India Contact Lens Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD2631

December 2024

87

About the Report

India Contact Lens Market Overview

- The India Contact Lens market, valued at USD 165 million, is driven by increasing vision correction needs and the rising prevalence of myopia and astigmatism among both urban and rural populations. The market has also benefited from the growth of disposable income, particularly in urban areas, where consumers are more inclined toward premium brands and advanced lens technology. Additionally, the growing awareness of eye health and the desire for convenient alternatives to eyeglasses are contributing to market expansion.

- Indias contact lens market is primarily dominated by metropolitan areas such as Mumbai, Delhi, and Bangalore. These cities have a high concentration of working professionals, students, and fashion-conscious individuals, which drives the demand for contact lenses. The strong presence of optometrists, eye care centers, and modern retail outlets, as well as the penetration of e-commerce platforms in these regions, further strengthens their dominance in the market.

- Countries in the region have also introduced packaging waste reduction initiatives to minimize environmental impact. Japan, for example, implemented its Extended Producer Responsibility (EPR) program in 2023, requiring manufacturers to take responsibility for the entire lifecycle of their packaging products. This has incentivized companies to develop more sustainable and flexible packaging solutions.

India Contact Lens Market Segmentation

By Product Type: The India Contact Lens market is segmented by product type into Soft Contact Lenses, Rigid Gas Permeable (RGP) Lenses, Hybrid Contact Lenses, and Scleral Lenses. Soft contact lenses dominate the market due to their comfort, flexibility, and widespread usage for correcting common vision problems such as myopia, hyperopia, and astigmatism. Soft lenses are preferred by a large segment of the population due to their ease of use and adaptability for various conditions. Major manufacturers such as Johnson & Johnson Vision Care and Bausch + Lomb focus heavily on this category, increasing their market penetration through innovative daily disposable lenses and extended-wear options.

