India Butyl Acrylate Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8716

December 2024

81

About the Report

India Butyl Acrylate Market Overview

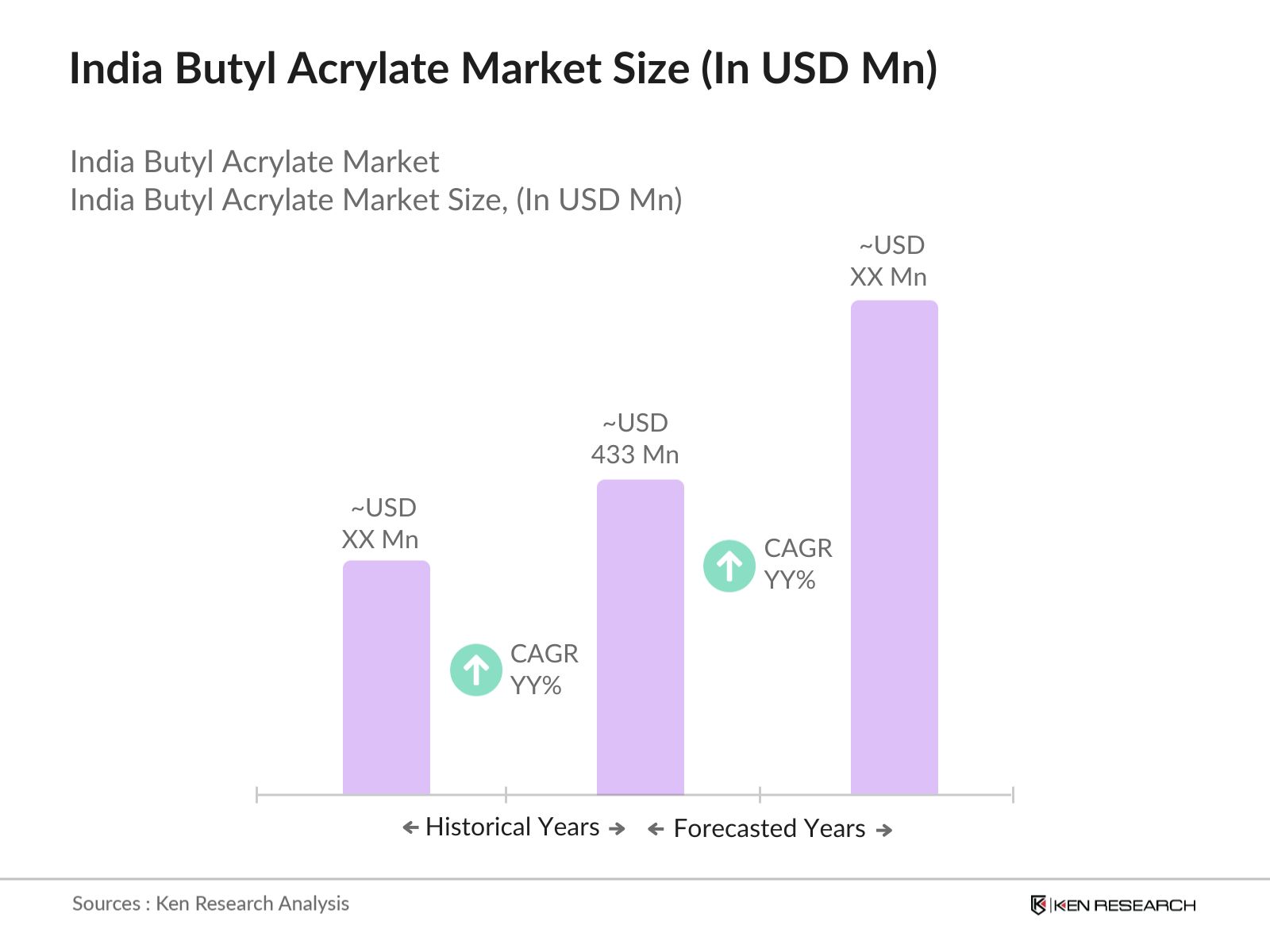

- The India Butyl Acrylate market was valued at USD 433 million, driven largely by its increasing demand in the paints and coatings and adhesive & sealants sectors. Butyl acrylate, a key raw material in these industries, is used extensively due to its properties, such as durability and weather resistance. The construction and automotive sectors are significant drivers of this demand, as water-based coatings continue to replace traditional coatings in both industries.

