India Construction Equipment Rental Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3710

November 2024

94

About the Report

India Construction Equipment Rental Market Overview

- The India construction equipment rental market is valued at USD 900 billion, driven by an increase in infrastructure projects across the country. Major initiatives like the Bharatmala and Sagarmala programs are boosting the demand for construction machinery. Additionally, the rental model is gaining popularity as it allows construction companies to reduce the capital costs associated with equipment ownership while ensuring access to modern, well-maintained machinery. The rental market benefits from the cost flexibility it offers, particularly for short-term projects, thereby increasing its attractiveness.

- Key cities that dominate the construction equipment rental market in India include Delhi, Mumbai, and Bengaluru. These cities lead due to their continuous expansion of urban infrastructure, large-scale residential and commercial projects, and their role as major hubs for construction-related activities. Furthermore, Delhis focus on improving its road networks and Bengalurus expanding metro system is driving the need for construction equipment rentals, making these cities central to the markets growth.

- The PM Gati Shakti initiative, launched in 2021, is a government plan to develop integrated infrastructure projects across sectors, providing a long-term roadmap for construction equipment rental growth. The National Infrastructure Pipeline (NIP) outlines projects worth INR 111 lakh crore, creating substantial demand for construction machinery. Rental companies will play a crucial role in supplying equipment for these large-scale initiatives, as contractors seek cost-effective solutions for project completion.

