India Cement Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD901

July 2024

100

About the Report

India Cement Market Overview

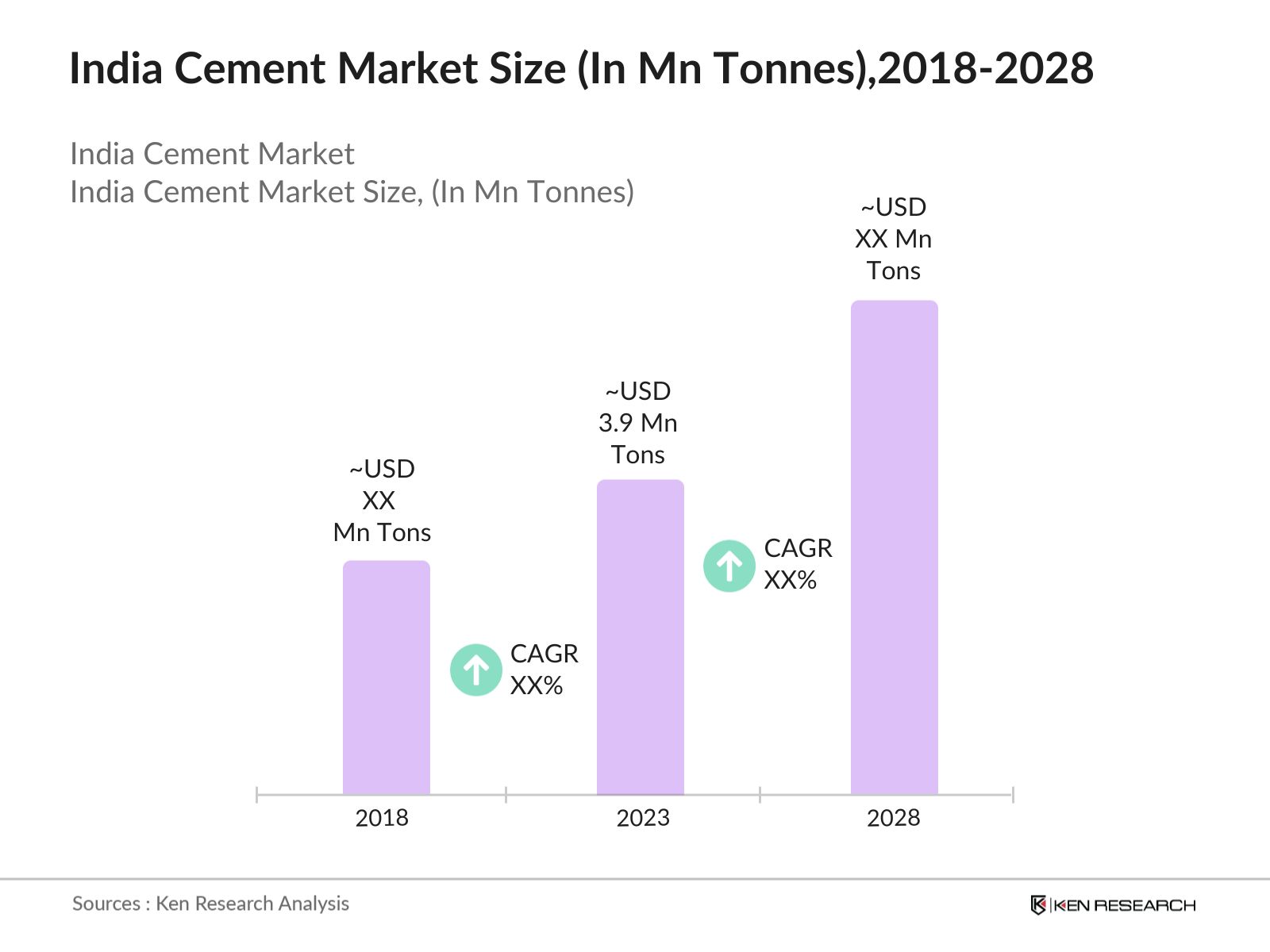

- India cement market was valued at 3.9 million tons in 2023. The major factors driving this growth are the rapid expansion in infrastructure and housing projects, supported by the government's focus on building smart cities and enhancing urban infrastructure.

