India Cabin Interior Market Outlook to 2030

Region:Asia

Author(s):Ananya Singh

Product Code:KROD8818

October 2024

94

About the Report

India Cabin Interior Market Overview

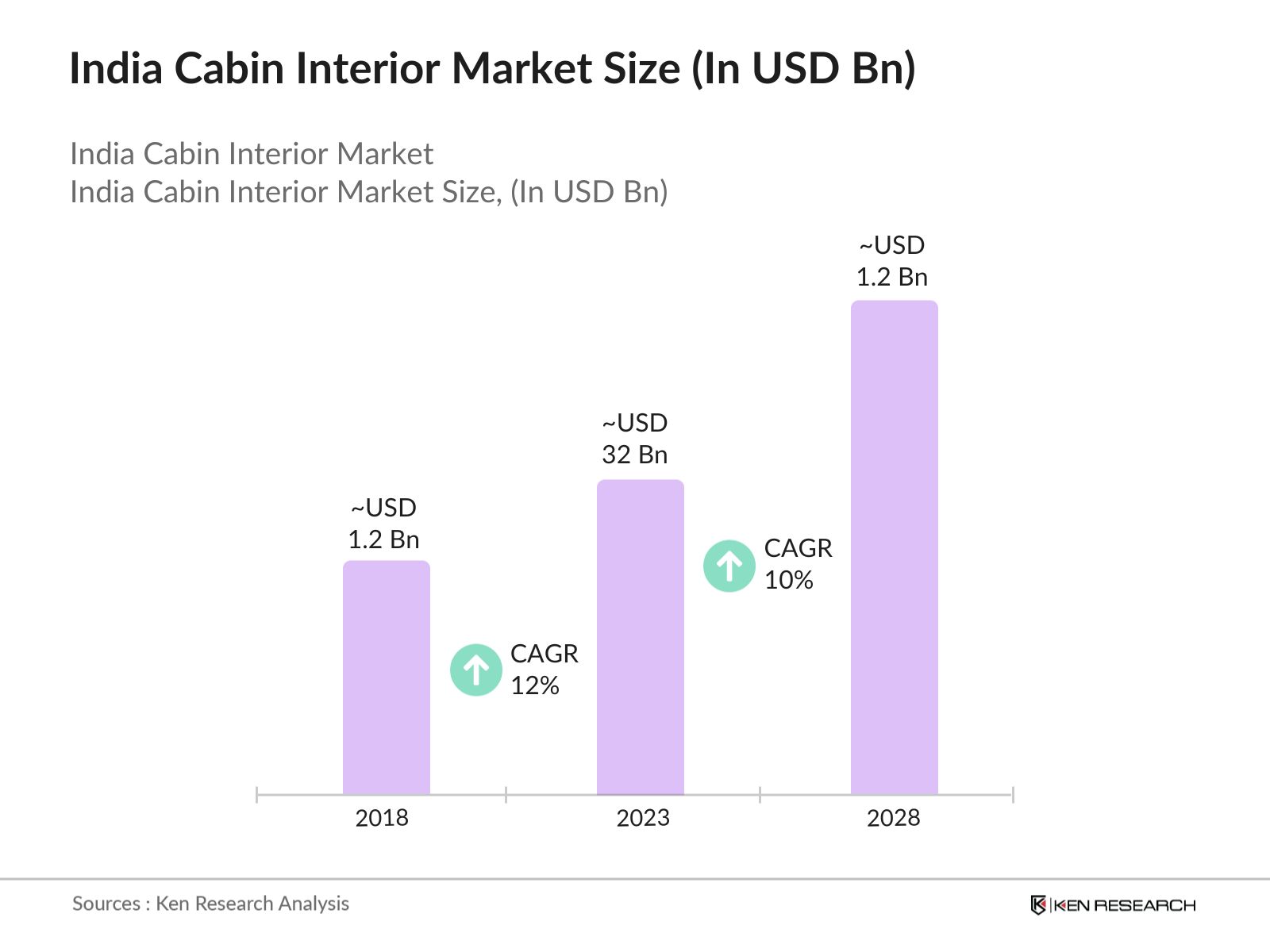

- The India Cabin Interior Market, driven by the rapid expansion of the aviation industry, reached a valuation of INR 32 billion. Growth in air traffic, increased government expenditure on infrastructure, and rising disposable incomes have fueled the demand for modern cabin interiors. The markets growth is particularly influenced by the need for lightweight materials, advanced in-flight entertainment systems, and the integration of smart technologies for a superior passenger experience.

