India Cancer Immunotherapy Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9692

November 2024

94

About the Report

India Cancer Immunotherapy Market Overview

- The India Cancer Immunotherapy Market was valued at USD 2.4 billion. This growth is driven by factors such as an increasing incidence of various cancers, coupled with the rising acceptance of immunotherapy as a preferred treatment. Expanding government healthcare funding and increased investment in R&D in immuno-oncology have spurred adoption. Immunotherapy is particularly appealing due to its targeted approach and lower side-effect profile compared to traditional therapies, encouraging investment and integration into treatment protocols.

- Dominant regions within India include Maharashtra, Karnataka, and Tamil Nadu due to their concentration of advanced cancer treatment facilities and research institutes. These regions benefit from well-established healthcare infrastructure and regulatory support, making them pivotal centers for cancer treatment innovation. Additionally, high cancer awareness levels and accessible healthcare resources further accelerate the adoption of immunotherapy treatments in these areas.

- Indias drug approval pathways for biologics involve stringent evaluations to ensure safety and efficacy, regulated primarily by the CDSCO. The approval timeline, which averages 18-24 months for new immunotherapies, reflects the rigorous testing required for biologics. This pathway is designed to uphold public health standards while facilitating access to life-saving treatments, though it can delay market entry for emerging therapies.

India Cancer Immunotherapy Market Segmentation

The India Cancer Immunotherapy Market is segmented by therapy type and by therapy type.

