India Blister Packaging Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD5547

December 2024

85

About the Report

India Blister Packaging Market Overview

- The India blister packaging market is valued at USD 2.7 billion, based on a five-year historical analysis. The market is driven by the increasing demand for pharmaceutical packaging, particularly for oral medications, due to the growing pharmaceutical sector. This growth is further supported by advancements in packaging technology, including child-resistant and senior-friendly designs, which enhance consumer safety and product integrity. Moreover, blister packaging is gaining traction in the consumer goods industry, especially in packaging products such as toys, hardware, and electronics. The emphasis on product protection and durability in the packaging industry also fuels this market's growth.

- Indias blister packaging market is dominated by cities like Mumbai, Hyderabad, and Bengaluru due to their well-established pharmaceutical industries. Mumbai, as the financial hub, attracts a concentration of manufacturing plants and distribution centers, making it a key player in the blister packaging sector. Hyderabad is a prominent hub for pharmaceutical research and production, contributing significantly to the demand for blister packaging. Additionally, Bengalurus growth in the consumer electronics industry also drives the market as blister packaging is essential for product protection and shelf appeal in electronics.

- The Indian government has introduced strict packaging and labeling regulations to ensure product safety and consumer protection. The Legal Metrology (Packaged Commodities) Rules mandate that all products, including pharmaceuticals and consumer goods, be packaged with clear labels detailing the contents, expiration dates, and safety information. This regulation has spurred the adoption of blister packaging, particularly for pharmaceuticals, as it offers an efficient solution for meeting compliance requirements. These regulations are a key driver for packaging innovation in India.

