India Bottled Water Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD1692

October 2024

87

About the Report

India Bottled Water Market Overview

- India Bottled Water Market is valued at USD 6 billion, based on a five-year historical analysis. The market is primarily driven by increasing consumer awareness about health and safety, coupled with growing concerns over the contamination of tap water. Urbanization has also significantly contributed to the rising demand for bottled water, as consumers in cities prefer bottled water for its convenience and perceived purity.

- In the India bottled water market, metropolitan cities like Delhi, Mumbai, and Bangalore dominate consumption due to their dense population and a higher percentage of urbanized residents. These cities are home to a substantial middle-class population that prefers bottled water due to convenience and hygiene concerns.

- The Food Safety and Standards Authority of India (FSSAI) enforces regulations for bottled water, particularly focusing on water quality and labeling requirements. FSSAI has amended the standards for packaged drinking water, which now includes specifications for total dissolved solids (75-500 mg/l), calcium (10-75 mg/l), and magnesium (5-30 mg/l). The authority’s efforts have ensured greater transparency in labeling and improved the overall safety of bottled water sold in India.

India Bottled Water Market Segmentation

By Product Type: The market is segmented by product type into still water, sparkling water, flavored water, and functional water. Recently, still water has dominated the market due to its affordability, wide availability, and consumer preference for plain drinking water. Brands like Bisleri and Kinley have maintained strong market positions by ensuring quality and reliability, making still water the most popular choice. With increasing urbanization and greater awareness of safe drinking water, still water continues to be the preferred option for the majority of consumers, especially in both retail and on-the-go consumption.

