India Combine Harvester Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2489

November 2024

89

About the Report

India Combine Harvester Market Overview

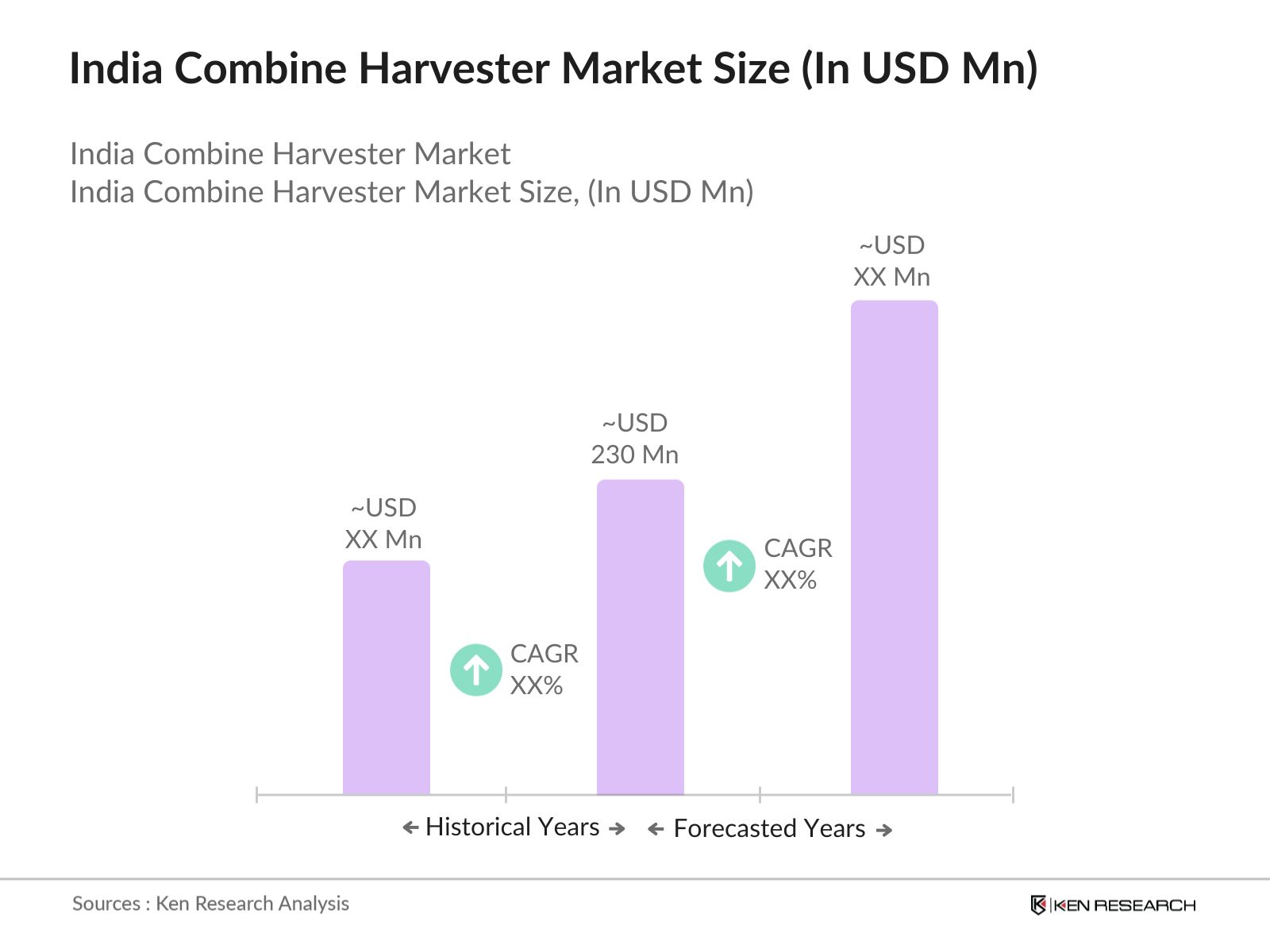

- The India Combine Harvester Market is valued at USD 230 million, supported by a five-year historical trend highlighting growth due to increased mechanization in agriculture and government incentives. The adoption of harvesters is primarily driven by rising labor costs and the growing demand for efficient harvesting processes, especially during peak crop seasons. The government's subsidized programs, including schemes like the Sub-Mission on Agricultural Mechanization (SMAM), further encourage farmers to invest in these machines.

