India Chatbot Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3414

November 2024

99

About the Report

India Chatbot Market Overview

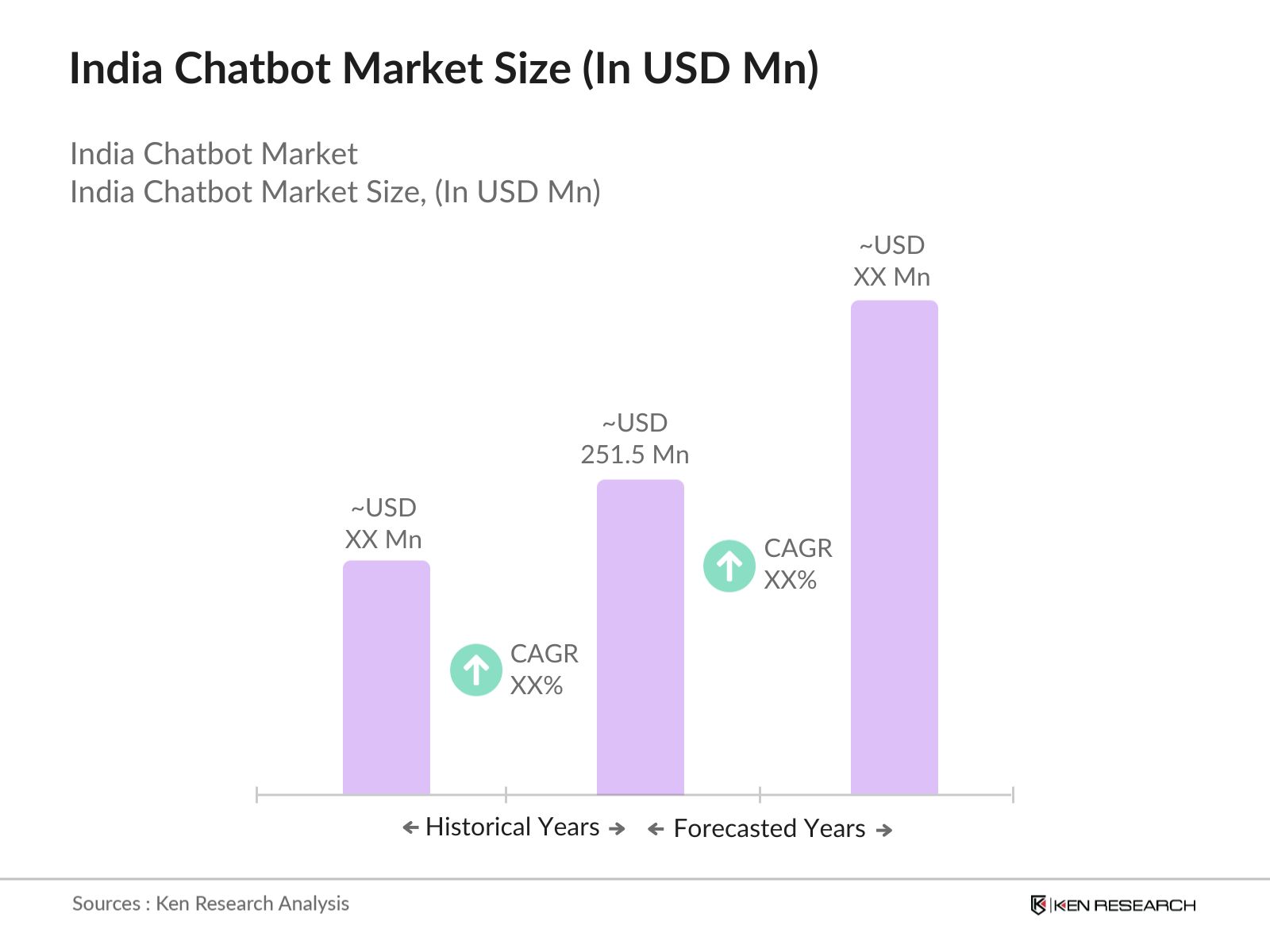

- The India Chatbot Market is valued at USD 251.5 million, based on a five-year historical analysis. This growth is primarily driven by the rising adoption of digital transformation strategies across various industries, including banking, healthcare, and e-commerce. Companies are increasingly investing in AI and natural language processing (NLP) technologies to enhance customer engagement and streamline business processes. The market is supported by technological advancements and a surge in mobile internet users, creating a favorable environment for chatbot adoption in India.