- The market in India is geographically dominated by Bharat Petroleum Corporation Limited (BPCL), which holds a unique position as the sole domestic producer of butyl acrylate. Major cities like Mumbai, with its strong industrial base, and Visakhapatnam, due to its proximity to petrochemical hubs, dominate the regional market due to their infrastructural advantages and access to major port facilities.

- The Indian governments Make in India campaign, aimed at boosting domestic manufacturing, has opened up opportunities for the butyl acrylate market. The government has allocated INR 2 trillion for chemical industry development under this initiative, which includes incentives for setting up new chemical production facilities in 2024, fostering local production and reducing import dependency.

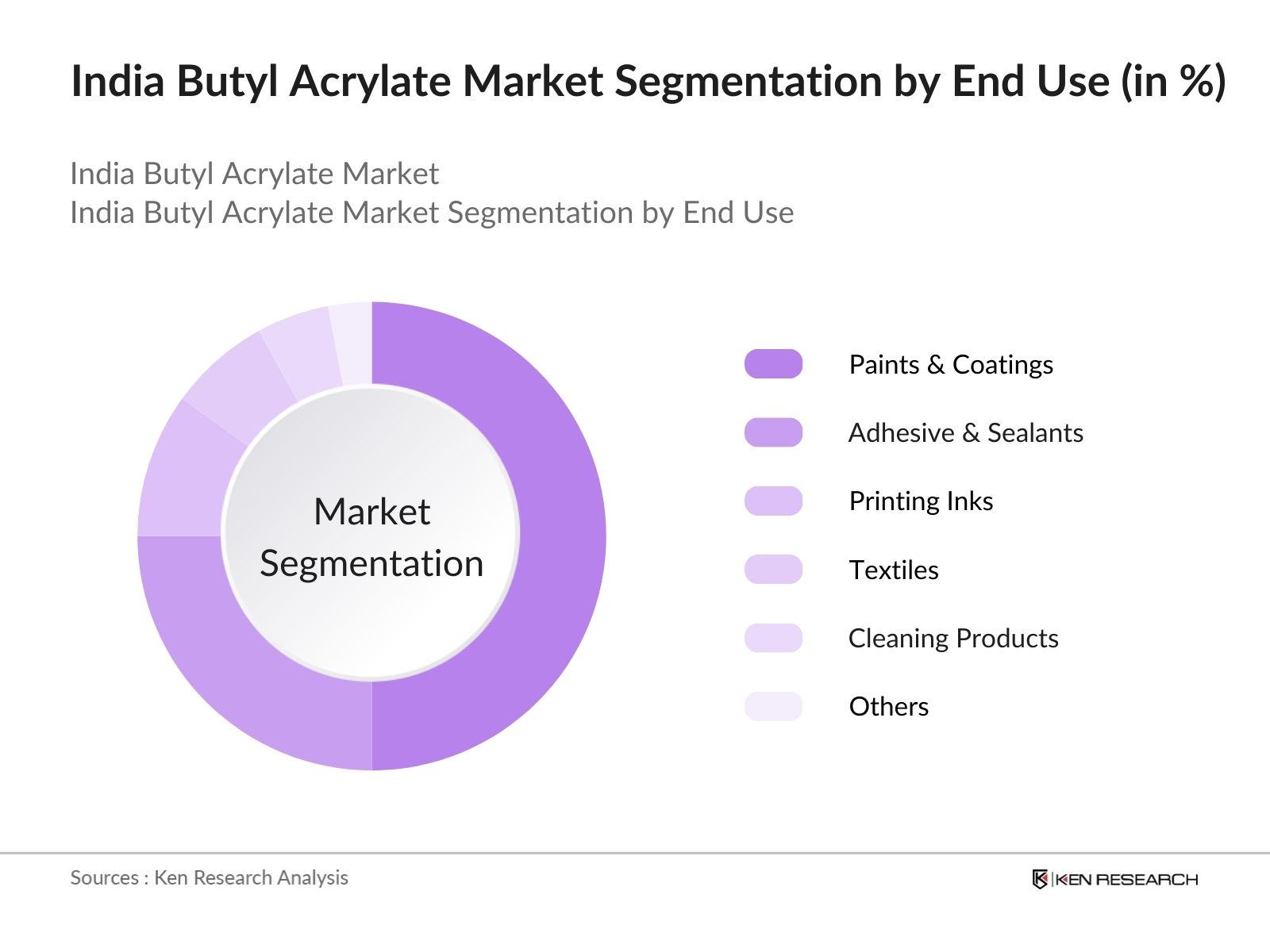

India Butyl Acrylate Market Segmentation

By End-Use: The market is segmented by end-use into Paints & Coatings, Adhesive & Sealants, Printing Inks, Textiles, Cleaning Products, and Others. Paints & Coatings, this sub-segment commands the largest market share in 2023, primarily due to its wide range of industrial applications. Butyl acrylate's high durability and weather resistance make it a critical component for coatings used in the automotive and construction sectors, which are expanding rapidly in India.

