India Cancer Diagnostics Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD11324

December 2024

93

About the Report

India Cancer Diagnostics Market Overview

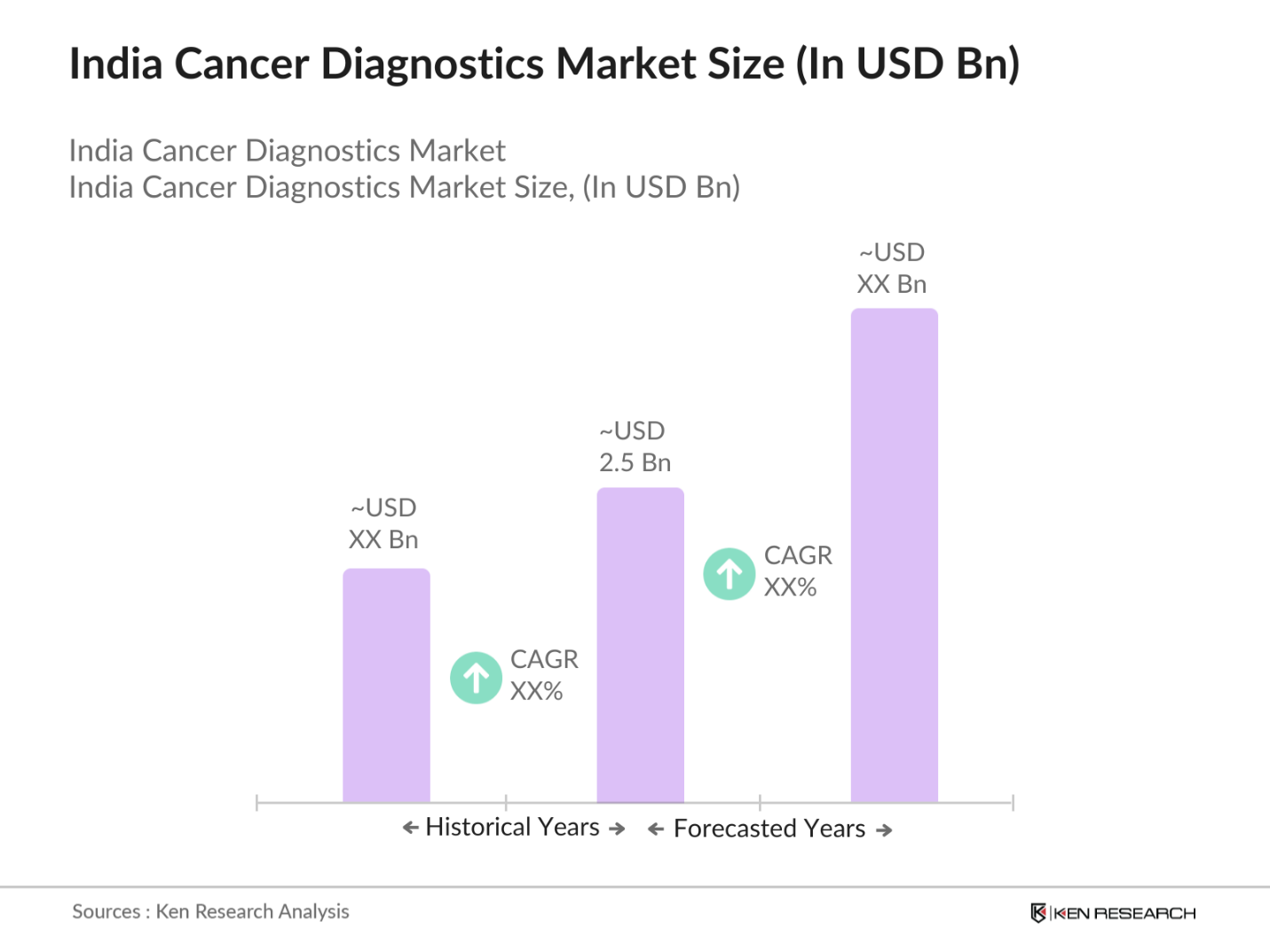

The India cancer diagnostics market is valued at USD 2.5 billion, based on a five-year historical analysis. This substantial valuation is primarily driven by the increasing prevalence of cancer across the country, advancements in diagnostic technologies, and heightened awareness regarding early detection. The integration of innovative diagnostic tools and government initiatives aimed at improving healthcare infrastructure have further propelled market growth.