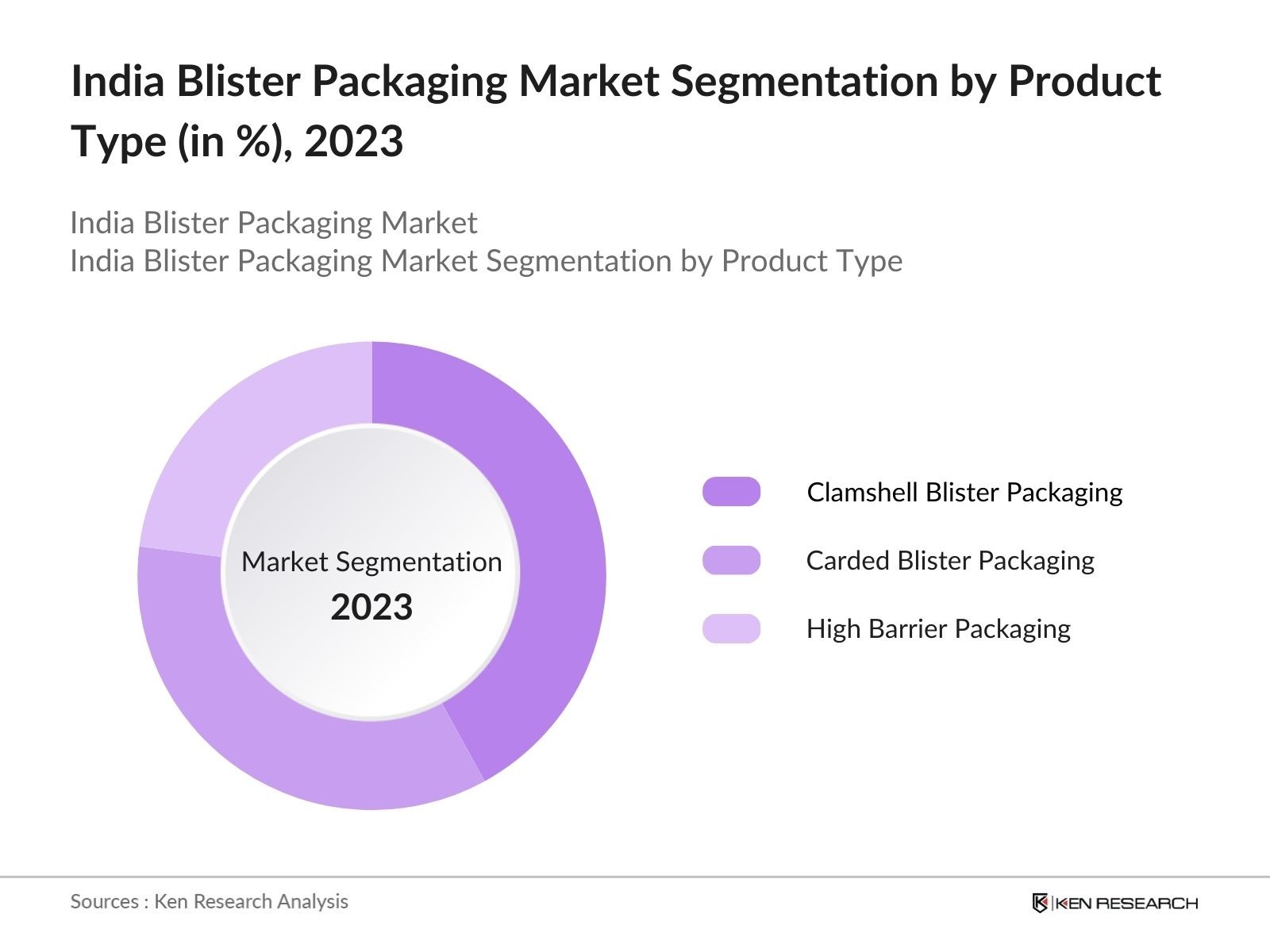

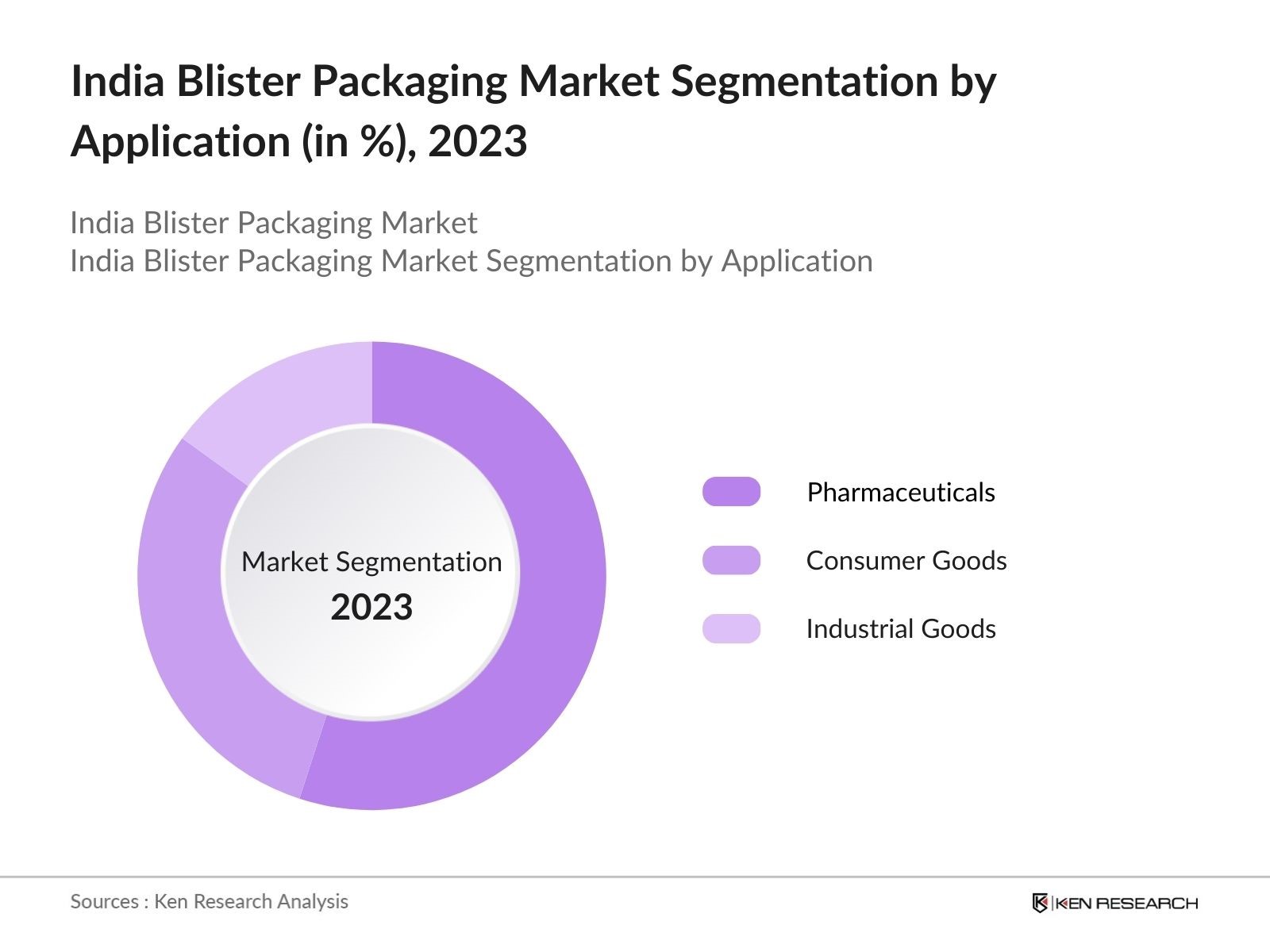

India Blister Packaging Market Segmentation

By Product Type: The market is segmented by product type into clamshell blister packaging, carded blister packaging, and high barrier blister packaging. Recently, clamshell blister packaging has dominated the market share in India due to its versatility and ability to provide both security and product visibility. This type of packaging is widely used in the consumer goods and electronics sectors, where product protection from damage during transport and tamper-evidence are critical factors. The use of eco-friendly materials in clamshell packaging has also supported its dominance in the market.

By Application: The market is also segmented by application into pharmaceuticals, consumer goods, and industrial goods. The pharmaceutical segment holds the largest market share due to the increasing demand for safe, tamper-evident packaging for medications. Blister packaging is a preferred choice in pharmaceuticals as it ensures dosage accuracy, protects medicines from external factors like moisture and contamination, and enhances product shelf life. The rise in chronic diseases and the increasing need for over-the-counter drugs further solidify blister packaging's dominance in this sector.

India Blister Packaging Market Competitive Landscape

The India Blister Packaging Market is dominated by several key players, including both domestic and international companies. The market's competitive landscape is characterized by a strong presence of companies focusing on innovation in sustainable packaging, the use of advanced technology, and expanding manufacturing capacities. The consolidation of these companies highlights the influence of international players alongside domestic giants in shaping the market.

|

Company |

Establishment Year |

Headquarters |

Number of Employees |

Revenue (USD Mn) |

Sustainability Initiatives |

Global Presence |

Product Innovation |

|

Amcor Plc |

1860 |

Melbourne, Australia |

|||||

|

