India Car Wash Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD7411

December 2024

98

About the Report

India Car Wash Market Overview

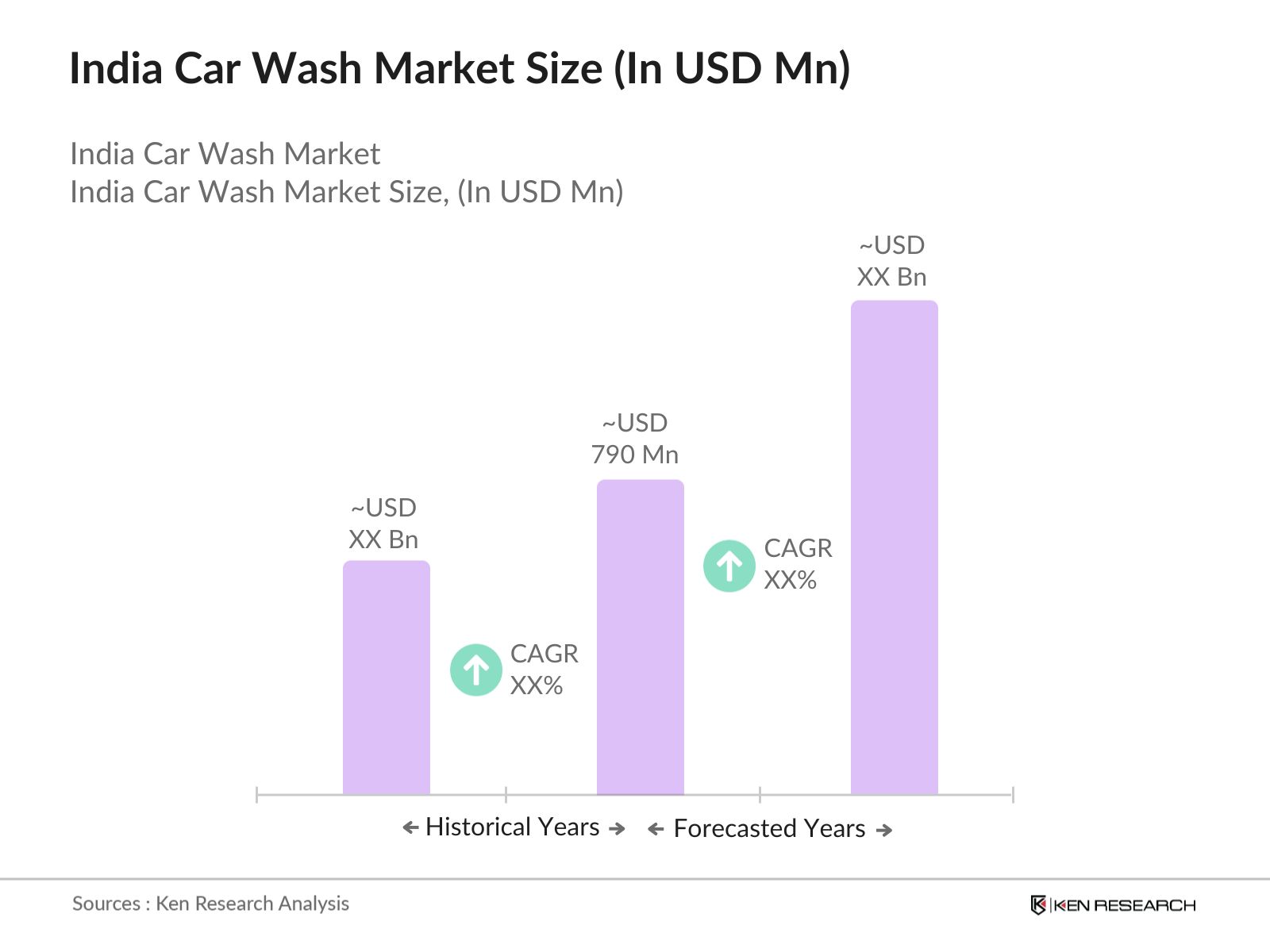

- The India car wash market, based on a five-year historical analysis, is valued at USD 790 million. The market is driven by increasing vehicle ownership, rapid urbanization, and a growing preference for professional car wash services over traditional home washing methods. Rising disposable incomes, coupled with time constraints in urban areas, are pushing consumers towards convenient car care solutions.

- Cities such as Mumbai, Delhi, and Bengaluru are at the forefront of the India car wash market, primarily due to their high vehicle density, affluent population, and well-developed infrastructure. These metropolitan areas host a significant number of vehicles, contributing to the increased demand for professional car wash services. Additionally, stringent water usage regulations and environmental concerns in these cities have led to the adoption of water-efficient car wash technologies, further boosting their dominance in the market.