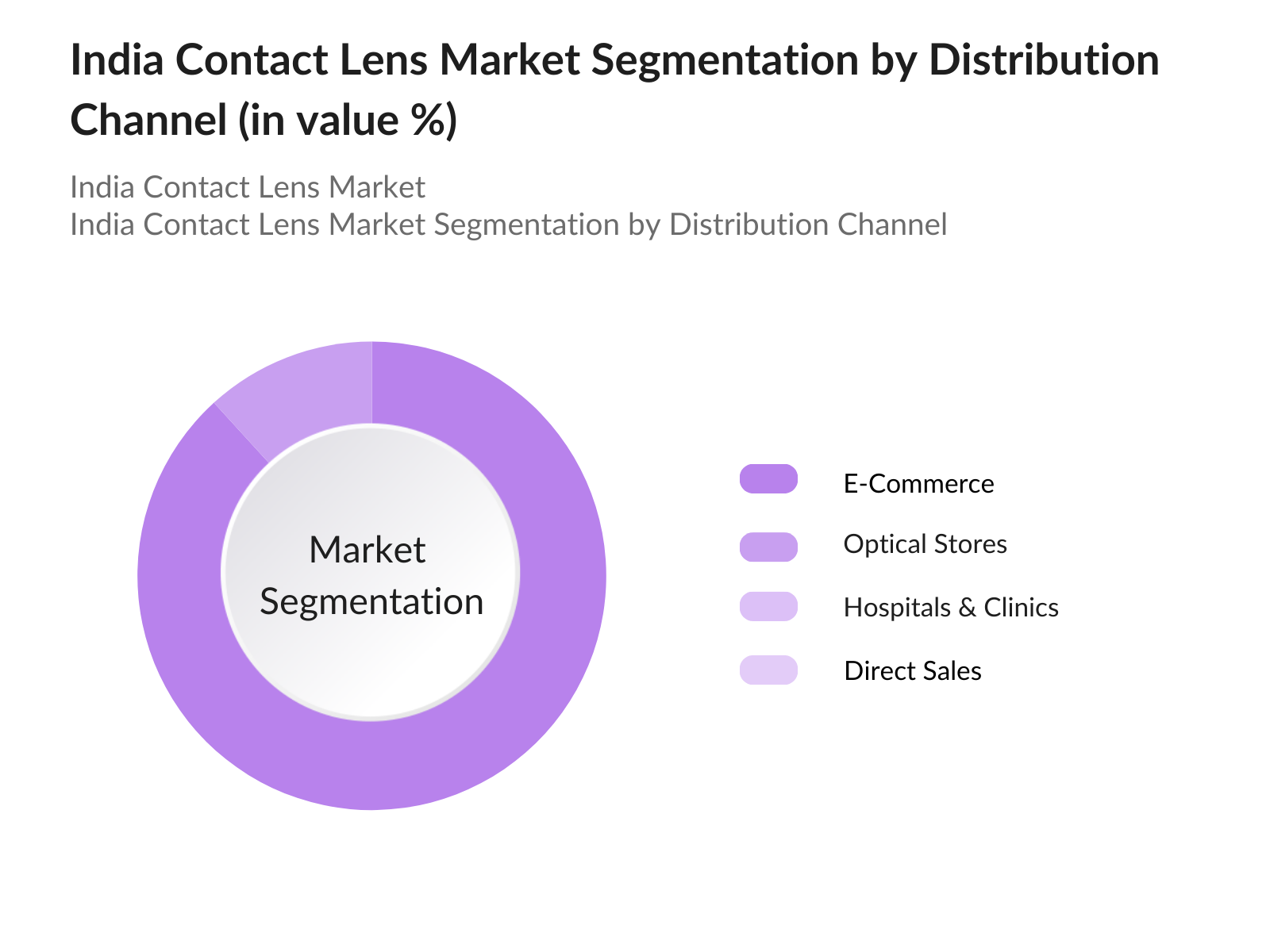

By Distribution Channel: The market is segmented by distribution channels into E-Commerce, Optical Stores, Hospitals & Clinics, and Direct Sales. E-commerce has emerged as the dominant distribution channel due to the convenience it offers, especially in a post-pandemic world where online shopping has seen a significant surge. The ease of access to a variety of brands, combined with discounts and home delivery services, has made online platforms such as Lenskart the preferred choice for many consumers. Additionally, subscription services for regular delivery of disposable lenses have further boosted the share of this segment.

India Contact Lens Market Competitive Landscape

The India Contact Lens market is concentrated among a few key players, with global giants and local manufacturers competing for dominance. Major brands such as Johnson & Johnson Vision Care, Alcon, and CooperVision are leaders due to their advanced research and development, strong marketing strategies, and extensive distribution networks. Local companies such as Titan Eye+ have carved a niche by catering to the Indian market with customized offerings and affordability.

Competitive Landscape Table

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Regional Presence |

Distribution Network |

Key Brands |

Market Position |

Strategic Initiatives |

|

Johnson & Johnson Vision Care |

1959 |

New Brunswick, USA |

|||||||

|

Alcon (Novartis) |

1945 |

Geneva, Switzerland |

|||||||

|

CooperVision |

1980 |

Pleasanton, USA |

|||||||

|

Bausch + Lomb |

1853 |

Rochester, USA |

|||||||

|

Titan Eye+ |

2007 |

Bengaluru, India |

India Contact Lens Market Analysis

Growth Drivers

- Shift towards Lightweight Packaging: The Asia Pacific region has witnessed a significant shift toward lightweight packaging in recent years due to rising demand for cost-effective and efficient packaging solutions. Lightweight flexible packaging reduces transportation costs and material usage, making it a preferred choice among manufacturers. According to the World Bank, the region's urban population increased by approximately 2.4 billion people in 2023, intensifying the demand for compact and sustainable packaging solutions. This has driven companies to adopt flexible packaging materials such as polyethylene and polypropylene for a variety of consumer products.

- Growing E-commerce and Food Delivery Demand: With the booming e-commerce and food delivery sectors in Asia Pacific, there has been a sharp rise in the demand for flexible packaging to meet logistics and consumer needs. In 2023, China recorded over 1.2 billion online transactions, while India saw a 30% increase in food delivery orders from 2022 to 2024. This surge has led to the widespread use of flexible packaging in shipping and food delivery, due to its lightweight and adaptable nature, making it easier to transport and stores.