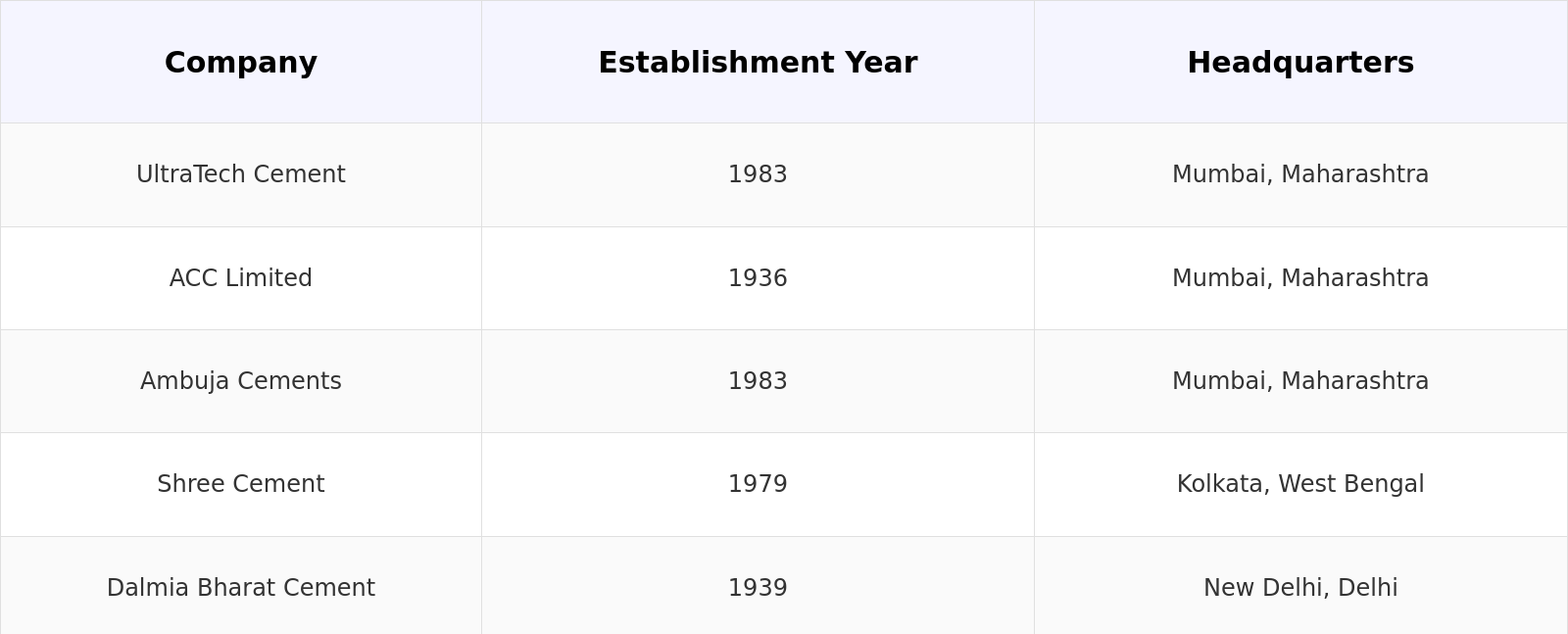

- The Indian cement market is dominated by several key players, including UltraTech Cement, ACC Limited, Ambuja Cements, Shree Cement, and Dalmia Bharat Cement. These companies hold significant market shares due to their extensive distribution networks, robust manufacturing capacities, and strong brand presence.

- In January 2023, UltraTech Cement announced an investment of $1.2 billion to increase its cement production capacity. This expansion, which includes a mix of brownfield and greenfield projects, will strengthen UltraTech's position as India's largest cement producer.

India Cement Current Market Analysis

- India currently has 1.4 billion people out of which 35% of the population lives in urban areas, increasing the demand for residential and commercial buildings, thus driving the cement market. This urbanization trend is expected to continue, further boosting construction activities and cement consumption.

- Industrialization has led to a consistent increase in production capacity and utilization rates. This, in turn, has enhanced the competitiveness of the Indian cement industry on a global scale, making it one of the largest producers and consumers of cement worldwide.