- Key regions dominating the combine harvester market in India include Punjab, Haryana, and Uttar Pradesh. These states lead due to the extensive cultivation of rice and wheat, coupled with supportive agricultural policies. The regions substantial investments in mechanized equipment enhance crop productivity and encourage the adoption of modern harvesting technologies, securing their dominance in the market.

- MSP assurances provided by the government for staple crops encourage farmers to invest in productivity-enhancing equipment like combine harvesters. MSP for wheat, as an example, increased to INR 2,125 per quintal in 2024, securing farmer incomes and justifying mechanization investments.

India Combine Harvester Market Segmentation

India's combine harvester market is segmented by product type and by crop type.

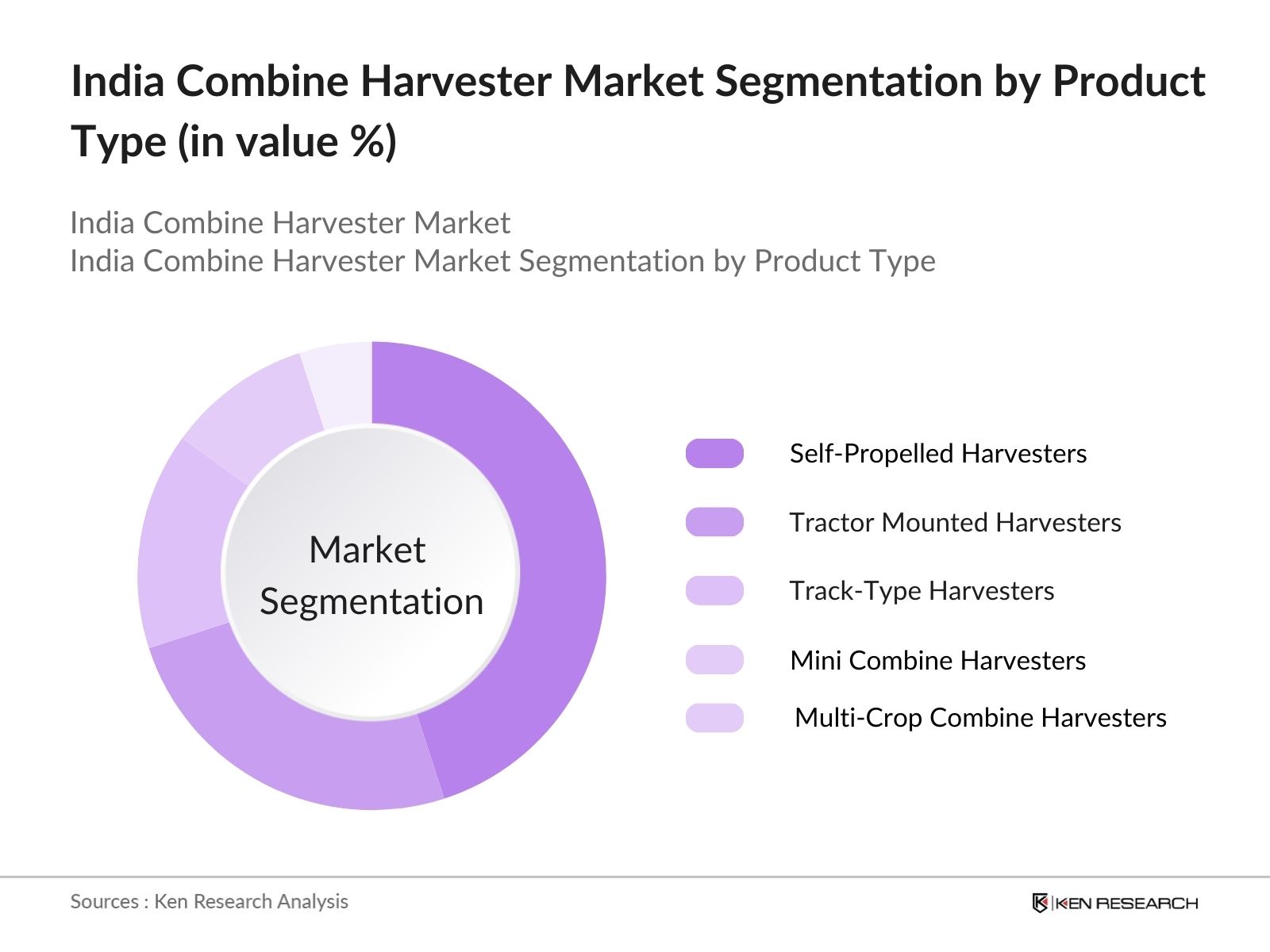

- By Product Type: India's combine harvester market is segmented by product type into self-propelled harvesters, tractor-mounted harvesters, track-type harvesters, mini combine harvesters, and multi-crop combine harvesters. Self-propelled harvesters hold the dominant market share in India, owing to their adaptability across different terrains and suitability for large-scale farms. These machines offer higher efficiency, reducing both time and labor costs, making them ideal for major agricultural regions.

