India Communication Services Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD4494

November 2024

93

About the Report

India Communication Services Market Overview

- The India Communication Services Market, based on a five-year historical analysis, is valued at USD 23 billion. The market is driven primarily by the expanding 5G networks and rising internet penetration. The Digital India initiative has also played a crucial role in enhancing connectivity, especially in rural areas. Additionally, the increasing demand for OTT platforms and internet-based communication has spurred market growth, as more consumers shift toward digital communication services.

- Indias major cities, such as Mumbai, Delhi, and Bengaluru, dominate the market due to their developed telecom infrastructure, high internet usage, and consumer base. These cities have well-established fiber optic networks and host the headquarters of leading telecom service providers, making them hubs for technological advancements and high data consumption.

- The National Digital Communications Policy, introduced in 2018 and updated in 2022, outlines the Indian governments long-term vision for the telecom sector. By 2024, the policy's objectives have already seen progress, the policy aimed to establish1 million public Wi-Fi hotspotsin urban areas and2 million in rural areas. This policy has provided a clear roadmap for the development of communication services, aligning with the government's Digital India goals. Sources: Department of Telecommunications 2024.

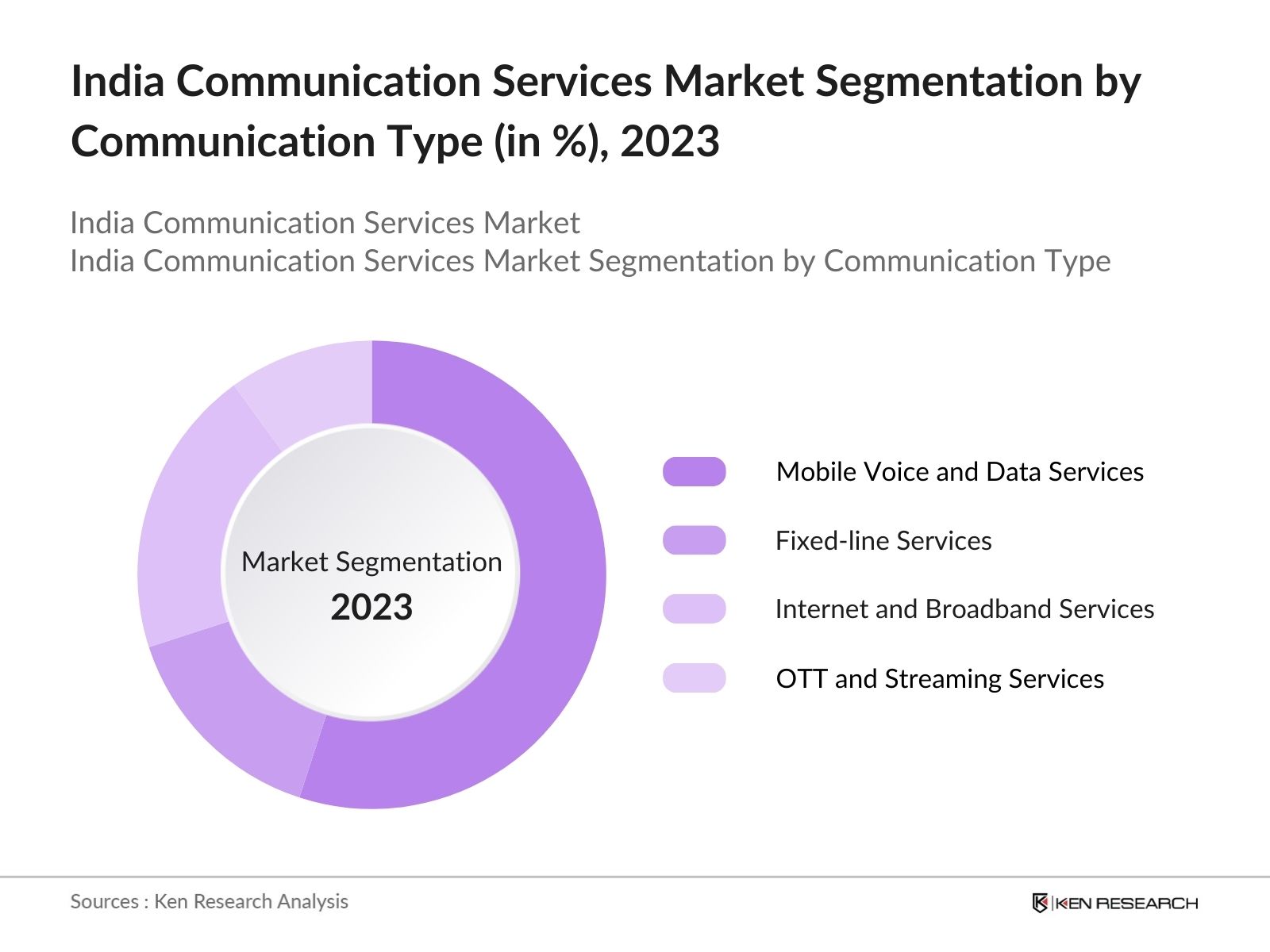

India Communication Services Market Segmentation

By Communication Type: The Market is segmented by communication type into mobile voice and data services, fixed-line services, internet and broadband services, and OTT and streaming services. Mobile voice and data services dominate the market under the communication type segmentation. The dominance is due to the high mobile penetration rate and the increasing shift towards 4G and 5G networks. The rapid expansion of mobile internet users, driven by affordable smartphone prices and competitive data tariffs, continues to fuel the demand for mobile services.