India Construction Equipment Rental Market Segmentation

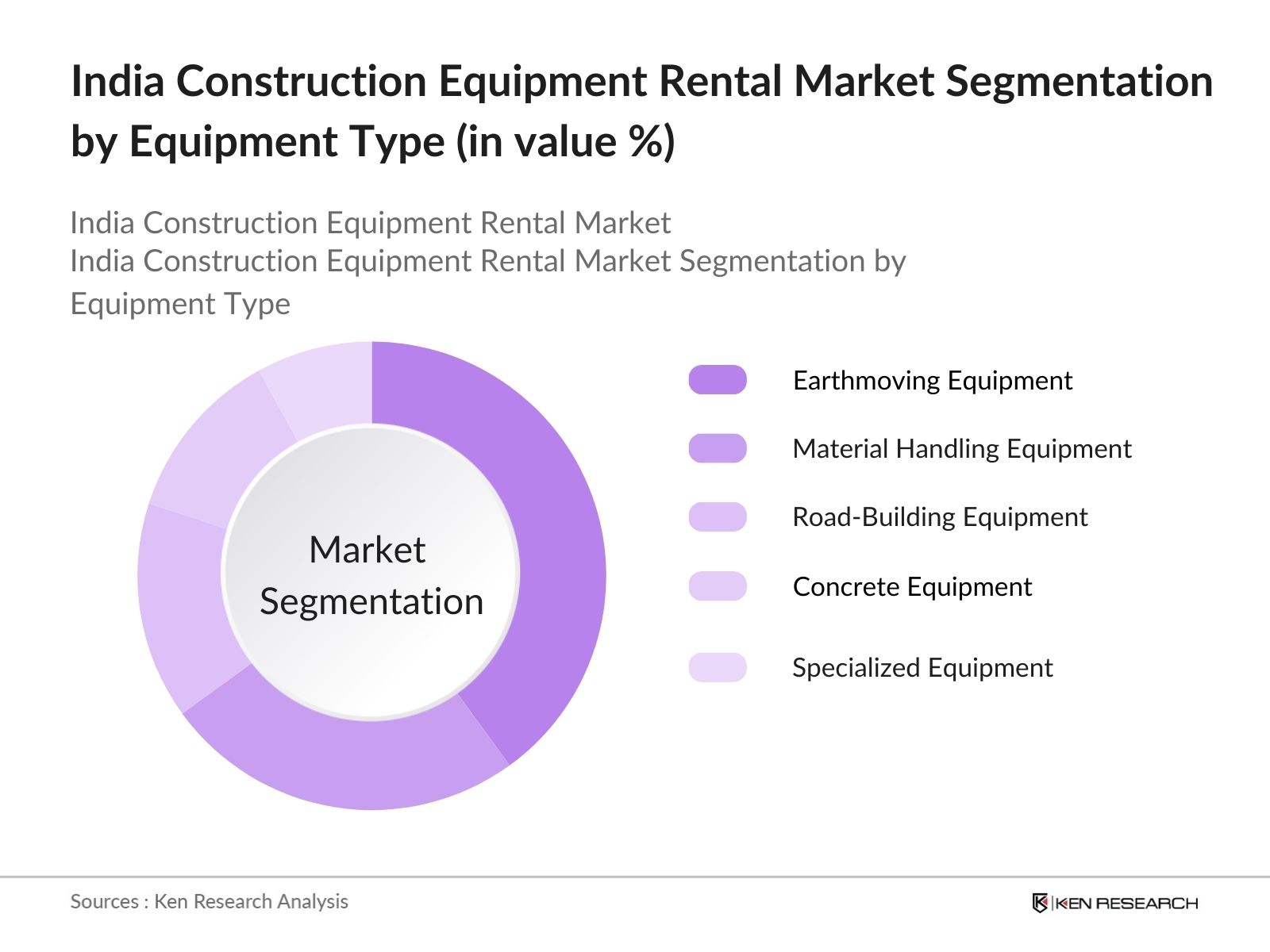

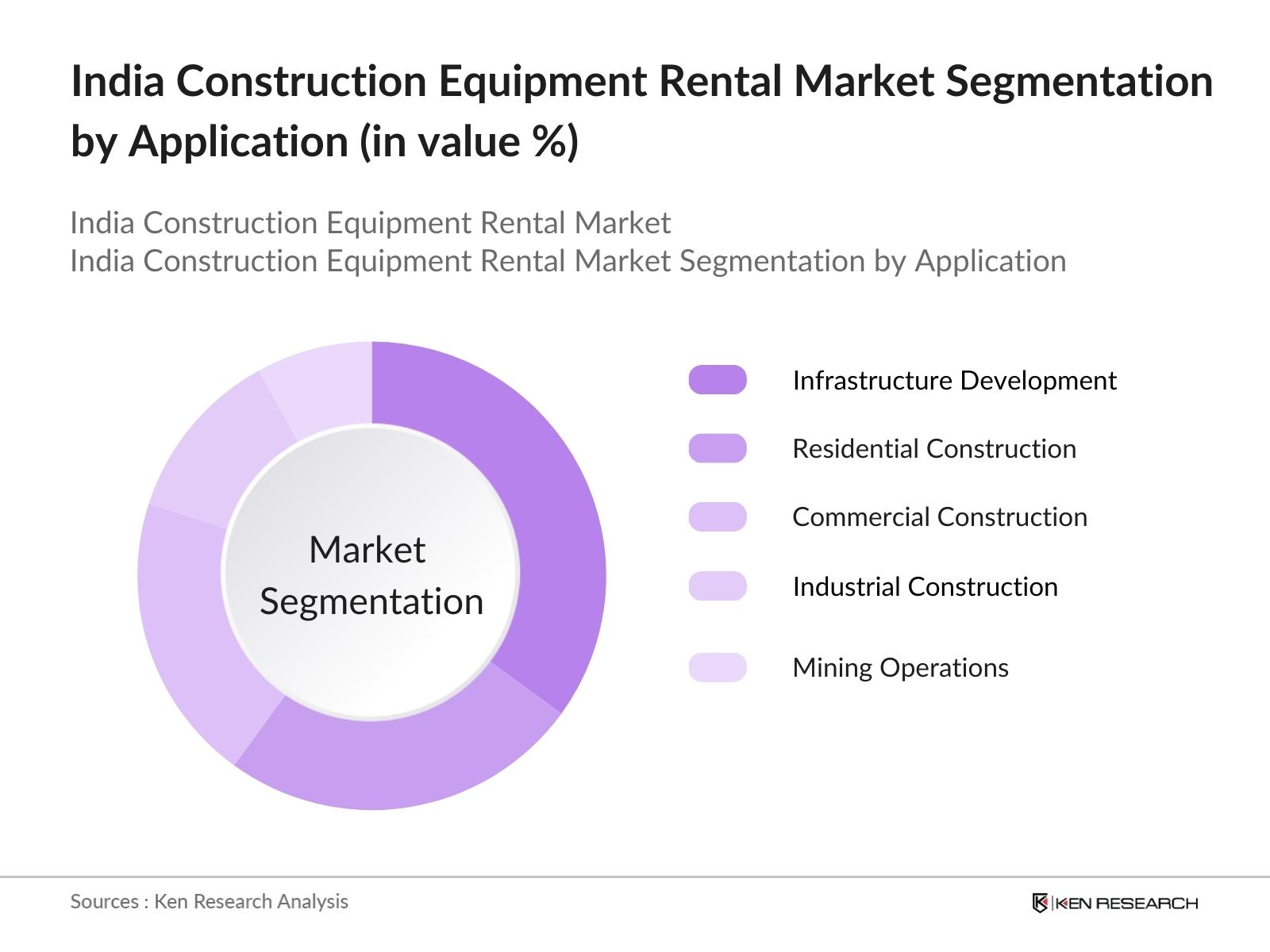

India's construction equipment rental market is segmented by equipment type and by application.

- By Equipment Type: India's construction equipment rental market is segmented by equipment type into earthmoving equipment, material handling equipment, road-building equipment, concrete equipment, and specialized equipment. Earthmoving equipment, which includes excavators and bulldozers, dominates this segment due to its critical role in a wide variety of construction activities, from road development to large-scale infrastructure projects. The strong demand for earthmoving equipment is driven by ongoing efforts to enhance road connectivity across rural and urban areas. Additionally, its versatility and utility in almost every type of construction project contribute to its dominant market share.

- By Application: The market is also segmented by application into residential construction, commercial construction, industrial construction, infrastructure development, and mining operations. Infrastructure development, including roadways, railways, and airports, holds a dominant market share under the application segment. Indias ambitious infrastructure plans, driven by both state and central government projects, have created immense demand for construction equipment. These large-scale projects require heavy machinery such as cranes, graders, and pavers, making this segment essential for construction equipment rental companies.

India Construction Equipment Rental Market Competitive Landscape