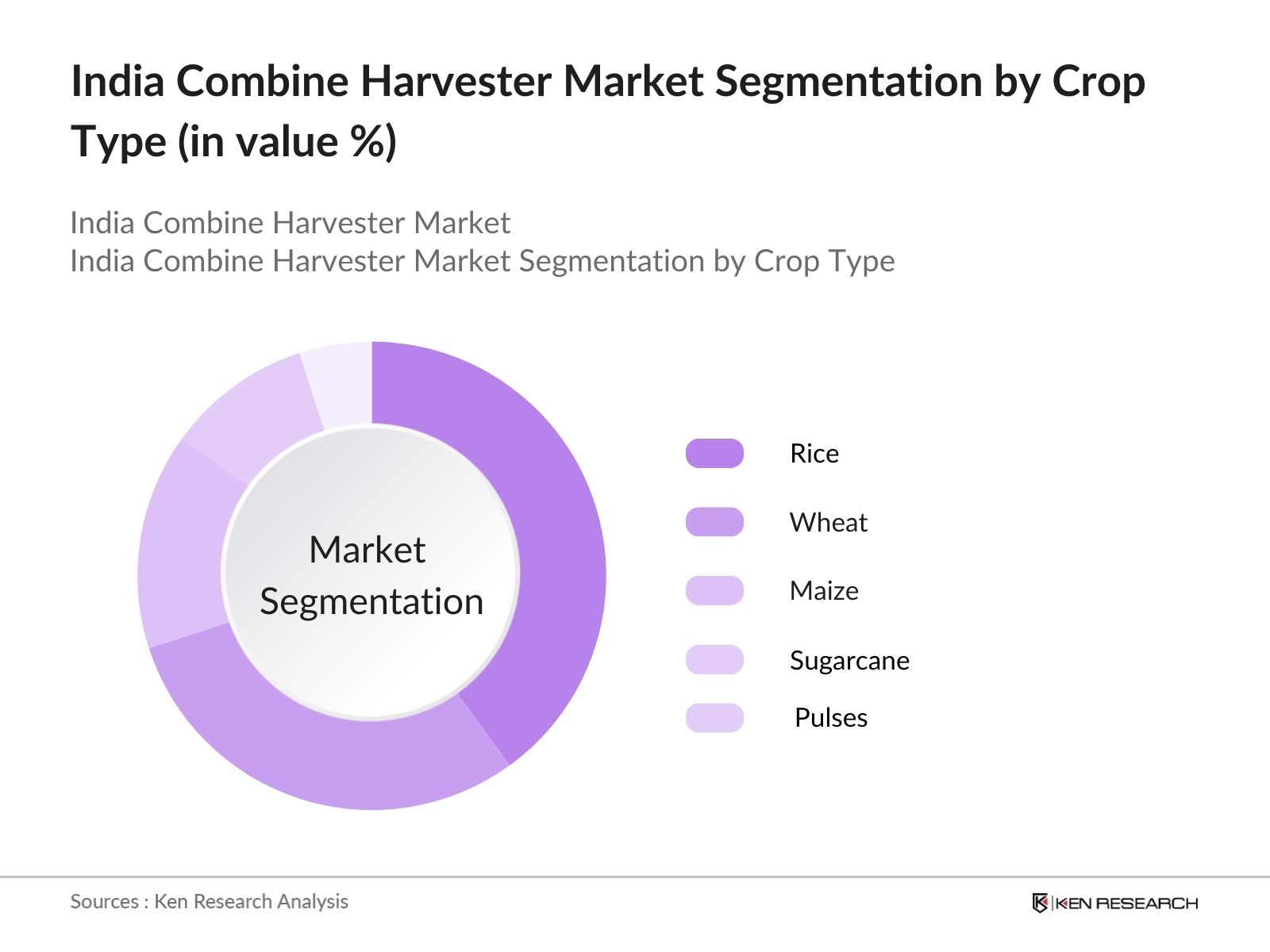

- By Crop Type: India's combine harvester market is also segmented by crop type, including rice, wheat, maize, sugarcane, and pulses. Rice harvesters dominate the market as rice is one of the staple crops in India. The rice sector benefits from specialized equipment and government support in states like Punjab and Haryana, which have optimized their harvesting systems to handle larger outputs with minimal grain losses.

India Combine Harvester Market Competitive Landscape

The India Combine Harvester Market is primarily led by major players such as Mahindra & Mahindra Ltd., John Deere India Pvt. Ltd., and TAFE. These companies leverage their extensive dealer networks and after-sales services to maintain a strong market position. Local players like Preet Tractors and Sonalika contribute by catering to region-specific demands, particularly in smaller farm segments.

India Combine Harvester Market Analysis

Growth Drivers

- Agricultural Mechanization Initiatives: Indias agricultural mechanization rate has increased due to concerted government efforts. Mechanization in agriculture rose from 40% in 2022 to 47% in 2024, aiming to reach over 60% by 2025 as per Ministry of Agriculture estimates. These initiatives include dedicated programs under the Sub-Mission on Agricultural Mechanization (SMAM), focusing on accessible technologies for small and marginal farmers. Data from the Indian Council of Agricultural Research shows mechanization advancements in states like Punjab and Haryana, with 75% mechanization, signaling high adoption in major crop-producing regions.

