India Bus Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD3923

October 2024

90

About the Report

India Bus Market Overview

- The India bus market was at 50 Th units, based on a five-year historical analysis. The growth is driven by a combination of increasing urbanization and the government's focus on public transportation initiatives, including the expansion of electric bus fleets. Key government programs, such as the FAME scheme, and rising demand for sustainable transport solutions are further propelling the market.

- Dominant cities like Delhi, Mumbai, and Bengaluru lead the market due to their well-developed public transport infrastructure and higher population densities. These cities have consistently invested in expanding and modernizing their bus fleets to meet the growing demand for reliable and efficient urban transportation, making them key players in the national bus market.

- The Government of India has significantly bolstered public transport through initiatives like the Smart Cities Mission and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) II scheme. The Smart Cities Mission, targeting 100 cities across the nation, aims to improve urban infrastructure, with a budget of INR 6,000 crore ($725 million) in 2023 specifically earmarked for public transport development. This initiative prioritizes the integration of electric buses in public transit systems. Moreover, FAME II allocated INR 10,000 crore ($1.2 billion) in subsidies for electric buses, promoting electrification and modernization of bus fleets. Data from the Ministry of Road Transport and Highways highlights a 25% increase in electric bus deployment in 2023, driven by these schemes.

India Bus Market Segmentation

By Vehicle Type: The market is segmented by vehicle type into electric buses, diesel buses, hybrid buses, CNG buses, and LNG buses. Electric buses have recently emerged as a dominant segment due to government policies promoting eco-friendly public transport, such as FAME II, which offers incentives for the adoption of electric buses. These vehicles are favored in urban areas for reducing pollution and offering cost-effective, long-term benefits.

