India Carbonated Beverages Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD9786

December 2024

83

About the Report

India Carbonated Beverages Market Overview

- The India carbonated beverages market, valued at USD 75.1 billion, has shown steady growth driven by increasing urbanization and a large youthful population. The growing middle-class segment, with rising disposable incomes, has also boosted demand for ready-to-drink beverages, particularly in urban areas. This market is influenced by lifestyle changes, where consumers are gravitating toward convenience and global consumption patterns.

- Cities like Mumbai, Delhi, and Bangalore dominate the market due to their high population density and significant exposure to global trends. These urban centers not only have better distribution networks but also benefit from a youth demographic that drives the consumption of trendy, innovative products. Rural penetration, while growing, still lags behind urban centers due to differences in disposable income and access to products.

- In 2024, the Indian government reduced the Goods and Services Tax (GST) on non-alcoholic beverages, including carbonated soft drinks, from 28% to 18% to stimulate consumption. This reduction was aimed at making carbonated beverages more affordable, especially in rural areas. As a result, major companies like PepsiCo reported an increase in volume sales by over 50 million units in the quarter following the tax revision.

India Carbonated Beverages Market Segmentation

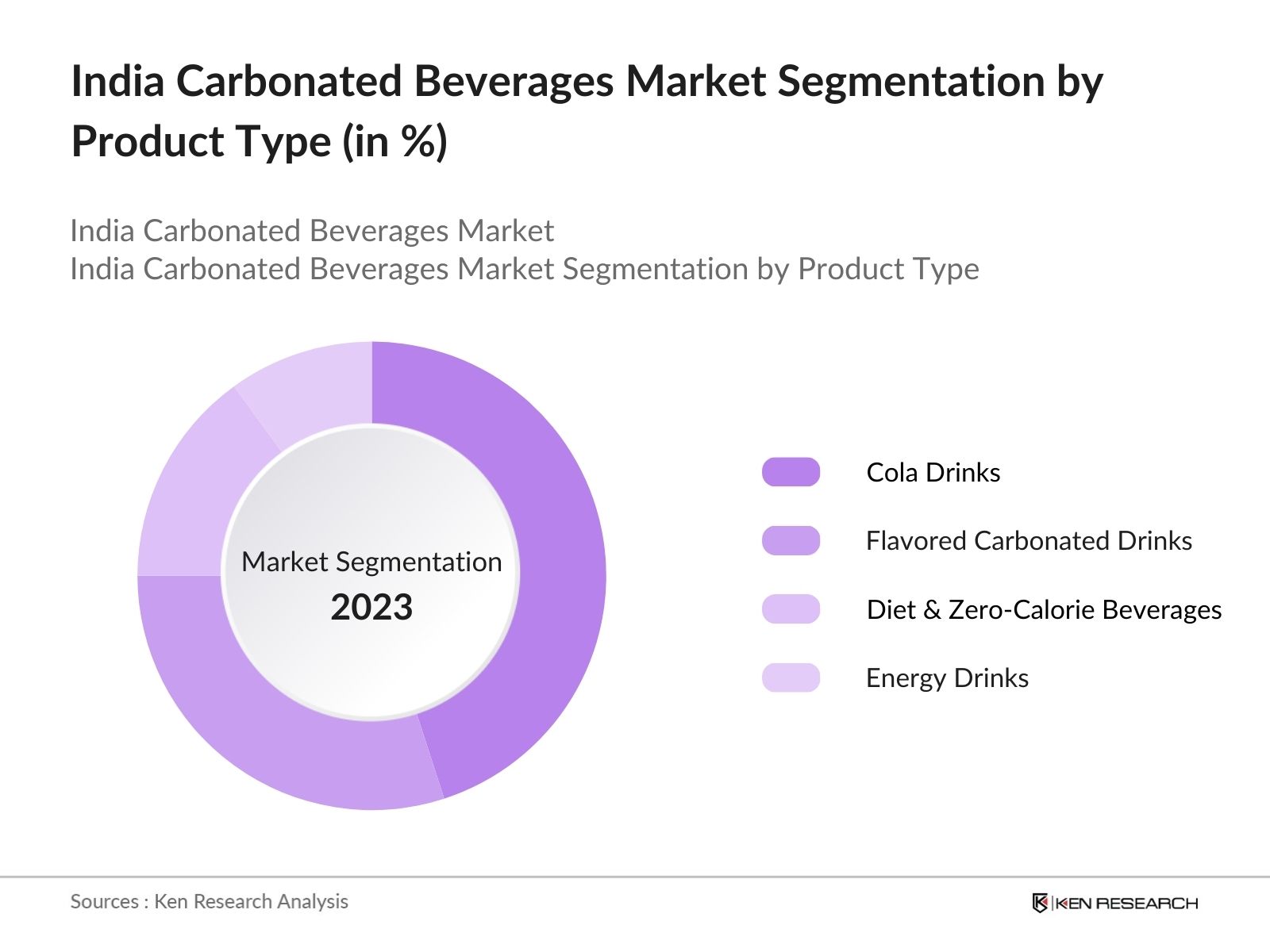

By Product Type: The market is segmented by product type into cola drinks, flavored carbonated drinks, diet and zero-calorie beverages, and energy drinks. Cola drinks dominate the market, largely because of established brands like Coca-Cola and PepsiCo, which have cultivated long-standing brand loyalty. These drinks remain popular due to extensive marketing and consumer familiarity. However, flavored carbonated drinks, including regional and seasonal varieties, are seeing increased interest from younger consumers.

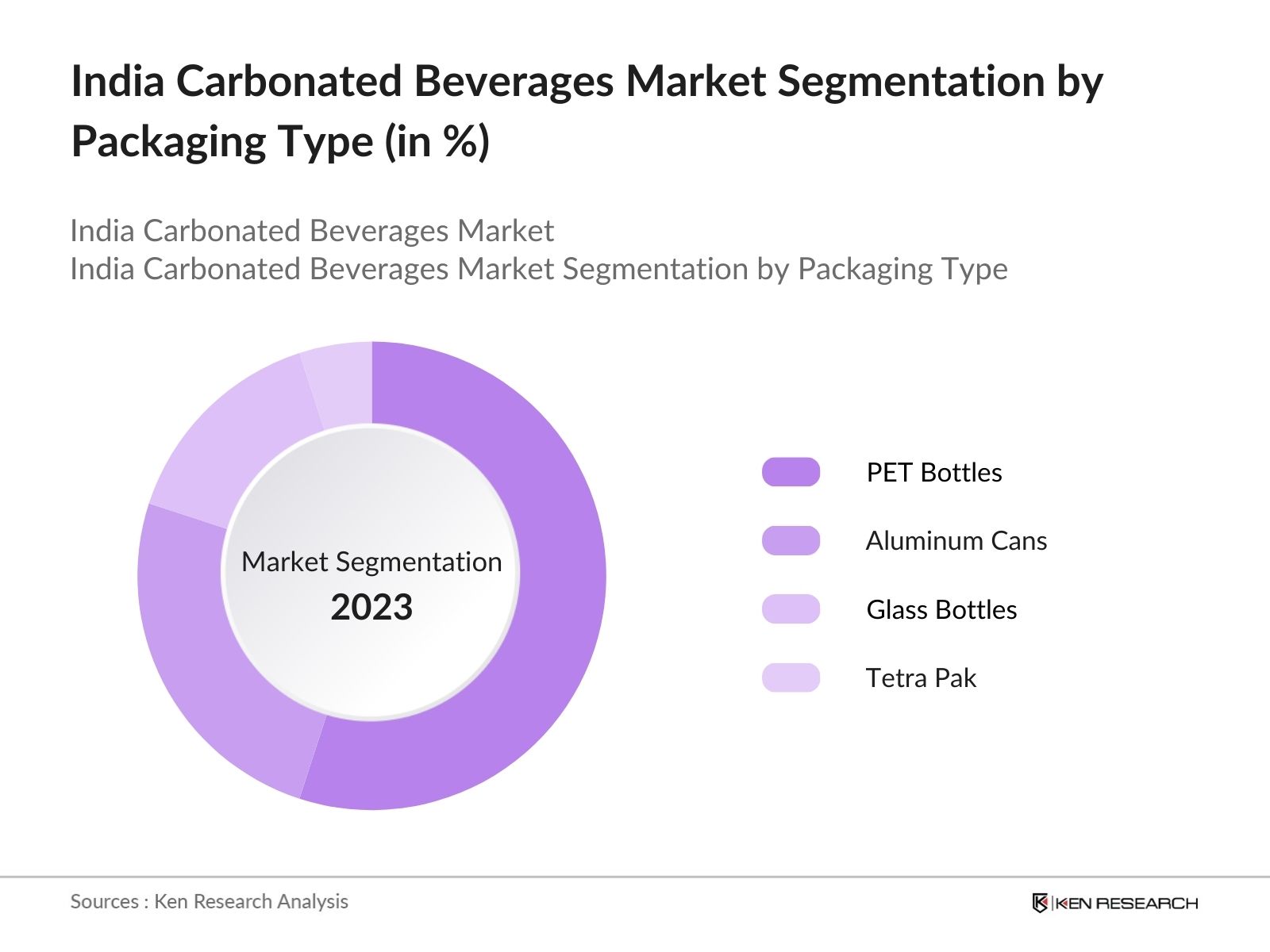

By Packaging Type: The market is also segmented by packaging into PET bottles, aluminum cans, glass bottles, and Tetra Pak. PET bottles dominate due to their cost-effectiveness and convenience. These bottles are widely used across urban and rural regions because they are durable and easy to transport. However, aluminum cans are gaining traction, especially in urban areas, where consumers are becoming more environmentally conscious and prefer recyclable packaging.

