India Cardiovascular Devices Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD2575

October 2024

91

About the Report

India Cardiovascular Devices Market Overview

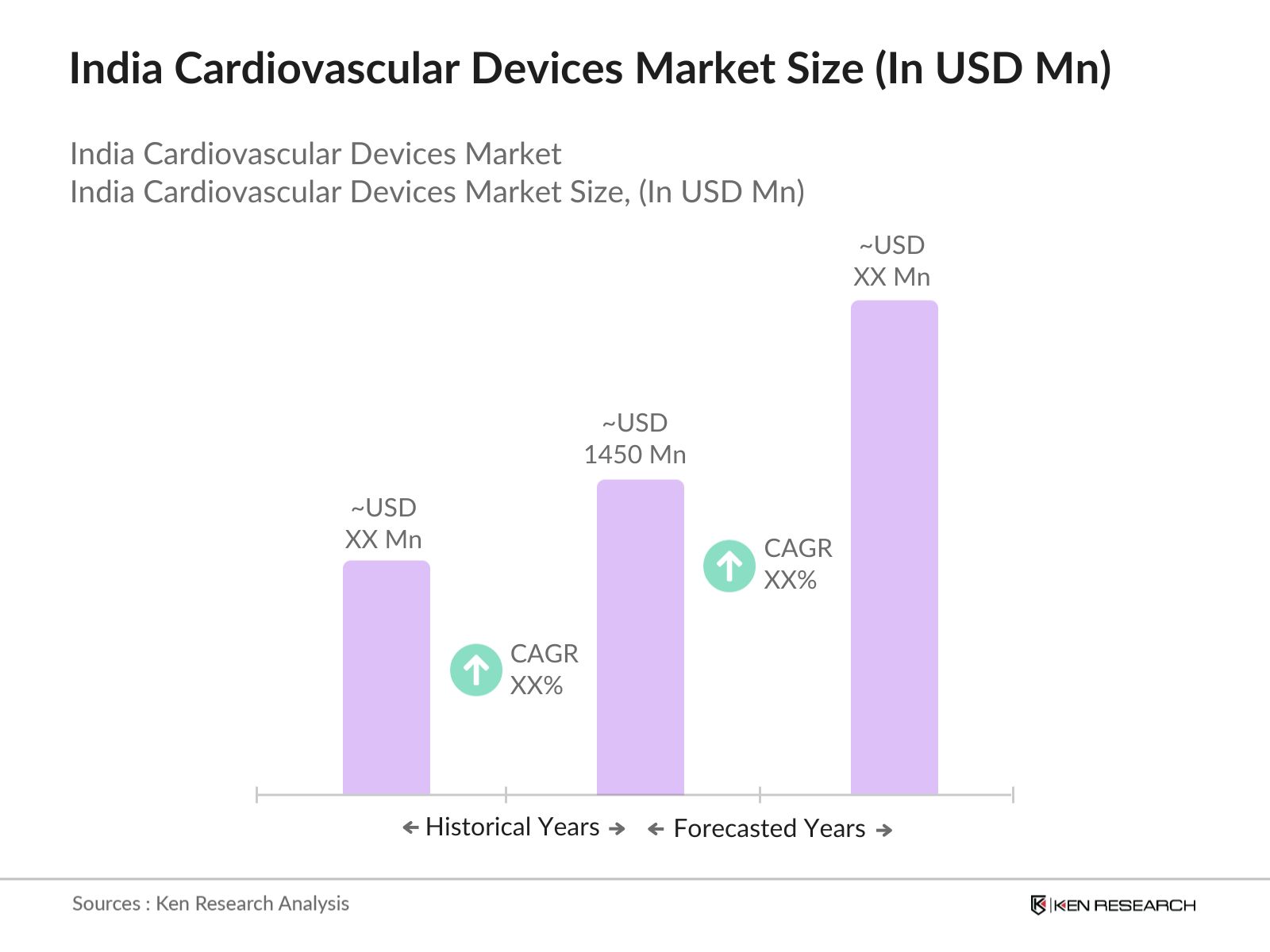

- The India cardiovascular devices market reached USD 1450 million, driven by increasing incidences of cardiovascular diseases (CVD) due to changing lifestyles and rising health awareness. The market is growing as more advanced treatment solutions become available, with demand bolstered by both private healthcare providers and government healthcare schemes. The growth is driven by urbanization, a higher number of medical procedures, and an aging population.