- Dominant regions within India, such as Bengaluru and Hyderabad, are leading the charge in chatbot innovation and deployment. These cities are home to several tech giants and startups, fostering a robust ecosystem for AI and machine learning (ML) development. The presence of IT hubs, a high concentration of skilled professionals, and extensive government support for AI initiatives contribute to the dominance of these regions in the India Chatbot Market.

- The Union Ministry of Agriculture & Farmers Welfare has introduced an AI chatbot specifically for the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN)scheme in 2024. This chatbot enhances the efficiency of the scheme by providing farmers with quick access to information related to their applications and payments. It helps farmers check application statuses, payment details, and eligibility criteria. Initially available in English, Hindi, Bengali, Odia, and Tamil, it is planned to support all 22 official languages of India soon.

India Chatbot Market Segmentation

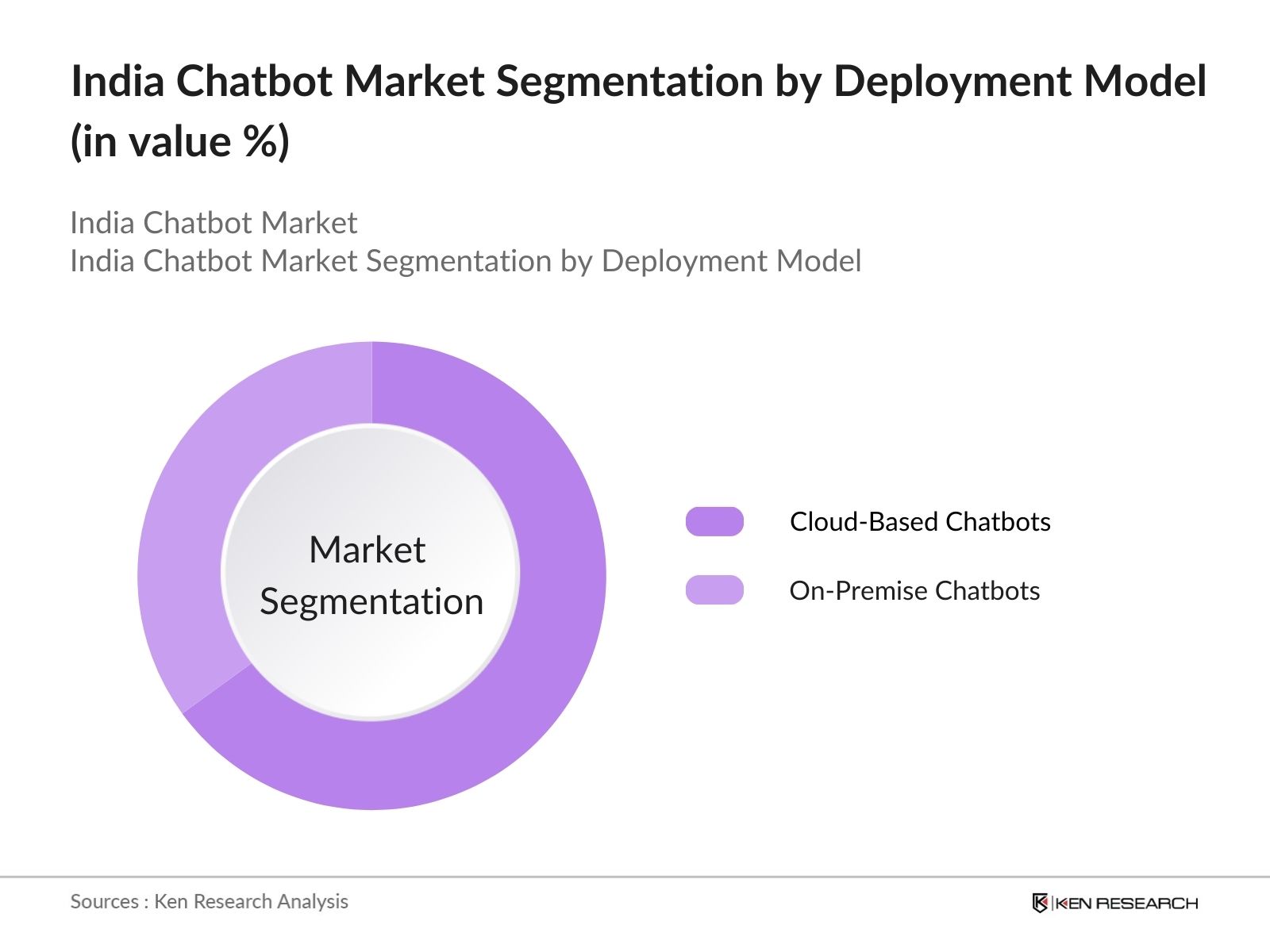

By Deployment Model: India Chatbot Market is segmented by deployment model into cloud-based chatbots and on-premise chatbots. Cloud-based chatbots hold the dominant market share due to their scalability, cost-efficiency, and easy integration with existing digital infrastructure. Businesses prefer cloud-based solutions as they offer greater flexibility and the ability to scale operations without heavy investment in IT infrastructure. The growing demand for real-time customer interactions and the ease of deploying cloud-based chatbots across various platforms also contribute to their leadership in the deployment segment.

