India Bioplastics Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD2735

December 2024

94

About the Report

India Bioplastics Market Overview

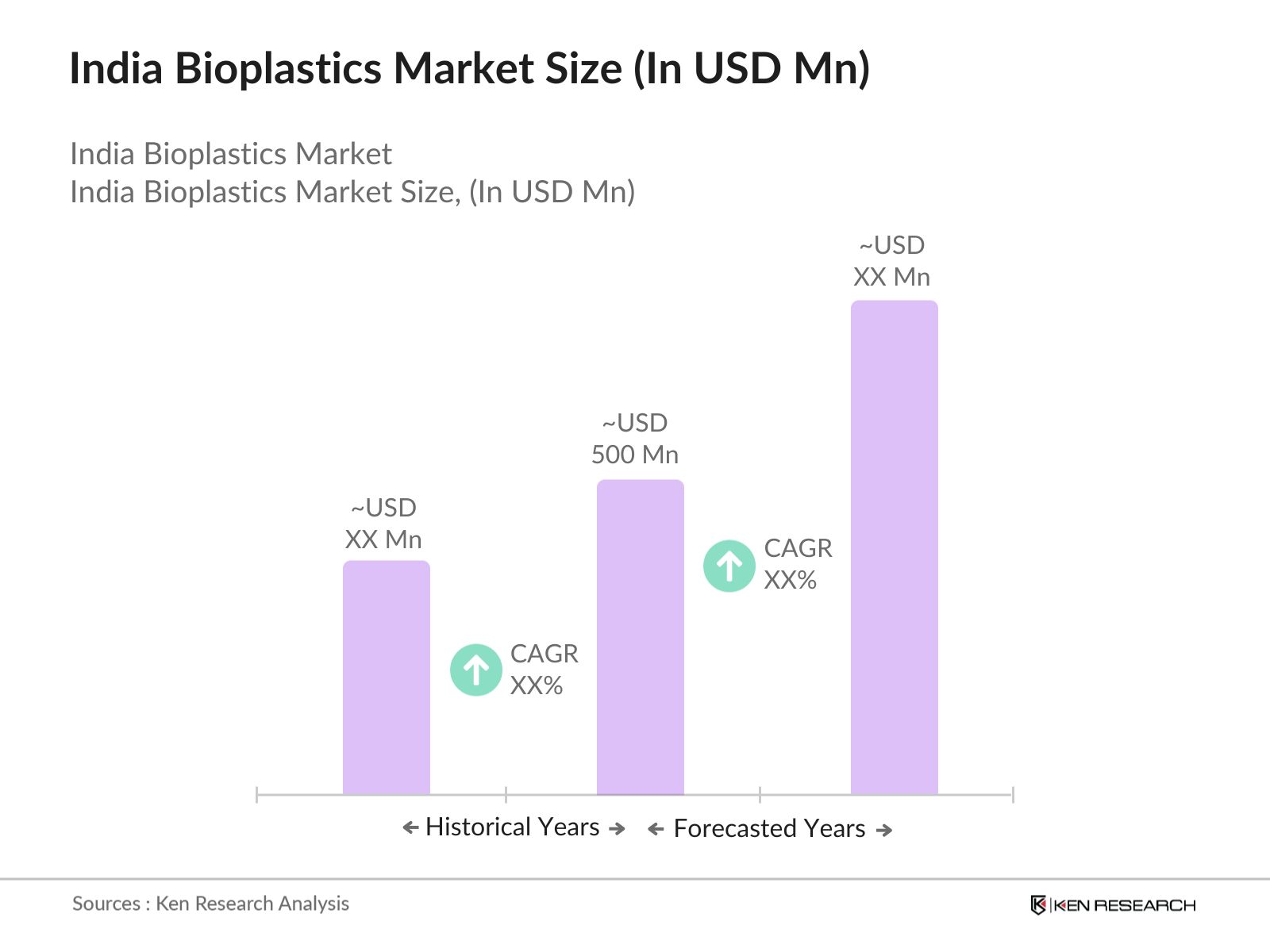

- The India Bioplastics market is valued at USD 500 Mn, concerns and government policies promoting sustainable alternatives to traditional plastics. The demand is further boosted by industries such as packaging, agriculture, and automotive, which are actively adopting bioplastics to reduce carbon footprints and align with global sustainability goals. Large corporations and new startups are also investing heavily in R&D for bioplastics, leading to rapid technological advancements in the sector.

