India Breakfast Cereal Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9748

November 2024

90

About the Report

India Breakfast Cereal Market Overview

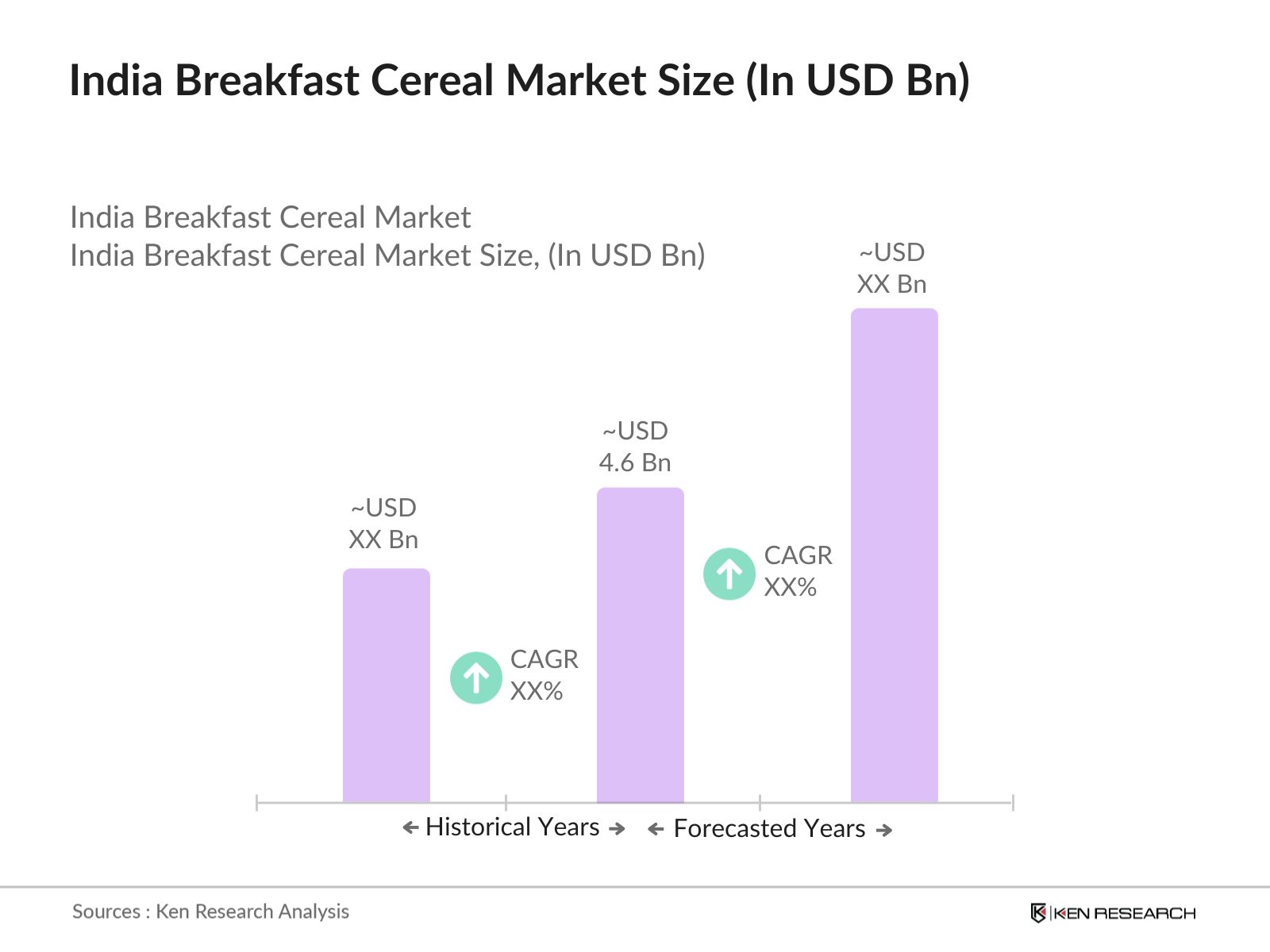

- The India Breakfast Cereal Market is valued at USD 4.64 billion, based on a five-year historical analysis. This market is driven by increasing urbanization, rising disposable income, and growing health consciousness among Indian consumers. The demand for convenience foods, particularly breakfast cereals, has seen significant growth as consumers prioritize quick and healthy meal options. Additionally, increasing awareness about nutrition, influenced by digital platforms and government campaigns, has propelled the consumption of healthier cereals, such as oats and muesli, which are seen as better alternatives to traditional Indian breakfasts.

