India Connected Car Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD462

July 2024

85

About the Report

India Connected Car Market Overview

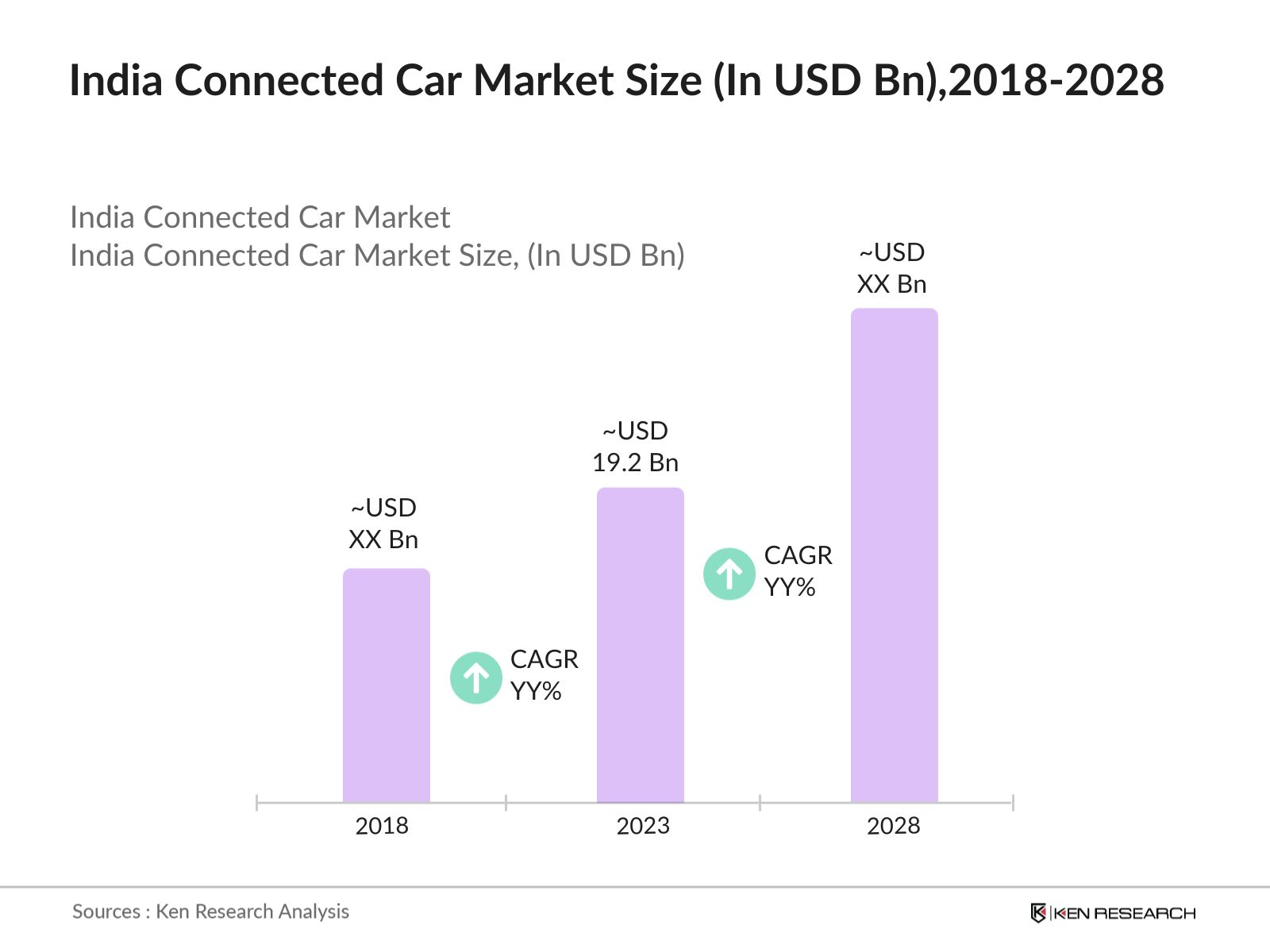

- The India Connected Car Market was valued at 19.2 billion in 2023. This growth is affected by increasing consumer demand for enhanced in-car connectivity, the advent of advanced driver assistance systems (ADAS), and the rising adoption of electric vehicles (EVs) government initiatives promoting digital infrastructure and smart city projects have further fueled market expansion.