- Government Subsidies (State-Specific Programs): Many state governments in India, like Punjab, Uttar Pradesh, and Maharashtra, offer subsidies covering up to 50% of combine harvester acquisition costs. SMAM allocates around INR 1,000 crores annually to support mechanization equipment subsidies. This financial support increases affordability for farmers, with 200,000 harvesters deployed nationwide by the end of 2023, as recorded by the Ministry of Agriculture. Government data shows such subsidy programs contributing to a 15% increase in equipment acquisition since 2022.

- Rising Labor Costs: The rural labor shortage and wage inflation make mechanized harvesting a more viable option. According to the Ministry of Labor and Employment, average rural wages rose from INR 380 in 2022 to INR 420 per day in 2024. This wage inflation has driven small and medium-scale farmers to shift towards mechanization, including combine harvesters, to mitigate dependency on manual labor.

Market Challenges

- High Cost of Acquisition: Combine harvesters have an average acquisition cost upwards of INR 10 lakhs, making them challenging for smallholder farmers to afford. Government reports suggest only 20% of farmers in rural areas can independently afford such machinery without subsidies. This high initial cost limits market penetration, particularly in eastern regions where mechanization rates are still below 30%. Source.

- Seasonal Demand Variability: Combine harvester demand peaks during harvesting seasons, leading to underutilization in other periods. For instance, wheat and rice harvest cycles occur during specific months, accounting for only 3-4 months of machinery use annually. The Agricultural Ministrys statistics highlight that over 70% of harvesting equipment is idle outside these peak times, impacting equipment ROI and market growth.