- The market is dominated by metro cities like Mumbai, Delhi, and Bengaluru, primarily due to the higher disposable incomes, more significant health awareness, and the greater availability of international brands in these regions. These cities also exhibit a larger working population, which further drives the demand for convenient and nutritious breakfast options. Furthermore, the growing influence of Western culture and lifestyles in these cities contributes to the dominance of ready-to-eat breakfast cereals.

- The Food Safety and Standards Authority of India (FSSAI) introduced stringent guidelines in 2022, requiring food products, including breakfast cereals, to display comprehensive nutritional information. This includes details on calories, fat, sugar, and salt content. As of 2023, over 90% of cereal brands have complied with these regulations, ensuring that consumers can make informed choices.

India Breakfast Cereal Market Segmentation

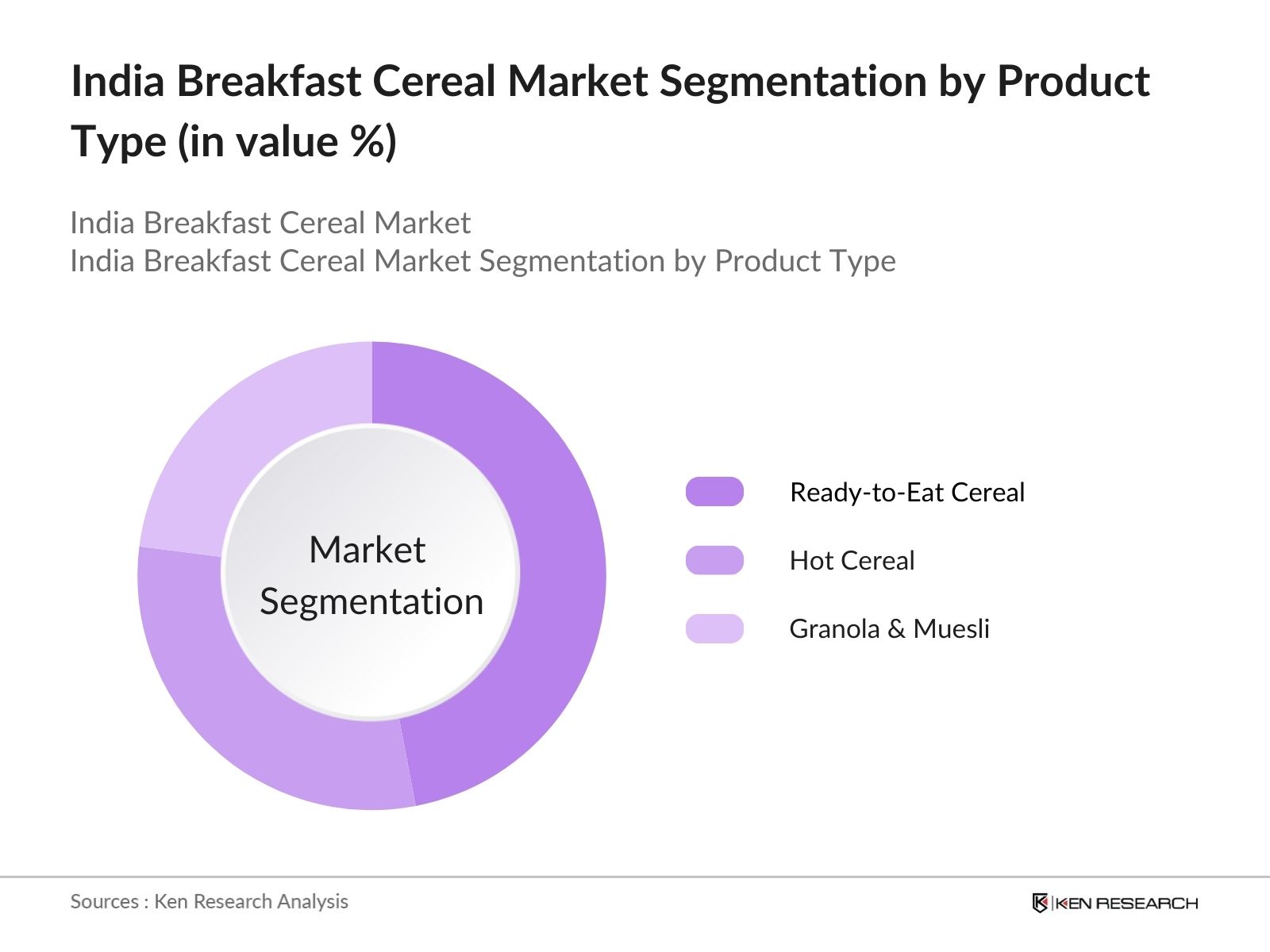

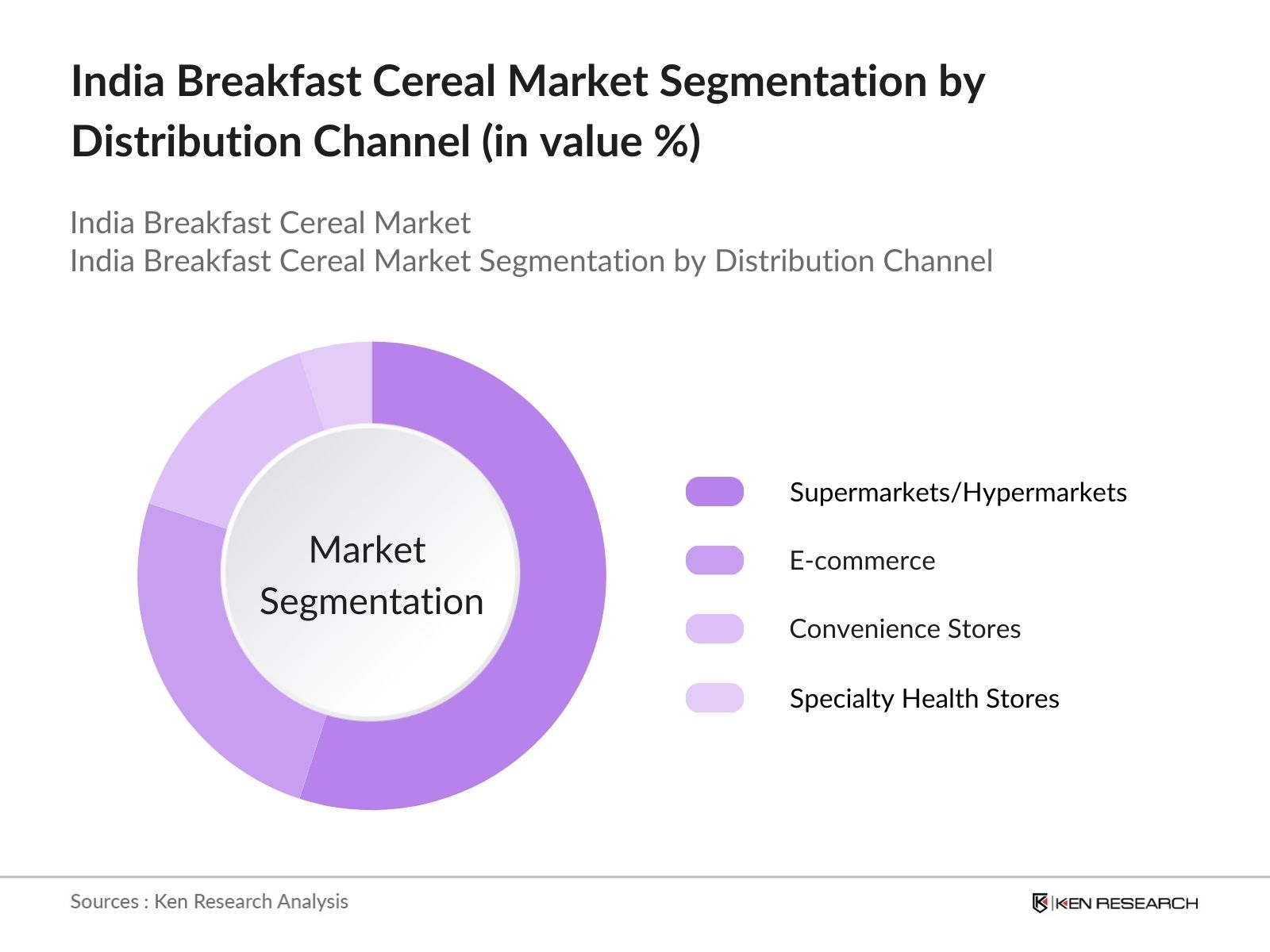

The India Breakfast Cereal market is segmented by product type by distribution channels.

- By Product Type: The India Breakfast Cereal market is segmented by product type into ready-to-eat cereals, hot cereals (such as oatmeal and porridge), granola, and muesli. Recently, ready-to-eat cereals have held a dominant market share due to their ease of preparation and convenience, particularly for urban consumers who seek quick meal options. Major brands like Kelloggs and Nestl have established significant market penetration through extensive distribution networks and brand loyalty. However, hot cereals such as oatmeal are gaining traction due to the rising demand for healthier options, driven by the increasing awareness of the nutritional benefits of oats, especially for heart health and weight management.

- By Distribution Channel: The India Breakfast Cereal market is further segmented by distribution channels, including supermarkets and hypermarkets, convenience stores, e-commerce, and specialty health stores. Supermarkets and hypermarkets hold the largest market share as they provide a wide variety of product choices, allowing consumers to compare prices and nutritional content easily. E-commerce is also emerging as a significant channel, particularly in Tier-1 and Tier-2 cities, owing to the increasing penetration of online grocery shopping platforms like BigBasket and Amazon. This shift towards online purchasing is driven by the convenience of home delivery and competitive pricing.