Major metropolitan areas such as Mumbai, Delhi, and Bengaluru dominate the cancer diagnostics market in India. This dominance is attributed to the concentration of advanced healthcare facilities, higher patient awareness levels, and the presence of leading diagnostic companies in these cities. Additionally, these urban centers have better access to cutting-edge diagnostic technologies and specialized medical professionals, facilitating early detection and treatment of cancer.

The National Cancer Control Program aims to reduce cancer incidence and mortality through prevention, early detection, and treatment. The Ministry of Health and Family Welfare provides comprehensive details on this program, outlining its strategies and objectives.

India Cancer Diagnostics Market Segmentation

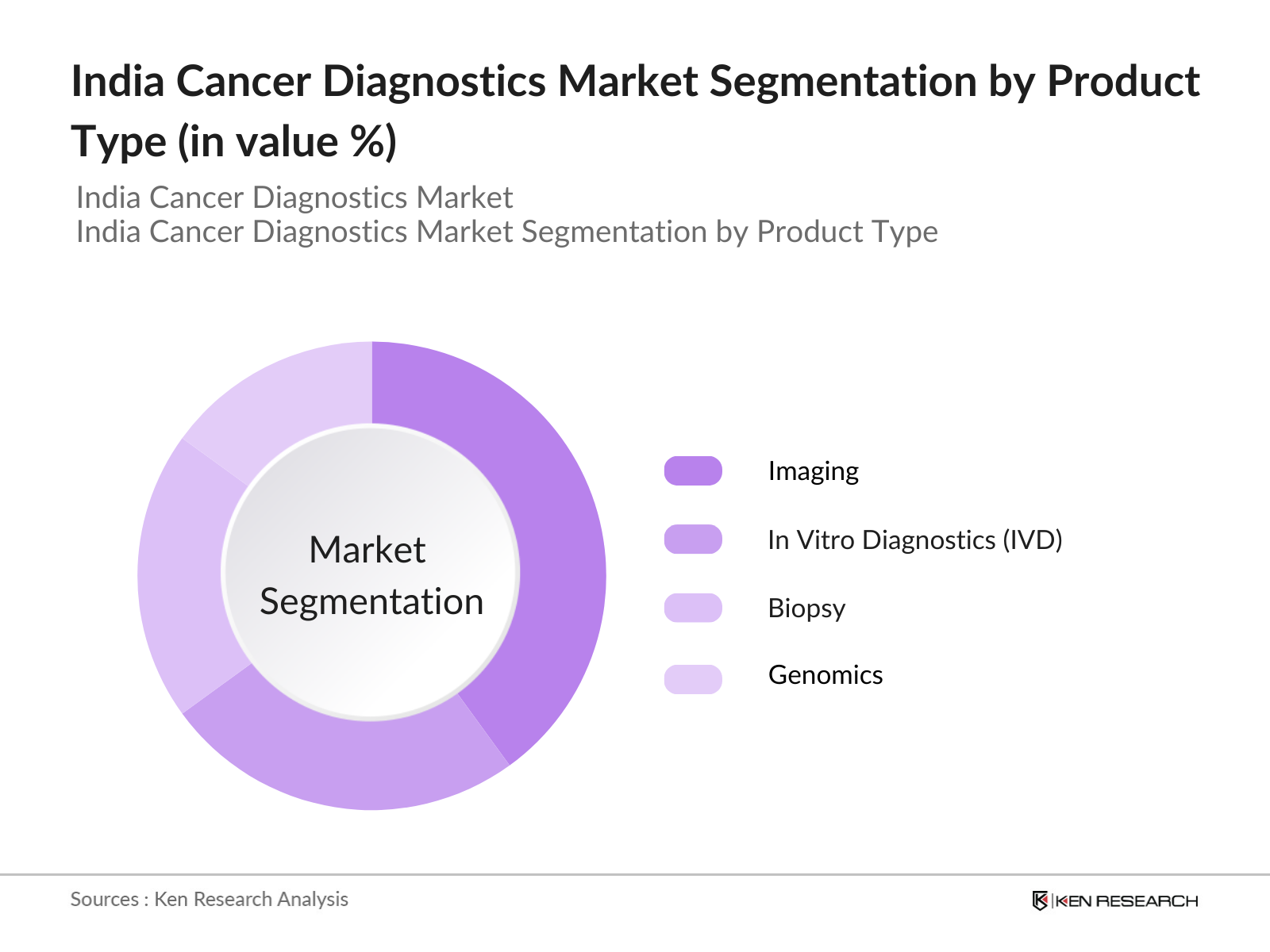

By Technology: The market is further segmented by technology into imaging, in vitro diagnostics (IVD), biopsy, and genomics. Imaging technologies, such as MRI, CT scans, and PET scans, dominate the market share. Their dominance is due to their non-invasive nature, widespread availability, and effectiveness in detecting various types of cancers at early stages. The ability of imaging technologies to provide detailed visualization of internal body structures makes them indispensable in cancer diagnostics.

By Technology: The market is further segmented by technology into imaging, in vitro diagnostics (IVD), biopsy, and genomics. Imaging technologies, such as MRI, CT scans, and PET scans, dominate the market share. Their dominance is due to their non-invasive nature, widespread availability, and effectiveness in detecting various types of cancers at early stages. The ability of imaging technologies to provide detailed visualization of internal body structures makes them indispensable in cancer diagnostics.

India Cancer Diagnostics Market Competitive Landscape

The India cancer diagnostics market is characterized by the presence of several key players who contribute significantly to its growth and development. These companies are engaged in continuous research and development to introduce innovative diagnostic solutions, thereby enhancing their market position.

India Cancer Diagnostics Industry Analysis

Growth Drivers

- Rising Cancer Incidence: India has witnessed a significant increase in cancer cases, with approximately 1.39 million new cases reported in 2020. This surge underscores the escalating demand for advanced diagnostic services to facilitate early detection and treatment. The National Health Profile 2022 highlights this trend, emphasizing the need for enhanced diagnostic infrastructure to manage the growing cancer burden.

