India Coffee Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD4462

October 2024

98

About the Report

India Coffee Market Overview

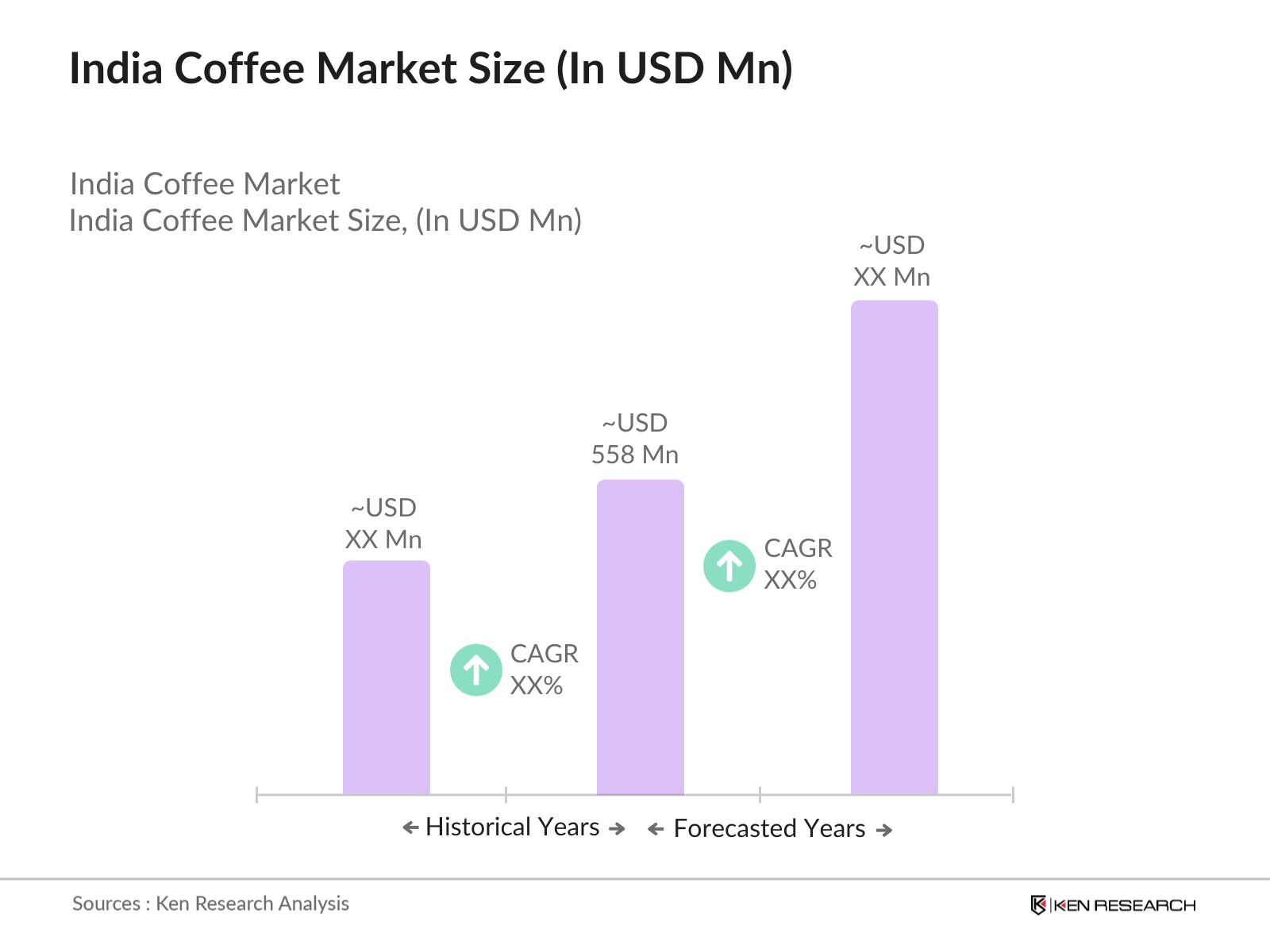

- The India coffee market is valued at USD 558 million based on a five-year historical analysis, driven by a rising preference for coffee among millennials and an expanding middle class in urban areas. Coffee consumption is also boosted by the growing coffee shop culture, especially in major metropolitan areas like Bangalore, Chennai, and Mumbai. Additionally, the increased demand for premium and specialty coffee has also played a role in driving the market forward, supported by the expansion of domestic coffee chains.