India Breakfast Cereal Market Competitive Landscape

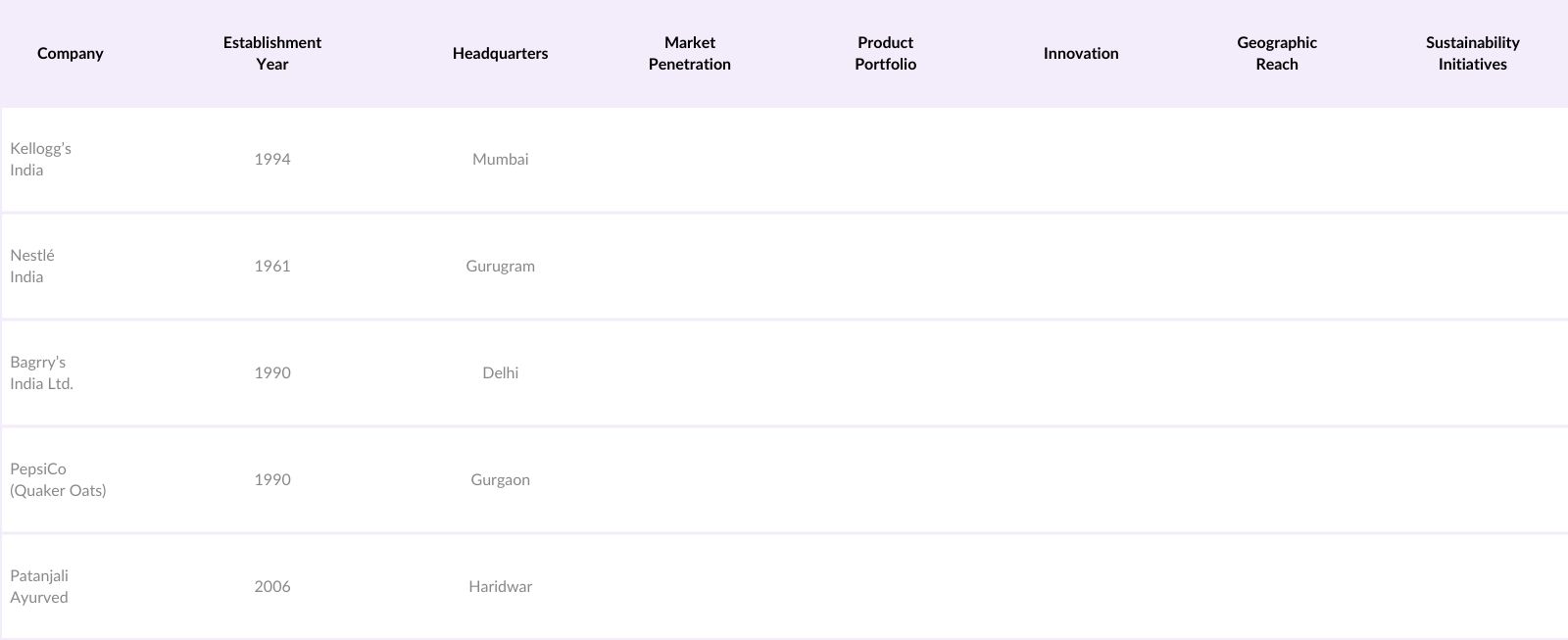

The India Breakfast Cereal market is characterized by the presence of both international and domestic players, creating a competitive landscape where companies strive for market share through product innovation and extensive distribution networks. The market is dominated by major international brands such as Kelloggs and Nestl, but local brands like Bagrrys and Patanjali Ayurved are gaining prominence due to their focus on natural and organic products.

The competition revolves around product differentiation, with health-focused brands tapping into the growing demand for organic, low-sugar, and gluten-free cereals. The established players maintain their dominance through aggressive marketing strategies and constant product innovation to cater to the evolving consumer preferences.

India Breakfast Cereal Industry Analysis

Growth Drivers

- Rising Health Awareness: The rise in health consciousness among Indian consumers has significantly impacted the breakfast cereal market. India, currently grappling with increasing lifestyle-related health issues like diabetes and obesity, has prompted a shift towards healthier food choices. According to the National Health Profile 2023, around 77 million people in India suffer from diabetes. This shift towards healthier diets is driving demand for breakfast cereals fortified with essential vitamins and minerals. The growing awareness of nutrition is further fueled by government campaigns like the "Eat Right India" initiative led by FSSAI.

