India CAD Software Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD10833

November 2024

84

About the Report

India CAD Software Market Overview

- The India CAD Software market is valued at USD 619 million, with growth driven by the rising adoption of CAD technologies across industries such as automotive, construction, and manufacturing. Government initiatives promoting digital transformation and infrastructural development have significantly contributed to the demand for CAD software solutions.

- Dominant regions in the CAD software market include metropolitan areas like Bengaluru, Mumbai, and Delhi, which are hubs for engineering, manufacturing, and IT sectors. These regions benefit from a high concentration of engineering talent and access to cutting-edge technology, making them focal points for CAD software application and development.

- The Indian government has allocated INR 80 billion to the National Industrial Corridor Development Program in 2024, aiming to accelerate industrial growth across several states. This initiative directly supports the adoption of CAD software by fostering modernized infrastructure, where digital design and precision manufacturing are priorities.

India CAD Software Market Segmentation

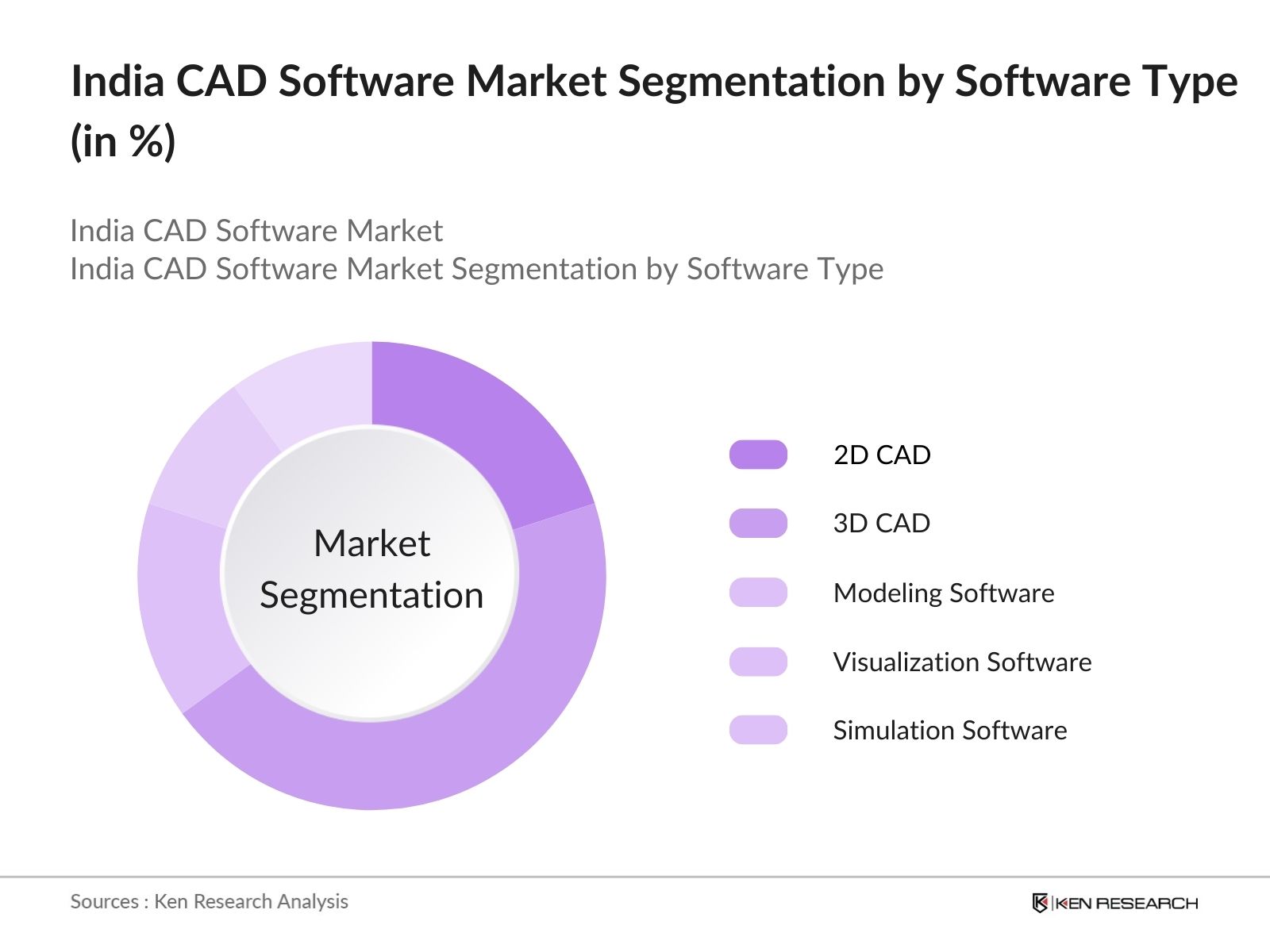

By Software Type: The market is segmented by software type into 2D CAD, 3D CAD, Modeling Software, Visualization Software, and Simulation Software. The 3D CAD segment holds a dominant share due to its crucial role in modern engineering and design applications. Industries like automotive and aerospace rely on 3D CAD for precise modeling, allowing engineers to create complex geometries and simulate real-world conditions, which drives its widespread adoption.

By Deployment Type: The market in India is divided by deployment type into On-Premise and Cloud-Based solutions. Cloud-based CAD solutions are leading the market due to their accessibility, scalability, and reduced infrastructure requirements. This type of deployment is increasingly popular among SMEs, which benefit from reduced setup costs and easy remote collaboration, fueling its growth.

Inda CAD Software Market Competitive Landscape

The market is dominated by a few global and local players. This consolidation emphasizes the influence of these companies in shaping industry standards and fostering innovation in CAD technologies.

India CAD Software Market Analysis

Market Growth Drivers

- Increasing Digital Transformation in Indias Infrastructure Sector: India's infrastructure sector, including roads, railways, and smart cities, is witnessing significant investments to meet the government's ambitious development targets. In 2024, an estimated INR 6,000 billion has been allocated for infrastructure projects by the Indian government, with a focus on efficient design processes facilitated by CAD software.

- Rising Demand in the Manufacturing Sector: The Indian manufacturing sector, currently valued at over INR 44 trillion, is undergoing a modernization shift due to incentives for production-linked manufacturing, aiming to boost exports and improve production efficiency. CAD software plays a pivotal role in designing prototypes, enabling precision in product development, and reducing production costs, making it indispensable for manufacturing companies.