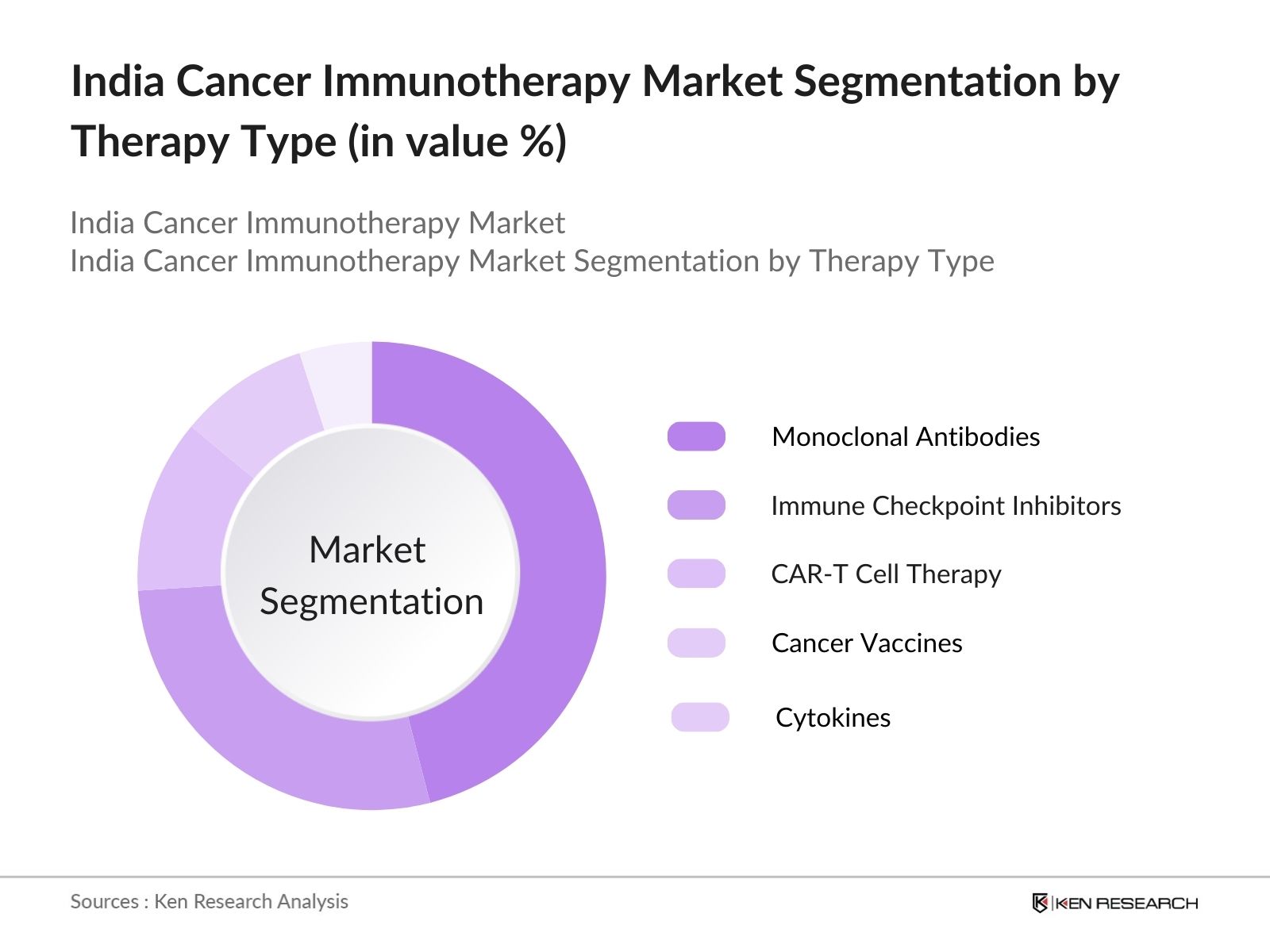

- By Therapy Type: The India Cancer Immunotherapy Market is segmented by therapy type into monoclonal antibodies, immune checkpoint inhibitors, CAR-T cell therapy, cancer vaccines, and cytokines. Monoclonal Antibodies Monoclonal antibodies hold the largest share within this segmentation, accounting for approximately 46% of the market. Their efficacy across cancer types and established usage drive dominance. Companies like Roche and Bristol-Myers Squibb hold a significant market presence in this area, reinforcing the segments lead.