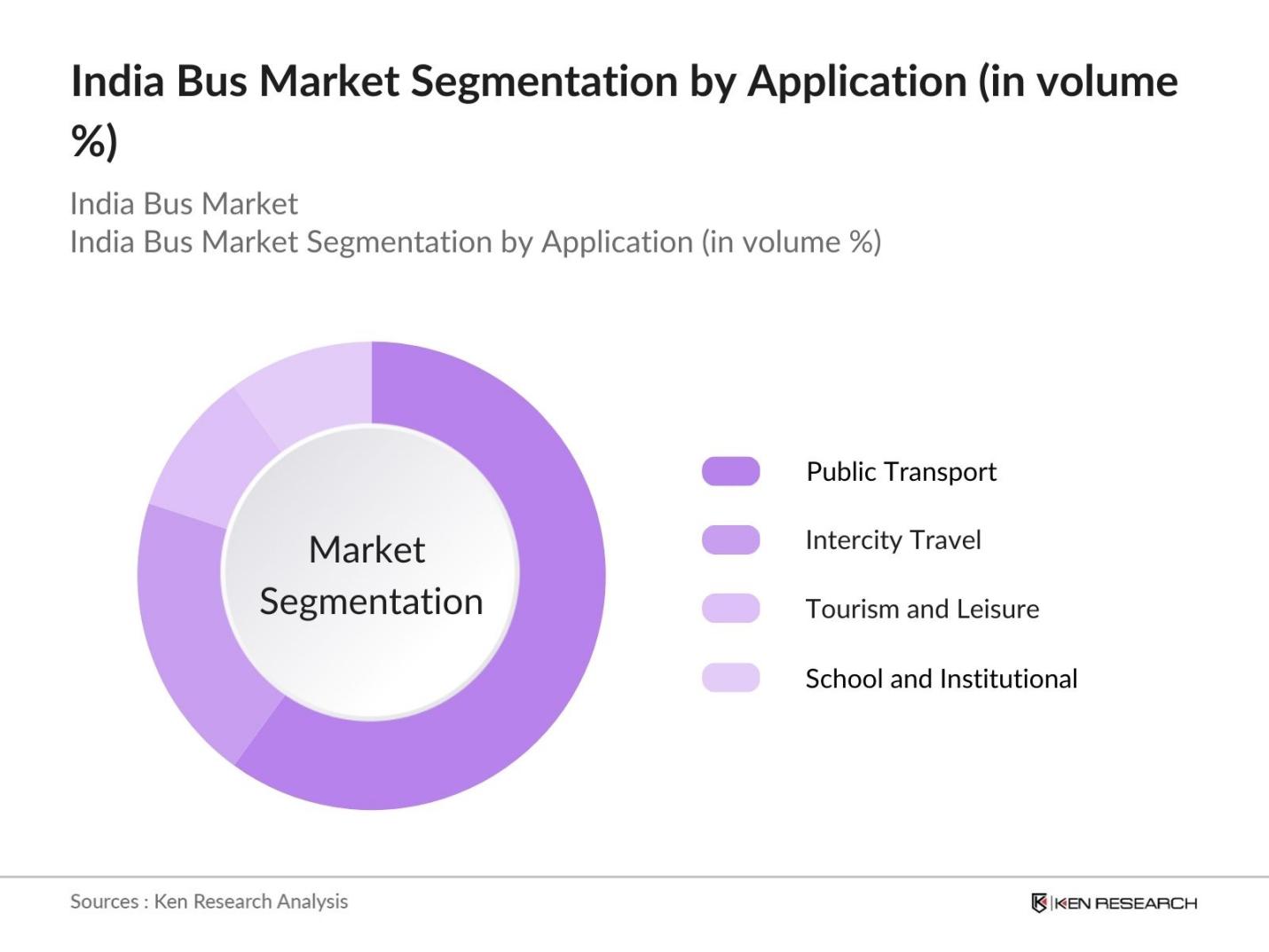

By Application: Market is segmented by application into public transport, intercity travel, tourism and leisure, and school and institutional buses. Public transport dominates the market due to the growing demand for mass transit systems in urban centers. This is bolstered by infrastructure development projects aimed at increasing public transport penetration in key cities, reducing traffic congestion, and lowering emissions.

India Bus Market Competitive Landscape

The India bus market is dominated by a few major players, including Tata Motors, Ashok Leyland, and Volvo Buses. This consolidation highlights the influence of these key companies in shaping the market landscape through product innovation and strategic partnerships with government bodies.

|

Company Name |

Establishment Year |

Headquarters |

Annual Revenue |

Employees |

Key Product |

R&D Investment |

Global Presence |

Electric Bus Models |

|

Tata Motors |

1945 |

Mumbai, India |

||||||

|

Ashok Leyland |

1948 |

Chennai, India |

||||||

|

Volvo Buses |

1968 |

Bengaluru, India |

||||||

|

Eicher Motors |

1948 |

Gurgaon, India |

||||||

|

Mahindra & Mahindra |

1945 |

Mumbai, India |

India Bus Industry Analysis

Growth Drivers

-

Urbanization and Population Growth: India's rapid urbanization has created enormous demand for mass transit systems. According to the World Bank, Indias urban population reached 500 million in 2024, representing over 35% of the total population. The rise in urban sprawl has strained existing transport systems, prompting the need for better connectivity through buses. In cities like Mumbai and Bengaluru, public bus services form the backbone of daily commutes for over 20 million people. This growing need for mass transit solutions, coupled with rural-to-urban migration, presents opportunities for fleet expansion, with a focus on last-mile connectivity.

- Demand for Sustainable Transport: Indias increasing emphasis on sustainability has led to a surge in demand for electric buses. As part of its commitment to the Paris Agreement, India aims to reduce carbon emissions by 33% by 2030, a goal supported by government-backed initiatives promoting green mobility. According to data from the Central Electricity Authority, the share of electric vehicles, including buses, in public transport increased by 19% in 2023. Additionally, state governments such as those in Delhi and Maharashtra have launched dedicated schemes to transition to electric buses, reducing reliance on fossil fuels and contributing to Indias net-zero emissions target for 2070.

- Economic Factors: Economic growth in India has been a crucial driver of bus market expansion. With a GDP of $3.7 trillion in 2024, up from $3.4 trillion in 2022, and per capita income reaching $2,500, rising disposable income allows more citizens to opt for safer and comfortable bus travel options. Additionally, rural-urban migration continues to grow, with over 35% of the population now residing in urban areas as of 2024. This shift has intensified the need for mass transit systems to manage the increasing commuter load. Rural bus connectivity has also improved, with more buses catering to intercity routes, providing affordable and accessible transport options for the lower-income population.

Market Challenges

-

Inadequate Charging Infrastructure for E-Buses: While the adoption of electric buses is increasing, inadequate charging infrastructure remains a major bottleneck. Data from the Ministry of Power reveals that as of 2024, India has approximately 5,000 public charging stations, with only 30% supporting heavy-duty vehicles like buses. This deficit has created challenges in the widespread deployment of electric buses in both urban and rural regions. A single electric bus typically requires charging facilities every 200-250 kilometers, and the absence of a widespread charging network limits operational efficiency, particularly on long-distance routes. This constraint necessitates further investment in charging infrastructure to support the anticipated growth in electric bus fleets.

