India Bubble Tea Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD10576

November 2024

96

About the Report

India Bubble Tea Market Overview

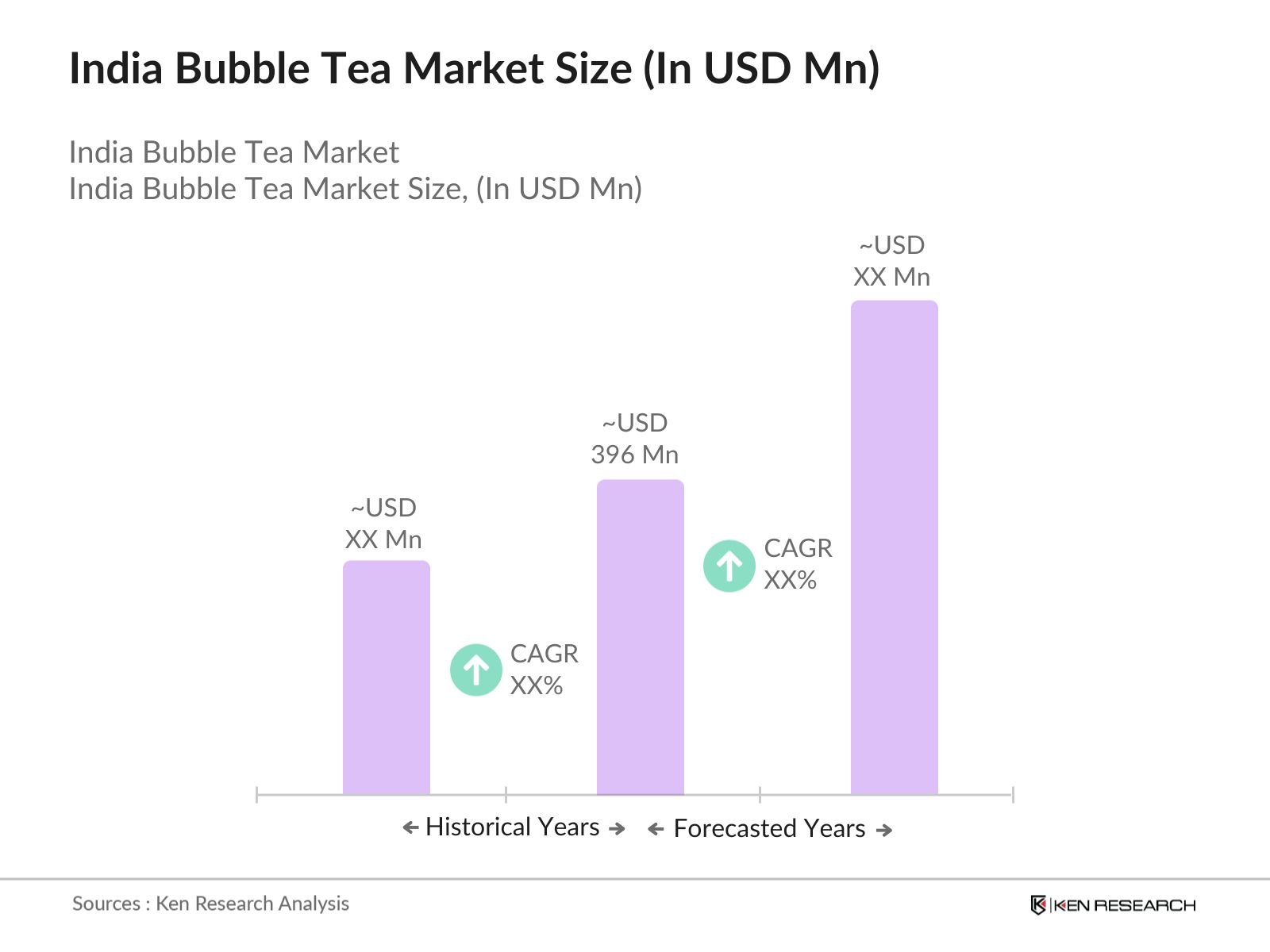

- The India Bubble Tea market is valued at USD 396 million, based on a five-year historical analysis. The market is primarily driven by the increasing popularity of non-alcoholic beverages, especially among the younger population seeking unique and flavorful options. Urban areas, particularly Tier I and II cities, have seen a surge in demand due to the proliferation of cafs and the adoption of bubble tea as a trendy beverage choice. The growth is also supported by expanding online delivery platforms, making bubble tea more accessible to a broader consumer base.