- Technological Advancements in Diagnostics: The Indian healthcare sector has embraced cutting-edge diagnostic technologies, including molecular diagnostics and imaging modalities like PET-CT scans. These advancements have improved the accuracy and efficiency of cancer detection. The National Health Profile 2022 documents the integration of such technologies in healthcare facilities, reflecting a commitment to modernizing diagnostic capabilities.

- Government Initiatives and Funding: The Indian government has launched several programs to combat cancer, such as the National Cancer Control Programme and the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS). These initiatives aim to enhance diagnostic and treatment services across the country. The Ministry of Health and Family Welfare provides detailed information on these programs, highlighting their impact on cancer diagnostics.

Market Challenges

- High Cost of Diagnostic Procedures: Advanced cancer diagnostic procedures, such as PET-CT scans and molecular tests, are often expensive, making them inaccessible to a significant portion of the population. The National Health Profile 2022 discusses the financial barriers patients face in accessing these services, highlighting the need for cost-effective solutions.

- Limited Access in Rural Areas: Rural regions in India face a shortage of diagnostic facilities, leading to delayed cancer detection and treatment. The National Health Profile 2022 emphasizes the disparity in healthcare infrastructure between urban and rural areas, underscoring the necessity for targeted interventions to bridge this gap.

India Cancer Diagnostics Market Future Outlook

Over the next five years, the India cancer diagnostics market is expected to exhibit significant growth. This growth is anticipated to be driven by continuous advancements in diagnostic technologies, increasing government support, and a rising emphasis on early detection and personalized medicine. The integration of artificial intelligence and machine learning in diagnostic procedures is also expected to enhance accuracy and efficiency, further propelling market expansion.

Future Market Opportunities

- Expansion of Private Diagnostic Centers: The private sector has been instrumental in establishing diagnostic centers equipped with advanced technologies, particularly in urban areas. The National Health Profile 2022 notes the proliferation of private diagnostic facilities, presenting opportunities for public-private partnerships to enhance cancer diagnostic services nationwide.

- Integration of Artificial Intelligence in Diagnostics: The adoption of artificial intelligence (AI) in diagnostic procedures offers the potential to improve accuracy and efficiency in cancer detection. The National Health Profile 2022 discusses the emerging role of AI in healthcare, indicating a trend towards integrating AI-driven tools in diagnostic practices.