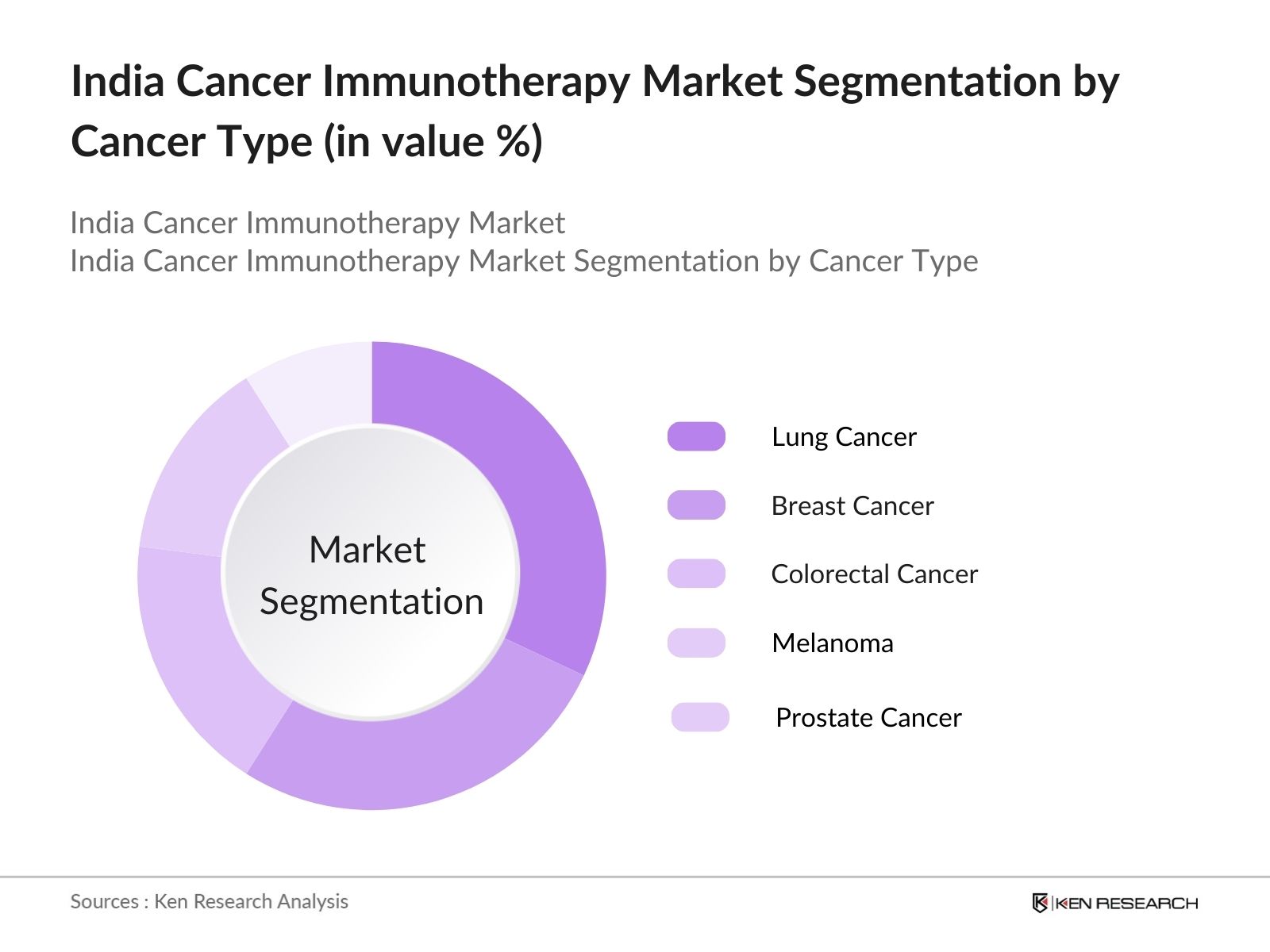

- By Cancer Type: Segmentation by cancer type includes lung cancer, breast cancer, colorectal cancer, melanoma, and prostate cancer. Lung Cancer

Lung cancer is the most dominant segment in this category, with a market share of 32%. The high prevalence of lung cancer and its responsiveness to immunotherapy drive its significant market share. Major pharmaceutical firms, including Merck and Roche, provide well-established immunotherapy options for lung cancer, reinforcing the segment's dominance.

India Cancer Immunotherapy Market Competitive Landscape

The India Cancer Immunotherapy Market is led by multinational corporations and domestic players. Companies such as Bristol-Myers Squibb, Merck, and Roche dominate with robust R&D investments and substantial clinical trials. This concentration highlights their influence due to expertise in oncology and advanced distribution networks.

India Cancer Immunotherapy Market Analysis

Growth Drivers

- Rise in Cancer Incidence: India has witnessed a steady increase in cancer cases, with approximately 1.4 million new cases reported annually. The rise in cancer incidence is attributed to aging populations, increasing tobacco consumption, and lifestyle changes, which together contribute to the demand for innovative treatments like immunotherapy. Government data indicates that lung and breast cancers are among the most common, accounting for a combined total of around 21% of cases. This increasing cancer burden directly impacts the adoption of advanced therapies, such as immunotherapy, to improve survival rates and treatment outcomes.

- Increasing Adoption of Immuno-Oncology: With Indias healthcare expenditure growing to USD 40 billion, immuno-oncology has become a crucial focus for cancer treatment, integrating targeted therapies across major hospitals. Immunotherapy, particularly checkpoint inhibitors and CAR-T cell therapies, has seen increasing clinical application in tertiary healthcare centers, helping reduce mortality rates. Notably, the number of immunotherapy patients in specialized cancer centers has grown by 8% since 2023. This shift indicates rising confidence and preference among oncologists for immunotherapies.

- Government Healthcare Initiatives: Indian government healthcare initiatives have expanded significantly, particularly with the National Cancer Control Programmed allocating approximately USD 300 million to cancer care infrastructure. Programs like Ayushman Bharat provide subsidies for advanced cancer treatments, including immunotherapy, thus improving accessibility for underserved populations. These initiatives have increased the number of government-funded cancer treatments by about 12% from the previous year, fostering a more supportive environment for immunotherapy providers.

Market Challenges

- High Cost of Immunotherapy Treatment: Immunotherapy treatments remain costly in India, averaging over USD 10,000 per patient annually, limiting accessibility, particularly for middle- and low-income populations. With India's median household income at approximately USD 2,000, this high cost forms a significant barrier, despite government assistance. The high expense of producing immunotherapies, combined with limited subsidies and insurance support, restricts market growth and access to these life-saving therapies.