- Cities such as Mumbai, Delhi, and Bengaluru dominate the India Bubble Tea market due to their cosmopolitan lifestyle, high disposable incomes, and a growing caf culture. These urban centers are hubs for culinary trends, attracting younger consumers who are more willing to experiment with different flavors and varieties. The presence of a high concentration of bubble tea outlets and international chains further reinforces their leadership in the market, making them trendsetters for new product launches.

- The Food Safety and Standards Authority of India (FSSAI) enforces stringent standards for the ingredients used in beverages, including bubble tea. In 2023, over 1,200 inspections were conducted on tea-based beverages to ensure compliance with safety regulations. These regulations cover permissible additives, quality standards for imported ingredients, and labeling requirements. Compliance with FSSAI standards is crucial for bubble tea brands to maintain product quality and avoid penalties, ensuring safe and standardized products for consumers.

India Bubble Tea Market Segmentation

By Flavor: The market is segmented by flavor into classic milk tea, fruit-flavored tea, matcha-flavored tea, and others (such as taro and coffee). Recently, classic milk tea holds a dominant position under this segmentation due to its strong appeal among Indian consumers. The rich and creamy texture combined with the familiarity of milk-based beverages resonates well with local preferences. Additionally, many international and local brands offer innovative twists to the classic flavor, maintaining its popularity.

