India Business Intelligence (BI) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5556

December 2024

99

About the Report

India Business Intelligence (BI) Market Overview

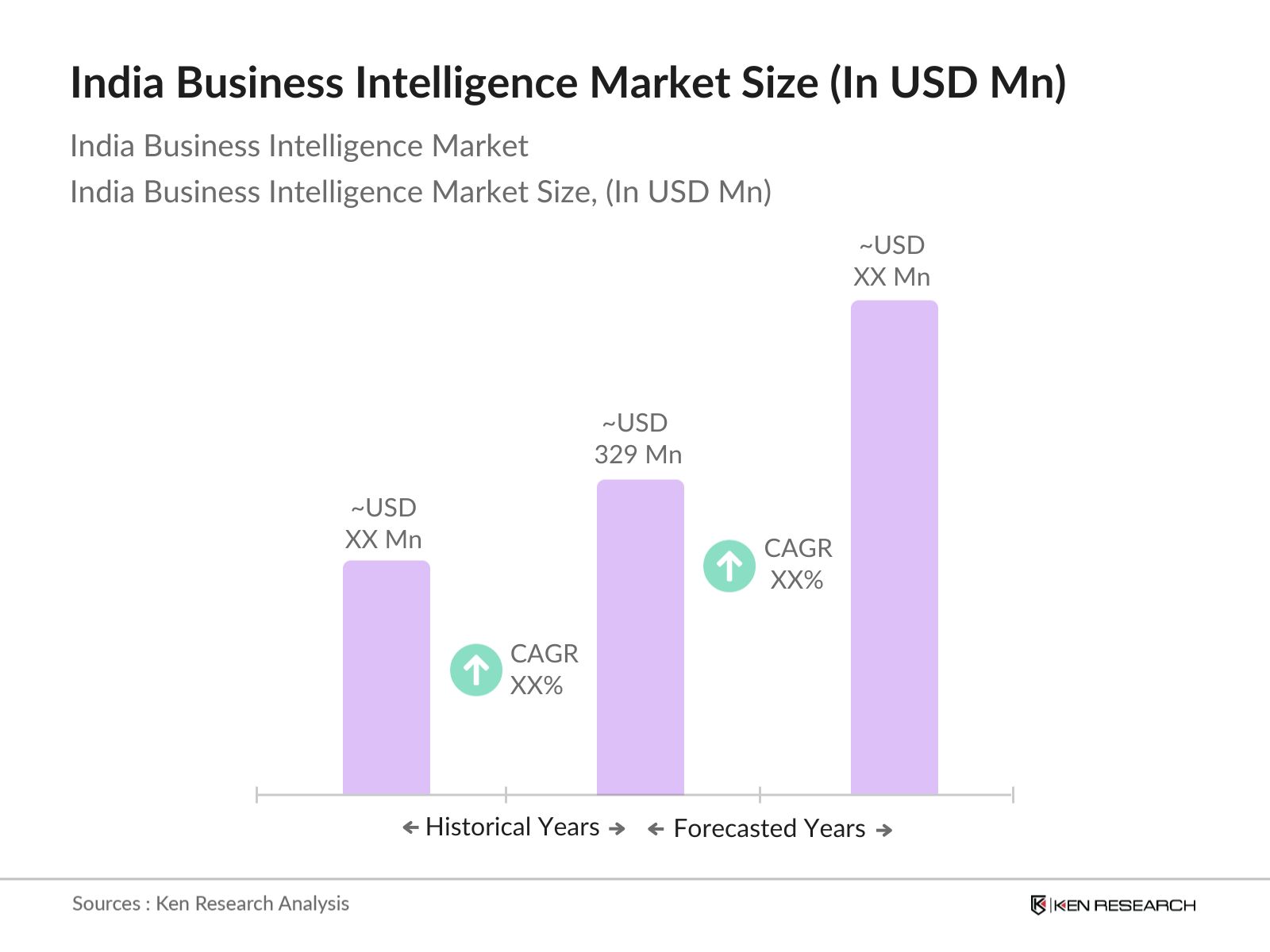

- The India Business Intelligence (BI) market is valued at USD 329 million, based on a five-year historical analysis. This market size is primarily driven by the increasing adoption of data-driven decision-making among businesses, digital transformation across industries, and the growing need for real-time data analytics. The integration of AI, machine learning, and cloud computing technologies into BI tools has further propelled the market's expansion. The rise of SMEs adopting affordable cloud-based BI solutions also contributes to the markets growth.