- The Indian government has introduced stringent water conservation policies aimed at reducing water wastage across industries, including car wash services. In 2022, the Central Pollution Control Board mandated that all commercial car wash facilities must install water recycling systems to conserve resources. This policy has led to a surge in the adoption of water-saving technologies in metro cities like Delhi and Bangalore. In 2023, more than 40% of new car wash establishments complied with these regulations by integrating water recycling units, a trend that is expected to continue as environmental concerns grow.

India Car Wash Market Segmentation

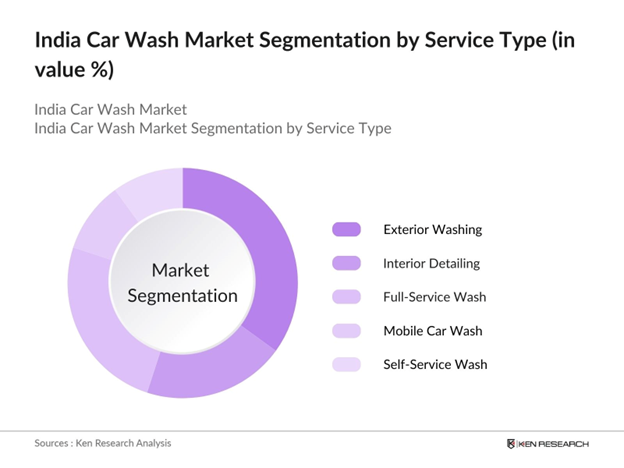

By Service Type: The India car wash market is segmented by service type into exterior washing, interior detailing, full-service wash, mobile car wash, and self-service wash. Recently, exterior washing services have dominated the market, driven by the convenience of quick washes and lower costs compared to comprehensive detailing services. The ease of exterior washing, especially with the rise of automated car washes, has garnered significant customer interest, particularly in urban areas where consumers value time-saving options.

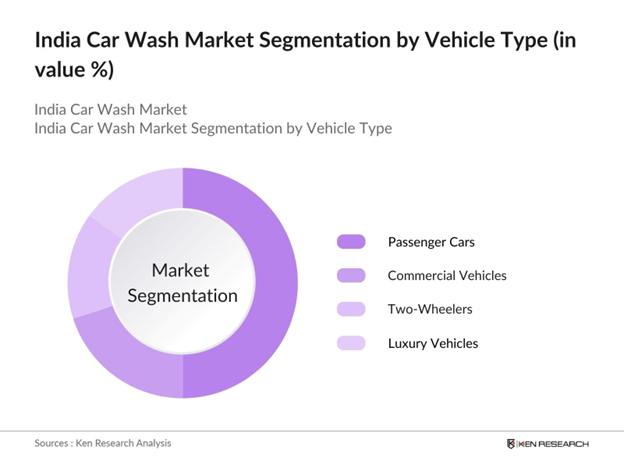

By Vehicle Type: The market is also segmented by vehicle type, including passenger cars, commercial vehicles, two-wheelers, and luxury vehicles. Passenger cars hold a dominant market share, as the car ownership rate in urban and semi-urban areas continues to rise. With increasing vehicle sales and an expanding middle-class population, more consumers are opting for professional car wash services to maintain their vehicles, especially in cities with higher pollution levels, where frequent washing is necessary.

India Car Wash Market Competitive Landscape

The India car wash market is dominated by several key players, both local and international, who have established a significant presence in major cities. Their focus on technology integration, customer convenience, and sustainable solutions has helped them capture substantial market share. The following table outlines the top five competitors in the market, along with their establishment year, headquarters, and six key market-specific parameters.

|

Company Name |

Year Established |

Headquarters |

Service Type |

Technology Used |

Locations |

Revenue |

No. of Employees |

Eco-Friendly Initiatives |

Franchise Model |

|

3M Car Care |

2009 |

Bengaluru |

- |

- |

- |

- |

- |

- |

- |

|

Express Car Wash |

2010 |

New Delhi |

- |

- |

- |

- |

- |

- |

- |

|

The Car Laundry |

2012 |

Hyderabad |

- |

- |

- |

- |

- |

- |

- |

|

Bosch Car Service |

1921 |

Germany |

- |

- |

- |

- |

- |

- |

- |

|

AutozSpa |

2013 |

Mumbai |

- |

- |

- |

- |

- |

- |

- |

India Car Wash Market Analysis

Growth Drivers

- Rising Urbanization: India's urban population is expected to reach 600 million in 2024, increasing the demand for personal vehicles. With vehicle registrations standing at 295 million in 2022, there is a clear trend toward higher vehicle ownership in urban centers like Delhi and Mumbai. The number of registered vehicles in Delhi alone exceeded 12 million in 2023. This rise in vehicle ownership is directly driving the demand for car wash services, as urban consumers seek professional cleaning solutions due to their busy schedules.

