India Coatings Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10678

November 2024

95

About the Report

India Coatings Market Overview

- The India Coatings Market, valued at USD 1.6 billion, is supported by continuous advancements in the construction and automotive sectors, which are primary consumers of coatings. With extensive infrastructure development initiatives and the rising focus on sustainable and eco-friendly solutions, the market has seen steady growth over the past five years.

- In India, major cities such as Mumbai, Delhi, and Bengaluru dominate the coatings market. This is attributed to the high concentration of construction activities, industrial establishments, and a strong automotive manufacturing presence in these regions. Additionally, these metropolitan areas see increased demand for premium and innovative coatings due to their rapid urbanization, advanced consumer preferences, and stringent regulatory frameworks for environmental compliance, particularly regarding emissions and VOC levels in coatings.

- Indias environmental standards, led by the Central Pollution Control Board, set stringent VOC regulations in 2023, impacting coatings production. These standards demand low-VOC formulations to minimize pollution, posing compliance requirements for manufacturers. VOC compliance has become mandatory in high-urbanization zones, influencing market dynamics as companies must align with emissions standards.

India Coatings Market Segmentation

By Product Type: The market is segmented by product type into water-based coatings, solvent-based coatings, powder coatings, and specialty coatings. Solvent-based coatings hold a dominant market share due to their resilience in industrial applications and the ability to adhere well on metallic surfaces, making them ideal for automotive and heavy machinery. Despite increasing regulatory concerns about VOC emissions, their durability and performance in high-stress environments sustain their market demand.

By End-Use Industry: The market is segmented by end-use industry into automotive, construction, marine, aerospace, and industrial. Within this category, the construction sector holds a leading share due to extensive infrastructure and residential projects across urban and semi-urban regions. The demand for protective coatings that can withstand various environmental factors and provide durability is essential in this sector, especially with the governments push towards Housing for All and infrastructure expansion programs.

India Coatings Market Competitive Landscape

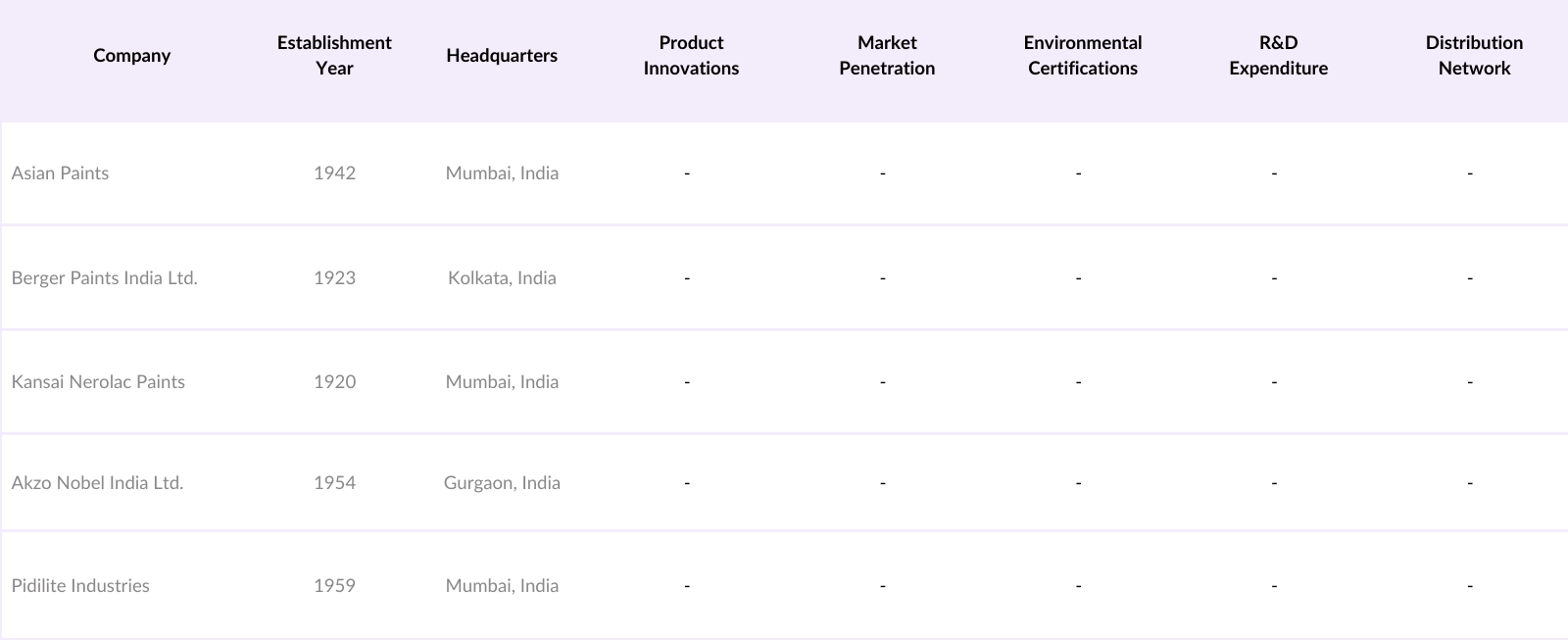

The India Coatings Market is concentrated, with major players such as Asian Paints and Berger Paints leading due to their extensive distribution networks, product range, and innovation capabilities. This competitive landscape is shaped by both local and international companies, each focusing on expanding sustainable product lines and investing in technological advancements to meet market demands and regulatory standards.