- The market dominance in India is largely concentrated in metropolitan cities like Bengaluru, Mumbai, and Delhi. These cities are home to major IT hubs, financial institutions, and large corporations that generate a massive volume of data daily. Bengaluru, known as the Silicon Valley of India, leads the pack due to its thriving tech ecosystem, while Mumbai and Delhi benefit from strong financial sectors and governmental initiatives in digital transformation.

- The Personal Data Protection (PDP) Bill of India has introduced a strict regulatory framework around data privacy, fundamentally affecting the way businesses handle data. Under the PDP Bill, organizations are required to implement stringent data protection measures and obtain explicit consent from individuals before processing personal data. The bill also enforces local data storage, restricting the transfer of sensitive data outside of India. Non-compliance with these regulations can result in penalties of up to INR 150 million or 4% of the companys global turnover, influencing how businesses approach their BI strategies.

India Business Intelligence (BI) Market Segmentation

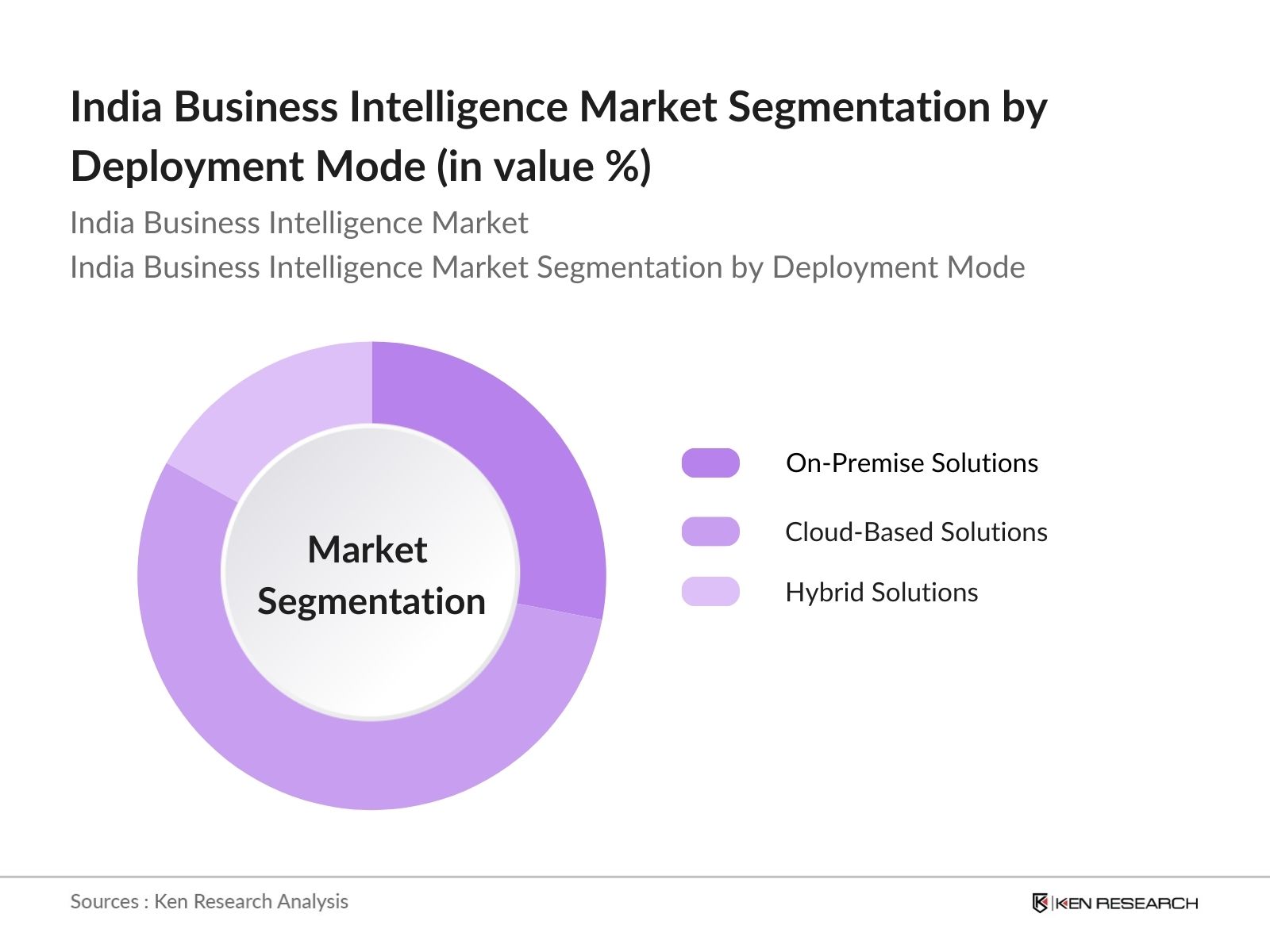

- By Deployment Mode: The India Business Intelligence (BI) market is segmented by deployment mode into on-premise solutions, cloud-based solutions, and hybrid solutions. In 2023, cloud-based solutions dominate the market due to their scalability, flexibility, and cost-effectiveness. The rapid increase in internet penetration and the need for real-time data access have made cloud-based BI tools attractive, especially for small and medium enterprises (SMEs). The shift from traditional on-premise systems to cloud solutions has also been driven by lower upfront costs and easier integration with existing business systems.