- The connected car market in India is dominated by several key players, including Tata Motors, Mahindra & Mahindra, Maruti Suzuki, Hyundai Motors, and Mercedes-Benz India. These companies have been instrumental in driving technological advancements and innovations in the connected car segment, offering features such as telematics, in-car entertainment, and advanced navigation systems.

- In 2023, Tata Motors launched its new range of connected electric vehicles equipped with the ZConnect technology, offering over 35 advanced features including remote control, vehicle diagnostics, and real-time traffic updates. This move aligns with the company's vision to lead the Indian market in connected and sustainable mobility solutions.

India Connected Car Market Analysis

- The Indian government has committed substantial investments towards developing the country's digital infrastructure. In the 2024 budget, the government allocated USD 68.5 Bn to enhance digital connectivity and smart city initiatives. These investments are crucial for the proliferation of connected car technologies, as they provide the necessary infrastructure for seamless connectivity, real-time data transmission, and advanced vehicle-to-everything (V2X) communication systems.

- The Indian automotive industry has been experiencing growth in vehicle production and sales. In 2024, vehicle production in India is over 23 million units, driven by the rising demand for personal and commercial vehicles. This increase in vehicle production and sales is propelling the adoption of connected car technologies as manufacturers integrate advanced telematics and infotainment systems to meet consumer preferences and enhance vehicle safety and convenience.

- Maharashtra, particularly the city of Pune known as the automotive hub of India, Pune is home to several leading automobile manufacturers and technology providers. In 2023, Pune hold the largest market share in India. The region's well-established automotive infrastructure, skilled workforce, and favorable government policies have contributed to its dominance in the connected car market.

India Connected Car Market Segmentation

The India connected car market is segmented by various factors such as product, connectivity solutions and region.