Scope of the Report

|

Product Type |

- Instruments |

|

Technology |

- Imaging |

|

Application |

- Breast Cancer |

|

End User |

- Hospitals |

|

Region |

- North |

Products

Key Target Audience

Diagnostic Equipment Manufacturers

Healthcare Providers

Research Institutes

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

Medical Device Distributors

Oncology Specialists

Pharmaceutical Companies

Investors and Venture Capitalist Firms

Companies

Major Players

Roche Diagnostics

Abbott Laboratories

Siemens Healthineers

Thermo Fisher Scientific

GE Healthcare

Philips Healthcare

Hologic Inc.

Becton, Dickinson and Company

Bio-Rad Laboratories

Qiagen N.V.

Illumina Inc.

Agilent Technologies

PerkinElmer Inc.

Danaher Corporation

Fujifilm Holdings Corporation

Table of Contents

India Cancer Diagnostics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Cancer Diagnostics Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Cancer Diagnostics Market Analysis

3.1. Growth Drivers

3.1.1. Rising Cancer Incidence

3.1.2. Technological Advancements in Diagnostics

3.1.3. Government Initiatives and Funding

3.1.4. Increasing Healthcare Expenditure

3.2. Market Challenges

3.2.1. High Cost of Diagnostic Procedures

3.2.2. Limited Access in Rural Areas

3.2.3. Lack of Skilled Professionals

3.3. Opportunities

3.3.1. Expansion of Private Diagnostic Centers

3.3.2. Integration of Artificial Intelligence in Diagnostics

3.3.3. Public-Private Partnerships

3.4. Trends

3.4.1. Adoption of Liquid Biopsy Techniques

3.4.2. Shift Towards Personalized Medicine

3.4.3. Growth of Point-of-Care Testing

3.5. Government Regulations

3.5.1. National Cancer Control Program

3.5.2. Regulatory Framework for Diagnostic Devices

3.5.3. Quality Standards and Accreditation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

India Cancer Diagnostics Market Segmentation

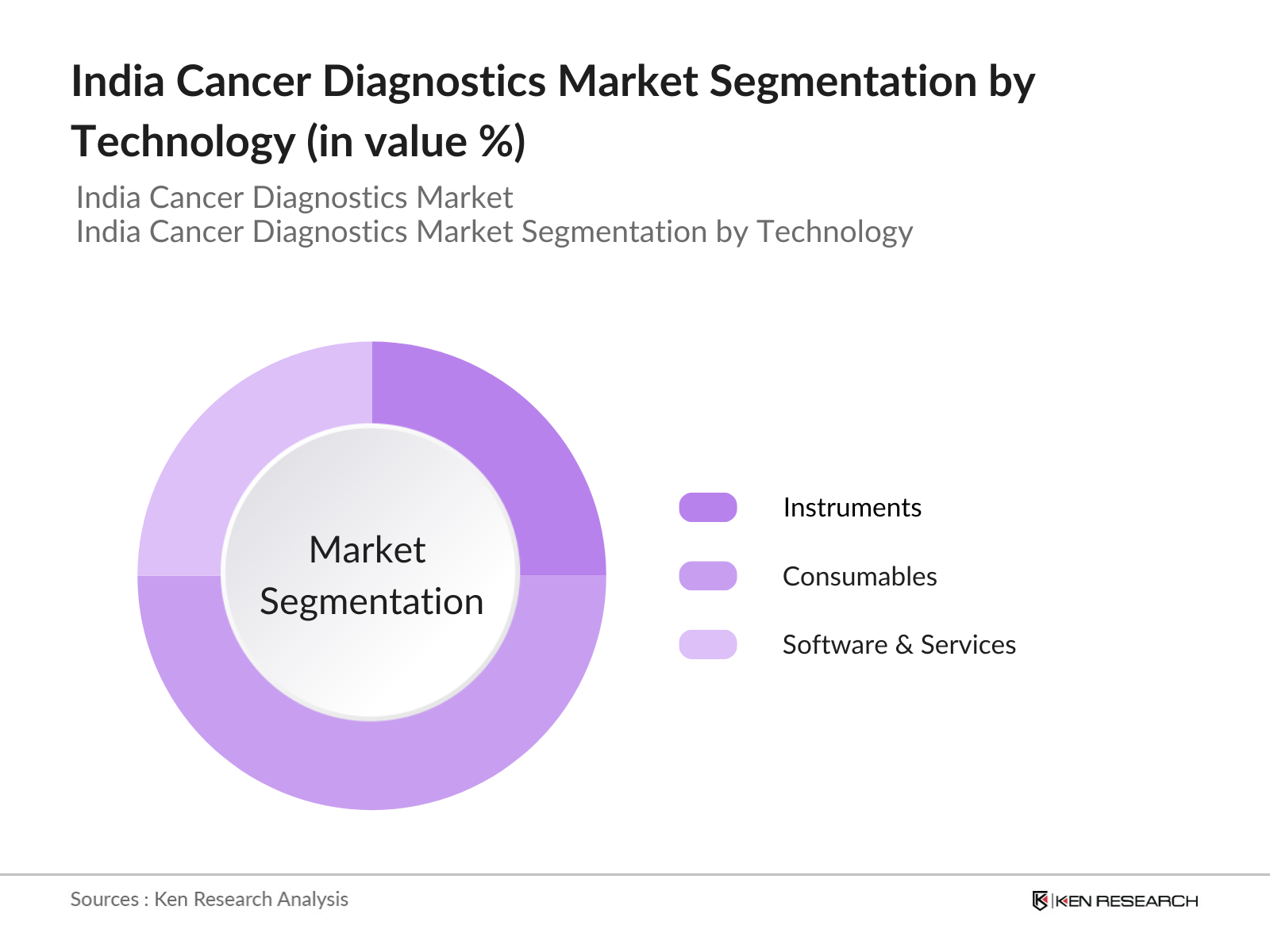

4.1. By Product Type (In Value %)

4.1.1. Instruments

4.1.2. Consumables

4.1.3. Software & Services

4.2. By Technology (In Value %)

4.2.1. Imaging

4.2.2. In Vitro Diagnostics (IVD)

4.2.3. Biopsy

4.2.4. Genomics

4.3. By Application (In Value %)

4.3.1. Breast Cancer

4.3.2. Lung Cancer

4.3.3. Colorectal Cancer

4.3.4. Prostate Cancer

4.3.5. Others

4.4. By End User (In Value %)

4.4.1. Hospitals

4.4.2. Diagnostic Laboratories

4.4.3. Research Institutes

4.4.4. Others

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

India Cancer Diagnostics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Roche Diagnostics

5.1.2. Abbott Laboratories

5.1.3. Siemens Healthineers

5.1.4. Thermo Fisher Scientific

5.1.5. GE Healthcare

5.1.6. Philips Healthcare