- Expanding Automotive Industry with Focus on Electric Vehicles (EVs): Indias automotive sector is projected to grow with increased investments in EV production, as manufacturers target the governments aim of EVs representing 30% of the countrys vehicle fleet by 2030. The anticipated production increase requires precise design and simulation tools, creating a substantial demand for CAD software among automotive companies.

Market Challenges

- High Cost of CAD Software Licenses and Training: The cost of acquiring CAD software and the associated training remains a challenge for small and medium enterprises (SMEs), with license fees reaching up to INR 200,000 per user annually. This cost barrier impacts adoption rates among smaller companies that are price-sensitive, limiting the overall market expansion.

- Limited Technical Support and Localization for Indian Market Needs: Indian industries often require localized CAD software versions adapted to specific standards, but many providers offer generic, globally optimized solutions. This lack of localization has resulted in underutilized software capabilities, particularly in sectors like civil engineering, where regional codes are essential.

India CAD Software Market Future Outlook

The India CAD Software industry is anticipated to see robust growth due to advancements in cloud computing, integration with AI, and a surge in demand for automation across industries. Factors such as government initiatives aimed at fostering digital transformation and infrastructure development are also expected to boost the demand for CAD solutions.

Future Market Opportunities

- Growth of Cloud-Based CAD Solutions with Enhanced Security Protocols: By 2029, cloud-based CAD solutions will become the preferred choice for an estimated 70% of Indian companies, as security features continue to advance. This trend will be particularly notable in manufacturing and defense sectors where data sensitivity is critical, with projected adoption in over 500 companies.

- Rise in AI Integration for Design Automation: Over the next five years, AI-powered CAD solutions are expected to be adopted widely, with AI algorithms supporting automated design suggestions. By 2029, nearly 80% of CAD users are projected to utilize AI capabilities to optimize design processes and reduce manual intervention.

Scope of the Report

|

By Software Type |

2D CAD 3D CAD Modeling Software Visualization Software Simulation Software |

|

By Deployment Type |

On-Premise Cloud-Based |

|

By End-User Industry |

Automotive Construction and Architecture Electronics and Electrical Healthcare Aerospace and Defense |

|

By Functionality |

Parametric Non-Parametric Integrated CAD Solutions |

|

By Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Engineering Firms

Manufacturing and Automotive Companies

Government and Regulatory Bodies (Ministry of Electronics and Information Technology, Ministry of Skill Development and Entrepreneurship)

Construction and Infrastructure Developers

Industrial Design Agencies

Cloud Service Providers

Software Development Companies

Investor and Venture Capitalist Firms

Companies

Autodesk Inc.