- Increasing Disposable Income: India's per capita income rose to 170,620 in 2023-24, a significant increase from 150,326 in 2021-22, as per the Ministry of Statistics and Programme Implementation. The rise in disposable income, particularly among the middle class, has expanded the consumption of packaged and ready-to-eat foods, including breakfast cereals. As household income increases, consumers are increasingly opting for more premium, health-focused cereal brands, making breakfast cereals a staple in middle-income households.

- Expanding Retail Infrastructure: India's retail sector has seen rapid growth, supported by the government's push for infrastructural development. According to the Department of Industrial Policy and Promotion (DPIIT), the retail sector's gross value added (GVA) was 25.72 trillion in 2023, with a significant portion attributed to food and grocery. The expansion of organized retail in urban and semi-urban areas has provided better access to breakfast cereals, facilitating market growth. Modern retail outlets, which accounted for around 10% of India's retail market in 2023, offer wider product varieties and increased visibility for branded cereals.

Market Challenges

- Price Sensitivity among Consumers: India's breakfast cereal market faces price sensitivity challenges due to a diverse consumer base with varying purchasing power. While urban consumers may opt for premium products, rural consumers still prioritize affordability. According to data from the National Statistical Office (NSO), the rural per capita expenditure in India was 42,000 in 2023, considerably lower than in urban areas, making price a significant consideration for companies targeting rural markets.