- Southern states, including Karnataka, Kerala, and Tamil Nadu, dominate the coffee market in India due to favorable climatic conditions, which make them ideal for coffee cultivation. These regions also benefit from well-established coffee estates and a strong processing infrastructure, positioning them as the hub for coffee production. Karnataka alone accounts for the majority of the coffee produced in India, further emphasizing its dominance in the market.

- The Indian government offers various subsidies and tax exemptions to boost coffee exports. In 2023, the Ministry of Commerce extended export subsidies under the Merchandise Exports from India Scheme (MEIS), benefiting coffee exporters by reducing their operational costs. Additionally, tax exemptions on income derived from coffee plantations have provided a significant boost to the profitability of coffee growers. These policies aim to enhance the competitiveness of Indian coffee in international markets.

India Coffee Market Segmentation

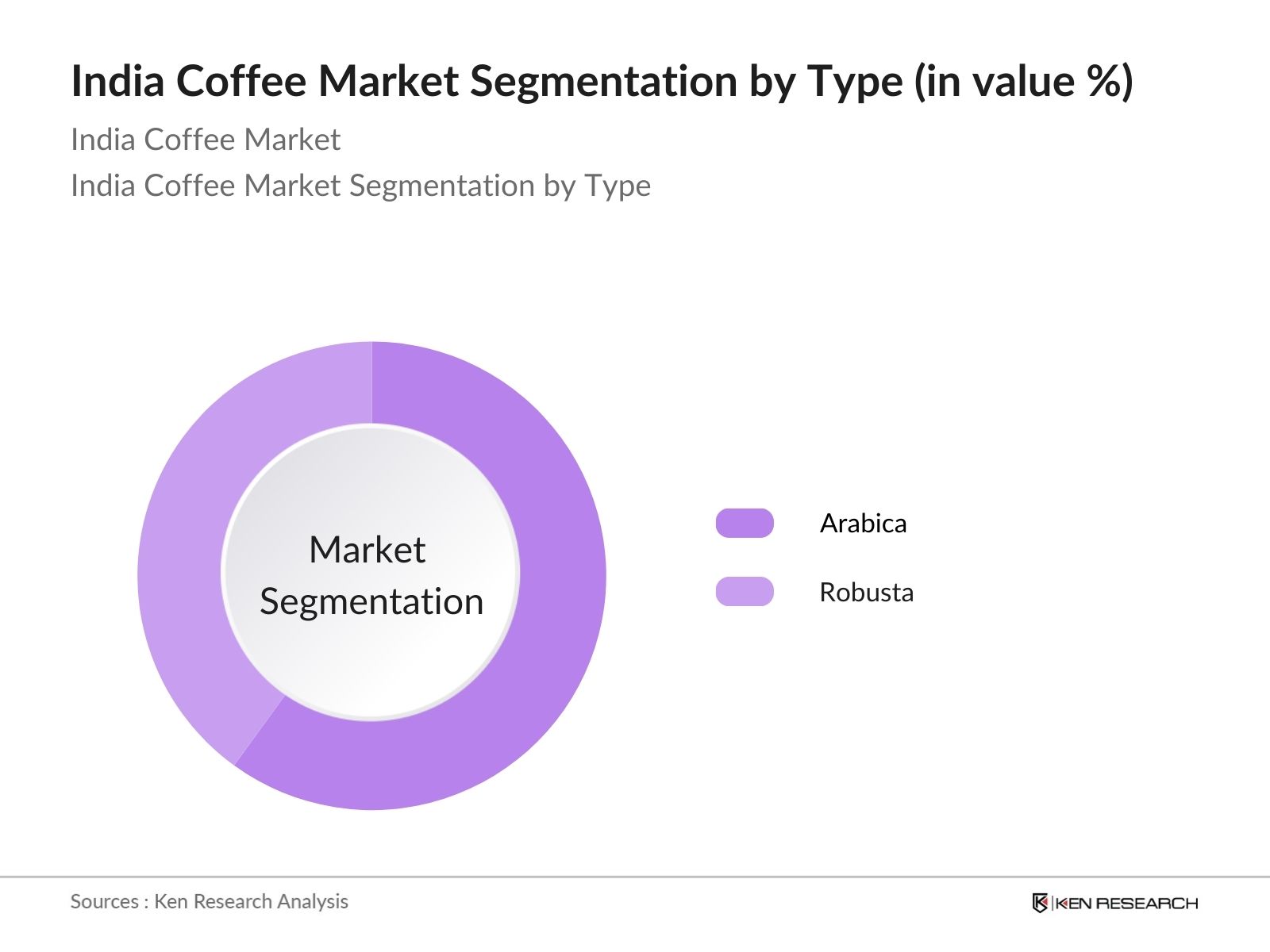

- By Type: India's coffee market is segmented by type into Arabica and Robusta coffee. Arabica coffee holds a larger share in the market due to its mild flavor and premium status, making it more popular among high-end consumers and specialty coffee brands. Additionally, Indias favorable climatic conditions, particularly in Karnataka, have made it a key region for growing high-quality Arabica beans, further boosting its market dominance. Robusta, though significant in production, is more popular in instant coffee and commercial coffee segments, but lacks the premium appeal of Arabica.