The India construction equipment rental market is dominated by both international and domestic players who offer a wide range of equipment. The consolidation within the market showcases how a few key players exert influence due to their comprehensive service offerings, equipment availability, and technical support. This includes companies that provide earthmoving machinery, cranes, and concrete equipment to fulfill the requirements of various construction activities. Major players, including Caterpillar India, JCB India, and Tata Hitachi Construction Machinery, have solidified their positions through strong dealer networks, reliable after-sales services, and rental fleet diversity.

|

Company Name |

Establishment Year |

Headquarters |

Fleet Size |

Revenue |

Number of Branches |

|

Caterpillar India |

1925 |

Bengaluru, India |

|||

|

JCB India |

1945 |

Delhi, India |

|||

|

Tata Hitachi Construction Machinery |

1984 |

Kolkata, India |

|||

|

L&T Construction Equipment |

1980 |

Mumbai, India |

|||

|

Volvo CE India |

1832 |

Bangalore, India |

India Construction Equipment Rental Industry Analysis

Growth Drivers

- Infrastructure Development (Government-led initiatives: Bharatmala, Sagarmala): India's Bharatmala Pariyojana aims to build 34,800 kilometers of highways connecting economic corridors, a project with a financial outlay of INR 5.35 lakh crore. The Sagarmala project is enhancing port infrastructure with 574 projects valued at INR 6.01 lakh crore. This investment is propelling the demand for heavy equipment rentals as contractors require cost-effective machinery to meet project demands. For instance, the Bharatmala project alone necessitates a large fleet of equipment for road construction and maintenance, influencing the rental market's growth. These initiatives contribute to India's improving infrastructure and connectivity.