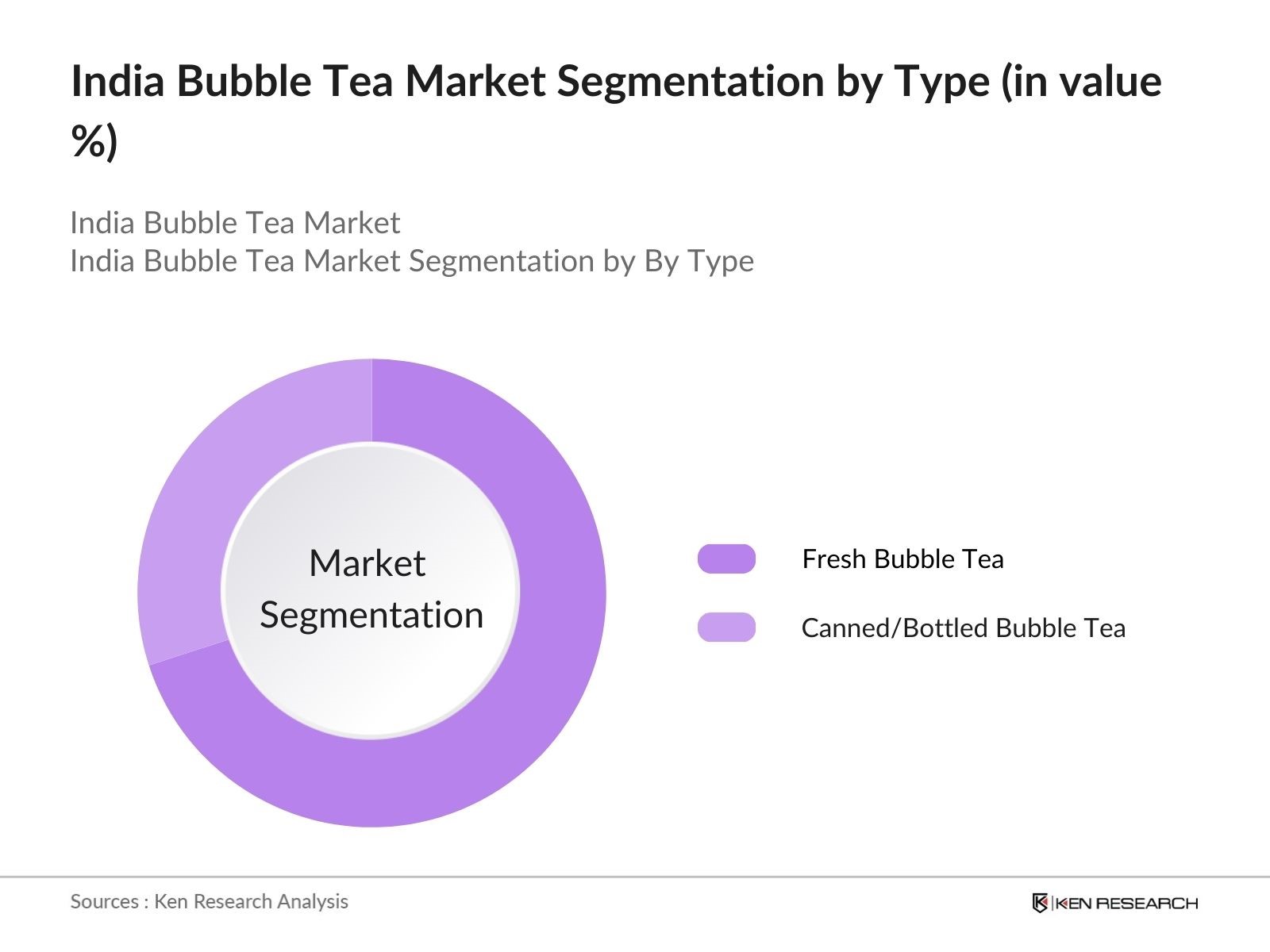

By Type: The market is segmented by type into fresh bubble tea and canned/bottled bubble tea. Fresh bubble tea dominates the market share due to the preference for freshly prepared beverages, particularly in urban cafs and specialty stores. Consumers appreciate the customizable nature of fresh bubble tea, where they can adjust sweetness levels and choose their preferred toppings. This type also benefits from the growing trend of experiential dining, where customers can watch their beverages being prepared.

India Bubble Tea Market Competitive Landscape

The India Bubble Tea market is characterized by the presence of both local and international players, contributing to a dynamic competitive environment. Major companies include those with robust franchise networks and localized flavors tailored to Indian tastes. This competitive landscape is marked by continuous product innovations and marketing campaigns targeting youth.

|

Company Name |

Establishment Year |

Headquarters |

Number of Outlets |

Revenue (INR Mn) |

Popular Flavors |

Distribution Channels |

Brand Loyalty |

Marketing Strategies |

Partnerships |

|

Chaayos |

2012 |

New Delhi |

|||||||

|

Dr. Bubbles |

2015 |

Mumbai |

|||||||

|

Bubble Tea Caf |

2010 |

Bengaluru |

|||||||

|

Gong Cha |

2016 |

Taipei |

|||||||

|

Chai Point |

2010 |

Bengaluru |

India Bubble Tea Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Non-Alcoholic Beverages: The demand for non-alcoholic beverages in India has been growing significantly, driven by changing consumer preferences and urbanization. According to the World Bank, urbanization in India reached 35.4% in 2022, contributing to increased consumption of beverages like bubble tea in cities. In 2023, Indias non-alcoholic beverage market saw a rise in consumption volume, with a noticeable shift toward innovative drinks like bubble tea, reflecting evolving consumer tastes. Additionally, disposable income levels in urban areas have increased, reaching INR 2,64,000 per capita in 2023, further encouraging spending on premium non-alcoholic beverages.

