India Carpet and Rugs Market Outlook to 2030

Region:Asia

Author(s):Geetanshi Chugh

Product Code:KROD258

June 2024

100

About the Report

India Carpet and Rugs Market Overview

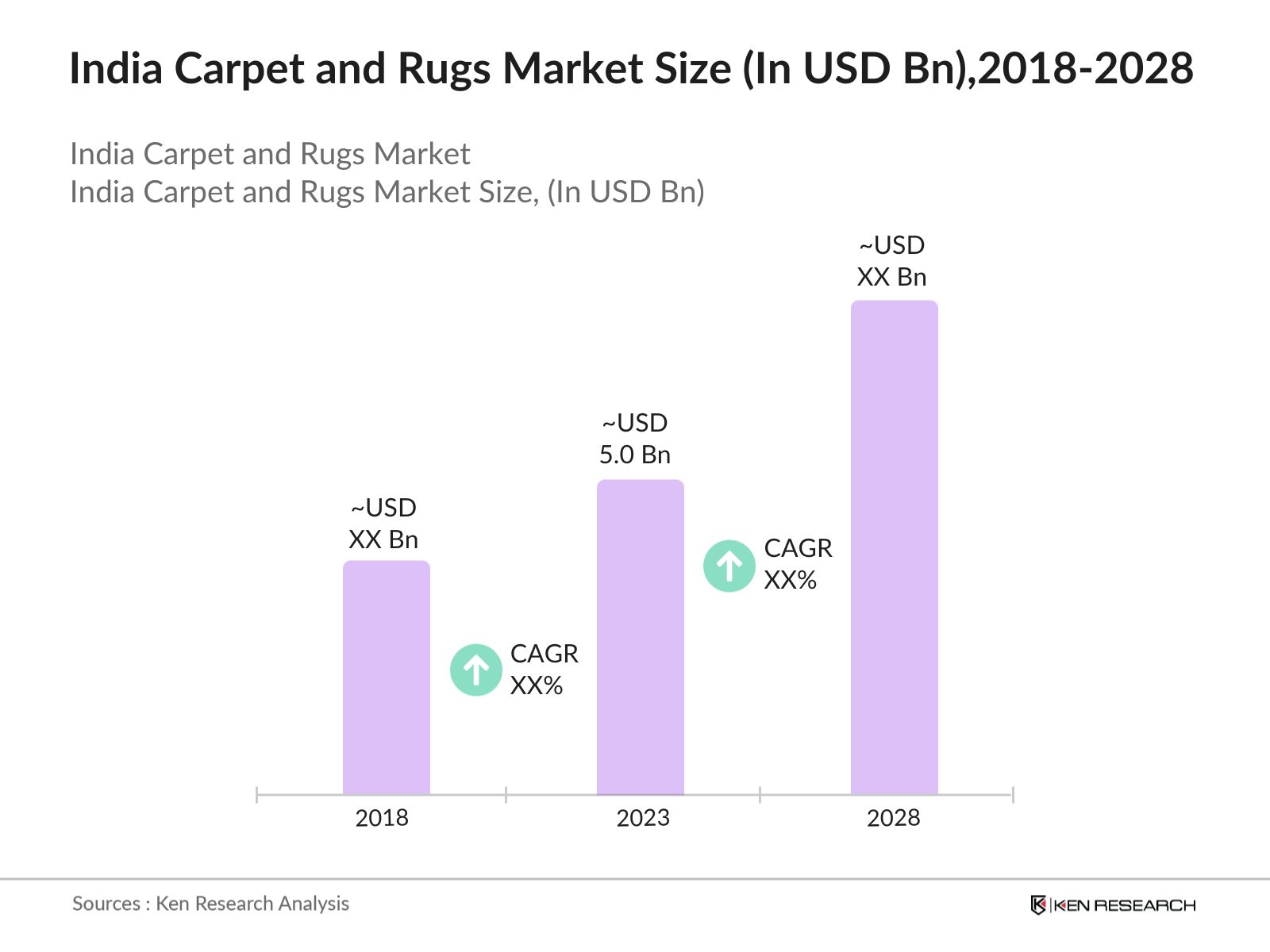

In 2023, the India Carpet and Rugs market reached a market size of approximately USD 5.0 billion, highlighting robust growth and industry expansion.

Prominent players in the market include Obeetee Pvt. Ltd., Jaipur Rugs, The Rug Republic, and Saraswati Global Pvt. Ltd. These companies dominate the market through extensive distribution networks and innovative product offerings.

Key drivers include the rising popularity of home improvement shows, increased spending on home interiors, the influence of social media on consumer preferences, and government support for the textile industry.

Challenges include the high cost of premium carpets, competition from low-cost alternatives, and the fragmented nature of the market which complicates brand building and market penetration efforts.