- Urbanization (Expansion of Metropolitan Areas, Affordable Housing): India's urban population is expected to reach 600 million by 2031, intensifying the need for residential and commercial spaces. The Pradhan Mantri Awas Yojana (PMAY) has sanctioned the construction of over 113 lakh houses by 2024, boosting demand for construction equipment rentals in metropolitan areas. Affordable housing and the expansion of Tier-II and Tier-III cities require advanced machinery to meet building targets. Renting equipment allows developers to scale operations cost-effectively while maintaining flexibility in project execution timelines.

- Construction Industry Boom (Industrial Hubs, SEZ Development): The construction industry is witnessing a surge in Special Economic Zones (SEZs), with over 400 approved SEZs contributing to an increase in demand for rental equipment. SEZs house multiple industries requiring construction machinery for site development, infrastructure building, and maintenance. Additionally, industrial clusters, like those in Gujarat and Maharashtra, are focusing on heavy infrastructure projects, increasing the demand for machinery like cranes, earthmovers, and excavators available for rent, ensuring contractors can access equipment without heavy capital outlay.

Market Challenges

- Equipment Maintenance Costs (Technological Upkeep, Maintenance Resources): Maintaining technologically advanced construction equipment poses a challenge due to high costs. Each machine requires regular servicing, which can cost between INR 2 lakhs to INR 20 lakhs annually. Equipment with advanced technologies like IoT sensors and telematics has higher maintenance demands, further increasing operational costs. Companies offering rental services must invest in maintenance facilities and trained personnel, adding to the financial burden. Additionally, sourcing spare parts and skilled technicians for timely repairs adds complexity to managing fleets.

- Skilled Workforce Shortage (Operators, Technicians): India faces a severe shortage of skilled operators and technicians, critical for running and maintaining construction equipment. According to the National Skill Development Corporation (NSDC), the construction sector needs an additional 30 million skilled workers by 2025. The lack of trained operators not only increases project delays but also escalates operational costs as companies spend more on training programs. The shortage impacts the rental sector, where frequent rotation of machinery requires a constant supply of trained personnel to ensure operational efficiency and safety compliance.

India Construction Equipment Rental Market Future Outlook

Over the next five years, the India construction equipment rental market is expected to witness growth. The primary drivers of this expansion include the ongoing urbanization and infrastructure projects in India, the increasing use of technologically advanced equipment, and the cost-efficiency offered by renting equipment. Additionally, government initiatives like PM Gati Shakti, aimed at reducing logistic costs and improving infrastructure, will continue to boost the demand for rental equipment in the country. Moreover, the shift towards eco-friendly and sustainable equipment, such as electric and hybrid machinery, will shape the future of the market. Companies are likely to focus on enhancing their rental fleet with environmentally sustainable options to comply with stricter environmental regulations.

Market Opportunities

- Digital Transformation in Equipment Management (IoT, Telematics): The integration of IoT and telematics in construction equipment offers opportunities for digital transformation in the rental market. By 2024, IoT-enabled construction machinery is expected to make up 30% of the global fleet, streamlining real-time tracking, predictive maintenance, and fuel efficiency. Rental companies can leverage IoT technology to optimize fleet management, reducing downtime and improving profitability. The telematics market in India is growing, driven by innovations in fleet tracking, leading to more efficient and accountable equipment rental operations.

- Strategic Alliances with Construction Firms (Leasing Partnerships, Contractor Networks): Forming strategic alliances with construction firms presents a opportunity for rental companies. Collaborations with top contractors, who manage projects worth over INR 100 crore, provide long-term leasing contracts for machinery like cranes, earthmovers, and graders. These partnerships create a stable revenue stream while fostering greater trust between contractors and equipment providers. Leasing partnerships also offer cost-sharing models, where the financial burden of equipment ownership and maintenance is minimized for construction firms, further driving demand for rental services.