- Shift Towards Professional Services: The rising middle class in India has significantly influenced consumer behavior, with a marked shift toward convenience. By 2023, approximately 72% of Indian car owners in metro cities were using professional car wash services instead of manual cleaning. The time-constrained urban lifestyle and increased disposable income have driven the preference for professional car care services, which offer more efficient, faster, and reliable solutions.

- Government Regulations on Water Usage: The National Green Tribunal mandated in 2022 that commercial car washes must implement water recycling systems to reduce wastage. These regulations have encouraged the adoption of advanced technologies, such as waterless car washing methods and efficient water recycling systems. In 2023, more than 40% of new car wash outlets in Tier-1 cities like Bangalore and Hyderabad integrated water-saving technologies to comply with these mandates. This regulatory environment is pushing the industry toward sustainable practices.

Challenges

- High Initial Investment: Setting up a professional car wash facility in India requires significant capital. On average, establishing a fully automated car wash unit costs $50,000 - $60,000, depending on the equipment and location. This high initial investment poses a barrier for small entrepreneurs looking to enter the market. In 2023, many startups faced difficulties securing loans due to these capital-intensive requirements.

- Seasonal Demand Variations: Car wash services in India are heavily influenced by seasonal variations. During the monsoon season, which spans June to September, demand for car wash services decreases significantly in states like Maharashtra and Kerala, where rainfall exceeds 2500 mm annually. In contrast, demand surges during the summer and post-monsoon months, creating operational challenges for service providers who struggle to balance fluctuating demand.

India Car Wash Market Future Outlook

India car wash market is expected to witness significant growth, driven by the increasing number of vehicles on the road, rising disposable incomes, and growing consumer preference for organized car wash services. Additionally, advancements in eco-friendly and water-efficient technologies will cater to both consumer and regulatory demands, fostering further market expansion. Furthermore, the rise of mobile and on-demand car wash services will provide a new level of convenience, particularly in urban areas, where time-saving solutions are in high demand.

Market Opportunities

- Expansion into Rural Areas: Rural India, where over 70% of the population resides, presents a significant opportunity for car wash service expansion. Vehicle ownership in rural areas reached 8 million by the end of 2023. Despite this, professional car wash services remain scarce in these regions. With rising vehicle ownership and improved infrastructure, rural markets offer untapped potential for businesses willing to expand their footprint beyond urban centers.

- Growing Trend of Eco-Friendly Car Washes: Eco-friendly car wash services are gaining momentum in India due to increased environmental awareness and government regulations on water conservation. Waterless car wash solutions, which use biodegradable cleaning agents, are becoming popular in water-scarce areas like Gujarat and Rajasthan. In 2023, more than 20% of new car wash businesses in these regions adopted waterless technologies, offering a green alternative to traditional methods.

Scope of the Report

|

By Service Type |

Exterior Washing Interior Detailing Full-Service Wash Mobile Car Wash Self-Service Wash |

|

By Vehicle Type |

Passenger Cars Commercial Vehicles Two-Wheelers Luxury Vehicles |

|

By Technology |

Automated/Touchless Wash Tunnel Car Wash Hand Wash Steam Wash |

|

By Ownership |

Independent Operators Franchised Car Washes |

|

By Region |

North South East West |

Products

Key Target Audience

Car Wash Service Providers

Car Dealerships and Showrooms

Automotive Accessories Manufacturers

Franchise Operators

Sustainable Technology Companies

Automotive Maintenance Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Road Transport & Highways, Ministry of Environment, Forest and Climate Change)

Companies

Players Mentioned in the Report

3M Car Care

Express Car Wash

The Car Laundry

Exppress Car Wash

Service Spa

AutozSpa

Bosch Car Service

Steam n Shine Car Wash

CarzSpa

GoMechanic

Table of Contents

1. India Car Wash Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Car Wash Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Car Wash Market Analysis