- Some of the major players dominating the India cardiovascular devices market include Medtronic, Abbott Laboratories, Boston Scientific Corporation, GE Healthcare, and Johnson & Johnson. These companies have built a strong presence in the country through partnerships with local healthcare providers and by offering a diverse range of products that cater to varying medical needs.

- The Indian government is supporting the creation of four Medical Devices Parks in Himachal Pradesh, Madhya Pradesh, Tamil Nadu, and Uttar Pradesh. These parks are designed to facilitate the manufacturing of high-quality medical devices, including cardiovascular devices, by providing necessary infrastructure and resources.

- In 2023, Mumbai, Delhi, and Bengaluru are the dominant cities in the cardiovascular devices market, primarily due to the concentration of multi-specialty hospitals, access to advanced treatment facilities, and the high purchasing power of residents. These cities have witnessed a significant increase in the adoption of technologically advanced cardiovascular devices, driven by a growing aging population and lifestyle-related cardiovascular issues.

India Cardiovascular Devices Market Segmentation

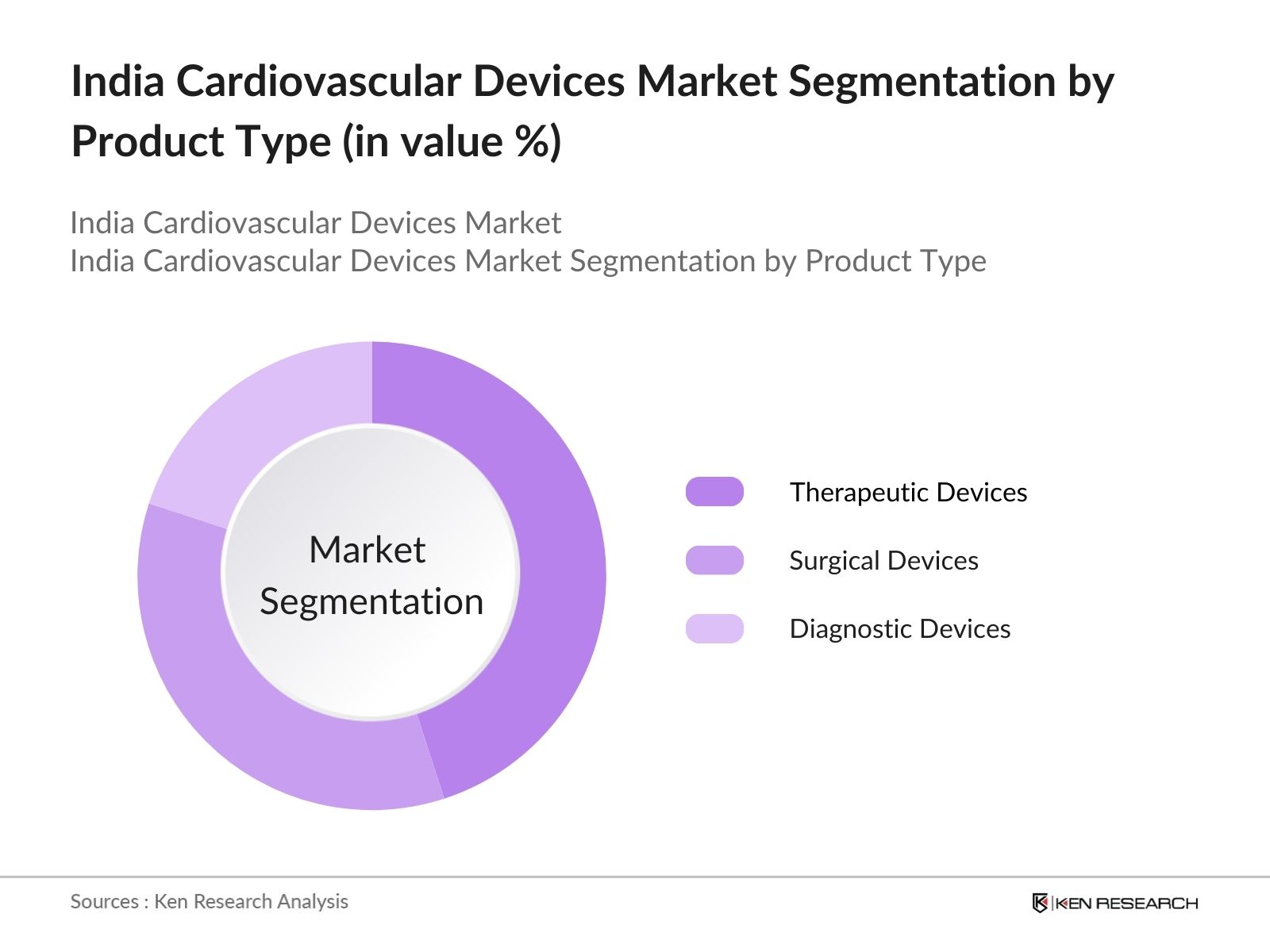

By Product Type: The India cardiovascular devices market is segmented by product type into diagnostic and monitoring devices, surgical devices, and therapeutic devices. In 2023, therapeutic devices held the dominant market share due to their widespread use in treating critical cardiovascular conditions. The increasing demand for products like pacemakers, stents, and defibrillators is driven by advancements in minimally invasive surgery techniques and a growing preference for efficient post-operative recovery options.