- The Southern region of India, particularly states like Tamil Nadu, Andhra Pradesh, and Karnataka, dominates the cement market. This dominance is attributed to the presence of abundant limestone reserves, which are essential for cement production, and a high concentration of cement plants.

Market Segmentation

The India Cement Market can be segmented based on several factors:

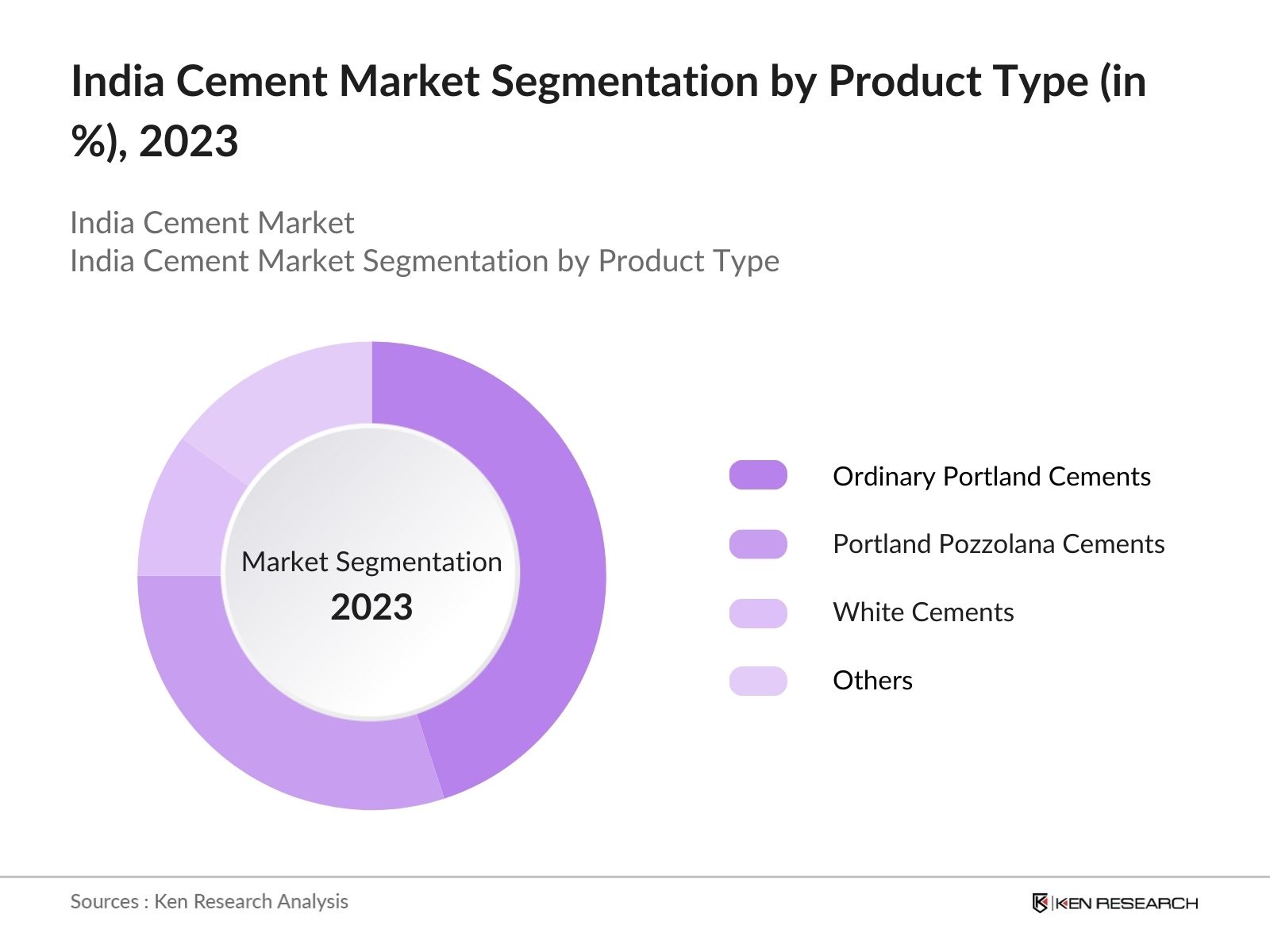

By Product Type: The India Cement Market Segmentation by Product Type is segmented into Ordinary Portland Cements, Portland Pozzolana Cement, White Cement & others. In 2023, Ordinary Portland cements reign as the most dominant sub-segment, holding a substantial market share, due to its high strength and versatility in various construction projects.