- Rising Popularity of Asian Flavors and Culture: The popularity of Asian flavors has been rising in India, driven by a growing interest in international cuisines. Bubble tea, a well-known Asian drink, has gained traction among young consumers, contributing to the expansion of specialized tea outlets. India's cultural exchanges with East Asian countries increased by 15% between 2022 and 2023, leading to a stronger presence of Asian food and drink brands. This cultural influence has spurred interest in bubble tea flavors like matcha and jasmine, which have become a popular choice in urban cafs.

- Expansion of Caf Culture in Tier I and Tier II Cities: Caf culture in Tier I and Tier II cities is witnessing a robust expansion, with bubble tea being a trendy addition to menus. In 2023, there were over 11,500 registered caf outlets across major Indian cities, according to the Ministry of Commerce and Industry. The rise of such cafs in Tier II cities like Indore and Chandigarh has introduced new beverage choices, including bubble tea, to a broader audience. This urbanization, coupled with an increase in disposable income, is driving the growth of bubble tea as a preferred social beverage among the youth.

Market Challenges

- Fluctuating Raw Material Prices: The bubble tea industry in India faces challenges due to the fluctuating prices of raw materials like tapioca pearls and tea leaves. According to the Reserve Bank of India (RBI), the wholesale price index for tea increased by 8% between 2022 and 2023, which directly affects the cost structure for bubble tea manufacturers. Additionally, tapioca imports, primarily from Southeast Asian countries, saw a price volatility of 5-7% in 2023 due to changing trade policies. These fluctuations pose a challenge for bubble tea outlets to maintain consistent pricing without affecting their margins.

- Limited Awareness in Rural Markets: While bubble tea is popular in urban centers, its awareness and acceptance remain limited in rural markets. According to data from the National Sample Survey Office (NSSO), urban households accounted for 75% of Indias packaged beverage consumption in 2023. Rural markets, with lower exposure to global food trends, pose a challenge for bubble tea brands aiming to expand their reach. Despite having a large consumer base, these areas require targeted awareness campaigns and distribution networks, which can be resource-intensive for brands focusing on rapid urban market expansion.

India Bubble Tea Market Future Outlook

The India Bubble Tea market is poised for substantial growth, driven by the increasing awareness of specialty beverages among young consumers and the rapid expansion of caf culture. The market's future trajectory will likely benefit from the rising popularity of health-oriented variants, such as low-sugar or plant-based bubble tea options. Additionally, increasing investments in franchising and the expansion of international bubble tea brands are expected to create more accessibility and variety for consumers. The rise of food-tech platforms and partnerships with online delivery services will further enhance market penetration.

Future Market Opportunities

- Expansion through Franchising Models: Franchising is emerging as a key growth opportunity for bubble tea brands in India, allowing rapid market penetration without substantial capital investment. In 2023, the Indian franchise industry generated INR 1,000 billion in revenue, with the food and beverage segment being one of the fastest-growing sectors. Bubble tea brands are leveraging this trend to expand their presence in Tier II and Tier III cities, tapping into local entrepreneurs' interest in low-investment, high-return business models. This expansion through franchising has enabled brands to establish a presence in regions with high growth potential.

- Growth in Online Delivery Channels: The growth of online delivery channels presents a significant opportunity for bubble tea brands to reach a wider customer base. Data from the Department for Promotion of Industry and Internal Trade (DPIIT) indicated that online food delivery transactions in India reached 120 million orders in 2023, with a growing preference for beverages like bubble tea. Brands have partnered with delivery platforms like Swiggy and Zomato, facilitating seamless access to customers in both urban and semi-urban areas. The increasing popularity of online ordering offers bubble tea brands an effective channel to drive sales and customer engagement.