- India Cabin Interior market is primarily dominated by major cities such as Delhi, Mumbai, and Bangalore due to their status as key aviation hubs. These cities possess large international airports and high air traffic volumes, making them prime locations for cabin interior investments. Their well-developed infrastructure and increasing focus on enhancing passenger experience have made these cities leaders in cabin interior advancements.

- The UDAN scheme, aimed at connecting remote regions of India with affordable air travel, has provided significant impetus to the cabin interior market by boosting demand for regional aircraft. Over 75 new airports and airstrips have been developed under this scheme as of 2024, increasing the need for cabin interiors specifically designed for smaller aircraft, which focus on maximizing space efficiency while maintaining passenger comfort.

India Cabin Interior Market Segmentation

By Product Type: The India Cabin Interior Market is segmented by product type into seating systems, cabin lighting, in-flight entertainment systems, galley equipment, and lavatory systems. Among these, seating systems dominate the market due to their direct impact on passenger comfort and increasing airline investments in ergonomic designs to optimize space. Leading companies like RECARO Aircraft Seating and Safran have introduced innovative lightweight seat designs that enhance passenger comfort without compromising on cabin space. This has positioned seating systems as a crucial area of focus for airlines aiming to improve customer satisfaction.

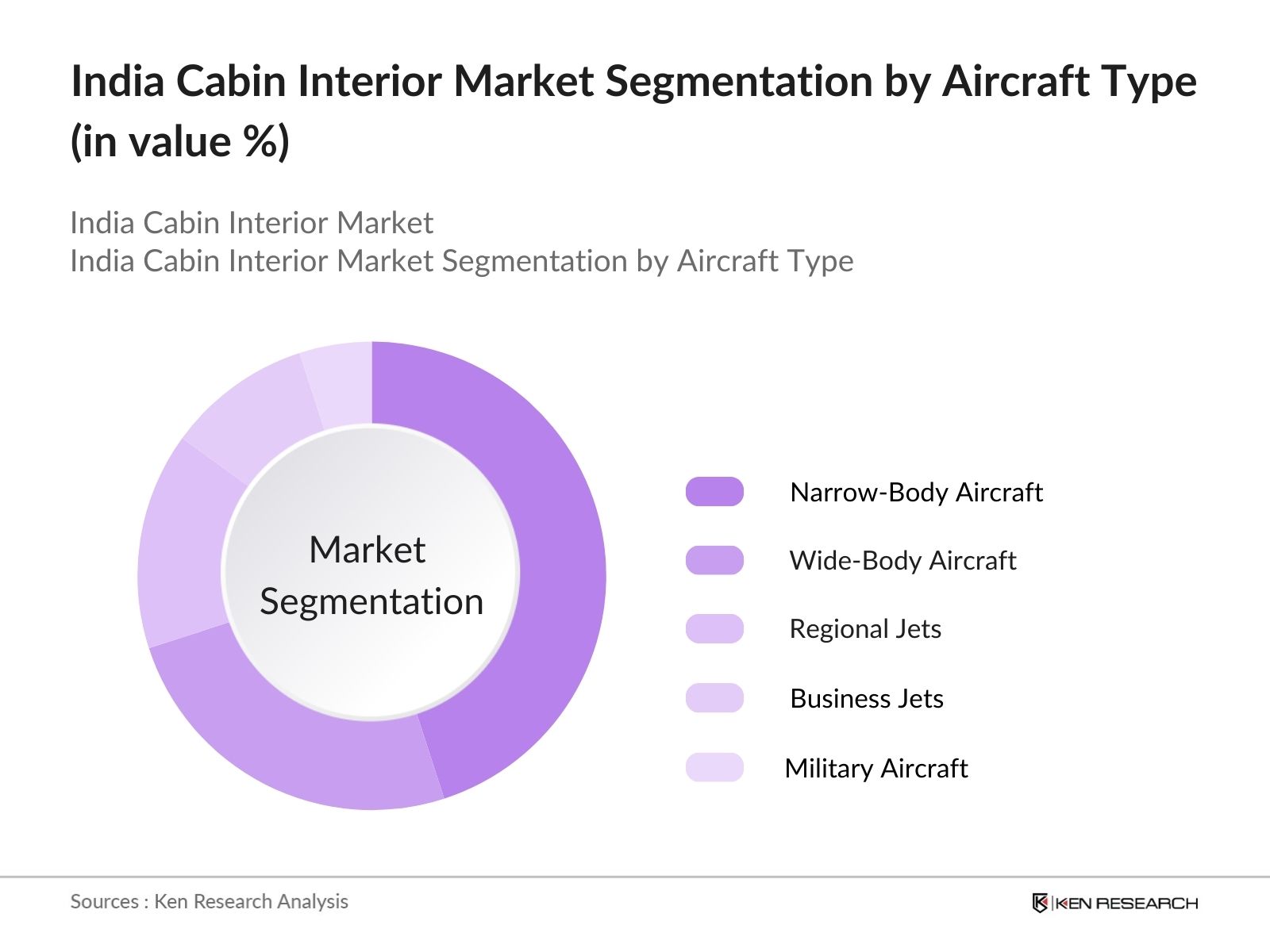

By Aircraft Type: The India Cabin Interior Market is segmented by aircraft type into narrow-body aircraft, wide-body aircraft, regional jets, business jets, and military aircraft. Narrow-body aircraft hold the largest market share due to the increasing demand for short-haul domestic flights and cost efficiency for airlines. Airlines such as IndiGo and SpiceJet primarily operate narrow-body fleets, making them the largest consumers of cabin interiors tailored for narrow-body aircraft. As these aircraft serve high-frequency domestic routes, the demand for durable and comfortable interiors continues to grow.