- In India, cities such as Mumbai, Delhi, and Bangalore dominate the bioplastics market due to their extensive industrial bases and the presence of key manufacturing and packaging companies. These cities are not only hubs for innovation but also benefit from government initiatives aimed at reducing plastic waste. The strong infrastructure for manufacturing and distribution also plays a crucial role in the dominance of these cities.

- Indias 2022 ban on single-use plastics has spurred the adoption of alternatives such as bioplastics across sectors like retail and food services. By 2023, the ban had removed approximately 100,000 tonnes of single-use plastic from circulation, with bioplastics emerging as a key replacement for banned products.

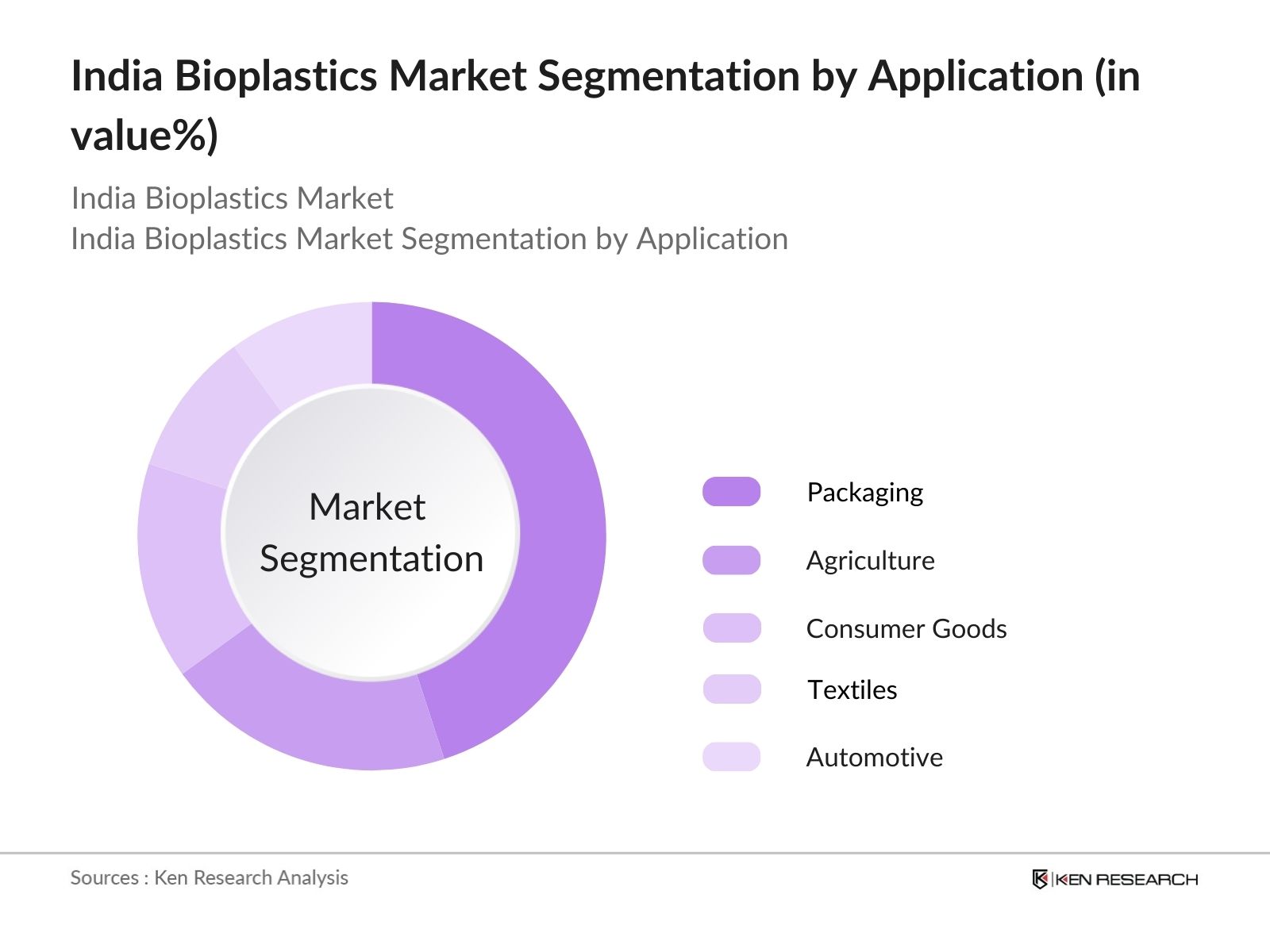

India Bioplastics Market Segmentation

- By Material Type: India's Bioplastics market is segmented by material type into starch-based plastics, polylactic acid (PLA), polyhydroxyalkanoates (PHA), bio-polyethylene (Bio-PE), and other bioplastics (Bio-PET, Bio-PP). Starch-based plastics hold the dominant market share due to their wide application in packaging and agriculture. The abundant availability of starch from crops such as corn and potatoes in India makes it a cost-effective solution, allowing companies to produce bioplastics at lower costs compared to other materials.

- By Application: India's Bioplastics market is also segmented by application into packaging, agriculture, consumer goods, textiles, and automotive. The packaging sector dominates the market with its extensive use of bioplastics for food containers, bottles, and other consumable goods. The rising awareness of eco-friendly packaging solutions among both consumers and manufacturers has driven the adoption of bioplastics in this sector, further supported by strict government regulations on plastic waste management.

India Bioplastics Market Competitive Landscape

The India Bioplastics market is highly competitive, with both global and domestic players investing in innovative materials and production technologies. The market is dominated by a few major players, including BASF SE and NatureWorks LLC, known for their advancements in polylactic acid (PLA) and other bioplastic materials. Additionally, several local companies are expanding their footprint by focusing on biodegradable materials that are suited to the Indian ecosystem.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Production Capacity (tons) |

Global Reach |

Key Products |