India Carpets and Rugs Market Analysis

- The India Carpet and Rugs market is fueled by rising interest in home decoration. The handmade segment, particularly, is witnessing significant demand.

- The market value for handmade carpets reached approximately USD 1.2 billion in 2023, reflecting the strong consumer inclination towards unique and high-quality home decor items.

- Woolen carpets dominate the Indian market due to their durability and premium appeal. They account for a substantial portion of sales, with consumers willing to pay up to USD 5,000 for high-quality woolen carpets.

- Handmade woolen carpets are the bestselling product, especially in urban areas where consumers seek unique and high-quality home decor items. These carpets, often priced between USD 1,000 and USD 10,000 depending on the intricacy and craftsmanship.

India Carpet and Rugs Market Segmentation

The India Carpet and Rugs market can be segmented based on various factors. Here are three key segmentation types with their sub-segments and estimated market share:

By Product Type: In 2023, handmade carpets dominate the Indian carpet and rugs market with half of the market share due to their unparalleled craftsmanship, unique designs, and cultural significance. Handmade carpets are highly valued for their authenticity, durability, and intricate detailing, making them preferred choices for both domestic and international buyers.

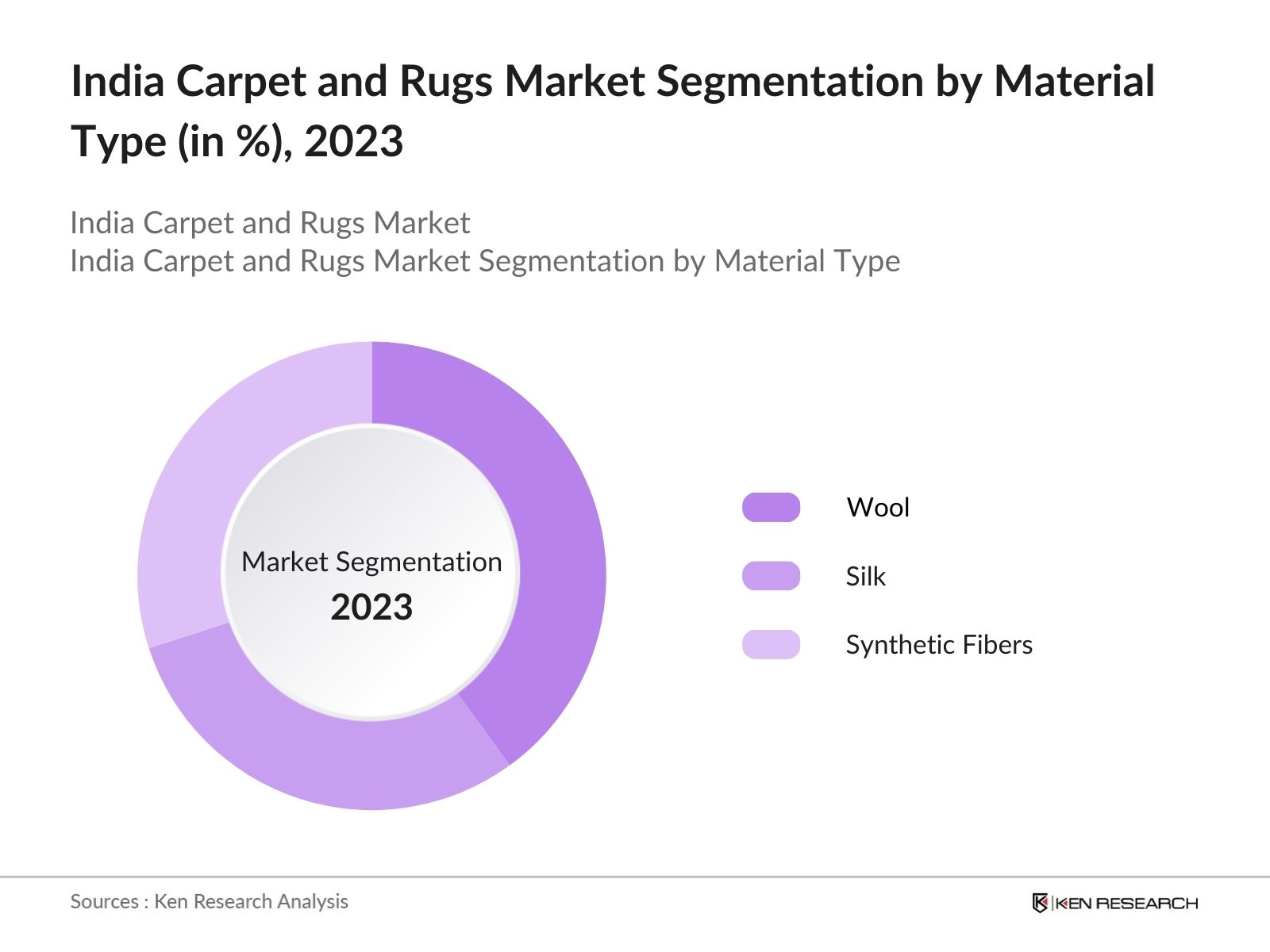

By Material Type: In 2023, wool dominates the Indian carpet and rugs market due to its inherent qualities such as durability, softness, and natural insulation properties. Wool carpets are highly prized for their luxurious feel, rich texture, and ability to retain vibrant colors over time. Additionally, wool is readily available in India, making it a cost-effective and sustainable choice for carpet manufacturing.

By Distribution Channel: the India Carpet and Rug market is segmented into distribution channels by exports, wholesale and retail stores. Exports is the dominant segment with more than half of the market share, this dominance is driven by several factors India has a strong tradition of exporting carpets and rugs, contributing significantly to the country's foreign exchange earnings. Competitive production costs in India are lower as compared to some competitors allowing for competitive pricing in the global market.

India Carpets and Rugs Market Competitive Landscape

The competitive landscape in the India Carpet and Rugs market is summed up in following points:

- Companies offering a broad range of carpet and rug products can cater to diverse consumer needs and preferences, from budget-friendly synthetic options to high-end handmade woolen carpets.

- For instance, Jaipur Rugs offers over 10,000 unique designs, catering to different tastes and requirements, enhancing their market appeal and customer base.

- High-quality materials and craftsmanship distinguish premium brands from others. For example, Obeetee Pvt. Ltd. uses top-grade wool and advanced weaving techniques, ensuring durability and luxury.

- Competitive pricing strategies attract cost-conscious consumers. The Rug Republic, for instance, offers a range of products starting from as low as USD 50, making stylish home decor accessible to a wider audience without compromising on quality.

