India Cargo Shipping Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5079

December 2024

82

About the Report

India Cargo Shipping Market Overview

- The India cargo shipping market is valued at 815 million tonnes (MT), primarily driven by increasing trade volumes, government initiatives like Sagarmala and Gati Shakti, and investments in port infrastructure across the country. The market shows a steady upward trend as Indias logistics network expands to accommodate growing domestic and international trade. Key factors such as technological advancements in logistics, digitalization, and a robust industrial sector contribute to the market's growth, establishing India as a key player in global shipping logistics.

- Major demand centers for cargo shipping in India include Mumbai, Chennai, and Visakhapatnam. Mumbais strategic location on the west coast allows access to both domestic and international markets, while Chennai and Visakhapatnam support strong regional trade networks due to their high-capacity ports and advanced logistics infrastructure. The focus on enhancing port facilities and connectivity further strengthens these cities roles as leading cargo shipping hubs.

- Indian maritime laws have undergone significant updates to align with international standards, addressing the evolving needs of the cargo shipping industry. The Ministry of Shipping has implemented stringent safety protocols for cargo handling, focusing on reducing accidents and ensuring compliance with global best practices. These regulations mandate periodic safety audits, advanced training for port workers, and the use of certified equipment for cargo operations.

India Cargo Shipping Market Segmentation

-

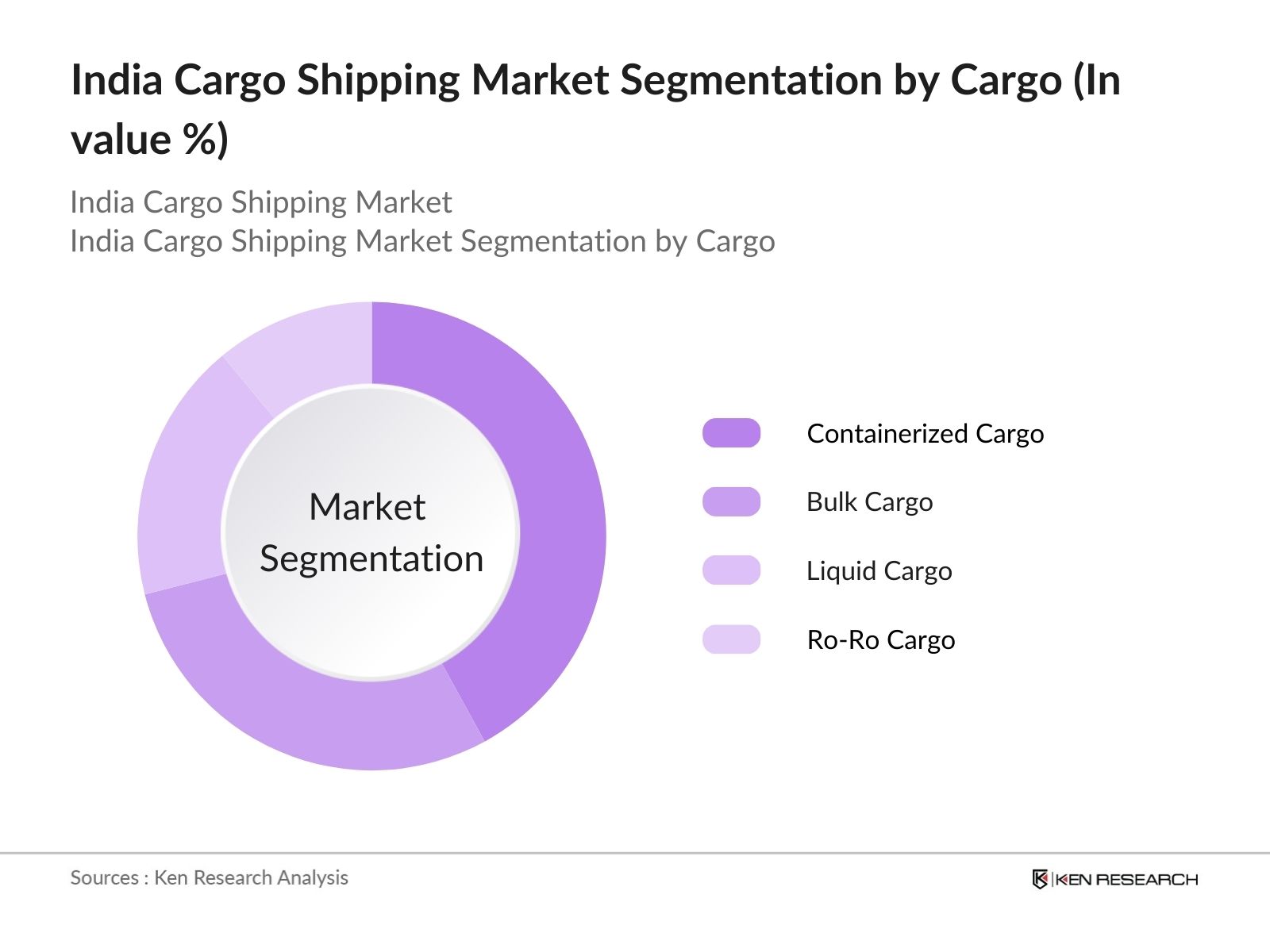

By Cargo Type: The market is segmented by cargo type into containerized cargo, bulk cargo, liquid cargo, and Ro-Ro cargo. Containerized cargo holds a dominant market share in this segmentation due to its efficiency and ability to handle various goods, from consumer products to industrial materials. With the growing e-commerce sector and organized logistics networks, containerized cargo has become a preferred option, contributing significantly to market revenue.

- By End-User: The market is segmented by end-use industry into automotive, FMCG, chemicals, pharmaceuticals, and electronics. The automotive segment dominates, driven by consistent demand for high-volume shipments and the rapid expansion of Indias automobile manufacturing industry. The strategic reliance on efficient cargo shipping supports both domestic distribution and international exports, securing this segments leading position.