Sustainability Initiatives |

Revenue (USD Bn) |

|

BASF SE |

1865 |

Germany |

||||||

|

NatureWorks LLC |

1997 |

USA |

||||||

|

Mitsubishi Chemical Holdings |

1933 |

Japan |

||||||

|

Total Corbion PLA |

2017 |

Netherlands |

||||||

|

Biome Technologies PLC |

1994 |

UK |

Growth Drivers

- Government Environmental Regulations: India has seen a significant push towards environmentally sustainable practices, driven by government policies such as the Plastic Waste Management Rules. In 2022, the Indian government announced a ban on single-use plastics, including straws, cutlery, and packaging materials, to address plastic pollution. The government has also pledged over INR 500 crore ($67 million) to support the development of biodegradable alternatives and eco-friendly packaging. This is expected to drive the adoption of bioplastics, particularly in packaging industries that are seeking alternatives to conventional plastic.

- Shift Towards Sustainable Packaging: In 2023, the demand for eco-friendly packaging solutions in India grew by over 15% as consumer awareness about environmental sustainability surged. FMCG companies like ITC and Tata Consumer Products are increasingly adopting bioplastics for their packaging. The introduction of bioplastics in packaging is further driven by global giants like Unilever, which invested INR 200 crore ($26 million) in sustainable packaging solutions in 2023, with a substantial portion allocated towards bioplastics.

- Rise in Consumer Awareness for Eco-Friendly Products: In 2024, nearly 80 million Indian consumers reported prioritizing eco-friendly products, leading to a steady shift towards sustainable alternatives such as bioplastics. The increasing media coverage on climate change and environmental degradation has significantly influenced consumer preferences. With the Indian government supporting nationwide campaigns like "Swachh Bharat," this rise in awareness is expected to further propel the demand for biodegradable and compostable materials.

Market Challenges

- High Cost of Production: The production of bioplastics in India faces substantial cost challenges due to the higher price of raw materials, particularly bio-based feedstocks like corn starch and sugarcane. The per-unit cost of bioplastics in 2023 was found to be nearly 50% higher than conventional plastics, making them less appealing to price-sensitive consumers. This cost disparity has limited the wider adoption of bioplastics across various sectors.