India Carpet and Rugs Market Industry Analysis

India Carpet and Rugs Market Growth Drivers:

Tourism and Hospitality: Growth in the tourism sector drives demand for carpets and rugs in hotels and resorts. India's travel and tourism industry, valued at USD 20 billion in 2022, heavily invests in premium furnishings, including bespoke carpets and rugs, to enhance the aesthetic appeal and comfort of their properties.

Government Support: Initiatives to promote the textile industry and handloom sector enhance market growth. The Indian government allocated USD 1.3 billion in 2023 for the development of the textile sector, including incentives for carpet manufacturers to boost production and export capacities.

E-commerce Growth: Expansion of e-commerce platforms makes carpets and rugs more accessible to a broader audience. Online sales of home decor, including carpets and rugs, were valued at USD 1.5 billion in 2023.

India Carpet and Rugs Market Trends:

Customization: Increasing demand for customized carpets and rugs tailored to individual consumer preferences. Companies like Jaipur Rugs offer bespoke services, allowing customers to personalize designs, colors, and sizes, resulting in a significant rise in bespoke order volumes by 15% annually.

Collaborations: Collaborations between carpet manufacturers and renowned designers to launch exclusive collections. For example, Obeetee's collaboration with designer Tarun Tahiliani resulted in a unique collection that boosted their premium segment sales by 25% in 2023.

Smart Carpets: Introduction of smart carpets with built-in sensors for various applications, including home automation and health monitoring. The market for smart home products, including smart carpets, was valued at USD 1 billion in 2023, reflecting the growing integration of technology in home decor.

India Carpet and Rugs Market Challenges:

High Costs: Premium carpets are expensive, limiting their accessibility to a broader consumer base. For instance, high-end handmade wool carpets can cost upwards of USD 5,000, making them a luxury purchase for affluent consumers only.

Market Fragmentation: The market is highly fragmented with numerous small players, complicating market penetration. The presence of over 1,000 small and medium-sized enterprises in the carpet industry creates a competitive and fragmented market landscape.

Supply Chain Issues: Disruptions in the supply chain, especially for raw materials, impact production and pricing. The COVID-19 pandemic highlighted vulnerabilities, causing a 15% increase in raw material costs and delays in production schedules.

India Carpet and Rugs Market Recent Developments:

Obeetee launched a new collection in collaboration with renowned designers, enhancing its premium product range. The launch generated significant market interest, contributing to a 10% increase in their annual sales.

Jaipur Rugs announced the expansion of its retail network to increase its market reach. This expansion included opening 15 new stores across major cities, enhancing their market penetration and accessibility to customers.

The Rug Republic introduced a new line of eco-friendly carpets made from recycled materials. This initiative aligns with global sustainability trends and attracted environmentally conscious consumers.