- Increasing Demand for Recyclable Packaging: The growing environmental awareness among consumers has fueled the demand for recyclable and eco-friendly packaging solutions in Asia Pacific. In 2023, the global push towards reducing plastic waste saw countries like Japan and South Korea implementing recycling mandates that resulted in over 60% of plastic packaging being recycle. Flexible packaging manufacturers are increasingly adopting materials like polylactic acid (PLA) to meet consumer expectations, while also aligning with government sustainability initiatives.

Market Challenges

- Fluctuating Raw Material Prices: The flexible packaging market in Asia Pacific faces significant challenges from fluctuating raw material prices, particularly for polymers like polyethylene and polypropylene. In 2023, the global crude oil prices surged to $80 per barrel, affecting the cost of raw materials used in flexible packaging production. This price volatility has strained manufacturers' profit margins and increased the overall cost of packaging solutions.

- Stringent Environmental Regulations on Plastics: Governments in Asia Pacific have implemented stringent regulations on plastic usage, posing a challenge to the flexible packaging industry. In 2023, India enforced its ban on single-use plastics, impacting industries that rely heavily on plastic-based flexible packaging. Other countries, like South Korea and Thailand, have introduced strict penalties for non-compliance with plastic recycling laws, further pressuring manufacturers to adopt alternative materials.

- Recycling Infrastructure Deficiency: The lack of robust recycling infrastructure in many parts of Asia Pacific remains a significant challenge for the flexible packaging industry. According to the World Bank, less than 20% of plastic waste was recycled in Southeast Asia in 2023 due to inadequate facilities. This has resulted in an increased environmental burden and limited the adoption of recyclable packaging materials

India Contact Lens Market Future Outlook

Over the next five years, the India Contact Lens market is expected to experience steady growth, driven by increasing consumer awareness of eye health, advances in lens technology, and the growing preference for aesthetically pleasing and convenient alternatives to eyeglasses. Government support for healthcare and the expansion of optical healthcare services into rural areas are also likely to play a significant role in the market's growth trajectory. Additionally, the development of innovative products like UV-protective lenses and lenses for specific eye conditions will further enhance market demand.

Market Opportunities

- Introduction of Biodegradable Packaging Solutions: The Asia Pacific market has seen a rise in biodegradable packaging solutions, driven by government regulations and consumer demand for sustainable options. In 2024, Australia introduced a national policy to reduce non-biodegradable plastic waste by 80%. As a result, companies are increasingly turning to biodegradable flexible packaging materials like PLA and PHA, offering a lucrative opportunity for innovation in the sector.

- Adoption of Flexible Packaging in Emerging Markets: Emerging markets in Asia Pacific, particularly in Southeast Asia, are rapidly adopting flexible packaging due to its cost-efficiency and suitability for various industries. Countries like Vietnam and the Philippines saw an increase in flexible packaging adoption by over 40% in 2023, especially in the food and beverage industry. This adoption is expected to grow

Products

Key Target Audience

Contact Lens Manufacturers

Optical Stores and Chains

Hospitals and Eye Care Centers

E-Commerce Platforms (Lenskart, Amazon India)

Ophthalmologists and Optometrists

Government and Regulatory Bodies (Ministry of Health & Family Welfare, Central Drugs Standard Control Organization)

Investors and Venture Capitalist Firms

Technology Providers for Contact Lens Manufacturing

Companies

Players mentioned in the report

Johnson & Johnson Vision Care

Alcon (Novartis)

CooperVision

Bausch + Lomb

Titan Eye+

Carl Zeiss Meditec AG

Menicon Co., Ltd.

Hoya Corporation

SEED Co., Ltd.

Lenskart Solutions Pvt. Ltd.

Clearlab International

GKB Hi-Tech Lenses Pvt. Ltd.