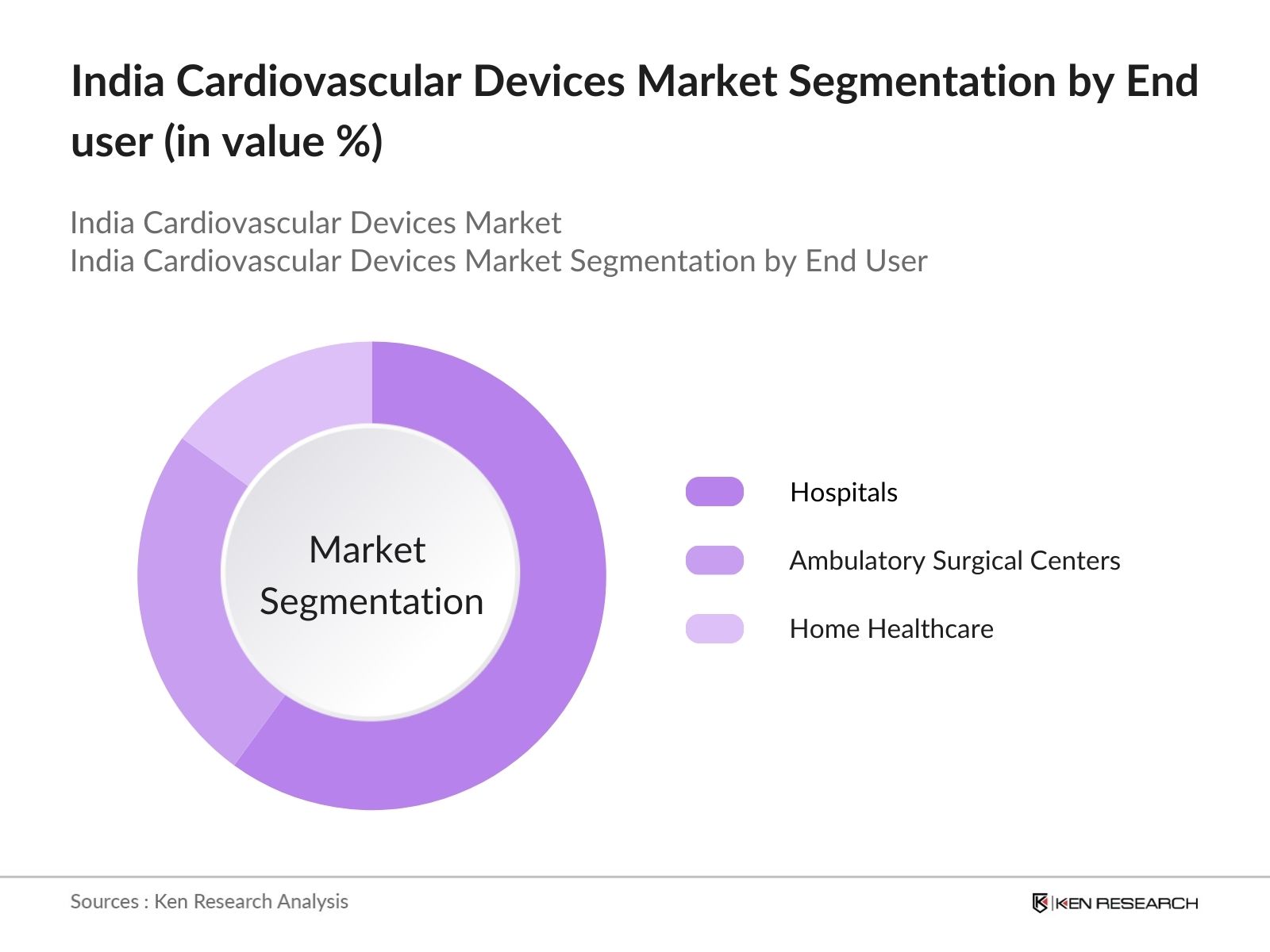

By End-User: The market is segmented into hospitals, ambulatory surgical centers, and home healthcare. Hospitals held the highest market share in 2023 due to their advanced infrastructure, specialized healthcare professionals, and high patient turnover. Major government and private hospitals, particularly in metro cities, have heavily invested in sophisticated cardiovascular treatment equipment, leading to the segment's dominance.

By Region: The India cardiovascular devices market is segmented into North, South, East, and West. The northern region holds the largest market share in 2023 due to the presence of top-tier hospitals and the high disposable income of the population. Government schemes and private insurance coverage have also improved access to advanced cardiovascular treatments in the region.

India Cardiovascular Devices Competitive Landscape

|

Company |

Year Established |

Headquarters |

|---|---|---|

|

Medtronic |

1949 |

Dublin, Ireland |

|

Abbott Laboratories |

1888 |

Chicago, USA |

|

Boston Scientific Corporation |

1979 |

Marlborough, USA |

|

GE Healthcare |

1892 |

Chicago, USA |

|

Johnson & Johnson |

1886 |

New Jersey, USA |

- Medtronic: Medtronic India launched the Micra AV pacemaker in June 2021, a miniaturized device using minimally invasive techniques to treat atrioventricular block. In November 2021, Medtronic introduced the Arctic Front Cardiac Cryoablation Catheter System, the first cryoballoon catheter approved by CDSCO for treating atrial fibrillation, highlighting the companys commitment to innovative cardiac care solutions in India.

- Boston Scientific Corporation: In August 2022, Boston Scientific partnered with Wipro GE Healthcare to provide advanced cardiac care solutions in India. This collaboration aims to enhance access to high-quality cardiovascular care across India by combining Boston Scientifics innovative medical devices with Wipro GEs diagnostic and imaging solutions, strengthening the cardiovascular healthcare ecosystem in the country.

India Cardiovascular Devices Market Analysis

Growth Drivers

- Rising Cardiovascular Disease Incidence: The increasing prevalence of cardiovascular diseases is a major growth driver for the market, which is being driven by lifestyle changes, a rising aging population, and growing risk factors such as hypertension and diabetes. This has led to a surge in demand for advanced diagnostic and treatment devices, further supported by government healthcare initiatives.