India Combine Harvester Market Future Outlook

The India Combine Harvester Market is projected to experience steady growth driven by the increasing focus on agricultural mechanization. Government policies encouraging the adoption of advanced machinery and expanding subsidies under programs like SMAM will play a significant role. Additionally, rising labor costs and the need to improve agricultural productivity will bolster the market, while innovations in energy-efficient harvesters are anticipated to enhance adoption further.

Market Opportunities

- Growth in Small-Scale Farming Mechanization: Government programs are increasingly targeting small-scale farmers, making affordable mechanization options accessible. Recent reports show that 60% of new subsidies under SMAM were directed towards small and marginal farmers in 2023, facilitating a 20% rise in harvester acquisitions.

- Partnerships for Rural Financing Solutions: Financial institutions in India have introduced low-interest loans specifically for agricultural machinery. NABARD data reveals that in 2023, INR 2,500 crore was allocated toward rural mechanization financing, benefiting over 50,000 small farmers with easier access to combine harvesters.

Scope of the Report

|

Self-Propelled Harvesters Tractor Mounted Harvesters Track-Type Harvesters Mini Combine Harvesters Multi-Crop Combine Harvesters |

|

|

By Crop Type |

Rice Wheat Maize Sugarcane Pulses |

|

By Power Source |

Diesel Electric Hybrid |

|

By Mode of Sales |

Direct Sales Indirect Sales Custom Hiring |

|

By Region |

North East West South |

Products

Key Target Audience

Farm Equipment Manufacturers

Agricultural Cooperatives

Large-Scale Farming Enterprises

Regional Agricultural Departments (e.g., Punjab Agriculture Department)

Government and Regulatory Bodies (e.g., Ministry of Agriculture and Farmers Welfare)

Agricultural Financing Institutions

Investments and Venture Capitalist Firms

Agricultural Supply Chain Distributors

Companies

Players Mention in the Report:

Mahindra & Mahindra Ltd.

John Deere India Pvt. Ltd.

TAFE (Tractors and Farm Equipment)

Preet Tractors Pvt. Ltd.

Sonalika International Tractors

Kubota Agricultural Machinery India Pvt. Ltd.

Claas India Private Limited

New Holland Agriculture

Indo Farm Equipment Limited

Shaktiman Agritech India Pvt. Ltd.

VST Tillers Tractors Ltd.

Kartar Agro Industries Private Limited

Yanmar India Pvt. Ltd.

Escorts Limited

Greaves Cotton Limited

Table of Contents

1. India Combine Harvester Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Combine Harvester Market Size (In USD)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Combine Harvester Market Analysis

3.1 Growth Drivers

3.1.1 Agricultural Mechanization Initiatives

3.1.2 Government Subsidies (State-Specific Programs)

3.1.3 Rising Labor Costs

3.1.4 Increase in Crop Production

3.2 Market Challenges

3.2.1 High Cost of Acquisition

3.2.2 Seasonal Demand Variability

3.2.3 Lack of After-Sales Service Infrastructure

3.2.4 Fuel Price Volatility

3.3 Opportunities

3.3.1 Growth in Small-Scale Farming Mechanization

3.3.2 Partnerships for Rural Financing Solutions

3.3.3 Technological Advancements in Harvester Design

3.3.4 Custom Hiring Centers (CHCs) Expansion

3.4 Trends

3.4.1 Adoption of Precision Agriculture

3.4.2 Use of IoT and AI for Efficiency Tracking

3.4.3 Shift Towards Electric and Hybrid Harvesters

3.5 Government Regulations

3.5.1 Minimum Support Price (MSP) Influence

3.5.2 Mechanization Subsidies (PM-KUSUM, SMAM)

3.5.3 Import-Export Regulations for Agricultural Machinery

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India Combine Harvester Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Self-Propelled Harvesters

4.1.2 Tractor Mounted Harvesters

4.1.3 Track-Type Harvesters

4.1.4 Mini Combine Harvesters

4.1.5 Multi-Crop Combine Harvesters

4.2 By Crop Type (In Value %)

4.2.1 Rice

4.2.2 Wheat

4.2.3 Maize

4.2.4 Sugarcane

4.2.5 Pulses

4.3 By Power Source (In Value %)

4.3.1 Diesel

4.3.2 Electric

4.3.3 Hybrid

4.4 By Mode of Sales (In Value %)

4.4.1 Direct Sales

4.4.2 Indirect Sales

4.4.3 Custom Hiring

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Combine Harvester Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mahindra & Mahindra Ltd.