India Cargo Shipping Market Competitive Landscape

The India cargo shipping market is dominated by a few major players, including both domestic giants and global shipping leaders. This consolidation reflects the influence of established companies that leverage robust infrastructure, strong brand presence, and technological integration to maintain competitive advantages in the market.

India Cargo Shipping Market Analysis

Growth Drivers

- Trade Expansion (Imports, Exports, Domestic Cargo): Indias cargo shipping industry has significantly grown due to a steady rise in trade activities. According to the Ministry of Commerce, India's overall exports for the financial year 2023-24 amounted to USD 776.68 billion, which included both merchandise and services exports. Merchandise exports specifically were USD 437.06 billion, while services exports contributed USD 339.62 billion. Imports, meanwhile, totaled around 645 million tons, driven by demand for crude oil and consumer goods. The domestic cargo segment has also grown, with 300 million tons handled in coastal shipping routes. This surge reflects Indias increased connectivity with international markets, especially through major ports like Mumbai and Chennai.

- Infrastructure Development (Ports, Terminals): Infrastructure investment is key to Indias cargo shipping market. The Ministry of Ports reported that around billions was invested in 2024 to expand port capacities, such as those in Jawaharlal Nehru Port and Mundra Port. Terminal expansions are estimated to have raised handling capacity by an additional hundreds of million tons, supporting larger vessels and reducing turnaround times. Such infrastructural improvements directly benefit cargo shipping, accommodating the rising demand and improving overall operational efficiency.

- Economic Growth Impact: Indias GDP growth, recorded at USD 3.90 trillion in 2024 (World Bank), has a positive impact on the cargo shipping sector. Growing industrial output, primarily from the manufacturing and automotive sectors, has contributed significantly to domestic and export cargo volumes, with an estimated 500 million tons of cargo generated by these industries alone. Economic growth bolsters the purchasing power of consumers, further increasing demand for imported goods, positively affecting shipping activities.