Scope of the Report

|

By Flavor |

Classic Milk Tea Fruit-Flavored Tea Matcha-Flavored Tea Others |

|

By Ingredient |

Tea Base (Black, Green, Oolong) Tapioca Pearls Sweeteners Creamers |

|

By Type |

Fresh Bubble Tea Canned/Bottled Bubble Tea |

|

By End-user |

Cafes & Specialty Stores Online Delivery Channels QSRs Household Consumption |

|

By Region |

North South East West |

Products

Key Target Audience

Bubble Tea Manufacturers

Caf and Restaurant Chains

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Online Delivery Platforms

Franchise Operators

Raw Material Suppliers (Tea, Tapioca Pearls)

Food and Beverage Distributors

Banks and Financial Institutions

Companies

Major Players

Chaayos

Dr. Bubbles

Bubble Tea Caf

Gong Cha

Chai Point

Tea Trails

The Bubble Tea Factory

Starbucks India (Bubble Tea Offerings)

The Coffee Bean & Tea Leaf

CoCo Fresh Tea & Juice

ShareTea India

Yi Fang Tea

Drunken Monkey

Cha Bar

Bubblelicious Tea

Table of Contents

1. India Bubble Tea Market Overview

- 1.1. Definition and Scope

- 1.2. Market Taxonomy

- 1.3. Market Growth Rate (Growth Rate %)

- 1.4. Market Segmentation Overview (Flavor, Ingredient, Type, End-user, Region)

2. India Bubble Tea Market Size (In INR Mn)

- 2.1. Historical Market Size

- 2.2. Year-On-Year Growth Analysis (In %)

- 2.3. Key Market Developments and Milestones

3. India Bubble Tea Market Analysis

- 3.1. Growth Drivers

- 3.1.1. Increasing Consumer Demand for Non-Alcoholic Beverages

- 3.1.2. Rising Popularity of Asian Flavors and Culture

- 3.1.3. Expansion of Caf Culture in Tier I and Tier II Cities

- 3.1.4. Product Innovations (Bubble Tea Variants)

- 3.2. Market Challenges

- 3.2.1. Fluctuating Raw Material Prices (Tapioca, Tea Leaves)

- 3.2.2. Regulatory Compliance for Imported Ingredients

- 3.2.3. Limited Awareness in Rural Markets

- 3.3. Opportunities

- 3.3.1. Expansion through Franchising Models

- 3.3.2. Growth in Online Delivery Channels

- 3.3.3. Increasing Health Consciousness (Low-Sugar Variants)

- 3.4. Trends

- 3.4.1. Incorporation of Organic Ingredients

- 3.4.2. Seasonal Flavor Launches (Mango, Matcha)

- 3.4.3. Use of Eco-Friendly Packaging Solutions

- 3.5. Government Regulations

- 3.5.1. FSSAI Standards for Beverage Ingredients

- 3.5.2. Import Tariffs on Key Ingredients

- 3.5.3. GST Impact on Bubble Tea Pricing

- 3.6. SWOT Analysis

- 3.7. Stakeholder Ecosystem (Suppliers, Distributors, Retailers)

- 3.8. Porters Five Forces Analysis

- 3.9. Competitive Ecosystem

4. India Bubble Tea Market Segmentation

- 4.1. By Flavor (In Value %)

- 4.1.1. Classic Milk Tea

- 4.1.2. Fruit-Flavored Tea

- 4.1.3. Matcha-Flavored Tea

- 4.1.4. Others (Taro, Coffee)

- 4.2. By Ingredient (In Value %)

- 4.2.1. Tea Base (Black Tea, Green Tea, Oolong Tea)

- 4.2.2. Tapioca Pearls

- 4.2.3. Sweeteners (Sugar, Honey)

- 4.2.4. Creamers (Dairy, Non-Dairy)

- 4.3. By Type (In Value %)

- 4.3.1. Fresh Bubble Tea

- 4.3.2. Canned/Bottled Bubble Tea

- 4.4. By End-user (In Value %)

- 4.4.1. Cafes & Specialty Stores

- 4.4.2. Online Delivery Channels

- 4.4.3. Quick Service Restaurants (QSRs)

- 4.4.4. Household Consumption

- 4.5. By Region (In Value %)