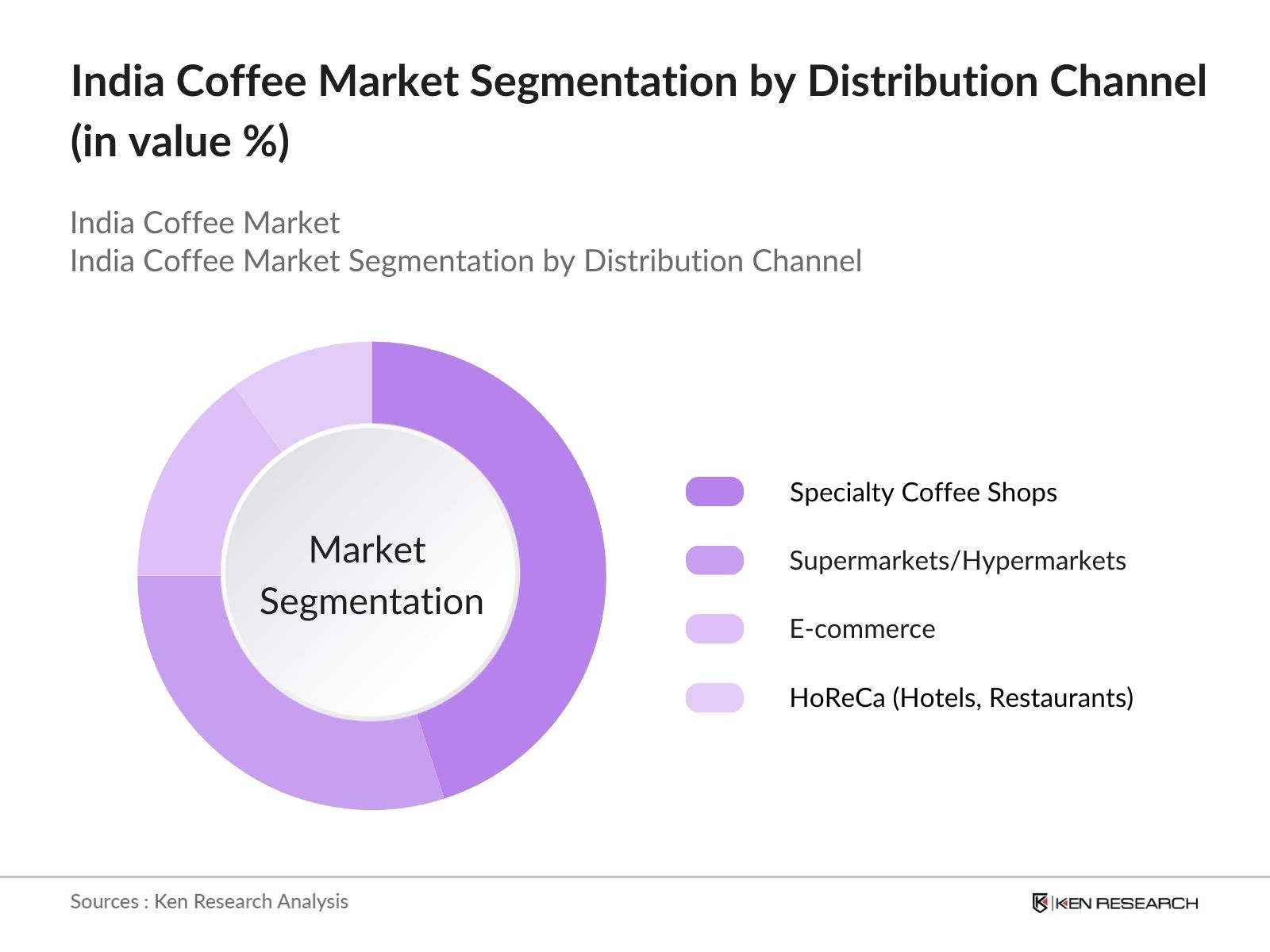

- By Distribution Channel: The coffee market in India is segmented by distribution channels into Supermarkets/Hypermarkets, Specialty Coffee Shops, E-commerce, and HoReCa (Hotels, Restaurants, Cafes). Specialty coffee shops dominate this segment due to the growing trend of caf culture, especially in urban centers. Brands like Caf Coffee Day and Starbucks have established significant market share by creating a customer experience that appeals to millennials and working professionals. The caf culture offers both convenience and social engagement, making this channel a preferred option for coffee consumption outside homes.

India Coffee Market Competitive Landscape

The India coffee market is dominated by several key players, both domestic and international. Major competitors include brands like Tata Coffee Ltd., Hindustan Unilever (Bru), and Nestl India (Nescaf), which have established a strong market presence through a combination of extensive distribution networks, branding, and product innovation. These companies compete not only in instant and filter coffee but also in the growing premium and specialty coffee segments. The market also sees competition from new-age roasters like Blue Tokai and The Flying Squirrel, who cater to the niche premium market.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

Global Presence |

Distribution Channels |

Product Range |

Sustainability Initiatives |

|

Tata Coffee Ltd. |

1922 |

Bangalore, India |

|||||

|

Hindustan Unilever (Bru) |

1933 |

Mumbai, India |

|||||

|

Nestl India (Nescaf) |

1961 |

Gurugram, India |

|||||

|

Coffee Day Enterprises (CCD) |

1996 |

Bangalore, India |

|||||

|

Blue Tokai Coffee Roasters |

2013 |

New Delhi, India |

India Coffee Industry Analysis

Market Growth Drivers

- Increasing Coffee Consumption (Domestic Demand, Specialty Coffee): India's coffee consumption has seen a significant increase, particularly driven by urbanization and rising middle-class incomes. According to the Coffee Board of India, domestic consumption rose to approximately 1.2 lakh metric tonnes by 2023. Specialty coffee consumption is on the rise, with cafs and coffee chains expanding rapidly in cities like Bengaluru, Mumbai, and Delhi. Indian coffee shops like Caf Coffee Day, alongside global brands like Starbucks, cater to evolving urban consumer preferences for premium, artisanal coffees.