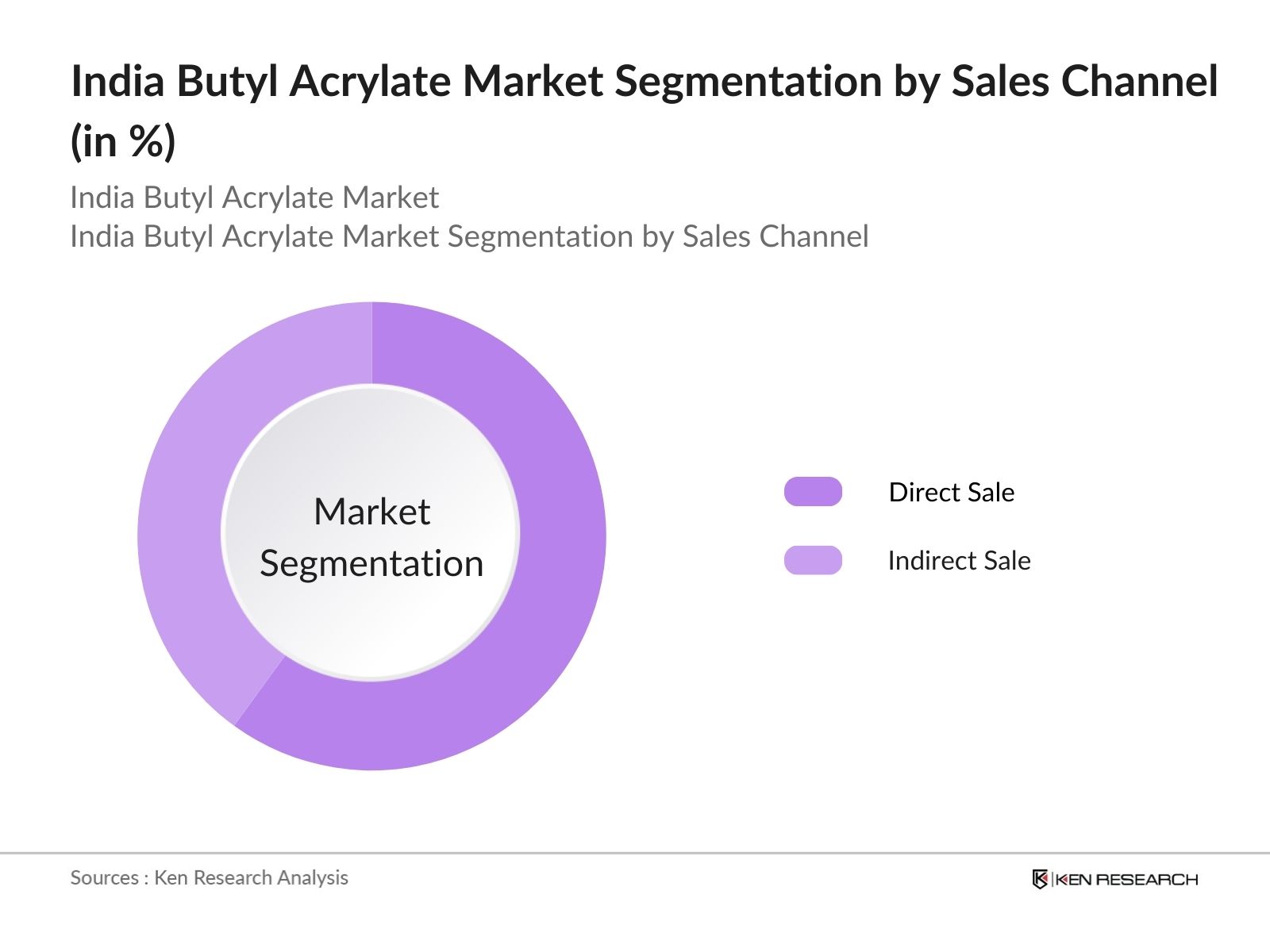

By Sales Channel: The India Butyl Acrylate market is segmented by sales channel into Direct Sale and Indirect Sale. The direct sales channel dominates the market, accounting for the highest market share in 2023. Manufacturers prefer direct sales to large-scale buyers, such as companies in the paints and coatings or adhesives industries, ensuring better control over pricing and supply.

India Butyl Acrylate Market Competitive Landscape

The market is highly consolidated, with a few major players controlling the majority of the market. Companies such as Bharat Petroleum Corporation Limited (BPCL) hold a unique position as the sole domestic producer, while other global players rely on imports to meet demand.

India Butyl Acrylate Market Analysis

Market Growth Drivers

- Rising Demand from the Paints and Coatings Industry: The Indian paints and coatings sector is witnessing robust growth due to increased infrastructure development and construction activities, leading to higher demand for butyl acrylate. In 2024, India's construction industry is expected to reach a value of INR 20 trillion, which is driving the consumption of paints and coatings.

- Growing Adoption in Adhesives and Sealants: The expanding automotive, packaging, and construction sectors in India have spurred the need for adhesives and sealants, which rely heavily on butyl acrylate as a critical raw material. India is set to produce 12 million new vehicles in 2024, and the increased use of adhesives in vehicle assembly processes will fuel the demand for butyl acrylate.

- Expanding Textile Sector: Indias textile sector, which is growing at a rapid pace with a projected output of 15 billion square meters of fabric in 2024, is increasingly adopting butyl acrylate-based polymers to produce textile coatings and finishes. With India's textile exports expected to cross INR 4 trillion in 2024, the need for enhanced fabric performance is creating a demand surge for butyl acrylate, especially in fabric finishes like waterproofing and elasticity enhancement.

Market Challenges