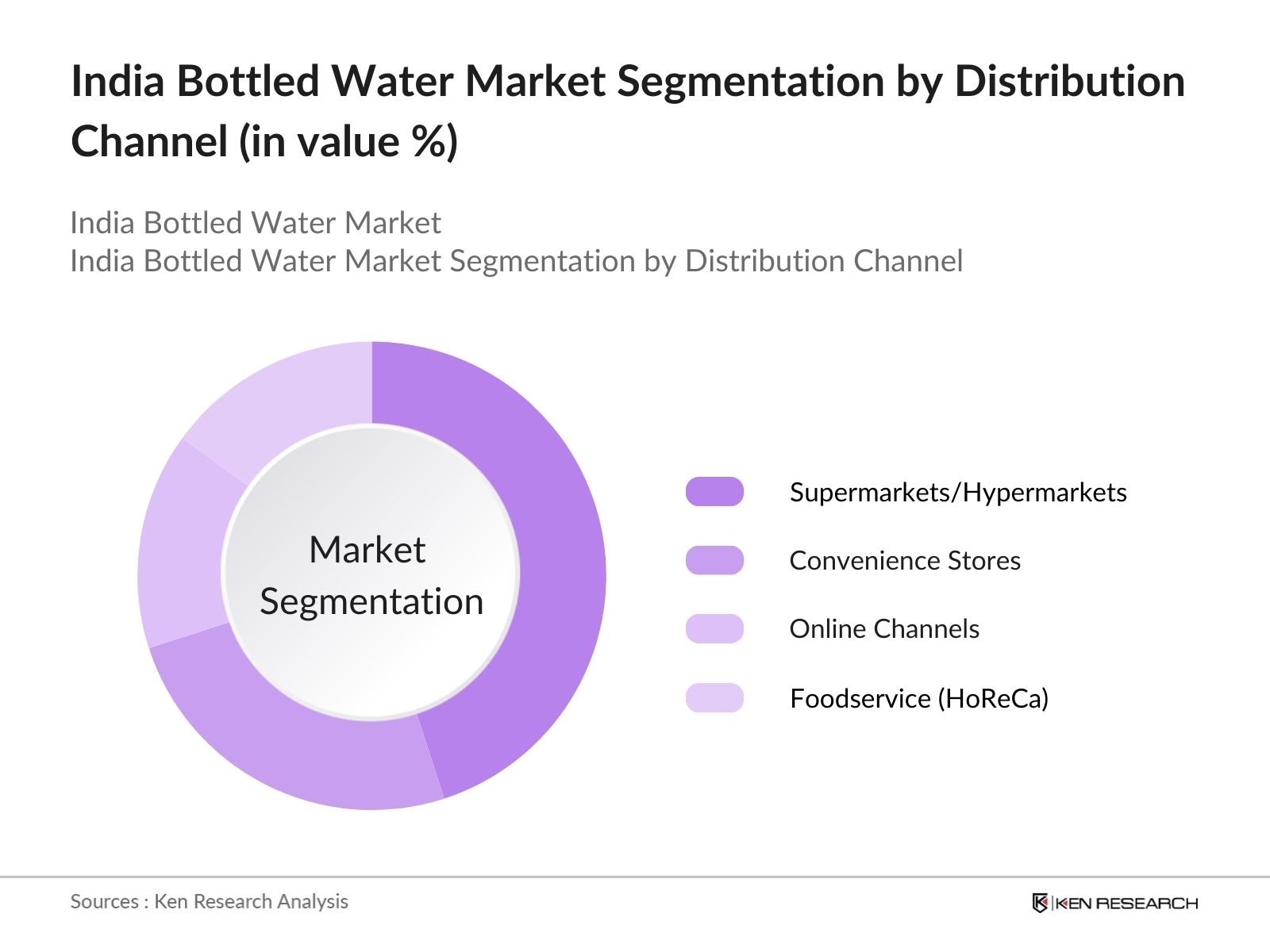

By Distribution Channel: The market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online channels, and foodservice (HoReCa). Supermarkets and hypermarkets have a dominant market share under this segmentation due to their wide availability and ease of access to a variety of products. These channels offer customers the convenience of bulk purchases and promotions, making them popular among urban consumers. Additionally, the modern retail format has helped brands expand their market presence by offering premium and functional bottled water products.

India Bottled Water Market Competitive Landscape

The India bottled water market is dominated by both domestic and international brands, with a few major players holding a significant market share. The market is highly competitive, with brands continuously innovating in packaging, product quality, and marketing strategies to maintain their position. Domestic brands like Bisleri and Kinley dominate due to their established distribution networks and brand loyalty, while international brands focus on premium water segments.

|

Company |

Established |

Headquarters |

Market Coverage |

Product Portfolio |

Innovation Rate |

Sustainability Initiatives |

Packaging Types |

|

Bisleri International |

1965 |

Mumbai, India |

- |

- |

- |

- |

- |

|

Tata Global Beverages |

1962 |

Kolkata, India |

- |

- |

- |

- |

- |

|

Coca-Cola India (Kinley) |

1993 |

Gurgaon, India |

- |

- |

- |

- |

- |

|

PepsiCo India (Aquafina) |

1989 |

Noida, India |

- |

- |

- |

- |

- |

|

Parle Agro (Bailley) |

1929 |

Mumbai, India |

- |

- |

- |

- |

- |

India Bottled Water Market Analysis

Growth Drivers

- Urbanization and Migration to Cities: The rapid pace of urbanization in India has been a major driver for the bottled water market, especially in metro cities. As of 2022, around 35% of the Indian population resides in urban areas, with 387 million people migrating from rural regions for better living conditions, leading to a growing demand for clean, packaged drinking water. This trend is expected to continue, with urban population numbers increasing in 2024 due to the infrastructure development in Tier-I and Tier-II cities, further fueling bottled water consumption.

- Rising Health Awareness and Preference for Safe Drinking Water: Health-conscious consumers are driving demand for bottled water as concerns about waterborne diseases increase. In Maharashtra, for example, there was a notable increase in waterborne disease cases in 2023, with 1,213 cases reported throughout the year. However, preliminary data for 2024 indicates a sharp rise, with over 2,441 cases recorded by early September. The shift towards healthier lifestyles has made bottled water a necessity for many, particularly in urban and semi-urban areas where concerns about tap water safety persist.

- Premiumization of Bottled Water Brands: With the rising disposable income in urban India, premium bottled water brands are seeing significant demand growth. In 2024, the premium bottled water segment is gaining traction, with brands like Himalayan, Qua, and Vedica leading the market. The premium bottled water segment is benefiting from this trend, with more consumers opting for value-added water products such as mineral-rich or alkaline water.