India Coatings Industry Analysis

Growth Drivers

- Industrial Expansion (Manufacturing, Automotive): The Indian coatings market is significantly driven by the growth in manufacturing and automotive sectors. In 2023, India's manufacturing GDP contribution rose to nearly $500 billion, reflecting growth in industrial coatings demand. The automotive sector, necessitating advanced coatings for protection and aesthetics in response to consumer demand for durable and weather-resistant finishes. This industrial expansion boosts coatings utilization in assembly lines, warehouses, and equipment maintenance, aligning with industry standards.

- Rising Urbanization: India's urban population 36.36% of the total population in 2023, creating a demand surge for housing and commercial spaces that utilize advanced coating materials for durability and aesthetics in urban infrastructure. Rapidly urbanizing regions such as Maharashtra, Karnataka, and Tamil Nadu are accelerating demand for decorative and protective coatings, with housing projects and commercial complexes expanding. This urban expansion necessitates durable, low-maintenance coatings, supporting the market's growth in cities where building resilience and environmental adaptation are critical.

- Infrastructure Development Initiatives: Indias infrastructure expansion, through projects like Bharatmala and Sagarmala, is creating substantial demand for durable coatings. These initiatives require specialized coatings to protect against corrosion and withstand high-use conditions in roads, bridges, and ports. By enhancing resilience in public infrastructure, these projects support a consistent demand for industrial-grade coatings, essential for long-term durability and performance in challenging environments.

Market Challenges

- Fluctuating Raw Material Prices: The coatings industry faces challenges from volatile raw material prices, impacting the stability of production costs and profit margins. Essential materials like titanium dioxide and resins are particularly affected by global supply chain disruptions, making it difficult for manufacturers to maintain consistent pricing and quality. These fluctuations increase financial pressure on both producers and end consumers, who seek more stable production costs.

- Regulatory Compliance Challenges (VOC, Environmental Standards): Strict regulatory compliance, especially concerning VOC emissions and environmental standards, presents a significant challenge for the coatings industry. Compliance with these regulations often requires advanced, eco-friendly formulations and costly technological upgrades. Non-compliance may result in penalties, pushing companies to prioritize sustainable practices and manage added compliance costs, especially in regions with stringent environmental regulations.

India Coatings Market Future Outlook

The India Coatings Market is poised for substantial growth, driven by the expansion of construction activities, especially in housing and industrial projects. Rising environmental awareness among consumers and regulatory compliance with sustainable coatings will encourage companies to innovate and adapt to eco-friendly solutions. Additionally, the automotive sector's shift toward electric vehicles will create demand for specialized coatings that enhance performance, contributing to the market's projected expansion.

Market Opportunities

- Rising Focus on Specialty Coatings: India's industrial sectors, particularly aerospace and defense, are driving demand for specialty coatings designed for high-performance applications. These coatings are essential for their resistance to chemicals, heat, and wear, making them critical in industries requiring durable, advanced materials. This focus creates valuable opportunities as companies are encouraged to develop tailored solutions to meet evolving industrial needs.

- Demand from Emerging Construction Markets: India's booming construction sector, especially with large-scale urban projects like Smart Cities, is increasing demand for high-quality coatings that offer both aesthetic appeal and durability. These growing markets require coatings that can withstand environmental challenges, offering extensive opportunities for manufacturers to supply durable solutions in the countrys expanding urban infrastructure.

Scope of the Report

|

Product Type |

Water-Based Coatings Solvent-Based Coatings Powder Coatings Specialty Coatings |

|

Technology |

Liquid Coatings Electroplating Nano-Coatings UV-Curable Coatings |

|

End-Use Industry |

Automotive Construction Marine Aerospace Industrial |

|

Application |

Protective Coatings Decorative Coatings Specialty Coatings |

|

Region |

North South East West |

Products

Key Target Audience

Automotive OEM Manufacturers

Industrial Coating Applicators

Residential and Commercial Construction Firms

Government and Regulatory Bodies (Bureau of Indian Standards)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Asian Paints

Berger Paints India Ltd.

Kansai Nerolac Paints

Akzo Nobel India Ltd.

Pidilite Industries Ltd.

Shalimar Paints Ltd.

Nippon Paint India Pvt. Ltd.

Jotun India Pvt. Ltd.

Axalta Coating Systems

BASF Coatings Pvt. Ltd.