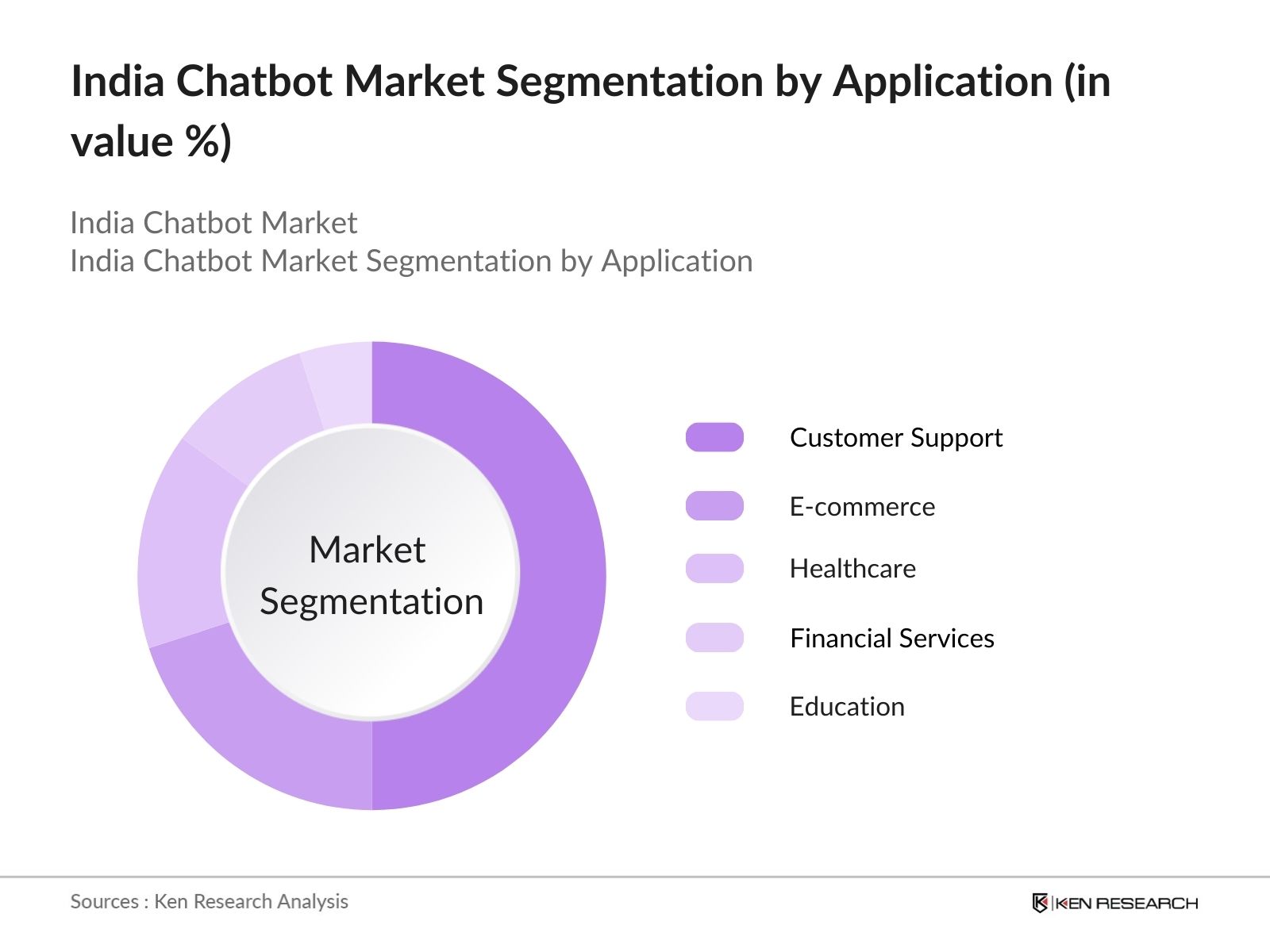

By Application: India Chatbot Market is segmented by application into customer support, e-commerce, healthcare, financial services, and education. Customer support chatbots dominate this segment, holding a significant market share. This dominance is driven by the increasing need for businesses to provide round-the-clock support and reduce response times. Customer support chatbots have become a critical tool for enhancing customer experience, resolving queries efficiently, and reducing operational costs. Additionally, the integration of AI and NLP has further improved chatbot capabilities, making them indispensable for large enterprises and SMEs alike.

India Chatbot Market Competitive Landscape

The India Chatbot Market is characterized by intense competition, with several key players driving innovation and growth. Leading companies such as Haptik and Yellow.ai are at the forefront, leveraging advanced AI and NLP technologies to provide customized solutions for various industries. This consolidation underscores the significant influence of these companies, particularly in sectors like banking, retail, and healthcare, where chatbots are becoming essential tools for improving operational efficiency and customer experience.

|

Company Name |

Established |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

AI Capabilities |

Product Portfolio |

Customer Base |

No. of Languages Supported |

Global Presence |

|

Haptik |

2013 |

Mumbai |

- |

- |

- |

- |

- |

- |

- |

|

Yellow.ai |

2016 |

Bengaluru |

- |

- |

- |

- |

- |

- |

- |

|

Gupshup |

2004 |

Mumbai |

- |

- |

- |

- |

- |

- |

- |

|

Wysa |

2015 |

Bengaluru |

- |

- |

- |

- |

- |

- |

- |

|

Verloop.io |

2016 |

Bengaluru |

- |

- |

- |

- |

- |

- |

- |

India Chatbot Market Analysis

Growth Drivers

- Digital Transformation Initiatives: India's digital transformation initiatives, like "Digital India," are driving the chatbot market by enhancing digital infrastructure and access. Over 700 million people have access to the internet in 2024, with more than 1.1 billion mobile connections. These initiatives are also improving digital literacy, particularly in rural areas. AI-based chatbots are becoming essential in banking, retail, and healthcare sectors, facilitating customer service automation. Digital transformation is a core driver behind the widespread adoption of chatbot solutions in the Indian market.