5.1.2 John Deere India Pvt. Ltd.

5.1.3 Tafe Motors and Tractors Limited

5.1.4 Claas India Private Limited

5.1.5 Preet Tractors Pvt. Ltd.

5.1.6 Kubota Agricultural Machinery India Pvt. Ltd.

5.1.7 New Holland Agriculture

5.1.8 Indo Farm Equipment Limited

5.1.9 Sonalika International Tractors Ltd.

5.1.10 Shaktiman Agritech India Pvt. Ltd.

5.1.11 VST Tillers Tractors Ltd.

5.1.12 Kartar Agro Industries Private Limited

5.1.13 Yanmar India Pvt. Ltd.

5.1.14 Greaves Cotton Limited

5.1.15 Escorts Limited

5.2 Cross Comparison Parameters (Market Share, Distribution Network, Technological Capabilities, Product Range, After-Sales Service Availability, Financial Performance, Operational Presence, Customer Satisfaction)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Combine Harvester Market Regulatory Framework

6.1 Agriculture Equipment Safety Standards

6.2 Regional Mechanization Policies

6.3 Subsidy and Financial Assistance Programs

6.4 Certification and Compliance Norms

7. India Combine Harvester Future Market Size (In USD)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Combine Harvester Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Crop Type (In Value %)

8.3 By Power Source (In Value %)

8.4 By Mode of Sales (In Value %)

8.5 By Region (In Value %)

9. India Combine Harvester Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves creating a comprehensive ecosystem map of key stakeholders in the India Combine Harvester Market. Extensive desk research is conducted, supported by reliable industry databases, to identify critical variables influencing market trends and dynamics.

Step 2: Market Analysis and Data Compilation

In this phase, historical data related to combine harvester adoption, market penetration by type, and crop-wise segmentation are compiled. Analysis also covers supply-demand dynamics, consumer preferences, and the economic implications of technological advancements in combine harvesters.

Step 3: Validation through Expert Consultation

Market hypotheses are refined through consultations with industry experts from leading companies in the sector. Insights gathered via interviews enhance the accuracy and reliability of data, especially concerning demand patterns and technology adoption rates.

Step 4: Final Research Synthesis

The final stage synthesizes all data gathered, validated, and analyzed. This comprehensive synthesis includes insights from primary research, with refined estimates based on a bottom-up approach, ensuring the India Combine Harvester Market analysis is thorough and robust.

Frequently Asked Questions

01. How big is the India Combine Harvester Market?

The India Combine Harvester Market is valued at USD 230 million, with growth driven by labor shortages, mechanization needs, and support from government subsidies.

02. What are the major challenges in the India Combine Harvester Market?

Challenges in India Combine Harvester Market include high acquisition costs, seasonality in demand, and limited access to after-sales services in rural areas, impacting the adoption rates among small and medium-scale farmers.

03. Who are the key players in the India Combine Harvester Market?

Key players in India Combine Harvester Market include Mahindra & Mahindra, John Deere India, TAFE, Preet Tractors, and Sonalika. These companies leverage extensive distribution networks and innovative products to maintain a competitive edge.

04. What drives the adoption of combine harvesters in India?

The India Combine Harvester Market is propelled by factors such as rising labor costs, the need for efficient harvesting solutions, and increasing government support in the form of subsidies and financial assistance programs.

05. How is government policy influencing the India Combine Harvester Market?

Policies under programs like the Sub-Mission on Agricultural Mechanization (SMAM) and state-level subsidies incentivize farmers to adopt mechanized equipment, supporting the market's expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.