Constantia Flexibles |

2009 |

Vienna, Austria |

|||||

|

Uflex Ltd. |

1983 |

Noida, India |

|||||

|

WestRock Company |

1956 |

Atlanta, USA |

|||||

|

Bilcare Limited |

1993 |

Pune, India |

India Blister Packaging Industry Analysis

Growth Drivers

- Pharmaceutical Industry Growth: The pharmaceutical sector in India has been witnessing robust growth due to increased demand for medicines and medical supplies. India's pharmaceutical market is expected to remain a critical driver for the blister packaging market, especially with the countrys healthcare spending reaching $42 billion in 2022. This demand is largely driven by increased production of generic medicines, which account for nearly 20% of global generic drug exports. The government's focus on increasing healthcare infrastructure and drug accessibility is further boosting the need for efficient packaging solutions like blister packaging.

- Rising Consumer Goods Sector: Indias expanding consumer goods market, which saw a retail sales volume of over $1 trillion in 2022, contributes to the demand for blister packaging. The sectors rapid expansion is primarily driven by urbanization and rising disposable incomes, resulting in a surge in consumer-packaged goods (CPG). Blister packaging is widely used for small consumer goods like batteries, toys, and personal care items, making it an integral part of the packaging industry. This sector is projected to remain a major contributor to the blister packaging market.

- Technological Advancements in Packaging: Technological advancements in blister packaging, such as the development of multi-layered packaging solutions and cold form foil technology, are enhancing product protection and shelf life. Indias investment in packaging technologies, worth $50 billion in 2022, is supporting the shift towards more innovative solutions. These technologies have revolutionized the blister packaging market by improving the functionality of packaging, making it more resistant to environmental factors and ensuring better compliance with regulatory standards.