5.1.7. Hologic Inc.

5.1.8. Becton, Dickinson and Company

5.1.9. Bio-Rad Laboratories

5.1.10. Qiagen N.V.

5.1.11. Illumina Inc.

5.1.12. Agilent Technologies

5.1.13. PerkinElmer Inc.

5.1.14. Danaher Corporation

5.1.15. Fujifilm Holdings Corporation

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

India Cancer Diagnostics Market Regulatory Framework

6.1. Approval Processes for Diagnostic Devices

6.2. Compliance Requirements

6.3. Certification Processes

India Cancer Diagnostics Market Future Outlook (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Cancer Diagnostics Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

India Cancer Diagnostics Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India cancer diagnostics market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India cancer diagnostics market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple diagnostic equipment manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India cancer diagnostics market.

Frequently Asked Questions

How big is the India Cancer Diagnostics Market?

The India cancer diagnostics market is valued at USD 2.5 billion, based on a five-year historical analysis. This valuation reflects the market's substantial size and its critical role in the healthcare sector.

What are the challenges in the India cancer diagnostics market?

Challenges in the India cancer diagnostics market include the high cost of diagnostic procedures, limited access in rural areas, and a shortage of skilled professionals. These factors restrict widespread access to early cancer detection and diagnosis, particularly in underserved regions.

Who are the major players in the India cancer diagnostics market?

Key players in the market include Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, and GE Healthcare. These companies maintain their leading positions due to extensive product portfolios, strong R&D investment, and a global presence in diagnostics.

What drives growth in the India cancer diagnostics market?

The market growth is primarily driven by an increasing incidence of cancer, advancements in diagnostic technology, and heightened awareness about the importance of early detection. Government initiatives and the expansion of healthcare infrastructure also contribute to this growth.

Which segments are most dominant in the India cancer diagnostics market?

Among product types, consumables dominate due to their recurring demand for various diagnostic procedures. In terms of technology, imaging techniques hold a leading share due to their non-invasive nature and effectiveness in early cancer detection.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.