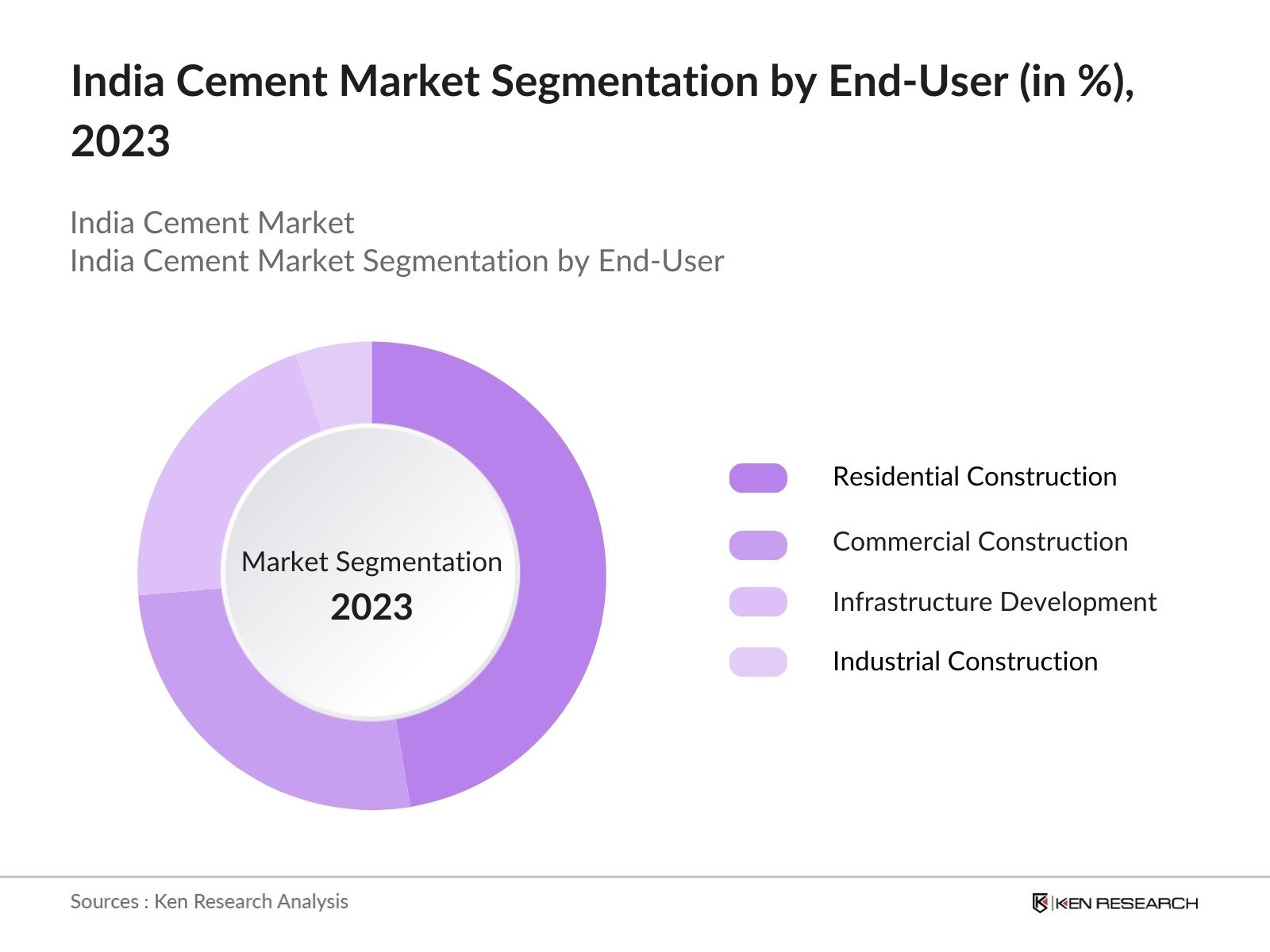

By End User: India Cement Market is segmented by End User into Residential Construction, Commercial Construction, Infrastructure Development & Industrial Construction. In 2023, Residential construction emerges as the most dominant sub-segment, commanding a significant percentage of the market share, due to government initiatives like Pradhan Mantri Awas Yojana which boosts demand for affordable housing.