India Cabin Interior Market Competitive Landscape

The India Cabin Interior Market is characterized by a competitive landscape dominated by a few key players. Leading global manufacturers have established strong footholds in India, supplying products to both commercial airlines and aircraft OEMs. These companies focus on offering innovative solutions that improve fuel efficiency, reduce overall aircraft weight, and enhance passenger experience.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (2023) |

Product Portfolio |

Innovation Focus |

Key Clients |

|

Jamco Corporation |

1955 |

Tokyo, Japan |

|||||

|

Safran S.A. |

1905 |

Paris, France |

|||||

|

RECARO Aircraft Seating |

1906 |

Stuttgart, Germany |

|||||

|

Collins Aerospace |

2018 |

Charlotte, USA |

|||||

|

Diehl Stiftung & Co. KG |

1902 |

Nrnberg, Germany |

India Cabin Interior Market Analysis

Market Growth Drivers

- Increasing Passenger Traffic in India: India's aviation industry continues to see significant growth, driven by rising domestic and international passenger numbers. According to the Directorate General of Civil Aviation (DGCA), in 2023, Indian airports handled more than 341 million passengers. This steady rise in air traffic has increased the demand for aircraft, which in turn boosts the demand for cabin interiors, including seating systems, in-flight entertainment, and lighting systems. The growth in passenger traffic directly correlates with airlines' need to enhance cabin experience to meet the competitive market demands.

- Fleet Expansion by Domestic Airlines: Major Indian airlines, such as IndiGo and Air India, are aggressively expanding their fleets to cater to the growing passenger demand. Air India, for instance, recently placed an order for 470 new aircraft, which includes wide-body and narrow-body planes. This expansion fuels the demand for modern and innovative cabin interior solutions, from lightweight seating to customizable cabin layouts. As airlines upgrade their fleets, the need for advanced and more efficient cabin interiors is expected to rise significantly, boosting the overall market.