Challenges

- Plastic Waste and Recycling Issues: The widespread use of plastic bottles has become a significant environmental concern in India. India generates 9.4 million metric tons of plastic waste annually. This has raised questions about the sustainability of bottled water packaging, prompting government and industry efforts to increase recycling rates. The government’s push towards a circular economy and its Swachh Bharat Mission to address waste management challenges have highlighted the need for better plastic recycling initiatives.

- High Operational and Distribution Costs: Operating costs for bottled water companies remain high, with substantial expenses in water extraction, bottling, and distribution. In 2023, the average operational cost for bottled water production stood at approximately ?120-150 per 20-liter unit. Additionally, the distribution network requires cold storage and efficient logistics, especially in remote areas, contributing to increased fuel and transportation expenses.

India Bottled Water Future Market Outlook

Over the next five years, the India bottled water market is expected to witness significant growth driven by rising health awareness, increased urbanization, and the growing popularity of premium water products. Furthermore, the shift towards sustainable packaging and eco-friendly practices is likely to create new growth opportunities in the market. The demand for flavored and functional water is also anticipated to grow as consumers seek healthier beverage options. Additionally, government regulations aimed at reducing plastic waste may propel innovation in sustainable packaging solutions, further boosting market expansion.

Market Opportunities

- Adoption of Eco-Friendly and Biodegradable Bottles: To address the environmental concerns surrounding plastic, several bottled water companies are adopting eco-friendly and biodegradable packaging options. This shift is expected to gain momentum, driven by government regulations and increasing consumer preference for sustainable products. The Swachh Bharat initiative has further incentivized companies to adopt sustainable practices, creating an opportunity for brands to stand out in the market

- Rising Demand in Tier-II and Tier-III Markets: In 2024, the increasing penetration of bottled water in Tier-II and Tier-III cities presents a substantial market opportunity. The rising affluence and improving infrastructure in these areas have made bottled water a popular choice. With more companies expanding their distribution networks to serve these regions, the market is expected to see steady growth.

Scope of the Report

|

Segments |

Sub Segments |

|

By Product Type |

Still Water |

|

|

Sparkling Water |

|

|

Flavored Water |

|

|

Functional Water |

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

|

Convenience Stores |

|

|

Online Channels |

|

|

Foodservice (HoReCa) |

|

By Packaging Type |

PET Bottles |

|

|

Glass Bottles |

|

|

Tetra Packs |

|

|

Cans |

|

By Size |

Small (500ml and Below) |

|

|

Medium (1L to 5L) |

|

|

Large (20L and Above) |

|

By Region |

North India |

|

|

South India |

|

|

East India |

|

|

West India |

Products

Key Target Audience

- Bottled Water Manufacturers

- Packaging Solution Providers

- E-commerce Platforms

- Hospitality and Foodservice Industry

- Government and Regulatory Bodies (FSSAI, BIS)

- Investments and Venture Capitalist Firms

- Distribution and Logistics Providers

Table of Contents

1. India Bottled Water Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Bottled Water Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Bottled Water Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Migration to Cities

3.1.2. Rising Health Awareness and Preference for Safe Drinking Water

3.1.3. Premiumization of Bottled Water Brands

3.1.4. Expansion into Tier-II and Tier-III Cities

3.2. Market Challenges

3.2.1. Plastic Waste and Recycling Issues

3.2.2. High Operational and Distribution Costs

3.2.3. Competition from Water Purifiers and RO Systems

3.3. Opportunities

3.3.1. Adoption of Eco-Friendly and Biodegradable Bottles

3.3.2. Rising Demand in Tier-II and Tier-III Markets

3.3.3. Introduction of Functional and Infused Waters

3.4. Trends (Sustainable Packaging, Enhanced Water, Digital Marketing)

3.4.1. Shift Towards Environmentally Sustainable Packaging

3.4.2. Increasing Popularity of Alkaline and Vitamin-Enriched Water

3.4.3. Growth of Digital Marketing and E-Commerce Channels

3.5. Government Regulations (Bureau of Indian Standards, FSSAI, Single-Use Plastic Ban)

3.5.1. BIS Certification for Bottled Water

3.5.2. FSSAI Standards for Bottled Water Quality

3.5.3. Impact of Single-Use Plastic Ban on the Industry

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, Bottling Plants, Distributors, Retailers)