- Environmental Regulations and Compliance: The Indian government is tightening regulations on the production and disposal of chemical waste, including butyl acrylate, due to its potential environmental hazards. With the expected implementation of more stringent guidelines in 2024 under the Hazardous Waste Management Rules, manufacturers face higher compliance costs, which could hinder production scalability and increase operational expenses by up to INR 500 crore annually.

- Limited Domestic Production of Raw Materials: India depends on imports for a significant portion of the raw materials required for butyl acrylate production. In 2024, Indias acrylic acid production is estimated at only 75,000 metric tons, far below the 300,000 metric tons needed to meet local demand. This reliance on imports leads to supply chain disruptions and price fluctuations, limiting the local industrys ability to meet the rising demand for butyl acrylate.

India Butyl Acrylate Market Future Outlook

Over the next five years, the India Butyl Acrylate industry is projected to experience substantial growth driven by increasing demand from the construction, automotive, and packaging industries. Expanding infrastructural projects, growth in urbanization, and rising environmental concerns pushing for water-based coatings are expected to further stimulate demand for butyl acrylate.

Future Market Opportunities

- Development of High-Performance Butyl Acrylate for Specialized Applications: By 2029, Indian manufacturers will diversify their product portfolio to offer specialized grades of butyl acrylate for niche applications, including high-performance coatings and medical adhesives. Research and development investments, estimated at INR 2,000 crore, will drive innovation in product formulations, aligning with the demands of high-growth sectors such as automotive and healthcare.

- Shift Towards Domestic Raw Material Sourcing: The next five years will see a gradual shift toward domestic production of raw materials like acrylic acid and n-butanol, reducing Indias dependency on imports. With the Indian government expected to invest INR 1,000 crore in petrochemical infrastructure development by 2029, this will enhance the self-reliance of the butyl acrylate industry and stabilize supply chains.