Dassault Systmes

Siemens PLM Software

PTC Inc.

Bentley Systems

Trimble Inc.

Hexagon AB

Bricsys NV

Corel Corporation

Graebert GmbH

Table of Contents

1. India CAD Software Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Growth Rate Analysis

1.4 Segmentation Overview

2.India CAD Software Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Milestones and Development

3. India CAD Software Market Analysis

3.1 Growth Drivers

Infrastructure Expansion

Government Initiatives for Digitalization

Increasing Demand from Manufacturing Sector

Rise in Adoption of Automation in Engineering

3.2 Market Challenges

High Implementation Costs

Skills Gap in CAD Utilization

Software Piracy Issues

3.3 Opportunities

Emergence of Cloud-Based CAD Solutions

Integration with AI and IoT

Expanding Market for 3D Printing

3.4 Trends

Growing Use of Collaborative CAD Tools

Integration with BIM Systems

Demand for Customized CAD Solutions

3.5 Government Regulations

Digital India Initiative

National Policy on Software Products

Data Localization Requirements

3.6 SWOT Analysis

3.7 Industry Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4. India CAD Software Market Segmentation

4.1 By Software Type (in Value %)

2D CAD

3D CAD

Modeling Software

Visualization Software

Simulation Software

4.2 By Deployment Type (in Value %)

On-Premise

Cloud-Based

4.3 By End-User Industry (in Value %)

Automotive

Construction and Architecture

Electronics and Electrical

Healthcare

Aerospace and Defense

4.4 By Functionality (in Value %)

Parametric

Non-Parametric

Integrated CAD Solutions

4.5 By Region (in Value %)

North India

South India

East India

West India

5. India CAD Software Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

Autodesk Inc.

Dassault Systmes

Siemens PLM Software

PTC Inc.

Bentley Systems

Trimble Inc.

Hexagon AB

Bricsys NV

Corel Corporation

Graebert GmbH

NanoSoft

RibbonSoft

Intellicad Technology Consortium

ProgeSOFT

Ashlar-Vellum

5.2 Cross Comparison Parameters (Market Share, Revenue, No. of Users, Deployment Type, Industry Focus, R&D Investments, Customer Satisfaction, Market Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6.India CAD Software Market Regulatory Framework

6.1 Industry Standards and Compliance

6.2 Licensing and Intellectual Property Laws

6.3 Certification Processes

7. India CAD Software Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Drivers for Future Growth

8. India CAD Software Future Market Segmentation

8.1 By Software Type (in Value %)

8.2 By Deployment Type (in Value %)

8.3 By End-User Industry (in Value %)

8.4 By Functionality (in Value %)

8.5 By Region (in Value %)

9. India CAD Software Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This stage involves building a comprehensive market ecosystem by mapping all relevant stakeholders. Extensive desk research was performed, utilizing proprietary databases to gather information on market dynamics.

Step 2: Market Analysis and Data Compilation

Historical data related to market performance was compiled, focusing on revenue growth, market penetration, and service quality metrics. This ensures accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Interviews

Market hypotheses were tested and validated via interviews with industry experts across various sectors. This step provides practical insights that refine the data collected.

Step 4: Synthesis and Final Reporting

Direct engagement with CAD software providers ensured a reliable analysis of market segments and consumer preferences. This engagement supports data verification and results in a comprehensive market assessment.

Frequently Asked Questions

1. How big is the India CAD Software Market?

The India CAD Software market is valued at USD 619 million, driven by a surge in demand from sectors like automotive, construction, and manufacturing.

2. What are the key challenges in the India CAD Software Market?

Key challenges in the India CAD Software market include the high cost of implementation, limited skilled workforce, and issues related to software piracy.

3. Who are the major players in the India CAD Software Market?

Major players in the India CAD Software market include Autodesk Inc., Dassault Systmes, Siemens PLM Software, PTC Inc., and Bentley Systems, each leveraging their strong market presence and diverse offerings.

4. What trends are shaping the India CAD Software Market?

Emerging trends in the India CAD Software market include cloud-based deployments, integration with AI and IoT, and a growing preference for collaborative CAD tools, which are redefining design capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.