Challenges

- Port Congestion: Port congestion remains a persistent issue for the Indian cargo shipping market, with major ports such as Mumbai and Chennai facing significant challenges due to high capacity utilization. During peak periods, delays in ship handling disrupt shipping schedules and reduce operational efficiency. Prolonged vessel turnaround times often result in delayed cargo deliveries, causing disruptions across supply chains. These inefficiencies highlight the need for capacity expansion and better management practices to ensure smoother operations at Indian ports.

- Regulatory Compliance: The need to comply with international and domestic regulations continues to challenge Indias shipping industry. Adherence to stringent standards set by global organizations such as the International Maritime Organization (IMO), along with local safety and environmental regulations, requires substantial operational adjustments. Failing to meet these compliance requirements can lead to penalties and operational restrictions, further complicating the already competitive shipping landscape. These challenges underscore the importance of regulatory alignment to maintain global trade competitiveness.

India Cargo Shipping Market Future Outlook

The India cargo shipping market is poised for robust growth as trade volumes continue to rise and infrastructure projects come to fruition. Government initiatives supporting green shipping practices and port digitalization are expected to further enhance operational efficiency and environmental compliance. Additionally, investments in coastal and inland waterways are anticipated to diversify transportation options, promoting sustainable long-term growth.

Future Market Opportunities

- Digitalization in Smart Ports, IoT, andAI: Digitalization offers significant potential for growth in the Indian cargo shipping market. The integration of AI and IoT in ports can reduce handling time substantially, as shown in pilot projects at Mundra Port. Smart ports equipped with advanced tracking and automation systems are predicted to improve overall productivity by around 15 million tons annually, offering a substantial efficiency boost.

- Green Shipping Initiatives: The Indian government is pushing for green shipping practices, with ports like Cochin shifting to renewable energy sources for their operations. In 2024, about 5 million tons of CO2 emissions were cut through fuel efficiency initiatives at various ports, supporting India's environmental goals. These practices, aligned with global environmental standards, offer competitive advantages to Indian shipping companies in global markets.

Scope of the Report

|

By Cargo Type |

Containerized Cargo |

|

By End-Use Industry |

Automotive |

|

By Mode of Transport |

Inland Waterways |

|

By Service Type |

Freight Forwarding |

|

By Region |

East |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Shipping, Directorate General of Shipping)

Cargo Shipping Companies

Port Authorities

Automotive Manufacturers

FMCG Distributors

Pharmaceutical Corporations

Companies

Players Mentioned in the Report

Shipping Corporation of India

Adani Ports and SEZ

DP World

Essar Ports

Maersk Line

MSC (Mediterranean Shipping Company)

CMA CGM

Hapag-Lloyd

Allcargo Logistics

JSW Infrastructure

APM Terminals

NYK Line

K Line

Shreyas Shipping & Logistics

Gujarat Pipavav Port Ltd.

Table of Contents

1. India Cargo Shipping Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Cargo Shipping Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Cargo Shipping Market Analysis

3.1 Growth Drivers

3.1.1 Trade Expansion (imports, exports, domestic cargo)

3.1.2 Infrastructure Development (ports, terminals)

3.1.3 Economic Growth Impact

3.1.4 Government Initiatives (Sagarmala, Gati Shakti)

3.2 Market Challenges

3.2.1 Port Congestion

3.2.2 Regulatory Compliance

3.2.3 Limited Technological Integration

3.2.4 High Operational Costs

3.3 Opportunities

3.3.1 Digitalization (smart ports, IoT, AI)

3.3.2 Green Shipping Initiatives (sustainable practices, fuel efficiency)

3.3.3 Expansion of Shipping Routes

3.4 Trends

3.4.1 Rise in Coastal Shipping

3.4.2 Containerization Growth

3.4.3 Increased Use of Automation in Ports

3.5 Government Regulations

3.5.1 Maritime Laws and Standards

3.5.2 Compliance with IMO Regulations

3.5.3 Cargo Handling Safety Norms

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. India Cargo Shipping Market Segmentation