- Expansion of Coffee Cultivation (Arabica vs Robusta Production): Indias coffee cultivation is primarily divided between Arabica and Robusta varieties. In 2023, the production of coffee reached 3.42 lakh metric tonnes, according to the Coffee Board of India, with Robusta accounting for nearly 70% of the total output. Key coffee-producing regions like Karnataka, Kerala, and Tamil Nadu have expanded cultivation, contributing to this output. While Arabica remains more sensitive to weather changes, Robusta has been more resilient, accounting for higher production levels.

- Rising Exports (Key Export Markets, Coffee Trade Agreements): India's coffee export market is robust, with approximately 70% of its total coffee production being exported. In 2023, coffee exports amounted to over 2 lakh metric tonnes, primarily directed toward countries like Italy, Germany, Belgium, and Russia, according to the Coffee Board of India. Trade agreements like the India-EU Free Trade Agreement have facilitated smoother export processes, helping India become one of the largest global exporters of Robusta coffee.

Market Restraints

- Impact of Climate Change (Yield Fluctuations, Crop Diseases): Climate change poses a significant challenge to Indias coffee production, with frequent droughts and erratic rainfall affecting yields. According to a report by the Coffee Board of India, Karnataka, the largest coffee-producing state, saw yield declines in 2022-2023, with Arabica yields dropping by nearly 5%. Diseases like coffee rust and white stem borer have further impacted the yield, particularly in regions where temperatures have risen consistently.

- Price Volatility (International Coffee Prices, Exchange Rate Risks): Indian coffee farmers face significant risks due to price volatility in the global coffee market. According to the International Coffee Organization (ICO), coffee prices in 2023 fluctuated due to supply chain disruptions and adverse weather conditions in major producing countries. Indian producers, who rely heavily on exports, face additional risks due to fluctuations in the Indian Rupee, especially when trading with key markets like the EU

India Coffee Market Future Outlook

The India coffee market is expected to witness strong growth driven by increasing coffee consumption, rising caf culture, and expanding e-commerce platforms. The premium and specialty coffee segments are anticipated to grow rapidly, fueled by consumer demand for unique flavors and high-quality coffee beans. Additionally, the coffee processing industry will see technological advancements that could improve yield and sustainability practices in coffee farming, further boosting production.

Market Opportunities

- Growing Domestic Coffee Chains: The rapid expansion of domestic coffee chains represents a considerable opportunity for the Indian coffee market. Brands like Caf Coffee Day and Blue Tokai have expanded their footprints, opening new outlets in both urban and semi-urban regions. As of 2023, Caf Coffee Day alone operated more than 1,500 stores across India. This growing chain culture is driving coffee consumption, especially among younger demographics. The Coffee Board of India also supports local roasters to enter the retail market, providing incentives and grants.

- Expansion of Premium Coffee Segment: The premium coffee segment, which includes artisanal, organic, and single-origin coffees, is expanding rapidly in India. In 2023, premium coffee brands like Araku Coffee and Black Baza saw increased demand in metropolitan areas. According to Coffee Board data, more than 50% of premium coffee sales now come from direct-to-consumer models via e-commerce platforms. With the rising disposable income of Indias urban middle class, the demand for higher-quality coffee experiences is set to sustain current growth

Scope of the Report

|

Type |

Arabica, Robusta |

|

Form |

Whole Bean, Ground Coffee, Instant Coffee |

|

Distribution Channel |

Supermarkets/Hypermarkets, Specialty Coffee Shops, E-Commerce, HoReCa |

|

End-Use |

Commercial, Residential |

|

Region |

Southern India, Northern India, Eastern India, Western India |

Products

Key Target Audience

Coffee Producers and Farmers

Coffee Processors and Exporters

Retailers and Distributors (Supermarkets, Specialty Shops)

Caf Chains and HoReCa Operators

Coffee Equipment Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Coffee Board of India, FSSAI)

E-commerce Platforms

Companies

Players Mentioned in the Report:

Tata Coffee Ltd.