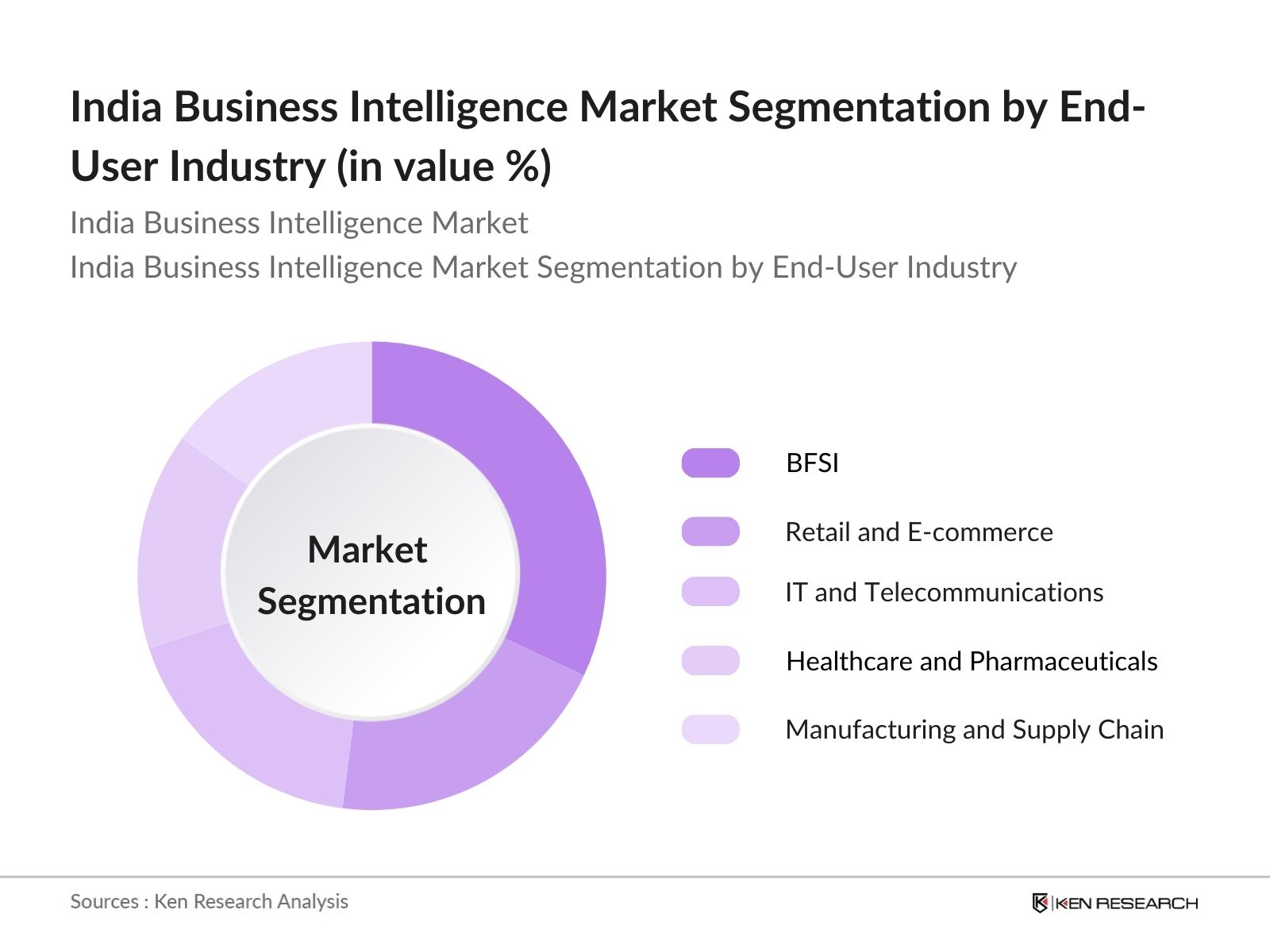

- By End-User Industry: The market is further segmented by end-user industry into Banking, Financial Services, and Insurance (BFSI), Retail and E-commerce, IT and Telecommunications, Healthcare and Pharmaceuticals, and Manufacturing and Supply Chain. The BFSI segment holds the dominant market share in 2023 due to its high demand for advanced data analytics tools to manage risks, optimize operations, and improve customer experience. The BFSI sector has been an early adopter of BI technologies, leveraging predictive analytics and big data to enhance decision-making processes.

India Business Intelligence (BI) Market Competitive Landscape

The India Business Intelligence (BI) market is dominated by several major players who leverage advanced technologies and have established market footprints. The market features both global and local companies, with a few dominant names accounting for the largest share. Companies like Tata Consultancy Services (TCS), Infosys, and HCL Technologies lead the market due to their comprehensive service offerings and strong presence in the Indian market, while international firms like Microsoft and Oracle have expanded their reach by offering cloud-based BI tools.

|

Company |

Year Established |

Headquarters |

Revenue (USD) |

Employee Count |

No. of BI Clients |

Cloud Solutions Portfolio |

Geographical Reach |

Partnerships and Collaborations |

Recent Market Initiatives |

|

Tata Consultancy Services |

1968 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

Infosys |

1981 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

- |

|

HCL Technologies |

1976 |

Noida, India |

- |

- |

- |

- |

- |

- |

- |

|

Microsoft India |

1990 |

Hyderabad, India |

- |

- |

- |

- |

- |

- |

- |

|

Oracle India |

1993 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

- |

India Business Intelligence (BI) Market Analysis

India Business Intelligence (BI) Market Growth Drivers

- Digital Transformation: Digital transformation in India has accelerated in recent years, with adoption rates among enterprises and SMEs showing strong growth. Large enterprises in India have been leading the charge, with 80% reporting ongoing digital initiatives. In contrast, 60% of small and medium enterprises (SMEs) are also embracing digital transformation, with a notable rise in the adoption of cloud technologies and analytics-driven decision-making tools. The Indian governments push through programs like Digital India has further catalyzed this shift, promoting the use of digital technologies across various sectors of the economy.

