India Cold Chain Logistics Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD8091

November 2024

94

About the Report

India Cold Chain Logistics Market Overview

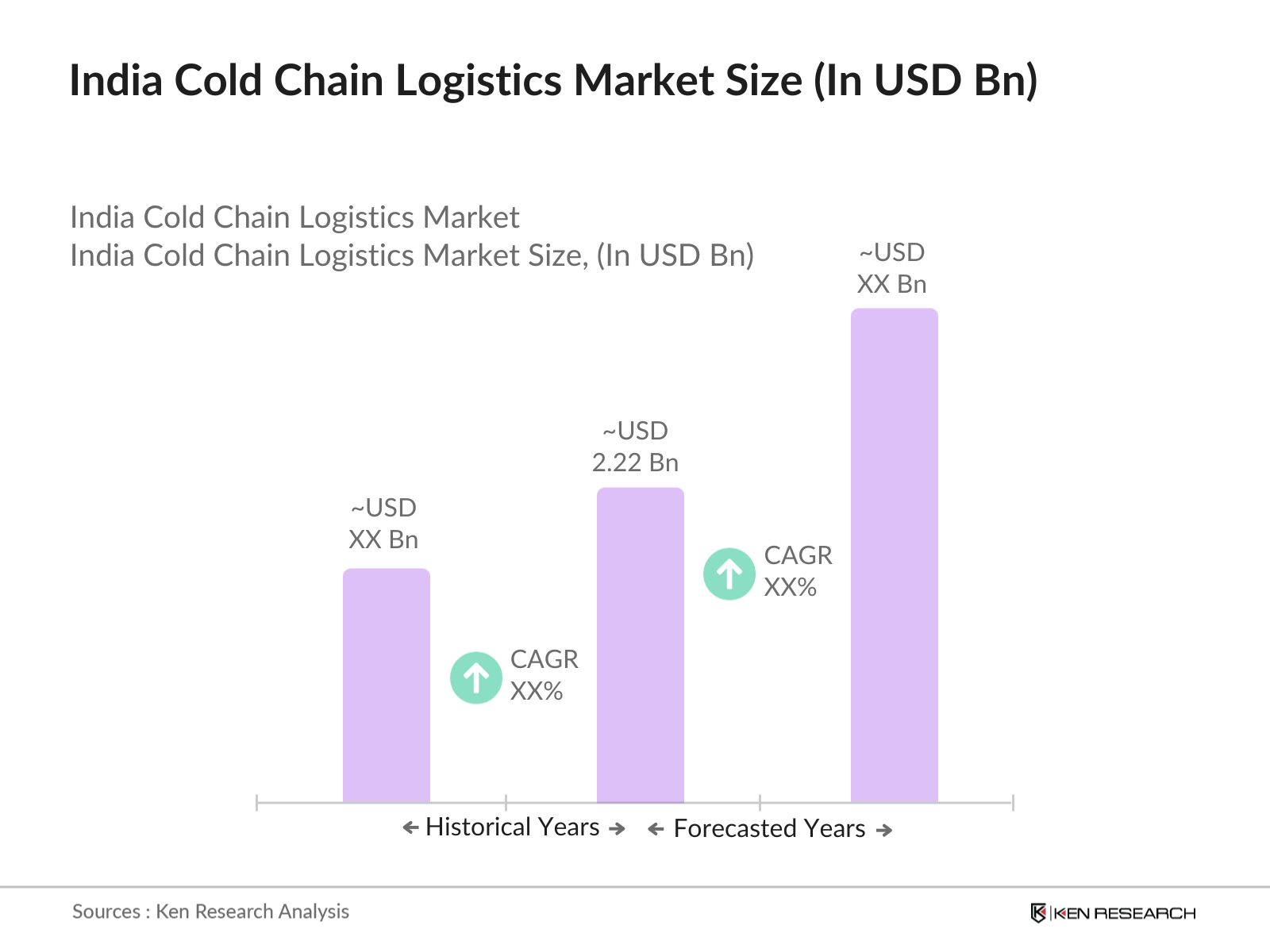

- The India cold chain logistics market is valued at USD 14.49 billion, driven by the growing demand for temperature-controlled logistics in industries like food & beverages, pharmaceuticals, and chemicals. The increasing consumption of perishable goods, coupled with government support for agricultural exports, is further boosting the market. The infrastructure expansion for cold storage facilities and refrigerated transport systems has significantly propelled market growth. This includes the deployment of advanced technologies such as IoT for real-time monitoring and automation in cold storage facilities.