India Carpet and Rugs Market Government Initiatives:

The government’s new textile policy includes incentives for the carpet and rug industry to boost exports and domestic sales. These incentives aim to increase the industry's export value by USD 2 billion by 2025.

Initiatives to promote handloom products and artisans, including financial assistance and marketing support. The government allocated USD 500 million for handloom promotion,

Investments in infrastructure to support the growth of the textile and carpet industry. The government invested USD 1 billion in developing modern infrastructure, including weaving clusters and textile parks.

India Carpet and Rugs Market Future Outlook

- The India Carpet and Rugs market is expected to rise exponentially. Future growth will be driven by technological advancements in manufacturing, improving quality and efficiency. Innovations such as digital printing and automated looms will enhance production capabilities and product variety.

- Increasing consumer preference for sustainable and customized products will shape the market dynamics. The demand for eco-friendly and bespoke carpets is expected to grow by 20%, reflecting changing consumer priorities.

- Continued urbanization and rising disposable incomes will drive demand for premium and luxury carpets. By 2028, urban households are expected to constitute 40% of the total demand for carpets and rugs in India.

Scope of the Report

|

Vietnam Retail Industry Segmentation |

|

|

By Product Type |

Handmade Carpets Machine-made Carpets Tufted Rugs |

|

By Material Type |

Wool Silk Synthetic Fibers |

|

By Distribution Channel |

Exports Wholesale Retail Stores |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Carpet and Rug Manufacturers

Retailers and Distributors

Raw Material Suppliers

Interior Designers and Architects

Investors

Micro Enterprises

Logistics and Supply Chain Companies

Regulatory Bodies

Research and Academic Institutions

Banks

Financial Institutions

Industry Associations

Government Entities

Time Period Captured in the Report:

Historical Period:2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Obeetee Pvt. Ltd.

Jaipur Rugs

The Rug Republic

Saraswati Global Pvt. Ltd.

Carpet Couture

Mahesh Exports

Genie Carpet Manufacturers

Cocoon Fine Rugs

SR International

Chinar International

Abeer Rugs

Surya Rugs

Rugs in Style

Viniyog Exports

YAK Carpet

Table of Contents

1. India Carpet and Rugs Market Overview

1.1 India Carpet and Rugs Market Taxonomy

2. India Carpet and Rugs Market Size (in USD Bn), 2018-2023

3. India Carpet and Rugs Market Analysis

3.1 India Carpet and Rugs Market Growth Drivers

3.2 India Carpet and Rugs Market Challenges and Issues

3.3 India Carpet and Rugs Market Trends and Development

3.4 India Carpet and Rugs Market Government Regulation

3.5 India Carpet and Rugs Market SWOT Analysis

3.6 India Carpet and Rugs Market Stake Ecosystem

3.7 India Carpet and Rugs Market Competition Ecosystem

4. India Carpet and Rugs Market Segmentation, 2023

4.1 India Carpet and Rugs Market Segmentation by Product Type (in %), 2023

4.2 India Carpet and Rugs Market Segmentation by Material Type (in %), 2023

4.3 India Carpet and Rugs Market Segmentation by Distribution Channel (in %), 2023

5. India Carpet and Rugs Market Competition Benchmarking

5.1 India Carpet and Rugs Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Carpet and Rugs Market Future Market Size (in USD Bn), 2023-2028

7. India Carpet and Rugs Market Future Market Segmentation, 2028

7.1 India Carpet and Rugs Market Segmentation by Product Type (in %), 2028

7.2 India Carpet and Rugs Market Segmentation by Material Type (in %), 2028

7.3 India Carpet and Rugs Market Segmentation by Distribution Channel (in %), 2028

8. India Carpet and Rugs Market Analysts’ Recommendations

8.1 India Carpet and Rugs Market TAM/SAM/SOM Analysis

8.2 India Carpet and Rugs Market Customer Cohort Analysis

8.3 India Carpet and Rugs Market Marketing Initiatives

8.4 India Carpet and Rugs Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on India Carpet and Rugs market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Carpet and Rugs market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple retail companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from carpet and rugs companies.

Frequently Asked Questions

01 What is the current size of the India Carpet and Rugs Market?

The India Carpet and Rugs Market was valued at approximately USD 5 bn in 2023.

02 What are the major drivers of growth in the India Carpet and Rugs Market?

Economic growth, government initiatives, rising exports, increasing disposable incomes, and are major growth drivers.

03 Which product type dominates the India Carpet and Rugs Market?

Handmade Carpets dominate the India Carpet and Rugs market.

04 What are the major challenges in India Carpet and Rugs Market?

High costs, market segmentation, supply chain issue, and competition from alternatives are major challenges in India Carpet and Rugs market.

05 Which distribution channel dominates India Carpet and Rugs market?

Exports stands out as the dominant distribution channel in India Carpet and Rugs market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.