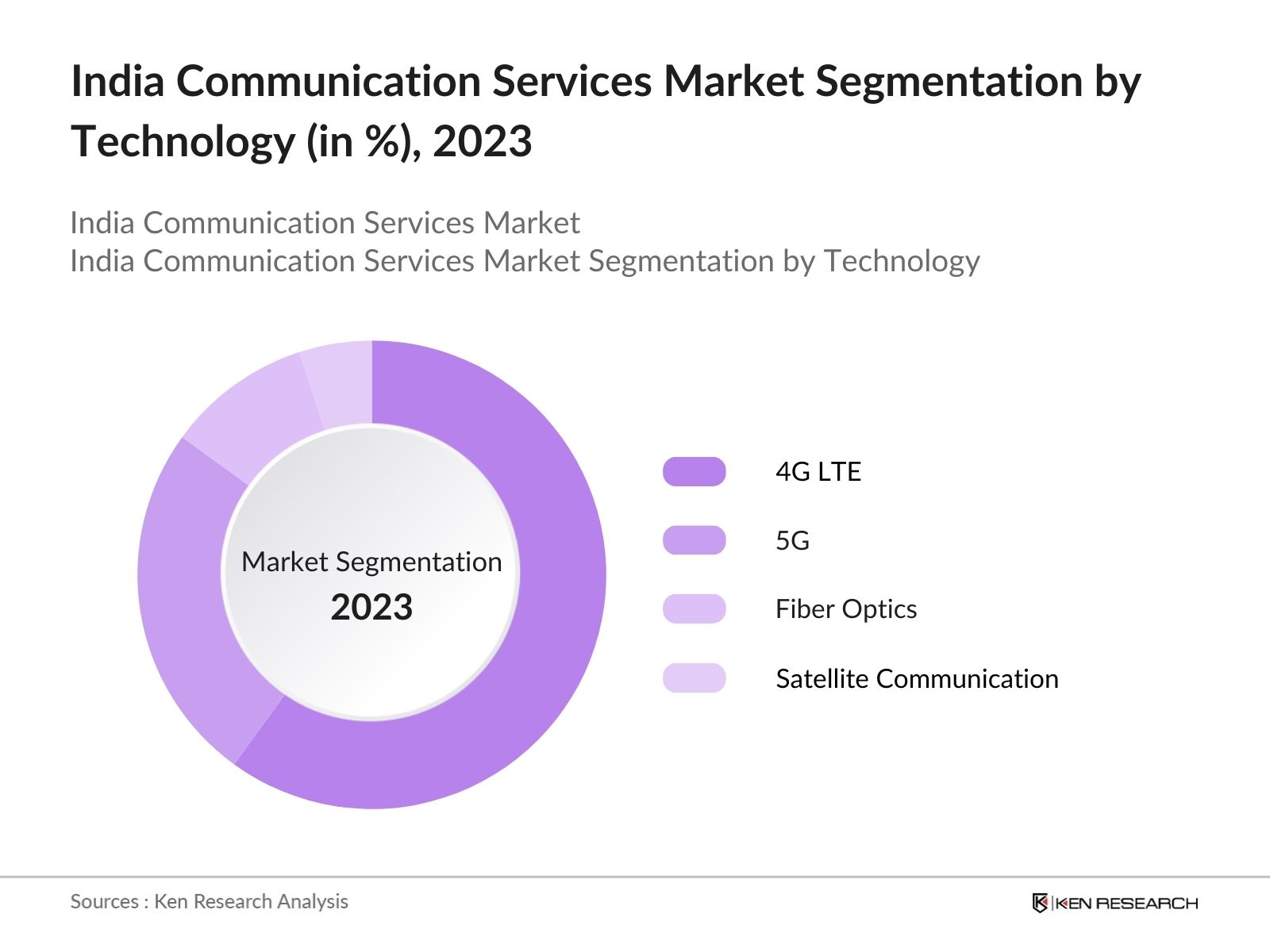

By Technology: The market is further segmented by technology into 4G LTE, 5G, fiber optics, and satellite communication. 4G LTE currently holds a dominant market share, given its widespread adoption across both urban and rural areas. However, with the increasing rollout of 5G networks, particularly in urban regions, 5G is expected to catch up rapidly. The growth of data-driven services like video streaming, IoT, and cloud applications also pushes for the continued dominance of advanced network technologies.

India Communication Services Market Competitive Landscape

India Communication Services Market Competitive Landscape

The India Communication Services Market is dominated by a mix of well-established national players and growing OTT service providers. These companies are focusing on expanding their 5G services and enhancing user experience through digital transformation and improved connectivity.

|

Company |

Establishment Year |

Headquarters |

Revenue (INR Bn) |

Subscribers (Million) |

ARPU (INR) |

5G Coverage |

OTT Platforms Offered |

Fiber Optic Network |

International Presence |

|

Bharti Airtel |

1995 |

New Delhi |

|||||||

|

Reliance Jio |

2007 |

Mumbai |

|||||||

|

Vodafone Idea |

2018 |

Mumbai |

|||||||

|

Bharat Sanchar Nigam Ltd (BSNL) |

2000 |

New Delhi |

|||||||

|

Tata Communications |

1986 |

Mumbai |

India Communication Services Industry Analysis

Growth Drivers

- Expansion of 5G Networks: India's communication services sector is undergoing a rapid transformation with the rollout of 5G networks. As of 2024, India has approximately 175 million 5G-enabled devices in operation, driving demand for faster connectivity. The government's push for 5G expansion, alongside investments by major telecom operators, is bolstered by the allocation of 1.5 trillion in the telecom sector for 5G infrastructure development between 2022 and 2025. This is expected to enhance internet speeds and improve the quality of communication services.

- Rising Internet Penetration: As of 2024, India's internet user base has grown to over 900 million users, driven by increasing mobile internet adoption and affordable data plans. Internet access in rural areas also saw a surge, contributing to the rise of communication services. Government programs, such as BharatNet, aimed at expanding broadband connectivity to rural regions, received 80,000 crore in funding between 2022 and 2025. This increase in internet penetration has directly boosted demand for communication services across the country.

- Digital India Initiatives: The Digital India program has played a role in boosting communication services by encouraging digital infrastructure development, promoting digital literacy, and supporting cashless transactions. Over 1.13 trillion has been allocated by the government between 2022 and 2024 to support digital initiatives, including the expansion of digital services in healthcare, education, and governance. This initiative has increased the use of mobile applications, boosting demand for communication platforms and technologies.