3.1. Growth Drivers

3.1.1. Rising Urbanization (Increased Vehicle Ownership)

3.1.2. Shift Towards Professional Services (Customer Preference for Convenience)

3.1.3. Government Regulations on Water Usage (Water-Saving Technologies)

3.1.4. Technological Advancements (Automation in Car Wash Facilities)

3.2. Market Challenges

3.2.1. High Initial Investment (Establishment Costs)

3.2.2. Seasonal Demand Variations (Weather-Dependent Operations)

3.2.3. Environmental Concerns (Water Wastage, Chemical Usage)

3.2.4. Competitive Landscape (Fragmentation of Service Providers)

3.3. Opportunities

3.3.1. Expansion into Rural Areas (Untapped Markets)

3.3.2. Growing Trend of Eco-Friendly Car Washes (Waterless Technologies)

3.3.3. Franchise Business Model Expansion (Scalability for Entrepreneurs)

3.3.4. Integration of Mobile Car Wash Services (On-Demand Services)

3.4. Trends

3.4.1. Adoption of Water Recycling Systems (Sustainability Focus)

3.4.2. Increased Use of Mobile Applications (Booking and Payment Solutions)

3.4.3. Smart Wash Systems (Integration with IoT and AI)

3.4.4. Growth of Subscription-Based Services (Loyalty and Retention Strategies)

3.5. Government Regulation

3.5.1. Water Conservation Policies (Mandatory Water Recycling)

3.5.2. Pollution Control Norms (Usage of Eco-Friendly Cleaning Products)

3.5.3. Licensing and Certification Requirements (Safety and Standards Compliance)

3.5.4. Taxation Policies (GST Implications on Car Wash Services)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. India Car Wash Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Exterior Washing

4.1.2. Interior Detailing

4.1.3. Full-Service Wash

4.1.4. Mobile Car Wash

4.1.5. Self-Service Wash

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Two-Wheelers

4.2.4. Luxury Vehicles

4.3. By Technology (In Value %)

4.3.1. Automated/Touchless Wash

4.3.2. Tunnel Car Wash

4.3.3. Hand Wash

4.3.4. Steam Wash

4.4. By Ownership (In Value %)

4.4.1. Independent Operators

4.4.2. Franchised Car Washes

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Car Wash Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. 3M Car Care

5.1.2. Express Car Wash

5.1.3. The Car Laundry

5.1.4. Exppress Car Wash

5.1.5. Service Spa

5.1.6. AutozSpa

5.1.7. Bosch Car Service

5.1.8. Steam n Shine Car Wash

5.1.9. CarzSpa

5.1.10. GoMechanic

5.2. Cross Comparison Parameters (Market Presence, Revenue, Number of Locations, Service Portfolio, Water Recycling Systems Used, Franchise Model, Consumer Base, Eco-Friendly Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, Franchise Expansion, Technology Integration)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. India Car Wash Market Regulatory Framework

6.1. Water Usage Norms

6.2. Environmental Compliance Standards

6.3. Licensing and Certification Processes

6.4. Safety Regulations

7. India Car Wash Market Future Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Car Wash Market Future Segmentation

8.1. By Service Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Technology (In Value %)

8.4. By Ownership (In Value %)

8.5. By Region (In Value %)

9. India Car Wash Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis

9.3. Marketing and Branding Strategies

9.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The research process began by identifying critical variables driving the India car wash market. This was achieved through comprehensive desk research, utilizing both proprietary databases and publicly available resources. The primary objective was to map out the markets major stakeholders, including service providers, automotive companies, and regulatory bodies.

Step 2: Market Analysis and Construction

This phase focused on collecting and analyzing historical data to understand the markets evolution. Various service types, vehicle ownership trends, and geographical distribution were evaluated to assess their impact on revenue generation. Key metrics such as service penetration and technology adoption were analyzed to establish a reliable market forecast.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through interviews with key industry experts from leading car wash service providers. These consultations provided valuable insights into market dynamics, technological advancements, and operational challenges, helping to refine the market outlook.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing research findings into a comprehensive report. Data from multiple sources, including government bodies and industry players, were cross-verified to ensure accuracy. The output includes validated market data, competitor analysis, and segmentation insights.

Frequently Asked Questions

01. How big is the India Car Wash Market?

The India car wash market is valued at USD 790 million, driven by increasing vehicle ownership, urbanization, and a shift towards professional car wash services over traditional methods.

02. What are the challenges in the India Car Wash Market?

Challenges in India car wash market include high initial investment costs, seasonal demand fluctuations, and environmental concerns related to water usage and chemical waste

03. Who are the major players in the India Car Wash Market?

Key players in India car wash market include 3M Car Care, Express Car Wash, The Car Laundry, AutozSpa, and Bosch Car Service. These companies dominate through innovation in technology and service delivery.

04. What are the growth drivers of the India Car Wash Market?

Growth drivers in India car wash market include rising vehicle ownership, increasing disposable incomes, and the demand for time-saving car wash solutions in urban areas. Additionally, advancements in eco-friendly washing technologies contribute to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.