- Limited Raw Material Supply: Indias domestic supply of key raw materials for bioplastics, such as starch and cellulose, remains limited. In 2022, the country imported 40% of the raw materials required for bioplastic production, which has caused supply chain disruptions and dependency on international suppliers. This limited availability constrains the markets growth, particularly in scaling up production

India Bioplastics Market Future Outlook

The India Bioplastics market is expected to experience significant growth over the next five years, driven by increasing awareness of environmental sustainability, stricter government regulations on plastic waste, and advancements in bioplastic technology. New materials such as PHA and bio-PE are expected to see increased adoption across industries, especially in packaging and agriculture. The rise of eco-friendly consumer demand and corporate social responsibility initiatives will further accelerate the market.

Market Opportunities

- Expansion into Non-Packaging Sectors (Agriculture, Textiles): Bioplastics are gaining traction beyond the packaging sector in India, particularly in agriculture and textiles. In 2023, the Indian agricultural industry began adopting biodegradable mulch films, with over 1,500 hectares utilizing these eco-friendly solutions. The textile industry is also exploring bioplastics for sustainable fabrics, with companies like Arvind Limited experimenting with bio-based polyester blends.

- Innovations in Biopolymer Technologies: The Indian Institute of Science reported breakthroughs in biopolymer technology in 2023, enabling the creation of stronger, more durable bioplastics suitable for industrial applications. The government is providing research grants worth INR 150 crore ($20 million) to foster innovations in biodegradable plastics, leading to improved product efficiency and performance. This presents significant growth potential for Indias bioplastics industry

Scope of the Report

|

Segment |

Sub-segment |

|

Material Type |

Starch-Based Plastics, Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Bio-PE, Other Bioplastics (Bio-PET, Bio-PP) |

|

Application |

Packaging, Agriculture, Consumer Goods, Textiles, Automotive |

|

End-Use Industry |

Food & Beverage, Pharmaceuticals, Electronics, Retail & E-commerce |

|

Processing Technology |

Injection Molding, Blow Molding, Extrusion, Thermoforming |

|

Region |

North India, South India, West India, East India |

Products

Key Target Audience

Bioplastics Manufacturers

Packaging Companies

Agricultural Equipment Providers

Automotive Parts Manufacturers

Venture Capital & Investment Firms

Government and Regulatory Bodies (Ministry of Environment, Forest and Climate Change)

FMCG and Retail Companies

Environmental NGOs

Companies

List of Major Players

BASF SE

NatureWorks LLC

Mitsubishi Chemical Holdings

Total Corbion PLA

Biome Technologies PLC

Braskem S.A.

Novamont S.p.A

FKuR Kunststoff GmbH

Danimer Scientific

Toray Industries Inc.

Plantic Technologies Ltd.

Cardia Bioplastics

Green Dot Bioplastics

BioBag International AS

Tianan Biopolymer

Table of Contents

1. India Bioplastics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Bioplastics Industry Life Cycle (Market Maturity)