India Carbonated Beverages Market Competitive Landscape

The market is highly competitive, with both international giants and domestic players contributing to intense rivalry. Global leaders like Coca-Cola and PepsiCo continue to dominate due to their expansive distribution networks, strong marketing campaigns, and the introduction of low-sugar variants to cater to health-conscious consumers.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Employees |

Distribution Channels |

Product Portfolio |

Market Penetration |

Brand Loyalty |

|

Coca-Cola India |

1993 |

Gurgaon |

||||||

|

PepsiCo India |

1989 |

Noida |

||||||

|

Parle Agro |

1984 |

Mumbai |

||||||

|

Bisleri International |

1969 |

Mumbai |

||||||

|

Red Bull India |

2003 |

Mumbai |

India Carbonated Beverages Market Analysis

Market Growth Drivers

- Expansion of Distribution Networks Major carbonated beverage brands in India are investing heavily in expanding their distribution networks to reach tier-2 and tier-3 cities. In 2024, large beverage companies like Coca-Cola India and PepsiCo plan to set up additional bottling plants, increasing production capacity to meet rising demand.

- Increased Focus on Flavored Variants There has been an increase in the variety of flavored carbonated beverages to cater to local tastes. In 2024, beverage companies introduced over 30 new flavor combinations specifically targeted toward regional preferences, including masala sodas and fruit-based carbonated drinks.

- Strategic Marketing and Promotions In 2024, beverage companies allocated over INR 5,000 crores for digital and influencer marketing to target India's younger, tech-savvy population. Popular brands are leveraging major sporting events such as the Indian Premier League (IPL) to boost brand visibility.

Market Challenges

- Health Consciousness Among Consumers: Rising health concerns are negatively affecting the sales of carbonated beverages. In 2024, a survey conducted by the Ministry of Health revealed that over 60 million Indians are reducing their consumption of sugary drinks due to concerns over diabetes and obesity.

- Environmental Sustainability Pressure: The Indian government has been cracking down on the plastic waste generated by the carbonated beverages industry. In 2024, the Ministry of Environment imposed stricter regulations on single-use plastics, which are extensively used in beverage packaging.

India Carbonated Beverages Market Future Outlook

The India carbonated beverages industry is projected to grow over the next five years, driven by product innovation, expanding distribution channels, and increasing consumer demand for healthier alternatives.

Future Market Opportunities

- Shift Toward Functional Carbonated Beverages: In the next five years, beverage companies are expected to introduce more functional carbonated drinks infused with vitamins and minerals to meet growing consumer demand for healthier options. By 2028, the Indian market could see a surge in sales of these beverages, with brands targeting over 200 million health-conscious consumers.

- Increased Penetration of Ready-to-Drink Beverages: The demand for ready-to-drink carbonated beverages is expected to grow significantly by 2028, with an estimated market reach of over 5 billion liters annually. The expansion of organized retail in tier-2 and tier-3 cities will contribute to this growth, with companies expanding their distribution networks to tap into these untapped markets.

Scope of the Report

|

Product Type |

Cola Flavored Drinks Diet & Zero-Calorie Energy Drinks Sparkling Water |

|

Packaging Type |

PET Bottles Aluminum Cans Glass Bottles Tetra Pak Pouches |

|

Distribution Channel |

Supermarkets Convenience Stores Online Retail Vending Machines |

|

Consumer Demographics |

Urban Rural Millennials Health-Conscious Consumers |

|

Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Manufacturers of Carbonated Beverages

Banks and Financial Institution

Private Equity Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Health and Family Welfare)

Packaging Solution Providers

Sustainability and Environmental Advocacy Groups

Companies

Players Mentioned in the Report:

Coca-Cola India

PepsiCo India

Parle Agro

Bisleri International

Red Bull India

Dabur India

Manpasand Beverages

Rasna Pvt Ltd

Varun Beverages

Hector Beverages

Table of Contents

1. India Carbonated Beverages Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Carbonated Beverages Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Carbonated Beverages Market Analysis