- Regulatory Challenges (Environmental, Emission Standards): Regulatory challenges, particularly concerning environmental and emission standards, have created compliance hurdles for bus manufacturers and operators. India's transition to BS-VI (Bharat Stage VI) emission standards, implemented in April 2020, requires buses to comply with stricter emissions controls, leading to increased costs of production and maintenance. The Ministry of Environment, Forest, and Climate Change estimates that transitioning to BS-VI compliant buses added around INR 10 lakh per bus in additional costs. Additionally, compliance with state-level environmental regulations further complicates the deployment of new buses, slowing market growth.

India Bus Market Future Outlook

Over the next five years, the India bus market is expected to see significant growth, driven by continuous government initiatives for promoting electric buses, infrastructure development, and public-private partnerships for enhancing public transportation systems. The shift towards sustainable urban mobility and the adoption of electric buses across major cities are set to shape the future of the market.

Future Market Opportunities

-

Partnerships with OEMs for Electric and Hybrid Buses: Collaborations between Original Equipment Manufacturers (OEMs) and state transport corporations are creating opportunities for the production and deployment of electric and hybrid buses. In 2023, the Delhi Transport Corporation partnered with Tata Motors to introduce 1,500 electric buses to its fleet, making it one of the largest such initiatives in the country. These partnerships enable technology transfer, reduce operational costs, and enhance access to innovative bus models. With OEMs focusing on both electric and hybrid technologies, future collaborations are expected to significantly increase the adoption of environmentally friendly buses across India's metropolitan areas.

- Expansion into Rural Markets: The expansion of bus services into rural areas offers immense potential for market growth. According to the Ministry of Rural Development, over 68% of India's population resides in rural regions, where public transportation infrastructure remains underdeveloped. Government schemes like the Pradhan Mantri Gram Sadak Yojana, which has built over 600,000 kilometers of rural roads since its inception, have opened new routes for buses, improving last-mile connectivity. In 2023, rural bus services saw a 15% increase in new routes, providing essential transport links for education, healthcare, and employment. The focus on rural connectivity is expected to continue driving bus demand in these regions.

Scope of the Report

|

By Vehicle Type |

Electric Buses Diesel Buses Hybrid Buses CNG Buses LNG Buses |

|

By Fuel Type |

Electric Diesel Hybrid |

|

By Application |

Public Transport Intercity Travel Tourism School and Institutional Buses |

|

By Capacity |

Light Buses Medium Buses Heavy Buses |

|

By Region |

North South East West |

Products

Key Target Audience

Electric Bus Manufacturers

Bus Fleet Operators

Public Transportation Authorities

Private Bus Operators

Urban Infrastructure Developers

Venture Capital and Investment Firms

OEMs and Component Suppliers

Banks and Financial Institutes

Government & Regulatory Bodies (Ministry of Road Transport and Highways, Department of Heavy Industry)

Companies

Players Mentioned in the Report:

Tata Motors

Ashok Leyland

Volvo Buses

Eicher Motors

Mahindra & Mahindra

BharatBenz

JBM Auto

Force Motors

BYD India

Scania India

Olectra Greentech

Piaggio Vehicles Pvt Ltd.

SML Isuzu

Swaraj Mazda

Tata Marcopolo Motors

Table of Contents

1. India Bus Market Overview

1.1. Definition and Scope (Market Size, Growth Potential, Major Players)

1.2. Market Taxonomy (Vehicle Type, Fuel Type, Application, Region)

1.3. Market Growth Rate (CAGR, Influencing Factors, Market Expansion)

1.4. Market Segmentation Overview (Segments, Sub-Segments, Key Factors)

2. India Bus Market Size (In Th units)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Bus Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives (Smart Cities, Electrification, Public Transport)

3.1.2. Urbanization and Population Growth (Mass Transit, Connectivity)

3.1.3. Demand for Sustainable Transport (Green Mobility, E-buses)

3.1.4. Economic Factors (Disposable Income, Rural-Urban Migration)

3.2. Restraints

3.2.1. High Capital Investment (Manufacturing, Infrastructure)

3.2.2. Regulatory Challenges (Environmental, Emission Standards)

3.2.3. Inadequate Charging Infrastructure for E-Buses

3.2.4. Competition from Alternate Modes of Transportation

3.3. Opportunities

3.3.1. Electrification of Fleet (Battery Technology, Charging Networks)

3.3.2. Expansion into Rural Markets (Last-Mile Connectivity, New Routes)

3.3.3. Partnerships with OEMs for Electric and Hybrid Buses

3.3.4. Export Opportunities (South Asian Markets, Middle East)

3.4. Trends

3.4.1. Adoption of Electric Buses (Fleet Modernization, Emission Norms)

3.4.2. Digitization in Public Transport (Smart Ticketing, Fleet Monitoring)

3.4.3. Customization of Buses for Specific Needs (School, Tourism, Intercity)

3.4.4. Integration with Shared Mobility Services (Ride-Sharing, Shuttle Buses)

3.5. Government Regulations

3.5.1. FAME II Scheme (Incentives, Subsidies for Electric Vehicles)

3.5.2. BS-VI Emission Standards (Compliance, Fleet Upgrade)

3.5.3. Public Transport Policies (Smart City Projects, Metro Feeder Buses)

3.5.4. Green Urban Mobility Initiatives (Sustainability, Reduced Congestion)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Operators, Government Agencies)