Hindustan Unilever Ltd. (Bru)

Nestl India Ltd. (Nescaf)

Coffee Day Enterprises Ltd. (Caf Coffee Day)

Tata Starbucks Private Ltd.

Blue Tokai Coffee Roasters

The Flying Squirrel Coffee

Continental Coffee Ltd.

ITC Ltd. (Sunbean)

Indian Coffee House

Narasus Coffee Company

Halli Berri

Seven Beans Coffee Company

Levista Coffee

Koinonia Coffee Roasters

Table of Contents

1. India Coffee Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Domestic Coffee Consumption, Export Volume)

1.4 Market Segmentation Overview (Type, Form, Distribution Channel, End-Use, Region)

2. India Coffee Market Size (In INR Mn)

2.1 Historical Market Size (Value and Volume)

2.2 Year-On-Year Growth Analysis (Volume Growth, Value Growth)

2.3 Key Market Developments and Milestones (New Production Facilities, Export Agreements)

3. India Coffee Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Coffee Consumption (Domestic Demand, Specialty Coffee)

3.1.2 Expansion of Coffee Cultivation (Arabica vs Robusta Production)

3.1.3 Rising Exports (Key Export Markets, Coffee Trade Agreements)

3.1.4 Changing Consumer Preferences (Specialty Coffee, Instant Coffee)

3.2 Market Challenges

3.2.1 Impact of Climate Change (Yield Fluctuations, Crop Diseases)

3.2.2 Price Volatility (International Coffee Prices, Exchange Rate Risks)

3.2.3 Labor Shortage in Coffee Plantations

3.3 Opportunities

3.3.1 Growing Domestic Coffee Chains

3.3.2 Expansion of Premium Coffee Segment

3.3.3 Technological Advancements in Coffee Processing (Value Addition)

3.4 Trends

3.4.1 Rise of Coffee Culture in Urban Areas

3.4.2 Organic Coffee Certification Growth

3.4.3 Use of E-commerce for Coffee Sales

3.5 Government Regulations and Policies

3.5.1 Coffee Board of India Initiatives

3.5.2 Export Subsidies and Tax Exemptions

3.5.3 Environmental and Sustainability Standards

3.6 SWOT Analysis (India Coffee Market)

3.7 Stakeholder Ecosystem (Farmers, Coffee Processors, Traders, Retailers)

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. India Coffee Market Segmentation