Table of Contents

1. India Coatings Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Dynamics

1.4. Segmentation Overview (Product Type, Technology, End-Use Industry, Application, Region)

2. India Coatings Market Size (In USD Mn)

2.1. Historical Market Size Analysis

2.2. Key Market Milestones

2.3. Year-on-Year Growth Analysis

3. India Coatings Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Expansion (Manufacturing, Automotive)

3.1.2. Rising Urbanization

3.1.3. Infrastructure Development Initiatives

3.1.4. Increasing Demand for Eco-Friendly Coatings

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Regulatory Compliance Challenges (VOC, Environmental Standards)

3.2.3. Technological Barriers in Adoption

3.3. Opportunities

3.3.1. Rising Focus on Specialty Coatings

3.3.2. Demand from Emerging Construction Markets

3.3.3. Government Incentives for Sustainable Practices

3.4. Trends

3.4.1. Digital Innovations in Product Customization

3.4.2. Growth of Powder Coatings

3.4.3. Nano-Coatings and High-Performance Applications

3.5. Regulatory Framework

3.5.1. Environmental Standards (VOC Regulations, Indian Standards)

3.5.2. Certification and Compliance Processes

3.5.3. State-Level Emission and Safety Regulations

3.6. SWOT Analysis

3.7. Value Chain Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. India Coatings Market Segmentation

4.1. By Product Type (In Market Share %)

4.1.1. Water-Based Coatings

4.1.2. Solvent-Based Coatings

4.1.3. Powder Coatings

4.1.4. Specialty Coatings

4.2. By Technology (In Market Share %)

4.2.1. Liquid Coatings

4.2.2. Electroplating

4.2.3. Nano-Coatings

4.2.4. UV-Curable Coatings

4.3. By End-Use Industry (In Market Share %)

4.3.1. Automotive

4.3.2. Construction

4.3.3. Marine

4.3.4. Aerospace

4.3.5. Industrial

4.4. By Application (In Market Share %)

4.4.1. Protective Coatings

4.4.2. Decorative Coatings

4.4.3. Specialty Coatings

4.5. By Region (In Market Share %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Coatings Market Competitive Analysis

5.1. Detailed Company Profiles of Major Players

5.1.1. Asian Paints

5.1.2. Berger Paints India Ltd.

5.1.3. Kansai Nerolac Paints Ltd.

5.1.4. Akzo Nobel India Ltd.

5.1.5. Pidilite Industries Ltd.

5.1.6. Shalimar Paints Ltd.

5.1.7. Nippon Paint India Pvt. Ltd.

5.1.8. Jotun India Pvt. Ltd.

5.1.9. Axalta Coating Systems

5.1.10. BASF Coatings Pvt. Ltd.

5.1.11. Sherwin-Williams India Pvt. Ltd.

5.1.12. Snowcem Paints

5.1.13. British Paints

5.1.14. Anabond Limited

5.1.15. Dulux Paints India

5.2. Cross Comparison Parameters (Production Capacity, Innovation Index, Sustainability Practices, Market Penetration, Workforce Strength, Revenue Share, Technology Adoption, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Developments

5.5. Mergers, Acquisitions, and Partnerships

5.6. Investment and Funding Patterns

5.7. Venture Capital and Private Equity Funding

5.8. Public-Private Partnerships

6. India Coatings Market Regulatory Framework

6.1. VOC Compliance Standards

6.2. Environmental Safety Regulations

6.3. Certification and Approval Processes

6.4. Emission Control Standards

6.5. Labeling and Chemical Use Standards

7. India Coatings Future Market Size (In USD Mn)

7.1. Growth Factors Influencing Future Market Size

7.2. Strategic Market Expansion Analysis

8. India Coatings Future Market Segmentation

8.1. By Product Type (In Market Share %)

8.2. By Technology (In Market Share %)

8.3. By End-Use Industry (In Market Share %)

8.4. By Application (In Market Share %)

8.5. By Region (In Market Share %)

9. India Coatings Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Optimal Market Entry Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the India Coatings Market ecosystem, identifying stakeholders, and gathering secondary data from reputable sources. This process focused on identifying critical market drivers, growth segments, and emerging consumer preferences.

Step 2: Market Analysis and Construction

In this phase, historical data was compiled and analyzed to assess the market's progression, including factors such as product performance, pricing trends, and the distribution channels shaping the current market structure.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated based on the analyzed data and validated through expert consultations with industry professionals. These insights were essential for confirming the reliability of market forecasts and identifying segment-specific growth opportunities.

Step 4: Research Synthesis and Final Output

In the final phase, we conducted interviews with manufacturers and distributors to gain direct insights into production trends, consumer preferences, and regional demand variations, ensuring a comprehensive and accurate analysis of the India Coatings Market.

Frequently Asked Questions

01. How big is the India Coatings Market?

The India Coatings Market is valued at USD 1.6 billion, primarily driven by expansion in the construction and automotive sectors.

02. What are the challenges in the India Coatings Market?

The primary challenges in India Coatings Market include high VOC emissions regulations, fluctuating raw material costs, and the demand for sustainable alternatives that comply with environmental standards.

03. Who are the major players in the India Coatings Market?

Key players in India Coatings Market include Asian Paints, Berger Paints India Ltd., Kansai Nerolac Paints, Akzo Nobel India Ltd., and Pidilite Industries Ltd., recognized for their extensive distribution and product innovation.

04. What are the growth drivers of the India Coatings Market?

The India Coatings Market growth drivers include infrastructure development, urbanization, and rising consumer preference for protective and decorative coatings in construction and automotive sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.