- Increased Government Healthcare Spending: The market is also being driven due to increasing utilization of cardiac care services under the Ayushman Bharat scheme. This government initiative has expanded access to free treatment for economically disadvantaged populations, leading to a significant rise in cardiac interventions and surgeries. As a result, demand for cardiovascular devices such as stents and pacemakers has grown rapidly.

- Growing Elderly Population: Indias elderly population is expected to increase from 138 million in 2021 to over 195 million by 2031, according to the Ministry of Statistics and Programme Implementation. With the elderly being more susceptible to cardiovascular diseases, the demand for cardiac care and devices is expected to surge. This demographic shift is a powerful growth driver for cardiovascular medical equipment, with pacemakers and monitoring devices being particularly essential in addressing age-related cardiac conditions.

Challenges

- High Cost of Cardiovascular Devices: One of the biggest challenges faced by the Indian cardiovascular devices market is the high cost of advanced treatment devices. Although government initiatives like PMJAY aim to cover these expenses, the coverage gap remains, limiting market growth.

- Lack of Trained Healthcare Professionals: Despite advancements in cardiac care, India faces a shortage of trained cardiologists and technicians. This shortage significantly impacts the adoption of cardiovascular devices, as the availability of qualified healthcare professionals to perform complex cardiac surgeries and manage devices is limited, particularly in rural areas.

Government Initiatives

- National Medical Devices Policy,2023: The Indian government approved the National Medical Devices Policy in 2023 to promote the domestic production of medical devices, including cardiovascular equipment. This policy aims to reduce dependency on imports, foster innovation, and improve infrastructure for manufacturing medical devices in India. The initiative seeks to strengthen the country's healthcare system by encouraging technological advancements and investment in the medical devices sector.