Market Challenges

- Raw Material Cost Fluctuations: Blister packaging relies heavily on raw materials like plastic, aluminum, and paperboard. The prices of these materials have been volatile due to global supply chain disruptions, causing significant challenges for manufacturers. In 2022, global plastic prices surged by 15%, affecting the production costs for blister packaging. With India importing substantial quantities of raw materials, manufacturers are facing higher input costs, which could affect their profit margins and slow down production.

- Stringent Environmental Regulations: Environmental regulations regarding plastic usage have become more stringent in India, with the country aiming to phase out single-use plastics by 2025. The governments Plastic Waste Management Rules, amended in 2022, now require companies to limit plastic waste, which directly impacts blister packaging manufacturers. Companies must now innovate and adopt eco-friendly alternatives such as biodegradable or recyclable materials. This transition to sustainable materials presents a significant challenge, as many companies lack the infrastructure to handle this change effectively.

India Blister Packaging Market Future Outlook

Over the next five years, the India blister packaging market is expected to witness steady growth, driven by several key factors. The growth will be supported by increasing pharmaceutical production, rising consumer demand for packaged goods, and advancements in packaging technology. The push for sustainability is likely to drive innovation in eco-friendly packaging solutions, making biodegradable materials and recyclable packaging increasingly popular in India. Furthermore, the market is set to benefit from the rising adoption of automation in packaging processes, improving efficiency and reducing costs. Expansion into rural markets, where pharmaceutical access is increasing, will also contribute to growth.

Future Market Opportunities

- Growing Demand for Sustainable Blister Packaging: With a shift towards sustainable packaging, blister packaging companies in India are increasingly exploring eco-friendly materials. The global sustainable packaging market, valued at $330 billion in 2022, has seen a notable increase in demand for biodegradable and recyclable materials. Indian manufacturers are capitalizing on this trend by developing plant-based and recyclable blister packs, which align with the country's growing sustainability initiatives. These initiatives present a major opportunity for blister packaging manufacturers to expand their product lines and cater to the environmentally conscious consumer base.

- Rise in Adoption of Smart Packaging Solutions: The adoption of smart packaging technologies, which include features like QR codes, RFID, and tamper-evident designs, is increasing in India. In 2022, the global smart packaging market was valued at $25 billion, and its adoption is particularly growing in sectors like pharmaceuticals, where tracking and traceability are critical. Indian companies are increasingly integrating such technologies into blister packaging to improve product safety, enhance customer interaction, and ensure regulatory compliance. This shift toward innovation presents a promising growth opportunity for blister packaging in India.

Scope of the Report

|

Product Type |

Clamshell Blister Packaging Carded Blister Packaging High Barrier Blister Packaging |

|

Application |

Pharmaceuticals Consumer Goods Industrial Goods |

|

Material |

Plastic Films (PVC, PET) Aluminum Foils Paper and Paperboard |

|

Technology |

Cold Forming Thermoforming |

|

Region |

North South East West |

Products

Key Target Audience

Pharmaceutical Manufacturers

Consumer Goods Manufacturers

Industrial Goods Manufacturers

Packaging Material Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Indian Pharmacopoeia Commission)

Sustainability Advocates

Logistics and Distribution Companies

Banks and Financial Institutions

Companies

Major Players

Amcor Plc

Constantia Flexibles

Sonoco Products Company

WestRock Company

Uflex Ltd.

Klckner Pentaplast

Honeywell International Inc.

Tekni-Plex

Bilcare Limited

Winpak Ltd.

Essentra Plc

Bemis Company, Inc.

Display Pack Inc.

3M Company

ACG Worldwide

Table of Contents

1. India Blister Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Blister Packaging Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Blister Packaging Market Analysis