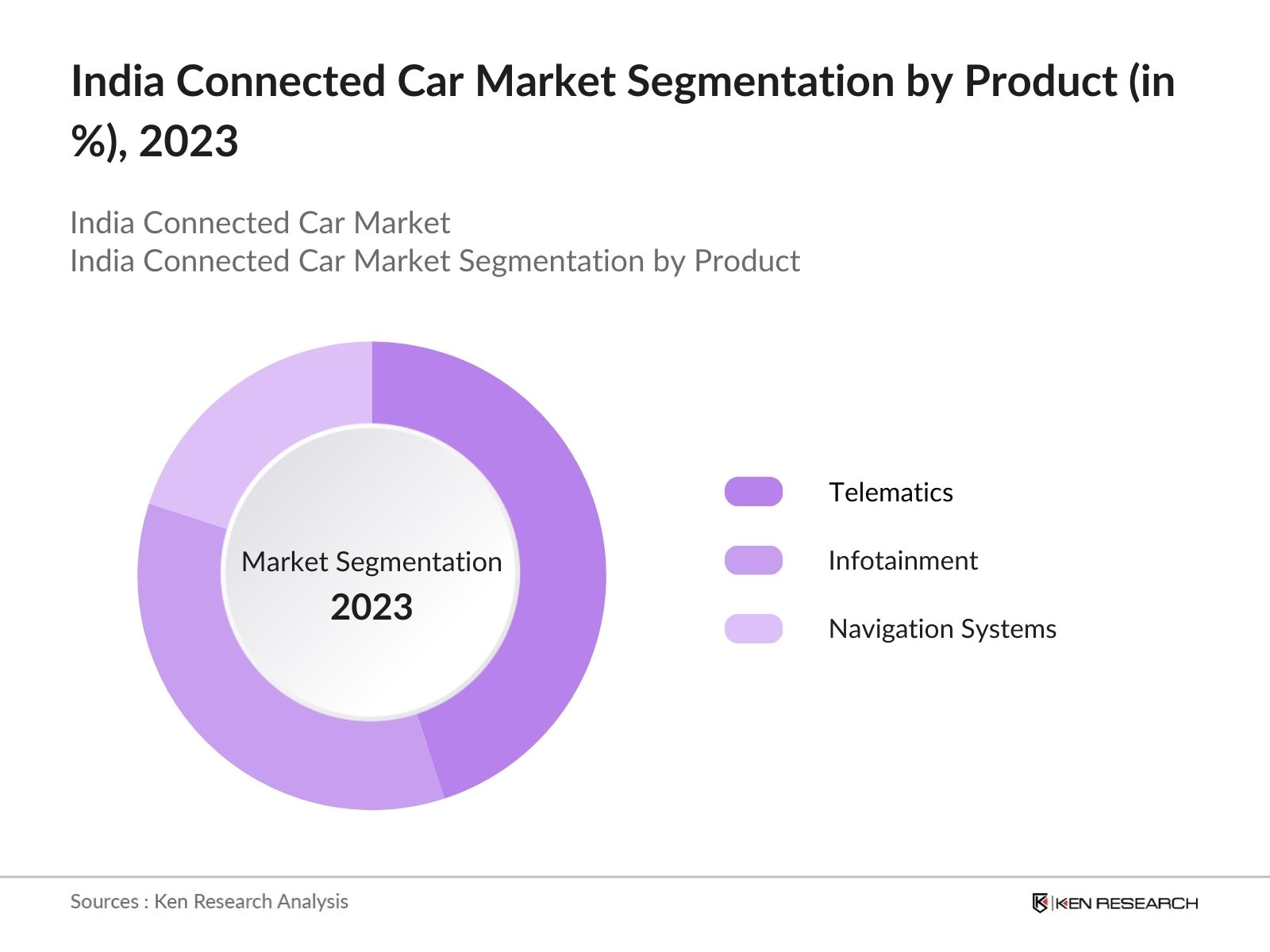

By Product: The India connected car market is segmented by product type into Telematics, Infotainment, and Navigation Systems. In 2023, Telematics held a dominant market share due to its critical role in enhancing vehicle safety and efficiency. The integration of telematics in commercial and passenger vehicles for real-time tracking, diagnostics, and emergency assistance has driven its widespread adoption.