- In India, the dominant regions for cold chain logistics include Maharashtra, Gujarat, and Uttar Pradesh. These states are home to major agricultural and industrial centers, contributing to the demand for cold storage and transport solutions. Maharashtra, with its significant production of fruits and vegetables, plays a crucial role in cold chain logistics. Gujarat's strong industrial base and port connectivity support the movement of temperature-sensitive goods. Additionally, Uttar Pradeshs vast agricultural output drives the need for cold chain infrastructure to ensure the efficient transportation of perishables.

- The Indian government has introduced various schemes to support the development of cold chain infrastructure. The Pradhan Mantri Kisan SAMPADA Yojana provides subsidies for the establishment of cold storage units and refrigerated transport systems. Over 6,000 crore in grants and subsidies have been disbursed under this scheme, targeting the reduction of food wastage and improving rural infrastructure for cold chains. These incentives encourage private sector participation and help scale cold chain operations across the country.

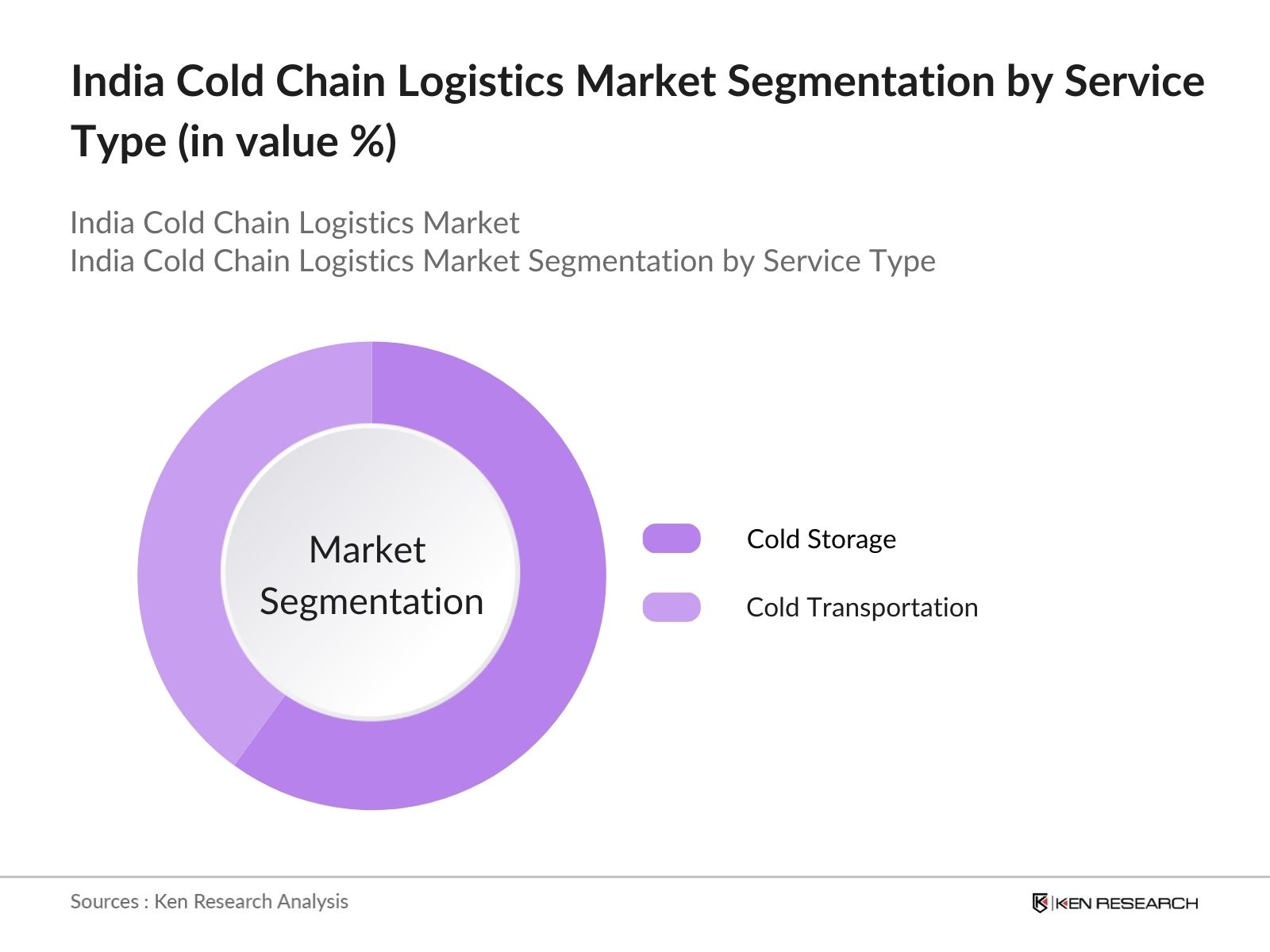

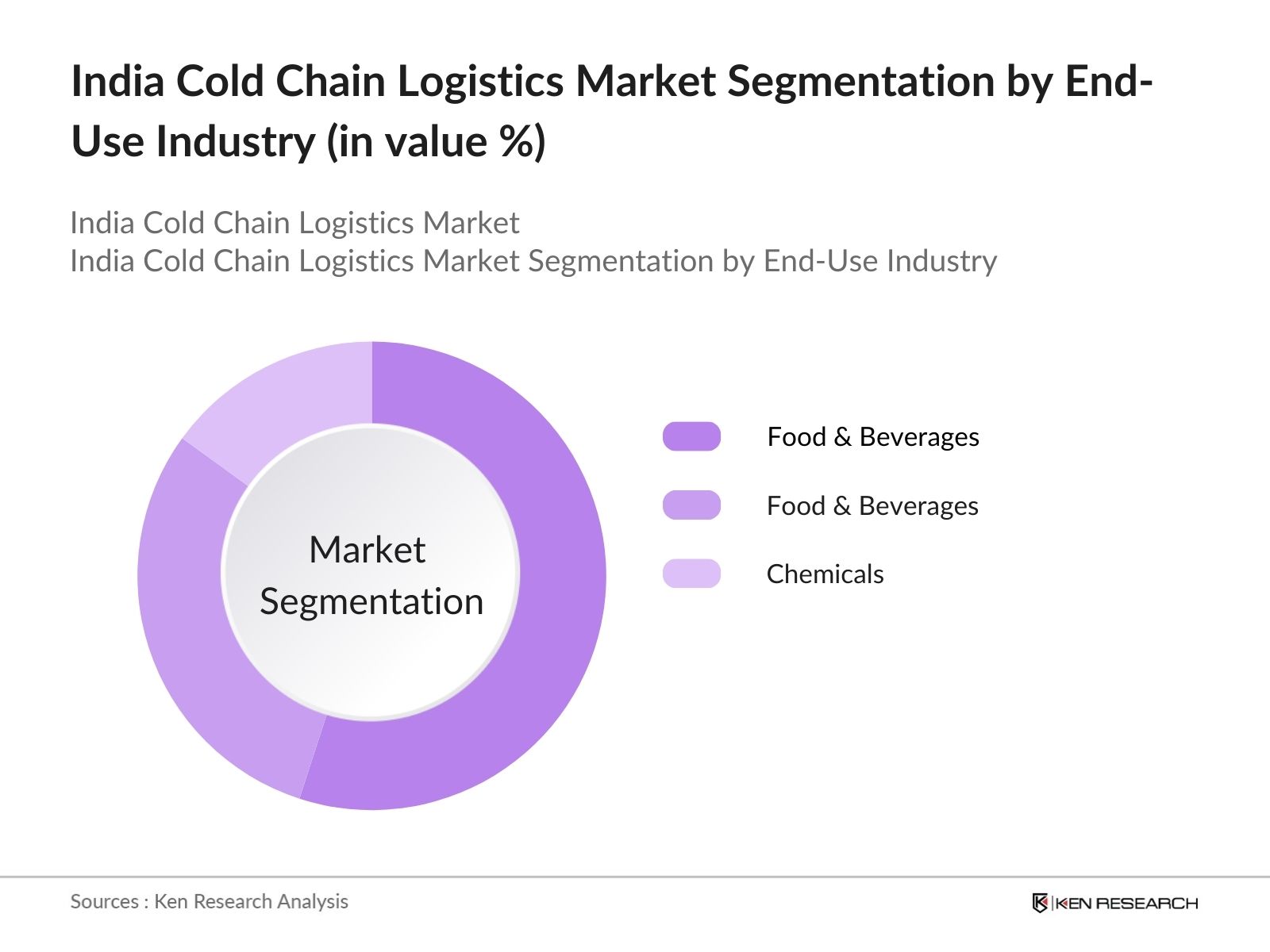

India Cold Chain Logistics Market Segmentation

- By Service Type: India's cold chain logistics market is segmented by service type into cold storage and cold transportation. Cold storage services dominate the market due to the increasing need for safe and prolonged storage of perishable food products, including dairy, meat, and fruits. Cold storage facilities are critical in maintaining product quality and safety, especially in the food & beverage industry. Cold transportation, on the other hand, is vital for the seamless movement of these products across supply chains. However, due to the scattered nature of Indias agricultural production, cold storage facilities remain the most in-demand service segment.

- By End-Use Industry: The cold chain logistics market is also segmented by end-use industries, which include food & beverages, pharmaceuticals, and chemicals. The food & beverage industry holds a dominant share due to the high volume of temperature-sensitive goods like fruits, vegetables, and dairy products requiring cold storage and transportation. The rising demand for processed and packaged food, driven by the growing urban population, has bolstered the demand for cold chain logistics in this sector. Pharmaceuticals follow closely, with the distribution of vaccines and temperature-sensitive medicines requiring strict cold chain adherence.