3.1. Growth Drivers (Health Trends, Changing Youth Preferences, Expanding E-commerce)

3.2. Market Challenges (Regulatory Framework, Taxation, Environmental Concerns)

3.3. Opportunities (Sustainability Initiatives, Product Innovation, Online Penetration)

3.4. Trends (Healthier Alternatives, Localized Flavors, Packaging Innovation)

3.5. Government Regulations (GST, Sugar Taxes, Food Safety Regulations)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Carbonated Beverages Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Cola Drinks

4.1.2. Flavored Carbonated Drinks

4.1.3. Diet and Zero-Calorie Beverages

4.1.4. Energy Drinks

4.1.5. Sparkling Water

4.2. By Packaging Type (in Value %)

4.2.1. PET Bottles

4.2.2. Aluminum Cans

4.2.3. Glass Bottles

4.2.4. Tetra Pak and Pouches

4.3. By Distribution Channel (in Value %)

4.3.1. Supermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Vending Machines

4.4. By Consumer Demographics (in Value %)

4.4.1. Urban Consumers

4.4.2. Rural Consumers

4.4.3. Millennial and Gen Z

4.4.4. Health-Conscious Consumers

4.5. By Region (in Value %)

4.5.1. North India

4.5.2. South India

4.5.3. West India

4.5.4. East India

5. India Carbonated Beverages Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Coca-Cola India

5.1.2. PepsiCo India

5.1.3. Parle Agro

5.1.4. Bisleri International

5.1.5. Red Bull India

5.1.6. Dabur India

5.1.7. Paper Boat (Hector Beverages)

5.1.8. Manpasand Beverages

5.1.9. Rasna Pvt Ltd

5.1.10. ITC Limited

5.1.11. Varun Beverages

5.1.12. Hector Beverages

5.1.13. Xotik Frujus Pvt Ltd

5.1.14. Tropicana (PepsiCo)

5.1.15. Tzinga

5.2. Cross Comparison Parameters (Headquarters, Revenue, No. of Employees, Distribution Channels, Brand Value, Market Share, Product Offerings, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Partnerships

5.5. Mergers and Acquisitions

5.6. Investment and Venture Capital Insights

5.7. Government Grants and Subsidies

6. India Carbonated Beverages Market Regulatory Framework

6.1. Packaging Regulations

6.2. Compliance with Food Safety Standards

6.3. Taxation and Pricing Controls

6.4. Environmental Sustainability Regulations

7. India Carbonated Beverages Future Market Size (in USD Bn)

7.1. Projections of Market Size

7.2. Factors Driving Future Market Growth

8. India Carbonated Beverages Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Packaging Type (in Value %)

8.3. By Distribution Channel (in Value %)

8.4. By Consumer Demographics (in Value %)

8.5. By Region (in Value %)

9. India Carbonated Beverages Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Targeting and Cohort Analysis

9.3. Marketing and Brand Building Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this step, we mapped the entire ecosystem of stakeholders in the India Carbonated Beverages Market. This involved extensive desk research using proprietary databases to capture key market drivers and challenges.

Step 2: Market Analysis and Construction

We compiled historical data for the market, analyzing the growth trajectory based on product categories and consumer demographics. This step helped to calculate market shares and performance across different segments.

Step 3: Hypothesis Validation and Expert Consultation

To validate the insights, we conducted interviews with industry leaders and beverage manufacturers to refine our market estimations. These consultations provided valuable operational data directly from the field.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the primary and secondary research data, ensuring that our insights were aligned with actual market trends. This comprehensive approach allowed us to provide a detailed and accurate analysis of the India carbonated beverages market.

Frequently Asked Questions

01. How big is the India Carbonated Beverages Market?

The India carbonated beverages market was valued at USD 75.1 billion, supported by the rising demand for convenient ready-to-drink beverages, especially in urban areas.

02. What are the challenges in the India Carbonated Beverages Market?

Challenges in the India carbonated beverages market include regulatory hurdles, such as GST and sugar-related taxation, as well as environmental concerns around plastic waste and sustainability.

03. Who are the major players in the India Carbonated Beverages Market?

Key players in the India carbonated beverages market include Coca-Cola India, PepsiCo India, Parle Agro, Bisleri International, and Red Bull India, all of which have a dominant market presence due to extensive distribution networks and strong brand recognition.

04. What are the growth drivers of the India Carbonated Beverages Market?

Growth in the India carbonated beverages market is driven by increasing urbanization, expanding middle-class consumer bases, and the rise of e-commerce as a significant distribution channel. The demand for low-sugar and diet beverages is also propelling market expansion.

05. What is the future outlook for the India Carbonated Beverages Market?

The India carbonated beverages market is expected to witness significant growth due to continued product innovation, expanding distribution networks, and increased consumer focus on health-conscious beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.