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. India Bottled Water Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Still Water

4.1.2. Sparkling Water

4.1.3. Flavored Water

4.1.4. Functional Water

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Channels

4.2.4. Foodservice (HoReCa)

4.3. By Packaging Type (In Value %)

4.3.1. PET Bottles

4.3.2. Glass Bottles

4.3.3. Tetra Packs

4.3.4. Cans

4.4. By Size (In Value %)

4.4.1. Small (500ml and Below)

4.4.2. Medium (1L to 5L)

4.4.3. Large (20L and Above)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Bottled Water Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bisleri International

5.1.2. Tata Global Beverages

5.1.3. Parle Agro

5.1.4. Coca-Cola India (Kinley)

5.1.5. PepsiCo India (Aquafina)

5.1.6. Himalayan Water (Narangs International)

5.1.7. Rail Neer (IRCTC)

5.1.8. Kingfisher Water

5.1.9. Manikchand Oxyrich

5.1.10. Qua Water (Gold Plus Beverages)

5.1.11. Aava Natural Mineral Water

5.1.12. Patanjali Divya Jal

5.1.13. Vedica Himalayan Mineral Water

5.1.14. Catch Natural Spring Water (DS Group)

5.1.15. Mulshi Springs

5.2. Cross Comparison Parameters (No. of Manufacturing Plants, Packaging Types, Revenue, Regional Presence, Product Range, Certifications, Innovation Rate, E-commerce Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Support and Incentives

5.8. Private Equity and Venture Capital Funding

5.9. Distribution Network Analysis

6. India Bottled Water Market Regulatory Framework

6.1. Environmental Standards and Packaging Regulations

6.2. BIS and FSSAI Certification Requirements

6.3. Compliance with Plastic Waste Management Rules

6.4. Industry-Specific Sustainability Initiatives

7. India Bottled Water Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Bottled Water Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Size (In Value %)

8.5. By Region (In Value %)

9. India Bottled Water Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Market Entry Strategies

9.4. Product Differentiation Opportunities

9.5. Innovation and R&D Focus

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves developing an ecosystem map, identifying all the critical stakeholders within the India bottled water market. Desk research is conducted using secondary databases and proprietary industry data to gather comprehensive market insights. The focus is on identifying key variables influencing demand, such as consumer preferences, urbanization trends, and regulatory impacts.

Step 2: Market Analysis and Construction

This phase entails compiling historical data related to market penetration, distribution channels, and consumer demand in the India bottled water market. By analyzing this data, market size and potential are constructed, with additional evaluations of product innovation trends and packaging preferences.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews and consultations with industry experts, representing major bottled water manufacturers and distributors. Insights from these consultations help validate the data and refine the market assumptions.

Step 4: Research Synthesis and Final Output

In this phase, the synthesis of data from secondary and primary sources is completed. A bottom-up approach is used to estimate market size and growth potential, verified through consultation with manufacturers and retailers to ensure accuracy and relevance.

Frequently Asked Questions

01 How big is the India Bottled Water Market?

The India Bottled Water Market is valued at USD 6 billion, driven by increasing health awareness and the demand for safe drinking water.

02 What are the challenges in the India Bottled Water Market?

Challenges of India Bottled Water Market include environmental concerns related to plastic waste, high operational costs, and competition from water purifiers and RO systems.

03 Who are the major players in the India Bottled Water Market?

Key players of India Bottled Water Market include Bisleri International, Tata Global Beverages, Coca-Cola India (Kinley), PepsiCo India (Aquafina), and Parle Agro (Bailley), dominating through strong distribution networks and brand loyalty.

04 What are the growth drivers of the India Bottled Water Market?

India Bottled Water Market is driven by rising urbanization, increasing health awareness, the expansion of retail channels, and a growing preference for premium and flavored water.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.