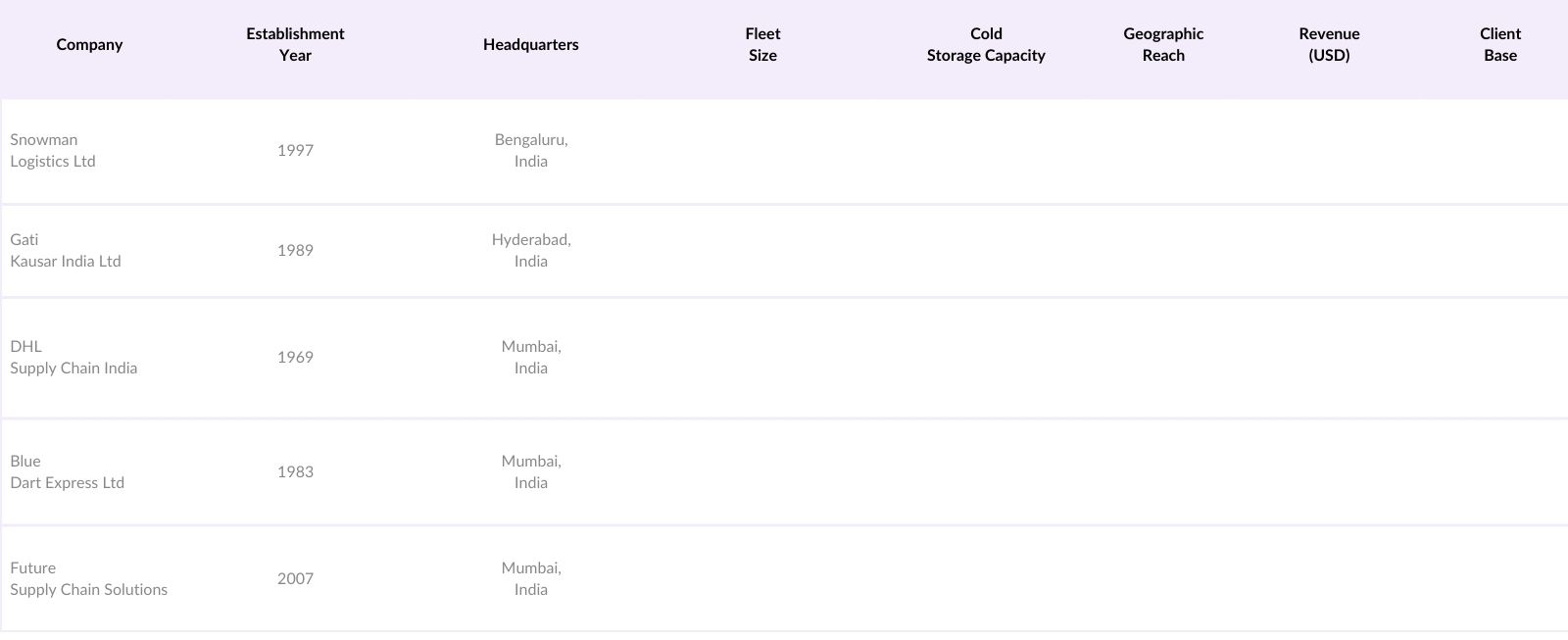

India Cold Chain Logistics Market Competitive Landscape

The India cold chain logistics market is dominated by both domestic and international players that have a strong foothold in the sector due to their infrastructure, service quality, and network reach. Companies like Snowman Logistics and Gati Kausar have a significant market presence, leveraging their nationwide network of cold storage facilities and refrigerated transport fleets. The landscape is further shaped by international companies like DHL and Blue Dart, which have expanded their cold chain offerings in India to meet the growing demand in pharmaceuticals and food industries.

India Cold Chain Logistics Industry Analysis

Growth Drivers

- Rising Demand in Food & Beverage: The demand for cold chain logistics in Indias food and beverage sector is rising, driven by growing consumption of perishable foods. India is currently the second-largest producer of fruits and vegetables, contributing over 297 million metric tons annually, requiring efficient cold storage. Additionally, organized retail is expanding, with India's retail market estimated to reach USD 1.75 trillion by 2025, necessitating robust cold chain systems. The Pradhan Mantri Kisan SAMPADA Yojana has allocated 6,000 crore for agri-infrastructure, including cold chains to reduce post-harvest losses. Source:

- Growth in Pharmaceutical Sector: The pharmaceutical sectors need for temperature-controlled logistics is growing rapidly due to the demand for temperature-sensitive drugs and vaccines. India produces over 60% of the worlds vaccines, with nearly 3 billion doses of COVID-19 vaccines distributed, emphasizing the need for efficient cold chain logistics. The Indian government has also invested heavily in healthcare infrastructure under schemes like the National Health Mission, allocating 37,800 crore to ensure the integrity of pharmaceutical cold chains in 2022-2025.