Market Challenges

- High Spectrum Costs: Spectrum costs remain a challenge for telecom operators in India. In the 2022 spectrum auction, the government raised over 1.5 trillion from telecom operators for the purchase of 5G airwaves. This high cost has strained the financials of many telecom companies, limiting their capacity to further invest in infrastructure development. Despite government efforts to ease the financial burden through deferred payments and tax reliefs, the cost of spectrum continues to challenge the sector's growth potential.

- Infrastructure Gaps in Rural Areas: Despite the government's efforts to expand digital connectivity, rural areas still face infrastructure deficits. As of 2024, nearly 30% of India's rural population lacks reliable internet access, affecting the penetration of communication services. The BharatNet initiative, although making progress, has faced delays due to logistical challenges and limited infrastructure in remote regions. This infrastructure gap has hindered the delivery of high-quality communication services to rural populations.

India Communication Services Market Future Outlook

Over the next five years, the India Communication Services Market is expected to witness growth, driven by continued expansion of 5G networks, government initiatives like Digital India, and increasing demand for broadband services, especially in rural areas. The surge in data consumption due to rising smartphone penetration and the growing OTT sector will further bolster the market.

Future Market Opportunities

- Growing Demand for OTT Platforms: As of 2024, India boasts over 500 million active OTT (Over-The-Top) platform users, driven by increasing internet penetration and smartphone usage. Platforms such as Netflix, Amazon Prime, and Disney+ Hotstar have become integral to India's entertainment landscape. The shift towards digital consumption offers a opportunity for telecom operators to capitalize on data-driven services. The growing demand for OTT platforms has also led to a 35% increase in data consumption in urban centers. Sources: Ministry of Information & Broadcasting 2024.

- Emergence of 6G Development Plans: India is already preparing for the next wave of communication technology with the development of 6G networks. The government announced plans in 2024 to allocate 1000 crore towards research and development for 6G technology. Although 6G is still in its infancy, India's efforts to stay ahead in the global race for technology innovation present immense opportunities for telecom companies to invest in next-generation communication infrastructure. Sources: Ministry of Communications 2024.

Scope of the Report

|

By Communication Type |

Mobile Voice and Data Services Fixed-line Services Internet and Broadband Services OTT and Streaming Services |

|

By Service Provider Type |

Telecommunication Companies ISPs, OTT Providers Satellite Communication Providers |

|

By Technology |

4G LTE 5G Fiber Optics Satellite Communication |

|

By Consumer Type |

Residential Enterprise Government |

|

By Region |

North South West East |

Products

Key Target Audience

Telecom Operators

Internet Service Providers (ISPs)

OTT Service Providers

Government and Regulatory Bodies (TRAI, Department of Telecommunications)

Investor and Venture Capitalist Firms

Satellite Communication Providers

Fiber Optic Infrastructure Developers

Smartphone Manufacturers

Companies

Major Players

Bharti Airtel

Reliance Jio

Vodafone Idea

Bharat Sanchar Nigam Ltd (BSNL)

Tata Communications

ACT Fibernet

Hathway Cable and Datacom

Tata Sky Broadband

Tikona Infinet Limited

Spectra ISP

You Broadband India Limited

Den Networks

Sun Direct

MX Player (OTT)

ZEE5 (OTT)

Table of Contents

India Communication Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (ARPU, penetration rate)

1.4. Market Segmentation Overview

India Communication Services Market Size (In INR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (5G rollout, OTT services)

India Communication Services Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of 5G Networks

3.1.2. Rising Internet Penetration

3.1.3. Increasing Smartphone Usage

3.1.4. Digital India Initiatives

3.2. Market Challenges

3.2.1. High Spectrum Costs

3.2.2. Regulatory Hurdles

3.2.3. Infrastructure Gaps in Rural Areas

3.3. Opportunities

3.3.1. Growing Demand for OTT Platforms

3.3.2. Telecom-Technology Integration (IoT, AI)

3.3.3. Emergence of 6G Development Plans

3.4. Trends

3.4.1. Shift Toward Cloud-based Communication Services

3.4.2. Increasing Adoption of VoIP Services

3.4.3. Growing Emphasis on Cybersecurity in Communication Services

3.5. Government Regulation

3.5.1. TRAIs Regulatory Framework

3.5.2. Spectrum Auction Policies

3.5.3. National Digital Communications Policy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Telecom operators, ISPs, OTT providers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