4.1 By Cargo Type (in Value %)

4.1.1 Containerized Cargo

4.1.2 Bulk Cargo

4.1.3 Liquid Cargo

4.1.4 Ro-Ro Cargo

4.2 By End-Use Industry (in Value %)

4.2.1 Automotive

4.2.2 FMCG

4.2.3 Chemicals

4.2.4 Pharmaceuticals

4.2.5 Electronics

4.3 By Mode of Transport (in Value %)

4.3.1 Inland Waterways

4.3.2 Coastal Shipping

4.3.3 Transoceanic Shipping

4.4 By Service Type (in Value %)

4.4.1 Freight Forwarding

4.4.2 Warehousing and Distribution

4.4.3 Customs Brokerage

4.5 By Region (in Value %)

4.5.1 East

4.5.2 West

4.5.3 South

4.5.4 North

5. India Cargo Shipping Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Shipping Corporation of India

5.1.2 Adani Ports and SEZ

5.1.3 Essar Ports

5.1.4 Gujarat Pipavav Port Ltd

5.1.5 DP World

5.1.6 Maersk Line

5.1.7 MSC (Mediterranean Shipping Company)

5.1.8 CMA CGM

5.1.9 Hapag-Lloyd

5.1.10 Allcargo Logistics

5.1.11 JSW Infrastructure

5.1.12 APM Terminals

5.1.13 NYK Line

5.1.14 K Line

5.1.15 Shreyas Shipping & Logistics

5.2 Cross Comparison Parameters (No. of Vessels, Port Ownership, Market Reach, Revenue, Capacity Handled, Global Alliances, Regional Focus, Infrastructure Capabilities)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Cargo Shipping Market Regulatory Framework

6.1 Port Regulatory Authorities

6.2 Compliance Requirements

6.3 Certification Processes

7. India Cargo Shipping Future Market Size (in USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Cargo Shipping Future Market Segmentation

8.1 By Cargo Type (in Value %)

8.2 By End-Use Industry (in Value %)

8.3 By Mode of Transport (in Value %)

8.4 By Service Type (in Value %)

8.5 By Region (in Value %)

9. India Cargo Shipping Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The research began with an extensive mapping of the India Cargo Shipping markets ecosystem, covering major stakeholders, regional markets, and supply chains. This step was informed by secondary research sources, such as proprietary databases and government publications, to pinpoint the core factors shaping market dynamics.

Step 2: Market Analysis and Data Collection

In this phase, historical and current data were collected to assess cargo movement, port throughput, and revenue generation in the India Cargo Shipping market. This comprehensive dataset enabled accurate trend analysis and market penetration insights, laying the foundation for reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Following data analysis, market hypotheses were constructed and validated through interviews with industry experts, including executives from shipping companies and regulatory bodies. This direct feedback provided critical insights into market operations, challenges, and growth prospects, enhancing the depth of the analysis.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing research findings and correlating data insights from various stakeholders, including key players in logistics and infrastructure. This approach ensured a balanced and well-rounded analysis of the India Cargo Shipping market, supported by validated data and first-hand insights.

Frequently Asked Questions

01. How big is the India Cargo Shipping Market?

The India Cargo Shipping market was valued at 815 million tonnes (MT), largely driven by trade volume, government-led infrastructure projects, and digital transformation in logistics.

02. What are the key drivers of the India Cargo Shipping Market?

Primary drivers in the India Cargo Shipping market include government initiatives like Sagarmala and Gati Shakti, rising import-export trade volumes, and digitalization efforts aimed at enhancing port efficiency and operational transparency.

03. Who are the major players in the India Cargo Shipping Market?

Leading companies in the India Cargo Shipping market include Shipping Corporation of India, Adani Ports and SEZ, DP World, and global players like Maersk Line and MSC, each contributing significantly to market development.

04. What challenges exist in the India Cargo Shipping Market?

Challenges in the India Cargo Shipping market include port congestion, regulatory compliance issues, and high operational costs, which collectively impact efficiency and profitability within the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.