Scope of the Report

|

Earthmoving Equipment Material Handling Equipment Road Building Equipment Concrete Equipment Specialized Equipment |

|

|

By Rental Duration |

Short-term (Less than 6 months) Medium-term (6 to 12 months) Long-term (Over 12 months) |

|

By Application |

Residential Construction Commercial Construction Industrial Construction Infrastructure Development Mining Operations |

|

By Customer Type |

Government Entities Private Construction Companies Public Sector Undertakings Independent Contractors |

|

By Region |

North East West South |

Products

Key Target Audience

Construction Contractors

Government Bodies (Ministry of Road Transport and Highways, Ministry of Housing and Urban Affairs)

Real Estate Developers

Infrastructure Development Companies

Mining Companies

Equipment Leasing Companies

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (NHAI, CPWD)

Companies

Players Mention in the Report:

Caterpillar India

JCB India

Tata Hitachi Construction Machinery

L&T Construction Equipment

Volvo CE India

Escorts Construction Equipment

ACE (Action Construction Equipment)

Sany India

BEML Limited

Komatsu India Pvt Ltd

Hyundai Construction Equipment India

Mahindra Construction Equipment

Doosan Bobcat India

Liebherr India

Kobelco Construction Equipment India

Table of Contents

1. India Construction Equipment Rental Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Rental Duration, Equipment Type, Application)

1.3. Market Growth Rate (Influence of Infrastructure Projects, Government Policies, and Industrial Growth)

1.4. Market Segmentation Overview

2. India Construction Equipment Rental Market Size (In USD Mn)

2.1. Historical Market Size (Sector Performance, Equipment Usage Trends)

2.2. Year-On-Year Growth Analysis (Influence of COVID-19, Recovery Trends, Mega Project Impact)

2.3. Key Market Developments and Milestones (Smart City Initiatives, Road Infrastructure Projects)

3. India Construction Equipment Rental Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Government-led initiatives: Bharatmala, Sagarmala)

3.1.2. Urbanization (Expansion of Metropolitan Areas, Affordable Housing)

3.1.3. Construction Industry Boom (Industrial Hubs, SEZ Development)

3.1.4. Rental Model Advantages (Cost-effectiveness, Flexibility)

3.2. Market Challenges

3.2.1. Equipment Maintenance Costs (Technological Upkeep, Maintenance Resources)

3.2.2. Skilled Workforce Shortage (Operators, Technicians)

3.2.3. Fluctuations in Construction Activity (Seasonality, Economic Slowdowns)

3.3. Opportunities

3.3.1. Digital Transformation in Equipment Management (IoT, Telematics)

3.3.2. Strategic Alliances with Construction Firms (Leasing Partnerships, Contractor Networks)

3.3.3. Growth in Renewable Energy Sector (Wind, Solar Projects Requiring Heavy Machinery)

3.4. Trends

3.4.1. Shift Toward Sustainable Construction Equipment (Electric and Hybrid Machinery)

3.4.2. Rising Preference for Short-term Rentals (Project-based, Risk Mitigation)

3.4.3. Increasing Adoption of Automated and Smart Equipment (AI-driven, Remote Monitoring)

3.5. Government Regulations

3.5.1. Infrastructure Development Regulations (PM Gati Shakti, National Infrastructure Pipeline)

3.5.2. Equipment Safety Standards (Certification, Safety Protocols)

3.5.3. Environmental Norms (Emission Regulations, Noise Control)

3.5.4. Leasing Policy Amendments (GST Impact, Ease of Doing Business)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Equipment Manufacturers

3.7.2. Rental Companies

3.7.3. Construction Contractors

3.7.4. End-Users

3.8. Porters Five Forces Analysis (Market Entry Barriers, Buyer-Supplier Dynamics)

3.9. Competition Ecosystem

4. India Construction Equipment Rental Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Earthmoving Equipment (Excavators, Bulldozers)