By Region: India Cement Market is segmented by North, South, West and East. In 2023, the southern region of India dominates this segment. States like Tamil Nadu, Andhra Pradesh, and Karnataka, has abundant limestone reserves, which are essential for cement production. These states collectively account for a significant portion of the country's total limestone reserves, ensuring a steady supply of raw materials for cement manufacturing.

India Cement Market Competitive Landscape

- In 2022, UltraTech Cement announced a significant investment of INR 5.4 billion to enhance its waste heat recovery systems (WHRS) across multiple plants. This strategic move aims to improve the company's energy efficiency and overall sustainability performance.

- Ambuja Cements and ACC Limited are both subsidiaries of Adani Group. In 2022, the Adani Group acquired a controlling stake in Ambuja Cements and ACC Limited from the Swiss firm Holcim (formerly LafargeHolcim) for $6.4 billion.

- Shree Cement has committed to the RE100 initiative, pledging to transition to 100% renewable electricity consumption by 2050. The company has one of the largest waste heat recovery systems (WHRS) in the global cement industry, generating over 55% of its power from renewable sources.

India Cement Industry Analysis

India Cement Market Growth Drivers:

- Infrastructure Development: The Indian government has allocated $134 billion in the Union Budget 2023-24 specifically for infrastructure projects, which significantly boosts the demand for cement. Initiatives like the Bharatmala and Sagarmala projects, aiming to enhance road and port connectivity, have led to increased cement consumption.

- Affordable Housing Initiatives: Government schemes like the Pradhan Mantri Awas Yojana (PMAY) aim to construct over 20 million affordable homes by 2022. As per the Ministry of Housing and Urban Affairs, over 11.3 million houses have been sanctioned under PMAY (Urban) as of December 2023, driving massive demand for cement in the residential sector.

- Foreign Direct Investment (FDI) in Construction: The construction sector has seen substantial FDI inflows, amounting to USD 25 billion between 2000 and 2023. This influx of foreign capital has led to the development of numerous large-scale infrastructure and real estate projects, significantly increasing the demand for cement.

India Cement Market Challenges

- High Input Costs: The cost of raw materials like coal and limestone has been rising, impacting the profit margins of cement manufacturers. These increased costs are challenging for the industry as they directly affect production expenses and overall profitability.

- Environmental Regulations: The Central Pollution Control Board (CPCB) has imposed stricter emission norms, requiring substantial investment in cleaner technologies. Compliance with these regulations increases operational costs and requires continuous monitoring and upgrades, impacting the industry's financial health.

- Overcapacity Issues: The Indian cement industry faces the issue of overcapacity, with installed capacity far exceeding demand, leading to price wars and reduced profitability. Managing production levels to match actual demand remains a critical challenge for maintaining market stability.

India Cement Market Government Initiatives

- National Infrastructure Pipeline (NIP): Launched in 2019, the NIP aims to invest INR 111 trillion in infrastructure projects by 2025, significantly driving cement demand. The initiative includes extensive development of roads, railways, urban infrastructure, and housing projects, providing a robust pipeline of projects that necessitate substantial cement supplies.

- Pradhan Mantri Awas Yojana (PMAY): Initiated in 2015, PMAY aims to provide affordable housing for all by 2022. As of December 2023, the scheme has sanctioned over 11.3 million houses under PMAY (Urban). This initiative has led to a considerable increase in cement demand in the housing sector, contributing significantly to market growth.

- Smart Cities Mission: Launched in 2015, the Smart Cities Mission aims to develop 100 smart cities with modern infrastructure and enhanced quality of life. The Ministry of Housing and Urban Affairs reports that INR 2.05 trillion has been allocated for smart city projects, including extensive construction activities that drive cement demand.