Scope of the Report

|

End-Use |

Paints & Coatings Adhesives & Sealants Printing Inks Textiles Cleaning Products Others |

|

Sales Channel |

Direct Sale Indirect Sale |

|

Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Butyl Acrylate Manufacturers

Adhesive & Sealants Industry Players

Paints & Coatings Industry Players

Textile Industry Players

Automotive Industry Players

Government and Regulatory Bodies (e.g., Ministry of Chemicals & Fertilizers, Pollution Control Boards)

Investors and Venture Capitalist Firms

Construction Industry Stakeholders

Companies

Players Mentioned in the Report:

Bharat Petroleum Corporation Limited

BASF SE

Arkema

Dow Chemical

LG Chem

Toyota Tsusho Corporation

Pinghu Petro Chemical Co Ltd

National Petrochemical Industrialza

Vizag Chemicals

Dhalop Chemicals

Table of Contents

India Butyl Acrylate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Life Cycle

1.4. Market Segmentation Overview

India Butyl Acrylate Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Butyl Acrylate Market Analysis

3.1. Growth Drivers

Demand from Paints and Coatings

Construction Sector Expansion

Increased Adhesives Usage

3.2. Market Challenges

Raw Material Volatility

Production Costs

3.3. Opportunities

Expansion in Water-Based Paints

Increased Textile Application

3.4. Trends

Eco-Friendly Product Demand

Rise of Water-Based Coatings

3.5. Regulatory Landscape

Environmental Standards

VOC Emission Controls

India Butyl Acrylate Market Segmentation

4.1. By End-Use (In Value %)

Paints & Coatings

Adhesives & Sealants

Printing Inks

Textiles

Cleaning Products

Others

4.2. By Sales Channel (In Value %)

Direct Sale

Indirect Sale

4.3. By Region (In Value %)

North India

South India

East India

West India

India Butyl Acrylate Competitive Landscape

5.1. Detailed Profiles of Major Companies

Bharat Petroleum Corporation Limited

BASF SE

Pinghu Petro Chemical Co Ltd

National Petrochemical Industrialza

Toyota Tsusho Corporation

Arkema

Dow Chemical

Dhalop Chemicals

Vizag Chemicals

LG Chem

Otto Chemie Pvt Ltd

KR Chemicals

BASF Petronas Chemicals

Reliance Industries

Aarti Industries Ltd.

5.2. Cross Comparison Parameters

(Number of Employees, Market Share, Revenue, Production Capacity, Global Reach, Product Innovation, Mergers and Acquisitions, Strategic Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

(Greenfield Projects, Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

India Butyl Acrylate Market Regulatory Framework

6.1. Environmental Regulations

6.2. Compliance Requirements

6.3. Certification Processes

India Butyl Acrylate Future Market Size (In USD Mn)

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

(Construction Sector, Growth in Adhesives)

India Butyl Acrylate Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, we map the ecosystem of stakeholders involved in the India Butyl Acrylate market. We identify critical variables such as raw material pricing, production capacities, and demand trends, using secondary and proprietary research databases to gather relevant information.

Step 2: Market Analysis and Construction

Historical data for the India Butyl Acrylate market is analyzed, covering production volumes, sales channels, and end-use industries. This involves assessing the market penetration rate and analyzing regional demand to build an accurate revenue estimate.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews to validate our market hypotheses. These experts provide insights on current trends, competitive dynamics, and the influence of key players, ensuring our data aligns with real-world conditions.

Step 4: Research Synthesis and Final Output

Data gathered from various sources is synthesized into a final report. We integrate findings from bottom-up and top-down research approaches, providing comprehensive, verified insights into the India Butyl Acrylate market.

Frequently Asked Questions

How big is the India Butyl Acrylate market?

The India Butyl Acrylate market was valued at 433 million, driven by strong demand from industries such as paints & coatings and adhesives & sealants.

What are the major challenges in the India Butyl Acrylate market?

Major challenges in the India Butyl Acrylate market include price volatility of raw materials, environmental regulations, and reliance on imports for a significant portion of supply.

Who are the key players in the India Butyl Acrylate market?

Key players in the India Butyl Acrylate market include Bharat Petroleum Corporation Limited, BASF SE, Arkema, Dow Chemical, and LG Chem.

What are the growth drivers for the India Butyl Acrylate market?

The India Butyl Acrylate market is primarily driven by the expanding construction sector, the shift towards eco-friendly coatings, and increased demand from the automotive industry.

Which end-use industry dominates the India Butyl Acrylate market?

The paints and coatings industry dominates the India Butyl Acrylate market due to its wide range of applications in various industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.