- Government Investment in Regional Connectivity: The Indian government's UDAN scheme, aimed at enhancing regional connectivity by making air travel accessible to smaller cities and towns, is another key growth driver for the cabin interior market. By improving access to aviation in these regions, more aircraft are being commissioned for short-haul routes, which require tailored cabin interiors. In 2023, under UDAN, the government sanctioned funding for the expansion of 46 underserved airports, creating new demand for regional jet cabin interiors.

Market Challenges

- High Costs of Upgrading Cabin Interiors

Upgrading aircraft interiors requires significant investment, which is a major challenge for airlines. A full interior upgrade, including seats, lighting, and entertainment systems, can cost airlines upwards of INR 30 crore per aircraft. For budget airlines operating with thin margins, these costs can be prohibitive, slowing down the adoption of advanced interior solutions. This challenge is particularly pressing for smaller regional airlines, which may struggle to justify the capital expenditure required for cabin upgrades. - Volatility in Raw Material Prices

The cabin interior market is highly dependent on the availability and cost of raw materials such as aluminum, plastics, and advanced composites. Global supply chain disruptions in 2023 led to a rise in the prices of key materials, with aluminum reaching INR 230 per kilogram in the Indian market. This volatility in material costs has put pressure on manufacturers, who face rising production costs, ultimately affecting the affordability and competitiveness of cabin interior products.

India Cabin Interior Market Future Outlook

Over the next five years, the India Cabin Interior Market is expected to experience robust growth due to increased investments in aviation infrastructure and fleet expansions. The governments initiatives to boost regional connectivity through the UDAN scheme, combined with rising air passenger traffic, are expected to create significant opportunities for cabin interior suppliers. Airlines are focusing on upgrading interiors to offer premium experiences even in economy classes, driving demand for advanced seating systems, smart cabin solutions, and innovative lighting systems.

The integration of sustainable materials, such as lightweight composites, and the growing adoption of IoT-enabled smart cabins are also anticipated to fuel market growth. This trend aligns with global efforts to improve energy efficiency and reduce the environmental impact of aviation.

Future Market Opportunities

- Increased Adoption of Sustainable Cabin Materials

In the next five years, the India Cabin Interior Market is expected to witness a shift toward the use of sustainable materials, such as bio-based composites and recycled plastics. Airlines are aligning with global sustainability goals, and manufacturers will focus on providing eco-friendly interior solutions that reduce aircraft weight and contribute to lower fuel consumption. This trend is expected to drive significant investments in R&D for innovative materials by 2029. - Expansion of In-Flight Entertainment Systems

As the demand for enhanced passenger experiences grows, in-flight entertainment systems will continue to evolve. Over the next five years, the India Cabin Interior Market will see the introduction of advanced, personalized entertainment systems, integrated with smart devices and high-speed internet connectivity. This will lead to a greater emphasis on cabin interior designs that cater to digital content consumption and connectivity.

Scope of the Report

|

Product Type |

Seating Systems |

|

Aircraft Type |

Narrow-body Aircraft |

|

End-User |

Airlines |

|

Material Type |

Composites |

|

Region |

North |

Products

Key Target Audience

Airlines (Commercial Airlines, Low-Cost Carriers, Regional Airlines)

Aircraft OEMs (Original Equipment Manufacturers)

MRO (Maintenance, Repair, and Overhaul) Providers

Aircraft Leasing Companies

Government and Regulatory Bodies (Directorate General of Civil Aviation - DGCA)

Investments and Venture Capitalist Firms

In-Flight Entertainment Providers

Cabin Component Suppliers

Companies

Players Mentioned in the Report

Jamco Corporation

Safran S.A.