3.1 Growth Drivers (Increasing Pharmaceutical Demand, Consumer Goods Expansion, Technological Advancements)

3.1.1 Pharmaceutical Industry Growth

3.1.2 Rising Consumer Goods Sector

3.1.3 Technological Advancements in Packaging

3.1.4 Regulatory Push for Packaging Standards

3.2 Market Challenges (Raw Material Price Volatility, Environmental Concerns)

3.2.1 Raw Material Cost Fluctuations

3.2.2 Stringent Environmental Regulations

3.2.3 Limited Recycling Infrastructure

3.3 Opportunities (Sustainability, Innovation in Smart Packaging)

3.3.1 Growing Demand for Sustainable Blister Packaging

3.3.2 Rise in Adoption of Smart Packaging Solutions

3.3.3 Opportunities in Generic Drugs

3.4 Trends (Eco-Friendly Materials, Automation, Increased Adoption in Retail)

3.4.1 Shift Towards Eco-Friendly Packaging Materials

3.4.2 Integration of Automation in Packaging Lines

3.4.3 Increasing Usage of Blister Packaging in Retail

3.5 Government Regulations (Environmental Standards, Packaging Safety)

3.5.1 Packaging & Labeling Regulations

3.5.2 Safety and Compliance Regulations for Pharmaceuticals

3.5.3 Environmental Packaging Policies

3.6 SWOT Analysis

3.7 Stake Ecosystem (Suppliers, Manufacturers, Distributors, End-users)

3.8 Porters Five Forces (Bargaining Power of Suppliers, Threat of Substitutes)

3.9 Competition Ecosystem

4. India Blister Packaging Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Clamshell Blister Packaging

4.1.2 Carded Blister Packaging

4.1.3 High Barrier Blister Packaging

4.2 By Application (In Value %)

4.2.1 Pharmaceuticals

4.2.2 Consumer Goods

4.2.3 Industrial Goods

4.3 By Material (In Value %)

4.3.1 Plastic Films (PVC, PET)

4.3.2 Aluminum Foils

4.3.3 Paper and Paperboard

4.4 By Technology (In Value %)

4.4.1 Cold Forming

4.4.2 Thermoforming

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Blister Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amcor Plc

5.1.2 Constantia Flexibles

5.1.3 Sonoco Products Company

5.1.4 Bemis Company, Inc.

5.1.5 WestRock Company

5.1.6 Tekni-Plex

5.1.7 Klckner Pentaplast

5.1.8 Honeywell International Inc.

5.1.9 Display Pack Inc.

5.1.10 DOW Chemical Company

5.1.11 Winpak Ltd.

5.1.12 Uflex Ltd.

5.1.13 Bilcare Limited

5.1.14 Essentra Plc

5.1.15 Rohrer Corporation

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Product Innovations, Market Share, Strategic Initiatives, Sustainability Practices, Global Footprint)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Expansions, Collaborations)

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Blister Packaging Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. India Blister Packaging Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Blister Packaging Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Material (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. India Blister Packaging Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we conduct an extensive desk review to map the blister packaging ecosystem in India, identifying the major players, their market strategies, and key product innovations. Data is gathered from secondary sources, including government reports and proprietary databases, to define variables influencing market dynamics.

Step 2: Market Analysis and Construction

We then analyze historical data to assess market trends and penetration levels. This step includes gathering data on product types, application sectors, and revenue generation. Key industry insights are derived by evaluating packaging demands in the pharmaceutical and consumer goods sectors.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypothesis through expert consultations, conducted via interviews with industry stakeholders and key decision-makers. These discussions help us refine our data and ensure the accuracy of market insights.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the collected data into actionable insights. We collaborate with blister packaging manufacturers to verify the accuracy of the market size, segmentations, and competitive landscape.

Frequently Asked Questions

01. How big is the India Blister Packaging Market?

The India blister packaging market is valued at USD 2.7 billion, driven by the rising pharmaceutical demand and expanding consumer goods sector.

02. What are the challenges in the India Blister Packaging Market?

The challenges include rising raw material costs, stringent environmental regulations, and a limited recycling infrastructure for blister packaging.

03. Who are the major players in the India Blister Packaging Market?

Key players in the India blister packaging market include Amcor Plc, Constantia Flexibles, Uflex Ltd., Sonoco Products Company, and WestRock Company, with a strong presence in both global and local markets.

04. What are the growth drivers of the India Blister Packaging Market?

The growth in the India blister packaging market is propelled by increasing pharmaceutical production, rising consumer demand for packaged goods, and advancements in packaging technology focusing on product protection and tamper-evidence.

05. What trends are shaping the India Blister Packaging Market?

Trends in the India blister packaging market include the shift toward eco-friendly and biodegradable packaging materials, increasing automation in packaging processes, and the rise of smart packaging solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.