- 4.5.1. North India

- 4.5.2. South India

- 4.5.3. East India

- 4.5.4. West India

- 4.5.5. Central India

5. India Bubble Tea Market Competitive Analysis

- 5.1. Detailed Profiles of Major Companies

- 5.1.1. Chaayos

- 5.1.2. Dr. Bubbles

- 5.1.3. Bubble Tea Caf

- 5.1.4. Bubblelicious Tea

- 5.1.5. Chai Point

- 5.1.6. Tea Trails

- 5.1.7. ShareTea India

- 5.1.8. Gong Cha

- 5.1.9. The Bubble Tea Factory

- 5.1.10. Drunken Monkey

- 5.1.11. Cha Bar

- 5.1.12. The Coffee Bean & Tea Leaf

- 5.1.13. Yi Fang Tea

- 5.1.14. Starbucks India (Bubble Tea Offerings)

- 5.1.15. CoCo Fresh Tea & Juice

- 5.2. Cross Comparison Parameters (No. of Stores, Revenue, Popular Flavors, Market Penetration, Partnerships, Pricing Strategy, Marketing Spend, Customer Base)

- 5.3. Market Share Analysis (In Value %)

- 5.4. Strategic Initiatives (Product Launches, Store Expansions)

- 5.5. Mergers and Acquisitions

- 5.6. Investment Analysis (FDI, Venture Capital)

- 5.7. Funding Trends

- 5.8. Government Incentives for Small Enterprises

- 5.9. Marketing Strategies (Digital Campaigns, Social Media Influence)

6. India Bubble Tea Market Regulatory Framework

- 6.1. FSSAI Compliance

- 6.2. Labeling Requirements for Beverage Products

- 6.3. Health and Safety Standards

- 6.4. Import Regulations for Key Ingredients

7. India Bubble Tea Market Future Market Size (In INR Mn)

- 7.1. Future Market Size Projections

- 7.2. Key Factors Driving Future Market Growth

8. India Bubble Tea Market Future Market Segmentation

- 8.1. By Flavor (In Value %)

- 8.2. By Ingredient (In Value %)

- 8.3. By Type (In Value %)

- 8.4. By End-user (In Value %)

- 8.5. By Region (In Value %)

9. India Bubble Tea Market Analysts Recommendations

- 9.1. TAM/SAM/SOM Analysis

- 9.2. Market Entry Strategy

- 9.3. Customer Cohort Analysis

- 9.4. Strategic Partnerships for Expansion

- 9.5. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Bubble Tea Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Bubble Tea Market. This includes assessing market penetration, the ratio of cafs to specialty stores, and the resultant revenue generation. Furthermore, an evaluation of product segment performance will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple bubble tea manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Bubble Tea Market.

Frequently Asked Questions

01. How big is the India Bubble Tea Market?

The India Bubble Tea market is valued at USD 396 million, based on a five-year historical analysis. The market is driven by the increasing demand for unique non-alcoholic beverages and expanding caf culture.

02. What are the challenges in the India Bubble Tea Market?

Challenges in the India Bubble Tea market include the fluctuating prices of raw materials such as tapioca pearls and tea leaves, as well as regulatory compliance for imported ingredients. Additionally, limited awareness in rural regions restricts market penetration.

03. Who are the major players in the India Bubble Tea Market?

Key players in the India Bubble Tea market include Chaayos, Gong Cha, Dr. Bubbles, Chai Point, and The Bubble Tea Factory. These companies dominate due to their extensive outlet networks, diverse product offerings, and strong brand presence.

04. What are the growth drivers of the India Bubble Tea Market?

The India Bubble Tea market is propelled by the increasing popularity of caf culture, the rise of online delivery platforms, and a growing preference for unique and customizable beverage options among young consumers.

05. Why is fresh bubble tea more popular than bottled options in India?

Fresh bubble tea is more popular in the India Bubble Tea market due to its customizable nature and the emphasis on freshly prepared beverages in Indian cafs. The experiential aspect of watching bubble tea being made also appeals to younger consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.