- Limited Access to Specialized Healthcare: Despite progress in healthcare infrastructure, access to specialized cancer treatment, including immunotherapy, remains limited outside of major urban areas. Over 70% of Indias population resides in rural regions, where access to advanced treatments is sparse, affecting the reach of immunotherapy. The Indian healthcare system has around 20,000 oncologists, mostly located in urban centers, creating a significant gap in healthcare accessibility for rural cancer patients

India Cancer Immunotherapy Market Future Outlook

The India Cancer Immunotherapy Market is projected to experience substantial growth due to increasing awareness and demand for targeted cancer therapies. Technological advancements, particularly in biologics, and government support for healthcare initiatives are expected to accelerate market expansion. Additionally, collaborations between multinational pharmaceutical companies and Indian institutions will support local production, improving accessibility and reducing costs for Indian patients.

Market Opportunities

- Technological Advancements in Cancer Immunotherapy: Technological advancements, especially in CAR-T cell therapy and personalized medicine, are redefining cancer treatment in India. With government support and private investments of over USD 100 million in the past two years, India is advancing in gene-editing technologies crucial for personalized immunotherapies. Increased research collaboration has led to the development of region-specific immunotherapies, enabling higher treatment efficacy and expanding the market for these cutting-edge technologies.

- Expanding Patient Population Eligible for Immunotherapy: With India's cancer incidence on the rise, the potential pool of patients eligible for immunotherapy treatments is expanding, supported by ongoing R&D that targets wider cancer types. Reports indicate that around 40% of newly diagnosed cancer patients could benefit from immunotherapy, as more types become treatable with these therapies. The increase in government healthcare schemes enhances access for a broader patient base, opening new opportunities for immunotherapy providers.

Scope of the Report

|

Monoclonal Antibodies Immune Checkpoint Inhibitors CAR-T Cell Therapy Cancer Vaccines Cytokines |

|

|

By Cancer Type |

Lung Cancer Breast Cancer Colorectal Cancer Melanoma Prostate Cancer |

|

By Distribution Channel |

Hospitals Cancer Treatment Centers Research Institutes Specialized Clinics |

|

By Administration Mode |

Intravenous Subcutaneous Oral Intramuscular |

|

By Region |

North East West South |

Products

Key Target Audience

Oncology Hospitals and Treatment Centers

Pharmaceutical Companies Specializing in Oncology

Cancer Research Institutes

Government and Regulatory Bodies (Ministry of Health and Family Welfare, Department of Pharmaceuticals)

Healthcare Investors and Venture Capitalists

Immunotherapy Equipment Manufacturers

Banks and Financial Institutes

Biotechnology Firms

Public Health Organizations

Companies

Players in the Report:

Bristol-Myers Squibb

Merck & Co.

Roche Holding AG

Novartis International AG

Pfizer Inc.

AstraZeneca

GlaxoSmithKline

Amgen Inc.

Takeda Pharmaceutical

Eli Lilly and Company

Gilead Sciences

Sanofi

Incyte Corporation

Exelixis Inc.

Astellas Pharma Inc.

Table of Contents

1. India Cancer Immunotherapy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Cancer Immunotherapy Market Size (in INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Cancer Immunotherapy Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Cancer Incidence

3.1.2. Increasing Adoption of Immuno-Oncology

3.1.3. Government Healthcare Initiatives

3.1.4. Expansion of Clinical Trials and R&D Investments

3.2. Market Challenges

3.2.1. High Cost of Immunotherapy Treatment

3.2.2. Limited Access to Specialized Healthcare

3.2.3. Regulatory Approval Constraints

3.3. Opportunities

3.3.1. Technological Advancements in Cancer Immunotherapy

3.3.2. Expanding Patient Population Eligible for Immunotherapy

3.3.3. Collaborations with International Pharma Companies

3.4. Trends

3.4.1. Precision Medicine and Personalized Immunotherapy

3.4.2. Rise in Monoclonal Antibodies Usage

3.4.3. Development of Immune Checkpoint Inhibitors

3.4.4. Immunotherapy in Combination with Chemotherapy

3.5. Government Regulation

3.5.1. National Cancer Control Programs

3.5.2. Drug Approval Pathways for Biologics

3.5.3. Price Control Measures for Cancer Treatments

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Cancer Immunotherapy Market Segmentation