RECARO Aircraft Seating GmbH

Collins Aerospace

Diehl Stiftung & Co. KG

Panasonic Avionics Corporation

Astronics Corporation

B/E Aerospace (Rockwell Collins)

HAECO Group

STELIA Aerospace

Table of Contents

1. India Cabin Interior Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Cabin Interior Market Size (USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Cabin Interior Market Analysis

3.1. Growth Drivers

3.1.1. Increased Air Passenger Traffic

3.1.2. Aircraft Deliveries

3.1.3. Airline Fleet Expansion

3.1.4. Growth in Commercial Aviation

3.2. Restraints

3.2.1. High Initial Investment Costs

3.2.2. Regulatory Compliance Costs

3.2.3. Volatility in Raw Material Prices

3.3. Opportunities

3.3.1. Advancement in Lightweight Cabin Materials

3.3.2. Emerging Markets in India

3.3.3. Expansion in Low-Cost Carriers

3.3.4. Customizable Cabin Designs

3.4. Trends

3.4.1. Adoption of Smart Cabins

3.4.2. Personalized In-Flight Entertainment

3.4.3. Use of Sustainable Materials

3.4.4. Integration with IoT

3.5. Government Regulations

3.5.1. Civil Aviation Authority Regulations

3.5.2. Safety Standards

3.5.3. Environmental Compliance

3.5.4. Aircraft Certification Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Cabin Interior Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Seating Systems

4.1.2. Cabin Lighting

4.1.3. In-Flight Entertainment Systems

4.1.4. Galley Equipment

4.1.5. Lavatory Systems

4.2. By Aircraft Type (In Value %)

4.2.1. Narrow-body Aircraft

4.2.2. Wide-body Aircraft

4.2.3. Regional Jets

4.2.4. Business Jets

4.2.5. Military Aircraft

4.3. By End-User (In Value %)

4.3.1. Airlines

4.3.2. OEMs

4.3.3. MRO Providers

4.4. By Material Type (In Value %)

4.4.1. Composites

4.4.2. Metals

4.4.3. Plastics

4.4.4. Textiles

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. India Cabin Interior Market Competitive Analysis

(No. of Employees, Headquarters, Inception Year, Revenue, Product Specialization, Customer Base)

6. India Cabin Interior Market Regulatory Framework

6.1. Aviation Safety Standards

6.2. Environmental Compliance

6.3. Aircraft Certification Processes

6.4. Civil Aviation Authority Directives

7. India Cabin Interior Market Future Size (USD Mn)

7.1. Market Size Projections

7.2. Key Growth Drivers

7.3. Technological Advancements

8. India Cabin Interior Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Aircraft Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. India Cabin Interior Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the entire ecosystem of stakeholders within the India Cabin Interior Market. This process relies heavily on desk research and analysis of secondary and proprietary databases, focusing on variables such as market size, segmentation, and key drivers.

Step 2: Market Analysis and Construction

In this phase, historical data regarding market penetration, supplier dynamics, and revenue generation in the India Cabin Interior Market is compiled and analyzed. The resulting data sets provide the foundation for understanding the current market environment and its future trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts using computer-assisted telephone interviews (CATIs). These experts will provide valuable insights into operational strategies, technology adoption, and future market trends.

Step 4: Research Synthesis and Final Output

The final step involves integrating the validated data with market insights derived from airline operators, component suppliers, and OEMs. This synthesis ensures the accuracy and comprehensiveness of the final market report.

Frequently Asked Questions

01. How big is the India Cabin Interior Market?

The India Cabin Interior Market was valued at INR 32 billion, driven by the expansion of airline fleets, increased air traffic, and rising demand for comfortable and innovative cabin interiors.

02. What are the challenges in the India Cabin Interior Market?

Challenges include fluctuating raw material prices, regulatory hurdles, and high initial investments required for cabin upgrades. Additionally, the market is heavily dependent on the overall health of the aviation industry.

03. Who are the major players in the India Cabin Interior Market?

Key players in the market include Jamco Corporation, Safran S.A., RECARO Aircraft Seating, Collins Aerospace, and Diehl Stiftung & Co. KG. These companies have a strong presence due to their innovative product portfolios and extensive industry experience.

04. What are the growth drivers of the India Cabin Interior Market?

The market is driven by increasing air passenger traffic, government initiatives to improve aviation infrastructure, and airline investments in upgrading cabin interiors to enhance passenger experience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.