- Government Initiatives: The Indian government has prioritized cold chain infrastructure development under the Pradhan Mantri Kisan SAMPADA Yojana, granting subsidies for cold storage units. The scheme has created over 290 cold chain projects, reducing post-harvest losses in agriculture. Furthermore, the government announced 2,000 crore in subsidies for the cold storage industry, incentivizing private sector involvement and further enhancing Indias cold chain capabilities. These initiatives are expected to expand cold chain facilities across rural and urban regions. Source: Ministry of Food Processing Industries.

Market Challenges

- High Energy Costs: Maintaining refrigeration in cold chain logistics is energy-intensive, with electricity costs constituting up to 30% of operational expenses. Indias electricity consumption for cold chain logistics is estimated at 90 billion kWh annually, according to the Ministry of Power. Rising fuel pricespetrol averaging 103 per liter in 2023further strain costs, particularly for refrigerated transport. This high energy demand makes cold chain logistics expensive, posing a significant challenge to market growth.

- Lack of Integrated Networks: Indias cold chain logistics infrastructure suffers from fragmented and inconsistent networks, especially in rural regions. With only 10,000 refrigerated trucks currently operational, rural-urban connectivity remains underdeveloped, limiting efficient distribution. Rural areas, where a large portion of Indias perishable goods are produced, are connected by inadequate infrastructure, increasing spoilage. The lack of seamless cold chain links hinders the industrys ability to scale and meet growing demand.

India Cold Chain Logistics Market Future Outlook

Over the next five years, the India cold chain logistics market is expected to experience substantial growth driven by increasing demand for perishable food products, expansion in the pharmaceutical industry, and continued government investment in cold chain infrastructure. As consumer preferences shift towards processed and packaged foods, and with the rising focus on healthcare logistics for vaccines and temperature-sensitive medicines, the market's growth potential is strong. Technological innovations like blockchain, IoT, and automation are also set to play a crucial role in the future evolution of the cold chain logistics sector.