- Technological Advancements: Artificial Intelligence (AI) and Machine Learning (ML) are transforming Indias BI landscape. In 2024, over 30% of enterprises reported integrating AI and ML into their BI platforms to enhance real-time analytics and automate data processing. These technologies are driving predictive analytics, allowing businesses to forecast trends and make data-driven decisions. The Indian governments investment in AI research and development has further accelerated this trend, with a budget allocation of over 600 million USD for AI initiatives in 2024, contributing to rapid technological advancements in the BI sector.

- Increasing Demand for Data-Driven Decision Making: The demand for data-driven decision-making in India is at an all-time high, with 65% of enterprises citing BI tools as essential for operational efficiency. This trend is reflected across various sectors, including retail, banking, and manufacturing, where data analytics is increasingly used for forecasting, customer insights, and performance tracking. The growth in demand is also evident in the financial sector, where over 70% of businesses have adopted BI tools for risk management and compliance purposes. This adoption rate highlights the critical role BI plays in enhancing decision-making processes.

India Business Intelligence (BI) Market Challenges

- Lack of Skilled Workforce: The shortage of skilled professionals is a major challenge in the Indian BI market, with an estimated skill gap of 40% in data analytics and BI-specific roles. Despite the increasing demand for data scientists and BI professionals, the education system has struggled to keep pace with industry requirements, creating a mismatch in the availability of qualified personnel. This has led to a heavy reliance on foreign talent or expensive training programs for local professionals. The Indian government has recognized this gap and allocated 500 million USD toward digital skills programs, yet the demand continues to outstrip supply.