- Budget 2024-Allocation to healthcare sector: Indian Government has taken initiative aimed at boosting the healthcare sector, including cardiovascular devices, focuses on increasing budget allocations for infrastructure development and encouraging innovation in medical technology. Experts have urged the government to allocate more funds in the upcoming budget to improve access to advanced treatments, particularly for cardiac care, and to promote domestic manufacturing of medical devices.

India Cardiovascular Devices Market Future Outlook

The India Cardiovascular Devices Market is projected to grow exponentially in future. This growth will be driven by rising cardiovascular disease incidence, increased government healthcare spending and growing elderly population.

Future Trends

-

Growing Demand for Wearable Cardiac Monitoring Devices: Over the next five years, the market for wearable cardiac monitoring devices in India is expected to grow rapidly. According to a report by the Ministry of Health, these devices will play a key role in preventive healthcare by offering real-time monitoring for patients at risk of cardiovascular diseases. The Indian government is likely to introduce incentives for domestic manufacturers to produce these devices, aiming to reduce the overall healthcare burden.

- Increased Focus on Indigenous Production of Cardiovascular Devices: With the government's PLI scheme driving domestic manufacturing, the cardiovascular devices market will see an influx of locally manufactured products by 2028. The Ministry of Commerce estimates that by 2025, India will reduce its dependence on imported cardiovascular devices by 30%, and this trend will continue, leading to lower costs and greater access to advanced medical technologies in rural and semi-urban areas.

Scope of the Report

|

By Product Type |

Diagnostic and monitoring devices Surgical devices Therapeutic devices |

|

By End-User Type |

Hospitals Ambulatory surgical centers Home healthcare |

|

By Region |

North South East West |

Products

Key Target Audience- Organizations and Entities Who Can Benefit by Subscribing This Report:

Multi-specialty hospitals and healthcare centers

Ambulatory surgical centers

Home healthcare service providers

Medical device distributors and retailers

Health insurance companies

Medical device manufacturers and suppliers

Government and regulatory bodies (e.g., Ministry of Health and Family Welfare)

Investments and venture capitalist firms

Companies

Players mentioned in the report:

Medtronic

Abbott Laboratories

Boston Scientific Corporation

GE Healthcare

Johnson & Johnson

Siemens Healthineers

Philips Healthcare

B. Braun Melsungen

Wipro GE Healthcare

Tata Group (Healthcare)

Table of Contents

1. India Cardiovascular Devices Market Overview

1.1. Definition and Scope

1.2. Market Structure & Dynamics

1.3. Market Taxonomy

1.4. Market Growth Rate (Financial Metrics: Y-o-Y Growth Analysis)

1.5. Market Segmentation Overview

2. India Cardiovascular Devices Market Size

2.1. Historical Market Size (Financial Parameters)

2.2. Market Growth Analysis (Operational Parameters)

2.3. Key Developments and Milestones (Notable Events and Investments)

2.4. Year-on-Year Growth

2.5. Drivers and Restraints Impact on Market Size

3. India Cardiovascular Devices Market Analysis

3.1. Key Growth Drivers

3.1.1. Rising Cardiovascular Disease Incidence

3.1.2. Increased Government Healthcare Spending

3.1.3. Growing Elderly Population

3.2. Challenges

3.2.1. High Costs of Advanced Cardiovascular Devices

3.2.2. Shortage of Trained Cardiac Surgeons

3.2.3. Regulatory Delays in Device Approvals

3.3. Opportunities

3.3.1. Growing Demand for Wearable Monitoring Devices

3.3.2. Expansion in Tier 2 and Tier 3 Cities (Infrastructure Development)

3.3.3. Government Initiatives Promoting Local Device Manufacturing

3.4. Trends

3.4.1. AI and Machine Learning in Cardiac Care

3.4.2. Remote Monitoring and Telecardiology Growth

3.4.3. Public-Private Partnerships in Healthcare Expansion

3.5. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.6. Stakeholder Ecosystem (Healthcare Providers, Device Manufacturers, Distributors)