Vision Express

EssilorLuxottica

Precision Lens India

Table of Contents

1. India Contact Lens Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Contact Lens Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Contact Lens Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Myopia and Astigmatism

3.1.2. Increasing Disposable Income and Urbanization

3.1.3. Growing E-commerce and Subscription-based Models

3.2. Market Challenges

3.2.1. High Cost of Premium Lenses

3.2.2. Regulatory and Safety Concerns

3.2.3. Low Adoption in Rural Areas

3.3. Opportunities

3.3.1. Expansion into Tier-2 and Tier-3 Cities

3.3.2. Advancements in Lens Technology (UV Protection, Smart Lenses)

3.3.3. Growth of Customized and Cosmetic Lenses

3.4. Trends

3.4.1. Preference for Daily Disposable Lenses

3.4.2. Increasing Demand for Multifocal and Astigmatism Lenses

3.4.3. Rising Adoption of Sustainable and Biodegradable Contact Lenses

3.5. Government Regulations

3.5.1. Quality and Safety Standards for Contact Lenses

3.5.2. Consumer Protection Laws for E-commerce Sales

3.5.3. Environmental and Packaging Waste Reduction Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape

4. India Contact Lens Market Segmentation

4.1. By Product Type (Market Share in %)

4.1.1. Soft Contact Lenses

4.1.2. Rigid Gas Permeable (RGP) Lenses

4.1.3. Hybrid Contact Lenses

4.1.4. Scleral Lenses

4.2. By Distribution Channel (Market Share in %)

4.2.1. E-Commerce

4.2.2. Optical Stores

4.2.3. Hospitals & Clinics

4.2.4. Direct Sales

5. India Contact Lens Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson Vision Care

5.1.2. Alcon (Novartis)

5.1.3. CooperVision

5.1.4. Bausch + Lomb

5.1.5. Titan Eye+

5.2. Cross Comparison Parameters (Product Portfolio, R&D Investments, Regional Presence, Distribution Network, Market Position, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Regulations and Compliance

5.8. Private Equity Investments

6. India Contact Lens Market Regulatory Framework

6.1. Compliance Requirements and Safety Standards

6.2. Certification Processes and Quality Control Measures

6.3. Packaging Waste and Environmental Policies

7. India Contact Lens Market Future Projections (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Contact Lens Market Future Segmentation

8.1. By Product Type

8.2. By Distribution Channel

8.3. By End-User

8.4. By Region

9. India Contact Lens Market Analysts’ Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives and Distribution Strategies

9.4. White Space Opportunity Analysis

DisclaimerConatct Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the contact lens market ecosystem, identifying all major stakeholders including manufacturers, distributors, and healthcare providers. Secondary research using reliable databases is conducted to gather industry-specific information and define the market's critical variables.

Step 2: Market Analysis and Construction

In this phase, historical data on market size, revenue generation, and product distribution is compiled. The penetration of different contact lens types and their performance is analyzed to ensure accurate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts are conducted to validate research findings. These include interviews with key executives and optometrists to obtain insights on product trends, consumer preferences, and technological advancements.

Step 4: Research Synthesis and Final Output

The final phase involves direct consultations with contact lens manufacturers to gather data on product performance and customer feedback, ensuring a well-rounded analysis. The synthesis of this data provides the foundation for the report's conclusions.

Frequently Asked Questions

01. How big is the India Contact Lens Market?

The India Contact Lens market was valued at USD 165 million. Its growth is driven by increasing demand for corrective vision solutions, rising disposable incomes, and greater consumer awareness regarding eye health.

02. What are the challenges in the India Contact Lens Market?

Challenges include high costs associated with premium contact lenses, lack of awareness in rural areas, and competition from affordable eyeglasses. Additionally, the need for regular maintenance and the higher price of daily disposable lenses poses challenges for widespread adoption.

03. Who are the major players in the India Contact Lens Market?

Key players in the India Contact Lens market include Johnson & Johnson Vision Care, Alcon, CooperVision, Titan Eye+, and Bausch + Lomb. These companies lead the market through extensive distribution networks, innovative product offerings, and strategic partnerships.

04. What are the growth drivers of the India Contact Lens Market?

Growth drivers include increasing urbanization, rising income levels, and the expanding middle-class population. The growing demand for cosmetic lenses and the convenience offered by disposable lenses further boost the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.