- High Implementation Costs: The cost of implementing BI solutions remains high for many businesses, particularly SMEs. On average, large enterprises in India spend between 200,000 to 500,000 USD annually on BI tools and infrastructure, while SMEs struggle with the high upfront costs of software licenses and cloud solutions. Despite cost reductions in cloud-based BI tools, the total cost of ownership, including training and integration, remains prohibitive for smaller businesses. As a result, nearly 30% of SMEs in India are unable to adopt advanced BI systems, hampering their ability to compete with larger firms.

India Business Intelligence (BI) Market Future Outlook

The India Business Intelligence (BI) market is expected to witness growth over the next five years, driven by increasing digital transformation initiatives across sectors, rising demand for data analytics, and the growing adoption of AI-powered BI solutions. Additionally, the governments push for digital India and the introduction of stricter data privacy laws will propel the adoption of BI tools to ensure regulatory compliance and better decision-making capabilities. Cloud-based BI solutions will continue to dominate as businesses seek cost-effective and scalable analytics platforms.

India Business Intelligence (BI) Market Opportunities

- SME Adoption: There is a major opportunity for BI vendors to target SMEs, as penetration rates among this segment remain relatively low at 35%. SMEs represent a growing market in India, contributing over 30% to the countrys GDP. As more SMEs look to streamline operations and improve decision-making, BI tools offer a clear advantage. Furthermore, the increasing availability of affordable cloud-based BI solutions, along with government incentives under the MSME Digital Scheme, is expected to drive higher adoption rates in this segment, creating a vast untapped market for BI providers.

- Cloud-Based BI Solutions: Cloud-based BI solutions are gaining rapid traction in India, with adoption rates growing steadily, particularly among SMEs. Currently, around 50% of Indian businesses have adopted cloud-based BI tools, owing to their scalability and lower upfront costs compared to traditional on-premise solutions. This shift is being driven by the proliferation of affordable cloud infrastructure provided by companies like AWS and Microsoft, coupled with the Indian governments push toward cloud adoption through initiatives such as the Cloud First Policy. This trend is expected to open new avenues for growth in the BI market.

Scope of the Report

|

Deployment Mode |

On-Premise Cloud-Based Hybrid |

|

End-User Industry |

BFSI Retail IT Healthcare Manufacturing |

|

Technology |

Data Warehousing Predictive Analytics Data Mining OLAP Visualization Tools |

|

Organization Size |

SMEs Large Enterprises |

|

Region |

North India South India East India West India |

Products

Key Target Audience

Business Intelligence Solution Providers

IT Companies

Government and Regulatory Bodies (Ministry of Electronics and Information Technology, India, Data Protection Authority)

Cloud Solution Providers

Banks and Financial Institutions

Investor and Venture Capitalist Firms

Large Enterprises

Financial Institutions

Data Analytics Firms

Companies

Players Mentioned in the Report

Tata Consultancy Services (TCS)

Infosys

HCL Technologies

Microsoft India

Oracle India

IBM India

SAP India

QlikTech India

Tableau Software

Zoho Corporation

Table of Contents

1. India Business Intelligence (BI) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Year-on-Year)

1.4. Market Segmentation Overview

2. India Business Intelligence (BI) Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Business Intelligence (BI) Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation (Adoption Rate, Enterprises vs SMEs)

3.1.2. Government Policies (Make in India, Digital India)

3.1.3. Technological Advancements (AI and ML Integration)

3.1.4. Increasing Demand for Data-Driven Decision Making (Market Adoption Metrics)

3.2. Market Challenges

3.2.1. Lack of Skilled Workforce (Professional Availability, Skill Gap %)

3.2.2. High Implementation Costs (Cost of BI Solutions Across Segments)

3.2.3. Data Privacy Concerns (Regulatory Framework, Compliance Requirements)

3.3. Opportunities

3.3.1. SME Adoption (BI Penetration Rate Among SMEs)

3.3.2. Cloud-Based BI Solutions (Adoption % of Cloud Solutions)

3.3.3. Regional Expansion (Adoption in Tier II & Tier III Cities)

3.4. Trends

3.4.1. Real-Time Data Analytics (Usage Statistics, Growth %)

3.4.2. Self-Service BI (Penetration % Across Businesses)

3.4.3. Embedded BI (Growth in Sector-Wise Use Cases)

3.4.4. Augmented Analytics (Natural Language Processing, Machine Learning)

3.5. Government Regulations

3.5.1. Data Protection Laws (Impact of Personal Data Protection Bill)

3.5.2. Digital Governance Initiatives (Key Government Programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Vendors, Service Providers, Consultants)