3.8. Porters Five Forces (Bargaining Power of Suppliers and Buyers, Threats)

3.9. Competition Ecosystem (Domestic vs. International Brands, Market Share)

4.India Bus Market Segmentation

4.1. By Vehicle Type (In Volume %)

4.1.1. Electric Buses

4.1.2. Diesel Buses

4.1.3. Hybrid Buses

4.1.4. CNG Buses

4.1.5. LNG Buses

4.2. By Fuel Type (In Volume %)

4.2.1. Electric

4.2.2. Diesel

4.2.3. Hybrid

4.3. By Application (In Volume %)

4.3.1. Public Transport

4.3.2. Intercity Travel

4.3.3. Tourism and Leisure

4.3.4. School and Institutional Buses

4.4. By Capacity (In Volume %)

4.4.1. Light Buses

4.4.2. Medium Buses

4.4.3. Heavy Buses

4.5. By Region (In Volume %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Bus Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Tata Motors

5.1.2. Ashok Leyland

5.1.3. Mahindra & Mahindra

5.1.4. Volvo Buses

5.1.5. Eicher Motors

5.1.6. BharatBenz (Daimler India)

5.1.7. JBM Auto

5.1.8. BYD India

5.1.9. Force Motors

5.1.10. Scania India

5.1.11. SML Isuzu

5.1.12. Swaraj Mazda

5.1.13. Olectra Greentech

5.1.14. Tata Marcopolo Motors

5.1.15. Piaggio Vehicles Pvt Ltd.

5.2 Cross Comparison Parameters (Market Share, Fleet Size, Production Capacity, Global Presence, Revenue, Employee Count, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Electrification, Collaborations)

5.5. Mergers And Acquisitions (Recent, Impact)

5.6. Investment Analysis (Public-Private Partnerships, Government Grants)

5.7 Venture Capital Funding (Startups, Innovators)

5.8. Private Equity Investments

6. India Bus Market Regulatory Framework

6.1. Vehicle Safety Standards (AIS 153, Crash Test Norms)

6.2. Emission Standards (BS-VI, Fuel Efficiency Norms)

6.3. Electric Vehicle Policies (Incentives for EV Adoption, Charging Infrastructure)

7. India Bus Future Market Size (In Th units)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Bus Market Future Segmentation

8.1. By Vehicle Type (In Volume %)

8.2. By Fuel Type (In Volume %)

8.3. By Application (In Volume %)

8.4. By Capacity (In Volume %)

8.5. By Region (In Volume %)

9. India Bus Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping the entire ecosystem of the India bus market, identifying key players, stakeholders, and market dynamics. Data from proprietary databases and secondary research sources will be utilized to pinpoint critical variables that shape the market.

Step 2: Market Analysis and Construction

In this phase, historical data for the India bus market is compiled, assessing the penetration of various bus types, government policy impacts, and overall market development. This helps create a comprehensive picture of the market structure and its evolution.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts, fleet operators, and manufacturers. These consultations provide insights into operational challenges, technological advancements, and future market directions, enriching the data collected.

Step 4: Research Synthesis and Final Output

In this final phase, data is synthesized into actionable insights, covering market segmentation, competition analysis, and growth opportunities. Key statistics from both the top-down and bottom-up approaches are integrated to ensure accuracy and reliability in the final report.

Frequently Asked Questions

01. How big is the USA Bus Market?

The USA Bus market, was at 50 Th units, is driven by demand from healthcare, entertainment, and defense sectors, seeking advanced 3D visualization technologies.

02. What are the challenges in the USA Bus Market?

Key challenges include in India bus market are high deployment costs, limited consumer awareness, and technical limitations, such as processing power and high data load requirements.

03. Who are the major players in the USA Bus Market?

Major players in India bus market include Voxon Photonics, Leia Inc., LightSpace Technologies, RealView Imaging, and Holoxica Ltd. These companies lead the market with their technological innovations and diverse product portfolios.

04. What are the growth drivers of the USA Bus Market?

The India bus market is propelled by advancements in AR/VR, increased adoption in medical imaging, and the growing need for interactive 3D displays in industries like defense and entertainment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.