Market Opportunities

- Expansion in Tier 2 and Tier 3 Cities: Tier 2 and Tier 3 cities are emerging as unexplored demand centers for cold chain logistics. These cities, with populations between 1 and 3 million, are experiencing rapid growth in retail hubs, driving demand for cold storage and transport. In 2024, the government launched initiatives to develop cold storage facilities in smaller cities with subsidies totaling 2,500 crore. This expansion is supported by growing disposable incomes and increased organized retail penetration in these regions.

- Technological Advancements: Technological innovations such as the Internet of Things (IoT) and automated warehouses are revolutionizing cold chain logistics. IoT-enabled sensors for temperature monitoring and real-time tracking have improved efficiency and reduced spoilage, particularly for pharmaceuticals and perishable foods. Automated warehouses, such as those developed in the National Capital Region (NCR), are reducing manual labor costs and improving operational efficiency. These advancements have gained traction due to investments exceeding 5,000 crore in cold chain technologies.

Scope of the Report

Products

Key Target Audience

Food and Beverage Companies

Pharmaceutical Companies

Chemical Manufacturers

Cold Chain Infrastructure Providers

Third-Party Logistics (3PL) Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Agriculture & Farmers Welfare)

Technology Providers (IoT, Blockchain Solutions)

Companies

Major Players in the India Cold Chain Logistics Market

Snowman Logistics Ltd

Gati Kausar India Ltd

DHL Supply Chain India

Blue Dart Express Ltd

Future Supply Chain Solutions

TCI Cold Chain Solutions

Stellar Value Chain Solutions Pvt Ltd

Coldman Logistics Pvt Ltd

Schedulers Logistics India Pvt Ltd

Crystal Logistic Cool Chain Ltd

Kelvin Cold Chain Logistics Pvt Ltd

Mahindra Logistics Ltd

Allcargo Logistics Ltd

LEAP India Pvt Ltd

Agarwal Packers and Movers Ltd

Table of Contents

1. India Cold Chain Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Key demand centers, regions with high temperature sensitivity, population growth)

1.4. Market Segmentation Overview (Cold storage, transportation, end-use sectors)

2. India Cold Chain Logistics Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (YoY growth driven by agricultural export, pharmaceutical demand)

2.3. Key Market Developments and Milestones (Government initiatives, technological adoptions, capacity expansion)

3. India Cold Chain Logistics Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in Food & Beverage (Perishable food consumption, organized retail growth)

3.1.2. Growth in Pharmaceutical Sector (Temperature-sensitive drug storage, vaccine distribution)

3.1.3. Government Initiatives (Grants, subsidy programs under Pradhan Mantri Kisan SAMPADA Yojana)

3.1.4. Infrastructure Development (New cold storage facilities, refrigerated transport capacity)

3.2. Market Challenges

3.2.1. High Energy Costs (Cost of maintaining refrigeration and associated fuel costs)

3.2.2. Lack of Integrated Networks (Inconsistent cold chain links, rural-urban connectivity)

3.2.3. Inefficient Logistics Infrastructure (Poor road conditions, fragmented service providers)

3.3. Opportunities

3.3.1. Expansion in Tier 2 and Tier 3 Cities (Unexplored demand centers, growing retail hubs)

3.3.2. Technological Advancements (Adoption of IoT in fleet management, automated warehouses)

3.3.3. Private Sector Investments (Entry of global players, increased FDI)

3.4. Trends

3.4.1. Integration with Digital Platforms (Real-time tracking, blockchain-enabled transparency)

3.4.2. Growth in Third-Party Logistics (Rise of 3PLs, shared warehousing)

3.4.3. Sustainability Initiatives (Green logistics, energy-efficient refrigeration systems)

3.5. Government Regulations

3.5.1. Cold Chain Development Schemes (Subsidies for cold storage, development of rural infrastructure)

3.5.2. FDI Policies in Logistics (Relaxation in foreign investments, public-private partnerships)

3.5.3. Compliance with Food Safety Standards (FSSAI regulations, pharmaceutical cold chain guidelines)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, service providers, end users, regulators)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Cold Chain Logistics Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Cold Storage (Warehousing, Inventory management)