- High Competition from Local and International Brands: The breakfast cereal market in India is highly competitive, with numerous local and international brands vying for market share. Companies such as Kelloggs and Nestl compete with local brands like Bagrry's and Patanjali. This competition is further exacerbated by the entry of new players in both the health and indulgence segments, leading to intense brand wars. Data from the Ministry of Commerce in 2023 shows that more than 50 players operated in the organized cereal market.

India Breakfast Cereal Market Future Outlook

Over the next five years, the India Breakfast Cereal market is expected to show moderate growth, driven by increasing health awareness, a growing urban population, and the rise of e-commerce platforms. The shift toward healthier eating habits, including a preference for low-sugar, organic, and gluten-free products, will be a key growth driver in the market. Furthermore, as consumers become more educated about nutrition and wellness, the demand for functional cereals with added vitamins, minerals, and probiotics is expected to rise, making this segment a critical area for product development.

Additionally, the penetration of breakfast cereals in Tier-2 and Tier-3 cities, facilitated by the expansion of modern trade channels and online platforms, will offer significant growth opportunities for manufacturers. However, the market will face challenges from fluctuating raw material prices and increased competition from traditional Indian breakfast options.

Market Opportunities

- Product Diversification (Gluten-Free, Organic, and Low-Sugar Cereals): The growing demand for health-focused products has opened opportunities for diversification in the breakfast cereal market. In 2023, the Ministry of Health and Family Welfare reported that India saw a rise in gluten intolerance, with an estimated 10 million people affected. This has created demand for gluten-free cereal options. Similarly, organic and low-sugar variants are gaining popularity due to rising concerns about diabetes and other lifestyle diseases.

- Expansion into Tier-2 and Tier-3 Cities: Tier-2 and Tier-3 cities present untapped growth opportunities for the breakfast cereal market. According to the National Sample Survey (2023), consumer spending in Tier-2 and Tier-3 cities grew by 17% year-on-year, driven by rising incomes and retail expansion. The increasing urbanization and growing disposable income in these cities have encouraged manufacturers to target these regions with affordable and regionally-tailored products.

Scope of the Report

Products

Key Target Audience

Retailers and Distributors

Breakfast Cereal Manufacturers

Health and Wellness Brands

Packaging Suppliers

Government and Regulatory Bodies (FSSAI)

Investments and Venture Capitalist Firms

E-commerce Platforms

Food Service Providers

Companies

Players Mention in the Report:

Kelloggs India

Nestl India

Bagrrys India Ltd.

Patanjali Ayurved

PepsiCo (Quaker Oats)

Marico Ltd. (Saffola)

True Elements

Soulfull (Tata Consumer Products)

MTR Foods

Yoga Bar

Hershey India

General Mills India

Eco Valley Organic

Mohan Meakin (Old Monk Cornflakes)

Hindustan Unilever

Table of Contents

1. India Breakfast Cereal Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Growth driven by consumer demand for convenience, health consciousness, and increased urbanization)

1.4. Market Segmentation Overview

2. India Breakfast Cereal Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones (Introduction of new product lines, increasing demand for gluten-free and organic cereals)

3. India Breakfast Cereal Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Awareness

3.1.2. Increasing Disposable Income

3.1.3. Expanding Retail Infrastructure

3.1.4. Growing Urbanization

3.1.5. Shift towards Convenience Foods

3.1.6. Government Initiatives on Nutrition Programs

3.2. Market Challenges

3.2.1. Price Sensitivity among Consumers

3.2.2. High Competition from Local and International Brands

3.2.3. Raw Material Price Fluctuations

3.2.4. Limited Penetration in Rural Markets

3.3. Opportunities

3.3.1. Product Diversification (Gluten-Free, Organic, and Low-Sugar Cereals)

3.3.2. Expansion into Tier-2 and Tier-3 Cities

3.3.3. E-commerce Penetration

3.3.4. Collaborations with Health and Fitness Influencers

3.4. Trends

3.4.1. Focus on Functional Ingredients (Protein-Rich, Fiber-Rich)

3.4.2. Premiumization of Products

3.4.3. Sustainability in Packaging

3.4.4. Personalization in Product Offerings (Customized Cereal Mixes)

3.5. Government Regulations

3.5.1. FSSAI Guidelines for Nutritional Labeling

3.5.2. Food Fortification Regulations

3.5.3. Sugar and Salt Reduction Initiatives

3.5.4. Sustainability and Environmental Regulations in Packaging

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Retailers, E-commerce Platforms, Distributors)