4.1 By Type (In Value and Volume %)

4.1.1 Arabica

4.1.2 Robusta

4.2 By Form (In Value and Volume %)

4.2.1 Whole Bean

4.2.2 Ground Coffee

4.2.3 Instant Coffee

4.3 By Distribution Channel (In Value and Volume %)

4.3.1 Supermarkets/Hypermarkets

4.3.2 Specialty Coffee Shops

4.3.3 E-Commerce

4.3.4 HoReCa (Hotels, Restaurants, Cafes)

4.4 By End-Use (In Value and Volume %)

4.4.1 Commercial

4.4.2 Residential

4.5 By Region (In Value and Volume %)

4.5.1 Southern India

4.5.2 Northern India

4.5.3 Eastern India

4.5.4 Western India

5. India Coffee Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Tata Coffee Ltd.

5.1.2 Hindustan Unilever Ltd. (Bru)

5.1.3 Nestl India Ltd. (Nescaf)

5.1.4 Coffee Day Enterprises Ltd. (Caf Coffee Day)

5.1.5 Tata Starbucks Private Ltd.

5.1.6 Levista Coffee

5.1.7 Blue Tokai Coffee Roasters

5.1.8 The Flying Squirrel Coffee

5.1.9 Koinonia Coffee Roasters

5.1.10 Continental Coffee Ltd.

5.1.11 ITC Ltd. (Sunbean)

5.1.12 Indian Coffee House

5.1.13 Narasus Coffee Company

5.1.14 Halli Berri

5.1.15 Seven Beans Coffee Company

5.2 Cross Comparison Parameters (Production Volume, Market Share, Revenue, Market Presence, Processing Facilities, Sustainability Initiatives, Distribution Network, Product Range)

5.3 Market Share Analysis (Arabica vs Robusta, Branded vs Non-branded)

5.4 Strategic Initiatives

5.4.1 Product Launches

5.4.2 Market Expansion

5.4.3 Sustainability Initiatives

5.5 Mergers And Acquisitions (Domestic and International Acquisitions)

5.6 Investment Analysis

5.7 Venture Capital Funding in Specialty Coffee Segment

5.8 Government Grants for Coffee Plantations and Exports

5.9 Private Equity Investments in Coffee Startups

6. India Coffee Market Regulatory Framework

6.1 Coffee Certification and Licensing Requirements

6.2 Export Regulations and Compliance (Including FSSAI, APEDA Guidelines)

6.3 Environmental Standards for Sustainable Coffee Cultivation

7. India Coffee Future Market Size (In INR Mn)

7.1 Future Market Size Projections (Export and Domestic Consumption Growth)

7.2 Key Factors Driving Future Market Growth (Technological Adoption, Consumer Preferences)

8. India Coffee Future Market Segmentation

8.1 By Type (In Value and Volume %)

8.2 By Form (In Value and Volume %)

8.3 By Distribution Channel (In Value and Volume %)

8.4 By End-Use (In Value and Volume %)

8.5 By Region (In Value and Volume %)

9. India Coffee Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2 Customer Cohort Analysis (Age Demographics, Coffee Preferences)

9.3 Marketing Initiatives for Premium Coffee Brands

9.4 White Space Opportunity Analysis (New Market Segments, Untapped Regions)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map covering all stakeholders in the India coffee market. This includes key producers, exporters, retailers, and end-consumers. Data is gathered from secondary sources and government reports to identify critical market drivers such as demand, pricing, and production.

Step 2: Market Analysis and Construction

In this step, historical data from 2018-2023 is analyzed to understand coffee production, export trends, and domestic consumption. Additionally, market penetration of various coffee types (Arabica, Robusta) is assessed.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including plantation owners and coffee chain operators, are consulted through interviews and surveys to validate the market hypotheses. Their insights provide a deeper understanding of market trends, challenges, and opportunities.

Step 4: Research Synthesis and Final Output

In the final phase, findings from all the previous steps are synthesized to provide a comprehensive view of the India coffee market. This includes cross-referencing with government data to ensure accuracy.

Frequently Asked Questions

01. How big is the India Coffee Market?

The India coffee market is valued at USD 558 million, driven by increasing coffee consumption, expanding caf culture, and a growing preference for premium coffee brands.

02. What are the challenges in the India Coffee Market?

Challenges in the India coffee market include fluctuating coffee prices due to international market conditions, labor shortages, and climate-related issues affecting yield and quality.

03. Who are the major players in the India Coffee Market?

Key players in the market include Tata Coffee Ltd., Hindustan Unilever Ltd. (Bru), Nestl India Ltd. (Nescaf), Coffee Day Enterprises Ltd., and Blue Tokai Coffee Roasters, each leveraging strong distribution networks and brand loyalty.

04. What are the growth drivers of the India Coffee Market?

The market is propelled by increasing consumer preference for coffee over tea, rising disposable incomes, and the growth of specialty coffee consumption in urban areas, particularly among millennials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.