sun Pharmaceutical Industries, Cipla Limited, and Serum Institute of India, all of which have investments in biosimilars and biologics.

04. What are the growth drivers of the India Biopharmaceutical Market?

The market is driven by increased R&D in biologics, rising healthcare expenditures, government support for biotechnology, and the growth of personalized medicine.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.