1.4 Bioplastics Value Chain Analysis

2. India Bioplastics Market Size (in USD Bn)

2.1 Historical Market Size (in USD Bn)

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Developments

3. India Bioplastics Market Analysis

3.1 Growth Drivers

3.1.1 Government Environmental Regulations

3.1.2 Shift Towards Sustainable Packaging

3.1.3 Rise in Consumer Awareness for Eco-Friendly Products

3.1.4 Supportive Policy Framework (Subsidies, Grants)

3.2 Market Challenges

3.2.1 High Cost of Production

3.2.2 Limited Raw Material Supply

3.2.3 Technological Limitations in Biodegradation

3.3 Opportunities

3.3.1 Expansion into Non-Packaging Sectors (Agriculture, Textiles)

3.3.2 Innovations in Biopolymer Technologies

3.3.3 Partnerships with Global Bioplastics Firms

3.4 Trends

3.4.1 Use of Bioplastics in Automotive & Aerospace Applications

3.4.2 Increasing Adoption of Bioplastic Products in FMCG Sector

3.4.3 Rising Preference for Compostable Packaging Materials

3.5 Government Regulations

3.5.1 Single-Use Plastics Ban

3.5.2 National Green Policy

3.5.3 Plastic Waste Management Rules

3.5.4 Mandatory Biodegradable Content Requirement

4. India Bioplastics Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Starch-Based Plastics

4.1.2 Polylactic Acid (PLA)

4.1.3 Polyhydroxyalkanoates (PHA)

4.1.4 Polyethylene (Bio-PE)

4.1.5 Other Bioplastics (Bio-PET, Bio-PP)

4.2 By Application (In Value %)

4.2.1 Packaging

4.2.2 Agriculture

4.2.3 Consumer Goods

4.2.4 Textiles

4.2.5 Automotive

4.3 By End-Use Industry (In Value %)

4.3.1 Food & Beverage

4.3.2 Pharmaceuticals

4.3.3 Electronics

4.3.4 Retail & E-commerce

4.4 By Processing Technology (In Value %)

4.4.1 Injection Molding

4.4.2 Blow Molding

4.4.3 Extrusion

4.4.4 Thermoforming

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 West India

4.5.4 East India

5. India Bioplastics Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 BASF SE

5.1.2 NatureWorks LLC

5.1.3 Mitsubishi Chemical Holdings Corporation

5.1.4 Total Corbion PLA

5.1.5 Biome Technologies PLC

5.1.6 Novamont S.p.A

5.1.7 FKuR Kunststoff GmbH

5.1.8 Danimer Scientific

5.1.9 Toray Industries Inc.

5.1.10 Plantic Technologies Ltd.

5.1.11 Cardia Bioplastics

5.1.12 Green Dot Bioplastics

5.1.13 Braskem S.A.

5.1.14 BioBag International AS

5.1.15 Tianan Biopolymer

6. Cross-Comparison Parameters

6.1 No. of Employees

6.2 Headquarters

6.3 Inception Year

6.4 Revenue

6.5 R&D Investment

6.6 Bioplastics Production Capacity

6.7 Key Strategic Partnerships

6.8 Market Presence (Global/Local)

7. India Bioplastics Market Regulatory Framework

7.1 Environmental Standards and Certification

7.2 Compliance with Plastic Waste Management Rules

7.3 Biodegradability Standards

7.4 Government Subsidies and Incentives

8. India Bioplastics Market Future Outlook

8.1 Future Market Size Projections (in USD Bn)

8.2 Key Factors Driving Future Market Growth

9. India Bioplastics Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Opportunity Analysis

9.3 Strategic Growth Initiatives for Key Players

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves the identification of critical variables within the India Bioplastics market. This process includes extensive desk research, utilizing secondary data sources such as industry reports, governmental publications, and proprietary databases. The aim is to map the entire market ecosystem, identifying key stakeholders and drivers of market dynamics.

Step 2: Market Analysis and Construction

Historical data of the Indian Bioplastics market is compiled to analyze market penetration, production capacities, and revenue generation. Detailed analysis is conducted on the bioplastics materials such as PLA, starch-based plastics, and others, determining their market contribution and growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts from bioplastics manufacturing companies are conducted to validate market hypotheses. These consultations offer insights into the bioplastics production process, technological advancements, and challenges faced in the supply chain, contributing to accurate market forecasting.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing the gathered data into a comprehensive market analysis. Bioplastic manufacturers and key stakeholders are consulted to verify the accuracy of the gathered data. This process ensures the creation of a validated and detailed report that provides actionable insights for market participants.

Frequently Asked Questions

01. How big is the India Bioplastics Market?

The India Bioplastics market is valued at USA 500 million, driven by increased consumer demand for sustainable alternatives and government policies aimed at reducing plastic waste.

02. What are the key challenges in the India Bioplastics Market?

Challenges include high production costs, limited raw material supply, and technological limitations in biodegradability. Moreover, the need for widespread consumer adoption of bioplastics is crucial for market growth.

03. Who are the major players in the India Bioplastics Market?

Key players include BASF SE, NatureWorks LLC, Total Corbion PLA, Mitsubishi Chemical Holdings, and Braskem S.A., dominating due to their R&D capabilities and extensive global reach.

04. What drives the growth of the India Bioplastics Market?

The growth is primarily driven by government regulations, increasing environmental awareness among consumers, and the shift towards sustainable packaging solutions in industries like FMCG and agriculture.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.