4. India Cardiovascular Devices Market Segmentation

4.1. By Product Type (Market Share % of Sub-segments)

4.1.1. Diagnostic and Monitoring Devices (ECG, Holter Monitors, Event Monitors)

4.1.2. Surgical Devices (Stents, Catheters, Valves)

4.1.3. Therapeutic Devices (Pacemakers, Defibrillators)

4.2. By End-User (Hospitals, Home Care, Ambulatory Surgical Centers)

4.2.1. Hospitals (Multi-specialty, Cardiac Centers)

4.2.2. Home Healthcare (Remote Monitoring, Post-Surgery Care)

4.2.3. Ambulatory Surgical Centers (Cardiac Procedures)

4.3. By Region (Market Share % for Sub-segments)

4.3.1. North (Delhi NCR, Chandigarh)

4.3.2. South (Bengaluru, Chennai, Hyderabad)

4.3.3. East (Kolkata, Bhubaneswar)

4.3.4. West (Mumbai, Pune, Ahmedabad)

5. India Cardiovascular Devices Market Cross-Comparison

5.1. Detailed Profiles of Major Players (Operational and Financial Metrics)

5.1.1. Medtronic

5.1.2. Abbott Laboratories

5.1.3. Boston Scientific Corporation

5.1.4. GE Healthcare

5.1.5. Johnson & Johnson

5.1.6. Siemens Healthineers

5.1.7. Philips Healthcare

5.1.8. Wipro GE Healthcare

5.1.9. Tata Group (Healthcare Division)

5.1.10. Terumo Corporation

5.1.11. B. Braun Melsungen

5.1.12. Stryker Corporation

5.1.13. Biotronik

5.1.14. Nihon Kohden

5.1.15. Dräger

5.2. Cross-Comparison Parameters (Revenue, Number of Employees, R&D Investments)

5.3. Competitive Landscape (Strategies, Market Shares, Brand Presence)

5.4. Company-Specific Developments (Product Launches, Partnerships, M&A)

6. India Cardiovascular Devices Market Competitive Landscape

6.1. Market Share Analysis (Leading Players and New Entrants)

6.2. Strategic Initiatives (Partnerships, Collaborations, Product Launches)

6.3. Mergers and Acquisitions (Noteworthy Transactions in Cardiovascular Devices)

6.4. Investment Analysis (Government Grants, Venture Capital, PE Investment)

7. India Cardiovascular Devices Market Regulatory Framework

7.1. Regulatory Bodies and Certifications (CDSCO, FSSAI)

7.2. Compliance Standards for Cardiovascular Devices (Safety, Quality Control)

7.3. Import and Export Regulations (Tariffs, Incentives for Local Manufacturing)

7.4. Domestic Manufacturing Policies (PLI Scheme, Aatmanirbhar Bharat)

8. India Cardiovascular Devices Market Future Projections

8.1. Future Market Size Projections (Growth Trajectory Based on Macroeconomic Indicators)

8.2. Key Factors Driving Future Growth (Government Initiatives, Demand Drivers)

8.3. Forecasted Market Growth by Product Type, End-User, and Region

9. India Cardiovascular Devices Market Segmentation (Future Outlook)

9.1. By Product Type (Market Forecast for Diagnostic, Surgical, Therapeutic Devices)

9.2. By End-User (Hospitals, Home Care, Surgical Centers – Projections)

9.3. By Technology (Invasive, Non-Invasive – Future Trends)

9.4. By Device Type (Market Outlook for Implants, External Devices)

9.5. By Region (North, South, East, West – Growth Projections)

10. India Cardiovascular Devices Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis (Total Addressable, Serviceable Available, Serviceable Obtainable Market)

10.2. Customer Segment Analysis (Key User Profiles, Decision-Making Insights)

10.3. Marketing Initiatives (Targeting Strategies, Growth Opportunities)

10.4. White Space Analysis (Opportunities for Expansion)

10.5. Actionable Insights for Investors, Manufacturers, and Healthcare Providers

Disclaimer

Contact Us

Frequently Asked Questions

1. How big is the India Cardiovascular Devices Market?

The India cardiovascular devices market was valued at USD 1450 million in 2023, driven by a rise in cardiovascular diseases, increasing healthcare spending, and the growing elderly population.

2. What are the challenges in the India Cardiovascular Devices Market?

Challenges include the high cost of advanced cardiovascular devices, a shortage of trained cardiologists, and regulatory delays in approving new medical devices. These factors affect the accessibility and adoption of life-saving treatments.

3. Who are the major players in the India Cardiovascular Devices Market?

Key players in the market include Medtronic, Abbott Laboratories, Boston Scientific Corporation, GE Healthcare, and Johnson & Johnson. These companies have established a strong presence through partnerships and advanced product offerings.

4. What are the growth drivers of the India Cardiovascular Devices Market?

The market is driven by rising cardiovascular disease incidence, increased government healthcare spending and growing elderly population.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.