4.1.2. Cold Transportation (Refrigerated trucks, Reefer containers)

4.2. By Temperature Range (In Value %)

4.2.1. Chilled (0C to 5C)

4.2.2. Frozen (-18C and below)

4.3. By End-Use Industry (In Value %)

4.3.1. Food & Beverages (Dairy, Meat, Seafood, Fruits & Vegetables)

4.3.2. Pharmaceuticals (Vaccines, Biologics, Insulin)

4.3.3. Chemicals (Specialty chemicals, Industrial raw materials)

4.4. By Ownership (In Value %)

4.4.1. Private Sector

4.4.2. Public Sector

4.4.3. 3PL (Third-Party Logistics)

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Cold Chain Logistics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Snowman Logistics Ltd

5.1.2. Gati Kausar India Ltd

5.1.3. Allcargo Logistics Ltd

5.1.4. DHL Supply Chain India

5.1.5. Blue Dart Express Ltd

5.1.6. Mahindra Logistics Ltd

5.1.7. TCI Cold Chain Solutions

5.1.8. Future Supply Chain Solutions

5.1.9. Coldman Logistics Pvt Ltd

5.1.10. Stellar Value Chain Solutions Pvt Ltd

5.1.11. Schedulers Logistics India Pvt Ltd

5.1.12. Crystal Logistic Cool Chain Ltd

5.1.13. Kelvin Cold Chain Logistics Pvt Ltd

5.1.14. Agarwal Packers and Movers Ltd

5.1.15. LEAP India Pvt Ltd

5.2. Cross Comparison Parameters (Fleet Size, Cold Storage Capacity, Geographic Reach, Employee Strength, Revenue, Client Industries, Partnerships, Technology Adoption)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Cold Chain Logistics Market Regulatory Framework

6.1. Food Safety and Standards Authority of India (FSSAI) Regulations

6.2. Compliance with Goods and Services Tax (GST) Laws

6.3. Infrastructure and Cold Chain Development Schemes

7. India Cold Chain Logistics Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Pharma growth, Rising disposable income, Export opportunities)

8. India Cold Chain Logistics Future Market Segmentation

8.1. By Service Type

8.2. By Temperature Range

8.3. By End-Use Industry

8.4. By Ownership

8.5. By Region

9. India Cold Chain Logistics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase of research focuses on mapping the cold chain logistics ecosystem in India, identifying key stakeholders, including cold storage operators, logistics providers, and end-use industries. Desk research is supplemented by proprietary databases to ensure comprehensive coverage of the markets key influencing factors.

Step 2: Market Analysis and Construction

In this stage, historical data from the India cold chain logistics market is analyzed, covering the penetration rate of cold storage and transport services. We assess the ratio of cold storage facilities to service providers and the subsequent impact on revenue generation across the market.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through extensive consultations with industry experts, using structured interviews to collect operational and financial insights. This step refines the market understanding by incorporating on-ground realities of the cold chain sector.

Step 4: Research Synthesis and Final Output

The final phase synthesizes research outputs through engagement with cold chain operators and technology providers to gather granular details on service performance and adoption trends. The combination of bottom-up and top-down approaches ensures data accuracy and reliability.

Frequently Asked Questions

01. How big is the India Cold Chain Logistics Market?

The India cold chain logistics market is valued at USD 14.49 billion, driven by the demand for temperature-controlled logistics in industries like food & beverages and pharmaceuticals.

02. What are the challenges in the India Cold Chain Logistics Market?

Key challenges in India cold chain logistics market include high energy costs, lack of integrated networks, and inconsistent rural-to-urban cold chain connectivity, which hinders the efficient transportation of temperature-sensitive goods.

03. Who are the major players in the India Cold Chain Logistics Market?

Major players in India cold chain logistics market include Snowman Logistics, Gati Kausar, DHL Supply Chain, Blue Dart Express, and Future Supply Chain Solutions. These companies dominate due to their extensive cold storage infrastructure and technological capabilities.

04. What are the growth drivers of the India Cold Chain Logistics Market?

The India cold chain logistics market is driven by the rising demand for perishable food products, increased pharmaceutical cold storage needs, and government support for infrastructure development.

05. What technologies are impacting the India Cold Chain Logistics Market?

Technological innovations such as IoT-enabled tracking systems, blockchain for transparency, and automated warehouses are playing a significant role in enhancing operational efficiency in the cold chain logistics sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.