India Communication Services Market Segmentation

4.1. By Communication Type (In Value %)

4.1.1. Mobile Voice and Data Services

4.1.2. Fixed-line Services

4.1.3. Internet and Broadband Services

4.1.4. OTT and Streaming Services

4.2. By Service Provider Type (In Value %)

4.2.1. Telecommunication Companies

4.2.2. Internet Service Providers (ISPs)

4.2.3. OTT Providers

4.2.4. Satellite Communication Providers

4.3. By Technology (In Value %)

4.3.1. 4G LTE

4.3.2. 5G

4.3.3. Fiber Optics

4.3.4. Satellite Communication

4.4. By Consumer Type (In Value %)

4.4.1. Residential

4.4.2. Enterprise

4.4.3. Government

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

India Communication Services Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Bharti Airtel

5.1.2. Reliance Jio

5.1.3. Vodafone Idea

5.1.4. Bharat Sanchar Nigam Limited (BSNL)

5.1.5. Tata Communications

5.1.6. ACT Fibernet

5.1.7. Hathway Cable and Datacom

5.1.8. Tata Sky Broadband

5.1.9. Tikona Infinet Limited

5.1.10. Spectra ISP

5.1.11. You Broadband India Limited

5.1.12. Den Networks

5.1.13. Sun Direct

5.1.14. MX Player (OTT)

5.1.15. ZEE5

5.2. Cross Comparison Parameters (ARPU, Subscriber Base, Network Coverage, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Communication Services Market Regulatory Framework

6.1. Licensing Requirements

6.2. Spectrum Allocation and Pricing

6.3. Compliance with TRAI Guidelines

6.4. Environmental and Health Regulations (EMF Exposure)

India Communication Services Future Market Size (In INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Communication Services Future Market Segmentation

8.1. By Communication Type (In Value %)

8.2. By Service Provider Type (In Value %)

8.3. By Technology (In Value %)

8.4. By Consumer Type (In Value %)

8.5. By Region (In Value %)

India Communication Services Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategies

9.3. Customer Cohort Analysis

9.4. Growth Opportunities in 5G and OTT Sectors

Research Methodology

Step 1: Identification of Key Variables

In this phase, we mapped out the communication services ecosystem in India, identifying key stakeholders including telecom operators, ISPs, and OTT service providers. Secondary research was used to gather data from government reports, industry publications, and telecom databases.

Step 2: Market Analysis and Construction

Historical data from the India Communication Services Market was analyzed, focusing on market penetration and revenue generation by key players. The evaluation involved assessing network quality, consumer demand, and service reliability.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews with telecom industry professionals, including network engineers and strategic planners, hypotheses were validated. This consultation provided operational insights, which were incorporated into the market data.

Step 4: Research Synthesis and Final Output

Finally, insights from primary and secondary research were synthesized to generate a detailed report. Feedback from telecom service providers on consumer demand and emerging technologies was critical in shaping the final market outlook.

Frequently Asked Questions

01 How big is the India Communication Services Market?

The India Communication Services Market is valued at USD 23 billion, with contributions from expanding 5G networks and rising OTT platform usage.

02 What are the key challenges in the India Communication Services Market?

Key challenges in the India Communication Services Market include high spectrum costs, limited infrastructure in rural areas, and regulatory hurdles that affect the smooth rollout of advanced communication technologies.

03 Who are the major players in the India Communication Services Market?

Key players in the India Communication Services Market include Bharti Airtel, Reliance Jio, Vodafone Idea, BSNL, and Tata Communications. These companies lead the market due to their extensive network coverage and strong consumer base.

04 What are the growth drivers for the India Communication Services Market?

Growth in the India Communication Services Market is driven by increasing smartphone penetration, rising internet users, and government initiatives aimed at expanding digital infrastructure across rural and urban India.

05 What are the market segments in the India Communication Services Market?

The India Communication Services Market is segmented by communication type, such as mobile voice and data services, and technology type, such as 4G LTE and 5G services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.