India Cement Future Market Outlook

The Indian cement market is expected to continue its growth trajectory, driven by ongoing infrastructure projects, government housing schemes, and increasing urbanization. The adoption of green construction practices and the development of low-carbon cement products will further support market growth.

Future Trends

- Sustainable Construction Practices: There is a growing trend towards sustainable construction practices, with increasing demand for eco-friendly cement. Companies will be investing in the production of low-carbon cement, utilizing industrial by-products like fly ash and slag.

- Increased Mergers and Acquisitions: The Indian cement industry will notice a wave of mergers and acquisitions as companies strive to expand their market presence and enhance capacity. In June 2024, UltraTech Cement acquired a 23% stake in Chennai-based India Cements through open-market transactions. Such strategic moves are aimed at consolidation and achieving economies of scale, making M&As a prominent trend.

Scope of the Report

|

By Product Type |

Ordinary Portland Cement Portland Pozzolana Cement White Cement Others |

|

By End-User |

Residential Construction Commercial Construction Infrastructure Development Industrial Construction |

|

By Region |

North India South India West India East & Central India |

Products

Key Target Audience – Organizations and Entities who can benefit by subscribing this report:

Cement Manufacturers

Construction Companies

Real Estate Developers

Engineering and Construction Equipment Manufacturer

Cement Suppliers and Distributors

Banks & Financial Institutions

Government & Regulatory Bodies (CPCB, BIS and others)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

UltraTech Cement

Shree Cement

Ambuja Cement

ACC Ltd

Dalmia Bharat

Ramco Cements

India Cements

JK Cements

Binani Cement

Birla Corp

Prism Cement

HeidelbergCement India

Century Textiles and Industries

Saurashtra Cement

Star Cement

Orient Cement

Nuvoco Vistas Corp

My Home Industries

Chettinad Cement

Kesoram Industries

Table of Contents

1. India Cement Market Overview

1.1 India Cement Market Taxonomy

2. India Cement Market Size (in Bn), 2018-2023

3. India Cement Market Analysis

3.1 India Cement Market Growth Drivers

3.2 India Cement Market Challenges and Issues

3.3 India Cement Market Trends and Development

3.4 India Cement Market Government Regulation

3.5 India Cement Market SWOT Analysis

3.6 India Cement Market Stake Ecosystem

3.7 India Cement Market Competition Ecosystem

4. India Cement Market Segmentation, 2023

4.1 India Cement Market Segmentation by Product Type (in value %), 2023

4.2 India Cement Market Segmentation by End User (in value %), 2023

4.3 India Cement Market Segmentation by Region (in value %), 2023

5. India Cement Market Competition Benchmarking

5.1 India Cement Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Cement Future Market Size (in Bn), 2023-2028

7. India Cement Future Market Segmentation, 2028

7.1 India Cement Market Segmentation by Product Type (in value %), 2028

7.2 India Cement Market Segmentation by End User (in value %), 2028

7.3 India Cement Market Segmentation by Region (in value %), 2028

8. India Cement Market Analysts’ Recommendations

8.1 India Cement Market TAM/SAM/SOM Analysis

8.2 India Cement Market Customer Cohort Analysis

8.3 India Cement Market Marketing Initiatives

8.4 India Cement Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2: Market Building:

Collating statistics on India Cement Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Cement Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4: Research Output:

Our team will approach multiple Cement suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Cement suppliers and distributors companies.

Frequently Asked Questions

01 How big is India Cement Market?

The India Cement Market was valued at 3.9 million tonnes in 2023 which is driven by urbanization & infrastructure development.

02 Which segment is dominant in India Cement Market?

The residential construction segment is dominant due to government housing initiatives like Pradhan Mantri Awas Yojana which boosts demand for affordable housing.

03 What factors drive India Cement Market?

Key drivers include infrastructure development, government housing schemes, urbanization, and foreign investments. Influx of foreign capital has led to the development of numerous large-scale infrastructure and real estate projects, significantly increasing the demand for cement.

04 What are challenges in India Cement Market?

Challenges include fluctuating raw material prices, environmental regulations, high transportation costs, and competition from regional players. The cost of raw materials like coal and limestone has been rising, impacting the profit margins of cement manufacturers.

Â

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.