4.1.2. Material Handling Equipment (Cranes, Forklifts)

4.1.3. Road Building Equipment (Graders, Rollers)

4.1.4. Concrete Equipment (Concrete Mixers, Batching Plants)

4.1.5. Specialized Equipment (Demolition Tools, Piling Machines)

4.2. By Application (In Value %)

4.2.1. Residential Construction

4.2.2. Commercial Construction

4.2.3. Industrial Construction

4.2.4. Infrastructure Development (Roads, Airports, Railways)

4.2.5. Mining Operations

4.3. By Rental Duration (In Value %)

4.3.1. Short-term (Less than 6 months)

4.3.2. Medium-term (6 to 12 months)

4.3.3. Long-term (Over 12 months)

4.4. By Region (In Value %)

4.4.1. North

4.4.2. South

4.4.3. East

4.4.4. West

4.5. By Customer Type (In Value %)

4.5.1. Government Entities

4.5.2. Private Construction Companies

4.5.3. Public Sector Undertakings

4.5.4. Independent Contractors

5. India Construction Equipment Rental Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Caterpillar India

5.1.2. JCB India

5.1.3. Tata Hitachi Construction Machinery

5.1.4. L&T Construction Equipment

5.1.5. Volvo CE India

5.1.6. Escorts Construction Equipment

5.1.7. ACE (Action Construction Equipment)

5.1.8. Kobelco Construction Equipment India

5.1.9. Sany India

5.1.10. BEML Limited

5.1.11. Komatsu India Pvt Ltd

5.1.12. Hyundai Construction Equipment India

5.1.13. Mahindra Construction Equipment

5.1.14. Doosan Bobcat India

5.1.15. Liebherr India

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Fleet Size, Market Share, Revenue, Equipment Innovation, Geographical Reach)

5.3. Market Share Analysis (Rental Penetration, Equipment Type Preference)

5.4. Strategic Initiatives (Partnerships, Collaborations, Joint Ventures)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Construction Equipment Rental Market Regulatory Framework

6.1. Licensing Requirements (State and Central Policies)

6.2. Compliance and Certification (Equipment Safety, Emission Standards)

6.3. Labor Laws (Operator Regulations, Employment Norms)

7. India Construction Equipment Rental Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Growth in Residential and Infrastructure Sectors)

7.2. Key Factors Driving Future Market Growth (Urbanization, Government Initiatives)

8. India Construction Equipment Rental Future Market Segmentation

8.1. By Equipment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Rental Duration (In Value %)

8.4. By Region (In Value %)

8.5. By Customer Type (In Value %)

9. India Construction Equipment Rental Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the first step, an ecosystem map of the India Construction Equipment Rental Market is constructed, including stakeholders such as equipment rental companies, construction contractors, and government bodies. Desk research is utilized to gather information on industry drivers, market trends, and company data, helping identify key market variables.

Step 2: Market Analysis and Construction

Next, historical data on market performance and trends is analyzed. This step focuses on understanding market penetration rates, demand for different equipment categories, and the revenue contribution of each segment to derive a comprehensive market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted to validate hypotheses regarding the future of the market. This is achieved through telephonic interviews and feedback from key personnel at leading construction equipment rental firms to gather qualitative insights on market trends.

Step 4: Research Synthesis and Final Output

Finally, insights from manufacturers and equipment suppliers are integrated with quantitative data from secondary research, ensuring an accurate and validated analysis. This provides a holistic view of the market, which is crucial for making informed business decisions.

Frequently Asked Questions

01. How big is the India Construction Equipment Rental Market?

The India construction equipment rental market is valued at USD 900 billion. It is driven by increasing infrastructure development projects such as the Bharatmala and Sagarmala programs.

02. What are the challenges in the India Construction Equipment Rental Market?

Key challenges in India construction equipment rental market include the high cost of equipment maintenance, a shortage of skilled operators, and fluctuating demand tied to the seasonality of construction activities.

03. Who are the major players in the India Construction Equipment Rental Market?

Major players in the India construction equipment rental market include Caterpillar India, JCB India, Tata Hitachi Construction Machinery, L&T Construction Equipment, and Volvo CE India. These companies dominate due to their extensive rental fleets and strong service networks.

04. What are the growth drivers of the India Construction Equipment Rental Market?

India construction equipment rental market Growth is driven by government-led infrastructure projects, the rising demand for urban development, and the cost advantages of renting equipment over owning it.

05. What trends are shaping the India Construction Equipment Rental Market?

India construction equipment rental market Key trends include the shift towards electric and hybrid machinery, the increasing adoption of smart equipment with IoT integration, and a growing preference for short-term rentals among construction firms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.