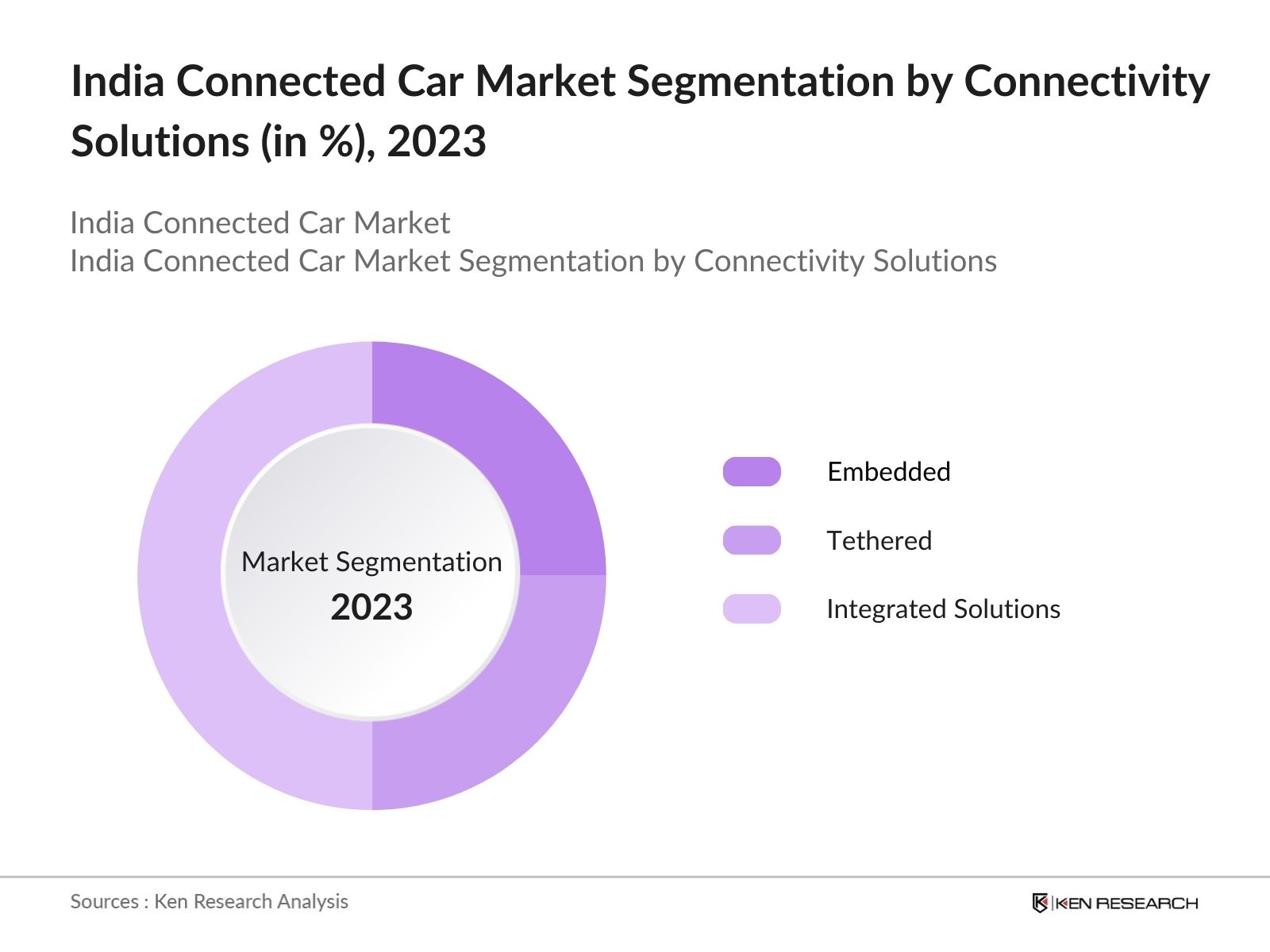

By Connectivity Soultions: The market is segmented by connectivity solution into Embedded, Tethered, and Integrated Solutions. In 2023, Integrated Solutions dominated the market share, driven by their ability to offer seamless connectivity and enhanced user experience.

By Region: The market is segmented by region into North, South, East, and West. In 2023, the North region, particularly the National Capital Region (NCR), dominated the market due to high urbanization rates, increased disposable income, and a higher concentration of tech-savvy consumers.

India Connected Car Market Competitive Landscape

- Mahindra & Mahindra: They have made strides in the connected car segment, emphasizing advanced telematics and infotainment systems. Their recent partnership with a leading tech firm to develop AI-driven solutions for connected vehicles is set to enhance their market presence and product offerings.

- Maruti Suzuki: Maruti Suzuki remains a dominant force in the India automotive market, with its connected cars gaining popularity. In 2023, the company reported a 20% increase in sales of its connected vehicle models, driven by consumer demand for enhanced safety and connectivity features.

- Mercedes-Benz India: Mercedes-Benz India's focus on luxury and innovation has positioned them as a key player in the connected car market. In 2023, their recent introduction of the MBUX (Mercedes-Benz User Experience) system, offering AI-powered features and augmented reality navigation, has set new standards in the market.

India Connected Car Industry Analysis

India Connected Car Market Growth Drivers

- Growing Adoption of Electric Vehicles: The adoption of electric vehicles (EVs) in India is on the rise, with over 1 million EVs expected to be on Indian roads by the end of 2024. This shift towards electric mobility is driving the demand for connected car technologies, as EV manufacturers focus on integrating advanced connectivity features to offer enhanced driving experiences, efficient vehicle management, and optimal battery usage.

- Consumer Demand for Enhanced Safety Features: In 2024, 80% of new cars sold in India are expected to come equipped with basic to advanced connectivity features such as emergency response systems, real-time traffic updates, and driver assistance systems. This growing preference for safety and convenience is driving manufacturers to invest in and adopt connected car technologies to meet market expectations and regulatory requirements.

India Connected Car Market Challenges

- Infrastructure and Network Limitations: Despite investments in digital infrastructure, India still faces limitations in terms of network coverage and quality, particularly in rural and semi-urban areas. In 2024, it is expected that only 60% of the country will have access to reliable 4G or 5G networks, essential for seamless connectivity and real-time data transmission in connected cars.

- Integration and Interoperability Issues: In 2024, the Indian market is expected to have over 500 different models of connected cars, each with varying degrees of connectivity and compatibility. Ensuring seamless integration and interoperability between different systems, devices, and platforms is crucial for providing a consistent and reliable user experience. Standardization efforts and industry collaboration are essential to address these challenges and promote the effective adoption of connected car technologies.

India Connected Car Market Government Initiatives

- FAME India Scheme: The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme, budget of INR 10,000 crore, incentivizes the adoption of electric and hybrid vehicles. This scheme also promotes the development and deployment of charging infrastructure and connectivity solutions for EVs. The government's support through subsidies and incentives is crucial for accelerating the adoption of connected car technologies in the EV segment.

- National Automotive Policy: The National Automotive Policy 2024 focuses on fostering innovation and technological advancements in the automotive sector. The policy encourages research and development in connected car technologies, offering financial support and tax incentives for companies investing in R&D activities.