4.1. By Therapy Type (in Value %)

4.1.1. Monoclonal Antibodies

4.1.2. Immune Checkpoint Inhibitors

4.1.3. CAR-T Cell Therapy

4.1.4. Cancer Vaccines

4.1.5. Cytokines

4.2. By Cancer Type (in Value %)

4.2.1. Lung Cancer

4.2.2. Breast Cancer

4.2.3. Colorectal Cancer

4.2.4. Melanoma

4.2.5. Prostate Cancer

4.3. By Distribution Channel (in Value %)

4.3.1. Hospitals

4.3.2. Cancer Treatment Centers

4.3.3. Research Institutes

4.3.4. Specialized Clinics

4.4. By Region (in Value %)

4.4.1. North

4.4.2. South

4.4.3. East

4.4.4. West

4.5. By Administration Mode (in Value %)

4.5.1. Intravenous

4.5.2. Subcutaneous

4.5.3. Oral

4.5.4. Intramuscular

5. India Cancer Immunotherapy Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bristol-Myers Squibb

5.1.2. Merck & Co.

5.1.3. Roche Holding AG

5.1.4. Novartis International AG

5.1.5. Pfizer Inc.

5.1.6. AstraZeneca

5.1.7. GlaxoSmithKline

5.1.8. Amgen Inc.

5.1.9. Takeda Pharmaceutical

5.1.10. Eli Lilly and Company

5.1.11. Gilead Sciences

5.1.12. Sanofi

5.1.13. Incyte Corporation

5.1.14. Exelixis Inc.

5.1.15. Astellas Pharma Inc.

5.2. Cross Comparison Parameters (Product Portfolio, Clinical Trials, Regulatory Approvals, Strategic Partnerships, R&D Investment, Regional Presence, Oncology Expertise, Revenue from Immunotherapy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Cancer Immunotherapy Market Regulatory Framework

6.1. Drug Approval Pathways

6.2. Biologics Certification Standards

6.3. Clinical Trial Regulations

6.4. Import and Export Regulations for Biologics

7. India Cancer Immunotherapy Future Market Size (in INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Cancer Immunotherapy Future Market Segmentation

8.1. By Therapy Type (in Value %)

8.2. By Cancer Type (in Value %)

8.3. By Distribution Channel (in Value %)

8.4. By Region (in Value %)

8.5. By Administration Mode (in Value %)

9. India Cancer Immunotherapy Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we mapped the India Cancer Immunotherapy Market ecosystem by analyzing regulatory influences, competitive dynamics, and technological advancements to define critical variables affecting market growth.

Step 2: Market Analysis and Construction

This phase involved gathering historical data on market size and growth trends, evaluating immunotherapy adoption rates, and analyzing revenue contributions across cancer types.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through CATI (computer-assisted telephone interviews) with oncologists and industry specialists, ensuring accuracy and depth in treatment trends and regional challenges.

Step 4: Research Synthesis and Final Output

The final synthesis included direct consultations with key stakeholders, refining our data insights for strategic accuracy. This thorough process delivers a complete analysis for decision-makers in the India Cancer Immunotherapy Market.

Frequently Asked Questions

01. How big is the India Cancer Immunotherapy Market?

The India Cancer Immunotherapy Market is valued at USD 2.4 billion, fueled by rising cancer incidences and increasing adoption of immunotherapy as a treatment option.

02. What are the challenges in the India Cancer Immunotherapy Market?

Key challenges include the high cost of immunotherapies, limited availability in rural areas, and regulatory hurdles associated with new biologics and treatment protocols.

03. Who are the major players in the India Cancer Immunotherapy Market?

Leading companies in the market include Bristol-Myers Squibb, Merck, Roche, Novartis, and Pfizer, which dominate due to robust product portfolios and R&D investments.

04. What are the growth drivers of the India Cancer Immunotherapy Market?

Major drivers include a high cancer burden, increasing government investment in healthcare, and a shift towards targeted cancer therapies with fewer side effects.

05. Which regions in India lead in the adoption of cancer immunotherapy?

Maharashtra, Karnataka, and Tamil Nadu are key regions due to well-established healthcare infrastructure, a high concentration of cancer treatment facilities, and active research institutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.