- Rise in Mobile User Engagement: With over 1.12 billion mobile subscribers in India, more than 700 million actively access the internet via mobile devices as of 2024. The surge in mobile data consumptionnow exceeding 15 GB per user per monthhas fueled the growth of mobile-first chatbots. Popular messaging apps like WhatsApp and Telegram have integrated chatbots for seamless customer-business interaction, leading to a higher adoption rate for these AI solutions in the Indian market.

- Increasing AI and NLP Integration: Indias linguistic diversity, with 22 recognized languages, is spurring the demand for AI chatbots capable of multilingual communication. By 2024, companies are increasingly leveraging AI and NLP technologies to serve different linguistic demographics, enhancing customer experience and reducing operational costs. The country's IT services export sector, surpassing $320 billion in 2023, indicates the rising importance of AI technologies in driving growth across sectors, including chatbot applications.

Market Challenges

- Data Privacy Concerns: India's chatbot market is grappling with data privacy challenges following the implementation of the Digital Personal Data Protection Act (DPDPA) in 2023. The act requires companies to ensure data security and user consent for data collection. Over 60% of businesses in 2024 cite privacy concerns as a major challenge in adopting AI chatbots, necessitating significant investments in secure data management and compliance measures to avoid legal repercussions.

- Integration Challenges with Legacy Systems: Many Indian companies, especially in banking and healthcare, rely on outdated IT infrastructure, which makes integrating advanced AI chatbot solutions difficult. As of 2024, nearly 70% of banking institutions still operate on legacy systems, complicating the implementation of seamless AI-driven customer service. This infrastructure limitation hinders the full potential of chatbots in automating customer support and improving efficiency, slowing the pace of chatbot adoption in these sectors.

India Chatbot Market Future Outlook

Over the next five years, the India Chatbot Market is expected to experience significant growth, driven by increasing investments in AI and NLP, along with the rapid digitalization of industries such as e-commerce and banking. The widespread adoption of cloud-based technologies, coupled with the growing demand for conversational commerce, is expected to bolster the market's expansion. Companies are increasingly focusing on improving chatbot functionalities to provide more personalized and efficient services, which will further fuel market growth in the coming years.

Market Opportunities

- Growth in Conversational Commerce: Indias e-commerce sector is growing rapidly, with more than 800 million internet users in 2024, leading to increased adoption of chatbot-driven conversational commerce. Chatbots are playing a key role in automating customer interactions, recommending products, and enabling seamless purchases. With over 100 billion digital payment transactions processed annually, businesses are increasingly turning to AI chatbots to enhance customer engagement and streamline online shopping experiences.

- Expansion into Tier-2 and Tier-3 Cities: Internet penetration is rising rapidly in Tier-2 and Tier-3 cities, where more than 300 million rural internet users are now online as of 2024. Businesses are increasingly deploying AI-powered, multilingual chatbots to engage these new digital consumers in regional languages. This expansion into previously underserved markets is driving chatbot adoption across industries such as e-commerce, banking, and healthcare, where customer engagement is crucial for growth.

Scope of the Report

|

By Deployment Type |

Cloud-Based Chatbots On-Premise Chatbots |

|

By Application |

Customer Support E-commerce Healthcare Financial Services Education |

|

By Technology |

AI-Powered Chatbots Rule-Based Chatbots Natural Language Processing (NLP) |

|

By End-User |

Large Enterprises Small & Medium Enterprises (SMEs) Startups |

|

By Region |

North South East West |

Products

Key Target Audience

Large Enterprises and Corporations

Small and Medium Enterprises (SMEs)

BFSI Sector (Banks, Financial Institutions)

Healthcare Providers

Retail and E-commerce Companies

Telecom Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Electronics and Information Technology, NITI Aayog)

Companies

Players mentioned in the report:

Haptik

Yellow.ai

Gupshup

Wysa

Verloop.io

Amplify.ai

Engati

Floatbot

AskSid

BotMan.ai

Niki.ai

Druid AI

Senseforth.ai

Rezo.ai

Ozonetel

Table of Contents

1. India Chatbot Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Chatbot Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Chatbot Market Analysis