India Connected Car Market Future Outlook

The future of the India connected car market looks promising, the market is anticipated to grow exponentially.

Future Trends

-

- Rise of Vehicle-to-Everything (V2X) Communication: By 2028, over 1 million vehicles will be equipped with V2X technology, enabling communication between vehicles, infrastructure, and other road users. This advancement will improve road safety, traffic management, and overall transportation efficiency. Government initiatives and collaborations between automotive and technology companies will play a pivotal role in driving V2X adoption.

- Growth in Autonomous Vehicle Adoption: By 2028, there will be around 50,000 autonomous vehicles on Indian roads. The integration of connected car technologies, including advanced sensors, AI algorithms, and real-time data processing, will be crucial for the safe and efficient operation of AVs. The development of regulatory frameworks and infrastructure to support AV deployment will drive this trend.

Scope of the Report

|

By Product |

Telematics Infotainment Navigation Systems |

|

By Connectivity Solution |

Embedded Tethered Integrated Solutions |

|

By Region |

North East West South |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing this Report:

Automobile Manufacturers

Government Agencies (Ministry of Road Transport and Highways)

Fleet Management Companies

Vehicle Rental Companies

Automotive Dealers and Distributors

Insurance Companies

Electric Vehicle Manufacturers

Banks and financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Tata Motors

Mahindra & Mahindra

Maruti Suzuki

Hyundai Motors

Mercedes-Benz India

Honda Cars India

Ford India

Nissan Motor India

Volkswagen India

BMW India

Audi India

Toyota Kirloskar Motor

Renault India

Skoda Auto India

Kia Motors India

Table of Contents

1. India Connected Car Market Overview

1.1 India Connected Car Market Taxonomy

2. India Connected Car Market Size (in USD Bn), 2018-2023

3. India Connected Car Market Analysis

3.1 India Connected Car Market Growth Drivers

3.2 India Connected Car Market Challenges and Issues

3.3 India Connected Car Market Trends and Development

3.4 India Connected Car Market Government Regulation

3.5 India Connected Car Market SWOT Analysis

3.6 India Connected Car Market Stake Ecosystem

3.7 India Connected Car Market Competition Ecosystem

4. India Connected Car Market Segmentation, 2023

4.1 India Connected Car Market Segmentation by Product (in %), 2023

4.2 India Connected Car Market Segmentation by Connectivity Solutions (in %), 2023

4.3 India Connected Car Market Segmentation by Region (in %), 2023

5. India Connected Car Market Competition Benchmarking

5.1 India Connected Car Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Connected Car Market Future Market Size (in USD Bn), 2023-2028

7. India Connected Car Market Future Market Segmentation, 2028

7.1 India Connected Car Market Segmentation by Product (in %), 2028

7.2 India Connected Car Market Segmentation by Connectivity Solutions (in %), 2028

7.3 India Connected Car Market Segmentation by Region (in %), 2028

8. India Connected Car Market Analysts’ Recommendations

8.1 India Connected Car Market TAM/SAM/SOM Analysis

8.2 India Connected Car Market Customer Cohort Analysis

8.3 India Connected Car Market Marketing Initiatives

8.4 India Connected Car Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2 Market Building:

Collating statistics on India Connected Car Market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for India Connected Car Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research output:

Our team will approach multiple automotive companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us validate statistics derived through bottom-to-top approaches from automotive companies.

Frequently Asked Questions

01 How big is the India connected car market?

The India Connected Car Market is valued at 19.2 billion in 2023. This growth is affected by increasing consumer demand for enhanced in-car connectivity, the advent of advanced driver assistance systems (ADAS), and the rising adoption of electric vehicles (EVs).

02 What are the challenges in India connected car market?

The India Connected Car Market faces challenges such as data privacy and security concerns, the high cost of connectivity solutions, infrastructure and network limitations, and integration and interoperability issues.

03 Who are the major players in the India connected car market?

Major players in the India Connected Car Market include Tata Motors, Mahindra & Mahindra, Maruti Suzuki, Hyundai Motors, and Mercedes-Benz India.

04 What are the main growth drivers of the India connected car market?

The key drivers of the India Connected Car Market include increased vehicle production and sales, substantial government investment in digital infrastructure, growing adoption of electric vehicles, and rising consumer demand for enhanced safety features.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.