3.8. Porters Five Forces (Market Competition, Supplier Power, Buyer Power)

3.9. Competition Ecosystem (Major Players, Emerging Competitors)

4. India Business Intelligence (BI) Market Segmentation

4.1. By Deployment Mode (In Value %)

4.1.1. On-Premise Solutions

4.1.2. Cloud-Based Solutions

4.1.3. Hybrid Solutions

4.2. By End-User Industry (In Value %)

4.2.1. Banking, Financial Services, and Insurance (BFSI)

4.2.2. Retail and E-commerce

4.2.3. IT and Telecommunications

4.2.4. Healthcare and Pharmaceuticals

4.2.5. Manufacturing and Supply Chain

4.3. By Technology (In Value %)

4.3.1. Data Warehousing

4.3.2. Data Mining

4.3.3. Predictive Analytics

4.3.4. OLAP (Online Analytical Processing)

4.3.5. Visualization Tools

4.4. By Organization Size (In Value %)

4.4.1. Small and Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Business Intelligence (BI) Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. TCS (Tata Consultancy Services)

5.1.2. Infosys

5.1.3. HCL Technologies

5.1.4. Wipro

5.1.5. IBM India

5.1.6. Oracle India

5.1.7. Microsoft India

5.1.8. SAP India

5.1.9. QlikTech India

5.1.10. Tableau Software

5.1.11. SAS Institute

5.1.12. Zoho Corporation

5.1.13. Domo India

5.1.14. MicroStrategy

5.1.15. Infor India

5.2 Cross Comparison Parameters (Revenue, Market Share, Employee Size, Regional Presence, Solution Offerings, Strategic Initiatives, Partnerships, Growth Metrics)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Strategic Partnerships, Alliances)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

5.8. Government Grants and Initiatives

6. India Business Intelligence (BI) Market Regulatory Framework

6.1. Data Protection and Privacy Regulations

6.2. Compliance and Certification Processes

6.3. Government Incentives for Digital Transformation

7. India Business Intelligence (BI) Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Business Intelligence (BI) Future Market Segmentation

8.1. By Deployment Mode

8.2. By End-User Industry

8.3. By Technology

8.4. By Organization Size

8.5. By Region

9. India Business Intelligence (BI) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the Business Intelligence ecosystem, identifying key stakeholders such as software providers, cloud service vendors, and end-user industries. Data collection involves extensive desk research, leveraging secondary databases to define the critical variables influencing the BI market.

Step 2: Market Analysis and Construction

Historical data regarding the BI market is collected and analyzed, focusing on revenue generation, adoption rates across industries, and regional penetration of BI solutions. Service quality statistics, as well as market penetration, are assessed to build an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses are validated through consultations with industry experts using computer-assisted telephone interviews (CATI). These consultations provide insights on market dynamics, technology adoption rates, and key growth drivers in the BI sector.

Step 4: Research Synthesis and Final Output

The final phase consolidates the findings through engagements with BI providers and users to validate market data and trends. The result is a comprehensive, verified report that includes an in-depth analysis of the Business Intelligence market.

Frequently Asked Questions

01. How big is the India Business Intelligence (BI) Market?

The India Business Intelligence market is valued at USD 329 million, driven by the increasing demand for data-driven decision-making and real-time analytics among businesses.

02. What are the challenges in the India Business Intelligence (BI) Market?

Challenges in the India Business Intelligence market include high implementation costs for on-premise solutions, a shortage of skilled professionals in data analytics, and concerns around data privacy and compliance with new regulations.

03. Who are the major players in the India Business Intelligence (BI) Market?

Key players in the India Business Intelligence market include Tata Consultancy Services, Infosys, HCL Technologies, Microsoft India, and Oracle India. These companies have a dominant market presence due to their wide range of solutions and strong client bases.

04. What are the growth drivers of the India Business Intelligence (BI) Market?

The India Business Intelligence market is driven by factors such as the growing need for real-time analytics, the rising adoption of cloud-based BI solutions, and the increasing demand from sectors like BFSI, retail, and healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.