3.8. Porters Five Forces (Bargaining Power of Suppliers, Buyers, Threat of New Entrants, etc.)

3.9. Competition Ecosystem

4. India Breakfast Cereal Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ready-to-Eat Cereal

4.1.2. Hot Cereal (Oatmeal, Porridge)

4.1.3. Granola and Muesli

4.1.4. Others (Cereal Bars, Cornflakes)

4.2. By Ingredients (In Value %)

4.2.1. Wheat-Based

4.2.2. Rice-Based

4.2.3. Oat-Based

4.2.4. Corn-Based

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. E-commerce

4.3.4. Specialty Stores

4.4. By Consumer Age Group (In Value %)

4.4.1. Children

4.4.2. Adults

4.4.3. Senior Citizens

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Breakfast Cereal Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Kelloggs India

5.1.2. PepsiCo India

5.1.3. Bagrrys India Ltd.

5.1.4. Nestl India

5.1.5. Marico Ltd.

5.1.6. Patanjali Ayurved

5.1.7. MTR Foods

5.1.8. Quaker Oats (PepsiCo)

5.1.9. True Elements

5.1.10. Saffola (Marico)

5.1.11. Yoga Bar

5.1.12. Hershey India

5.1.13. General Mills India

5.1.14. Soulfull (Tata Consumer Products)

5.1.15. Eco Valley Organic

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Market Penetration, Geographic Reach, Sustainability Initiatives, Product Innovation, Pricing Strategy, Customer Loyalty Programs)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Breakfast Cereal Market Regulatory Framework

6.1. Nutritional Standards

6.2. Compliance Requirements (FSSAI Guidelines)

6.3. Certification Processes (Organic, Gluten-Free Certifications)

7. India Breakfast Cereal Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Growing E-commerce, Changing Consumer Preferences, Increasing Health Consciousness)

8. India Breakfast Cereal Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredients (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Consumer Age Group (In Value %)

8.5. By Region (In Value %)

9. India Breakfast Cereal Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior and Preferences Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Breakfast Cereal market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the India Breakfast Cereal market is compiled and analyzed. This includes assessing market penetration, the ratio of retail outlets to population density, and the resultant revenue generation. Furthermore, an evaluation of product quality and consumer preferences will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through interviews with industry experts and representatives from major companies. These consultations provide valuable insights into both the operational and financial aspects of the market, which are instrumental in refining the analysis.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with breakfast cereal manufacturers to acquire detailed insights into sales performance, consumer preferences, and emerging trends. This interaction complements the quantitative analysis derived from desk research, ensuring a comprehensive and accurate market report.

Frequently Asked Questions

01. How big is the India Breakfast Cereal market?

The India Breakfast Cereal market was valued at USD 4.64 billion, driven by rising urbanization, increased disposable income, and growing health awareness among consumers.

02. What are the challenges in the India Breakfast Cereal market?

Key challenges in India Breakfast Cereal market include price sensitivity, competition from traditional Indian breakfasts, and fluctuating raw material costs, which can impact the profitability of breakfast cereal manufacturers.

03. Who are the major players in the India Breakfast Cereal market?

Major players in the India Breakfast Cereal market include Kelloggs India, Nestl India, Bagrrys, Patanjali Ayurved, and PepsiCo (Quaker Oats). These companies dominate the market due to their extensive distribution networks and product innovation.

04. What are the growth drivers of the India Breakfast Cereal market?

The India Breakfast Cereal market is propelled by increasing health awareness, a growing working population, and the rising demand for convenience foods. Moreover, the growing availability of e-commerce platforms is boosting sales of breakfast cereals.

05. What are the emerging trends in the India Breakfast Cereal market?

Emerging trends include the rising demand for organic, gluten-free, and low-sugar cereals, as well as an increasing focus on sustainable packaging and functional food ingredients.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.