3.1 Growth Drivers

3.1.1 Digital Transformation Initiatives

3.1.2 Rise in Mobile User Engagement

3.1.3 Increasing AI and NLP Integration

3.1.4 Government Support for AI Adoption

3.2 Market Challenges

3.2.1 Data Privacy Concerns

3.2.2 Integration Challenges with Legacy Systems

3.2.3 High Initial Costs for Advanced Chatbots

3.3 Opportunities

3.3.1 Growth in Conversational Commerce

3.3.2 Expansion into Tier-2 and Tier-3 Cities

3.3.3 Increase in Multilingual Chatbots

3.4 Trends

3.4.1 Adoption of Voice-Enabled Chatbots

3.4.2 Growing Demand for Omni-Channel Chatbot Solutions

3.4.3 Integration with E-commerce and Customer Support

3.5 Government Regulations

3.5.1 AI Policy and Data Governance Framework

3.5.2 Industry Standards and Compliance Requirements

3.5.3 IT Act Regulations and Data Security Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India Chatbot Market Segmentation

4.1 By Deployment Type (In Value %)

4.1.1 Cloud-Based Chatbots

4.1.2 On-Premise Chatbots

4.2 By Application (In Value %)

4.2.1 Customer Support

4.2.2 E-commerce

4.2.3 Healthcare

4.2.4 Financial Services

4.2.5 Education

4.3 By Technology (In Value %)

4.3.1 AI-Powered Chatbots

4.3.2 Rule-Based Chatbots

4.3.3 Natural Language Processing (NLP) Chatbots

4.4 By End-User (In Value %)

4.4.1 Large Enterprises

4.4.2 Small & Medium Enterprises (SMEs)

4.4.3 Startups

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Chatbot Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Haptik

5.1.2 Yellow.ai

5.1.3 Gupshup

5.1.4 Wysa

5.1.5 Verloop.io

5.1.6 Amplify.ai

5.1.7 Engati

5.1.8 Floatbot

5.1.9 AskSid

5.1.10 BotMan.ai

5.1.11 Niki.ai

5.1.12 Druid AI

5.1.13 Senseforth.ai

5.1.14 Rezo.ai

5.1.15 Ozonetel

5.2 Cross Comparison Parameters

5.2.1 Employee Count

5.2.2 Headquarters

5.2.3 Inception Year

5.2.4 Total Revenue

5.2.5 Product Portfolio

5.2.6 Chatbot User Base

5.2.7 Number of Languages Supported

5.2.8 AI and NLP Capabilities

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Chatbot Market Regulatory Framework

6.1 AI Adoption Guidelines

6.2 Data Protection and Privacy Laws

6.3 Compliance with Indian IT Act

6.4 Sector-Specific Regulations for BFSI, Healthcare, etc.

7. India Chatbot Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Chatbot Future Market Segmentation

8.1 By Deployment Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. India Chatbot Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Chatbot Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Chatbot Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple chatbot solution providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Chatbot Market.

Frequently Asked Questions

01. How big is the India Chatbot Market?

The India Chatbot Market was valued at USD 251.5 million, driven by increasing digital adoption across various industries and advancements in AI and NLP technologies.

02. What are the challenges in the India Chatbot Market?

Key challenges include integration issues with legacy systems, high costs associated with advanced AI chatbots, and data privacy concerns, which may hinder chatbot adoption across sensitive sectors.

03. Who are the major players in the India Chatbot Market?

Major players include Haptik, Yellow.ai, Gupshup, Wysa, and Verloop.io, who dominate the market due to their strong AI capabilities, wide product portfolios, and established customer bases.

04. What are the growth drivers of the India Chatbot Market?

Growth drivers include the rising demand for conversational commerce, increased use of cloud-based solutions, and the proliferation of mobile internet users across India, creating a strong demand for AI-powered chatbots.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.